[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Good evening to one and all.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

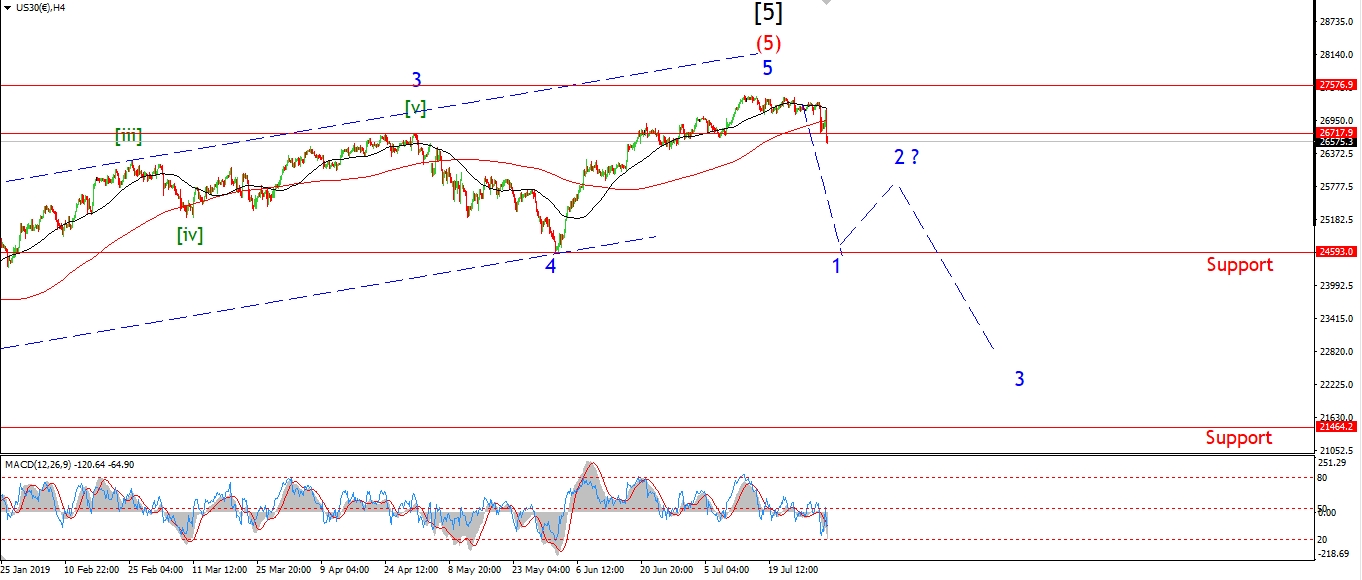

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

I have switched to the alternate count this evening after todays rally.

There was only a slight new high today by 13 points.

But that is enough to break the previous pattern.

The rally to date off the wave [i] low is still best viewed as a three wave correction in wave [ii].

The price is still completing wave (c) of [ii],

and when it does,

we should see a rapid decline again in wave [iii].

Wave [iii] will start with the formation of another lower high below 26000 with waves (i) and (ii).

At the moment it is a waiting game to see when wave (c) completes.

The price is holding below the 62% retracement level this evening,

And the minimum target for wave (c) has been met.

Tomorrow;

wave for wave (c) to top out.

We should see another spike lower to begin wave (i) soon.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

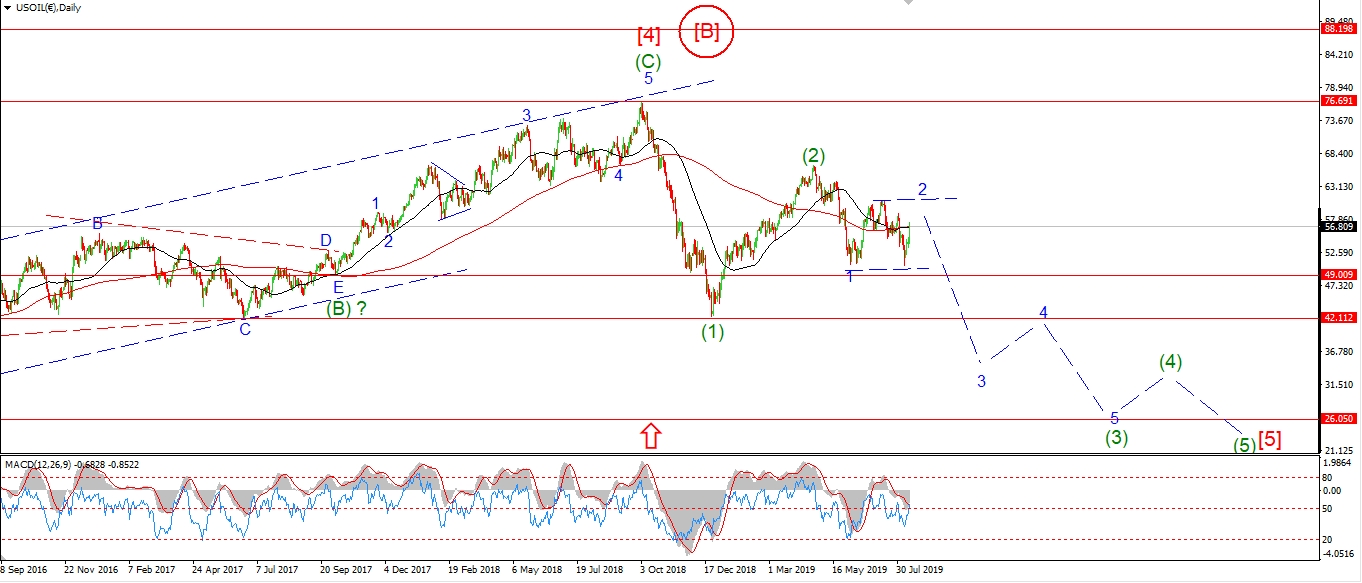

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Crude caught a serious bid today also.

This has not ruled out the current short term count,

but I think its worth considering the alternate count for wave '2' blue shown on the 4hr chart.

This views the recent decline as a large wave [b] of '2'.

And the current rise as wave [c] of '2'.

Once wave '2' completes,

it will lead to an acceleration lower in wave [iii].

A break of 58.67 will favor the alternate count.

Tomorrow;

Back to the current short term count.

If we see an equally sharp move lower tomorrow below 53.50,

that will favor the current bearish setup.

Watch for wave (ii) to hold below 58.67 and return lower in wave 'i' of (iii).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

Get instant access to more charts and analysis from tonights update.

See what's in store for the financial markets this week.

Check out Bullwaves Membership.

And stay ahead of the next BIG market move!

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]