(Above: the June 2015 federal reserve board meeting, to decide the fed interest rate.)

Did you ever want to know what way the FED Interest Rate decision will go next?

Did you ever think to yourself;

" now what made that room full monkeys come up with that interest rate decision?"

Do you believe in the almighty power of these Potent Director's of the economy?

Well I don't;

And in this article I will tell you why!

I suppose, all these niggling queries all boil down to one simple but pivotal question:

Does the FED control the interest rate, or; does the market in fact control the interest rate?

I am as far from a conspiracy theorist as you can imagine and I do not waste time meddling in intrigue and suggestion.

I deal in fact!

And the fact is;

The Fed exists for one simple reason, and it is not'

- to regulate inflation

- or maintain stable employment

- or keep a lid on the financial markets.

Even a fleeting glance at the anecdotal evidence will reveal otherwise, and the fed interest rates explained in one simple step!

In this article I will reveal to you:

- My take on the FEDs actual role in the this grand scheme.

- How I believe the FED "makes its interest rate decisions".

- What the future path for interest rate 'decisions' will likely be.

Read on, and I will reveal the man that lurks behind the curtain!

[vc_column][vc_custom_heading text="TOP ARTICLES!" font_container="tag:h2|text_align:center|color:%23dd3333" use_theme_fonts="yes"][vc_separator border_width="2"][vc_basic_grid post_type="post" max_items="8" element_width="2" gap="5" item="basicGrid_NoAnimation" grid_id="vc_gid:1489406338111-30fa07c6-e54a-7" taxonomies="19"][/vc_column]

The role of the FED.

Ever since the introduction of the Federal reserve system questions surrounding it loyalties have reverberated through political, and public spheres.

To me, there is no question as to whom the FED serves!

The Federal reserve has one simple role in life,

that is;

To ensure that the operations of the U.S Government are fully funded at all times by funneling cash from the economy to the treasury.

Nothing else, it is that simple!

If you look at all the FED's historical decisions through this lens, it will become clear that all the FED wants to do is funnel more and more of your cash to the Government.

I mean, it was instituted by government right?

What else do we need to know, It was given its veil of independence to put us off the scent as it were.

You may rightly ask,

then why does the FED buy treasuries on the open market if its not to give cash to the banks?

And the answer is:

So that the very same banks can re-invest that cash in government securities, thereby ensuring a steady flow of your cash to the Government.

You might also ask, well why does the FED buy so much mortgage backed securities if not to prop up the banks and give them free cash?

Well My argument would be, look at the data,

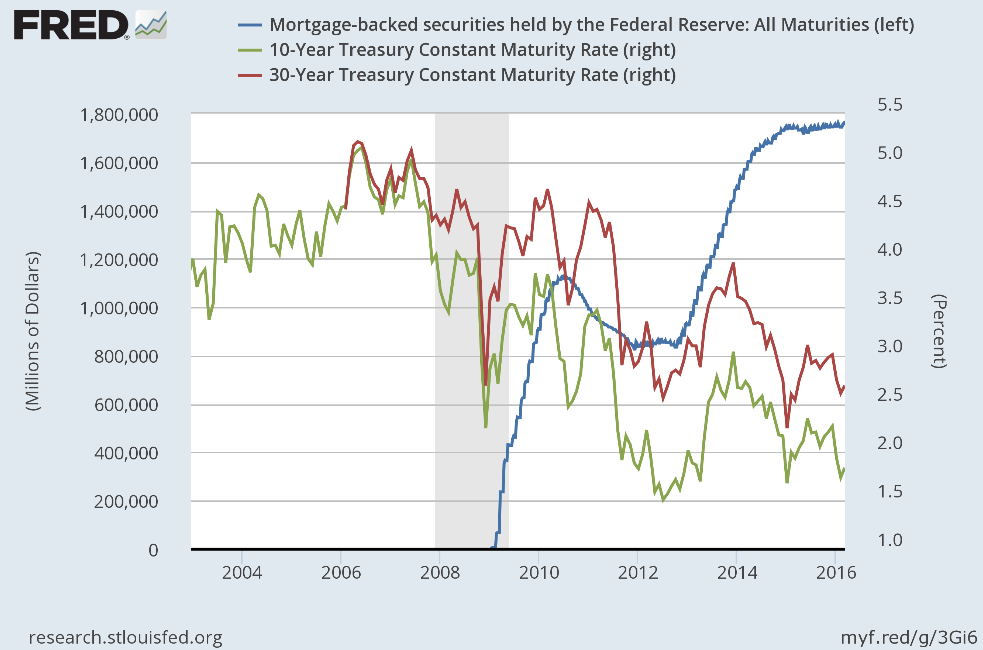

What happened to the 30 year treasury rate immediately before the FED commenced buying mortgage backed securities? The chart below might answer that. rates dived throughout 2007 and 2008 and this is fine by the government, cheap debt.

Then in early 2009 rates jumped from 2.5% to 4.5% in a matter of months, this presented a very serious problem for THE MAN!

Cheap debt was drying up, now how to we liquefy the treasury market and ease pressure in one easy stroke, well buy mortgage backed securities of course. and as soon as it was announced rates on 10yr and 30yr treasuries came back under the boot! and as soon as rates start falling, the MBS balance drops!

Notice the same phenomenon in 2012. rates spike, MBS purchases commence, then rates come back in line again!

The fact is that longer maturity treasury debt is in competition with the mortgage market and the government needs to attract investors to the market.

Keep in mind that the rates moved First then the FED moved after, this is a common theme in this game.

Does the FED 'decide' the interest rate, or is the decision made for them?

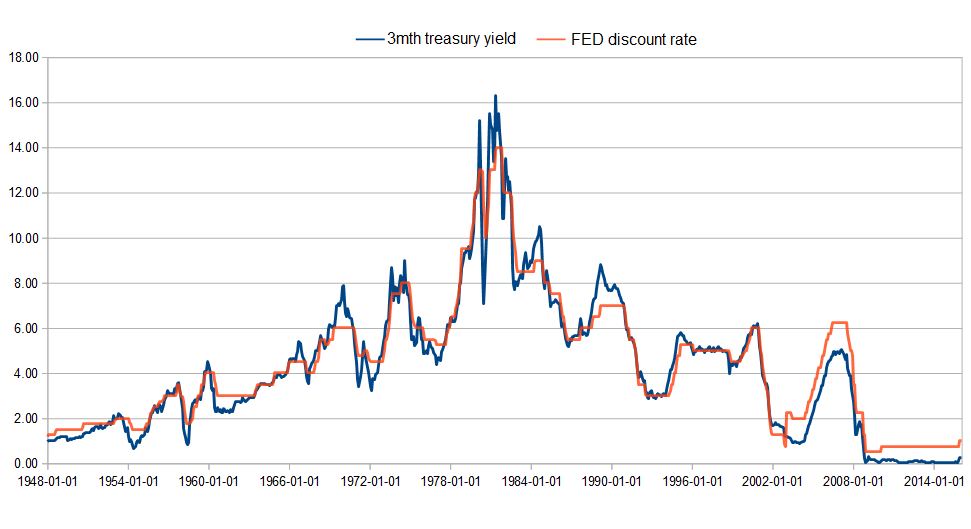

Below is a chart comparing the 3 month treasury yield to the fed interest rates history.

They do look very similar.

DO THEY NOT?

You might notice that on most every occasion of a cyclical change in the fed funds rate the 3mth treasury moved months BEFORE HAND.

The reason I point this out is because the FED is being led by the Market not the other way around, again, the rates move first.

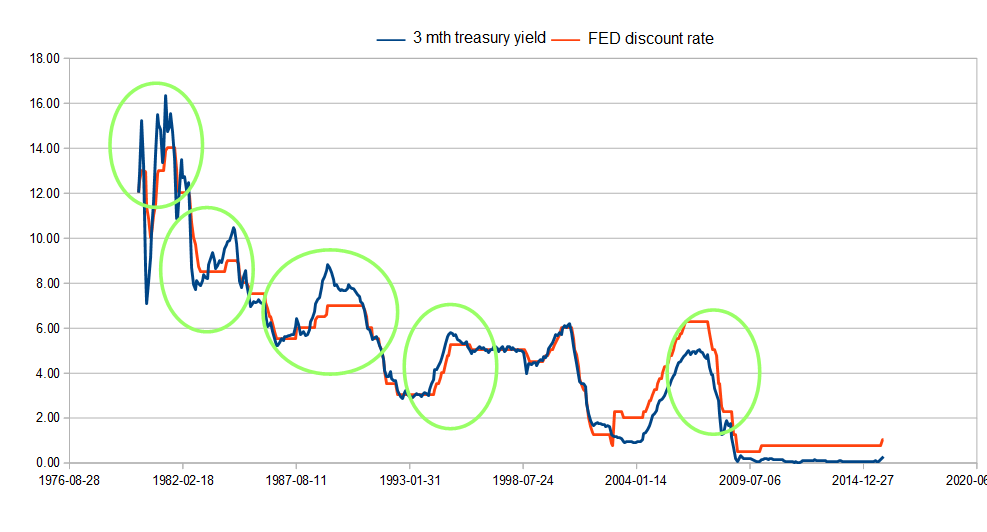

Below is a closer look at the same chart.

The data begins in 1980.

It is plain to see that the 3mth treasury is leading the way every time. I have highlighted some prime examples of the leading nature of market rates ahead of the fed interest rates.

I believe the main information that the Board of governors of the FED look at when they meet every month is the hourly chart of the 3mth treasury, why make the job harder than it needs to be

So, what's My fed interest rates forecast?

Well, what does the last year of action in the 3mth treasury bill market tell us for the future fed interest rates?

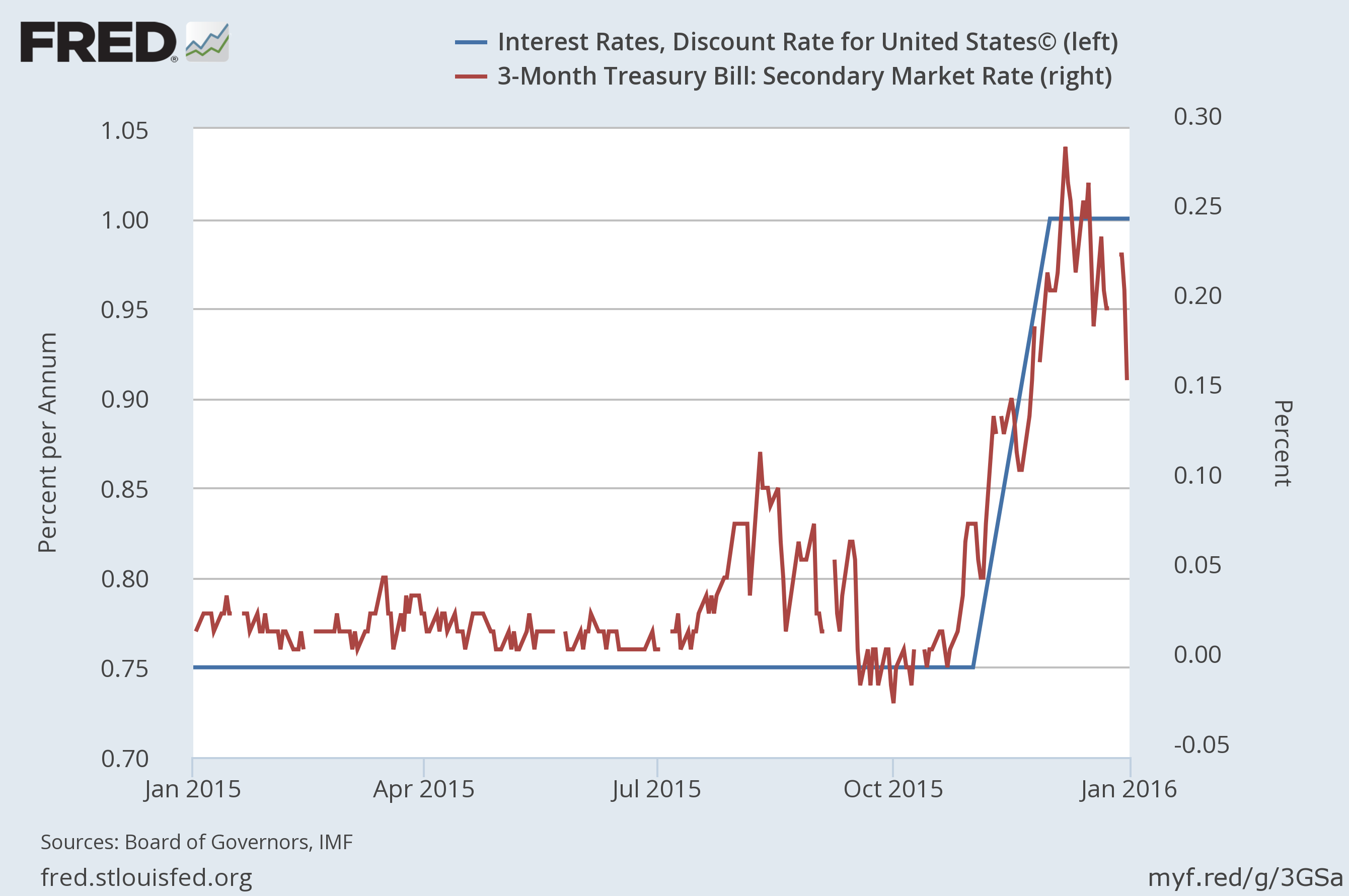

In December 2015 the federal reserve board raised the discount rate to 1.00% from .75%, a rise of 25 basis points.

This action was only taken after two spikes in the yield of the 3mth treasury bill. the first of 10 basis points, the next of 25 points which happened throughout the preceding month.

As I stated earlier, the market moves first. the fed follows later.

Why does this happen you ask?

The discount rate is the rate charged by the Federal reserve to eligible institutions for short term borrowings for liquidity purposes. The FED must alter the cost of borrowing from the FED with respect to the cost of borrowing of the government.

Meaning, it must not be getting cheaper for banks to borrow from the fed as it is getting more expensive for the government to borrow in the market.

If you want to know what direction that rates are likely to go;

first look at the 3mth treasury yield. the answer lies there.

What can you learn from this article?

There are a couple of points to take from this article.

- Interest rates move in cycles from high to low and back to high again.

- These cycles last about 7 years on average.

- Even though they might try, these cycles are largely beyond the control of the FED.

- The FED's decision to raise or lower the fed interest rates is based on the price action in the 3 month treasury bill market.

and finally,

- The current fed interest rates cycle is pointing higher and may have already turned the corner.

In my mind we have reached another one of those nasty cyclical turning points in rates, and the chart is pointing upwards for yields in the longer term.

The FED knows this, and may try to fight it but they will lose and, in the end, will have to follow the charts just like the rest of us!