[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

EURUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: long term bearish

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: long term bearish

Wave Structure: downward impulse wave

Long term wave count: lower in wave (3) red

Important risk events: EUR: German ZEW Economic Sentiment. USD: Mortgage Delinquencies.

Good evening everyone, and welcome to the weekend.

It has been another one of those strange weeks where a lot has happened,

but not a whole lot of progress has occurred in the price!

Those big moves are lining up accross the markets right now.

It is up to us to be ready when they come.

EURUSD made very little net progress today,

This action suggests the price is still locked up in a corrective wave.

The current wave count suggests the price is declining in wave ‘3’ of ‘iii’,

But there is also a possibility that the declines off the high is all part of a series of three initial moves to the downside.

This is shown as the alternate wave count circled in red.

The high at 1.1789 is the invalidation point for both wave counts shown,

So

For Monday;

Watch 1.1789.

The price simply must begin to make progress to the downside to increase the probability of a final high in place.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

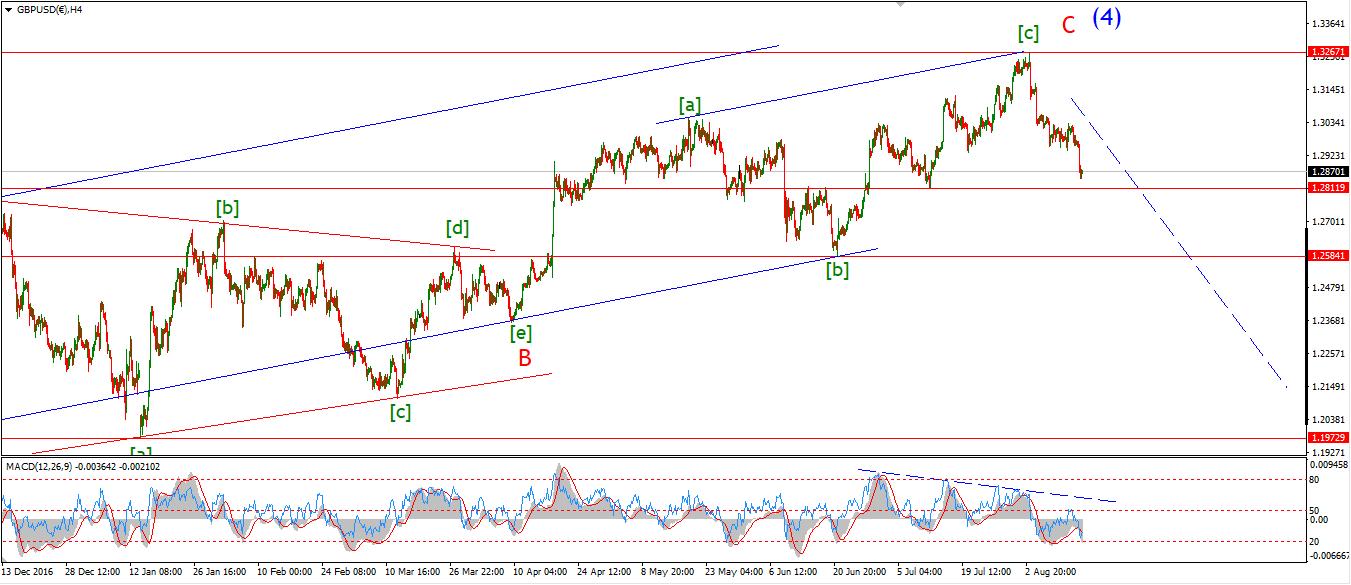

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

Wave Structure: continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

Important risk events: GBP: Public Sector Net Borrowing. USD: Mortgage Delinquencies.

Cable rose into 1.2920 today as expected,

This action fills out the parallel trend channel in a complex correction wave ‘4’ or wave ‘ii’.

I am now leaning in favor of the alternate wave count right now.

The delines off that high look impulsive and could be the beginning of wave ‘5’ grey.

A break of support at 1.2810 will rule out another bullish alternative wave count

And add weight to the bearish outlook.

Wave ‘iii’ should bring the price down to meet the lower trendline,

1.2650 remains the likely target for wave ‘iii’.

For next week;

1.2917 should hold the price as it declines in wave ‘5’ grey.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

Wave Structure: rally in wave [C]

Long term wave count: wave [C] is underway, upside to above 136.00

Important risk events: JPY: N/A. USD: Mortgage Delinquencies.

Another day another USDJPY disappointment.

The correction in wave [ii] grey has proved the most difficult wave structure to call of any of the markets I follow lately.

Every bullish signal has been followed by another corrective decline which breaks support!

Go figure.

The decline in wave (c) green has now been relabelled to account for todays break of support.

The structure gets more complex as the days go on.

It is now labelled as a double combination with a running flat wave ‘b’ brown.

This is shown circled in red.

That running flat is the cause of all the false signals of late.

Following todays support break,

The price again rallied impulsively

Which again raises the possibility of another turn on the cards.

So;

For Monday I will be looking to see how this structure develops to the upside.

A further impulsive is again on the cards.

Lets see how it goes early next week.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Topping in wave (5)

Important risk events: USD: Mortgage Delinquencies.

The declines continued today,

And I have switched the labeling to the alternate wave count.

This market is now in full bearish outlook mode!

And this does not auger at all well for our medium term financial future.

It is time to put your affairs in order if the current wave count proves correct.

The pattern is now labelled with a complete wave (i) and (ii) in grey,

Followed by a complete wave ‘i’ pink,

With wave ‘ii’ possibly under way as I write.

Wave ‘ii’ should reach up past resistance again at 21815 and it should trace out a three wave structure.

Form that point I will be looking for a further decline into wave ‘iii’.

For Monday;

Watch out for a corrective rally in wave ‘c’ blue to complete a three wave structure.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: Long towards 1550

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: Long towards 1550

Wave Structure: ZigZag correction to the upside.

Long term wave count: Topping in wave (B) at 1550

Important risk events: USD: Mortgage Delinquencies.

We are running out of labels to account for the price pattern in GOLD!

The rise off the low at 1267 labelled wave ‘ii’ brown is best counted as a five wave pattern to the upside,

I have labelled it wave ‘1’ pink.

The price broke 1300 today and immediately dropped, this could be a corrective decline in wave ‘2’ pink.

If so, the price sould decline in three waves,

And wave ‘ii’ must complete above 1267.

Given the size of the rally in wave ‘1’,

This projects an even bigger rally in wave ‘3’ once that begins.

The prospects for GOLD are looking very bright indeed if the current count proves correct.

For monday;

Watch for wave ‘2’ to complete and a very large rally in wave ‘3’ to begin.

That is it for me this week.

I wish you all a fun filled weekend![/vc_column_text][/vc_column][/vc_row]

[/_s2If]