Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

EURUSD.

EURUSD 1hr.

We have a larger than expected turn down from the high of wave ‘iii’ today.

this still qualifies as wave ‘iv’ for the moment,

and I am looking for a possible rally in wave ‘v’ of (c) on Monday to top out this pattern in wave [b] again.

Now,

the high this week did not break out to a new high yet,

so technically, the previous wave count has not been invalidated.

Just keep that alternate count on the back burner here incase the decline accelerates on Monday;

Monday;

Watch for wave (c) of [b] to opt and then wave (i) of [c] should turn lower again.

A break of 1.0722 again will signal wave [c] is underway.

GBPUSD

GBPUSD 1hr.

Cable has made a new high after the run up on Wednesday,

so there is a chance that wave (v) of [c] is already done at the recent high.

If the price falls again on Monday and breaks 1.2500 again that will signal wave (i) down is underway.

Monday;

The short term count is allowing for another pop in wave ‘v’ of (v) to complete this pattern.

At that point I will be looking lower again into wave (i) of [i] of ‘3’.

USDJPY.

USDJPY 1hr.

USDJPY is pretty flat today and that adds very little to this pattern.

Wave (i) is likey complete at this weeks low.

And the sideways action off that low at 140.93 is counted as wave (ii) now.

I am looking for wave (ii) to break above 143.00 again to complete.

And then wave (iii) down should begin.

I will have to wait until next week for that to happen now.

Monday;

Watch for another run above 143.00 again to signal wave (ii) is complete.

DOW JONES.

DOW 1hr.

The OPEX came and went without much fanfare but to be honest I wasn’t expecting a big reaction.

The point I was making here is that the size of the opex was an indication of how large the hope of a new high in the market is at the moment.

That bet was made throughout the last few weeks and the gravitational pull of the dream of new highs,

actually forced some additional buying it seems.

That pull higher is now gone.

So it is an opportunity to reset the market again.

We will soon see how sustainable that new top is.

I can at least hope that the air will come out of the bubble here to see if a reversal can be allowed to develop.

Tomorrow;

Watch for wave (v) of [v] of ‘C’ of (B) to show signs again of a top.

The rally in wave [v] green has run its course to the top of the trend channel.

Lets see if the price will drop out of below the trend channel again to signal a change of trend.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Three waves down off the top here and that allows for a possible alternate count reading here tonight.

If that alternate count is correct,

then we will see a bullish higher low build above 1972.

And then a rally into a third wave will begin next week.

Monday;

the main count is still valid here and that is worth following until it is ruled out.

Wave ‘i’ of (iii) should complete five waves down neat 1980 again on Monday.

And then the possibility of a sharp drop into wave ‘iii’ of (iii) will be open again later in the week.

Watch for wave (ii) to hold at 2047 again.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

The price corrected off wave ‘iii’ today and that completes wave ‘iv’ at the session low.

Wave ‘v’ should now break above 72.68 again to compete five waves up in wave (a) early next week.

once wave (a) is complete,

wave (b) should turn lower and drop in three waves as shown.

Monday;

Watch for wave (a) and (b) to complete over the next few days.

That will form a bullish higher low above 68.00,

and wave (c) of [iv] can then rally again back above 75.00 towards the end of next week.

S&P 500.

S&P 500 1hr

The S&P is finishing the week pretty flat after the early rally this week.

The action off the top is not enough to read anything into it yet.

Only a sharp drop back below the wave (iv) low at 4540 will open up the possibility that I have been waiting for.

Wave (i) down is long awaited now,

so another few days wont hurt!

Monday;

We will just have to wait and see what the next week brings us now.

An indication of the end of the rally phase will be welcome.

But I am looking at the wave (iv) low as the initial signal level here,

and that is almost 200 points below now.

It will take a solid impulsive decline to achieve that goal.

SILVER.

SILVER 1hr

The Silver patter is in a very interesting position here also.

There is a mirror image count possible here in that alternate count.

The price must hold above 22.50 to invalidate that alternate count.

And once we see a rally back above 25.00 again that will confirm the main count here for wave ‘iii’ of (iii).

If this wave count is correct,

then wave ‘iii’ of (iii) is coming our way next week.

So you can see we are sitting at a very key position in the developing pattern.

Its time to choose which way to go for this pattern!

Monday;

watch for wave ‘2’ of ‘iii’ to complete a higher low near 23.40 at the 50% retracement level of wave ‘1’.

A rally back above 25.00 again will signal wave ‘3’ of ‘iii’ is underway.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

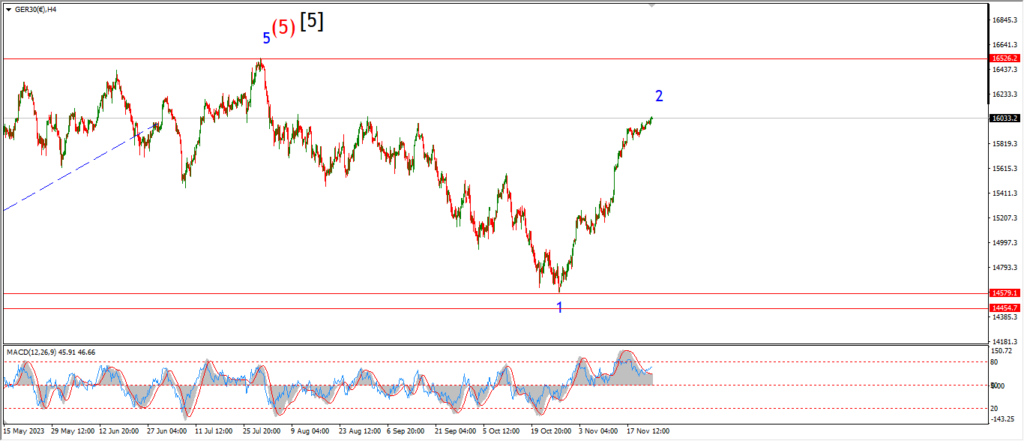

DAX.

DAX 1hr

….

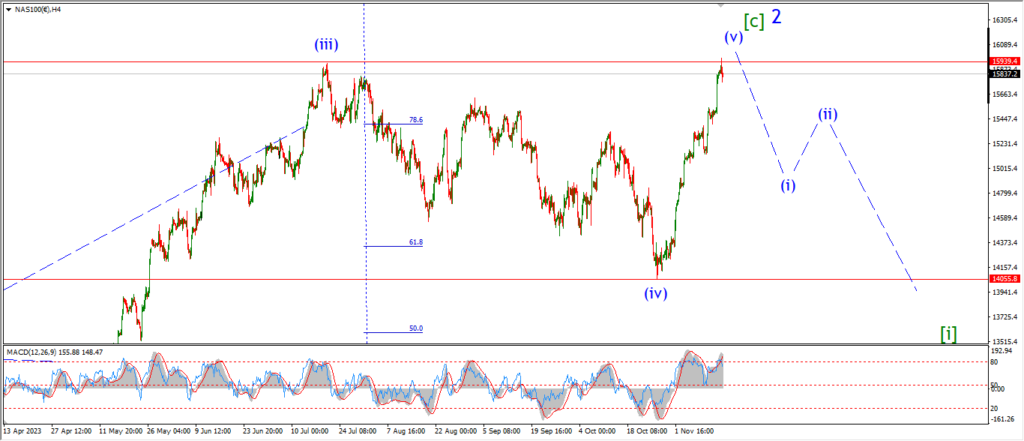

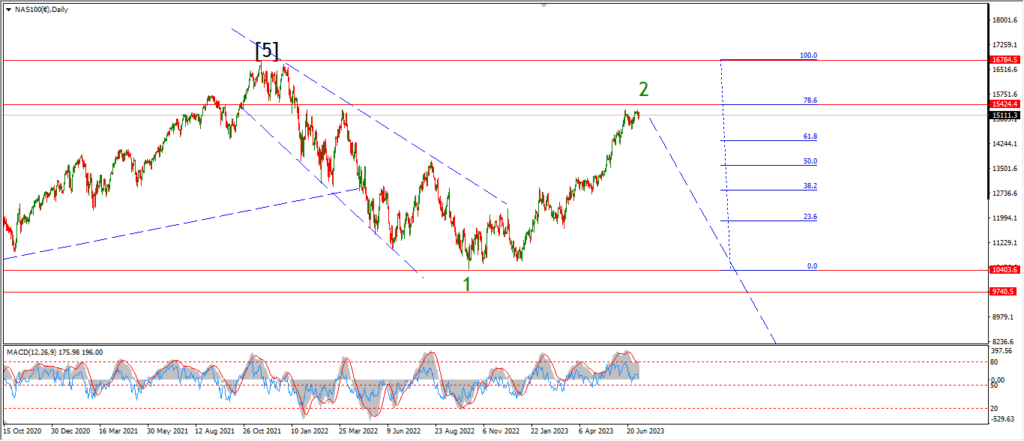

NASDAQ 100.

NASDAQ 1hr

….