Good evening folks and the Lord’s blessings to you.

Christmas week is ahead of us now, and I suspect the action in the market will be slim to non-existent overall.

The market is closed on Wednesday, and after that we can expect very little.

So, whatever will happen, will happen on Monday and Tuesday.

I will be taking a few days off this week, Most likely Tuesday through Thursday, and then back on Friday for a video and a chart round up.We will see how it goes.

So lets round up Fridays action.

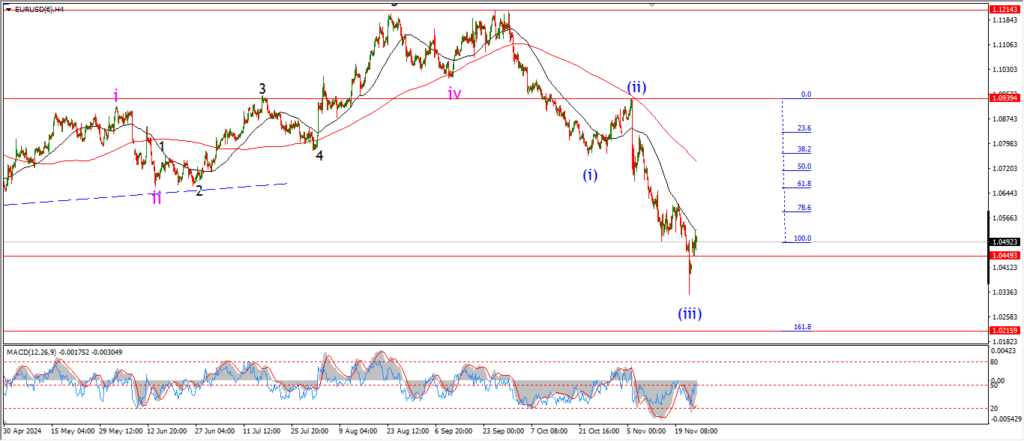

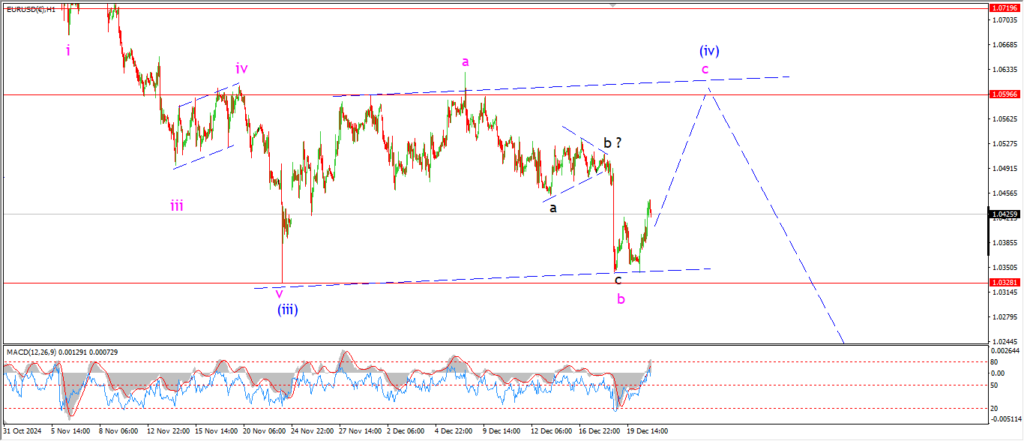

EURUSD.

EURUSD 1hr.

A small rise again on Friday keeps this main count active in wave (iv).

The price has only traced out three waves up so far off the wave ‘b’ low,

so I want to see a further rally over the coming days to confirm that wave ‘c’ is underway.

Monday;

watch for wave ‘c’ of (iv) to continue higher towards 1.06 to complete the correction and then I will focus again on wave (v) down.

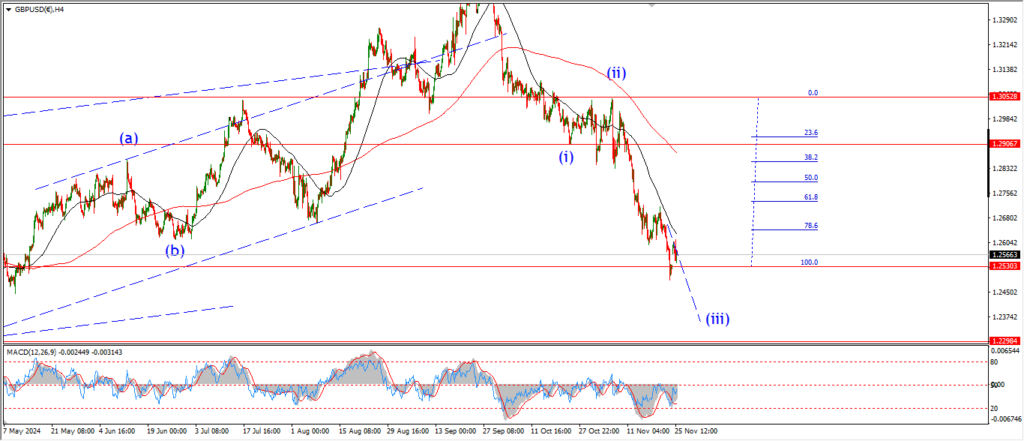

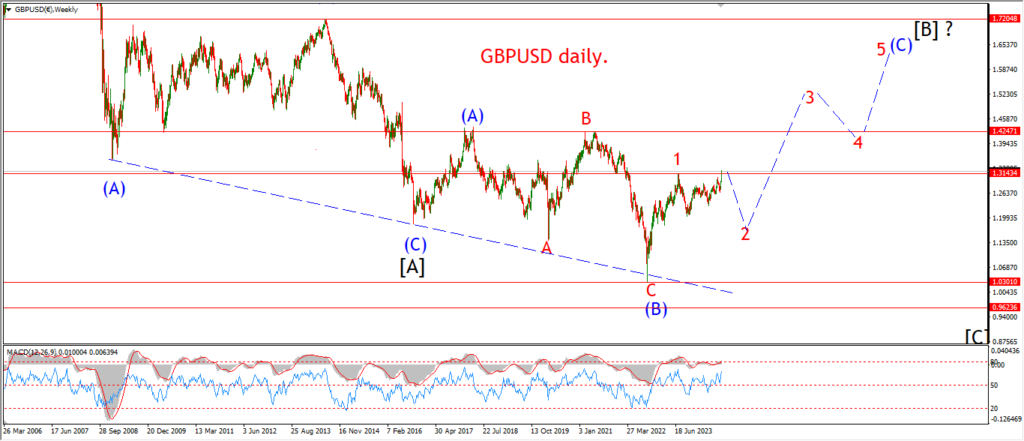

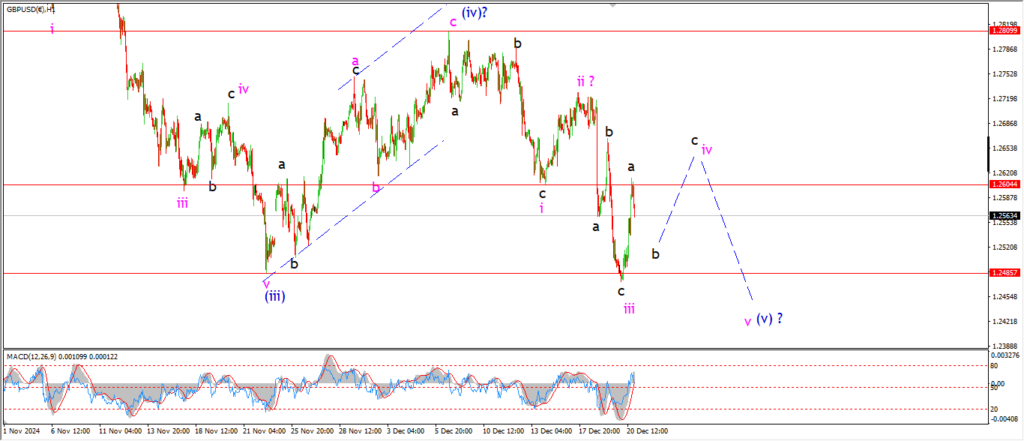

GBPUSD

GBPUSD 1hr.

Wave ‘a’ of ‘iv’ has pipped above the previous wave ‘i’ low at 1.2604 again which confirms the ending diagonal pattern in wave (v).

There is still more work to do here in this larger wave (v) pattern though.

Wave ‘iv’ must complete three waves up as shown,

and then wave ‘v’ must again fall in three waves to complete an ending diagonal in wave (v).

Monday;

Watch for this three wave pattern in wave ‘iv’ pink to continue as shown.

USDJPY.

USDJPY 1hr.

USDJPY has turned lower off a possible wave (i) high in this new bullish count.

I am now looking for a higher low to build in wave (ii).

Wave (ii) should hit a low near 153.27 at the 50% retracement level.

and that correction should take us towards the end of this week to complete.

Monday;

Watch for wave (ii) to fall in three waves as shown.

wave ‘b’ should form a lower high by midweek.

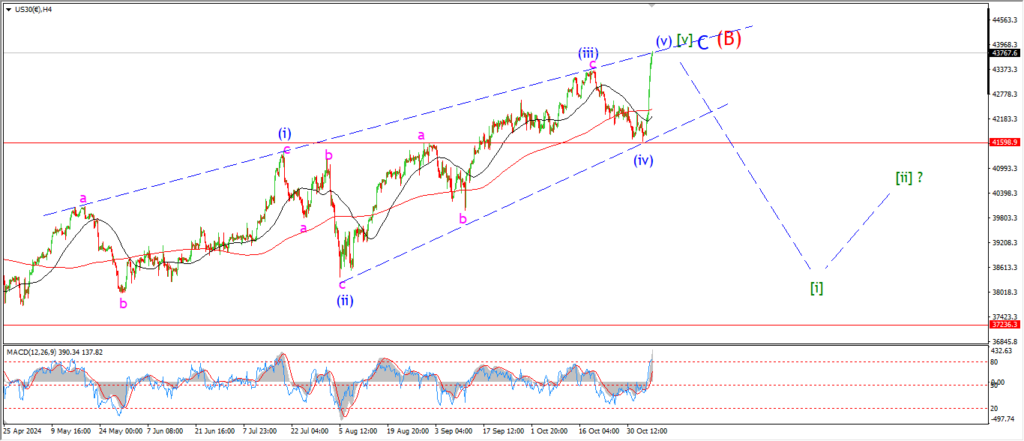

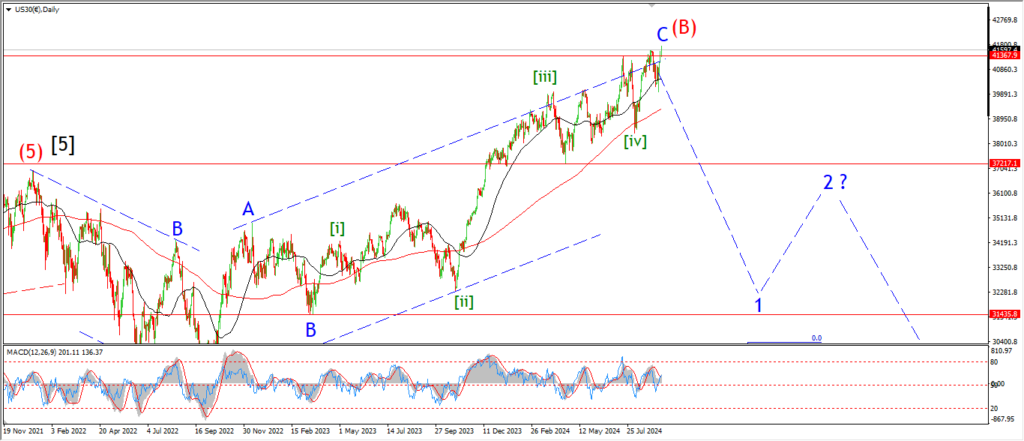

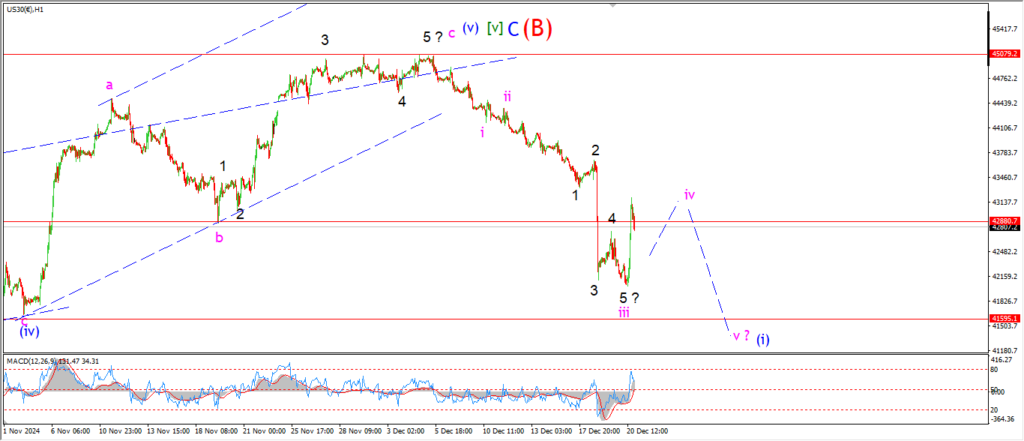

DOW JONES.

DOW 1hr.

The DOW made some interesting moves this week in favor of an impulse wave down in wave (i).

I am counting the pattern off the top as a five wave impulse now.

The market broke the first support level at 42880 at wave ‘b’ low.

This action gives a boost to the reversal idea.

If the market is finally turning here,

then we must see five waves down as shown.

Wave ‘iii’ may be complete at the recent low and wave ‘iv’ did rebound off that low on Friday.

Wave ‘iv’ has not completed a corrective pattern yet,

so that is the first thing to look for on Monday.

Later in the week I will be looking for a completed wave (i) down to boost the reversal idea overall.

Monday;

Watch for wave ‘iv’ to continue sideways overall early this week.

I don’t know what pattern will emerge for this correction.

so its a wait and see moment in this developing pattern.

GOLD

GOLD 1hr.

I must admit that the move higher off the wave ‘b’ low is a clear three wave pattern,

this action does suggest more downside is ahead.

And because of that,

the wave count for wave (b) is at risk now.

If the price rallies again early on Monday to break above 2666 again that will confirm wave ‘c’ and the main pattern.

Monday;

watch for the wave ‘b’ low to hold at 2583.

Wave ‘c’ must continue higher to break 2666.

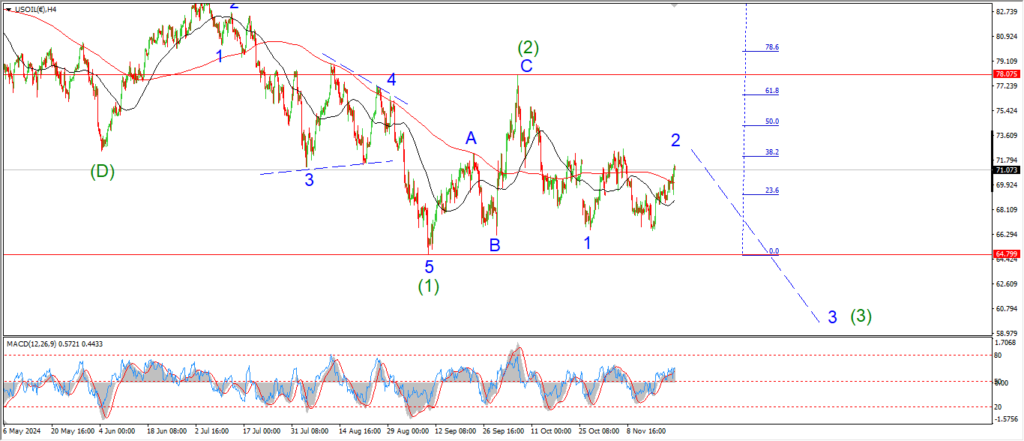

CRUDE OIL.

CRUDE OIL 1hr.

The action in crude for most of this week was corrective in nature,

drifting lower into the low at 68.40.

I am now looking at a possible complex correction in wave [ii] green.

With wave (c) of [ii] tracing out three waves up as shown.

The price bounced on Friday to begin wave ‘c’ of (c) of [ii].

And this rally must complete below 72.50 at the previous highs.

Monday;

Watch for wave ‘c’ to hit 71.45 to complete three waves up in wave (c) and wave [ii].

Later in the week I will be looking for wave (i) down to begin.

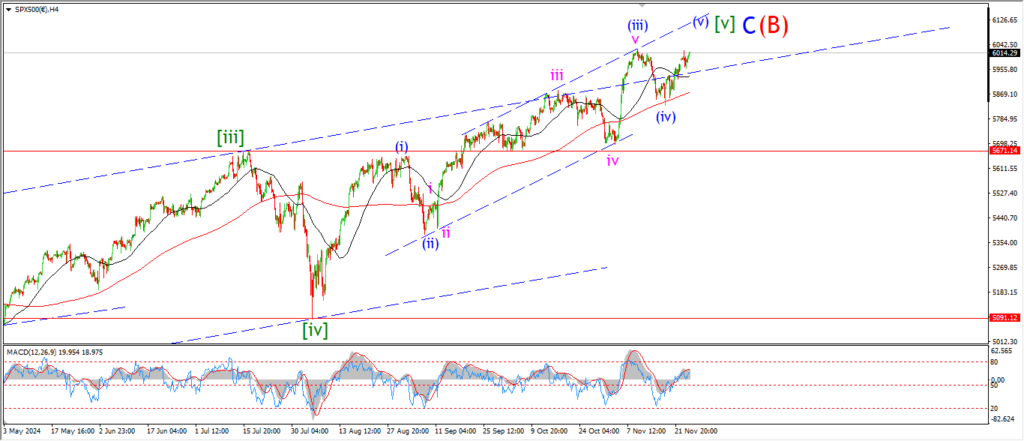

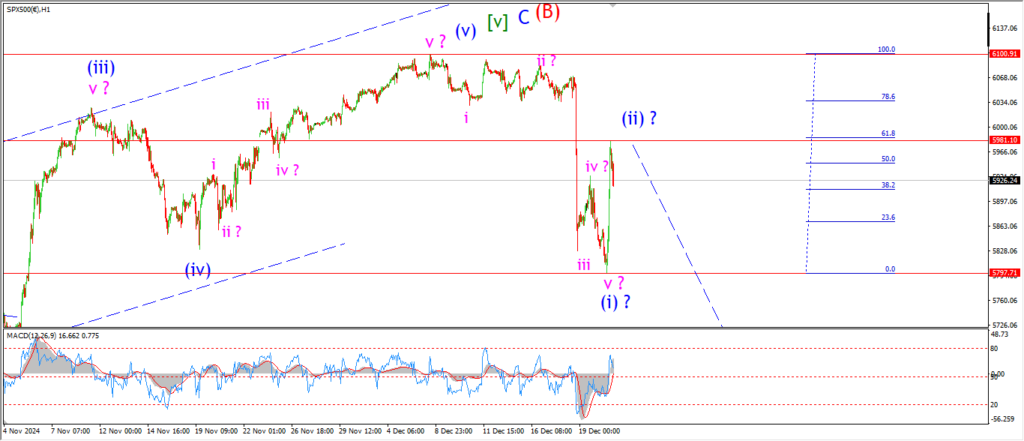

S&P 500.

S&P 500 1hr

The decline off the top in the S&P has a better five wave form overall than the pattern in the DOW.

So that is a vote in favor of the reversal pattern.

the rebound in wave (ii) is a little too impulsive to be honest.

So I am still on the fence here regarding the potential for a larger decline.

The high of the rally on Friday almost hit the 62% retracement level of the initial decline.

If the market turns higher again early this week,

then I will have to abandon this view I think.

Monday;

An early turn down will be favorable to the bearish pattern.

If wave (ii) is complete at Fridays highs,

then wave (iii) down must get going from here.

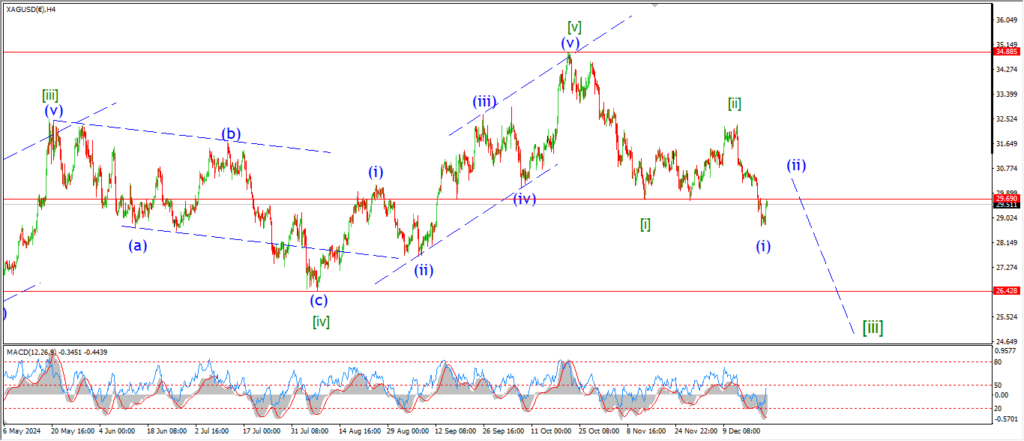

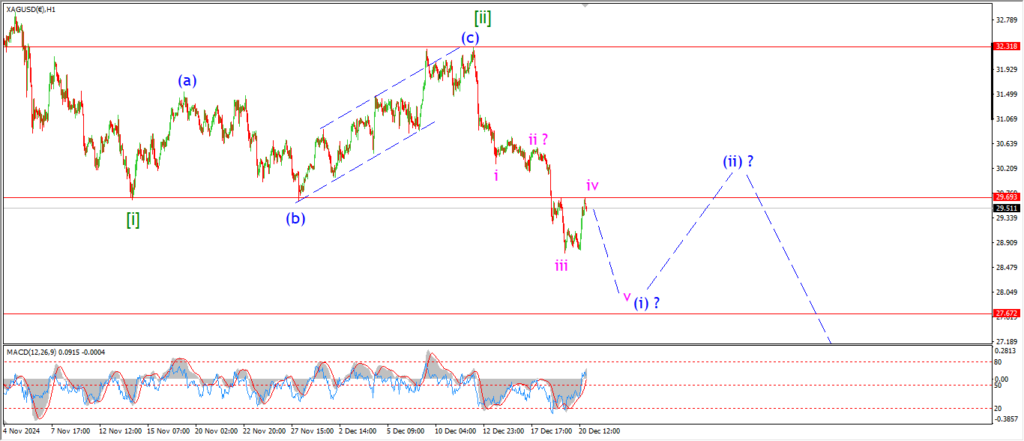

SILVER.

SILVER 1hr

The count in silver has been moved up by one degree today.

And now I am looking at wave (i) blue completing nearby.

Wave (i) and (ii) should create another lower high over the coming weeks,

and then a larger acceleration lower into wave (iii) can begin from there.

Monday;

watch for wave ‘v’ of (i) to drop once more towards 28.50 to complete five waves down.

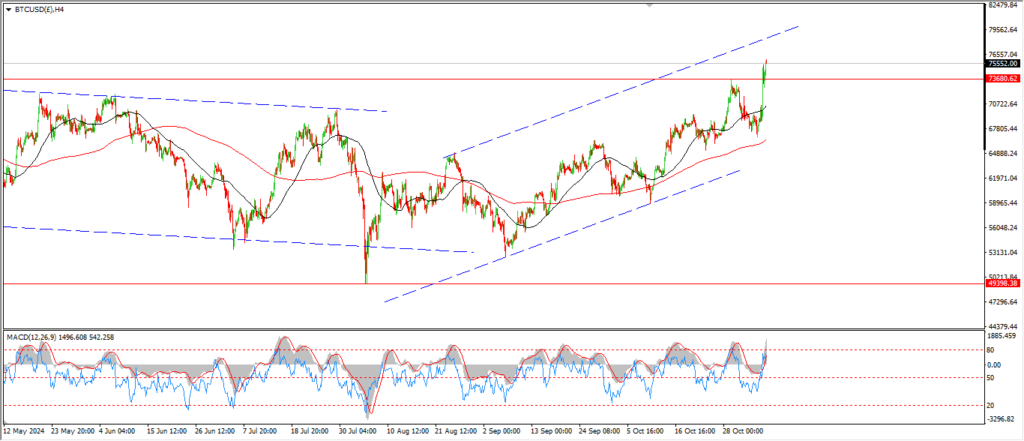

BITCOIN

BITCOIN 1hr.

….

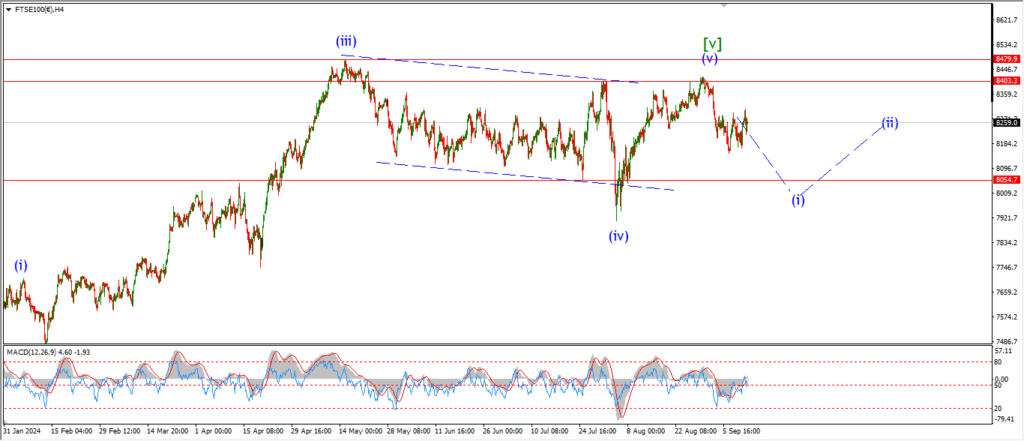

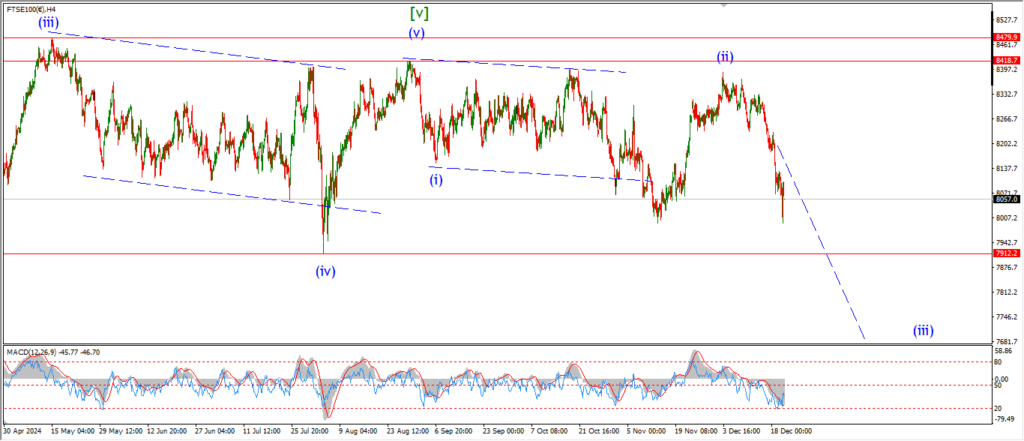

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

….

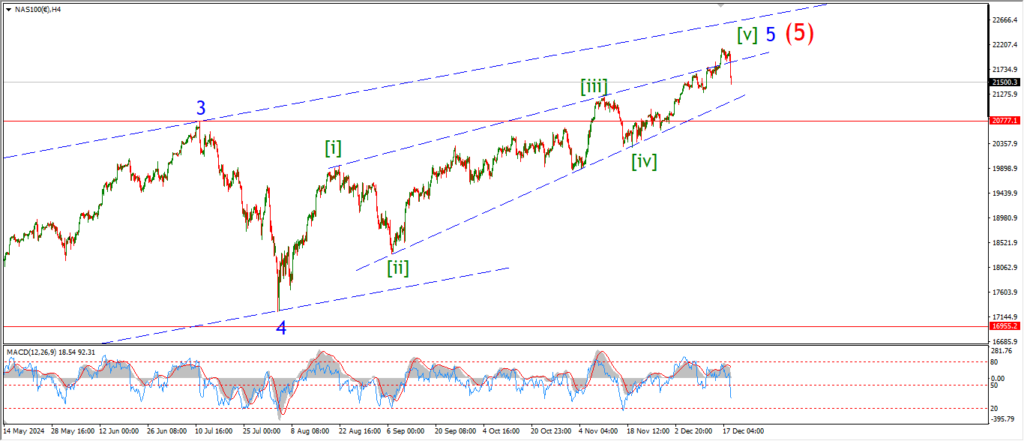

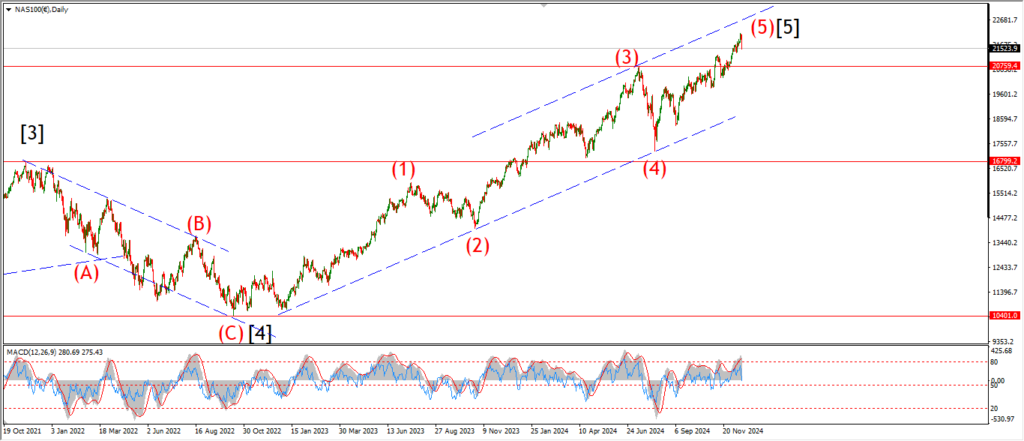

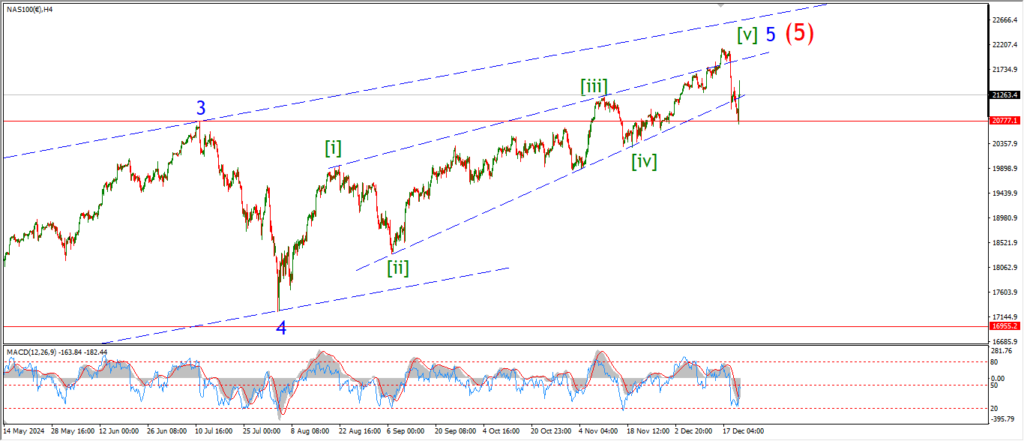

NASDAQ 100.

NASDAQ 1hr

….