Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

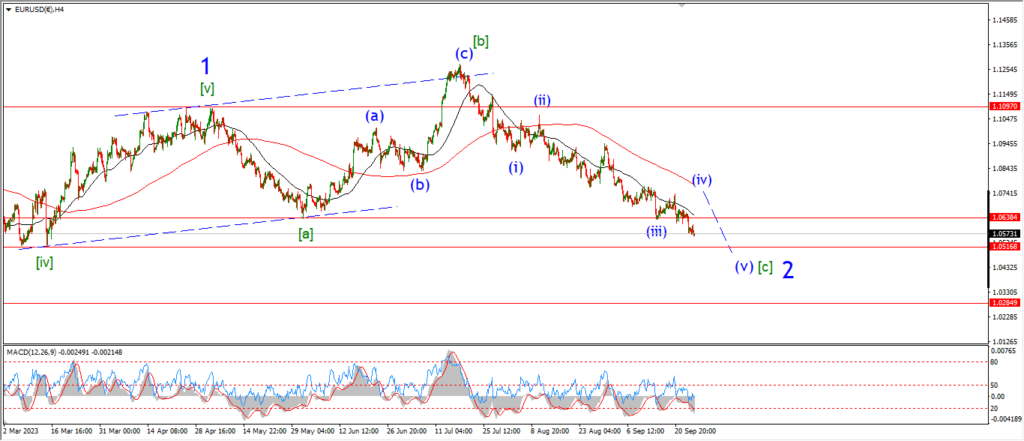

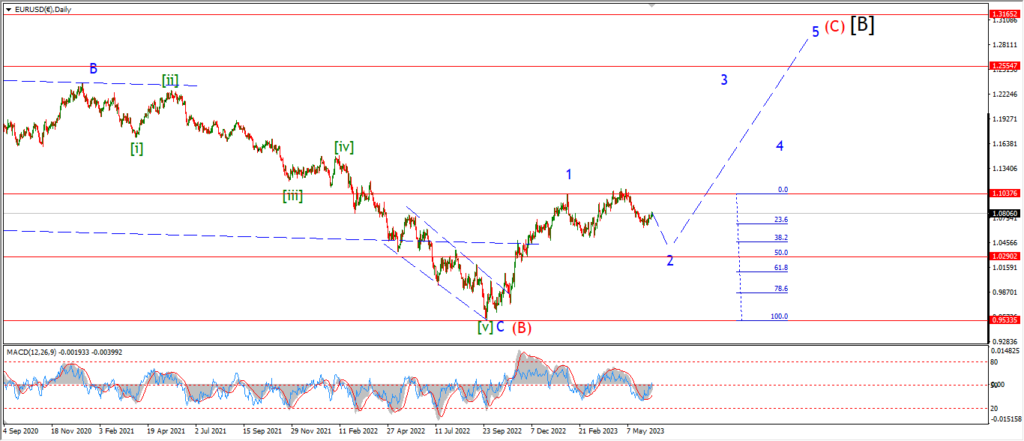

EURUSD.

EURUSD 1hr.

EURUSD did not managed to add anything to the story here for wave ‘i’ down,

the action is holding at the lows of wave ‘1’ again,

But I am looking for much more downside in wave ‘3’ of ‘i’ to confirm the pattern on Monday;

Monday;

Watch for wave ‘i’ to trace out five waves down and to retrace the rally in wave ‘c’ near the 1.05 level again.

GBPUSD

GBPUSD 1hr.

Cable did make a little more progress to the downside today but at this point we only have a three wave pattern lower in place off the top at wave [iv] green.

Wave (i) of [v] is still expected to complete five waves down near 1.2100 again early next week.

At that level wave (i) will retrace most of the rally in wave (c).

So it is important that we hit that area early next week.

Monday;

Watch for the wave ‘ii’ high at 1.2300 to hold.

Wave ‘iii’ of (i) should fall towards 1.21.

And the larger wave (i) is likely to complete with a break of 1.2100 again.

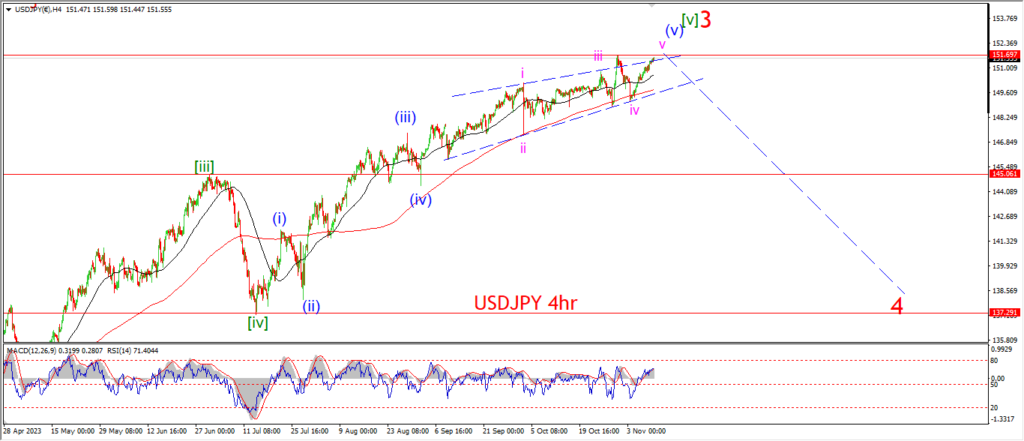

USDJPY.

USDJPY 1hr.

I have labelled the 4hr chart tonight with the alternate possibility for this pair now.

The action in general is very difficult to label as anything other than a completing pattern for wave (v) of [v].

If I call wave (v) blue an ending diagonal,

then you can see that the price is already at the upper trend line of the sedge.

And we can’t expect much more upside from this rally.

So I am willing to wait here and let the price show us the way.

Next weeks action should be enough to make clear what is happening.

Monday;

Both wave counts are still valid here so I will leave the main pattern in place on the hourly chart.

Watch for a clear turn lower out of the current highs to signal wave [a] of ‘4’ is underway.

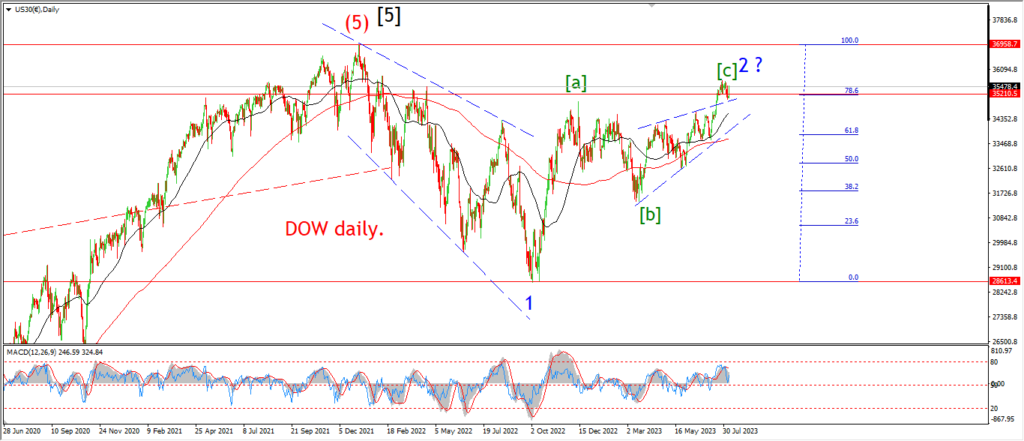

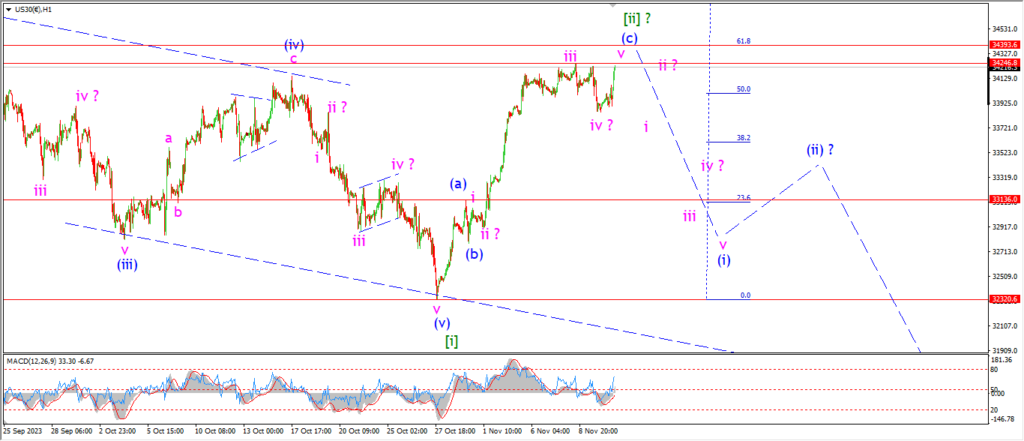

DOW JONES.

DOW 1hr.

Thursdays decline was a false start to a possible reversal pattern.

So tonight I am back to looking for a top in wave (c) of [ii] again.

Wave (i) down will have to wait until next week to become a clear prospect again.

The market has not made a new high yet even as I write,

so there is a small chance that wave (i) can still develop with a quick turn lower as per last nights count.

But there is so little between the two options here that it makes very little difference.

The bigger turn down that I am waiting for is pushed out to next week now.

Monday;

Wave (c) of [ii] is expected to close out pretty quickly on Monday.

Watch for wave ‘i’ of (i) to begin again with a drop back in five waves that completes near the 33500 area again.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

We now have a five wave decline in wave (a) of (ii) after a sharp break to a new low today.

This does not alter the main count very much though.

I am still suggesting a three wave decline overall into wave [ii].

Wave (b) of [ii] will retrace higher in to form a lower high as shown.

And wave (c) of [ii] should fall again towards that 50% retracement level at 1910 by the end of next week.

At that point we will have a clear bullish pattern in place off the lows to lead the way higher into wave [iii] of ‘3’.

Tomorrow;

Watch for wave (b) to turn higher in three waves early next week.

That lower high should form near 1980.

and then wave (c) will turn back down later next week.

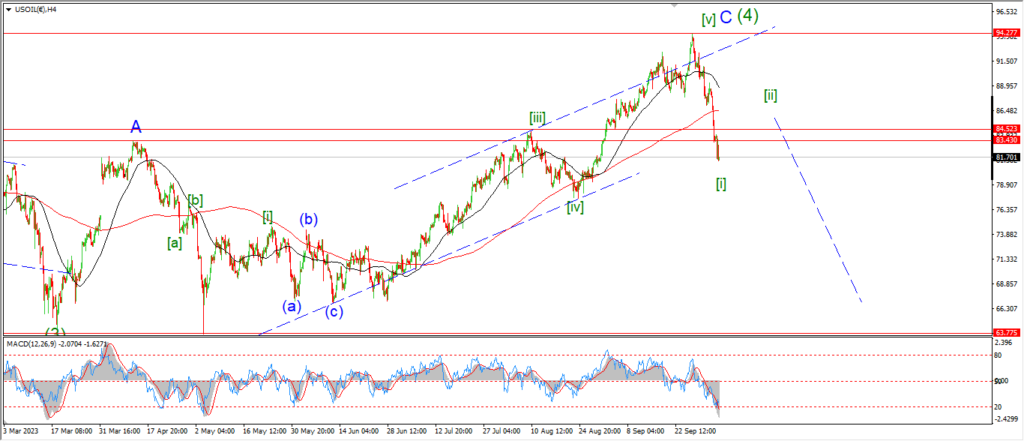

CRUDE OIL.

CRUDE OIL 1hr.

Three waves up are now in place for this correction higher in wave ‘iv’ this evening.

The correction in wave ‘iv’ can be finished with just that small pattern,

and that is the wave count that I am leading with here.

But I am also open to a larger formation building for wave ‘iv’ over the next few days.

Mondays trade will decide which idea is more likely.

Right now the price has hit the upper trend line and a small reversal off the top trend line is underway.

If that decline drops to a new low on Monday then wave ‘v’ is in play.

Monday;

watch for wave ‘iv’ to hold at the session top today.

Wave ‘v’ should fall in five waves from here and I am looking at the Fibonacci target at 73.10 to complete the larger wave (iii).

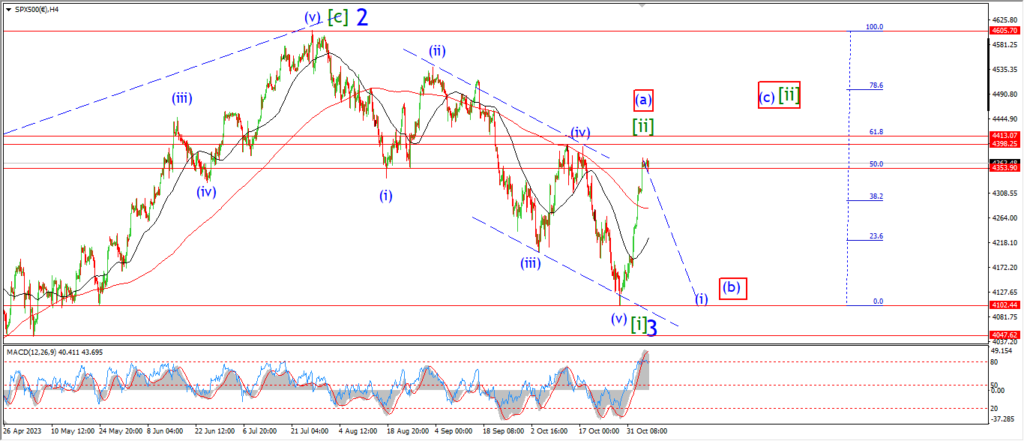

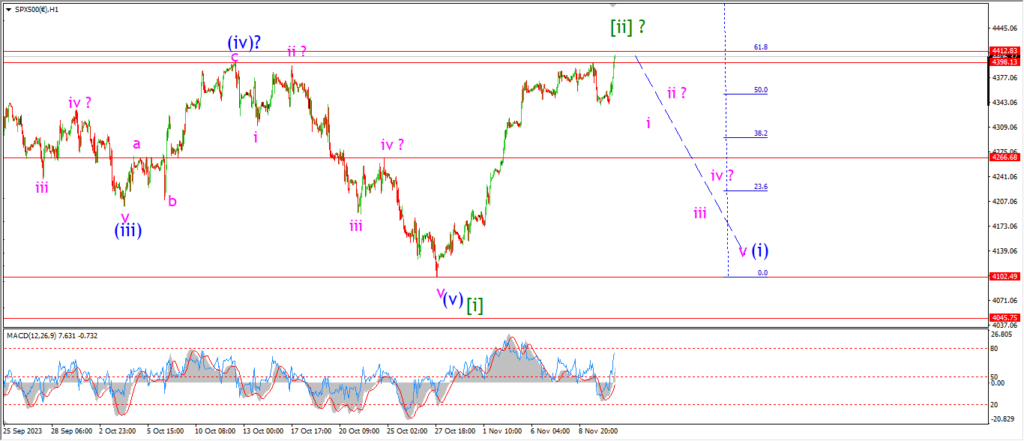

S&P 500.

S&P 500 1hr

The S&P has reached back to a new high this evening and right now the market is siting just below the 62% retracement level of wave [i] again.

This action has pushed out the wait for a reversal down into wave [iii] until next week of course,

but I have not changed my view here at all.

I do think this rally is a reactionary move,

and the market has gone too far too fast here into this high.

I am pretty sure this move will be retraced quite quickly once wave (i) of [iii] actually does take over.

So that is the focus for next week then.

Monday;

Watch for wave [ii] to close out at a nearby high.

There is enough indications in place already to call this rally done.

I think we will see the initial move lower into wave (i) of [iii] begin by midweek.

SILVER.

SILVER 1hr

The decline today signals that wave ‘c’ of (ii) is now underway.

The price has broken the wave ‘a’ low this evening,

and I have labelled a five wave pattern for wave ‘c’ with a target near the 62% retracement level.

That gives us a three wave decline in wave (ii) that should complete near 21.79.

And we should see that correction in wave (ii) in place by midweek.

At that point we can look higher again into wave (iii).

Monday;

Watch for wave ‘c’ of (ii) to complete near 21.79 again.

BITCOIN

BITCOIN 1hr.

….

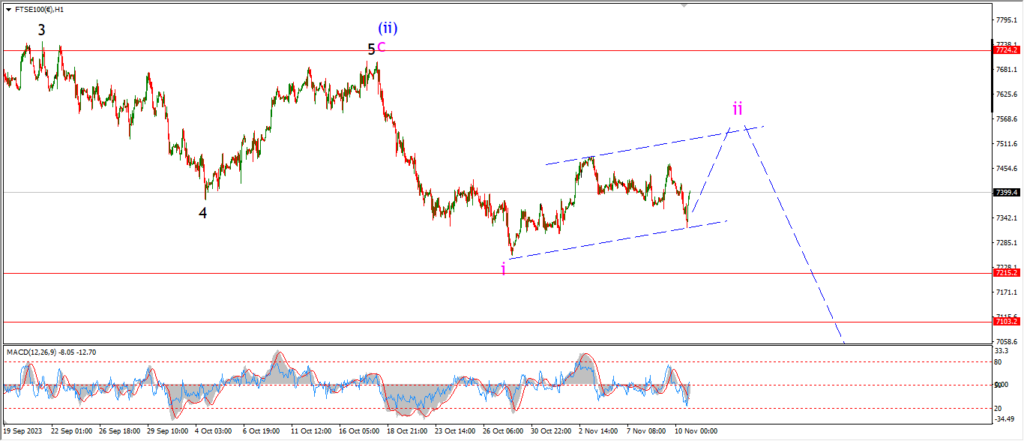

FTSE 100.

FTSE 100 1hr.

….

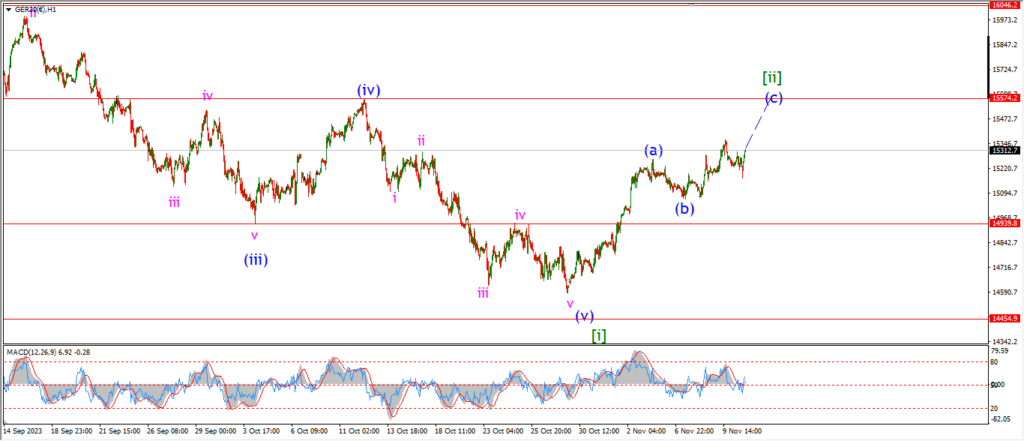

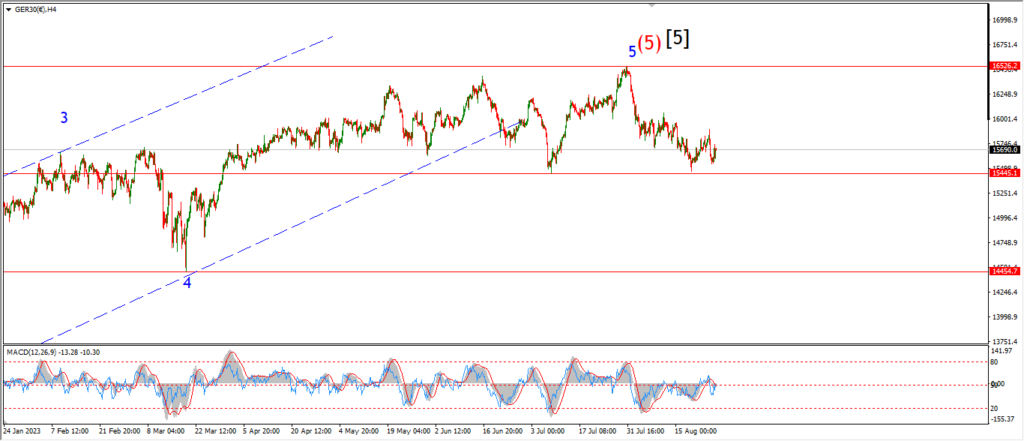

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

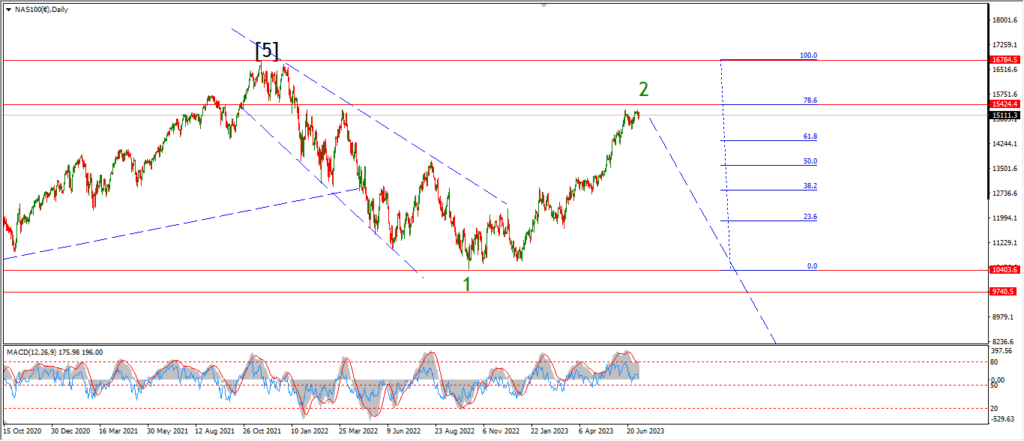

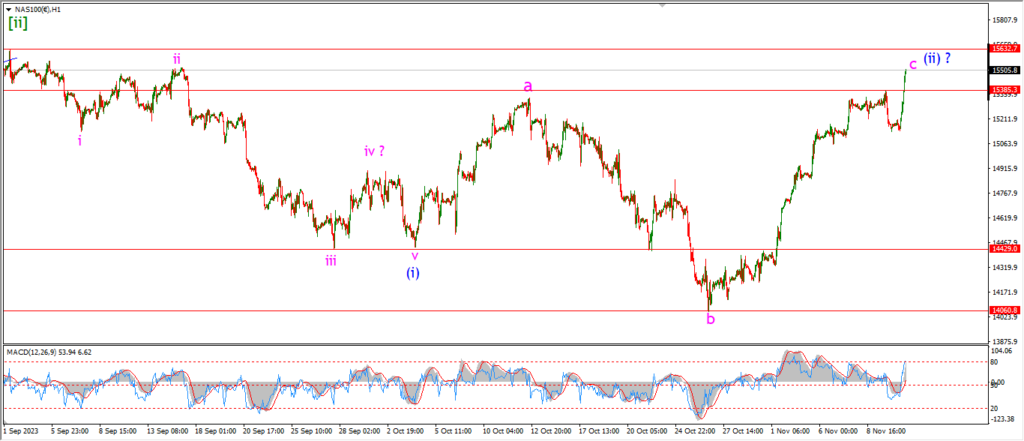

NASDAQ 100.

NASDAQ 1hr

….