Good evening folks, the Lord’s Blessings to you all.

A few charts to start the day.

https://twitter.com/bullwavesreal

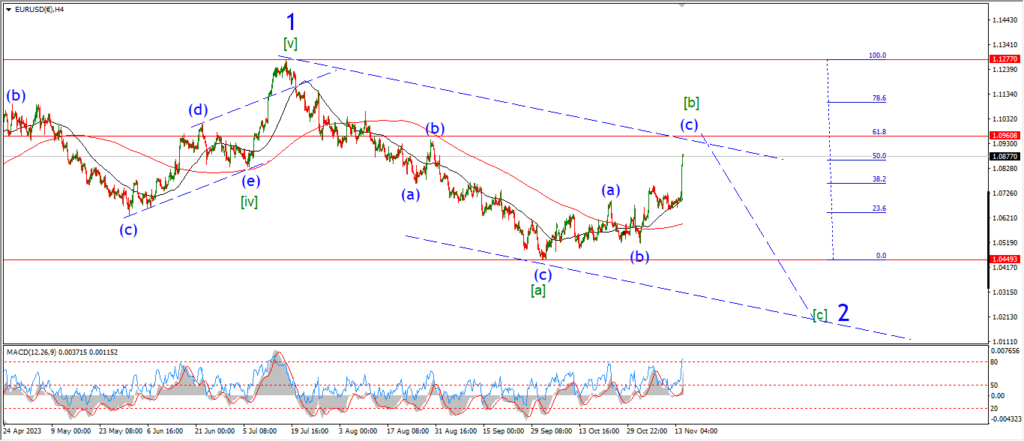

EURUSD.

EURUSD 1hr.

It’s quite hard to continue with the wave ‘iii’ of (i) idea tonight.

There is no acceleration into wave ‘iii’ yet so that does make me question the count.

on the other hand,

I can’t rule out wave ‘iii’ yet so I will give the idea one more day to be invalidated.

If the price continues lower towards the 1.0600 level,

that will favor this idea again.

Tomorrow;

Wave ‘ii’ just hold at 1.0891.

Wave ‘iii’ should continue lower towards 1.0600 again.

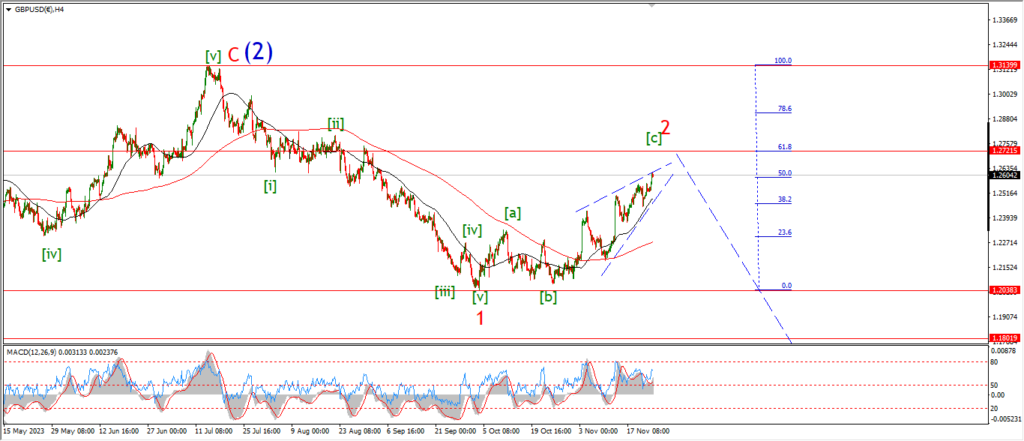

GBPUSD

GBPUSD 1hr.

A similar problem in cable also tonight.

The price is very slightly lower after todays session,

but the price continues to sit on that lower trend channel line.

This fact makes me lean in favor of the alternate count now,

but as I said earlier.

the action has not invalidated the main count here yet.

And if we see a rise back above 1.2650 again tomorrow that will trigger the alternate count.

Tomorrow;

I am still looking for a break of the initial support at 1.2500 to bring the action back in line with the main count.

So watch for that level to break tomorrow to confirm wave ‘iii’ of (i) again.

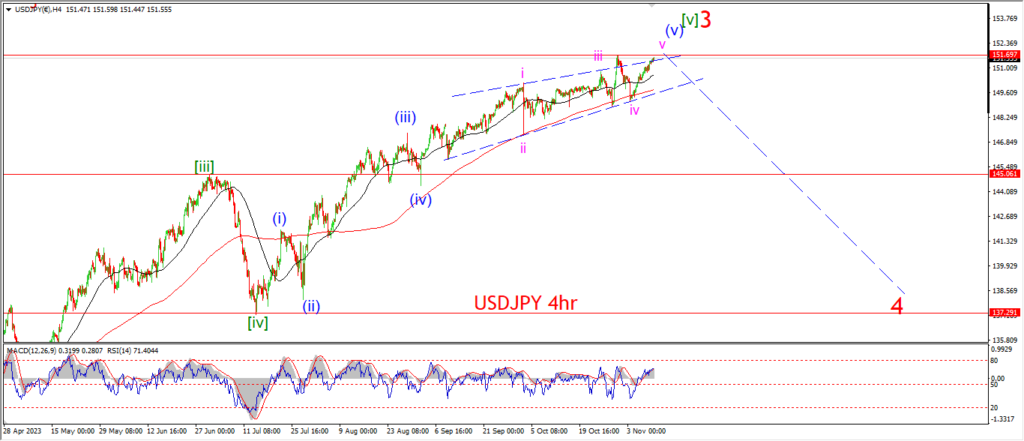

USDJPY.

USDJPY 1hr.

USDJPY has continued its corrective grind sideways today which still fits the main wave count.

As with most of the counts tonight,

I am going to stick with this idea until it no longer describes the action correctly.

Wave ‘2’ of ‘iii’ is holding a lower high tonight,

and wave ‘3’ of ‘iii’ is expected to turn lower again tomorrow to confirm this wave count.

Tomorrow;

Wave ‘ii’ must hold at 148.52.

Wave ‘3’ of ‘iii’ should turn lower again.

A break of the wave ‘1’ low at 146.20 will signal wave ‘3’ is underway.

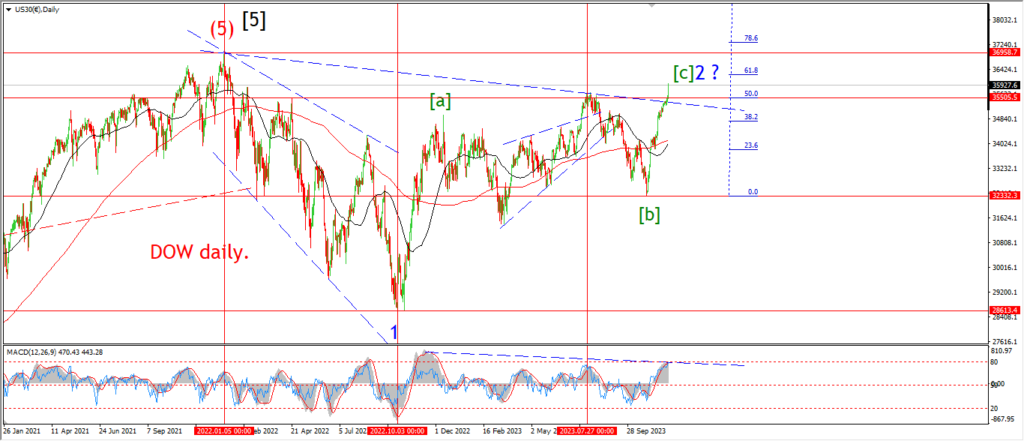

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

Thats five waves up in place now for wave ‘v’ of (v) of [c].

This short term pattern is complete now,

but we sill see soon enough if this has the results that you would expect.

The market is closing flat this evening after the earlier high in wave ‘5’,

so I can look for a small drop tomorrow to signal a change in trend into wave ‘1’ of ‘i’ as shown.

Tomorrow;

Watch for the session high to hold at wave ‘v’ pink.

Wave ‘i’ pink suggests a drop into the fourth wave low at 35280 again.

GOLD

GOLD 1hr.

That small move higher today in gold today is looking corrective so far,

and because of that I am going to track the alternate count a little closer for the next few days.

If this weeks low is wave (i) of [c],

then we can expect a corrective rise into wave (ii) over the coming few days.

Wave (ii) should trace out three waves up and hit the 50% retracement level of wave (i) at 2076.

And after that I can look lower again into wave (iii) of [c].

Tomorrow;

The main count has not been invalidated yet,

but we are so close to that now I do think it is worth while looking at the alternate idea here.

Watch for wave (ii) to complete a three wave rise into the 2076 level as per the alternate count.

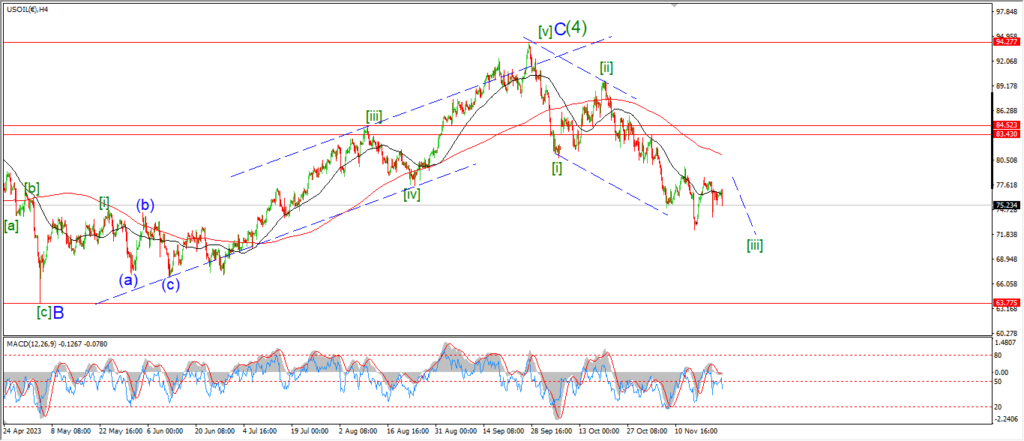

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude took another dive lower today and with that I think we can call this pattern pretty much complete.

It is too early to catch this falling knife yet of course.

But the price has met all expectations for wave (v) of [iii] now.

and like I said last night,

it is time to begin looking for a reversal higher over the next few days to begin wave (a) of [iv].

The low of the session today broke the 70.00 handle again,

that was the general target area for wave (v) of [iii] to complete.

The internal pattern in wave ‘v’ of (v) may take one more step lower tomorrow to complete a five wave internal pattern again.

So watch for that possibility early in the session.

I do think we will see a final low in wave (v) of [iii] this week though,

so there is not much more downside left here.

Tomorrow;

Watch for wave ‘v’ of (v) to complete an internal five wave pattern and complete the larger pattern in wave [iii].

A break above the wave (iii) low again at 72.40 will signal that wave (a) of [iv] is underway.

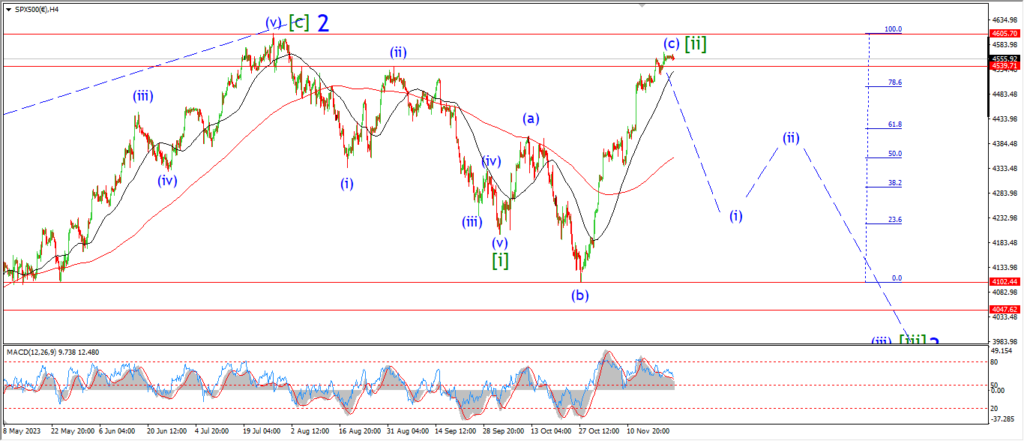

S&P 500.

S&P 500 1hr

I want to comment on the equal weighted S&P500 that I have shown above.

Notice that there is no challenge to the earlier high this year at all in the SPXEW.

This index has stalled at the current lower high,

and the MACD is showing a solid overbought scenario here also.

I do think it is very interesting what this index is showing us here,

we can see through the hype caused by crowding in specific companies that have an oversized effect on the standard index.

Here we can see no major shaking of the downtrend that started 2 years ago.

And the main trend seems about ready to assert itself again.

The S&P did manage a small pop earlier in the session,

but the high failed to break above the wave ‘v’ of (c) high at 4598.

And now this evening we have a solid decline off the high again as we hit the close.

This decline must continue tomorrow to allow the main count to gain some traction again.

If the market drops below 4500 again,

then I think we will have the makings of an impulsive pattern into wave ‘i’.

So there is a whole lot riding on the next few sessions.

I would love to see this week close out with an impulsive reversal in the bag for wave ‘i’.

But I know that is a big ask here.

We will see.

Tomorrow;

Watch for this decline to drop below the wave ‘iv’ low at 4536 again,

and then continue to break the 4500 level again.

SILVER.

SILVER 1hr

Silver has pushed to a very slight new low today in wave ‘a’ of ‘ii’.

I am sticking with the overall wave ‘ii’ pattern here tonight though,

and I expect wave ‘b’ to turn higher over the coming days.

Wave ‘b’ has the potential to hit the 25.00 area again also,

the 50% retracement level of wave ‘a’ lies at 24.88.

So lets see if wave ‘b’ can turn higher beginning tomorrow.

Tomorrow;

Watch for wave ‘a’ to complete its final low very soon.

The retracement in wave ‘b’ should take the rest of this week at least.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

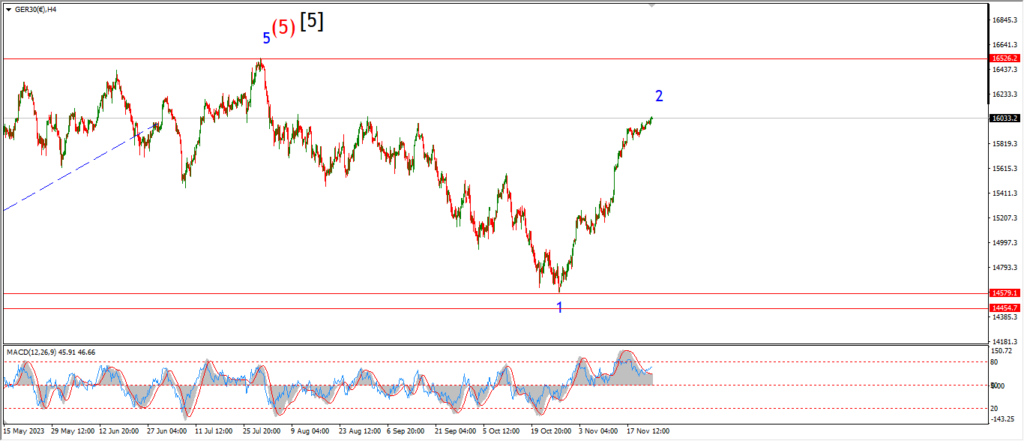

DAX.

DAX 1hr

….

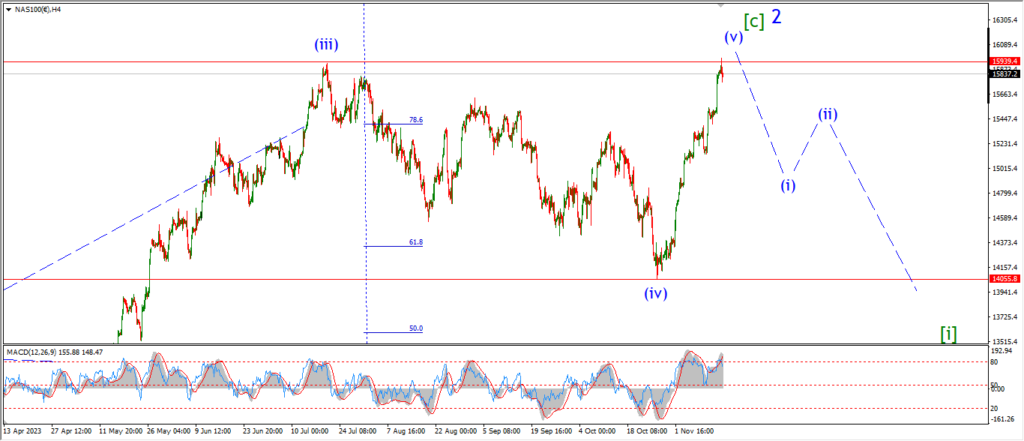

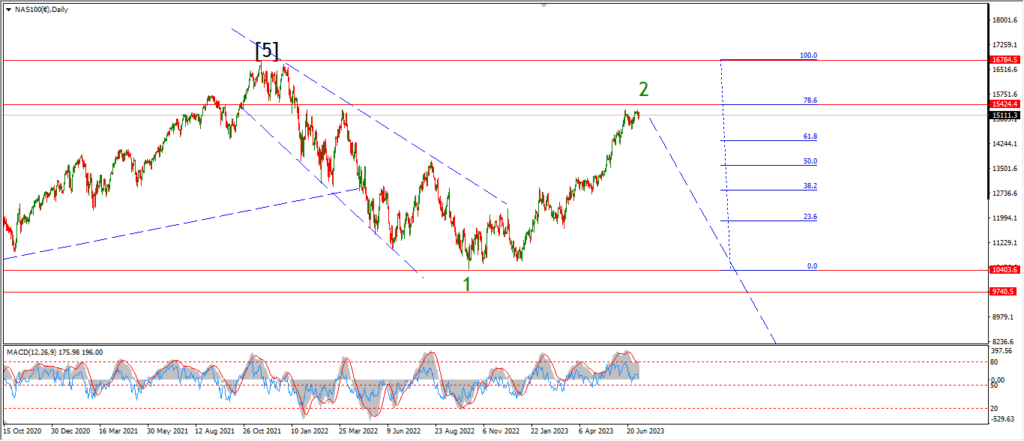

NASDAQ 100.

NASDAQ 1hr

….