Good evening folks and the Lord’s blessings to you.

EURUSD

EURUSD 1hr.

I am going to test a new count for EURUSD tonight.

Given that the action has not advanced into the rally I was expecting,

I think it is time to look at an alternative.

It is best viewed on the 4hr chart.

We have a long and drawn out sideways range that can be viewed as a triangle correction at this weeks highs.

I have labelled this wave (iv) of [c] of ‘2’.

Wave (v) will carry the price back below 1.0100 again in this scenario.

and from there I will look for a turn higher again to begin wave [iii].

Tomorrow;

Watch for the high at wave (iv) at 1.0513 to hold.

Wave ‘i’ of (v) should drop in five waves off that level.

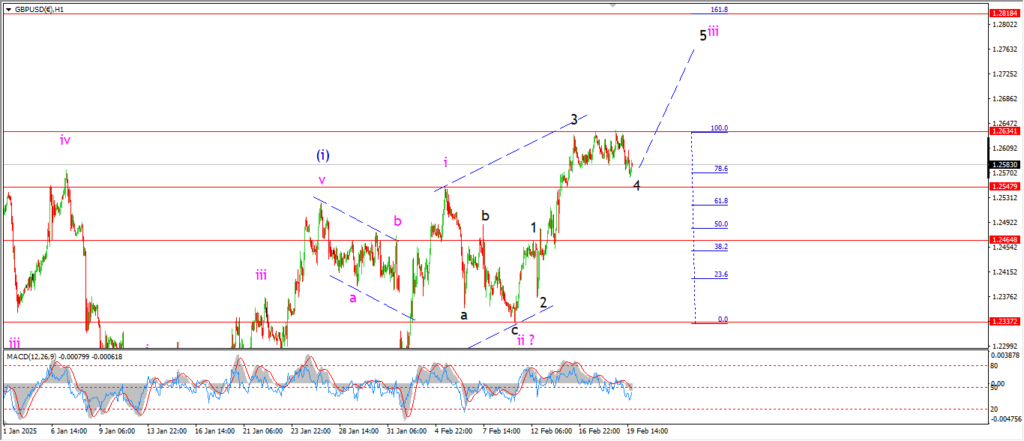

GBPUSD

GBPUSD 1hr.

Cable is still moving in line with that possible wave ‘iii’ rally.

the price is holding in a corrective formation in wave ‘4’ of ‘iii’ today.

and if we see a break back above 1.2650 again that will favor the wave ‘5’ of ‘iii’ idea.

this count will remain valid as long as the wave ‘1’ high holds at 1.2468.

Tomorrow;

Watch for wave ‘5’ of ‘iii’ to push higher again towards 1.2800.

The price should hold above the wave ‘i’ high at 1.2548.

Wave ‘1’ black must hold at 1.2465.

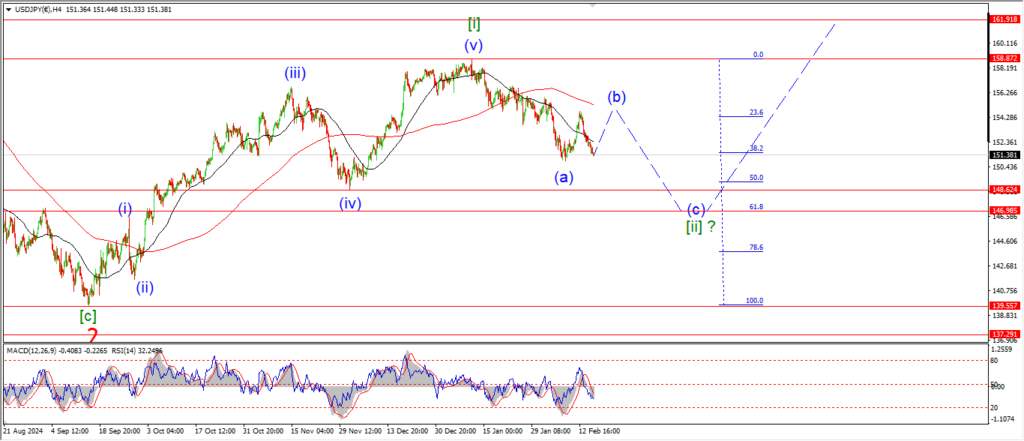

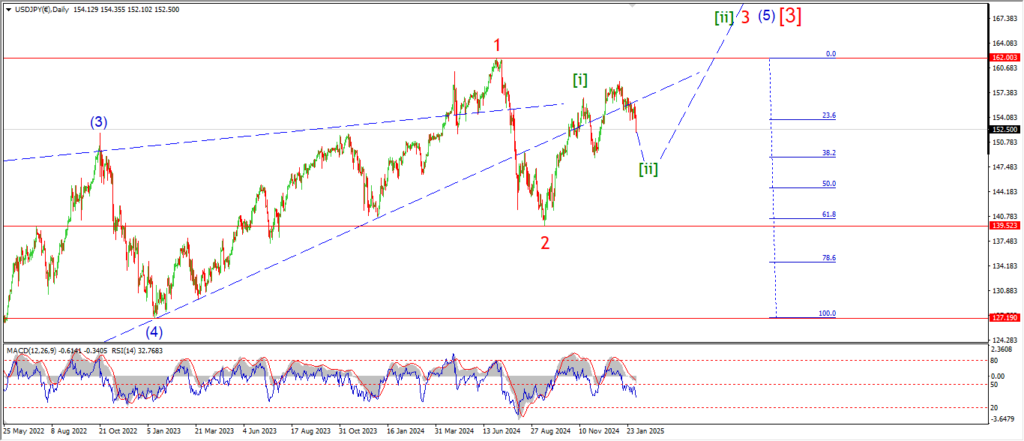

USDJPY.

USDJPY 1hr.

I am seriously considering the alternate for USDJPY also tonight.

I think it is worth taking a look at the possibility here if this pattern is correct.

The alternate count involves a three wave pattern higher into a possible wave (b) of [ii] as seen on the 4hr chart.

The price has dropped again today towards the invalidation level at 150.93.

This action favors the alternate count at least.

Wave ‘b’ should form a low soon around that low.

and then a turn higher into wave ‘c’ will rally back to the 155.00 level to complete a correction in wave (b).

Tomorrow;

Watch for wave ‘b’ of (b) to complete near that 150.93 low.

A rally above 152.00 again will suggest wave ‘c’ is underway.

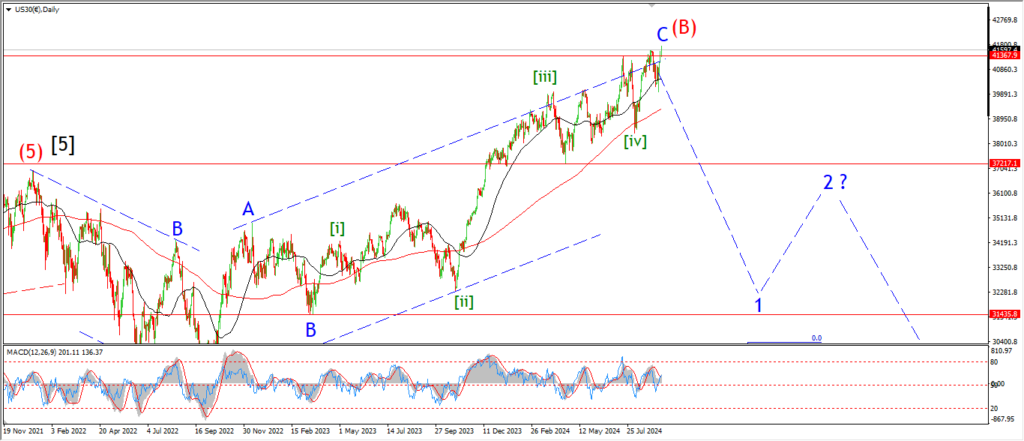

DOW JONES.

DOW 1hr.

The sideways move in the DOW continues today with the range getting tighter and tighter by the day.

This pattern will break down before the end of this week I suspect.

And the next move will dictate which pattern is in control here.

It is very easy to expect a rally out to a new high from here that will trigger the alternate count for wave [v] of ‘C’.

But I will just wait and see how this plays out.

Tomorrow;

If the price falls below 44000 again that will rule out the triangle pattern and may even open up the main count again for wave (iii) down.

GOLD

GOLD 1hr.

Gold has created a triple top over the last week and the pattern remains extended in wave [b].

We have a serious momentum top in place on the Daily chart.

The 4hr chart shows a momentum reversal underway.

And after a long rally,

this market is searching for a reason to see now.

There are so many steps higher within the recent rally that the internal wave count can be viewed in many different ways.

Wave ‘v’ of (c) is shown as the main extended wave in the hourly chart.

And the action this week can be viewed as a running flat followed by a final fifth today.

Tomorrow;

A drop below the recent trading range will signal wave ‘i’ of (i) of [c] is in play.

CRUDE OIL.

CRUDE OIL 1hr.

Wave ‘ii’ spiked again today with a push up to the 78.6% retracement level in wave ‘c’ of ‘ii’.

The count for wave ‘ii’ is still valid at the moment.

But I will need to see a drop back off the highs pretty soon to signal wave ‘iii’ down is underway.

If the price breaks 73.40 again that will trigger the alternate count for wave [ii] green.

tomorrow;

Watch for a drop off again to begin wave ‘iii’ of (iii) lower.

A break of 70.00 again will suggest wave ‘iii’ is underway.

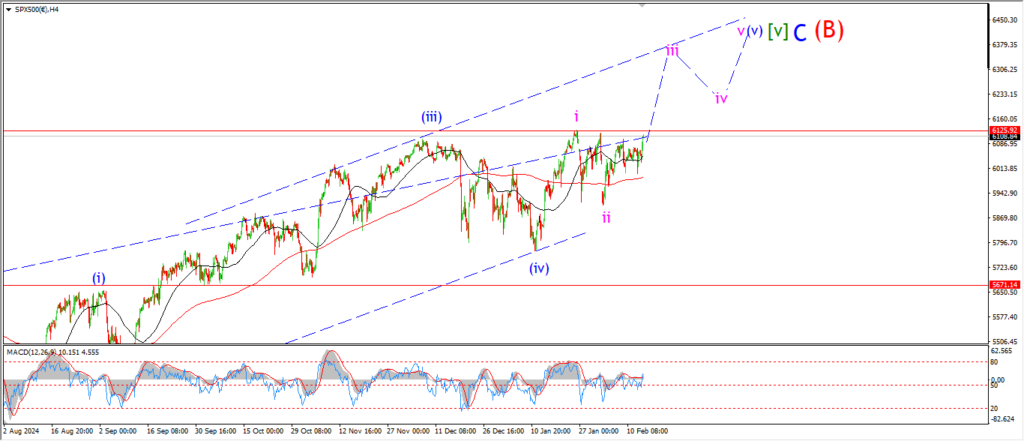

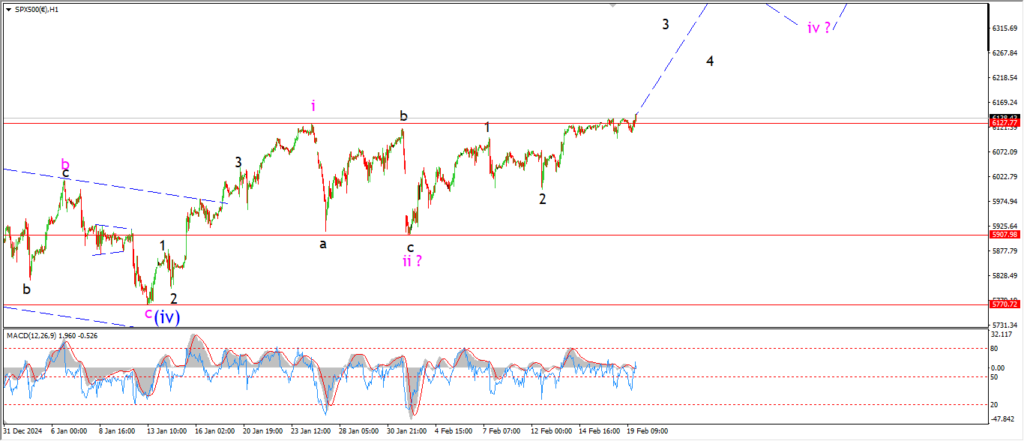

S&P 500.

S&P 500 1hr

The Market continues to hang around at the highs this evening with very little action at all to speak of.

Th main count has not been proven yet,

and it does require a rally into wave ‘3’ of ‘iii’ soon.

That has not happened.

We have two days left this week to get this rally going,

and if it does not appear I may be forced to rethink this new wave count again.

Tomorrow;

A new rally must now take place in wave ‘3’ of ‘iii’ of (v) to confirm this pattern.

SILVER.

SILVER 1hr

Silver has been spiking higher and then lower for most of this week,

and still we hare holding at a lower high in a possible wave ‘2’ black.

Wave ‘3’ of ‘i’ must now turn lower again.

Wave ‘3’ should fall into support at 31.20 again.

and five waves down in wave ‘i’ is expected to break below that previous wave ‘iv’ low.

Tomorrow;

Watch for wave ‘2’ to hold below the highs.

Wave ‘3’ of ‘i’ must continue lower as suggested.

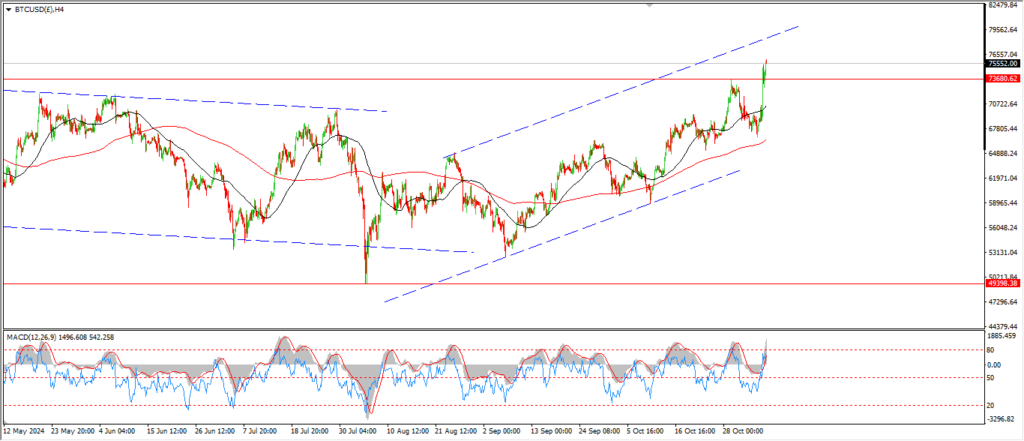

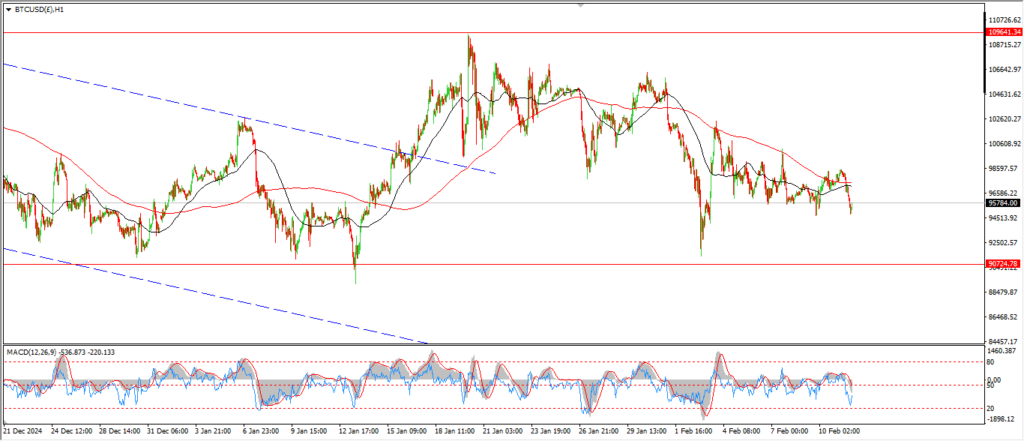

BITCOIN

BITCOIN 1hr.

….

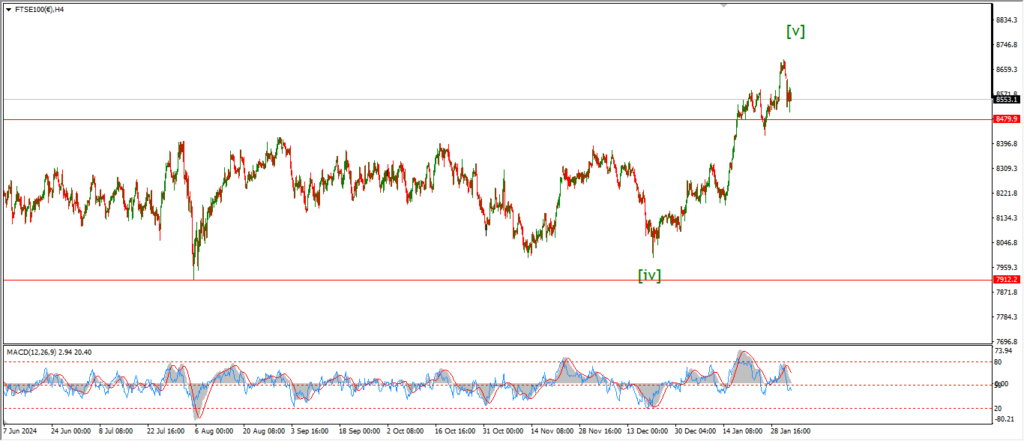

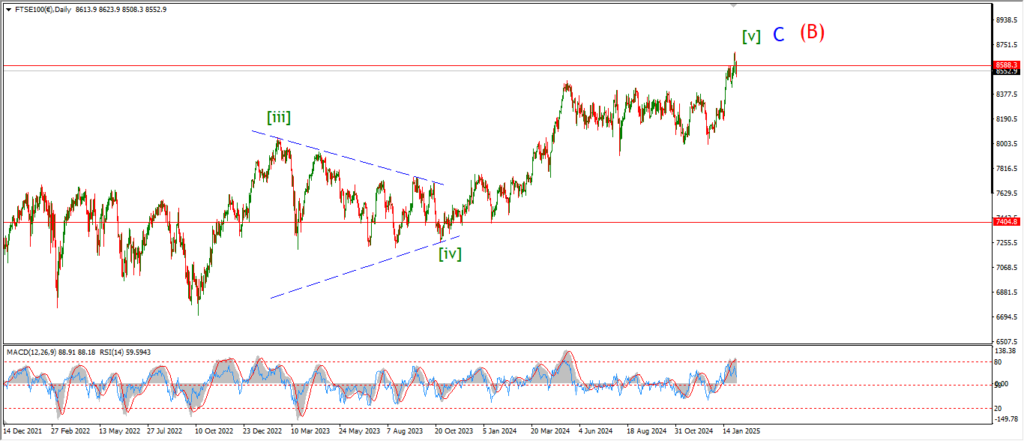

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

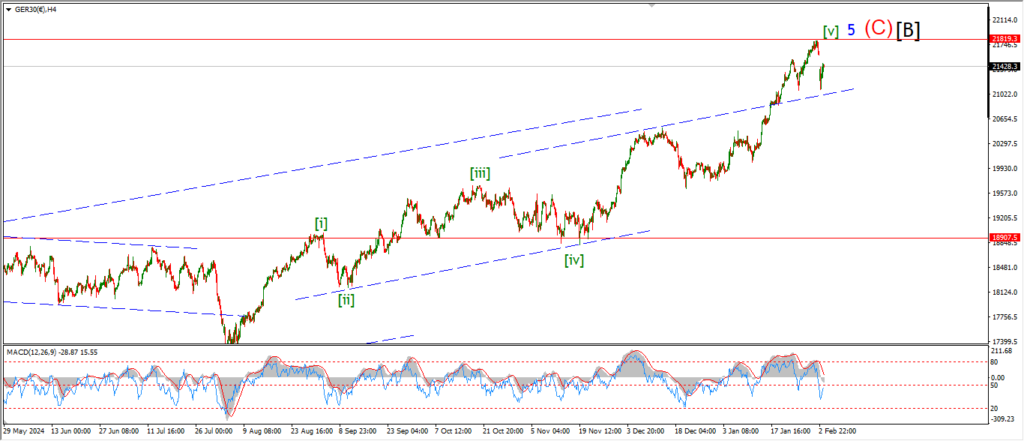

DAX.

DAX 1hr

….

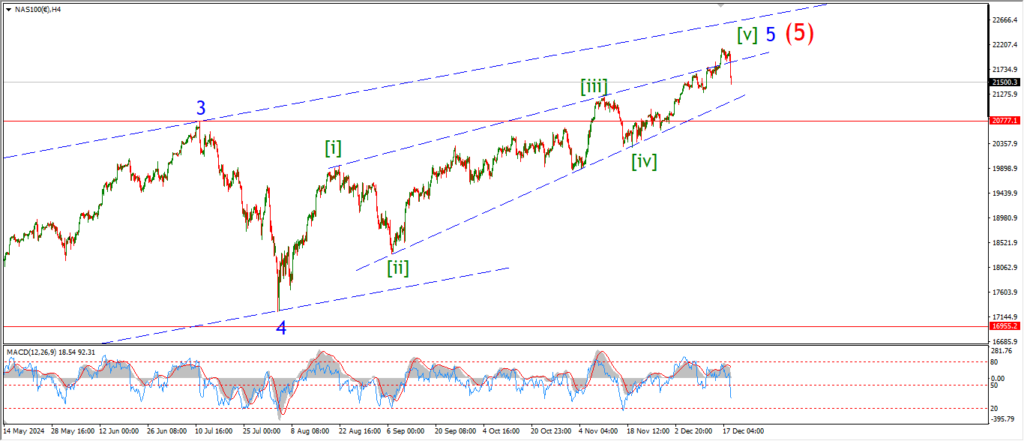

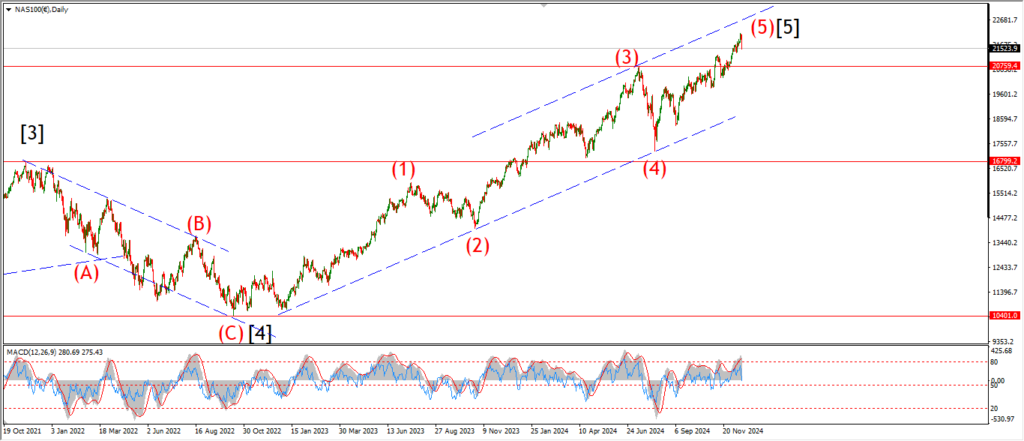

NASDAQ 100.

NASDAQ 1hr

….