Good evening folks, the Lord’s Blessings to you all.

At this point I’m sure I have run to the end of your patience.

The stock markets seem to have endless potential for upside and all else is forgotten.

There is no need to have another sell-off,

and the future is forever bright.

No matter what the fed does,

the outcome is higher stocks.

Raise rates,

stocks go up,

cut rates,

stocks go up.

Bad news in the economy,

stocks go up.

War breaks out everywhere,

stocks go up.

Does anything seem wrong to you,

or am I the only one who is sick to their stomach with this game?

It seems like something other than news is ruling the minds of men.

When they want to buy,

they will buy no matter what.

I am wrong in the short term that much is for sure.

But;

Reality is still the absolute dictator here.

And,

what cannot go on – will not go on.

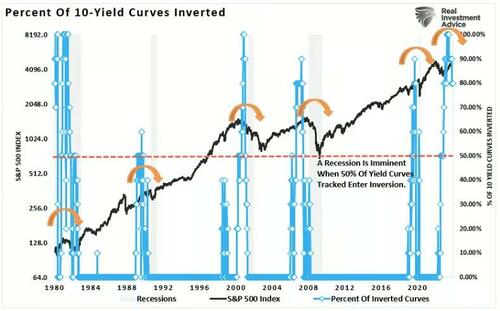

I have a real fear that next year will be the ruination of the financial world for a very long time.

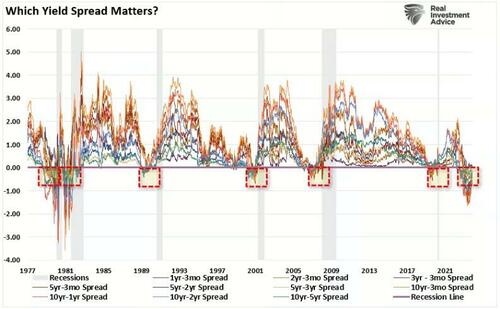

There are two markets that are acting like the world is turning into a depression.

They are;

crude oil and the treasury market.

Crude has dropped like a stone since early October.

And now treasuries are have turned into that long awaited rally.

yields topped in late October at 4.998 on the 10yr,

and closed today at 4.226.

Thats a real reversal with a huge impact.

The turn may be slow in coming,

but its happening where it matters.

Now that I have spitted and whined and my anger is vented a little.

I will take another look at the charts to see where we stand.

https://twitter.com/bullwavesreal

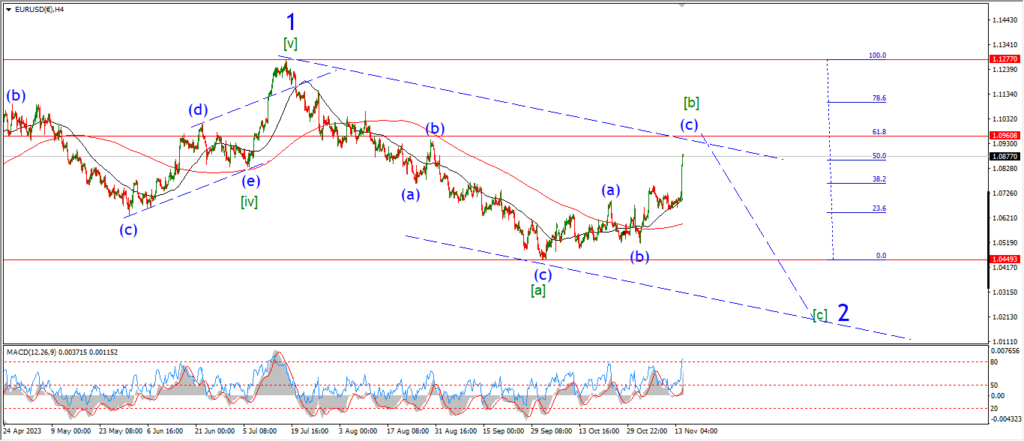

EURUSD.

EURUSD 1hr.

Five waves down to break the previous wave ‘iv’ low is what I was looking for and that’s what happened today.

This action is important as it suggests the top is in for wave [b] now.

The confirmation that wave [c] is underway should come along next week

with a larger wave (i) and (ii) pattern on the way.

Monday;

Watch for wave ‘ii’ to complete here with a small three wave correction to form a lower high near 1.0950 again.

Wave ‘iii’ of (i) should accelerate lower to break 1.0700 again.

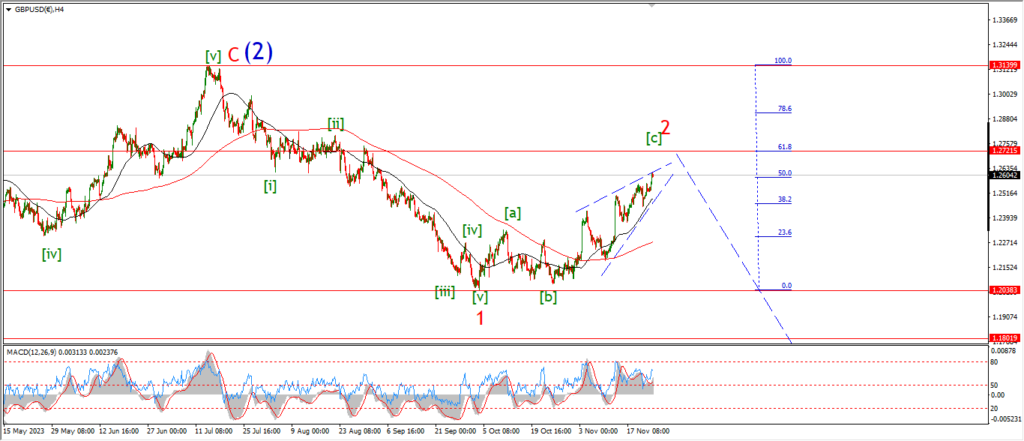

GBPUSD

GBPUSD 1hr.

Cable is still holding the lower high this evening

but the price is too close to the top at wave ‘2’ this evening.

And because of that I am going to hold judgement on the larger pattern until we get a solid decline towards 1.25 again.

If that happens I can then,

be more certain that wave (i) of [i] is underway here.

Monday;

Watch for wave (i) to turn back off the high again and fall into support at 1.2500 again.

I am looking for that five wave decline in wave (i) next week to confirm the top at wave ‘2’,

and the next leg down into wave [i] of ‘3’.

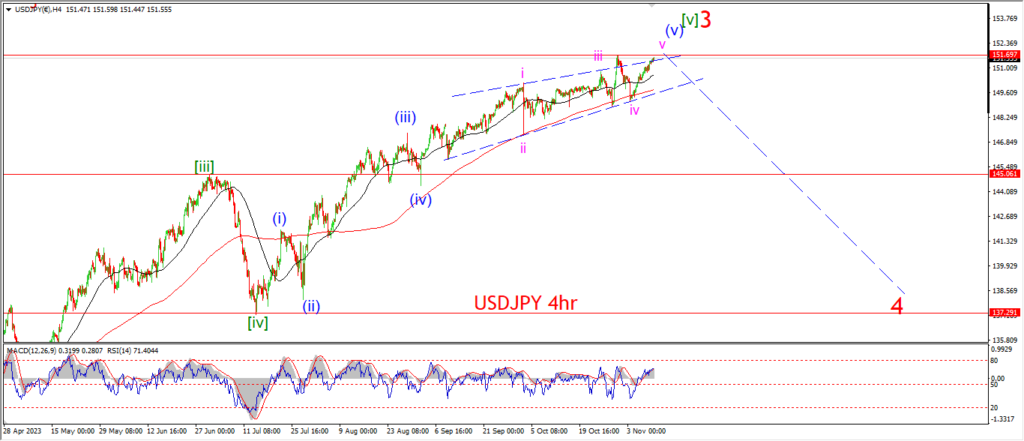

USDJPY.

USDJPY 1hr.

Todays decline seems to have confirmed the alternate count now with a sharp turn lower to break the previous low.

The price has broken lower out of the previous triangle pattern for wave (b).

And now I am looking at this new decline as the beginning of wave ‘iii’ of (c) of [a].

The minimum target for wave (c) lies at 145.00,

that is where wave (c) will reach equality with wave (a).

Monday;

Watch for wave ‘iii’ of (c) to continue lower towards that initial target level at 145.00.

The wave ‘ii’ high must hold at 148.25.

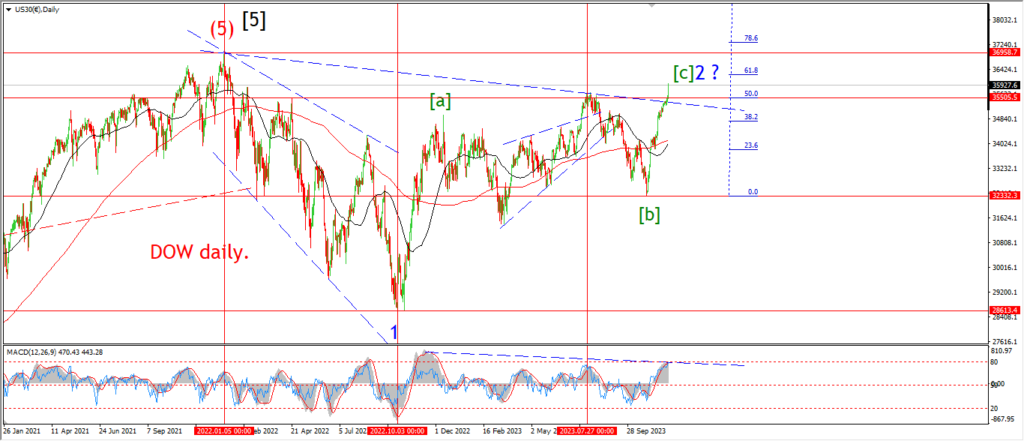

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The endless rally took hold again today

and just like that the market threatens to climb to a new all time high.

Something I never though possible again.

But here we are.

The rally today has taken wave [c] of ‘2’ up to the 62% Fib of the length of wave [a] of ‘2’.

The market is extended beyond belief right now,

and the pattern does not allow for much more of an upside stretch.

If a major reversal does not happen next week,

then I am completely wrong on the stock market,

and I will have to throw out every assumption that I have made this year.

the pattern can still be read as a ‘1’ ‘2’ decline,

but I can’t rule anything out at this late stage,

Monday;

This knee jerk rally must be reversed in the early sessions next week.

I will hold out on making any predictions until that happens.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

A rally today in gold along with the stock market.

This comes on the back of a few minor statements from Jerome Powell that could lead to an early rate reversal cycle next year.

I am firmly of the opinion that a rate reversal will happen next year,

for sure,

no doubt.

But this will happen as the Fed chases plummeting risk markets all the way down.

And it will not affect the declines as they happen.

It will be a reaction,

and a late one at that.

Gold is at risk of this fate too,

I must state that fact.

Even though I am a gold bug in the long run.

A run on the financial system could easily collapse prices everywhere.

And precious metals can fall victim to that early panic.

We will see how it copes as the time comes.

back to the pattern.

The rally today suggests wave ‘v’ of (iii) is now underway.

Wave ‘v’ has brought the market back to the the all time highs again.

If this pattern is correct,

then wave (iii) should take a break here soon.

and we can expect wave (iv) to fall back again next week in a corrective manner.

Monday;

Watch for wave ‘v’ of (iii) to hit a new all time high and then we should see a reversal in prices towards the end of next week as wave (iv) takes over.

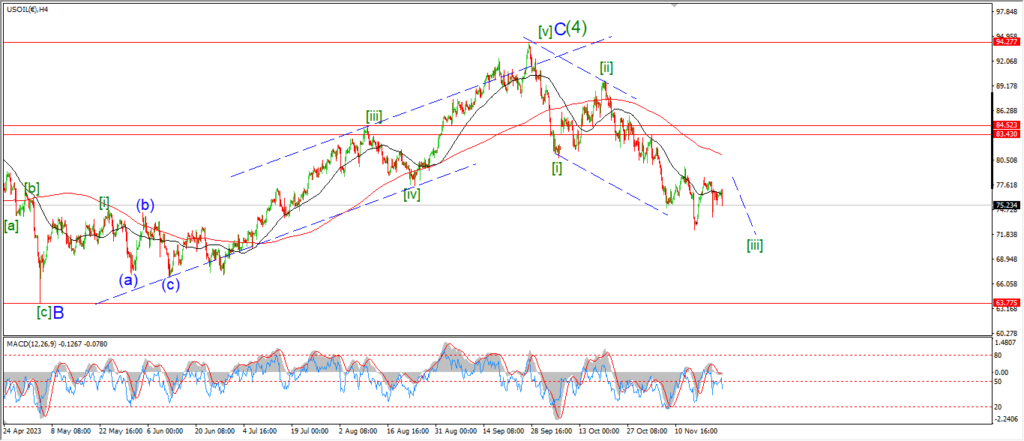

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Another drop in crude today suggests wave ‘iii’ of (v) is now in play here.

Wave (v) should take the price down towards the 70.00 handle again.

And wave ‘iii’ of (v) can break that wave (iii) low again at 72.36.

It looks like we will hit a low in wave [iii] green next week,

and then head higher again into wave [iv].

so I would not be surprised to see wave (v) complete by midweek and then turning higher into wave (a) of [iv] by the end of the week.

Monday;

Watch for wave ‘iii’ of (v) to hit the previous wave (iii) low at 72.36 again to confirm this wave (v) pattern.

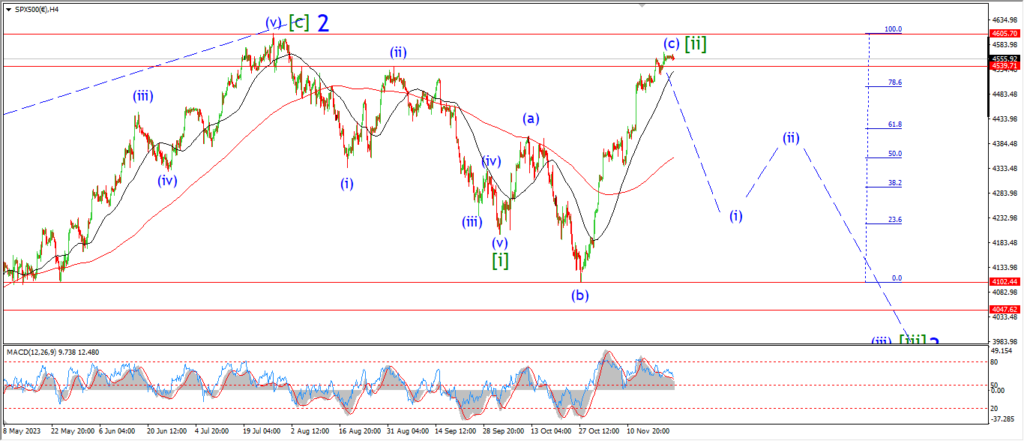

S&P 500.

S&P 500 1hr

The main count is still valid here wave [ii] of ‘3’ but I may as well give up the fight on this one!

It seems the market is just chomping at the bit here to get above that wave ‘2’ high again.

I have said my piece earlier regarding the madness of crowds,

so I hold my peace here.

Monday;

The market must turn lower and the high at 4607 must hold.

However unlikely that is at this late stage I know.

The market will do its best I’m sure to break out to a new high and complicate this wave count in the extreme.

So I will revisit this on Monday to see the damage after Mondays session.

SILVER.

SILVER 1hr

Silver continues to find the will to reach out to a new high even if the action is very labored looking.

The price continues to hold above the the upper trend line of the channel.

But dare I say that won’t remain the case next week.

Wave ‘ii’ is the very least that we can expect after the recent rally.

And that decline should unwind most of the bullish sentiment that has built up lately.

Monday;

watch for wave ‘i’ to close out during Mondays session.

Wave ‘a’ of ‘ii’ should drop back into the 24.00 area again to begin the three wave correction.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

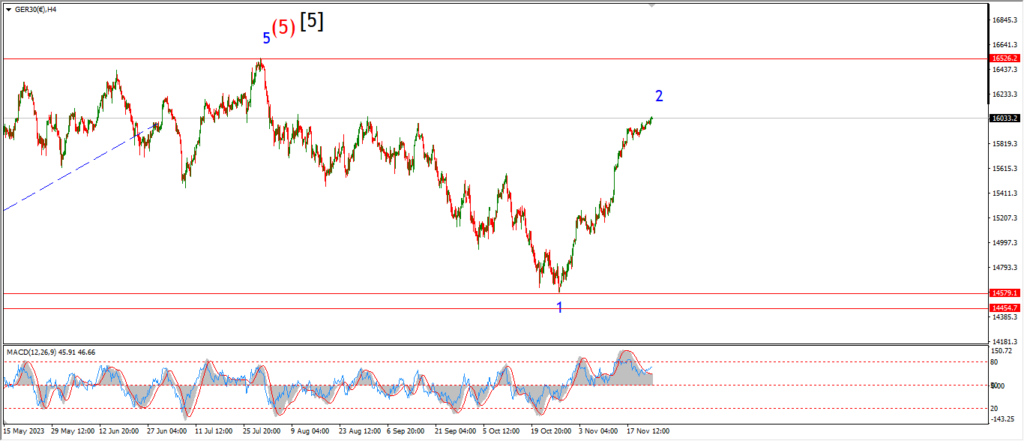

DAX.

DAX 1hr

….

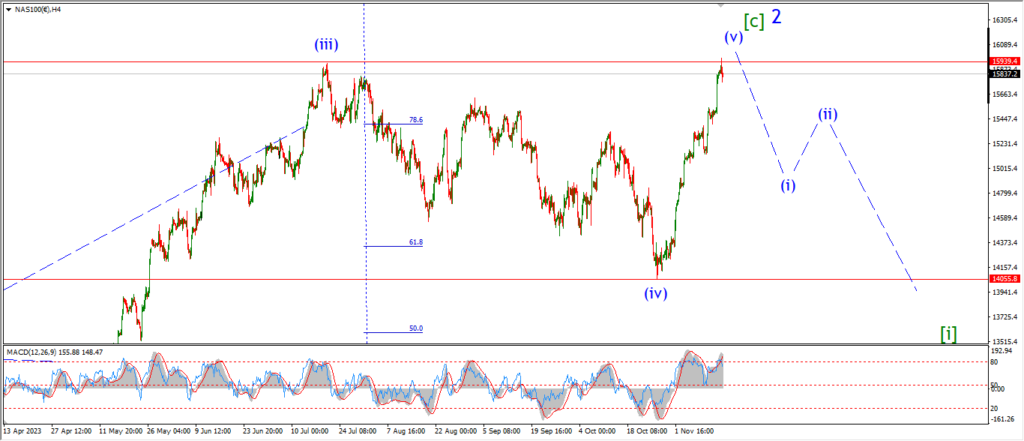

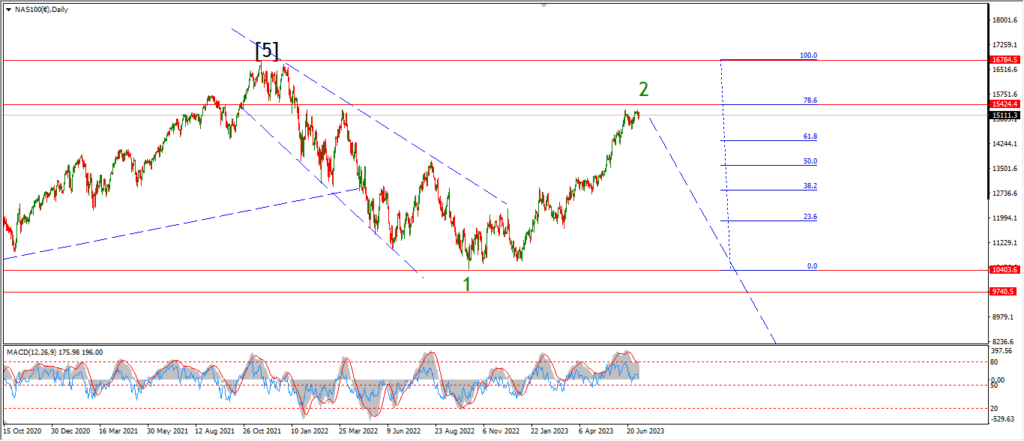

NASDAQ 100.

NASDAQ 1hr

….