Good evening folks and the Lord’s blessings to you.

Please forgive the fact that I missed Fridays update.

I was on the road Friday with the family.

We stayed with cousins in Dublin.

I convinced myself that I would get to the update first thing Saturday.

But it just did not happen.

I am sorry about that.

on with tonight’s update.

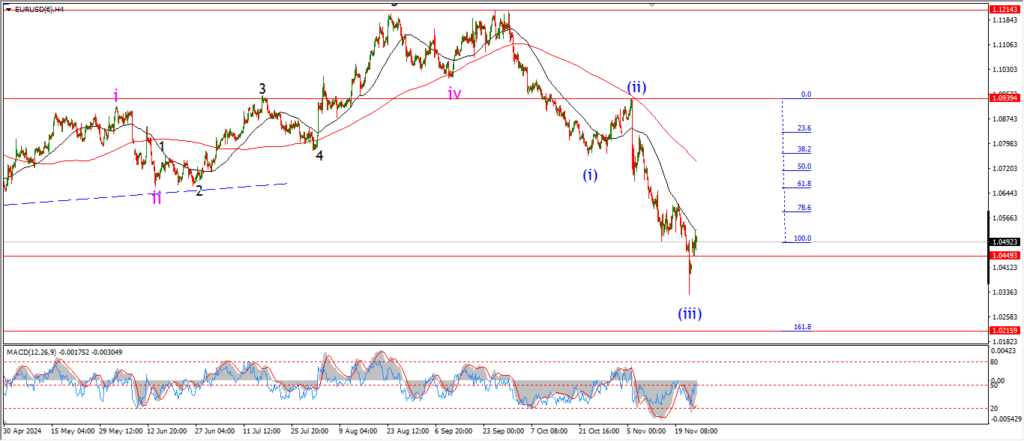

EURUSD.

EURUSD 1hr.

The wave count in EURUSD has not changed all that much,

the price spike higher on Friday in wave ‘b’ of ‘b’,

but the gains were soon reversed

and I am suggesting that wave ‘c’ of ‘b’ is now underway.

The target for wave ‘b’ pink lies at 1.0462.

And from there I will look higher into wave ‘c’ as the larger wave (iv) continues.

Tomorrow;

Watch for wave ‘b’ pink to continue as an expanded flat with the minimum target for wave ‘c’ of ‘b’ at 1.0462.

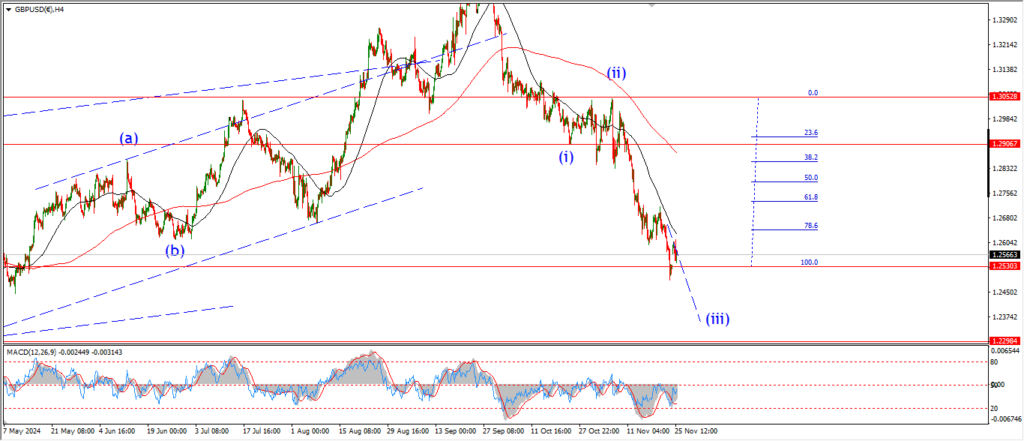

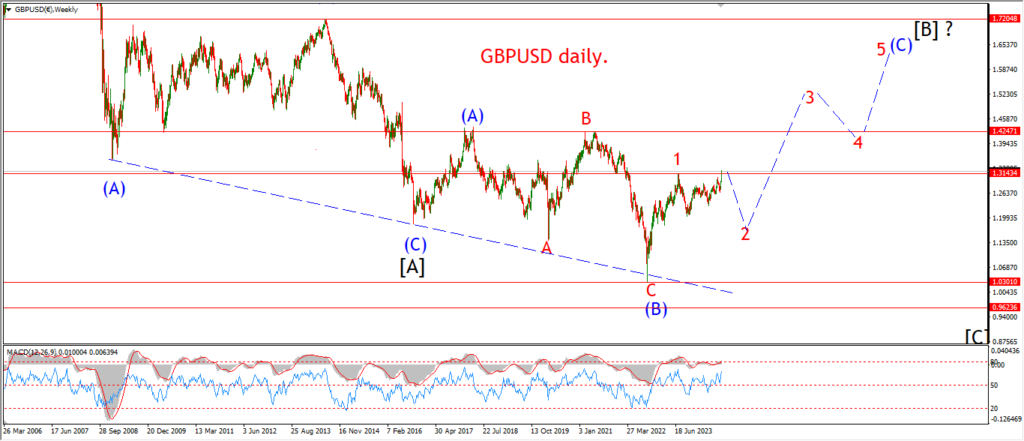

GBPUSD

GBPUSD 1hr.

There is a possibility that wave (iv) has already completed at Fridays highs in cable,

but I am only showing this as an alternate count at the moment.

The main count is still valid,

and that calls for a drop into wave ‘c’ of ‘b’ as part of the larger wave (iv) blue.

The premise is the same here as EURUSD.

A drop into support at 1.2600 again in wave ‘c’ of ‘b’.

And then a rally higher into wave ‘c’ of (iv) later in the week.

Tomorrow;

Watch for wave ‘b’ to complete as an expanded flat correction at 1.2600 over the next few days.

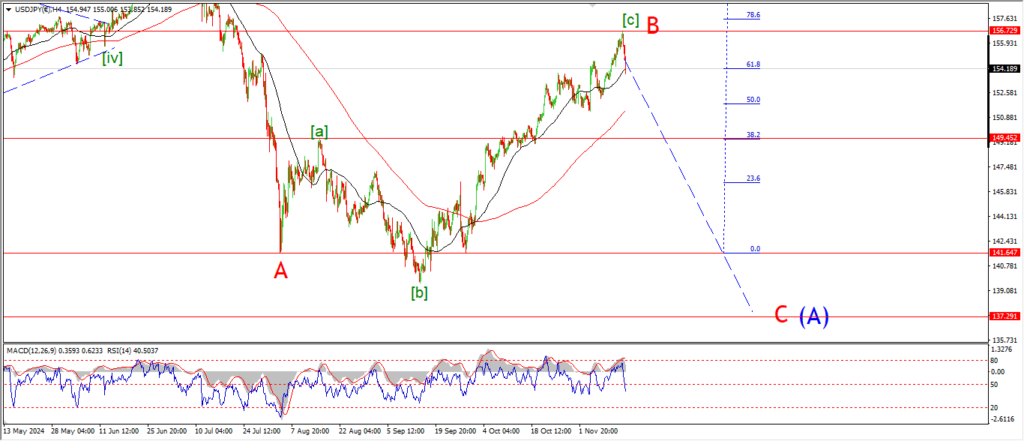

USDJPY.

USDJPY 1hr.

USDJPY is working out its correction in wave (iv) a little different than expected today.

I am tracking a three wave pattern higher off the recent lows in wave (iv) of [i].

The price will hit the top of that channel in wave ‘c’ of (iv) at about 152.00 again,

and then wave (v) will turn down again from that top if this pattern holds.

Tomorrow;

Watch for wave ‘c’ of (iv) to complete soon at the upper channel line,

and then wave (v) should begin a five wave drop from there towards the 147.00 handle.

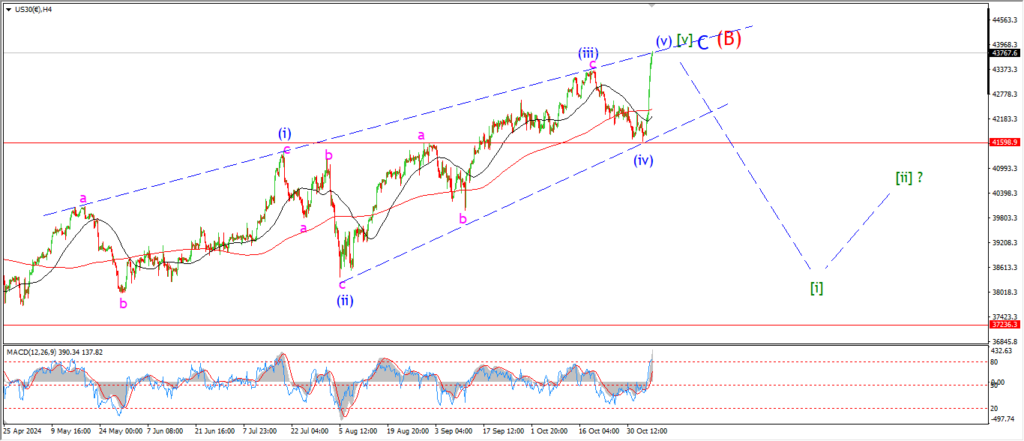

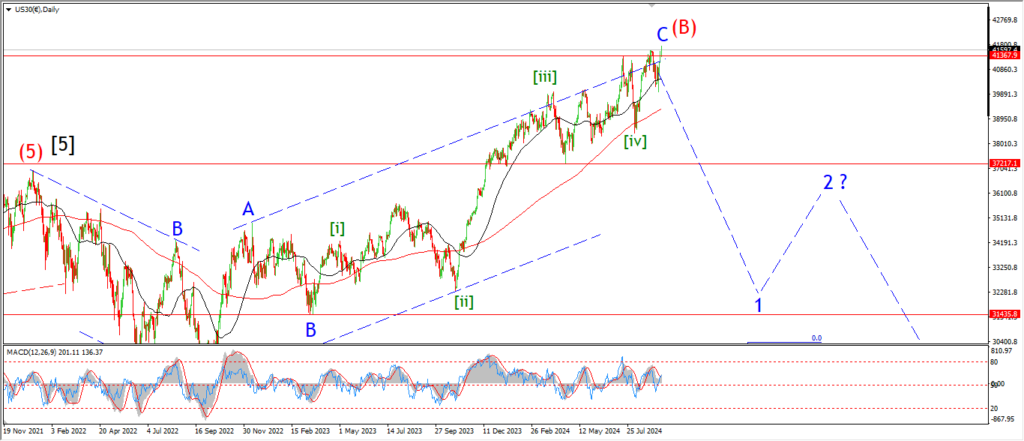

DOW JONES.

DOW 1hr.

Overall the DOW is still drifting in a range today.

The market is now holding at the previous wave ‘a’ high from November 11th.

that gives us a month of sideways to nowhere in the stock market.

It is a reality that flies in the face of the hype to be honest.

There is very little actually going on here.

The election sparked a final run up to beat the band.

and now the mood is deflating again.

We do have the possibility that a major pattern has completed also in wave (v) of [v].

We should get some indication this week on the validity of that idea.

A drop back into the range of the previous wave (iv) again will give that idea a boost.

but I will just have to wait on what this weeks trade brings overall.

Tomorrow;

the trade this week has started with a down day,

so lets see if we continue in that vein,

and if we do,

that will suggest the mood may be turning again.

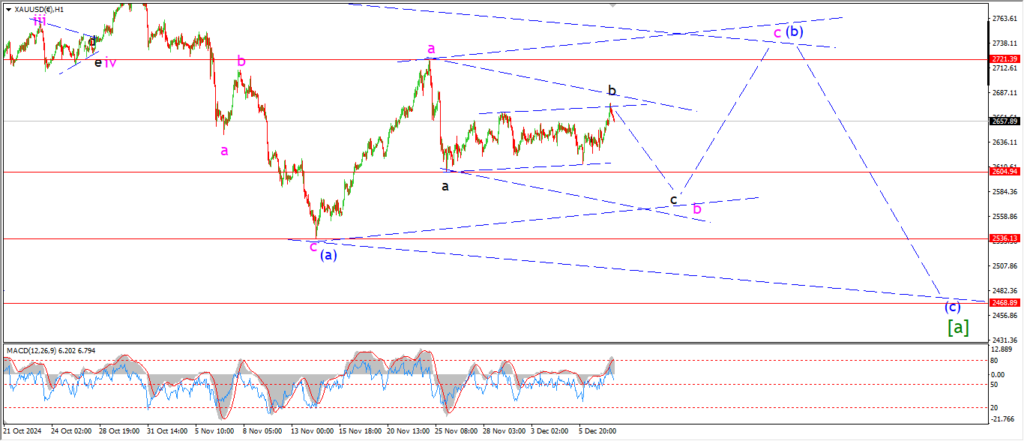

GOLD

GOLD 1hr.

I am rethinking the pattern in gold this evening because of the action today.

The previous high was labelled wave (b) of [a],

and now I think that can no longer be a valid option here.

Wave (b) is still in play here.

The price moved sideways all last week,

and this action is better viewed as corrective within wave (b) blue.

And I am tracking a three wave pattern higher into wave (b) which should happen this week.

Wave ‘b’ pink is not yet complete in this scenario.

A drop below 2600 will complete three waves down.

and then wave ‘c’ of (c) should turn higher again later this week as shown.

Tomorrow;

Watch for wave ‘c’ of ‘b’ to complete three waves down below 2600 and from there I can look up in wave ‘c’ again.

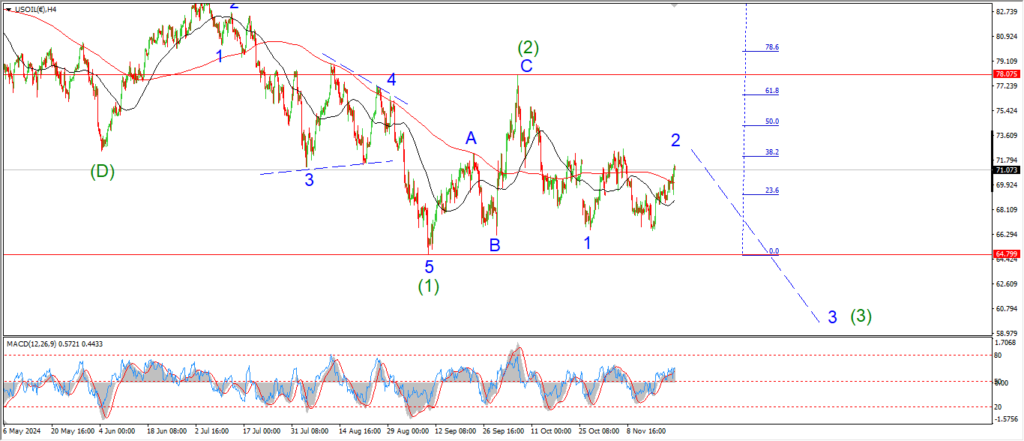

CRUDE OIL.

CRUDE OIL 1hr.

There have been a few changes in patterns tonight but nothing too drastic I think.

Crude oil gets its own reshuffle also tonight.

The price rebounded off the lows of today in quite an impulsive looking fashion.

The low of the session only managed to make a higher low above 66.50.

and,

the decline into todays lows created a pretty solid looking three wave pattern in a channel.

All this suggests wave [ii] is still underway here.

the spike off todays low is labelled as the beginning of wave (c) of [ii].

If this pattern is correct for wave [ii] green.

then we should see a five wave rally to break 71.45 at the wave (a) high this week.

That will complete three waves up in wave [ii].

and we can then look for wave [iii] down to begin from there.

Tomorrow;

watch for wave (c) to continue higher in a five wave pattern to hit 71.50 later this week.

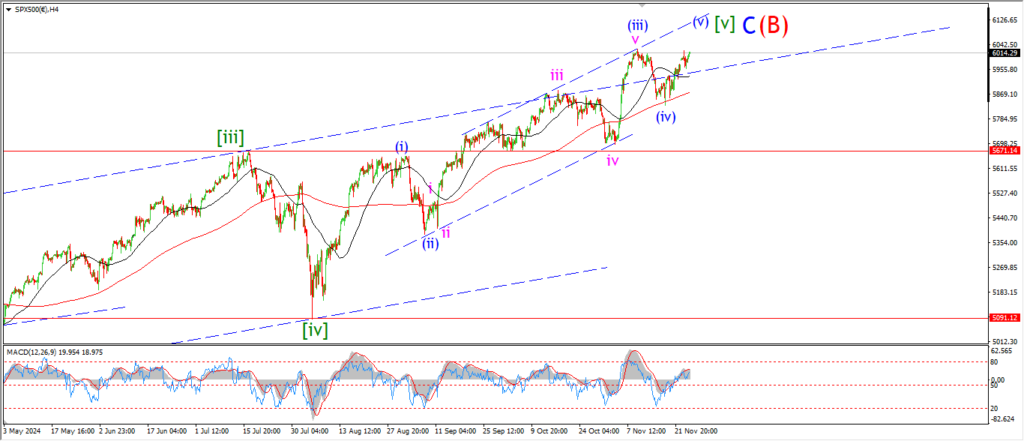

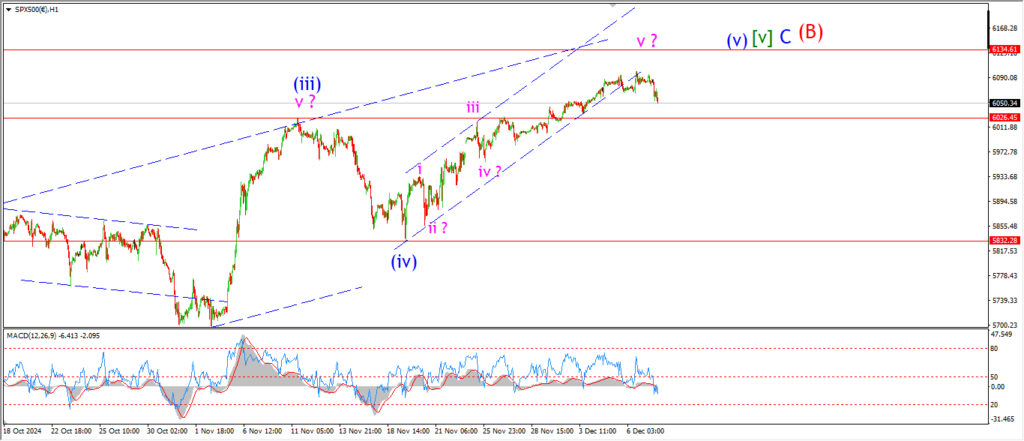

S&P 500.

S&P 500 1hr

The S&P is coming down off that high today and I am hoping this is the completed wave ‘v’ of (v) now in place.

It will be tested this week of course.

The market has given many indications of its completely insane over-bullish and overbought syndrome over the last several months,

but these conditions did not cause a top to form,

the syndrome continued,

and then got a boost from the election results which caused another leg up into the recent highs.

But all things come to an end, for certain.

I keep asking the question,

is this it,

have we finally hit the peak of the mad stock-market euphoria.

Tomorrow;

If the air continues to come out of the recent rally and we fall back below the wave (iv) lows at 5830,

then we have a chance of finally turning this market.

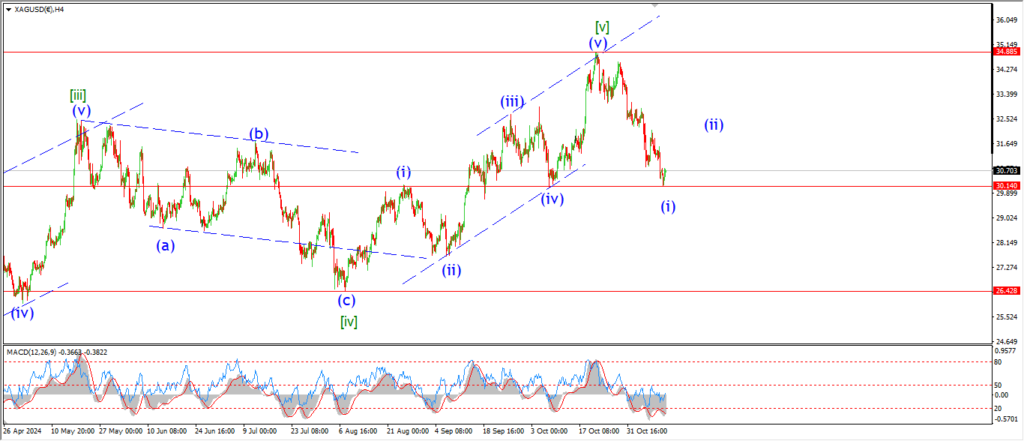

SILVER.

SILVER 1hr

Silver pushed out to a new lower high in wave ‘c’ of (ii) today.

the price actually hit the 50% retracement level that formed the upper end of the target range at todays highs.

And now we have a reversal off that level tonight.

It remains to be seen if this is wave ‘i’ of (iii) down now underway.

So I will be looking for a five wave decline from here to hit the 30.00 level again to confirm this pattern.

Tomorrow;

Watch for wave ‘i’ to fall in five waves to hit that 30.00 area again over the coming days.

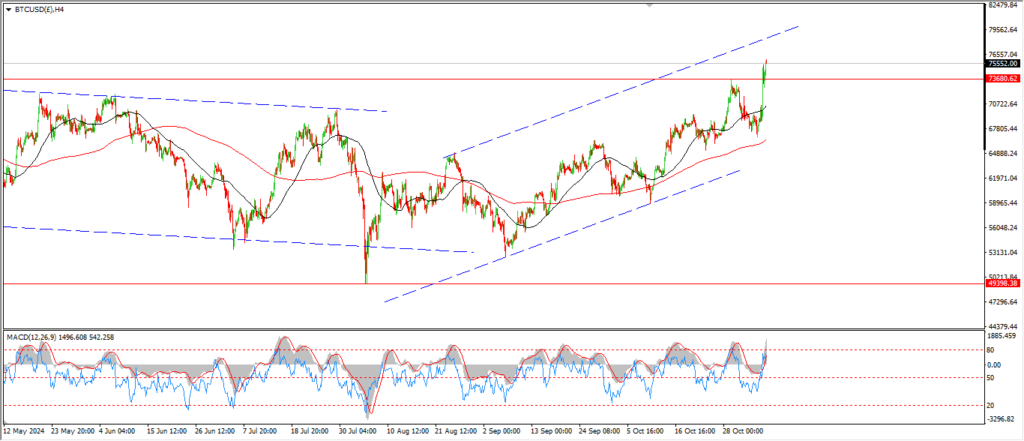

BITCOIN

BITCOIN 1hr.

….

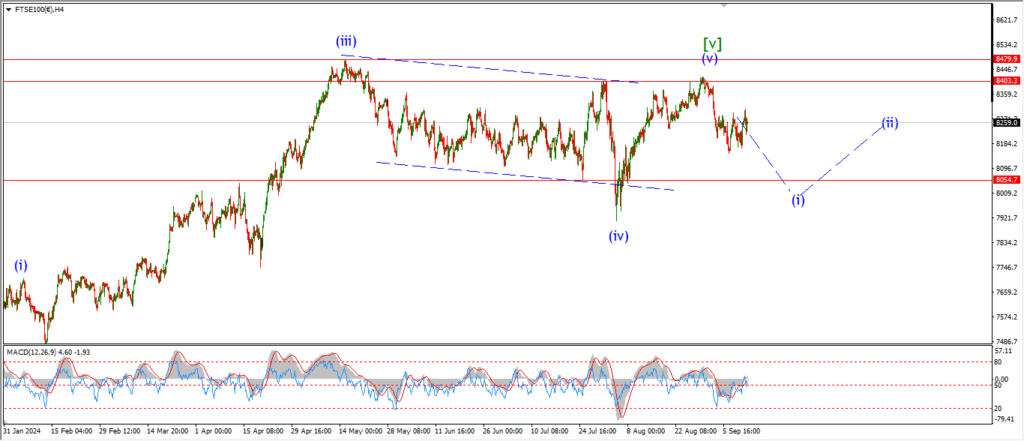

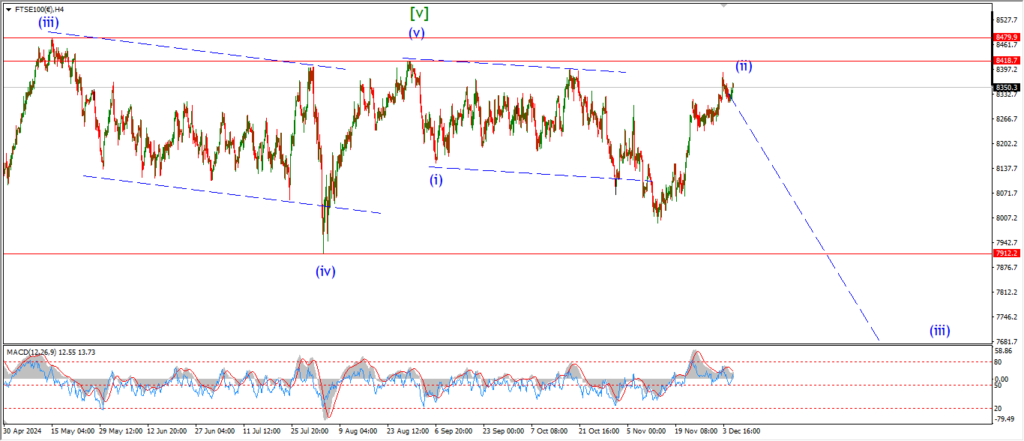

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

….

NASDAQ 100.

NASDAQ 1hr

….