Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

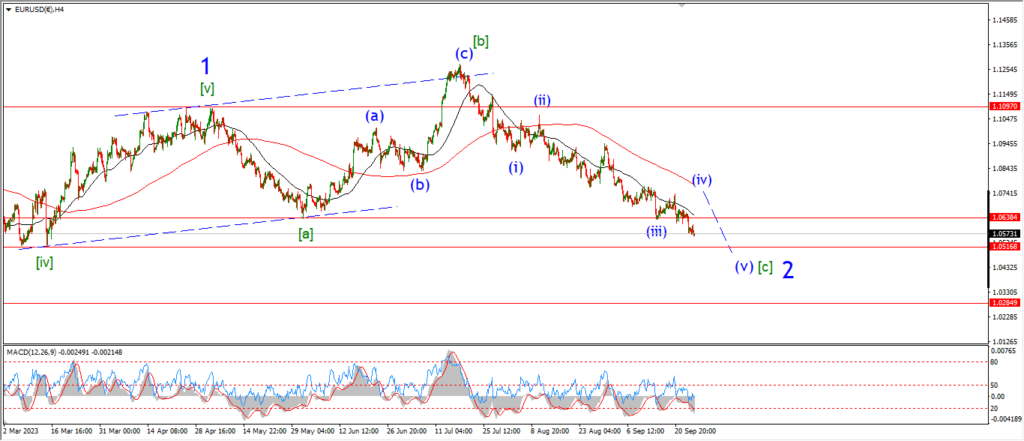

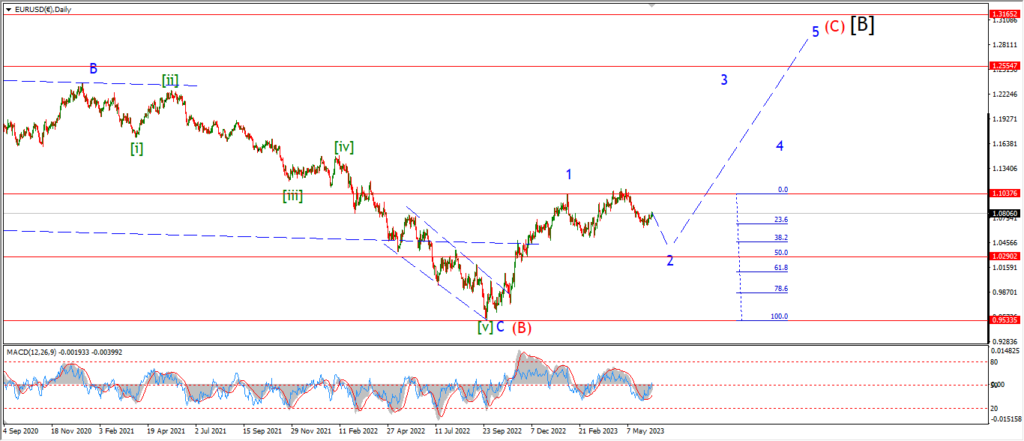

EURUSD.

EURUSD 1hr.

Three waves up are in place off that wave ‘i’ low now.

That action suggests wave ‘ii’ is complete at todays lower high.

WAve ‘ii’ can always go a little higher to complete,

but I do think it is worth looking lower again to see the beginning of wave ‘iii’ of (v) on Monday.

Wave ‘iii’ should fall fall below 1.0447 at a minimum.

and then the full five wave pattern in wave (v) should close out the trend channel down below 1.03 again.

Monday;

Watch for a break below 1.0520 to signal wave ‘iii’ has begun.

Wave ‘iii’ should break 1.0447 at a minimum.

GBPUSD

GBPUSD 1hr.

WAve ‘ii’ managed to hit a high of 1/2160 today and now the seems to have given up.

If wave ‘ii’ is complete at todays high,

then wave ‘iii’ down continue lower from that level.

I am suggesting wave ‘iii’ of (iii) will break 1.20 to complete.

And the larger wave (v) of [v] has the potential to break below 1.18 to complete if this pattern proves correct.

Monday;

Watch for a break of 1.2069 to signal wave ‘iii’ has begun.

A break of 1.2036 will confirm wave ‘iii’.

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

Wave ‘i’ down is back on track this evening after the price fell back back to a new low off the top.

Wave ‘i’ should trace out five waves down,

and I am looking at the 148.80 level as an initial target for that wave.

Todays decline is most likely in wave ‘3’ of ‘i’,

and that wave needs a little more action to complete,

so we should see this first wave down continue into Tuesday to fill out the pattern.

Monday;

150.77 must hold.

Watch for wave ‘i’ to complete five waves down early next week with a break of 148.00 again.

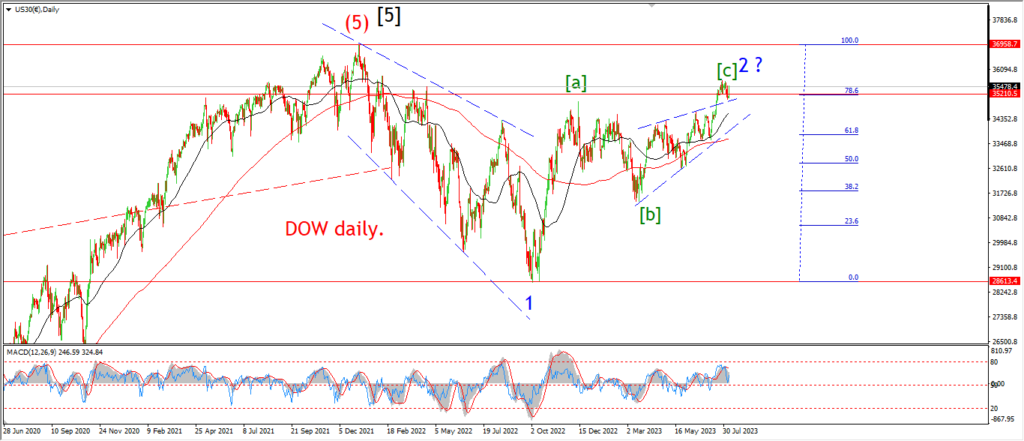

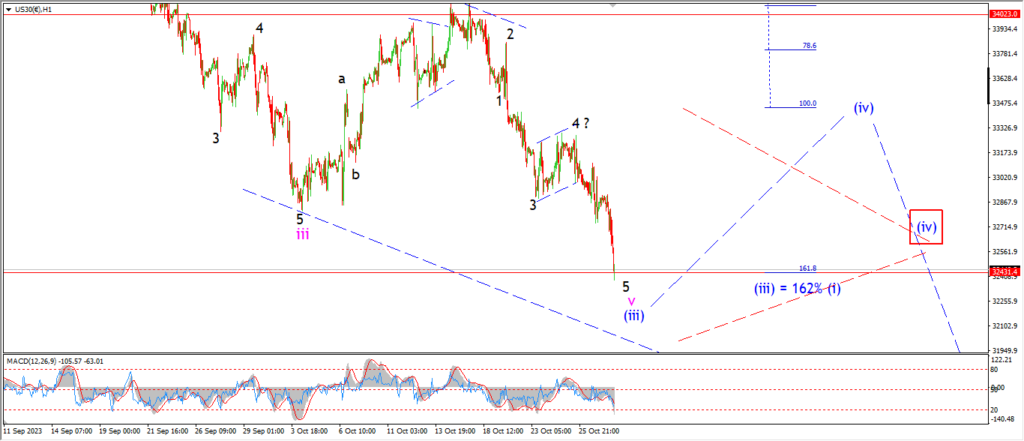

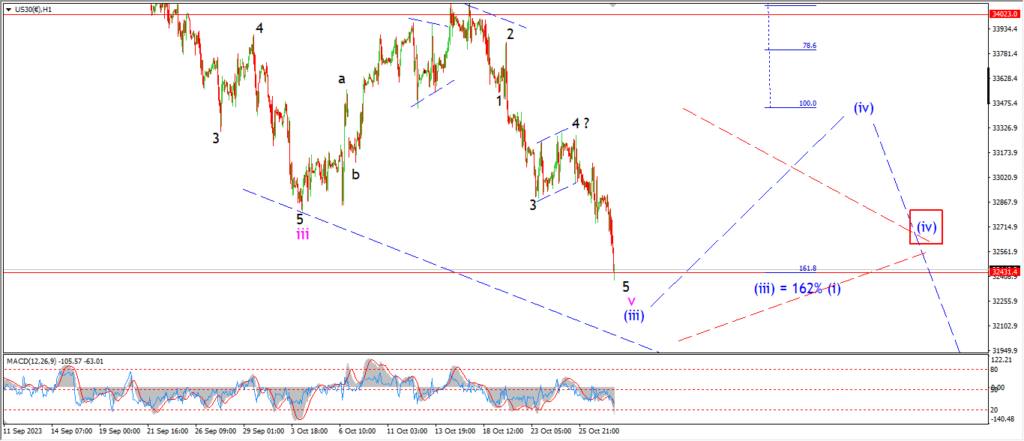

DOW JONES.

DOW 1hr.

The Dow is very close to hitting that preferred target for wave (iii) this evening.

My doubts have been proved wrong here!

It turns out that wave ‘5’ of ‘v’ has the potential after all to make that Fibonacci target.

And now this wave count is set up in a good way to correct into wave (iv) over the coming week.

The one thing I kept saying over the last few weeks was,

the lower the price goes in wave (iii),

the better the setup will be for wave (iv).

And here we are!

Sigh of relief on my part!

The most important level from here on as wave (iv) develops is that wave (i) low at 34020.

So wave (iv) is in the clear as long as 34000 holds.

Right now we have a 1500 point clearance between this wave (iii) low and the wave (i) invalidation level.

So that should be enough room to let wave (iv) play out over the next week.

Monday;

Watch for wave ‘v’ of (iii) to find a low somewhere around that target level at 32430.

I would prefer to see a triangle pattern play out in wave (iv).

But we will see how it develops as the week goes on.

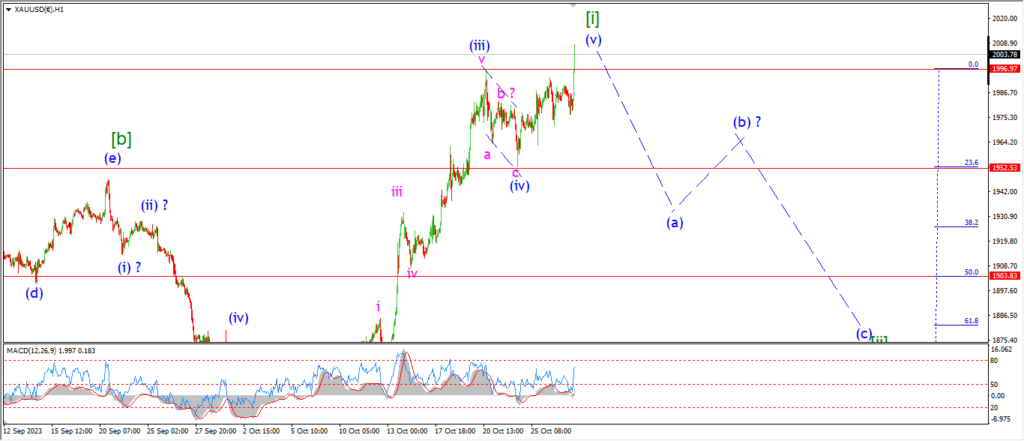

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

The actoin in gold has forced me to rethink the rally into the wave [i] high again tonight.

The price is close to hitting a new high for this rally as I write,

and now it seems wave (v) of [i] is back in focus again.

The recent three wave decline is labelled wave (iv) of [i].

And wave (v) up might be tracing out an ending diagonal now.

I am not quite sure of the internal pattern for wave (v) yet,

but that will be revealed early next week.

I still think the main action next week will be to the downside again in wave [ii].

But that correction has been postponed for a few days now.

Monday;

Lets see if wave (v) continues in a wage format to scrape to a new high above 2000 somewhere.

A break below 1952 again will confirm wave (a) of [ii] is underway.

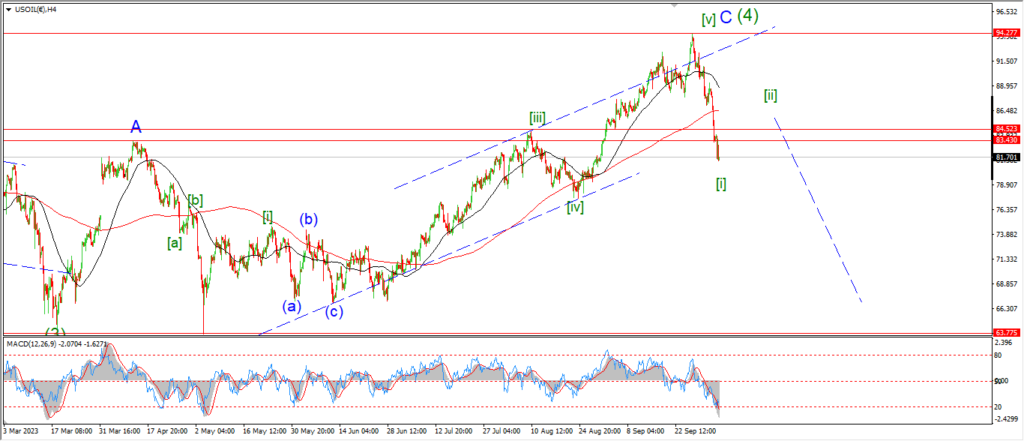

CRUDE OIL.

CRUDE OIL 1hr.

Crude oil has traced out three waves up into the session high tonight so the minimum expected target for wave (ii) has onw been met.

The correction in wave (ii) came close to hitting the 50% retracement level also this evening.

And now the rally has halted as I write.

The signals are pointing to a correction that is close to completion here.

I can’t say if wave ‘c’ of (ii) is finished yet though.

Only a solid reversal back below 81.90 again will confirm that.

Monday;

The correction in wave (ii) has done enough to start looking for a reversal into wave (iii) now.

so watch for wave ‘c’ of (ii) to complete soon.

Wave ‘i’ of (iii) should fall back below 83.00 pretty easily.

And then a break of the wave (i) low again will confirm this pattern.

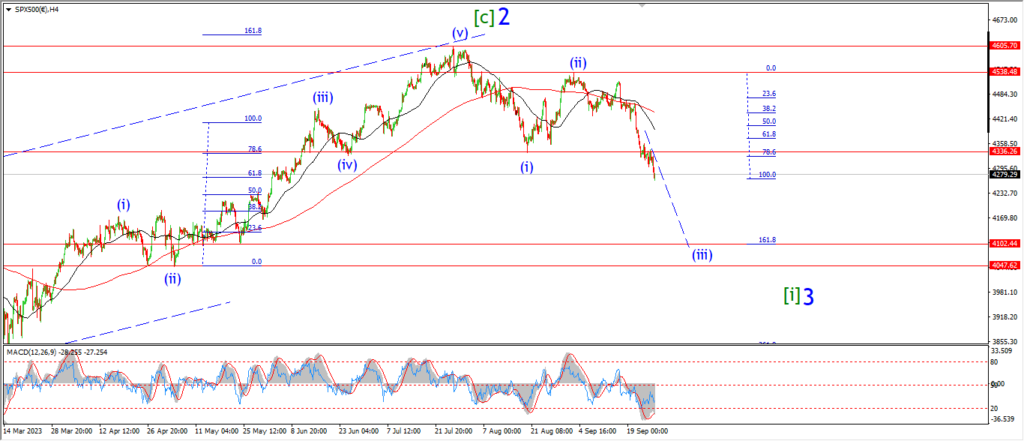

S&P 500.

S&P 500 1hr

It is a very similar story to the Dow here tonight

While it may have been a fantasy last week,

wave (iii) down is now very close to hitting that favored target level at 4100 again.

Wave ‘v’ of (iii) has expended the decline quite well into this target level.

And now the price has almost closed the trend channel again this evening.

That wave (iii) pattern has worked out very well now.

And now its time to begin looking higher into wave (iv) of [i] over the next week.

Monday;

I don’t know what pattern wave (iv) will take.

But like the Dow,

I would prefer to see a triangle develop.

I will be looking for wave wave ‘a’ of (iv) to turn higher by Monday evening.

And we will work from there.

This may be a low probability scenario;

But.

If the market decides to crash completely from here on out,

that will mean we have entered wave [iii] of ‘3’ earlier than expected.

If the market breaks 3800 next week,

then I will consider this possibility in more detail.

SILVER.

SILVER 1hr

That spike higher in silver today has mixed things up a little for the short term pattern.

Wave ‘a’ down is now shown at this weeks lows.

And the rise off that low is in three waves,

so that takes the wave ‘b’ label.

I am still expecting a five wave decline from here in wave ‘c’ of (ii).

and the initial target for wave (ii) lies at 22.18.

If the rally continues higher on Monday to break to a new high again above 23.68,

that will suggest wave ‘i’ of (iii) is already underway.

I don’t favor this idea though,

as the decline into wave (ii) is too shallow to consider complete yet.

Monday;

Watch for wave ‘b’ to top and reverse near 23.12 again.

Wave ‘c’ must break to a new low below 22.43 at a minimum.

BITCOIN

BITCOIN 1hr.

….

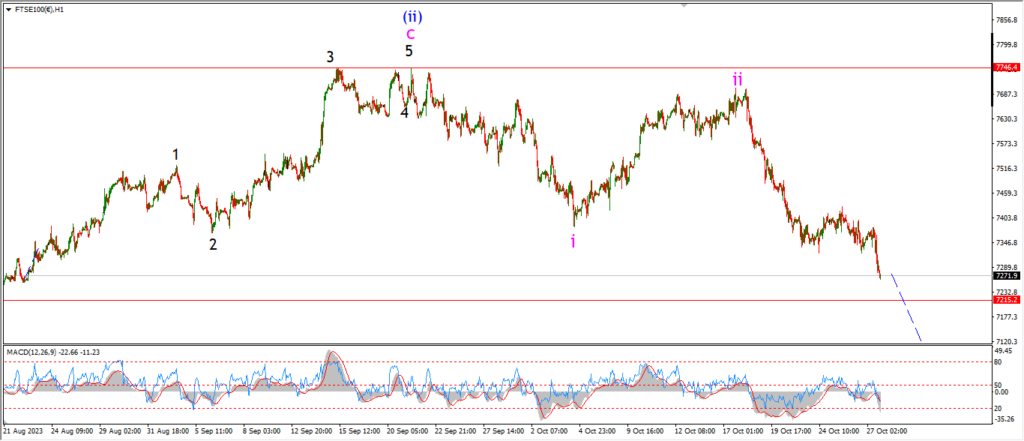

FTSE 100.

FTSE 100 1hr.

….

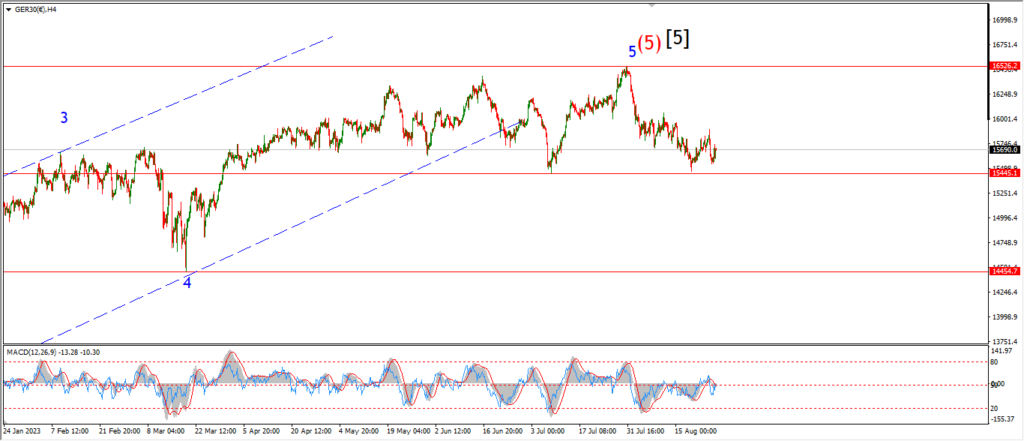

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

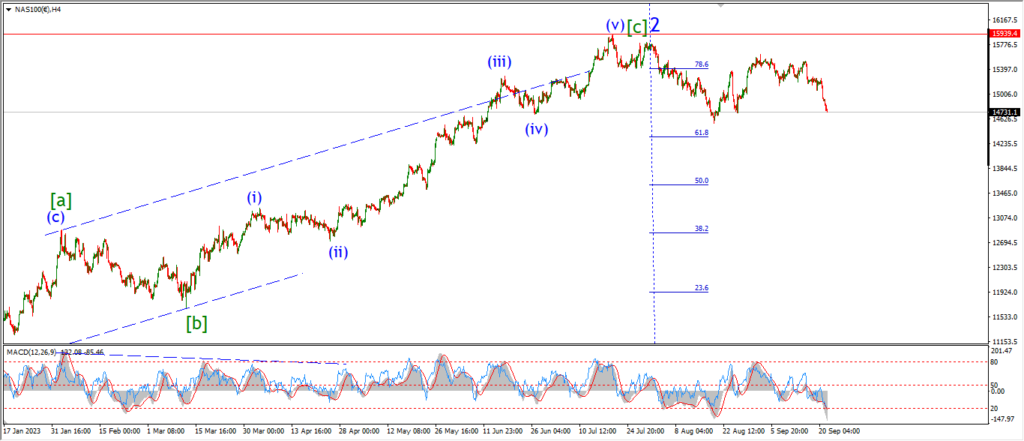

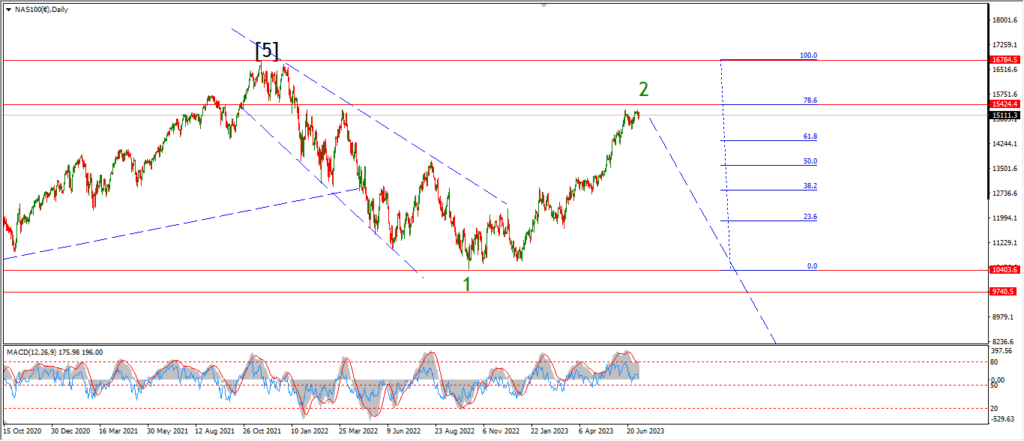

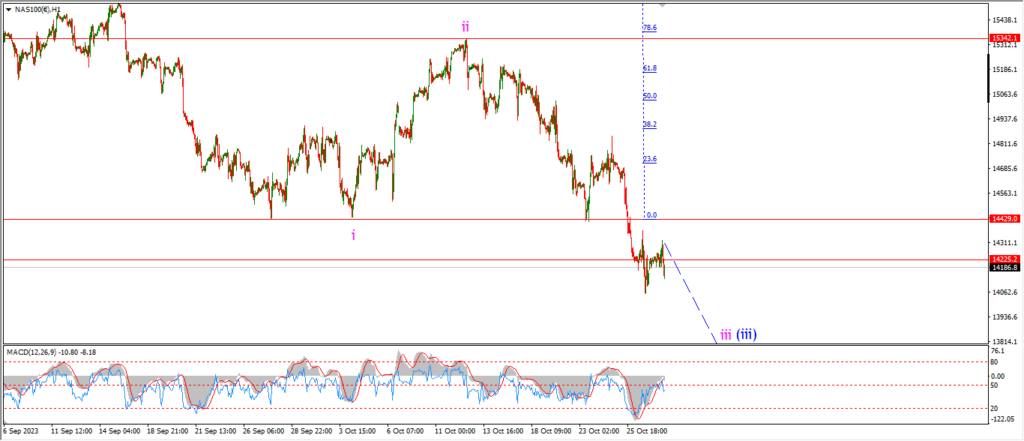

NASDAQ 100.

NASDAQ 1hr

….