Good evening folks and the Lord’s blessings to you.

A new week starts and also a new year comes around this week also.

The market will be closed on Wednesday so there won’t be an update that night. But this update should give you an idea of where we stand before Monday.

I will see you again on Monday.

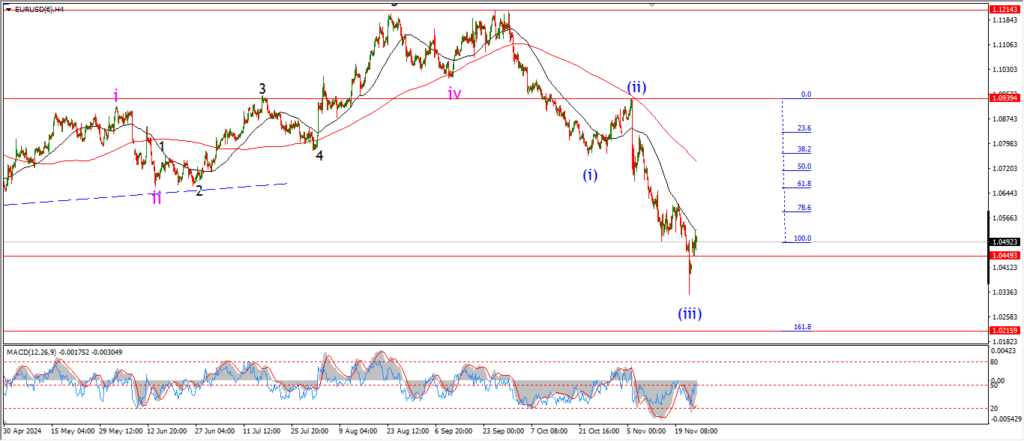

EURUSD.

EURUSD 1hr.

I am still tracking the possibility of a rally in wave ‘c’ of (iv) and that continues into next week.

Wave ‘2’ of ‘c’ should hold above the recent lows and rally in five waves from here to hit 1.0628.

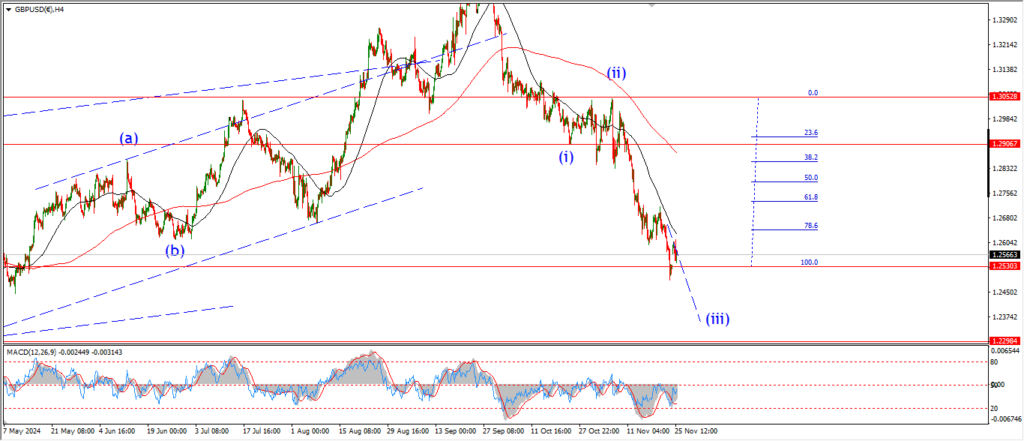

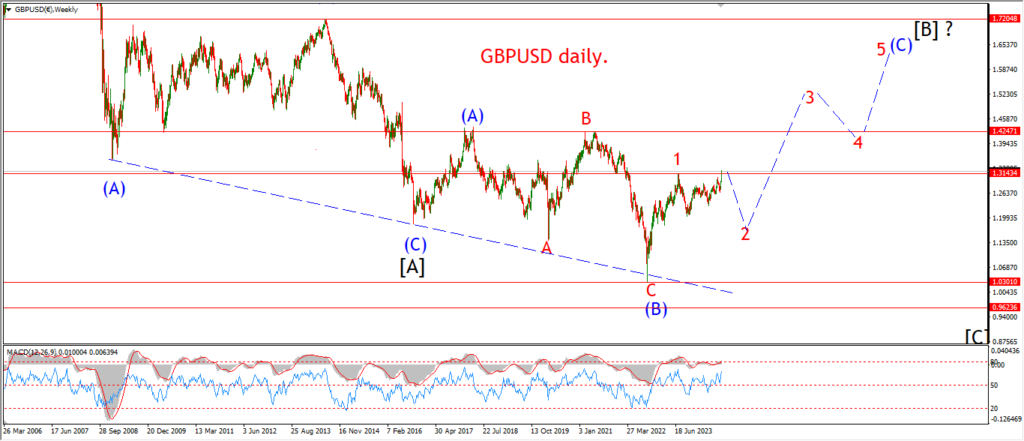

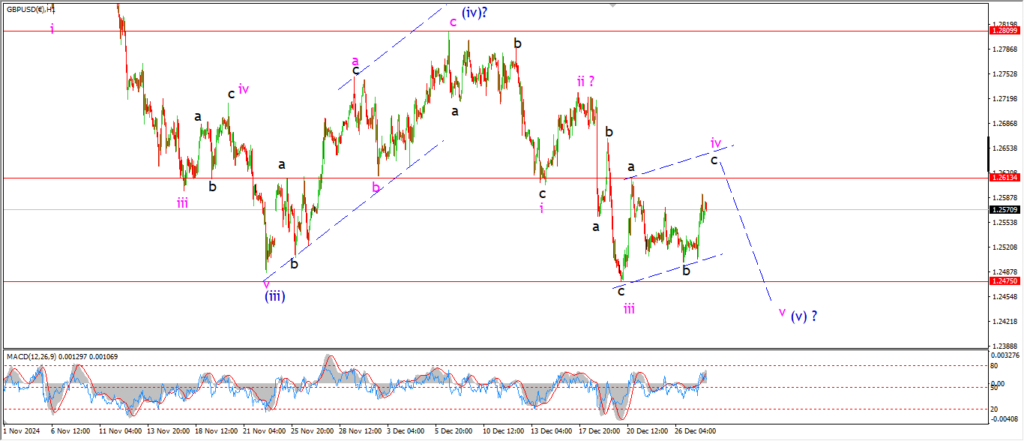

GBPUSD

GBPUSD 1hr.

A three wave pattern higher in wave ‘iv’ is on track in cable.

Wave ‘c’ of ‘iv’ will top out with a break of 1.2613.

and then the price will turn down again into wave ‘v’ of (v).

wave ‘v’ pink will take the rest of the week and bottom out with a low at 1.2400 again.

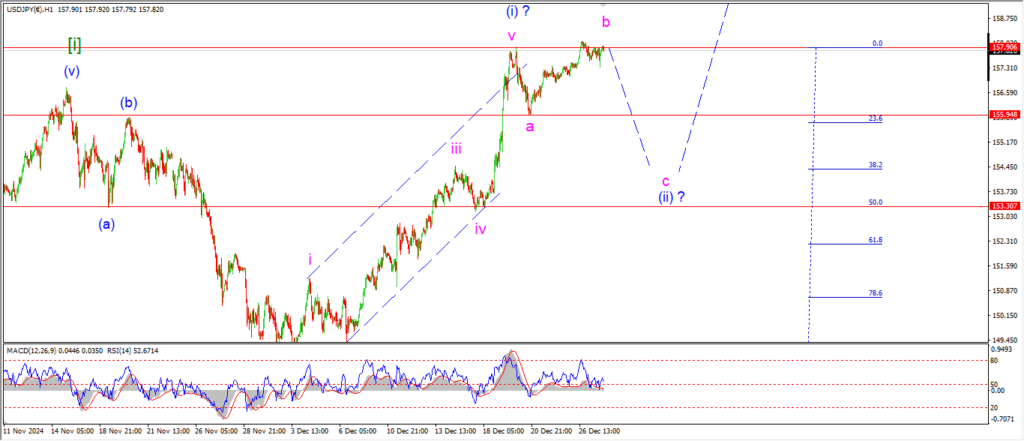

USDJPY.

USDJPY 1hr.

I still like the idea of a three wave correction into wave (ii) as shown.

The price pipped to a small new high above wave (i) on Friday,

but that can be viewed as wave ‘b’ of an expanded flat correction.

if that is the case,

then wave ‘c’ of (ii) will fall from here and break 155.90 at a minimum.

The 50% retracement level lies at 153.00 so that gives a good target range for this correction to complete.

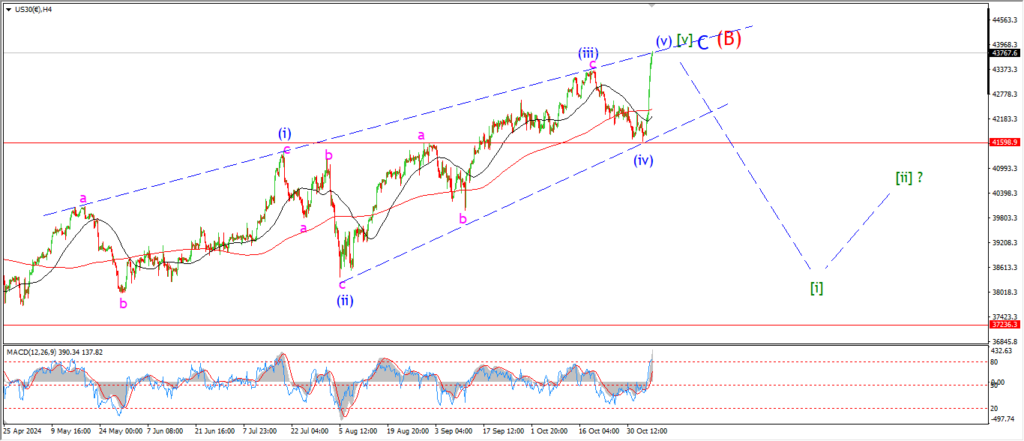

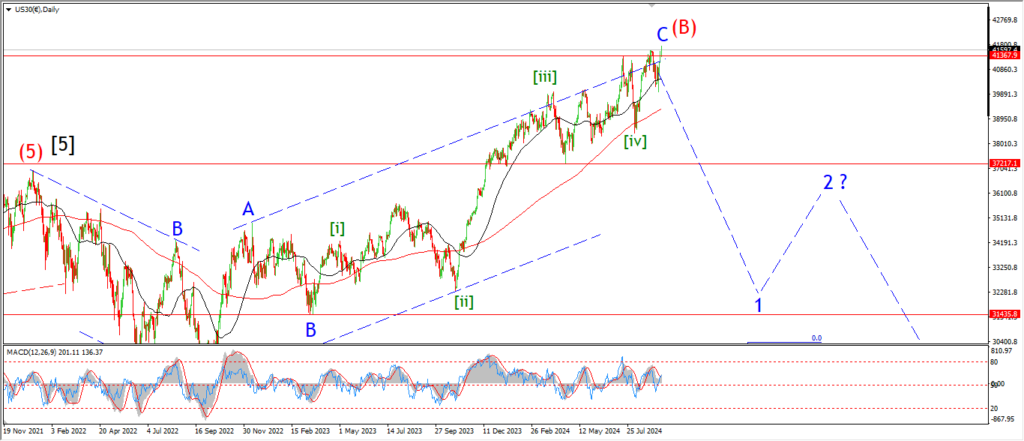

DOW JONES.

DOW 1hr.

A turn lower on Friday did fit the picture here for wave (i) down.

But I am still not convinced of the overall pattern yet.

The price has completed three waves up in wave ‘iv’.

and wave ‘v’ down is now left to complete this pattern.

There is a few ways we can interpret this overall pattern,

I obviously prefer the bearish idea!

but that idea has not been confirmed yet.

If we see a solid down week ahead,

then I will be convinced.

So we will see.

GOLD

GOLD 1hr.

Gold has failed to move higher into wave ‘c’ of (b) and actually fell again on Friday.

The low of wave ‘b’ has not been broken yet at 2583,

but if that does break,

then I will be looking at the possibility that wave (b) is already complete,

and wave (c) is underway.

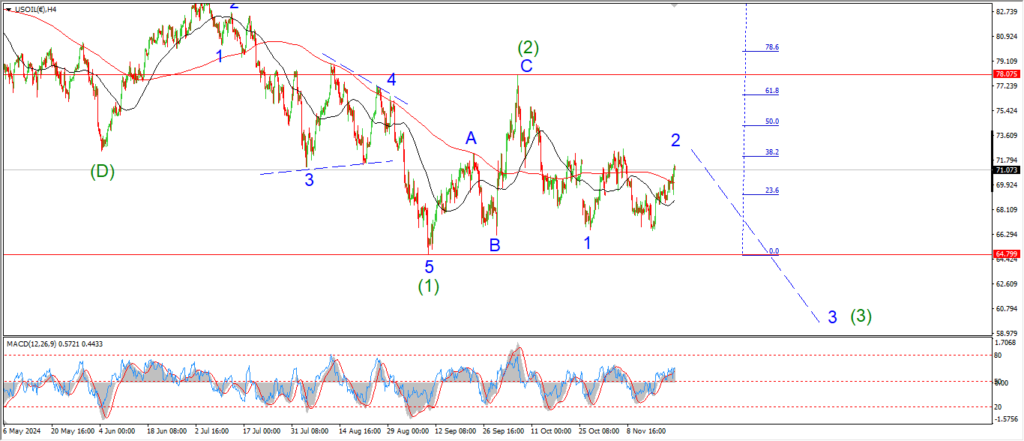

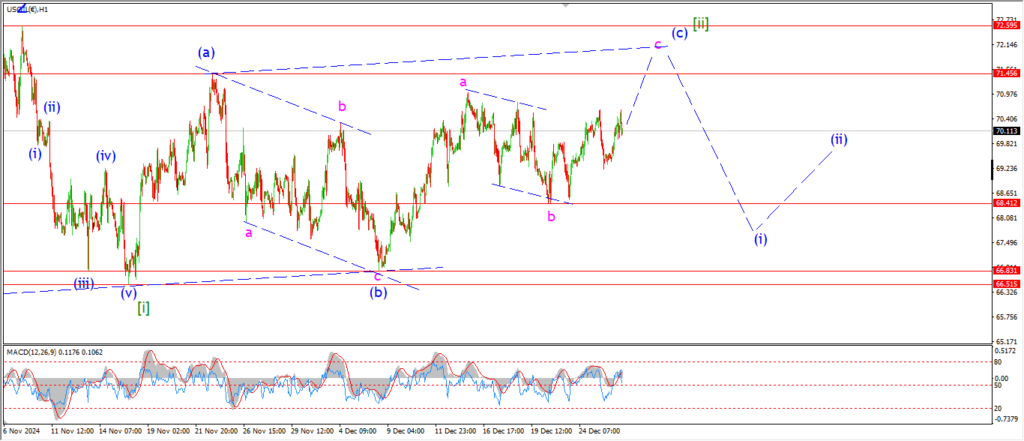

CRUDE OIL.

CRUDE OIL 1hr.

72.00 seems to be the greatest obstacle in the world to get over.

the market has failed on several occasions now to hit a new high in wave ‘c’ of (c).

And that does bring this wave count in wave [ii] into question.

A rally back above 72.00 will finish wave (c),

and then I will look lower again into wave [iii].

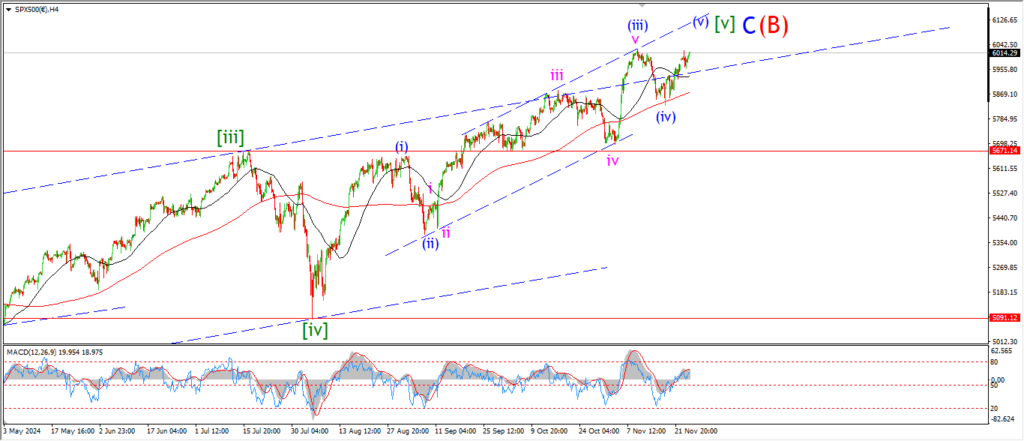

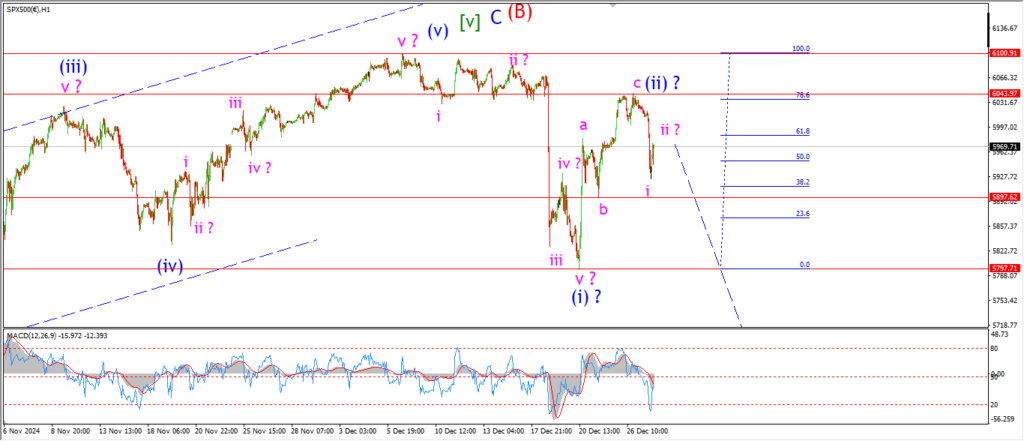

S&P 500.

S&P 500 1hr

There is a real question here with this pattern now.

did we just see the final farewell to the all time highs in wave (ii) blue.

the market completed three waves up and then dropped hard on Friday again.

The action has not confirmed wave (iii) down yet,

but,

we have a possible wave ‘i’ and ‘ii’ of (iii) in play here.

So,

if we get a follow through to the downside on Monday,

then wave ‘iii’ of (iii) is a real possibility.

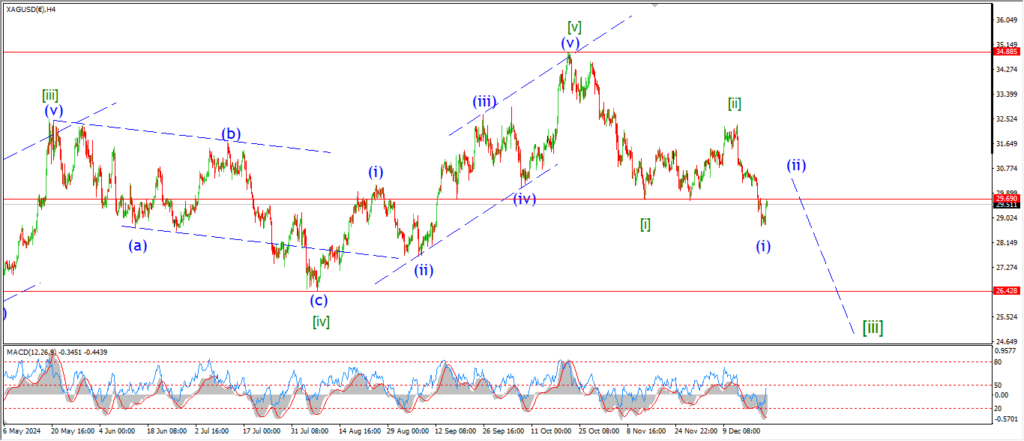

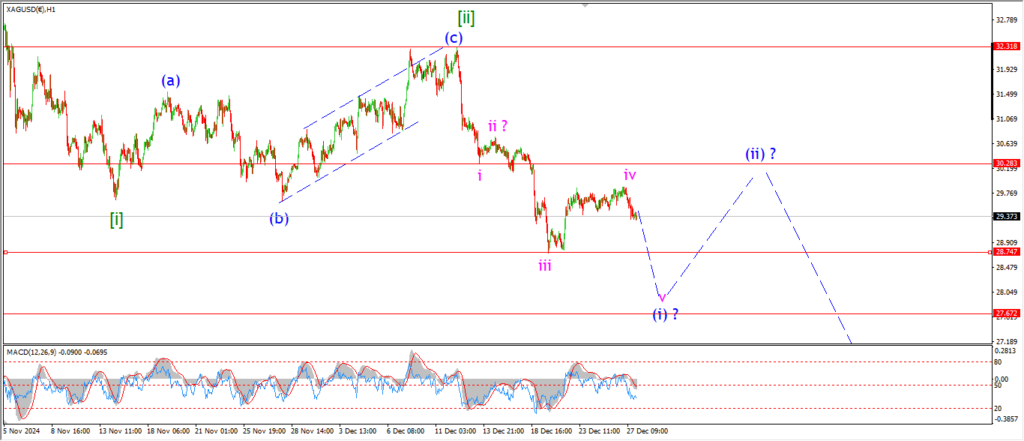

SILVER.

SILVER 1hr

I am looking at a drop off into wave ‘v’ of (i) now underway.

The price should break the wave (iii) low at 28.75 again early next week.

And a low in wave (i) should find a low near 28.00 again.

A lower high in wave (ii) will then build over the following days if this count holds up.

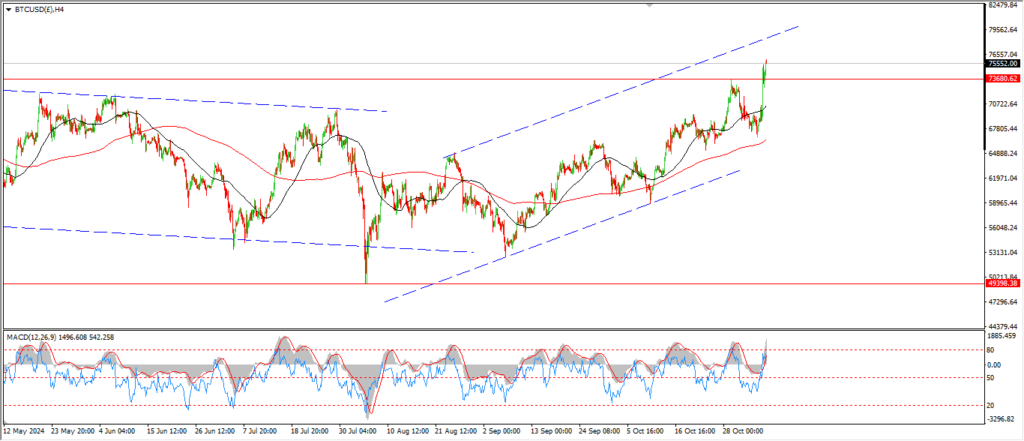

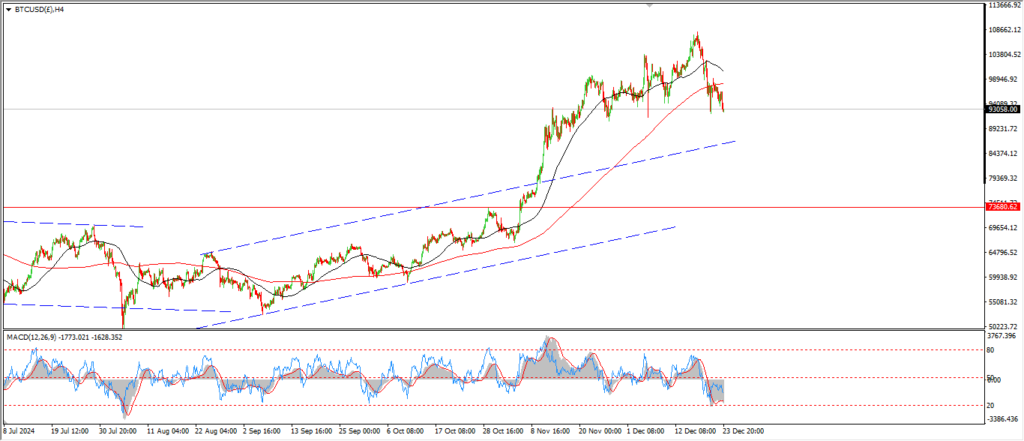

BITCOIN

BITCOIN 1hr.

….

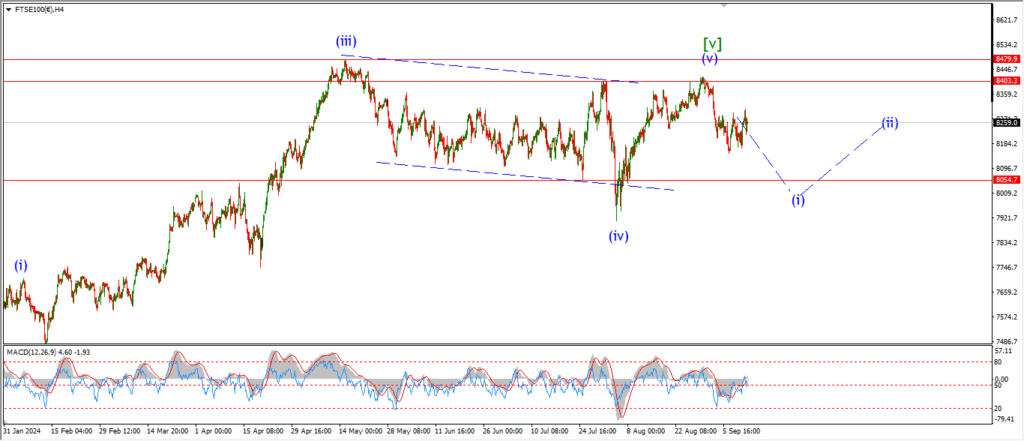

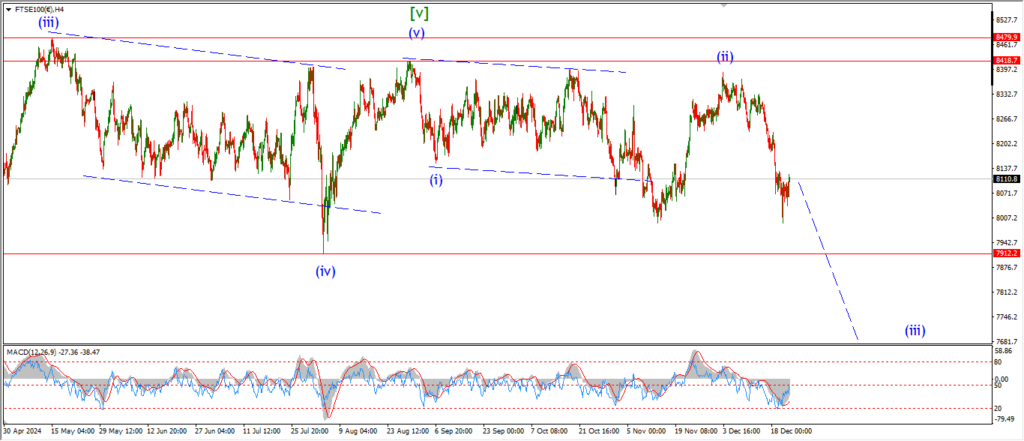

FTSE 100.

FTSE 100 1hr.

….

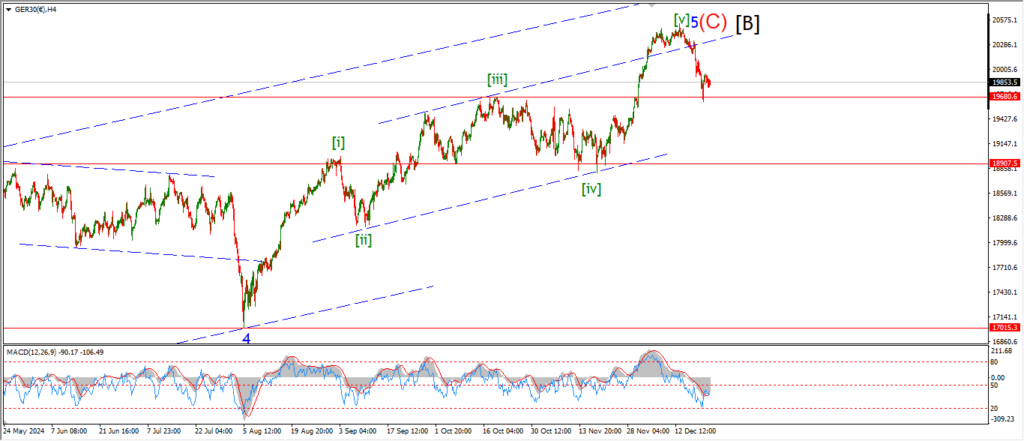

DAX.

DAX 1hr

….

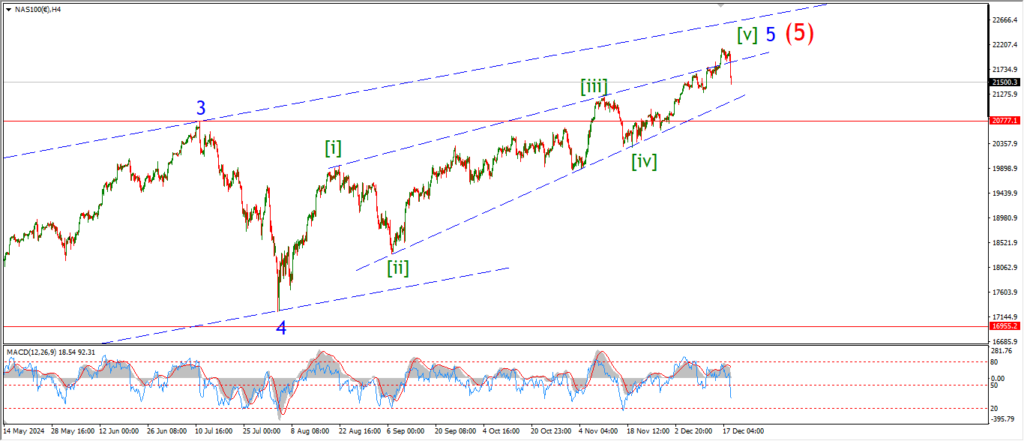

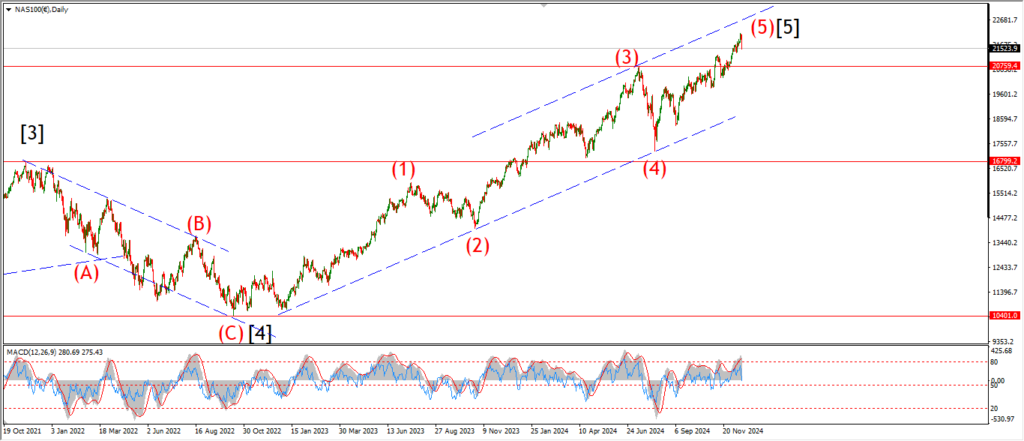

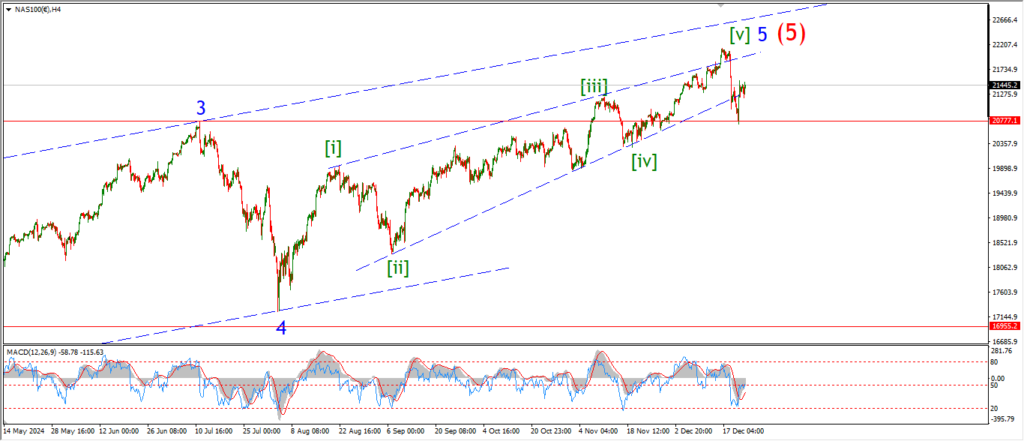

NASDAQ 100.

NASDAQ 1hr

….