[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

EURUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: long term bearish

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: long term bearish

Wave Structure: downward impulse wave

Long term wave count: lower in wave (3) red

Important risk events: EUR: N/A. USD: PPI m/m, Unemployment Claims, Core PPI m/m,

EURUSD looks to have completes a clear five wave pattern to the downside along with Cable.

This mornings trade drifted sideways in a contracting triangle within wave ‘5’ grey.

And then a final dip into a low at 1.1687.

The rise off the low this evening is possibly wave ‘a’ of a three wave correction higher in wave ‘ii’ pink.

The projections for wave ‘ii’ now lie between 1.1799 and 1.1825,

The 50% and 61.8% retracement levels.

For tomorrow;

Watch for the completion of a three wave correction in wave ‘ii’.

if we get a resumption of the decline after that,

It will be a sign that wave ‘iii’ down has begun.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

Wave Structure: continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

Important risk events: GBP: Manufacturing Production m/m, Goods Trade Balance. USD: PPI m/m, Unemployment Claims, Core PPI m/m,

Cable began the correction higher today as expected.

Wave ‘a’ and ‘b’ have completed in three waves and wave ‘c’ grey is possibly underway right now.

Wave ‘c’ should trace out five waves to complete and the initial target lies at 1.3110.

The price will meet the upper trendline of the minor trend channel at about 1.3060.

If the current wave count proves correct,

then wave ‘iii’ is on the cards once the correction is complete.

this wave should bring the price back down into the the region of the previous wave [B] green at about 1.2500.

Should this occur it will shift the momentum completely to the downside for the long term, in the resumption of the downtrend.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

Wave Structure: rally in wave [C]

Long term wave count: wave [C] is underway, upside to above 136.00

Important risk events: JPY: N/A. USD: PPI m/m, Unemployment Claims, Core PPI m/m,

USDJPY has again gone against the grain.

The wave structure off the last high at 114.50 is most definitely a corrective form.

there is no way to view it otherwise.

Wave ‘c’ has simply extended to a very large ending diagonal.

I have highlighted wave ‘4’, it has now taken the form of a three wave expanded flat correction.

This has cause mighty confusion, and made the larger structure almost impossible to read.

Although the price broke support today,

It has again made an impulsive looking recovery to the upside off todays low.

so there is again a possibility that the turn up is under way.

For tomorrow;

I will again be looking for a continuation of that small impulse move to the upside.

111.05 remains the initial resistance a break of which will reinforce the bullish outlook.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Topping in wave (5)

Important risk events: USD: PPI m/m, Unemployment Claims, Core PPI m/m,

The action in the DOW looks very corrective to the upside today.

After yesterdays impulsive decline from the target area,

Todays correction adds weight to the idea that this market may be topping.

There are question marks all round on the chart this evening.

If the decline off the high was wave ‘i’, then todays correction higher is wave ‘ii’ pink.

That wave ‘ii’ structure is a possible expanded flat, and is not complete just yet.

A rise into 22095 will complete wave ‘c’ and a 50% retracement.

So;

For tomorrow, lets see how the price reacts to 22095,

A further decline below wave ‘i’,

will add significant weight to the idea of a top,

And if we do in fact have a top in place here,

We should all get ready to suffer the consequences of reckless government and central bank policies over the last decade!

It will not be pretty.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

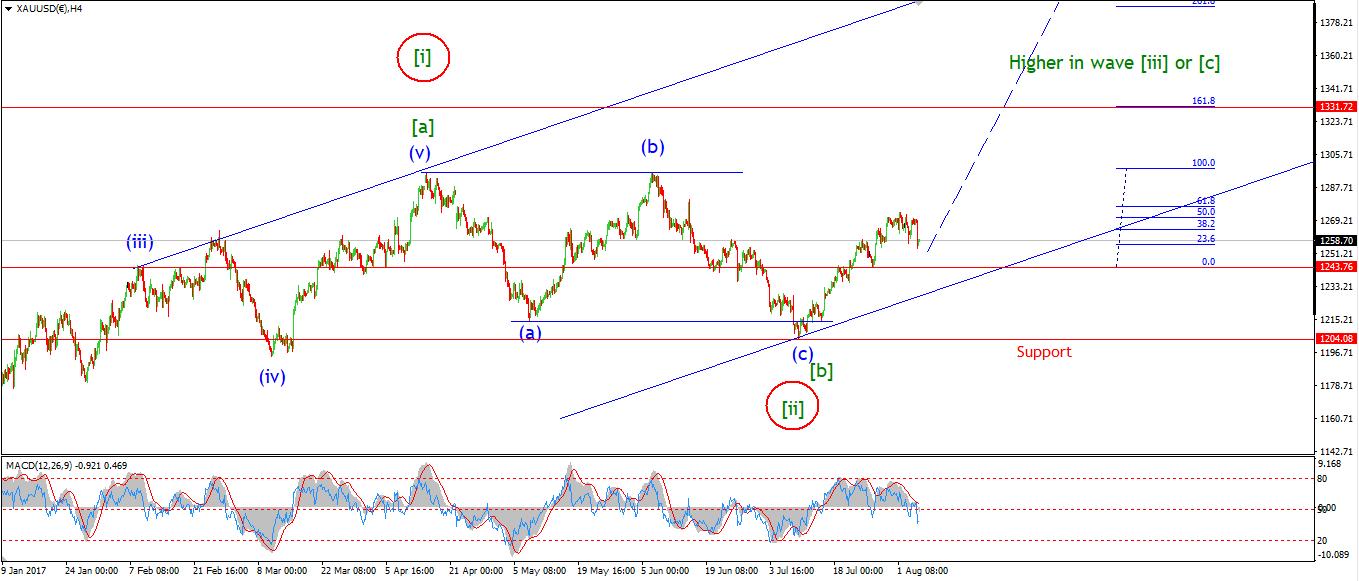

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: Long towards 1550

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: Long towards 1550

Wave Structure: ZigZag correction to the upside.

Long term wave count: Topping in wave (B) at 1550

Important risk events: USD: PPI m/m, Unemployment Claims, Core PPI m/m,

Well,

We got a break of 1274 in a very impulsive looking fashion.

The probability of a rally in wave (iii) blue, just got a big boost!

I have labelled the rally off the wave (ii) low as an ongoing wave ‘1’ pink or wave ‘i’ brown.

It is unclear at what degree of trend todays rally represents.

either way,

The internal structure seems incomplete at the moment,

one more push into 1280 will would create clear up the subdivision within the wave.

The next move to expect is a slight decline in either wave ‘ii’ or ‘2’.

This should occur in three waves,

1265 is a likely target for that decline.

For tomorrow;

Watch for a completion of wave ‘i’ / ‘1’,

And the beginning of a corrective decline.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]