Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

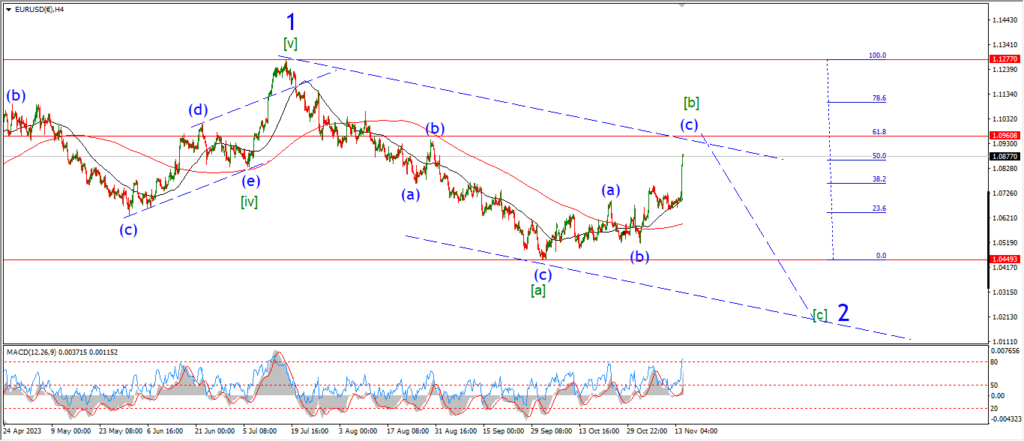

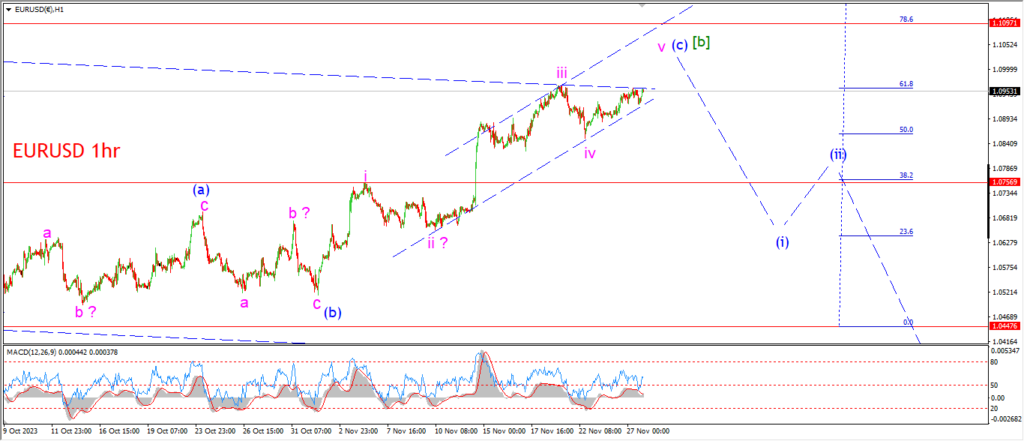

EURUSD.

EURUSD 1hr.

I must back track on my count from Fridays update now.

The price has moved back towards the recent high again today and while it has not hit a new high yet,

it looks likely that EURUSD will break to a new high in wave (c) tomorrow.

That does not change the overall count at all.

We are still waiting for this wave (c) of [b] to complete and then wave [c] green should turn lower again as shown.

Tomorrow;

Wave ‘v’ of (c) should pop to a new high for the pattern.

A top in wave ‘v’ should happen near 1.1050 again if the channel is filled in wave (c).

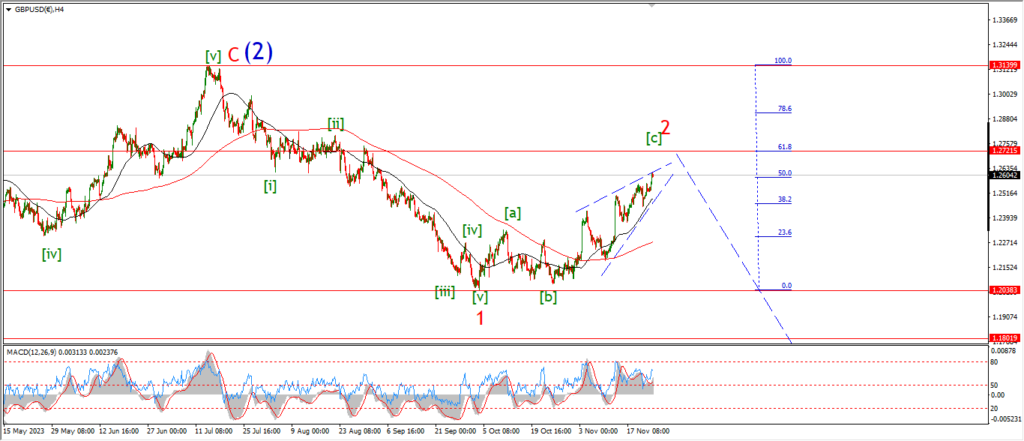

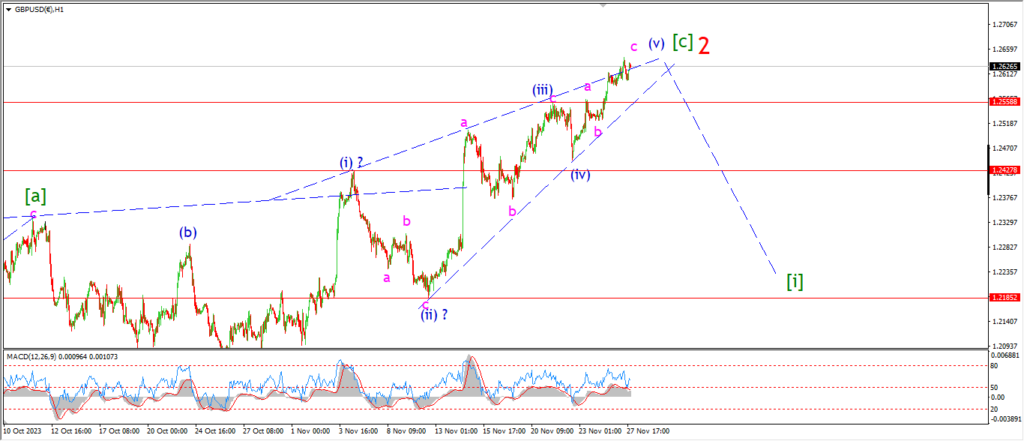

GBPUSD

GBPUSD 1hr.

We actually have a small throw-over in place tonight for wave (v) of [c] of ‘2’ as shown.

The rally in wave (v) reached up to that upper trend channel again today,

but the momentum is now seriously diminished here.

So I am expecting a reversal again this week to suggest wave [c] of ‘2’ is complete.

A nice sharp spike lower to break below 1.24 again will be a strong signal that wave ‘2’ red is complete and wave [i] of ‘3’ is beginning.

Tomorrow;

Watch for wave (v) of [c] of ‘2’ to close out soon.

The first sign of a reversal will come with a drop back below the rising wedge trend lines.

Lets see if we can get the first turn lower in place tomorrow.

1.2428 marks the wave (i) high and that is a good signal level to watch.

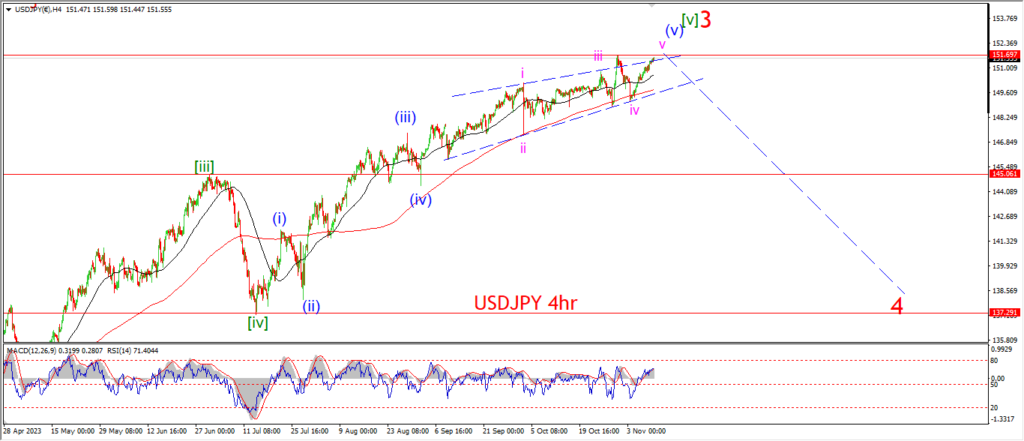

USDJPY.

USDJPY 1hr.

USDJPY came down again today in that corrective wave ‘b’ pattern.

We now have a three wave correction in place for wave ‘b’,

and the low of the session today has retraced almost 50% of wave ‘a’.

I am now looking for a rally in wave ‘c’ to turn higher again for the next few sessions.

With the initial target at 149.76 again at the wave ‘a’ high.

Tomorrow;

Watch for wave ‘b’ to complete soon and then wave ‘c’ of (b) to turn higher again to complete three waves up above 149.76.

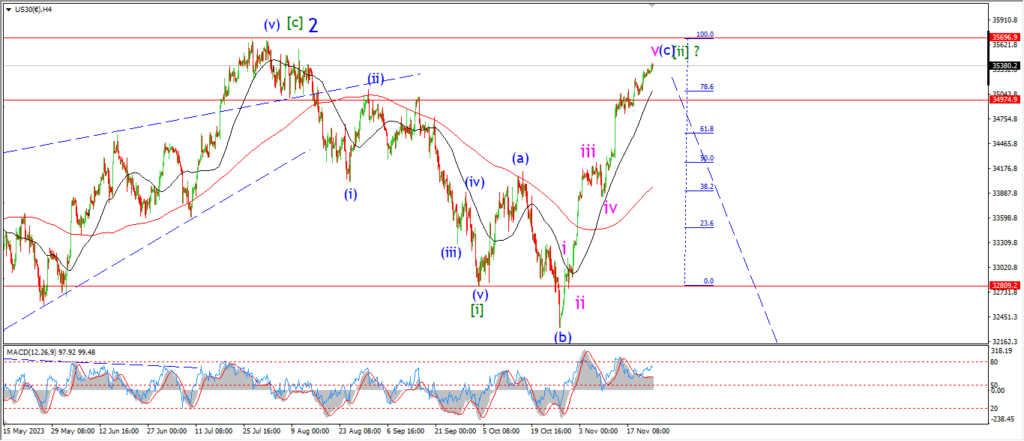

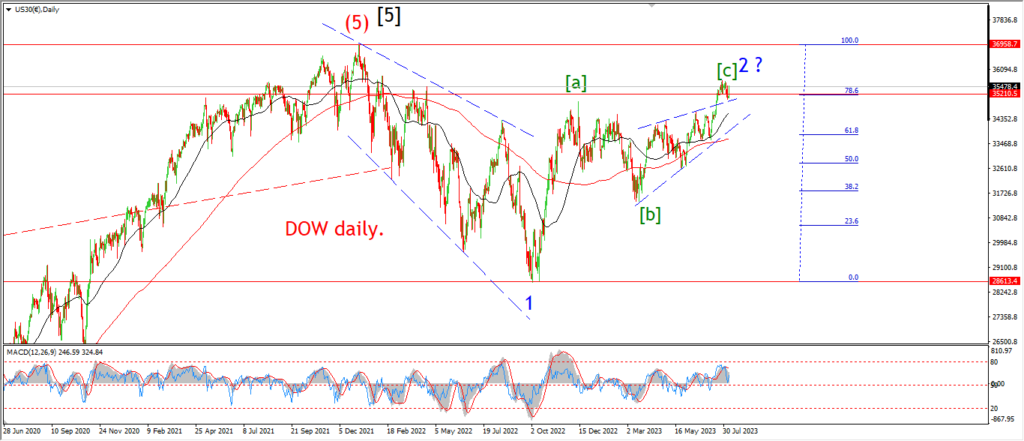

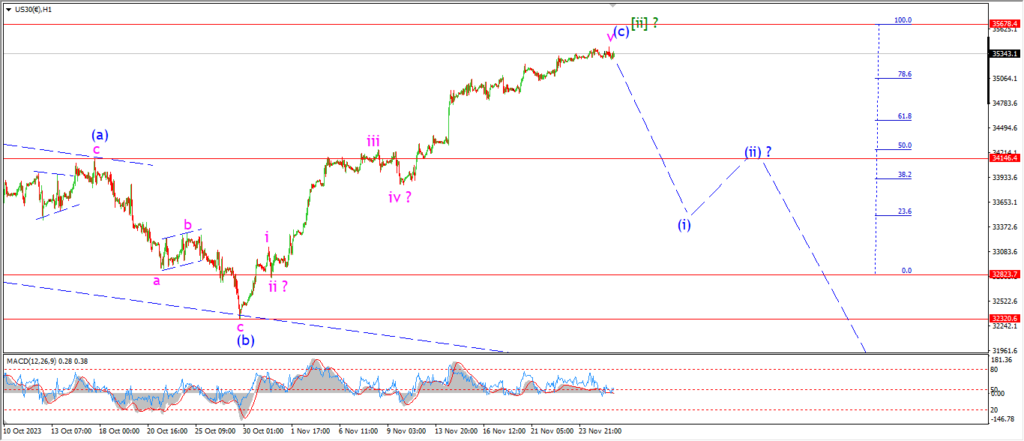

DOW JONES.

DOW 1hr.

The market is flat today and still holding too close to that invalidation line at the wave ‘2’ high!

Its far too close for any comfort at all.

But,

the wave count is still valid even at this late stage in the rally.

And as long as that high for wave ‘2’ holds,

then it remains very possible that wave [iii] of ‘3’ begins this week.

Obviously wave (i) of [iii] needs to begin with a real shock acceleration lower to give this wave count some breathing space below that invalidation line.

A break below the wave (a) high at 34146 again would be very welcome.

But I will just have to wait and see here!

At this point I now I am on the very edge of my speculations now.

Tomorrow;

Watch for wave (c) of [ii] to hold below the wave ‘2’ high at 35678.

WAve (i) of [iii] must begin very soon to save this wave count.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Wave [ii] green has now changed from a normal flat correction,

to an expanded flat correction.

With that pattern change,

then minimum target for wave (c) of [ii] should drop a little lower actually.

The minimum target for the normal flat correction was a break of the wave (a) low at 1931.

Now an expanded flat should manage a lower low in wave (c) to extend the pattern.

I know some will be shaking heads at me now saying why don’t I just jump on the bull train to the moon,

well,

At the minute this pattern looks a bit stretched to the upside,

and it reminds me of the wave ‘1’ high from last may.

The market took a big hit off that top also,

so my suggestion for a drop back towards 1900 here is not beyond the pale at all.

Also,

I am just a little suspect of the metals when they rally along with the stock market.

That correlation tends to suggest they will both turn lower in a similar fashion also.

so watch out for that!

Tomorrow;

Watch for wave (b) of [ii] to complete three waves up and top out very soon.

The price should turn lower in an impulsive manner this week to begin wave (c).

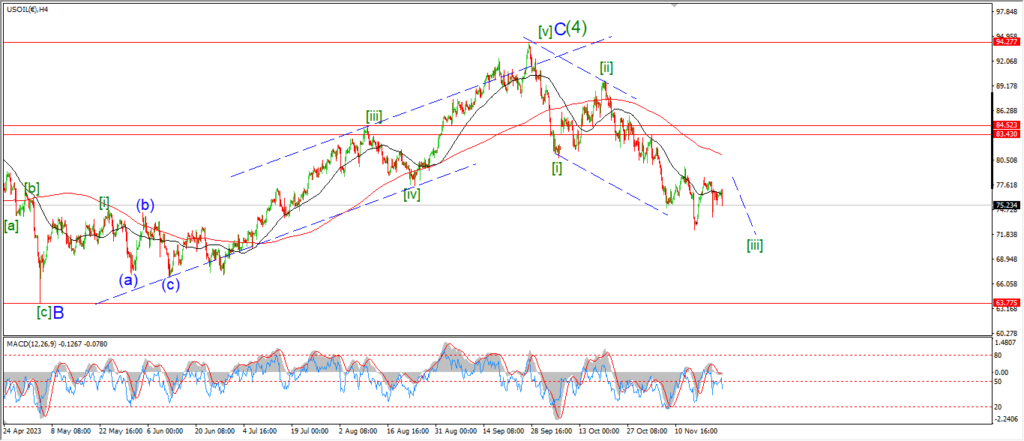

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude took another hit today which has set the pattern back a little.

The low of the session is still holding above the wave ‘b’ low at 73.80,

so the idea for wave ‘c’ of (iv) remains a valid interpretation.

However,

we need to see progress to the upside into wave ‘3’ of ‘c’ again to signal that the wave (iv) is still in play here.

It is possible that the simple three wave pattern for wave (iv) is going to get more complicated from here on out.

I will be keeping an eye on the possibility of a triangle for wave (iv) in the coming days also.

Tomorrow;

Watch for wave ‘3’ of ‘c’ to turn higher off todays lows to break above the 77.00 handle again.

That action will favor the main count for wave (iv).

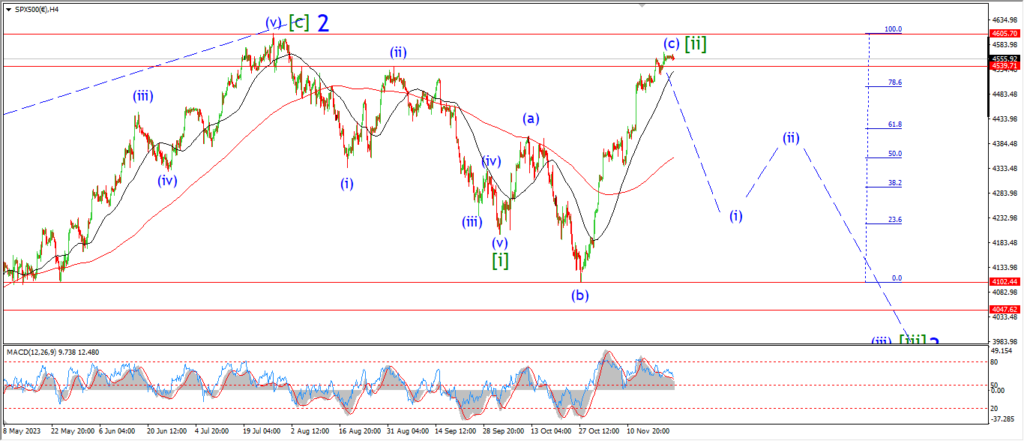

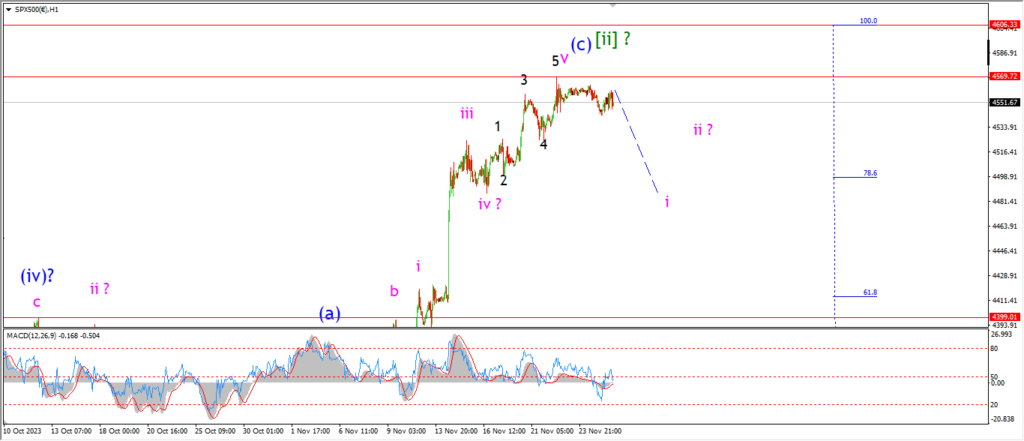

S&P 500.

S&P 500 1hr

Much like the Dow,

we don’t have much to go on in the S&P again today apart from the fact that last weeks highs are holding again.

We really do need a break from the constant rally now to save my bearish count for wave [ii] of ‘3’.

I have been waiting for wave [iii] of ‘3’ for too long now.

A drop back into wave ‘i’ down will offer that much needed reprieve.

The action off last weeks high is not very convincing yet as an impulsive reversal to be honest.

That might change for sure,

but it needs to change soon.

Tomorrow;

Lets see if the high at wave [ii] can hold long enough to turn this market down into wave (i) of [iii].

I am going to wait for more action before making any big decisions here.

I think the main count deserves more time.

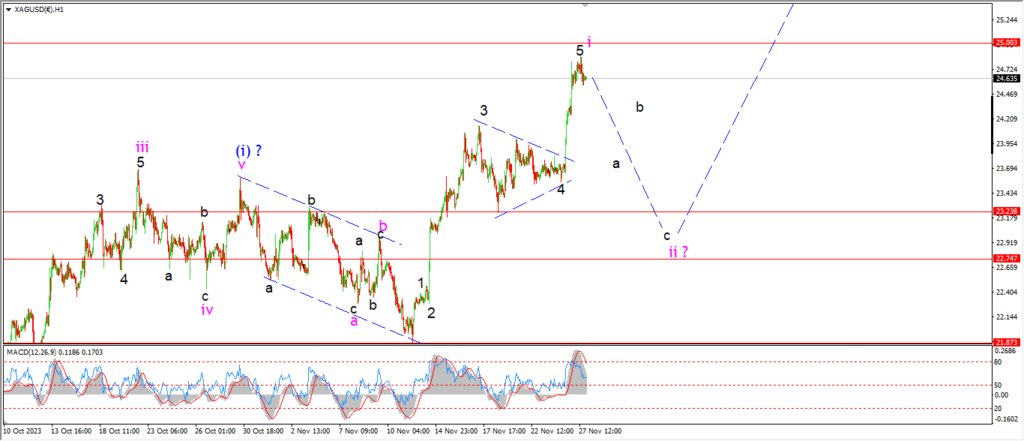

SILVER.

SILVER 1hr

I am going to go out on a limb here in silver.

I dont trust this latest rally at all!

I am a long term bull in the metals,

I think you know that from my long term counts.

but this short term action is very suspect given that it comes on the back of economic deterioration,

and the metals are moving higher along with the main risk asset complex.

This means one thing to me,

its all just one wide risk rally which is driving all boats higher at the moment.

Maybe that tide has peaked now.

The new pattern for wave ‘i’ pink in silver does suggest a top soon.

after last weeks triangle in wave ‘4’,

the market pushed higher again today in wave ‘5’ of ‘i’.

Wave ‘ii’ is what I am looking for again this week.

Last weeks action never completed the picture correctly for wave ‘ii’.

So that gap in the pattern remains open.

Tomororw;

Watch for a reversal of that strong wave ‘5’ rally in wave ‘a’ of ‘ii’ to begin.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

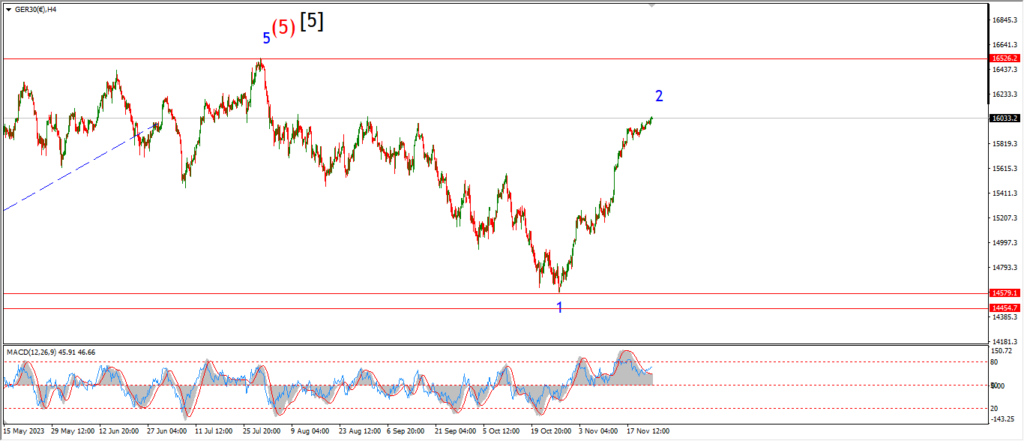

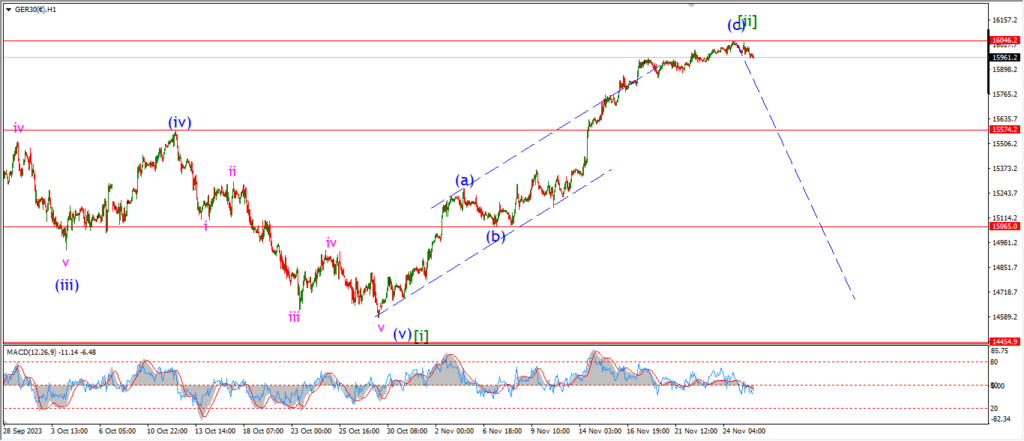

DAX.

DAX 1hr

….

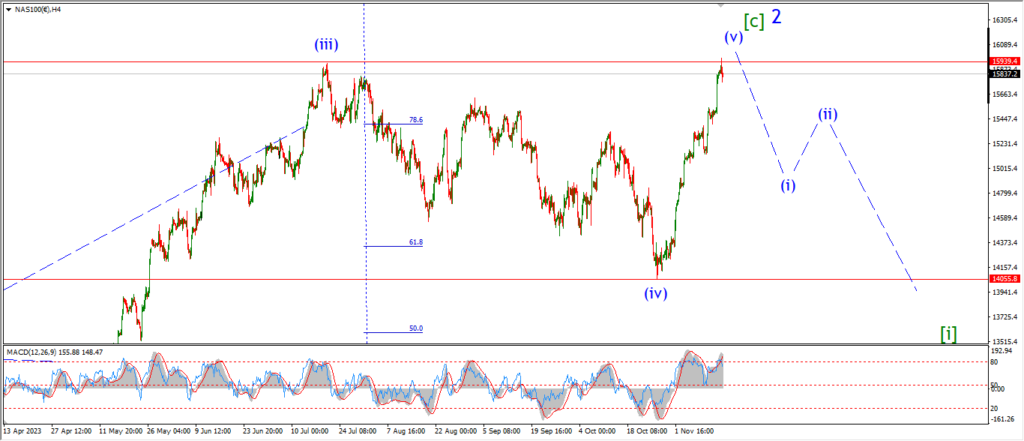

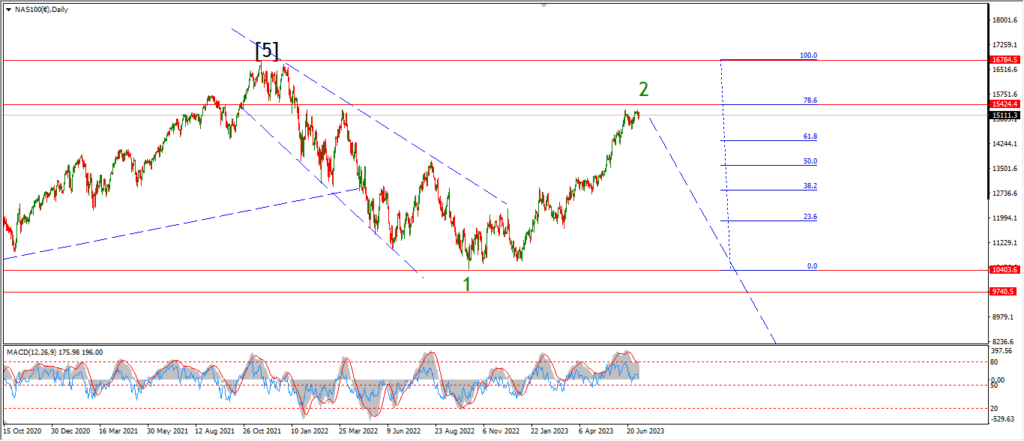

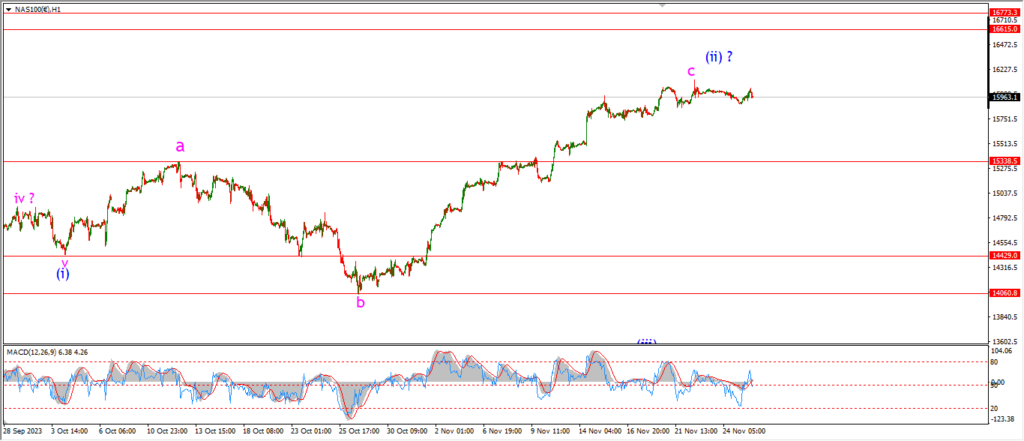

NASDAQ 100.

NASDAQ 1hr

….