Good evening folks, the Lord’s Blessings to you all.

National Activity Index Unexpectedly Tumbled In October, Chicago Fed Warns

Existing Home Sales Crash To Slowest Since 2010

https://twitter.com/bullwavesreal

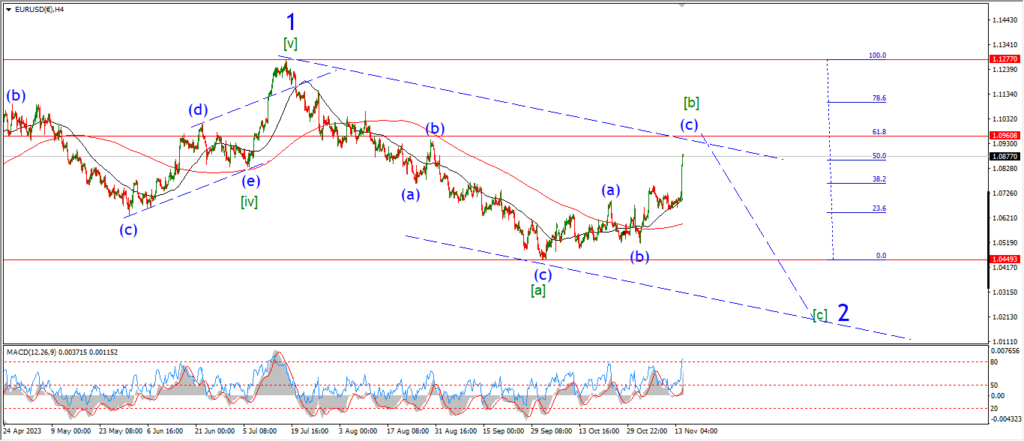

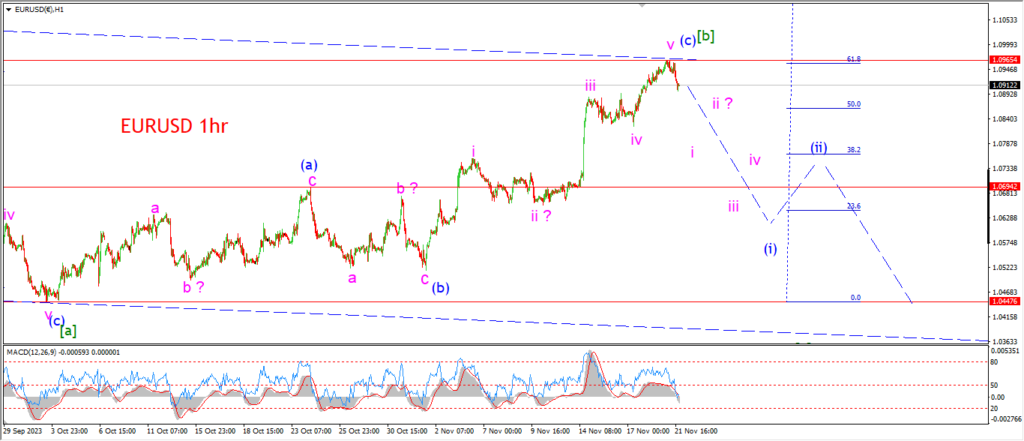

EURUSD.

EURUSD 1hr.

A small reversal off the top of the recent rally today and although it is small,

it is interesting none the less.

The top of wave ‘v’ of (c) hit the 62% retracement level of wave [a] after slowing the advance into that high.

And now we have a decline off the 62% retracement level today.

There are a number of levels below us here that should signal a reversal into wave (i) of [c].

However,

A break of the wave (a) high at 1.0694 will be the biggest hint.

Tomorrow;

Watch for wave (i) to continue lower in five waves over the coming few days.

And if we do see a break of the wave (a) high at 1.0694,

that will signal the larger decline in wave [c] is underway.

GBPUSD

GBPUSD 1hr.

Cable has stopped its rally also today and the final high in wave (c) of [ii] is now in play.

The action today is pretty flat off the top,

so there is very little to go on here yet.

But it is interesting that the price has hit the upper trend line of the wedge pattern,

and now we have a halt to the rally.

It is not clear yet if wave ‘v’ of (c) is complete,

but I do think the reversal into wave (i) will happen this week.

Tomorrow;

Watch for wave ‘v’ to top out and then wave ‘i’ of (i) to turn lower.

An break of the wave ‘iv’ low at 1.2372 again will be a good sign that the turn lower is underway.

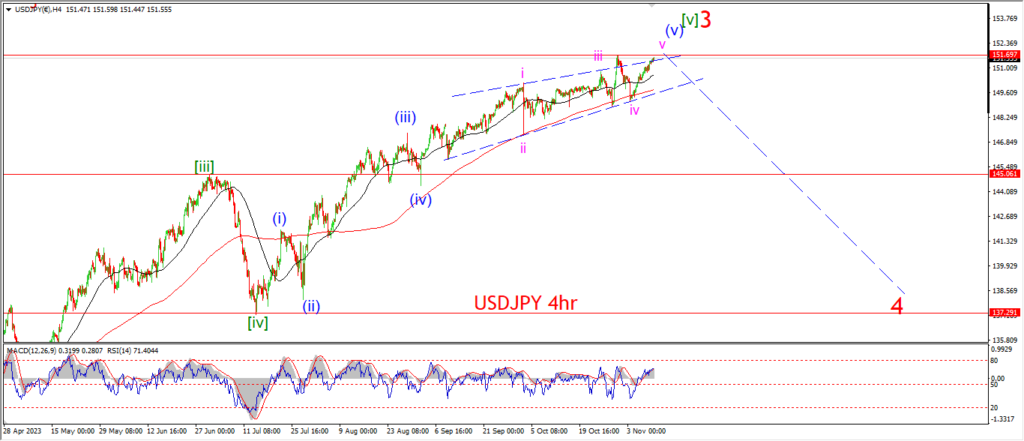

USDJPY.

USDJPY 1hr.

The overnight trade brought another spike lower into wave (a) with the low reaching 147.15 again.

The rally off that low today is now suggesting again that wave (b) has begun.

I am expecting a simple three wave rally in wave (b),

with todays rally coming in wave ‘a’ of (b).

The target area for wave (b) should be in the area of 150.00 again,

and that also marks the 62% retracement level of wave (a).

Tomorrow;

Watch for wave (b) to continue higher in three waves,

wave ‘a’ of (b) should hit the 149.00 area at the previous wave ‘iv’ low.

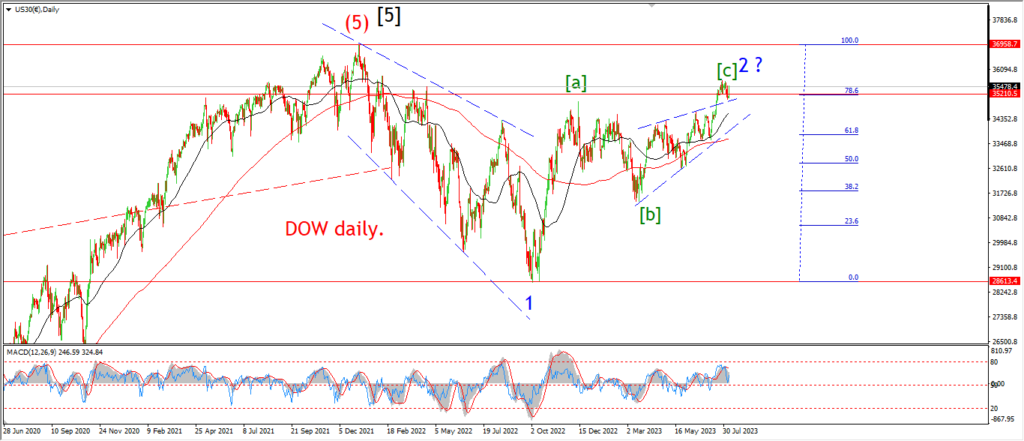

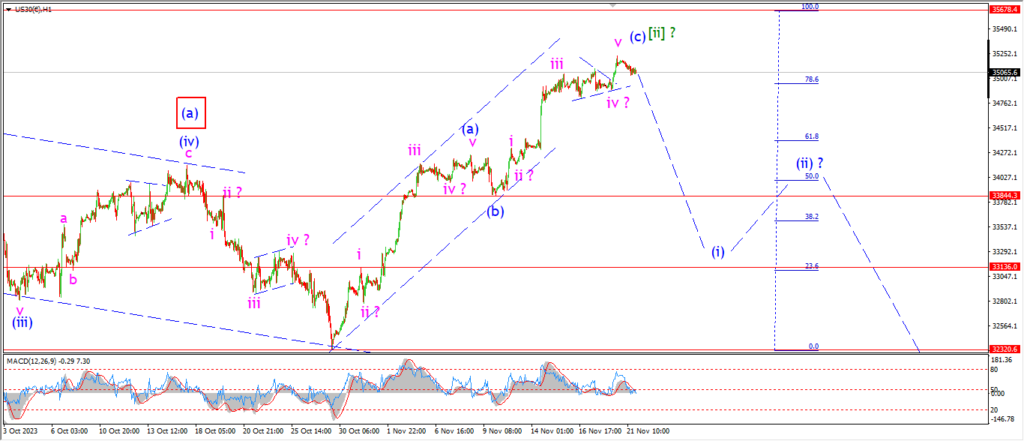

DOW JONES.

DOW 1hr.

Another soft day in the Dow with very little price action to indicate a turn lower is underway.

The market is essentially flat since the wave ‘iii’ high on the 15th.

So at the very least I can say that the desire to keep this rally going seems to be dead now.

Obviously I need the action to back up my statements here.

And that will come in the form of a five wave decline in wave (i) of [iii].

I have set a minimum target for wave (i) at the wave (b) low at 33840.

And that decline needs to happen soon to keep this wave count alive!

Tomorrow;

Watch for wave (c) of [ii] to top and reverse into wave (i) of [iii].

The large acceleration that happened in wave ‘iii’ last week is a good area to watch.

If we see a retracement of that price range then we have a real contender for wave (i) down in play.

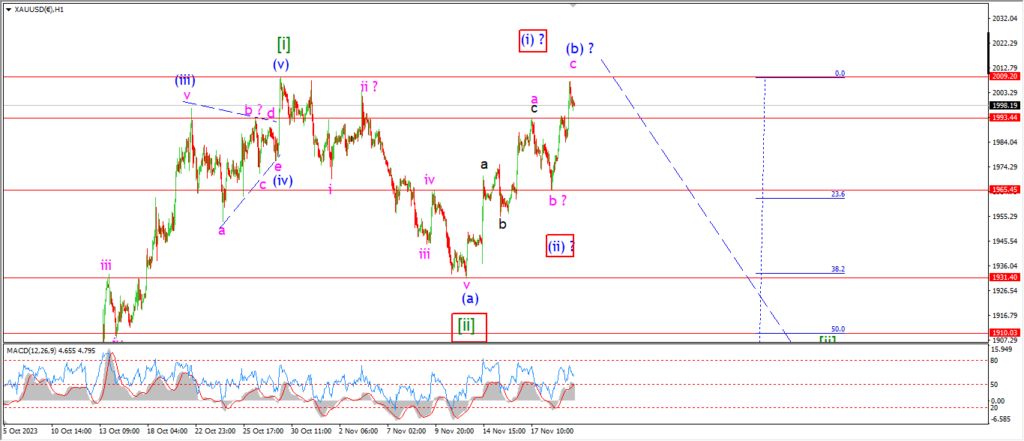

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Another move higher today has opened up the possibility again that the alternate count is correct here.

I still favor the main count here to be honest.

And I am allowing for a larger wave (b) at todays highs.

with the decline into wave (c) left to begin later this week.

The main thought in my mind is this;

The rally into the recent wave [i] high has not been answered with a large enough correction in wave [ii] yet.

The pattern off the top of wave [i] has been merely an after thought, or a minor hiccup in the run.

Wave [ii] needs to bring doubt and fear into the equation again.

And we are not there yet.

I may be wrong on this,

but I do expect wave (c) down to take over again by the end of this week.

Tomorrow;

Watch that wave ‘b’ low at 1965.

A break of that level will favor the main count.

If that level holds,

then we can look at the more bullish alternate count.

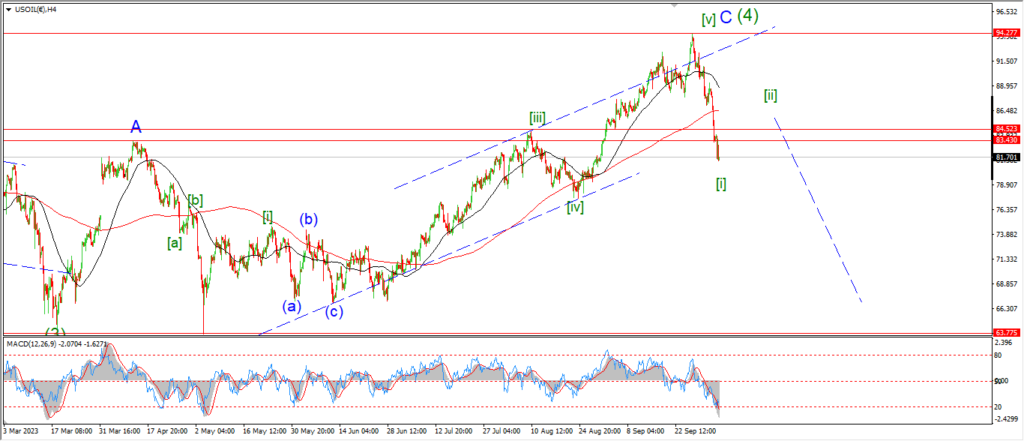

CRUDE OIL.

CRUDE OIL 1hr.

Crude oil is holding below the high at wave ‘a’ tonight and I am suggesting that wave ‘b’ is now underway off that high.

Wave ‘b’ has not completed a three wave decline yet,

and I am looking for another drop into the 76.00 handle again to complete wave ‘c’ of ‘b’.

Once that happens,

I can look higher again into wave ‘c’ of (iv) again.

Tomorrow;

Watch for wave ‘b’ pink to trace out a three wave decline into the 76.00 area to complete.

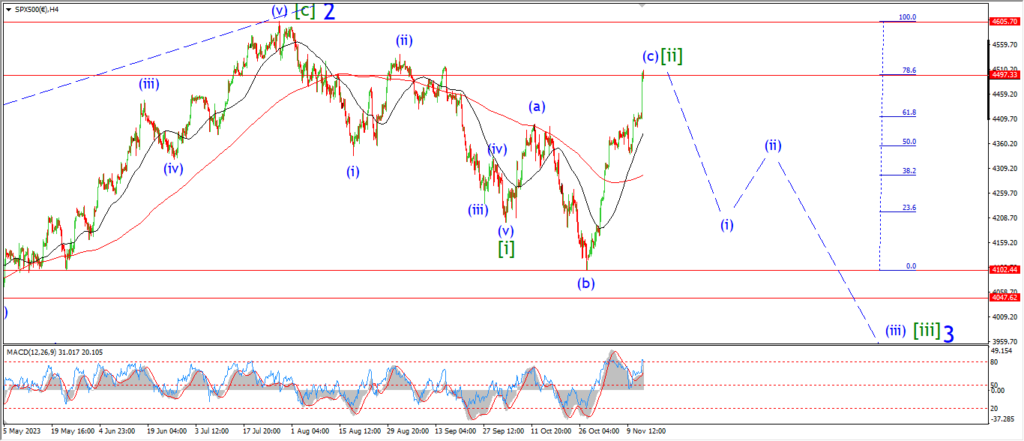

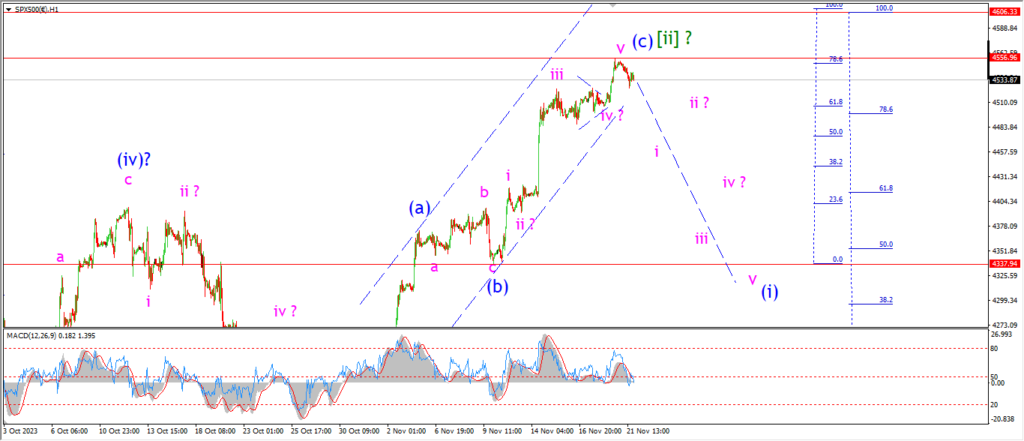

S&P 500.

S&P 500 1hr

I am reluctant to write very much tonight as I know that there are some results pending from Nvidia that can cause a kneejerk reaction across the markets tomorrow.

Even so,

I won’t be changing this wave count after todays action,

so there is little use in predicting what the results of one company will do.

I found it interesting that Lowes reported today and they are looking at serious yoy decline in revenue and profits of about 7%.

which says that the consumer driven economy is really contracting materially at the moment.

and everyone is hanging on the words of a company which is less than half the size and much less use as a bell weather for the economy.

WE will see how it goes.

But I cant rule out the knees jerking all over the place tomorrow!

The market is off the highs of wave (c) today without very much actually impulsive action though.

I will need much more than that small cooling off in order to signal wave ‘i’ of (i) is underway.

Tomorrow;

Watch for that high to hold at wave (c) of [ii].

Wave (i) must fall back below the wave (b) low at 4337 to re-affirm this bearish wave count again.

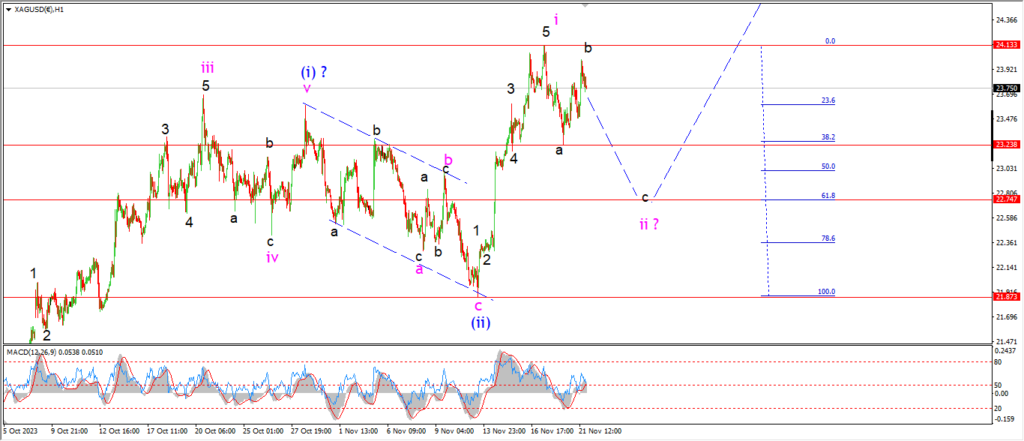

SILVER.

SILVER 1hr

Silver has pushed up to form another lower high today and I have not changed my outlook for wave ‘ii’ here yet,

the rally into todays high still reads as a correction higher in wave ‘b’,

and I expect wave ‘c’ to move lower again for the rest of this week as shown.

The target for wave ‘ii’ remains near the 62% retracement level at 22.74.

And once we hit that level then I will begin to look far higher into wave ‘iii’ of (iii).

Tomorrow;

Watch for wave ‘b’ to hold below the wave ‘i’ high.

Wave ‘c’ must break 22.24 at a minimum.

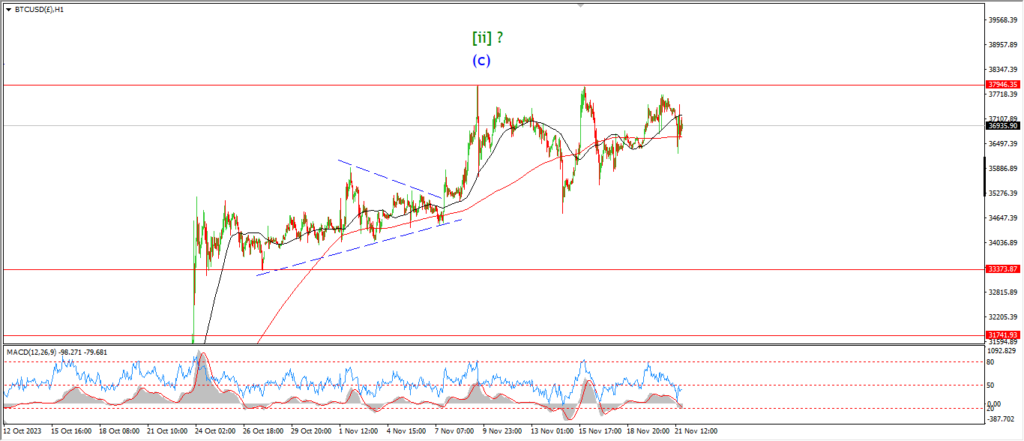

BITCOIN

BITCOIN 1hr.

….

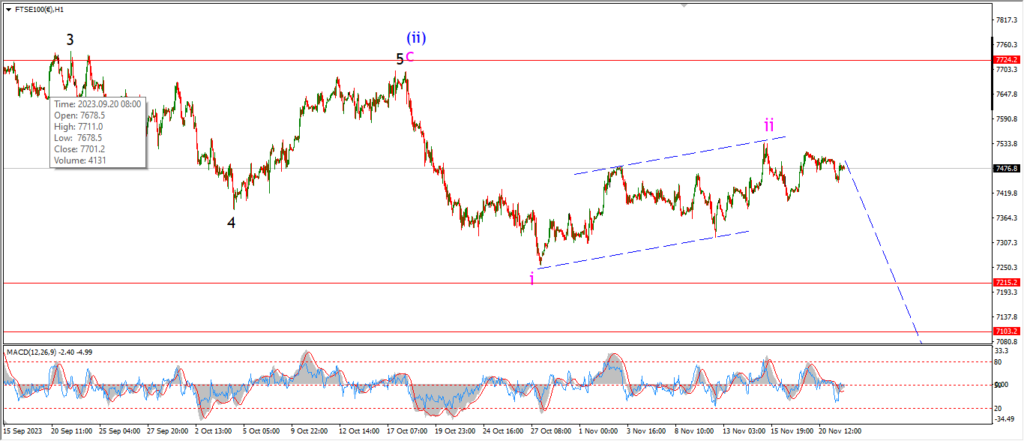

FTSE 100.

FTSE 100 1hr.

….

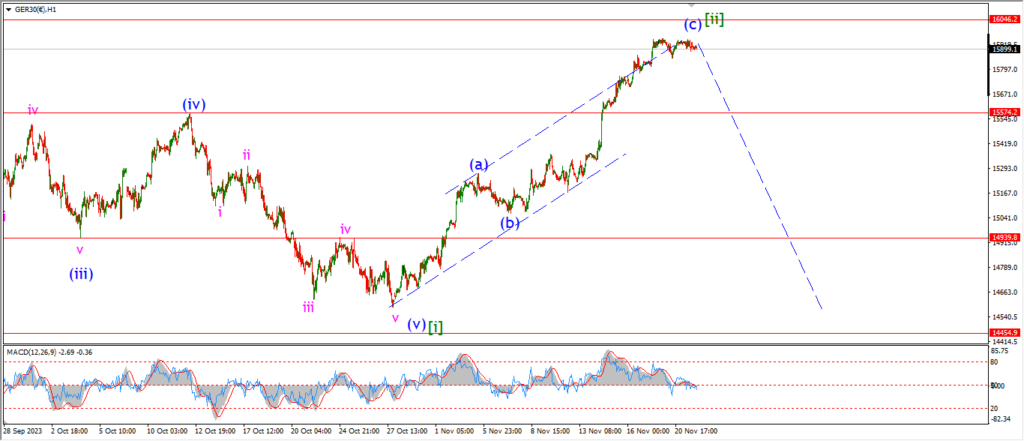

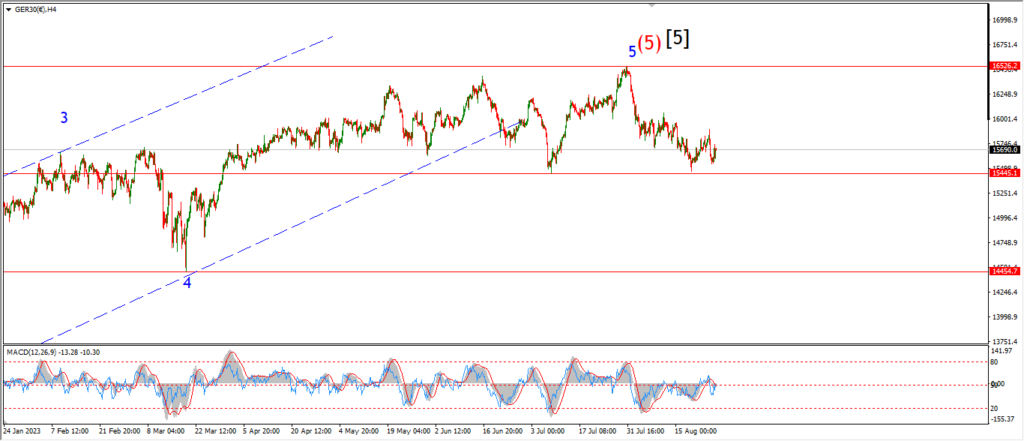

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

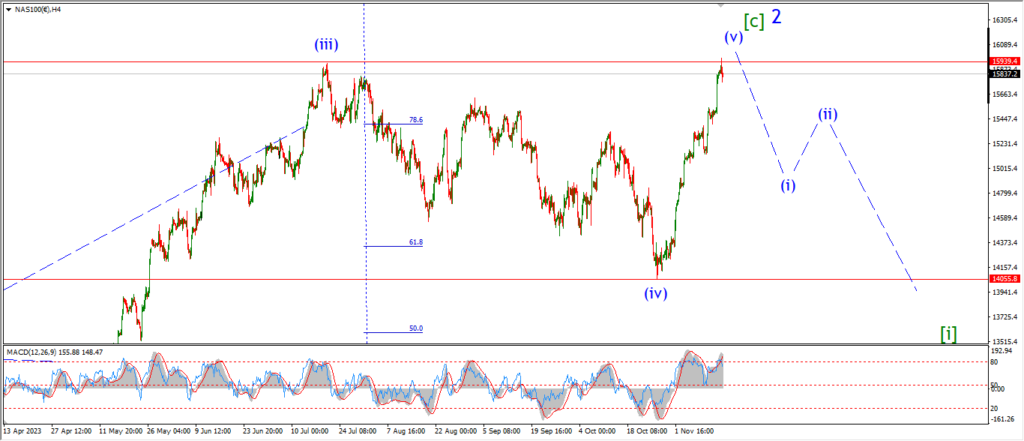

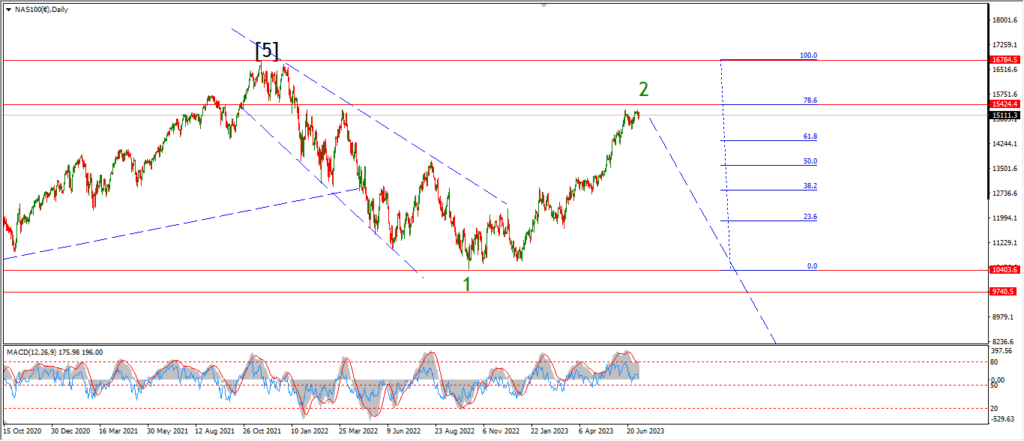

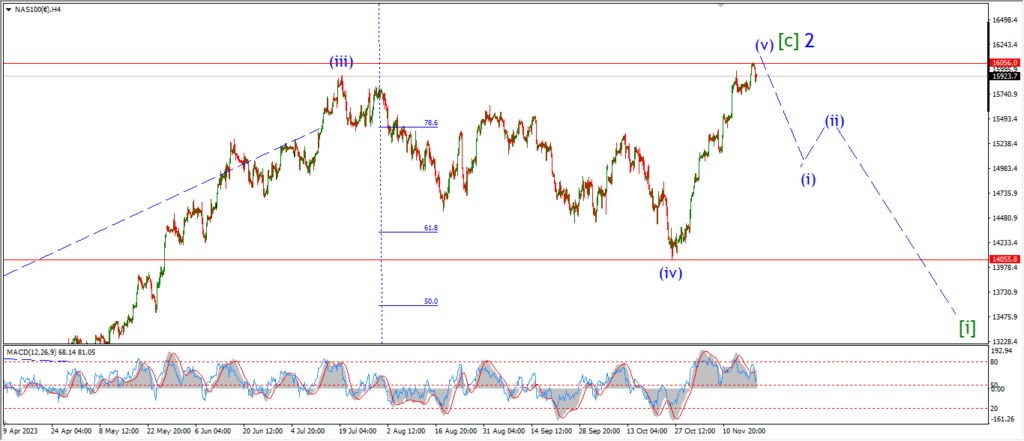

NASDAQ 100.

NASDAQ 1hr

….