Good evening folks, the Lord’s Blessings to you all.

I feel like I will be repeating myself tonight a whole lot,

so please forgive me in advance!

the financial world has found a new vehicle to ride higher this week after an almost flat trade in the stock market for the last week.

Gold and silver are now providing the ride so lusted after by the financial elites!

And as I said before,

I do not trust a rally in precious metals that is happening at a social mood peak.

It is very hard to see any other outcome than a major drop in the metals when the rest of the risk markets do fall hard.

I feel like this may be a very risky high in the metals complex.

But lets take a look at the days action to see where we stand.

https://twitter.com/bullwavesreal

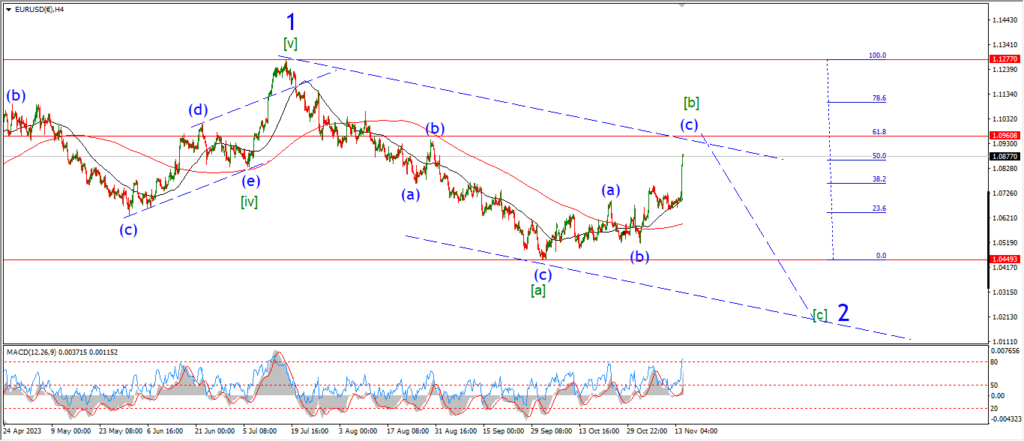

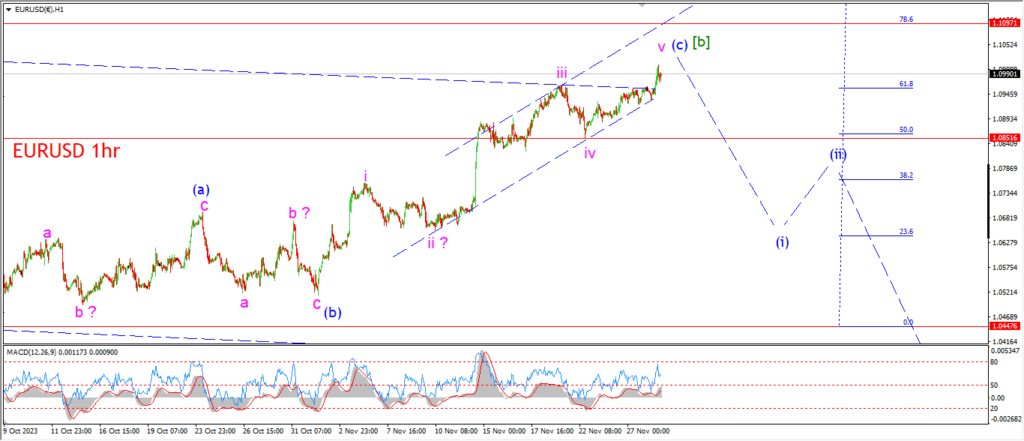

EURUSD.

EURUSD 1hr.

EURUSD has pushed higher to break above the wave ‘iii’ high again today.

that completes five waves up in wave (c) of [b].

We now have another opportunity to look for the top of this pattern in wave (c).

And if this pattern is correct,

we should see a reversal back off wave (c) to begin wave (i) of [c] before the end of this week.

tomorrow;

Watch for a potential break of support at wave ‘iv’ at 1.0852 to begin wave (i) down.

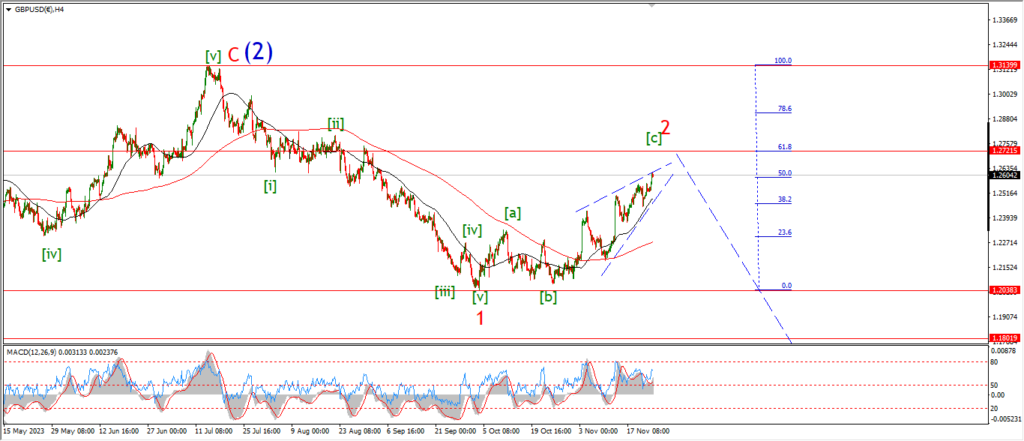

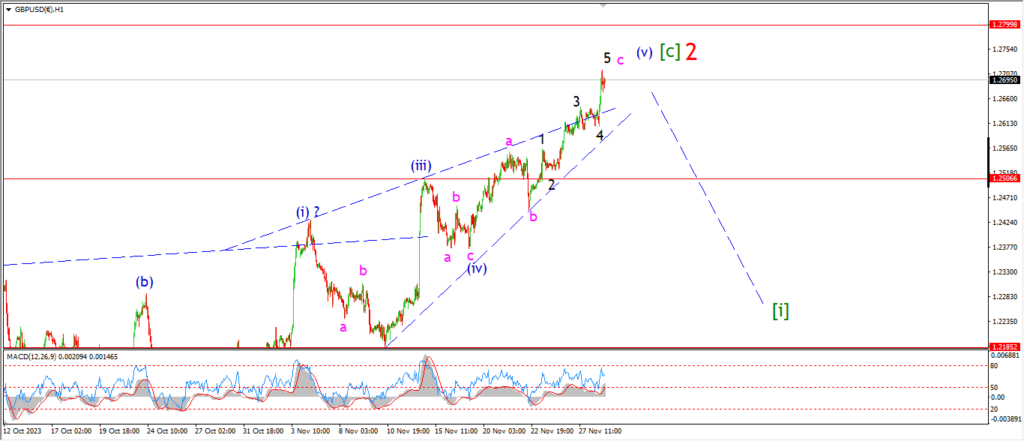

GBPUSD

GBPUSD 1hr.

Cable managed to pop out above the upper trend line again today.

and that has changed the internal count for wave (v) and wave [c] a little.

Wave [c] is still viewed as an ending diagonal pattern.

But wave (v) now has shows a larger three wave move completing at todays highs.

Wave ‘c’ of (v) has a clear internal five wave pattern,

and that again leads to the idea of a completed overall pattern in wave [c].

Tomorrow;

Watch for wave ‘c’ to compelte after that five wave rally into todays highs.

I have marked the wave (iii) high as the initial support to signal wave [i] is underway.

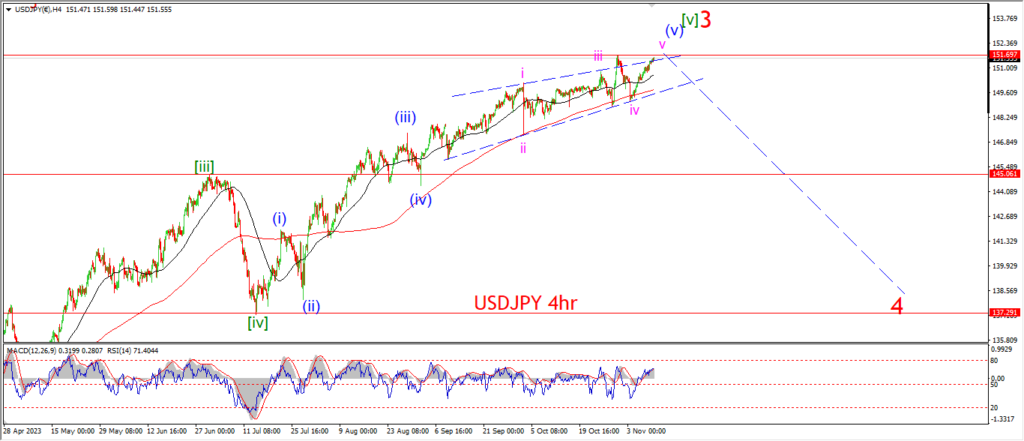

USDJPY.

USDJPY 1hr.

Last nights idea for a standard zigzag correction in wave (b) is less likely now after todays action.

After another sharp drop in USDJPY,

the action has opened up another possibility for this wave (b) correction.

I am showing a contracting triangle pattern for wave (b) now.

And if this pattern is correct,

we will see a grind sideways over the next few days to complete wave (b) early next week possibly.

The alternate count is still a possibility also,

and I have left that in place.

The price will need to continue the decline over the coming days to favor that idea though.

Tomorrow;

WAtch for wave ‘c’ to turn higher in three waves and top out near the 149.00 handle again.

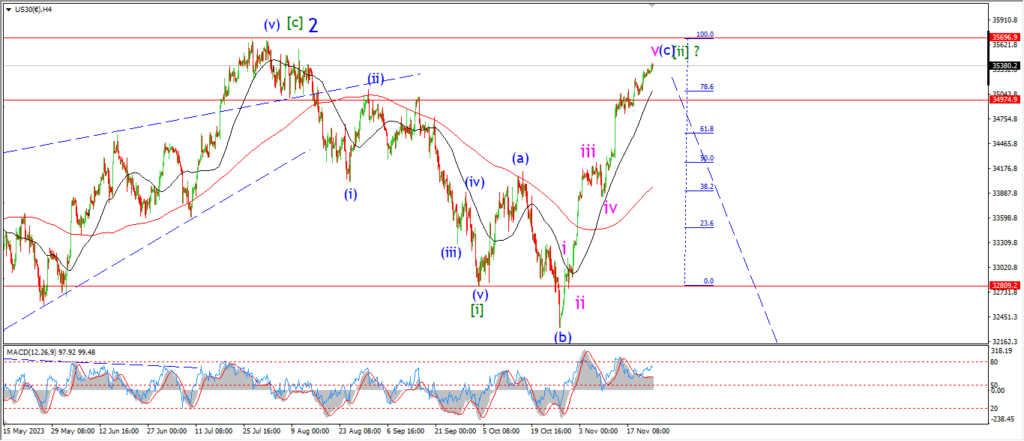

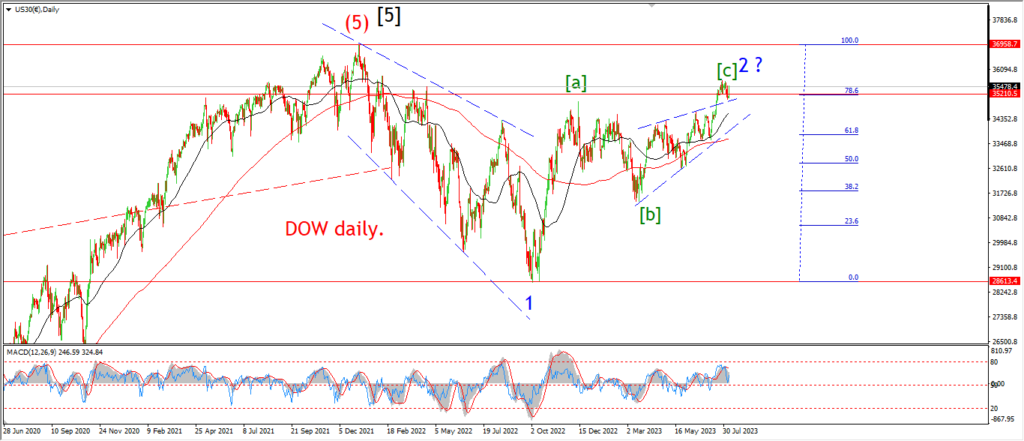

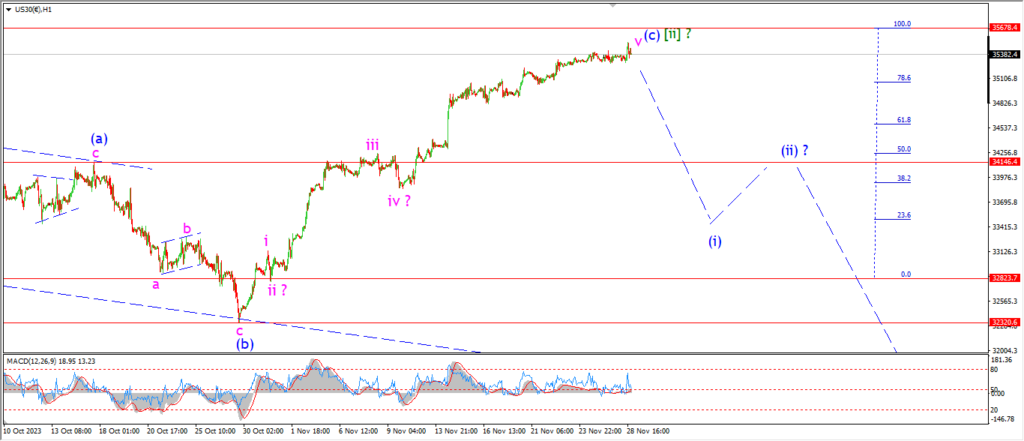

DOW JONES.

DOW 1hr.

As the Dow continues to linger below the invalidation line at 35678,

the possibility remains that this wave [ii] count is correct.

I have not changed that stance tonight,

and maybe you are going to think I am a bit crazy here.

But the chance remains for a big drop into wave (i) of [iii] at this point and that will remain open until proven otherwise.

I will just let the market decide what happens here.

you know where I stand,

and if I am wrong,

so be it.

Tomorrow;

Watch for a retracement of the recent long and slow rise into this high.

IT seems like the market is cresting the top of a hill here,

so a sharp drop will reverse to momentum setup for sure.

Wave ‘i’ of (i) is on the cards here.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

AS I mentioned at the top,

I don’t trust this rally in metals.

And you will see that I am conflicted by the action today.

I remember this feeling actually.

This is the fourth time in three years that we have hit these highs and each time it has ended in freefall for gold.

I am wary that the very same will happen this time.

My caution may be proved wrong.

But I just have to voice it!

Ok,

I have switched to the alternate count for wave [ii] this evening.

That wave bottomed out at the recent low at 1931.

The rally off that low is now labelled as wave (iii) of [iii] developing.

If this is wave (iii) of [iii],

then this rally should be unstoppable as we hit a new all time high in wave (iii) of [iii].

And that is where we hit a problem for the bullish wave count.

I fear the market has already hit a peak in momentum.

So that previous idea for an expanded flat can still be a reasonable explanation here.

Especially when you look at the 4hr chart.

We will know soon enough what the correct interpretation is here.

Tomorrow;

It is a simple proposition for the bullish count.

Wave (iii) of [iii] must continue to accelerate to a new all time high over the rest of this week.

If the price fall back below the wave (i) high at 1993 again that will rule out the bullish count and we will be back to the larger wave [ii] idea again.

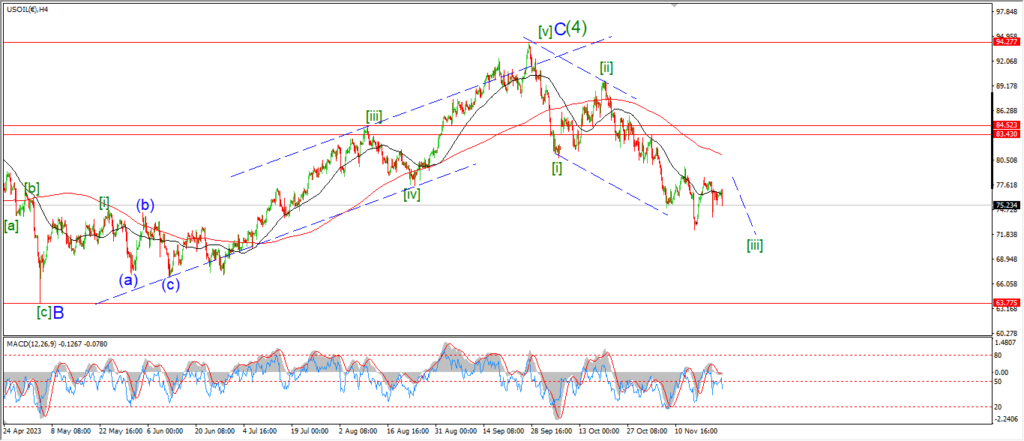

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude oil did manage to rally again today,

but this action has not proved the main count just yet for wave ‘c’ of (iv).

Wave ‘3’ of ‘c’ should push back above 78.45 again to confirm the pattern.

And so far that has not hapened.

I will give this wave count another day to see if wave ‘c’ can push higher again and confirm the pattern.

Tomorrow;

Watch for wave ‘b’ to hold at 73.80.

A break of that level will invalidate this count.

Wave ‘3’ of ‘c’ must turn higher again and break above 78.45.

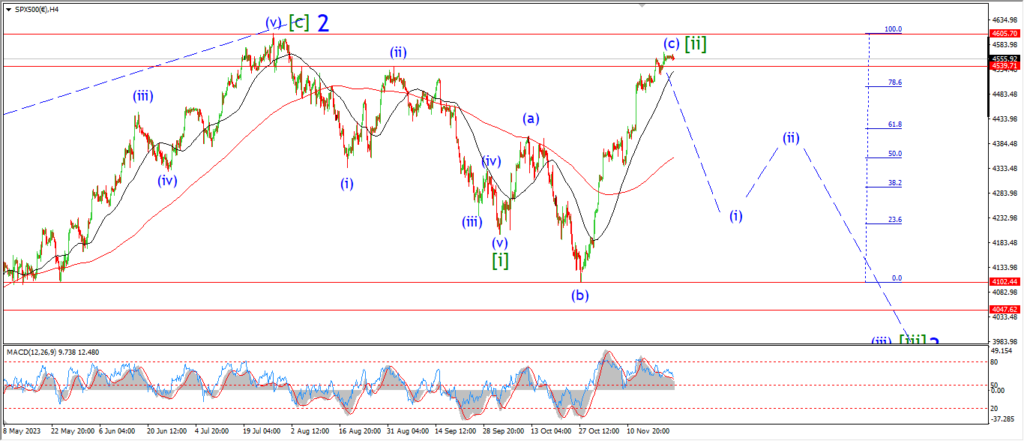

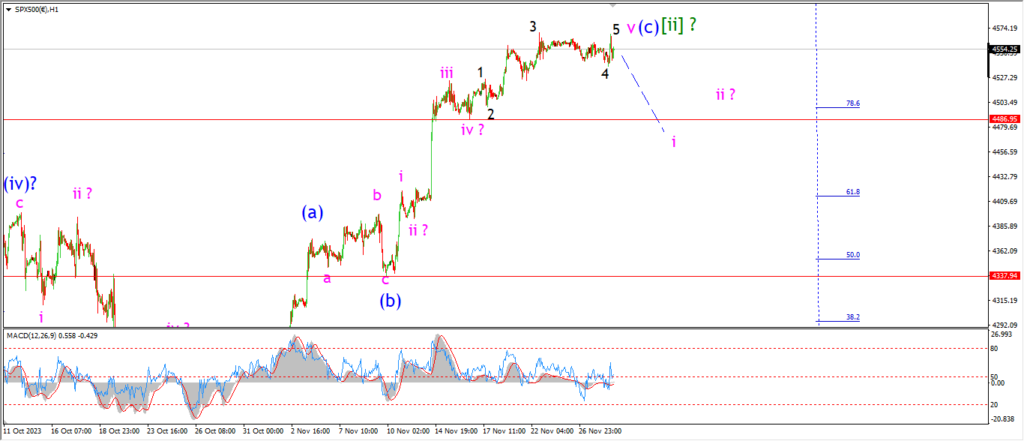

S&P 500.

S&P 500 1hr

Another day and the market holds flat again.

That brings the total to 7 days trading in a very tight range.

You could say that nothing has happened over the last week to be honest.

So its quite hard to write something new where nothing new has happened!

Anyway,

The price did spike to the top of the range today and reverse back off it again.

There is one explanation for this action,

that is a correction in wave ‘4’ of ‘v’ throughout the last few days,

and now a spike high to complete wave ‘5’ of ‘v’.

I am waiting for the turn that refuses to come again tonight.

And I will end with a similar outlook.

so forgive the repetition!

Tomorrow;

Watch for a drop back into the previous fourth wave low at 4486 to signal wave ‘i’ has begun.

SILVER.

SILVER 1hr

I hate to be the kill joy for precious metals,

but I can’t help myself!

I have not changed the main wave count yet,

but;

I want to point out something very simple on the 4hr chart that may cause some concern.

The rally over the last few days has brought us to an extreme in momentum again whish should lead to a cooling in the rally for sure.

Add to that fact

the price has completed a three wave pattern into todays highs.

The price is also sitting at the previous wave [b] high as I write.

And,

the price has closed the trend channel off the October lows now.

If this is only a corrective rally into this new high,

then the market is in for a MAJOR shock over the coming months.

I know that I am speaking out of both sides of my mouth tonight in regards to the metals.

But I do need to sound the alarm when I see something.

And this is ‘something’ worth watching.

Tomorrow;

Watch for this wave ‘i’ high to top and fall back into wave ‘ii’ over the rest of this week.

The initial target for wave ‘ii’ lies at the triangle low of wave ‘4’ at 23.55.

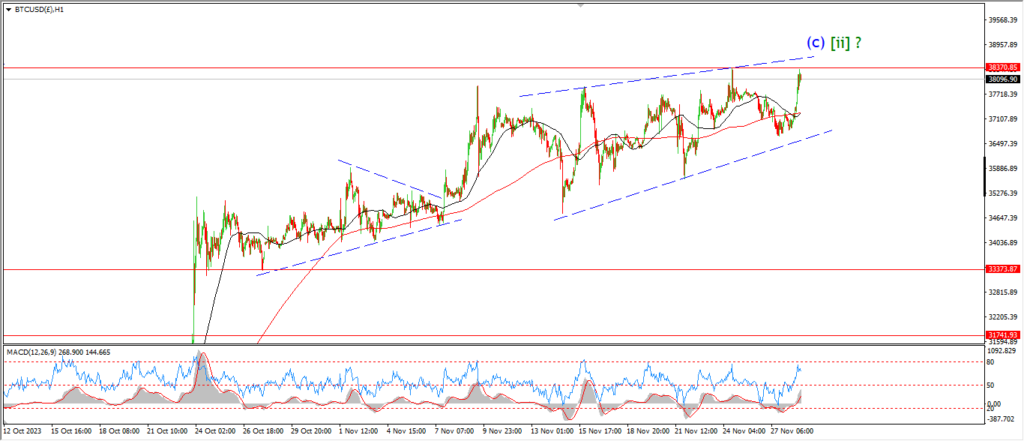

BITCOIN

BITCOIN 1hr.

….

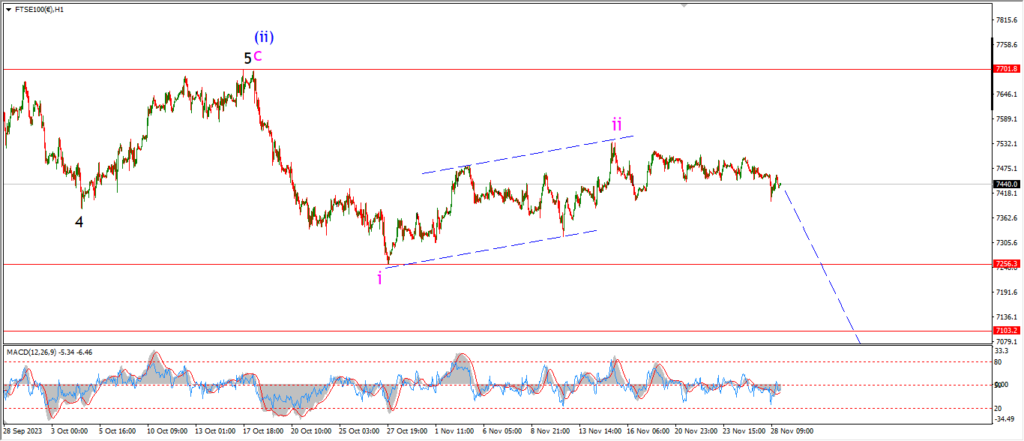

FTSE 100.

FTSE 100 1hr.

….

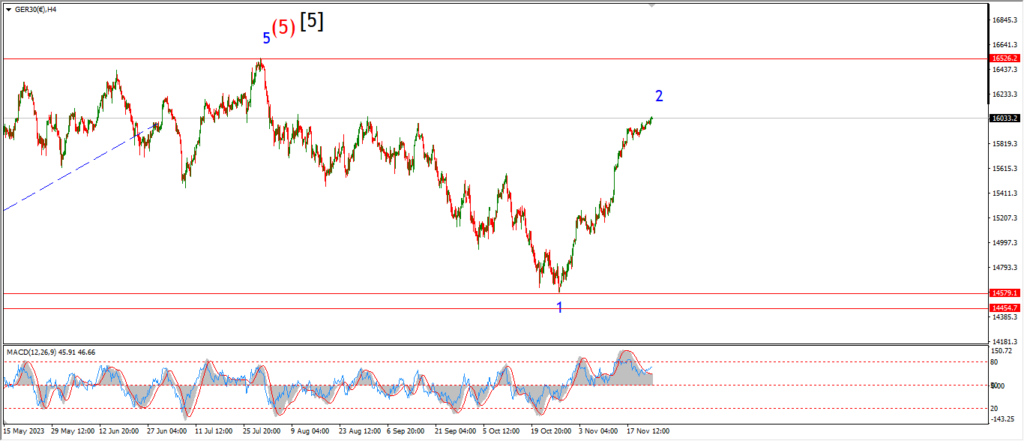

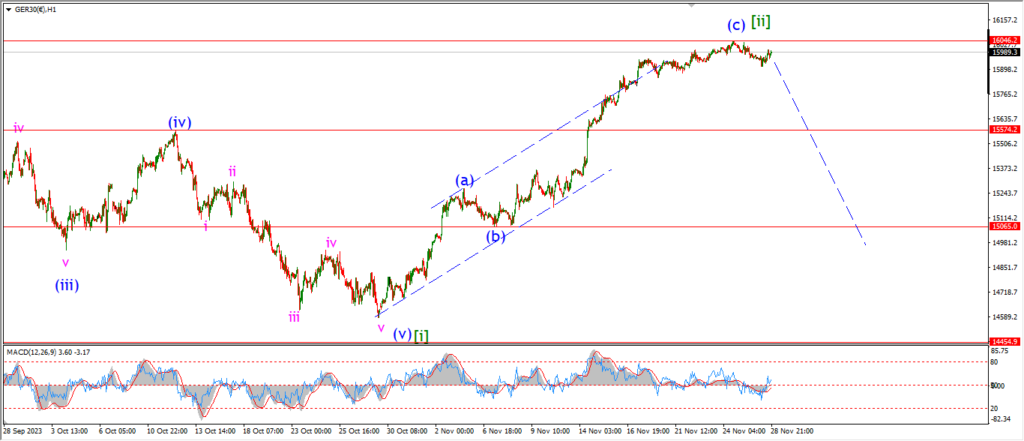

DAX.

DAX 1hr

….

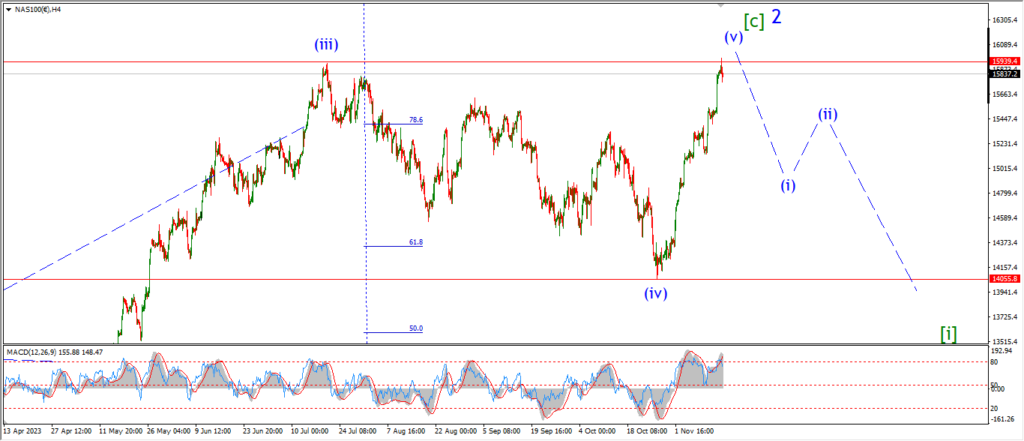

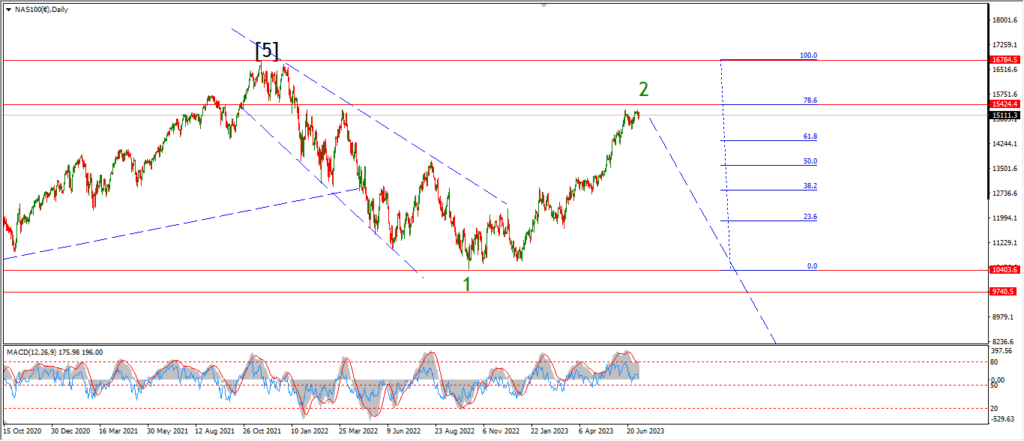

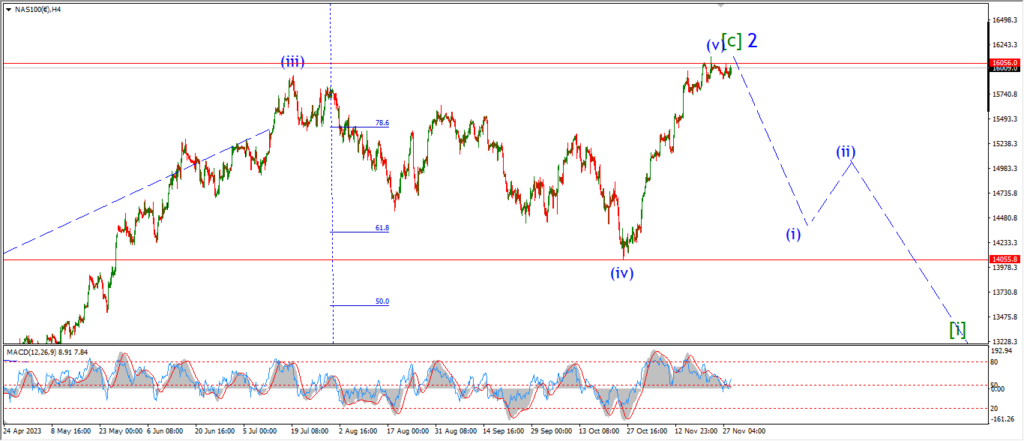

NASDAQ 100.

NASDAQ 1hr

….