Good evening to one and all.

The LORD’s blessings to you all tonight.

$SPX Bullish Percent Index now above 70%. The 2022 playbook says a reversal back below the 70% level indicates the bear market rally is over.

https://twitter.com/bullwavesreal

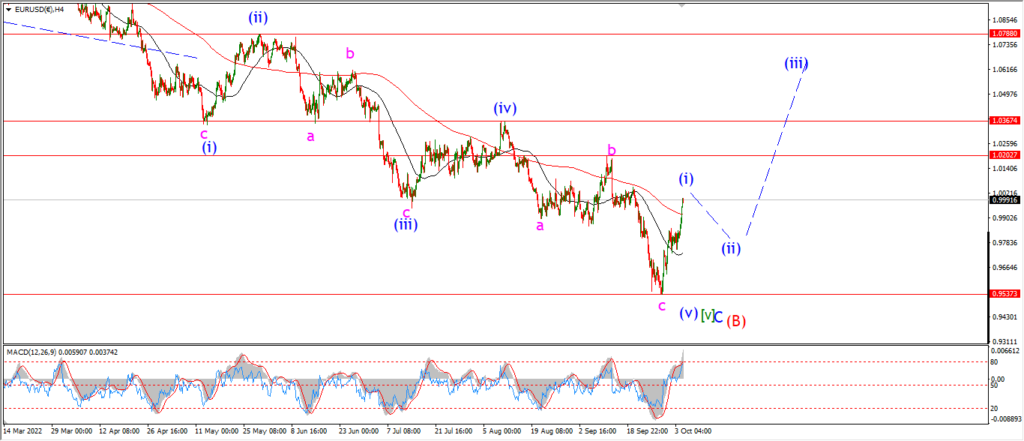

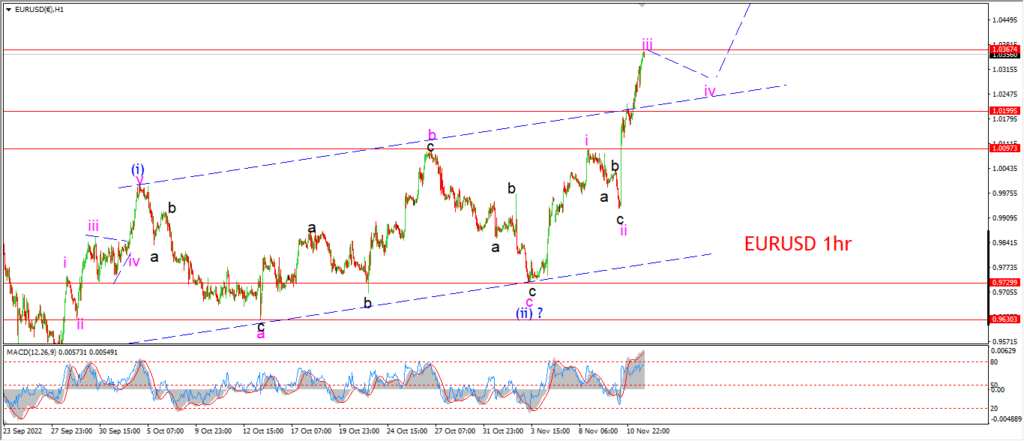

EURUSD.

EURUSD 1hr.

The advance into wave ‘iii’ of (iii) is loosing steam as we close out this week.

Wave ‘iii’ has reached above equality with wave ‘i’ today and now we should expect a short term top in wave ‘iii’ develop soon,

and then a correction lower into wave ‘iv’ will begin next week.

Wave ‘iv’ of (iii) must hold above the wave ‘i’ high at 1.0097,

a break of that high will invalidate this wave count for wave (iii) of [c].

Monday;

Wave ‘iii’ should top out by Monday evening and wave ‘iv’ will then turn lower in three waves.

Watch for that wave ‘i’ high to hold at 1.0097.

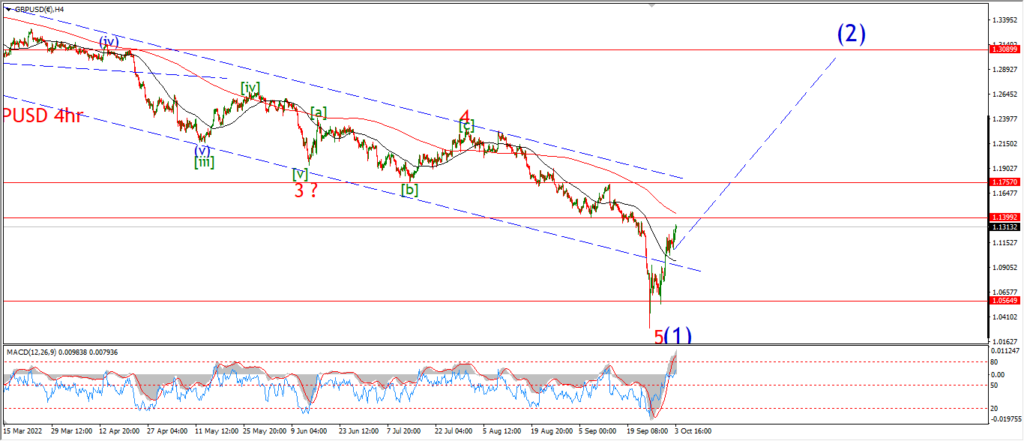

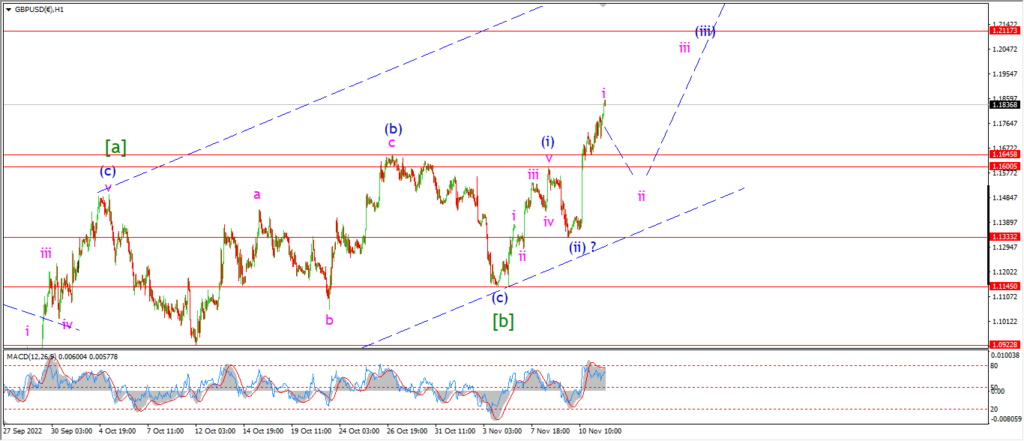

GBPUSD

GBPUSD 1hr.

Its a very similar picture in cable this evening as we have a third wave advance now underway

and the price now has a number of support levels at previous highs in the pattern.

Wave ‘i’ of (iii) is close to topping now.

And the action today is close to completing five waves in wave ‘i’.

A correction will begin in wave ‘ii’ on Monday.

Wave ‘iii’ is expected to drop back towards 1.1500 again in three waves.

And then wave ‘iii’ of (iii) is set for an acceleration higher in the second half of the week.

Monday;

There is a band of support between 1.1645 and 1.16 flat.

That may be enough to hold wave ‘ii’,

we will see early next week.

Watch for the low at wave (ii) to hold at 1.1333,

a break of that level will invalidate this pattern.

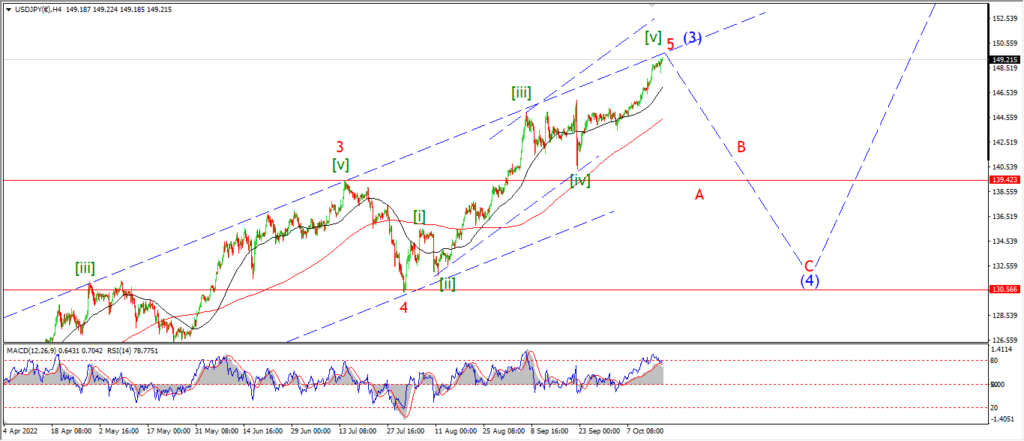

USDJPY.

USDJPY 1hr.

Wave [c] has completed a five wave internal pattern at todays lows.

And the pattern off the high has completed three waves down with a break of the lower trend line.

The early indications are that we are close to completing wave ‘A’ now.

And the next big move will be higher into wave ‘B’ beginning next week.

This move will take longer to complete as all ‘B’ waves tend to take their sweet time.

And I am suggesting a rally into the previous wave [b] area at 147.00 to complete wave ‘A’.

Monday;

Watch for wave ‘A’ to find a low to complete three waves down.

And I will be expecting a rally and higher low to begin wave ‘B’ by midweek if this count hold true.

Lets see how Monday goes first!

DOW JONES.

DOW 1hr.

The Dow is off the highs this evening without hitting that invalidation level for the short term count at 34285.

If this level is broken next week,

then the wave (ii) count is invalidated,

at that point the count will switch to either wave [ii] green,

or a higher degree top at wave ‘2’ blue shown on the 4hr chart.

Given the size of the rally of late and the shift to bullishness across the board in the market,

I am about as certain that this rally will be retraced,

as I was certain that the summer rally would be retraced completely.

The main question here is at what degree is this market correcting higher.

Wave (ii),

wave [ii],

or wave ‘2’.

What follows all of these waves is a rapid decline into a third wave.

So the outlook has not changed for a third wave decline.

We will see at what degree that comes in.

Monday;

I would like to see the high at 34285 holding and an impulsive decline begin into wave (iii) down.

I have marked the wave ‘4’ low at 31700 as the signal level for a reversal into wave ‘i’ of (iii).

GOLD

GOLD 1hr.

The rally in gold is hitting a top thie evening also,

so I suspect wave (i) is closing out now and wave (ii) should come in next week.

Wave (ii) should fall back into the 50% retracement level over the next week if all goes to plan here.

If we see a higher low build in that area,

I think that will be a solid signal in favor of the bullish outlook.

I have always been a little concerned when a so called risk or inflation hedge rallies along with the risk assets as glod has over the last week.

And because of that I am showning that alternate count for wave (ii) of [v] also on the hourly chart.

We should know by the end of next week if this alternate count will takeover or not.

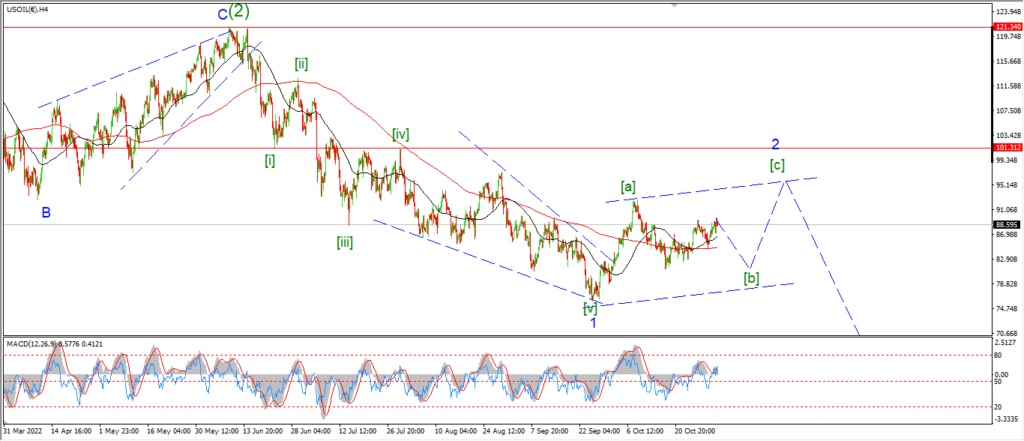

CRUDE OIL.

CRUDE OIL 1hr.

Crude topped out in wave (ii) today just below the 62% retracement level of wave (i).

The price then dropped sharply off the highs.

This action fits the bearish count quite well,

but we do need to see follow through to the downside on Monday in order to signal wave (ii) is in place at todays top.

If the price continues higher on Monday that will favor the alternate count for wave [c] of ‘2’.

And in that scenario we can expect a top in wave [c] of ‘2’ near 93.00 again.

Monday;

The early part of next week will be crucial to decide between the patterns.

An early decline is what I favor and a break of the wave (i) low will signal wave (iii) is underway.

Watch for todays wave (ii) high to hold and wave ‘i’ of (iii) to continue lower.

S&P 500.

S&P 500 1hr

I have changed the internal pattern in wave (ii) tonight and I think it shows a potential top emerging very soon for this correction.

The sideways consolidation that occured over the last two weeks fits a contracting triangle pattern in wave ‘b’ at Wednesdays lows of 3742.

And if that is correct,

then the rally out of that low is explained by wave ‘c’ to complete the larger correction.

If this interpretation is correct,

then three waves up in wave (ii) is now almost done after this weeks rally.

the trend channel is almost filled,

and wave ‘c’ of (ii) is sitting at the 62% retracement level this evening.

Again I can see the dominoes lining up in favor of another lower high top in wave (ii) now in place.

This pattern suggests a big reversal is ahead in wave (iii) starting next week.

Monday;

Watch for wave ‘c’ to hit a top near at the upper trend channel line near 4030.

A break of the wave ‘b’ low early will signal wave (ii) is compelte and wave (iii) down has begun.

Wave ‘i’ of (iii) should fall back into the 3600 area again in five waves.

SILVER.

SILVER 1hr

The three wave pattern in wave ‘4’ is holding today with the price falling back into the trend channel after a throw-over to complete wave (c) of [c] this week.

The key level next week lies at 19.66,

a break of that level will rule out a five wave pattern higher in wave [c],

and confirm that wave [i] of ‘5’ has begun.

So next week will prove to be critical for my assumption that wave ‘4’ is complete ow,

and wave ‘5’ is getting started.

Lets see if we can break that 20.00 level again and take out those previous sholder supports in the recent rally.

Monday;

Watch for wave (i) of [i] to fall back below 20.90 again at the previous wave ‘iv’ low.

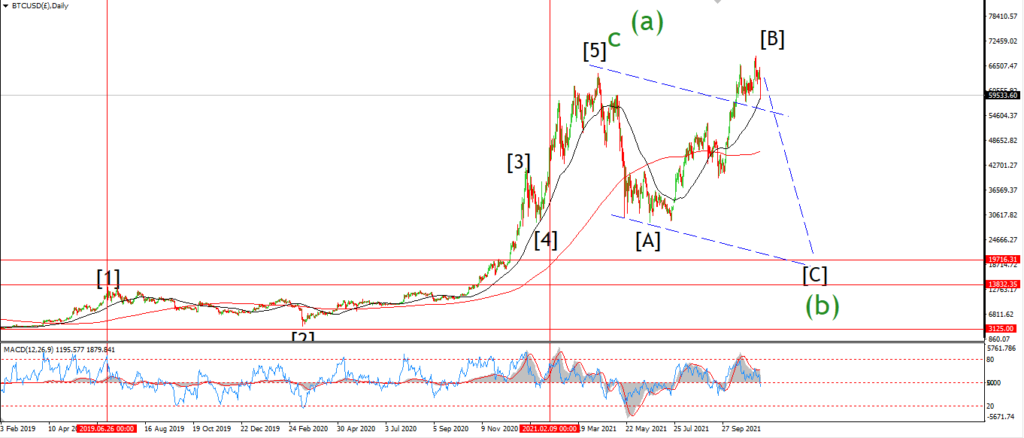

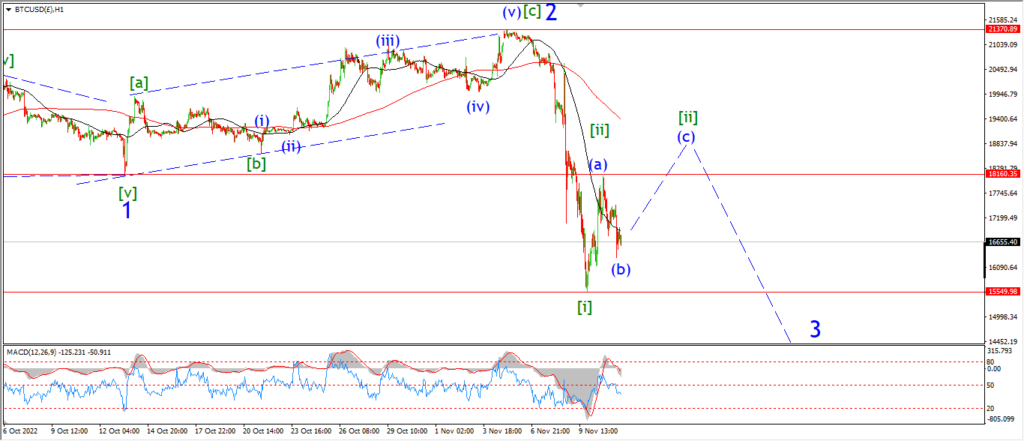

BITCOIN

BITCOIN 1hr.

….

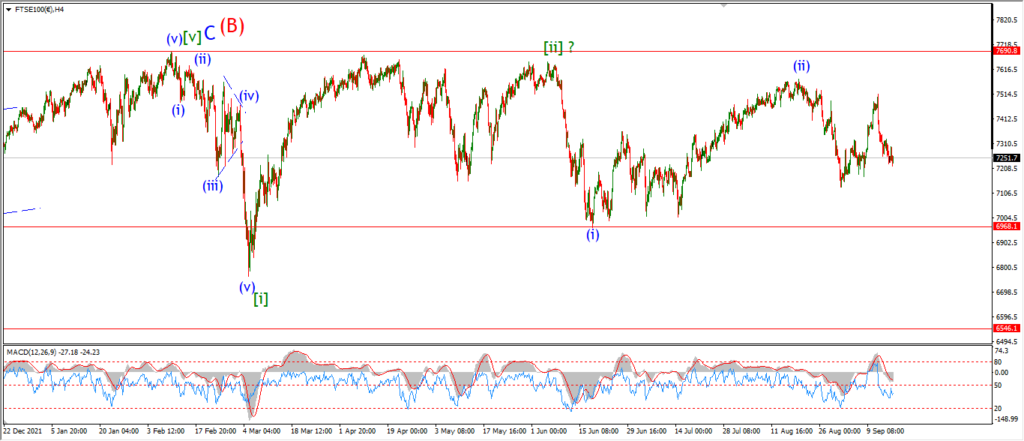

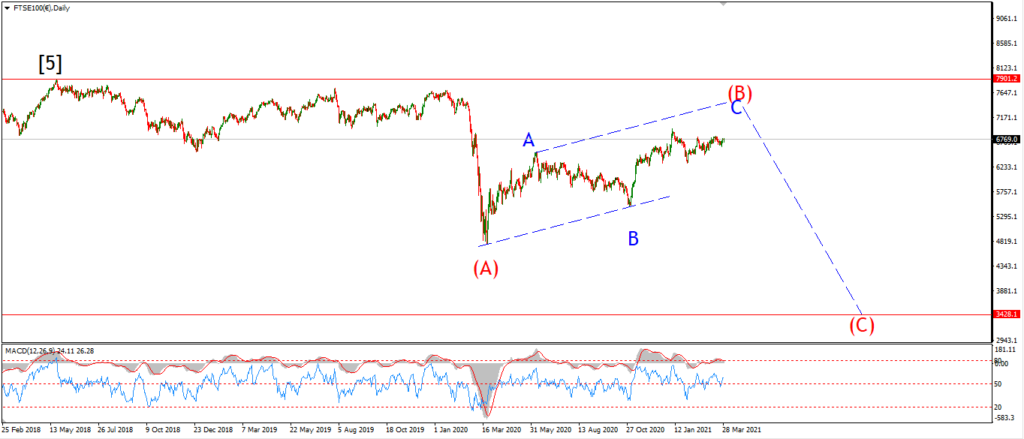

FTSE 100.

FTSE 100 1hr.

….

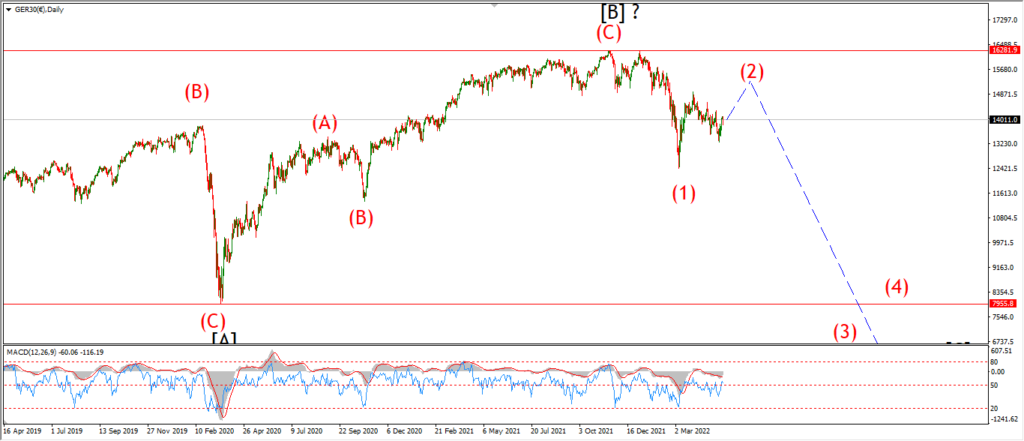

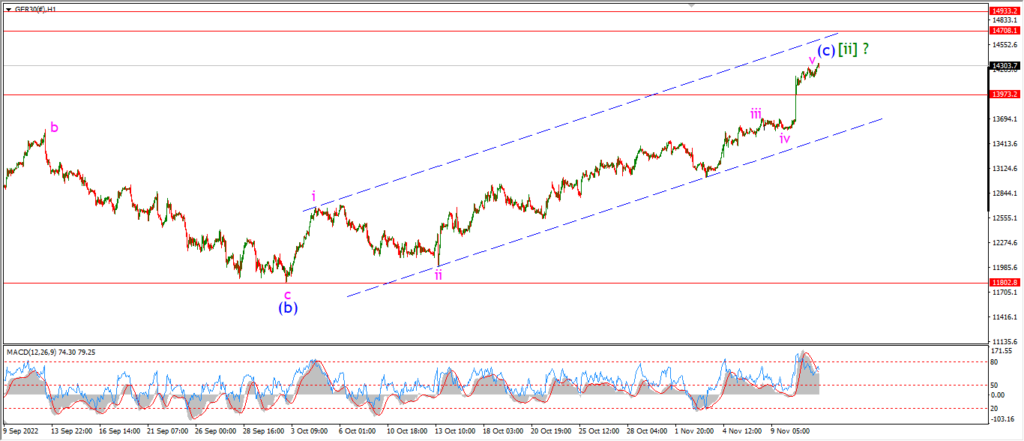

DAX.

DAX 1hr

….

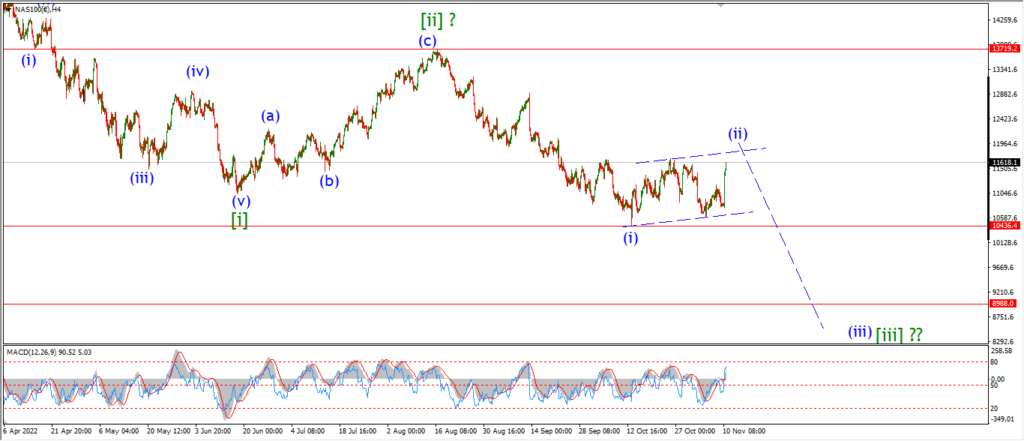

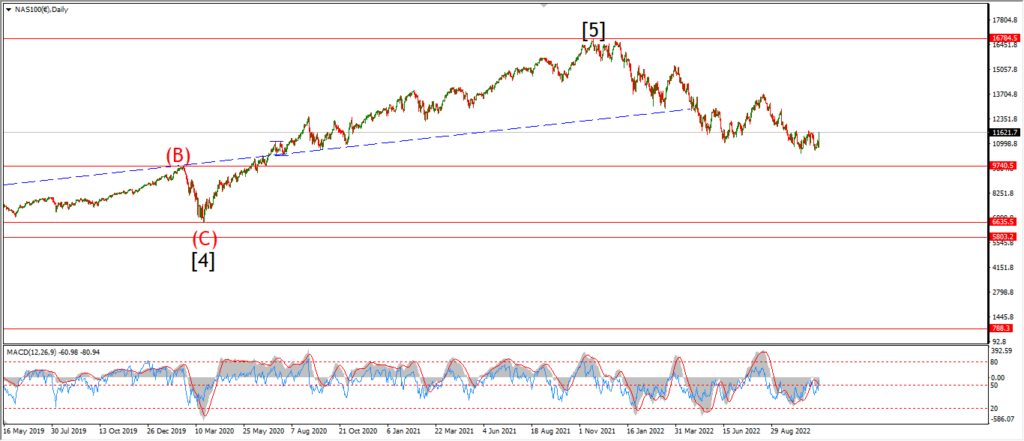

NASDAQ 100.

NASDAQ 1hr

….