Good evening folks, the Lord’s Blessings to you all.

Some housing news and charts and risk indicators to set the stage tonight.

Also, take a look below at the size of the options expiry that will happen this Friday.

If you are wondering why the market is levitating at these highs and has not reversed yet, this is a good reason why that might be.

No one will flinch before expiry is the usual rule of thumb, after expiry, all bets are off!

https://twitter.com/bullwavesreal

EURUSD.

EURUSD 1hr.

We got a spike higher today in EURUSD that broke above the wave ‘a’ high again.

That is enough to complete the required pattern for wave ‘c’ of (ii)

although wave (ii) did not get as far as I expected.

The price has dropped off the session high again today so that is a signal that wave (ii) is complete here and wave ‘i’ of (iii) has begun.

Wave (iii) is expected to fall back towards the 10400 area now,

and if we see a break of the wave (i) low at 1.0723 again that will signal wave (iii) is underway.

Tomorrow;

Watch for wave ‘i’ of (iii) to break 1.0723.

The wave (ii) high at 1.0828 must hold.

GBPUSD

GBPUSD 1hr.

Cable did break the wave (i) pattern early today and that has given me a pause for thought on this short term pattern now.

I can still allow the main pattern to remain for another day here,

if we view the initial decline in wave (i) as a leading wedge off the top.

If the price continues lower again tomorrow to break the wave (i) low at 1.2499 again,

that will tip the balance in favor of the main count again and suggest wave (iii) of [i] is underway.

Tomorrow;

Watch for wave (ii) to hold at 1.2614.

Wave ‘iii’ should fall again and break 1.2499 to signal wave (iii) blue is underway.

USDJPY.

USDJPY 1hr.

USDJPY dropped off the high at wave (a) today to signal that wave (a) is complete at 146.62.

WAve (b) should fall in three waves now and hit the 144.00 area to complete.

That should set up for another rally into wave (c) over the coming week to complete wave [b].

Tomorrow;

Watch for wave ‘c’ of (b) to fall into the 144.00 area to complete a higher low.

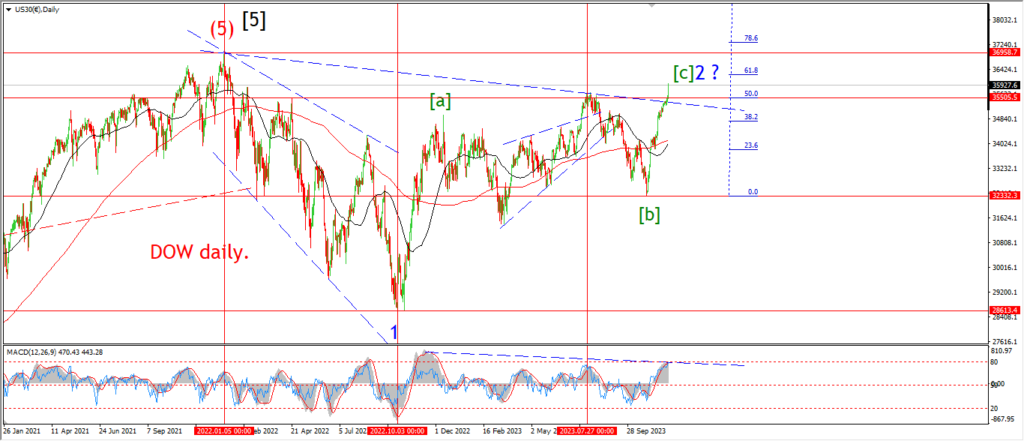

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The DOW is sitting 400 points off an all time high and the economy that is holding up this extreme valuation is cracking and crumbling underneath the weight.

The pattern is extended beyond my belief that is for sure.

Yet I know that there is nothing holding this market here except ignorance.

I suppose ignorance can take you a long way up,

but it wont hold you there that much is certain!

This pattern in wave ‘v’ pink has reached the upper trend channel line today as wave ‘5’ of ‘v’ stretches to close the channel.

The market did spike back off the high today but so far we are closing near the high of the session.

The pattern must turn back and break below the trend channel this week in wave ‘i’ pink.

Only that will save the wave ‘2’ high from being invalidated.

Tomorrow;

Watch for wave ‘v’ of (v) of [c] of ‘2’ to close now and turn lower into wave ‘i’ of (i).

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

I am presenting another view wave (iii) of [c] tonight as the price has turned lower again this afternoon.

There is a chance that wave ‘i’ and ‘ii’ of (iii) have just completed today,

and if this is correct,

then wave ‘iii’ of (iii) will fall again sharply tomorrow towards the lower support at 1931.

WAve ‘iii’ of (iii) should be an acceleration wave in the pattern.

so it will be easy to confirm this wave count if the price does fall sharply tomorrow.

Tomorrow;

Watch for wave ‘ii’ to hold at 1996.

If that level breaks tomorrow we can revert to the larger wave ‘ii’ idea.

wave ‘iii’ of (iii) should turn sharply lower tomorrow.

1931 is the target level for wave ‘iii’.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude took another sharp turn lower today and I think that rules out last nights count.

The pattern now shows an extended wave (v) of [iii] at todays lows.

Wave ‘v’ of (v) has broken to a new low below last weeks low.

and the price is now close to hitting the lower trend channel line again.

That should be enough to complete wave (v) of [iii].

and I am still expecting a larger correction higher into wave [iv] over the coming weeks.

Tomorrow;

WAtch for wave (v) to close out and turn higher again into wave ‘a’ of (a) of [iv].

S&P 500.

S&P 500 1hr

The 50% fib extension of wave [a] seems to be the target for this wave [c] rally now.

and that level lies at 4660.

The market has rallied back into the close this evening and that action has extended the pattern in wave (v) blue now.

The upper trend channel line is getting close now also.

Again we have pushed out the reversal to the very last possible moment with this latest rally.

Tomorrow;

Watch for wave (v) to top out its internal five wave pattern as shown.

This should lead to the required reversal to halt the rally and save this wave count from invalidation.

A rejection below 4660 again will be very welcome.

SILVER.

SILVER 1hr

Silver dropped to a new low for this decline in wave ‘ii’ today.

Wave ‘ii’ is getting a bit too close to that support at 21.87 now,

and I want to see the rally begin in wave ‘iii’ before the end of this week.

The expected rally into wave ‘1’ of ‘iii’ should come by tomorrow evening as it looks like we have a pretty full pattern in wave ‘ii’ already in place.

As for the alternate count in wave (i) and (ii),

this will require a three wave rally into wave (ii) over the coming days.

So in both scenarios we should see a rise off this current low.

Tomorrow;

Watch for wave ‘1’ of ‘iii’ to turn higher in five waves.

a break of 24.00 again will be a good initial target for wave ‘1’.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

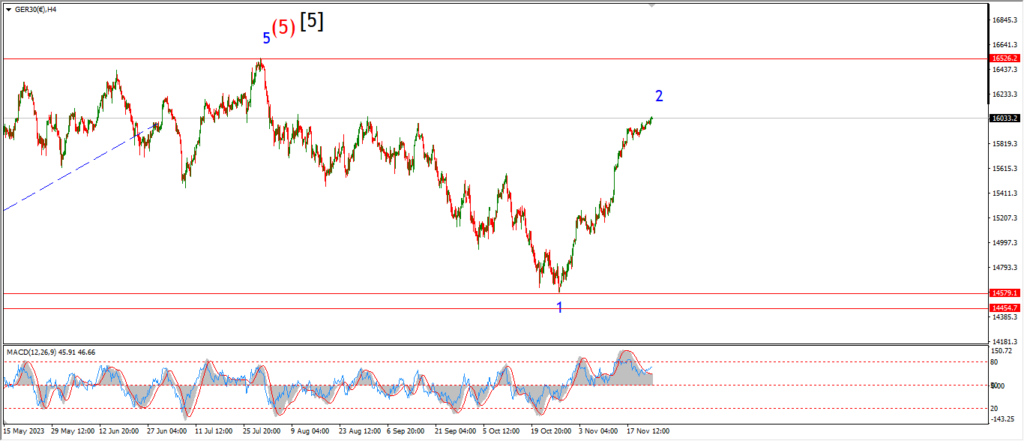

DAX.

DAX 1hr

….

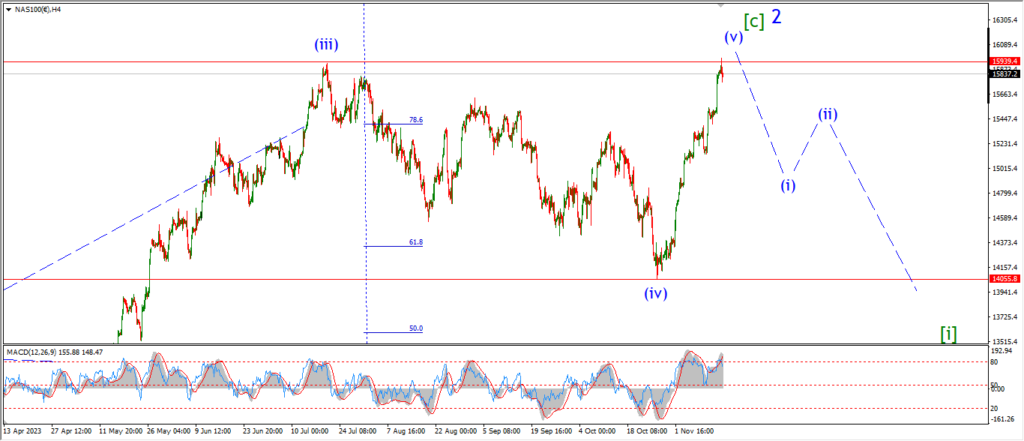

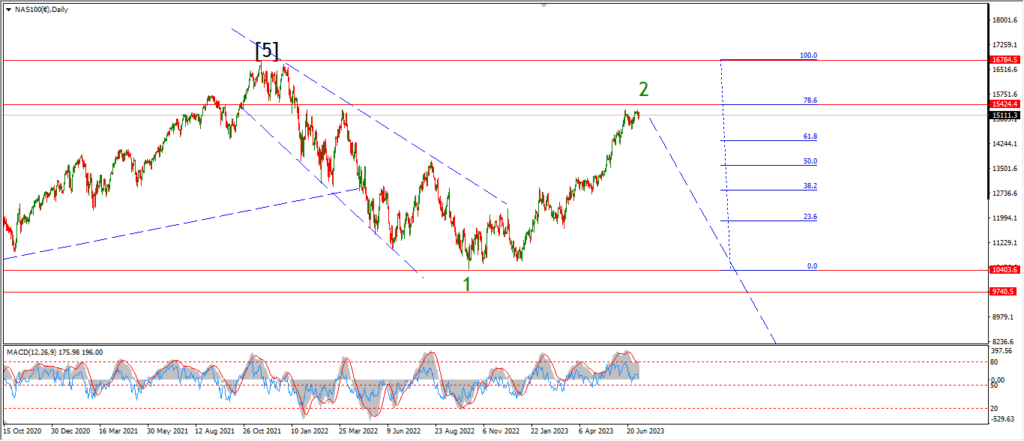

NASDAQ 100.

NASDAQ 1hr

….