Good evening to one and all.

The LORD’s blessings to you all tonight.

Here is the latest COT data for GOLD, interesting convergence in positioning now.

https://twitter.com/bullwavesreal

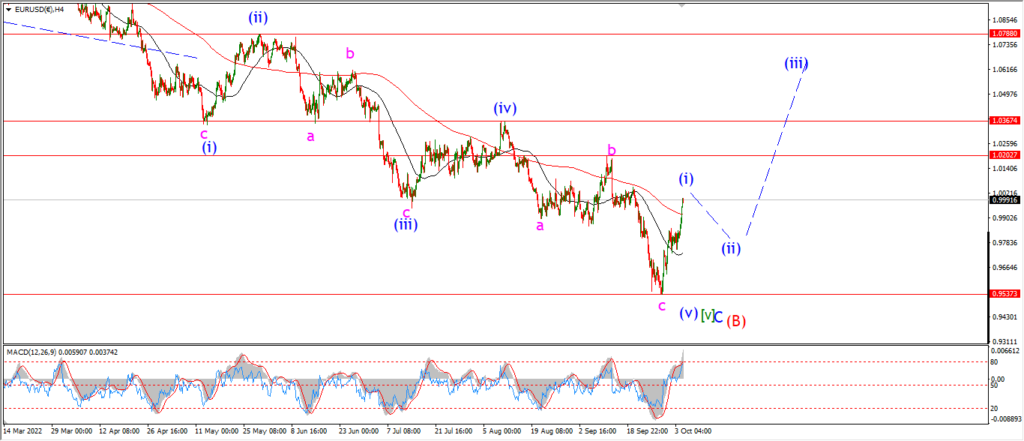

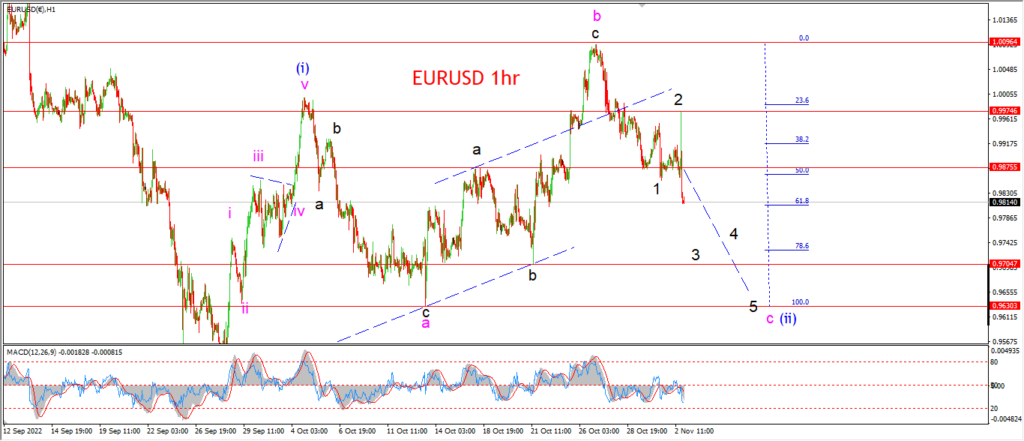

EURUSD.

EURUSD 1hr.

Its a week of whipsaw reversals so far and today was no exception.

The action in EURUSD today first invalidated the main count,

and now has confirmed the bearish count!

The internal pattern of wave ‘c’ is revealing itself in time,

but I think today we can say that wave ‘3’ of ‘c’ is most likely underway.

If this pattern is correct for wave ‘c’ and wave (ii),

then we should see a completed five wave pattern to a new higher low by the end of this week.

Tomorrow;

Watch for wave ‘c’ of (ii) to continue lower towards the wave ‘b’ low at 0.9704 again.

The overall target for wave ‘c’ lies below 0.9630 at a minimum.

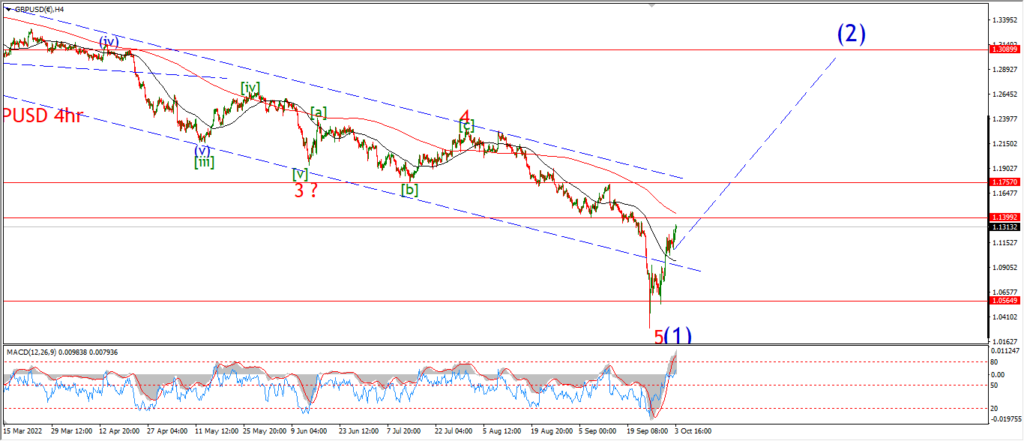

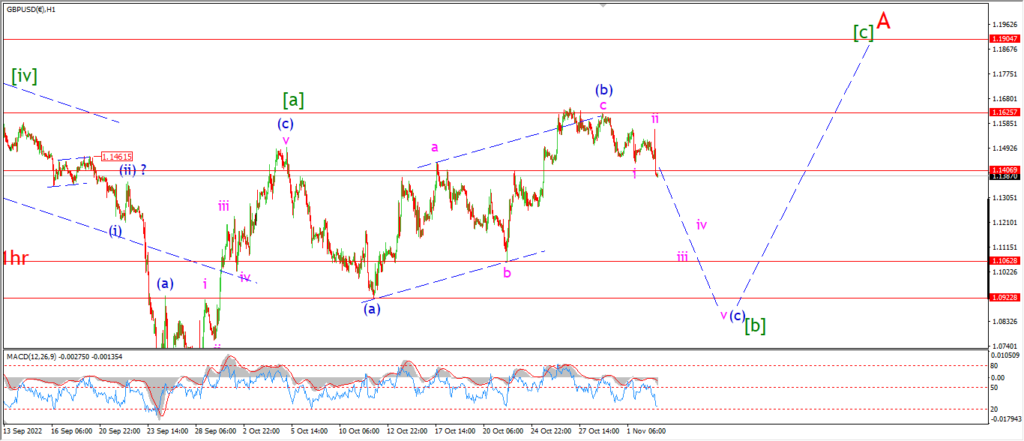

GBPUSD

GBPUSD 1hr.

Cable broke out of the previous pattern today and now has triggered the alternate count for wave [b] green.

The recent top is viewed as wave (b) complete as a three wave rally.

Wave ‘c’ of (b) seems to have completed as a failed fifth wave.

The action today has created a lower high in wave ‘ii’,

and if this new count proves correct,

then we should see further declines in wave (c) of [b] over the coming days.

Wave (c) of [b] is now expected to break below the wave (a) low at 1.0922.

Tomorrow;

Watch for wave ‘iii’ of (c) to continue lower in a five wave pattern,

the decline should find support near the wave ‘b’ low at 1.1063.

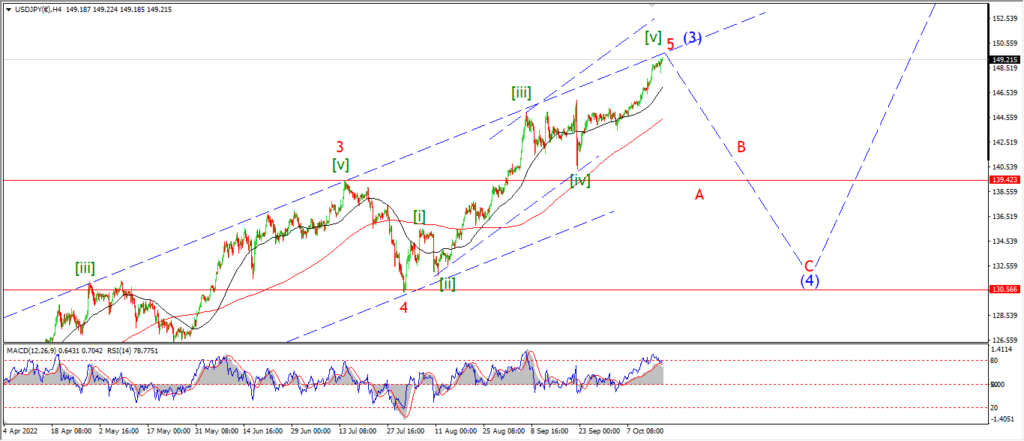

USDJPY.

USDJPY 1hr.

USDJPY is another market affected by todays whipsaw action.

The initial decline today was actually in favor of the main count,

and now we have a major spike higher that has more or less ruled out last nights count.

It seems USDJPY is doomed to stuck in wave [b] for longer than expected.

I have shown a possible pattern for wave [b] that explains the action a little better this evening.

A larger three wave correction higher in wave [b] should top out above wave (a) at 149.00.

And then wave [c] down should begin again.

Tomorrow;

Watch for wave (c) of [b] to trace out five waves up to complete above 148.86 at a minimum by the end of this week.

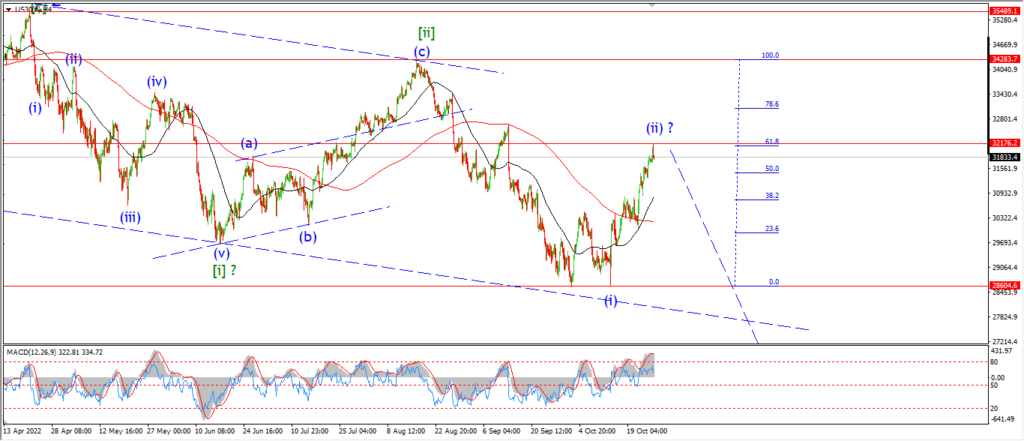

DOW JONES.

DOW 1hr.

It looks like automatic buy programs turned into panicked human sell orders almost like turning on a dime.

Higher rates are good,

oh no, higher rates are bad actually!

What madness has gripped the markets across the world.

The knee jerk initial buying managed to break to a new high only to be wiped out very quickly.

And now we have a move large enough off the highs to suggest a top may be in for wave (ii).

I am hopful todays top was enough to do it for that rally.

The price tagged the 78.6% retracement level and then immediately reversed back into the range of the previous correction from last week.

The drop off today is not yet large enough to retrace the rally from last week.

But If this count is now correct for wave ‘i’ of (iii) down,

then we should see a break of support this week and a nice five wave pattern lower towards 30000 again in wave ‘i’ down.

Tomorrow;

I am happy enough to consider todays top as the top of wave (ii) now.

And so we should see a five wave pattern develop off that top in wave ‘i’ of (iii) over the coming week.

If wave ‘1’ of ‘i’ is now in place at this evenings close,

then a small correction higher tomorrow in wave ‘2’ followed by an acceleration lower in wave ‘3’ of ‘i’ by the end of this week.

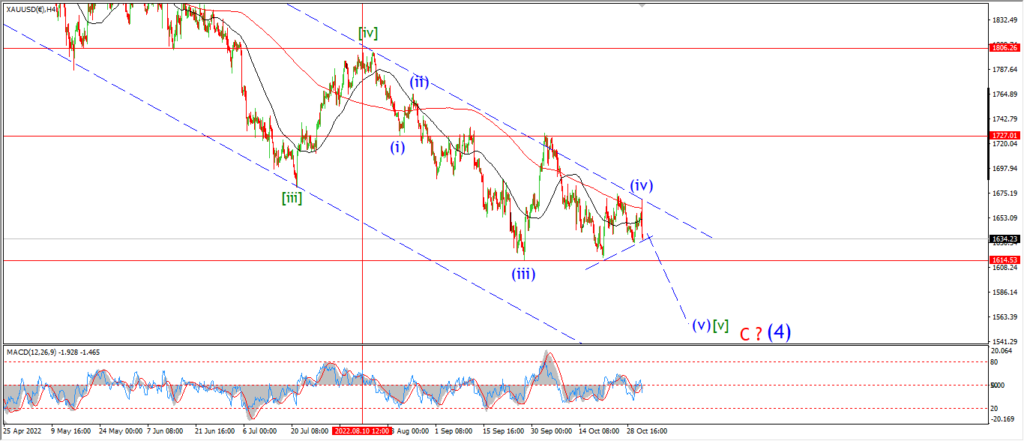

GOLD

GOLD 1hr.

I am afraid that all markets have been affected by the feds actions today,

and as usual gold has taken a hit which has ruled out the recent bullish count.

The 4hr chart shows the damage best,

wave (iv) can now be viewed as a contracting triangle which completed at tonight’s highs,

and wave (v) down is now underway off that high.

The hourly count shows the likely outcome of this action over the coming week.

A five wave decline into wave (v) of [v] has the potential to pull thie price down into the lower trend channel line near 1550.

The minimum target for wave (v) of [v] lies at 1617.

But I do think now the lower target is more likely.

Tomorrow;

If this new count is correct for wave (iv) and (v),

then we will see a corrective lower high form in wave ‘ii’ first,

and a new low made for gold with a break of 1617 in wave ‘iii’ of (v) early next week at the latest.

I am hoping that we can wrap up this dismal correction in wave (4) next week.

The market sentiment at that time should be horrendous,

and suitable for a rally again.

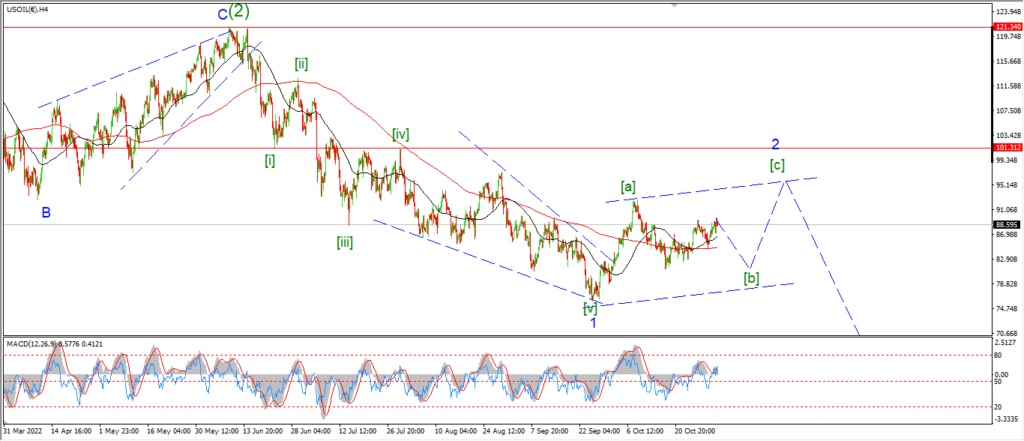

CRUDE OIL.

CRUDE OIL 1hr.

I am not quite sure what to make of the internal pattern of wave (b) after crude made a slight new high today.

The action off the wave (a) low is still corrective in nature,

and overall I still favor another drop into wave (c) to complete three waves down into wave [b] as shown.

But now I am just going to have to wait and see where the short term action breaks to either confirm my point of view,

or to invalidate this pattern.

I have marked the recent low at 84.80 as an important level to confirm this pattern,

so lets see if the price will fall and break that support to confirm wave (c) is underway.

Tomorrow;

The price must fall soon into wave (c) down to signal that I am on the right track here.

Lets see if wave ‘i’ of (c) can turn lower again tomorrow.

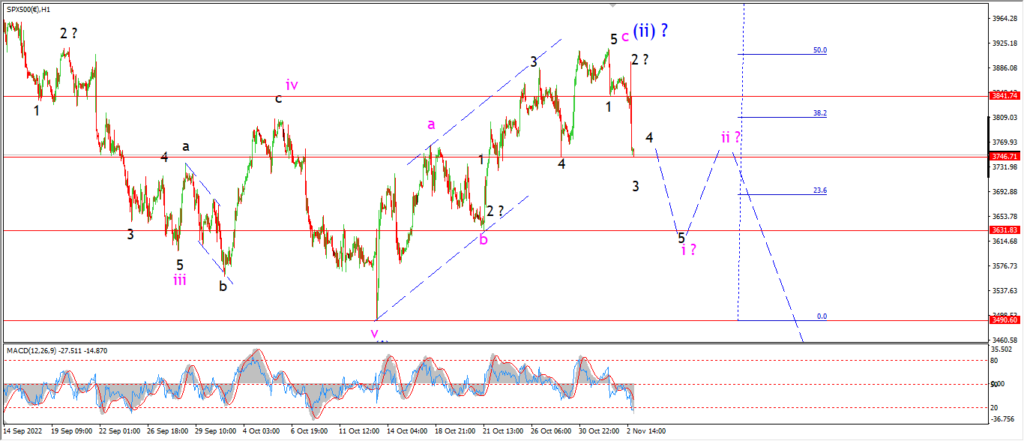

S&P 500.

S&P 500 1hr

The aftermarket trade is continuing the decline seen in the main session now,

and this decline has now wiped out the whole euphoric rally that happened last week in wave ‘5’ of ‘c’.

Even the whipsaw move earlier on did not manage a new high in the S&P as it did in the Dow,

so the wave count here is a little cleaner off that wave (ii) top.

We have a lower high in wave ‘2’ of ‘i’,

and an acceleration lower into wave ‘3’ of ‘i’ tonight.

The real test for this count will come over the next two days.

If my interpretation is correct,

then the Market should continue lower as suggested and trace out a five wave pattern in wave ‘i’ of (iii).

I would like to see a break of 3630 again in wave ‘i’.

That level marks the beginning of wave ‘c’ of (ii).

And if wave ‘i’ down manages to retrace all of that rally then we have a serious pattern to work with here.

Tomorrow;

I want to see 3840 hold at the wave ‘1’ low.

Watch for wave ‘i’ to develop lower into a five wave pattern.

A break of the wave ‘b’ low is the target for this possible reversal pattern to hit.

So lets see if this new decline can manage that before this weeks close.

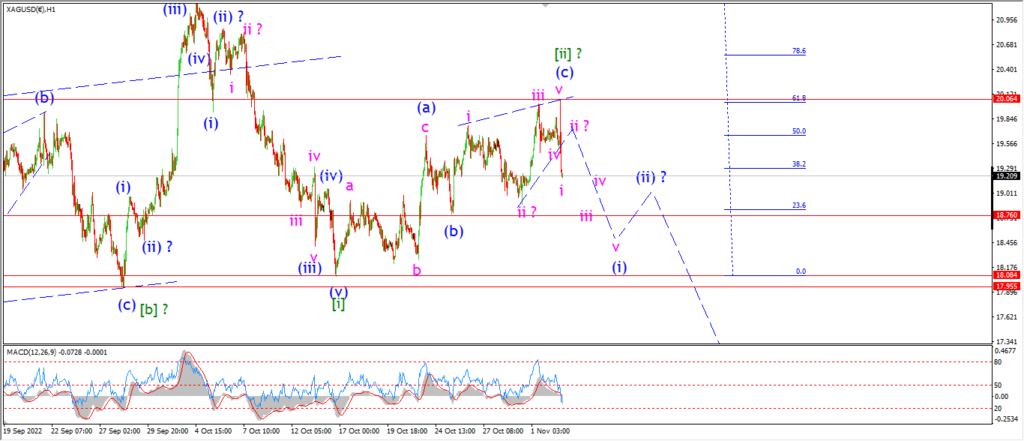

SILVER.

SILVER 1hr

Todays action in silver has actually cleared up short term pattern in my mind.

Wave (c) of [ii] has traced out a solid ending diagonal pattern to complete at todays high.

And now that sharp decline should begin the turn lower into wave (i) of [iii].

Wave (i) should break the wave (b) low at 18.76 maybe by the end of Fridays session.

A short correction in wave (ii) is then on the cards.

And then the pattern should make short work of that 17.95 low as wave (iii) down takes over next week.

I am not concerned on the depth of the final decline in silver,

I suspect we will hit the $15 handle to complete when this is all done.

In the long run,

that gives us a fantastic opportunity to ride an explosive rally when wave [3] does begin later this year!

Tomorrow;

Watch for wave (i) to trace out five waves down as shown.

A break of the wave (b) low at 18.76 is the target.

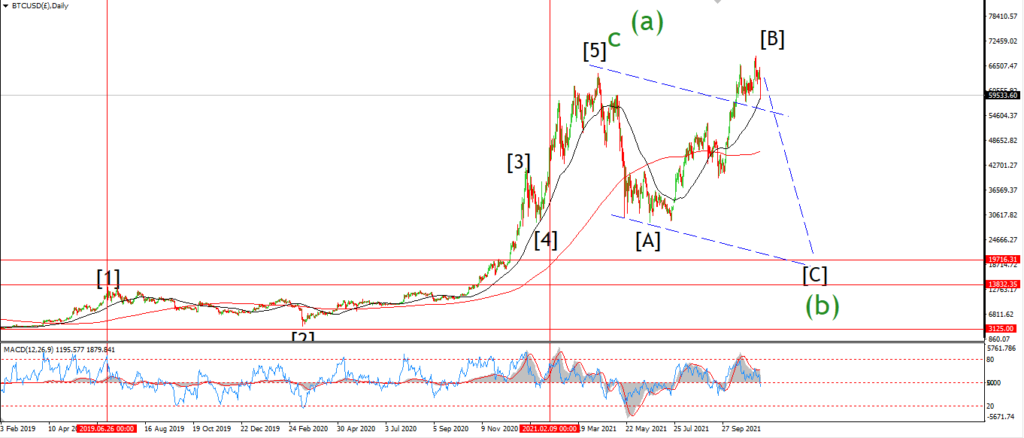

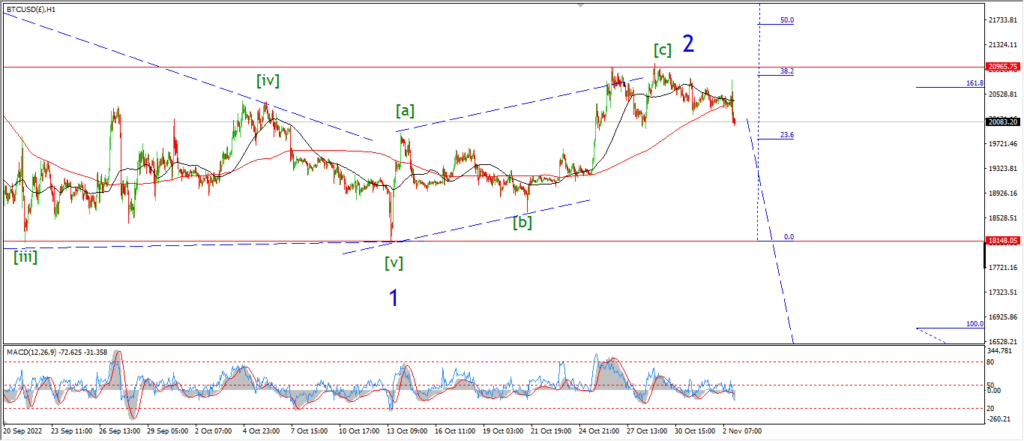

BITCOIN

BITCOIN 1hr.

….

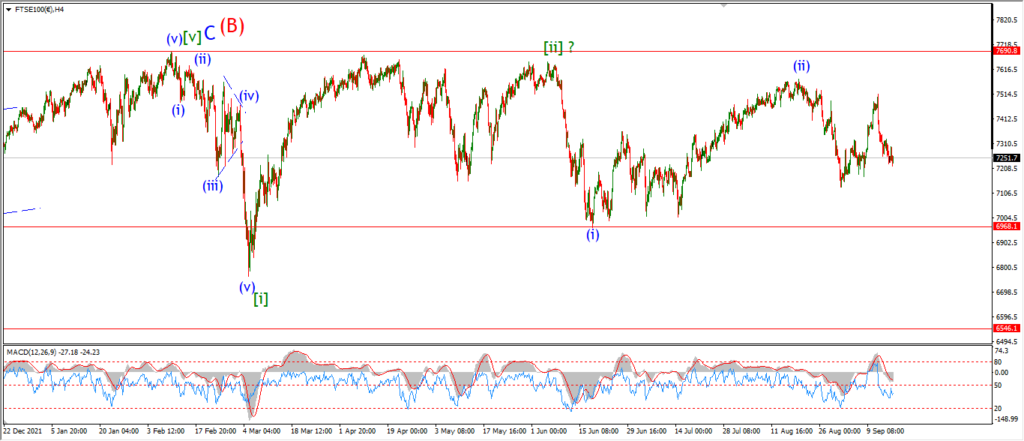

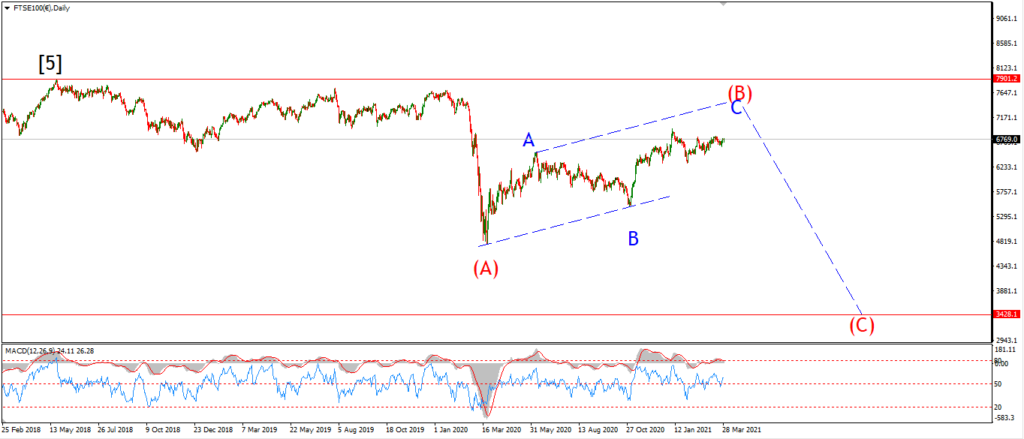

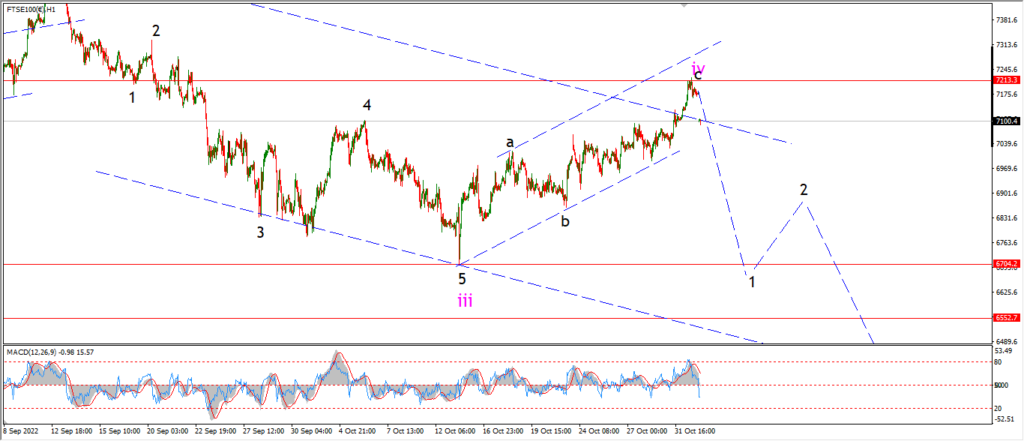

FTSE 100.

FTSE 100 1hr.

….

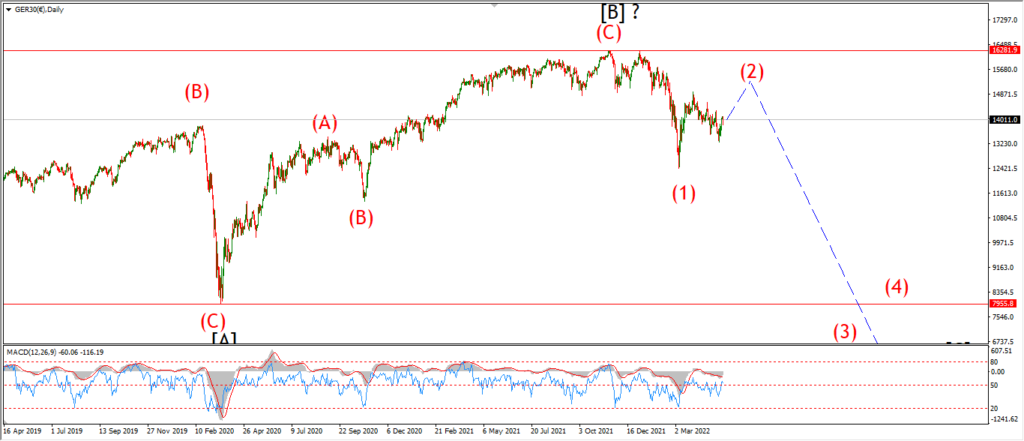

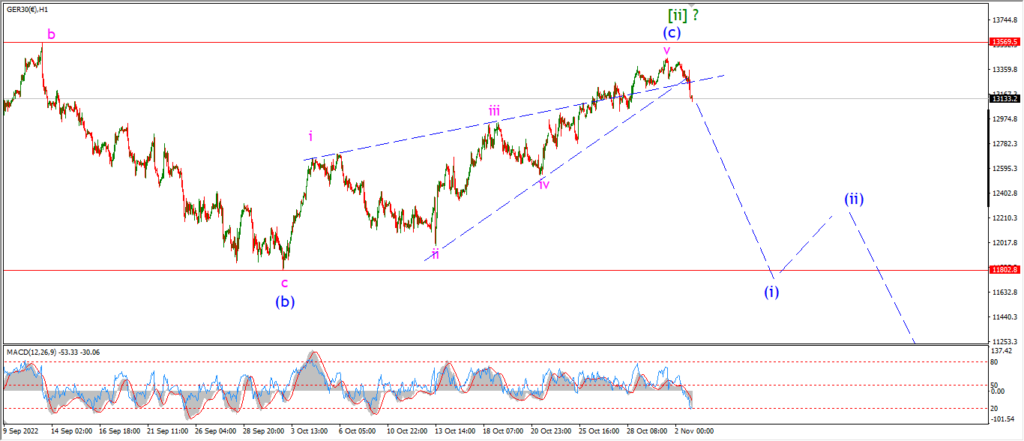

DAX.

DAX 1hr

….

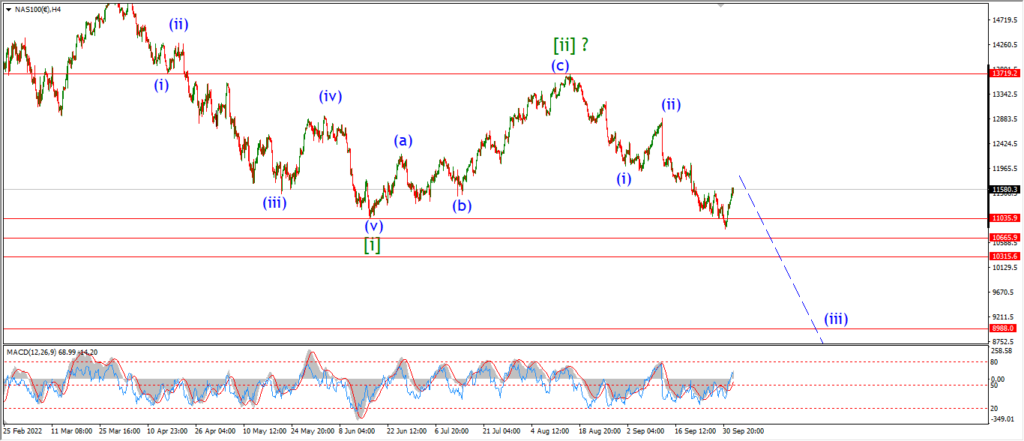

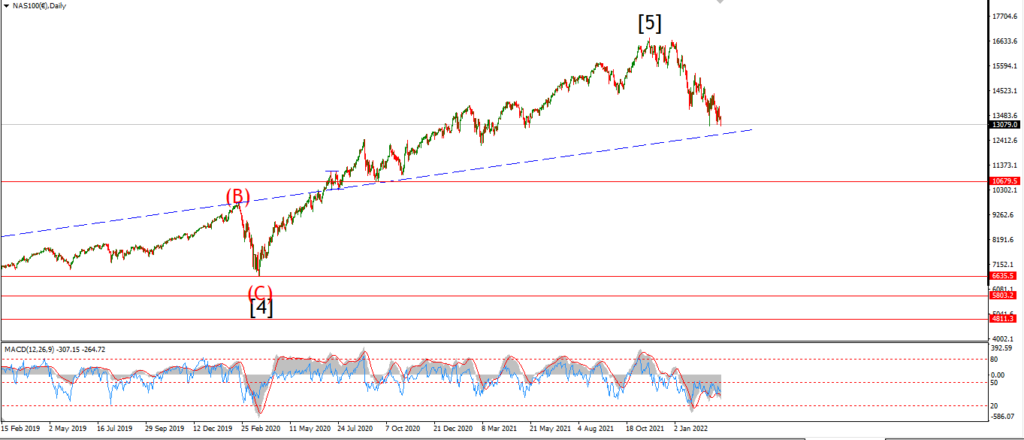

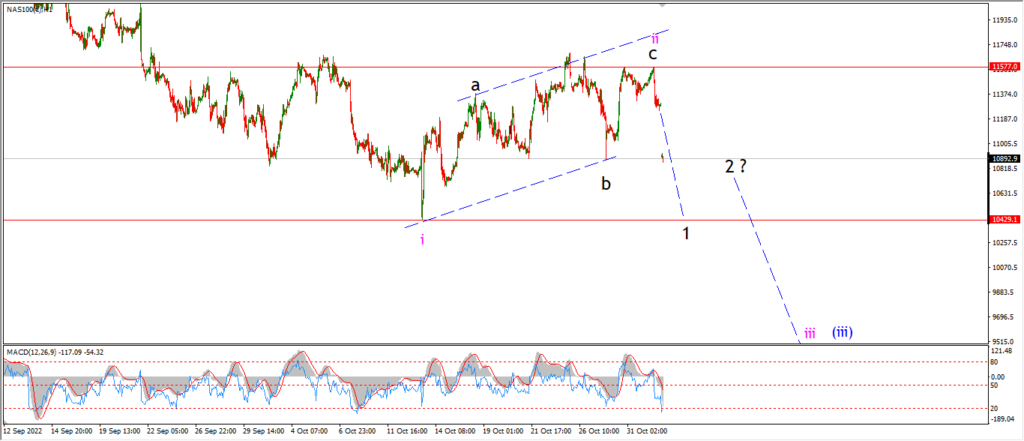

NASDAQ 100.

NASDAQ 1hr

….