[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Good evening everyone.

I have been thinking about introducing U.S crude oil to the service.

I am updating the long running wave counts which I abandoned last year!

Surprising enough,

the larger trend wave count is playing out quite nicely,

and it suggests an end is near for the sideways crude price action.

If I go ahead and introduce this new market to the service,

I will keep the actual written analysis on each market shorter.

To allow for the new content.

Let me know your thoughts on this change.[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

EURUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

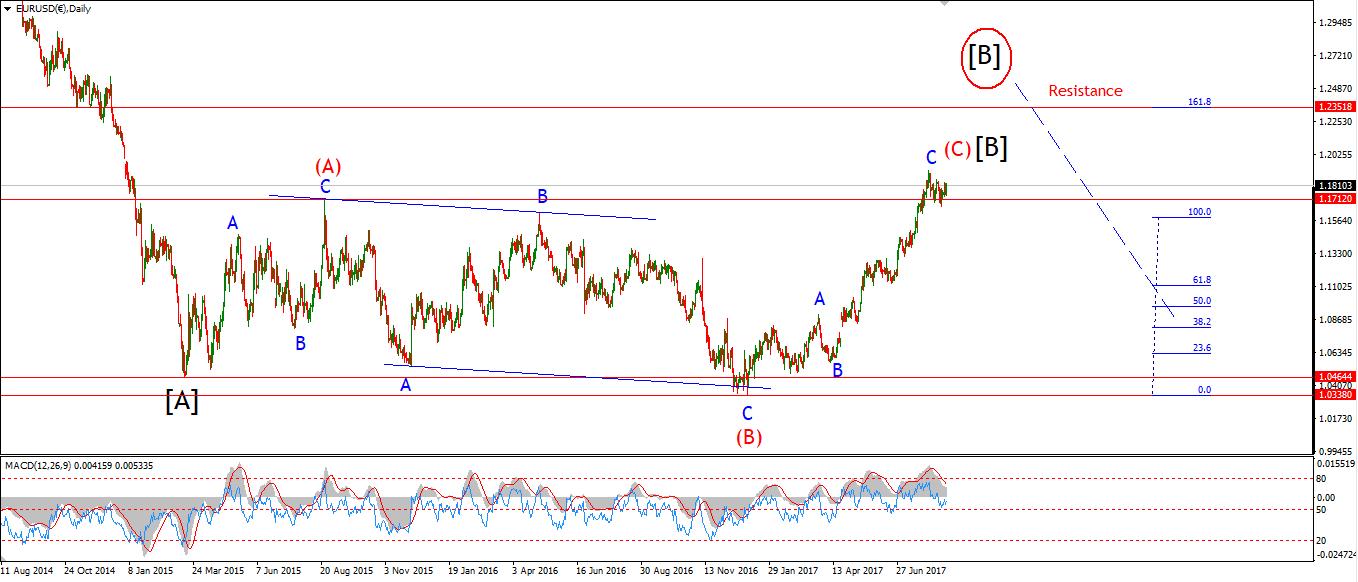

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: long term bearish

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: long term bearish

Wave Structure: downward impulse wave

Long term wave count: lower in wave (3) red

Important risk events: EUR: N/A. USD: PPI m/m, Crude Oil Inventories.

So far the short term wave count is holding up well.

The idea of a large contracting triangle wave ‘iv’ pink fits the price action.

As of this evening,

It looks like wave ‘c’ grey may have completed at 1.1926.

The triangle calls for a rise in wave ‘d’ into about 1.2045

before declining in wave ‘e’ completing wave ‘iv’ pink.

The alternate wave count shows a possible expanded flat wave ‘iv’ pink,

Which would see the price drop below 1.1824 again to complete.

For tomorrow;

Wave ‘d’ grey should trace out a three wave rise into 1.2045.

This compression of the price action should result in a sharp move in wave ‘v’ pink.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

Wave Structure: continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

Important risk events: GBP: Average Earnings Index 3m/y, Unemployment Rate. USD: PPI m/m, Crude Oil Inventories.

Todays rally above resistance at 1.3268 triggered the alternate wave count in cable.

I have altered both the 4hr and the short term charts

to show a rally in wave (c) brown which is almost complete again.

The current wave count and Fibonacci extension,

project an initial target range for wave (c) brown between 1.3450 and 1.3650.

The 4hr chart shows both projections.

The trend channel in the 4hr chart suggests the higher target will be reached.

For tomorrow;

The short term count suggests that wave ‘iii’ pink is coming to an end.

A decline in wave ‘iv’ should bring price down into 1.3150 again.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

Wave Structure: rally in wave [C]

Long term wave count: wave [C] is underway, upside to above 136.00

Important risk events: JPY: N/A. USD: PPI m/m, Crude Oil Inventories.

The action over the last few days in USDJPY is definately indicative of an impulsive move to the upside.

I have labelled the rise as an almost complete wave ‘i’ brown.

The rise could also be extending to a larger degree wave (i) green.

If the price breaks resistance at 110.68 before correcting, it will favor the higher degree move.

The bullish signal will be completed with a three wave decline wave ‘ii’ off the eventual high in wave ‘i’.

On the 4hr chart you can see that the price has broken above the declining trendline,

And crossed up over the 200MA line.

Both of these are bullish signals for a large trend change.

For Tomorrow;

I will concentrate on the structure of any short term decline,

Especially if a correction finds support at the 200MA line.

If this market is about to turn back into the larger uptrend,

Then we could be in for a hell of a ride![/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Possibly topped in wave (5)

Important risk events: USD: PPI m/m, Crude Oil Inventories.

I have switched to the alternate wave count today.

The impulsive looking rally off the fridays low seems to fit with a rally in wave ‘v’ pink as expalained in yesterdays post.

I have shown a possible path for prices to complete a further five wave rally into the new upper target

On the 4hr chart I have shown these higher targets as:

22414 – where wave (v) grey equals wave (i) grey.

And

22850 – where wave (v) grey equals 161.8% of wave (i) grey.

This short term bulish outlook does not change the larger bearish backdrop.

the rally in wave (5) red has meerly extended,

the outcome will be all the more painful on the far side of this wave structure.

For tomorrow;

Watch for a completing wave ‘i’ pink possibly at a new all time high,

A correction in wave ‘ii’ should begin soon.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: Long towards 1550

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: Long towards 1550

Wave Structure: ZigZag correction to the upside.

Long term wave count: Topping in wave (B) at 1550

Important risk events: USD: PPI m/m, Crude Oil Inventories.

GOLD recovered slightly today,

The expanded flat correction in wave ‘iv’ brown may have completed at the lows of the day.

The low in the cash market came at 1323.53.

What should follow is a five wave rally in wave ‘v’ brown to an initial target at 1363,

The higher extended target lies at 1372.

A higher low above 1323.53 would suggest a rally in wave ‘v’ brown was underway.

For tomorrow;

Watch for an impulsive rise into 1344, the previous wave ‘iii’ high.

A break above 1344 will be the initial signal that wave ‘v’ is underway.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]