Good evening folks, the Lord’s Blessings to you all.

Please forgive the late update,

it’s Saturday morning now,

I went to bed yesterday evening for a while to get some energy before starting work,

and I never woke up after that!

Better late than never I suppose!

https://twitter.com/bullwavesreal

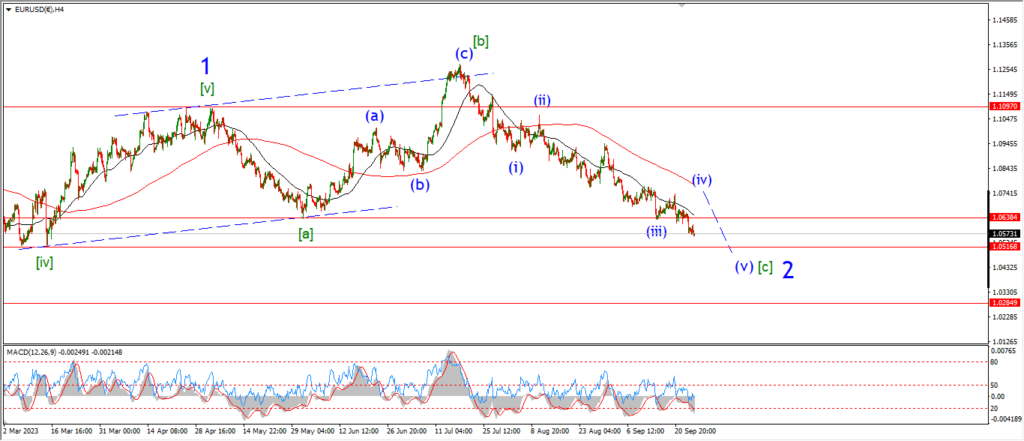

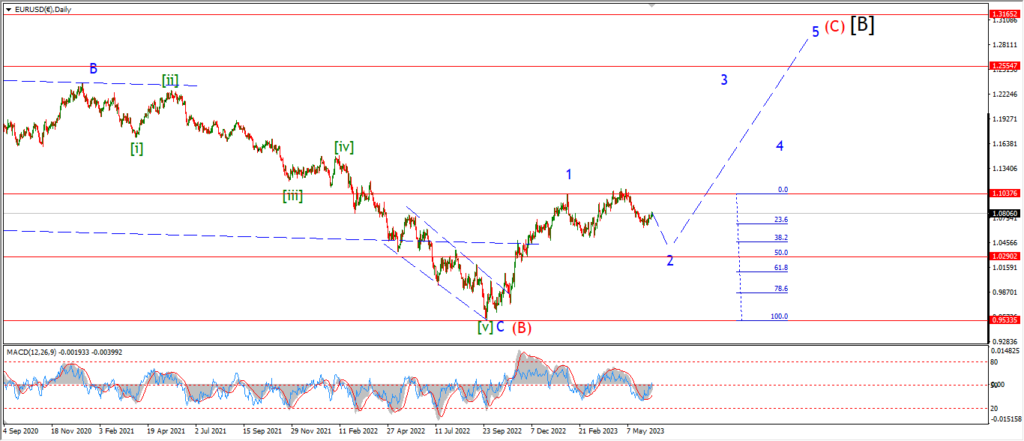

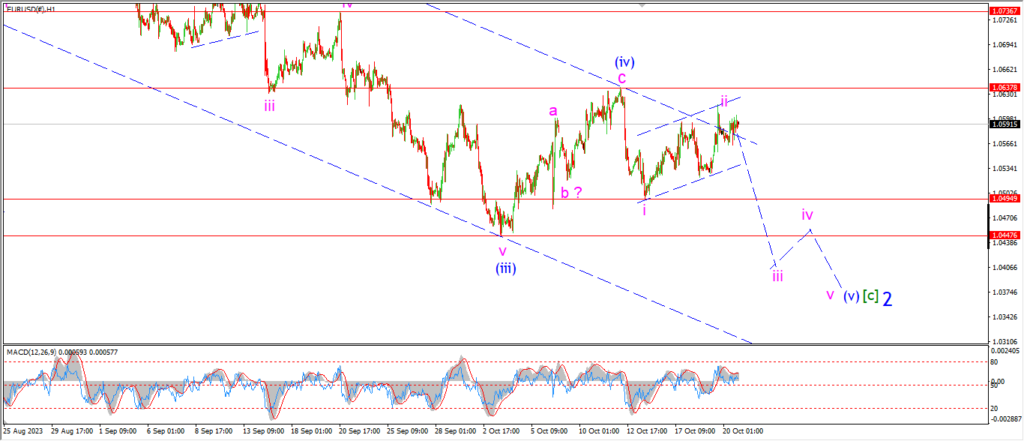

EURUSD.

EURUSD 1hr.

The larger wave ‘ii’ bounce hit the upper trend channel line and formed a new lower high on Thursday night.

On Friday we have another possible turn lower into wave ‘iii’.

the decline is too small to be confirmation of anything yet.

That wave ‘iii’ of (v) decline will be confirmed with a break of 1.0495 again.

Monday;

Watch for wave ‘iii’ of (v) to break 1.0495 and continue to make a new low for this whole decline phase.

GBPUSD

GBPUSD 1hr.

A new lower high in cable also yesterday.

This move suggests wave (iii) of [v] is underway here.

But now we need to see a larger five wave pattern make some progress over the coming few days and break to a new low near 1.20 again.

Monday;

The outlook for next week is simple enough.

More downside into wave [v] green.

Watch for wave ‘iii’ of (iii) to turn lower again and hit support at 1.2036.

Wave (iii) should make a new low in the pattern below that support level.

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

I am definitely a broken record this week when it comes to USDJPY.

the price has basically done nothing over the last few days.

And because of that the pattern has not changed for wave ‘c’ of (b).

I can’t add much to the outlook here except to say that wave (c) needs to turn down soon no matter how you read the patterns.

Tomorrow;

Watch for wave (c) to start with a nice spike lower to hit 148.80 again at that wave ‘4’ low.

When that happens we can then make some projections on the outlook for wave (c).

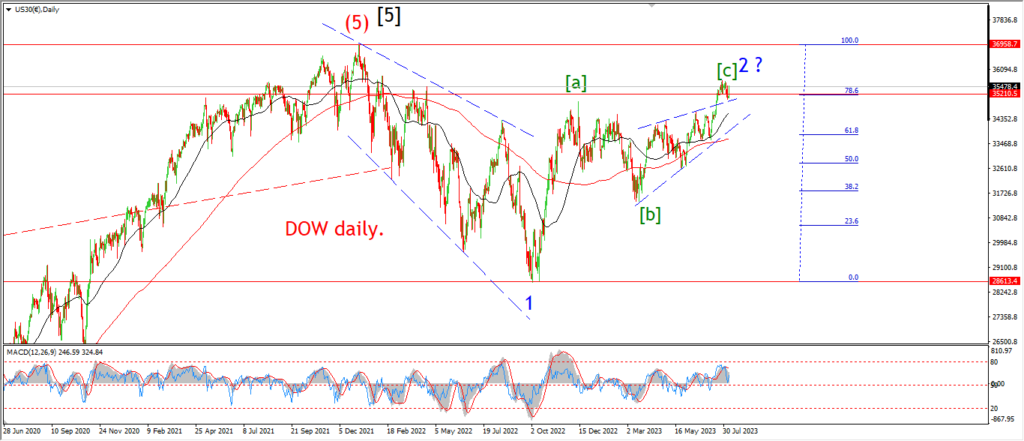

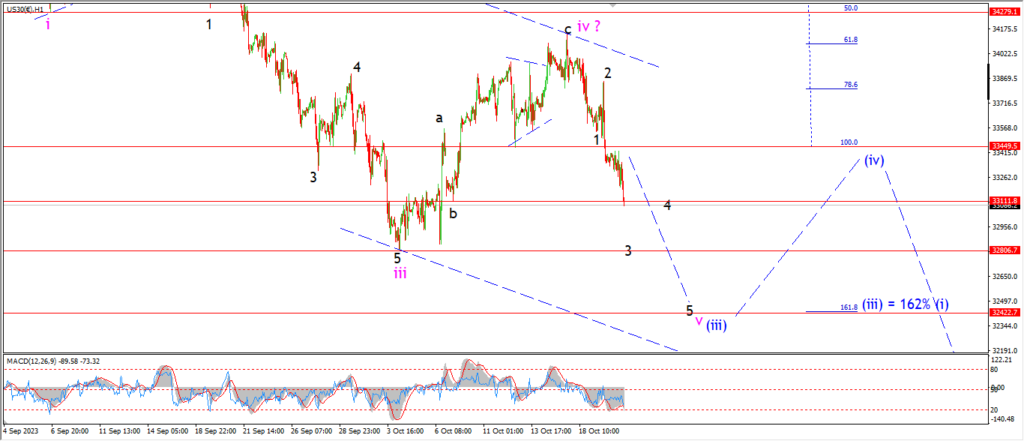

DOW JONES.

DOW 1hr.

The market gave us a big hint yesterday that wave ‘v’ of (iii) is now in play.

The internal pattern of wave ‘v’ can be argued over for sure.

You can even say that Fridays lows only complete wave ‘1’ of ‘v’.

I am suggesting that the continuation lower on Fridays is wave ‘3’ of ‘v’.

and we should see further declines early next week to break below 32800 at a minimum.

the ideal target for wave (iii) remains at 32400.

that level marks the 162% extension of wave (i).

And after this weeks reversal,

I can now say the ideal pattern is very much back in the possible realm again.

Monday;

Watch for wave ‘3’ of ‘v’ to find support near 32800 again.

if this pattern is correct,

then wave ‘4’ and ‘5’ should make a new low near that ideal target area by the end of next weeks trade.

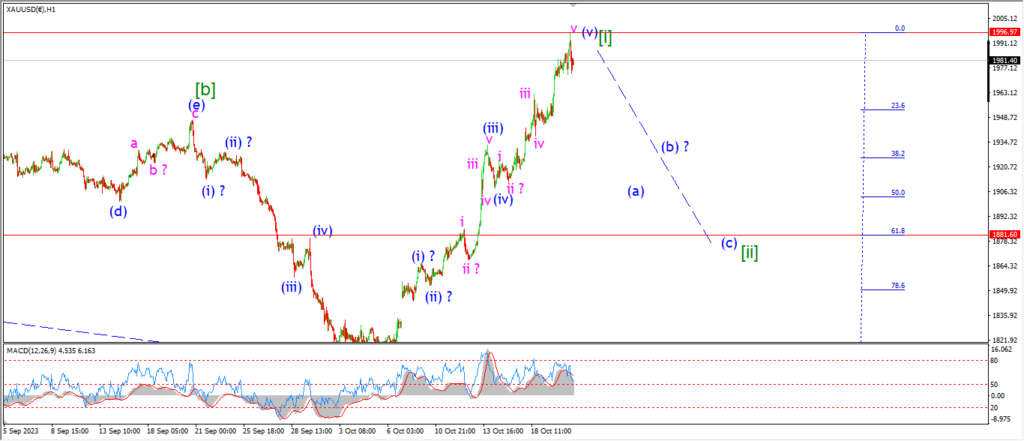

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

I am going out on a limb here to say that this wave [i] rally is all but done now.

And we should see a significant reversal in the price next week into wave [ii].

Maybe its just the fever talking,

but I do think gold has gone way too far, way too fast this week.

We will see soon enough,

but if I am correct here,

then next week will offer a very interesting entry point to the upside for the longer term.

Monday;

Wave [ii] should fall back into the 1880 area again in three waves.

that will create a 62% retracement of that initial rally in wave [i].

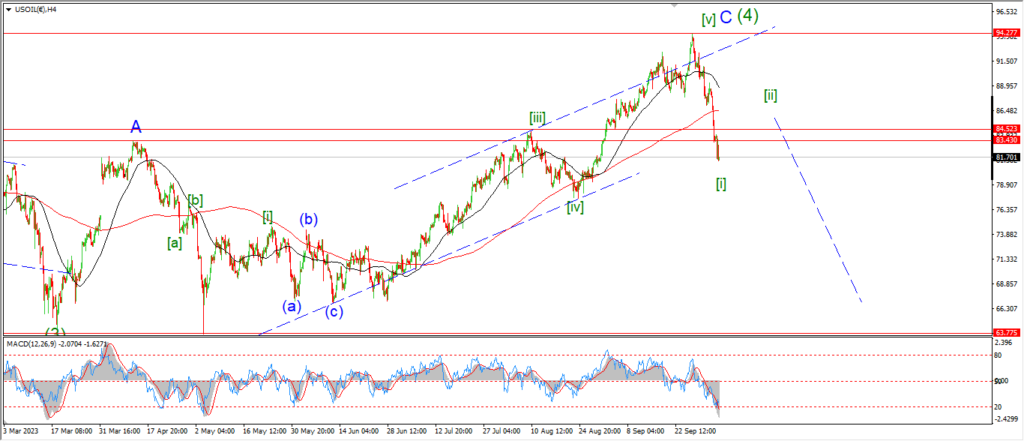

CRUDE OIL.

CRUDE OIL 1hr.

Crude came back off the highs on Friday

and the action looks like a good reversal candidate again.

The rally in wave [ii] stopped just above the 62% retracement level and now we have a small rejection back into the trend channel again.

Wave (i) should come down back into the middle of the corrective range of wave [ii] again.

So I am suggesting the 84.00 area to complete wave (i) down.

WAve (i) and (iii) should create a lower high below wave [ii] by the end of next week if all goes to plan.

Monday;

Watch for wave (i) to fall in five waves towards 84.00 over the course of next week.

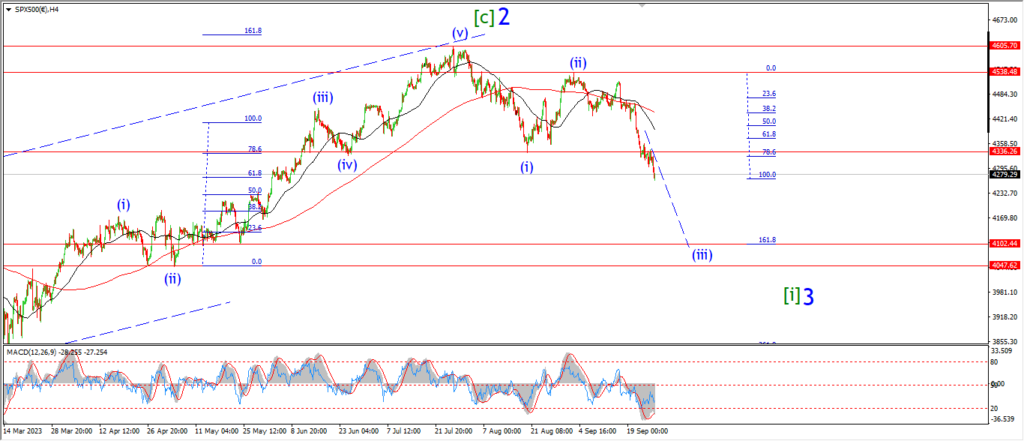

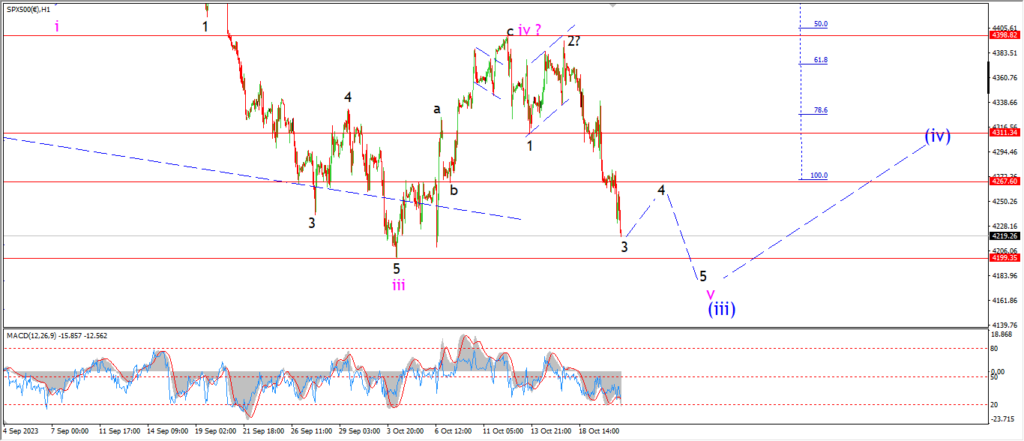

S&P 500.

S&P 500 1hr

That big scary rally in wave ‘iv’ has now almost all been retraced again after this weeks action.

The size of the decline this week definitely looks like a third wave extension alright.

wave ‘3’ of ‘v’ has brought the market back down to the minimum target area for the larger wave ‘v’ at 4199 again.

I can see a pretty well complete five wave pattern in wave ‘3’ also,

so I do expect a recovery on Monday into wave ‘4’,

and then one more step down into wave ‘5’ of ‘v’ of (iii).

the question now is how much lower can wave ‘v’ reach before completing the larger wave (iii) pattern.

My long standing preferred target for wave (iii) lies at 4100 where wave (iii) reaches 162% of wave (i).

WE will see next week if that is possible or not.

Monday;

Watch for wave ‘v’ to complete five waves down and break 4199 at a minimum.

We should know by Wednesday evening whether the lower target for wave ‘v’ of (iii) can be hit.

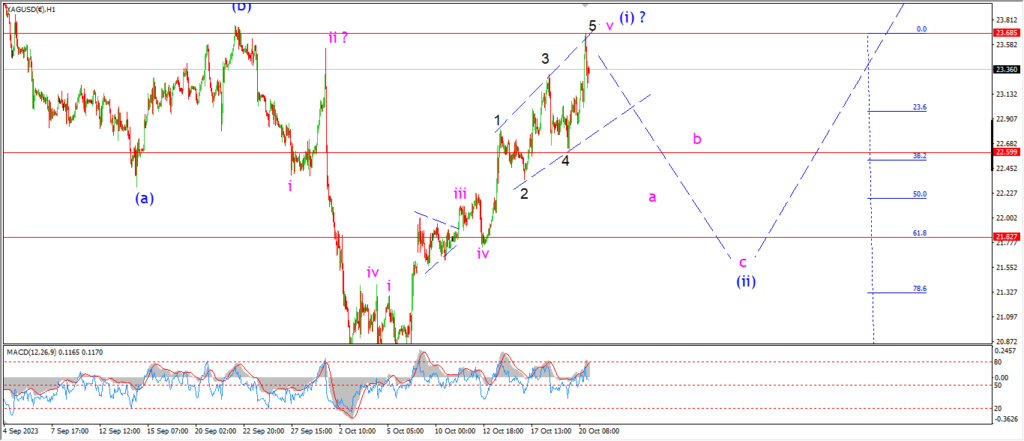

SILVER.

SILVER 1hr

Silver spiked to a new high in wave ‘v’ of (i) and then immediately reversed off that high again by the evening.

The top of the session tagged the upper line of that trumpet pattern in wave ‘v’ pink.

I am not certain that the rally is over for wave (i) now,

but I am confident that we will see a reversal into wave (ii) next week.

A break of 22.60 again at wave ‘4’ will signal wave ‘a’ of (iii) is underway.

And I think we can expect wave (ii) to fall into the 62% retracement level at 21.80 again.

Monday;

Watch for wave ‘a’ of (ii) to continue lower in three waves at least to break 22.60.

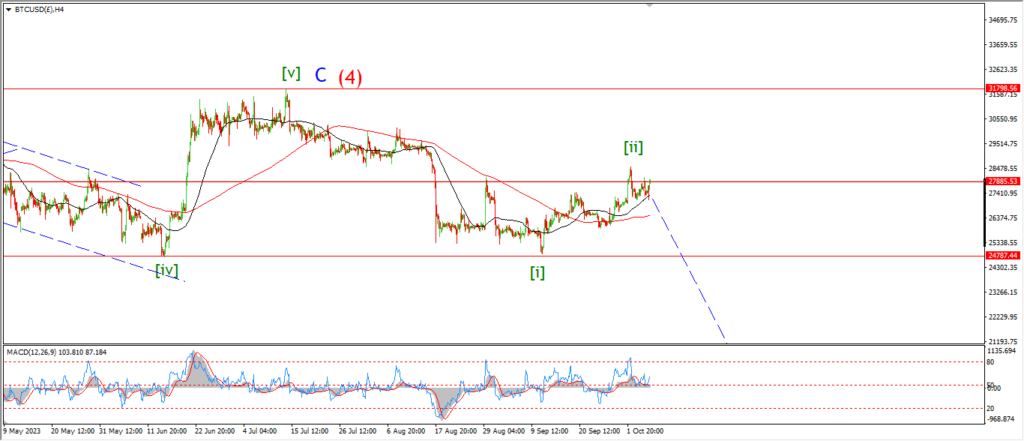

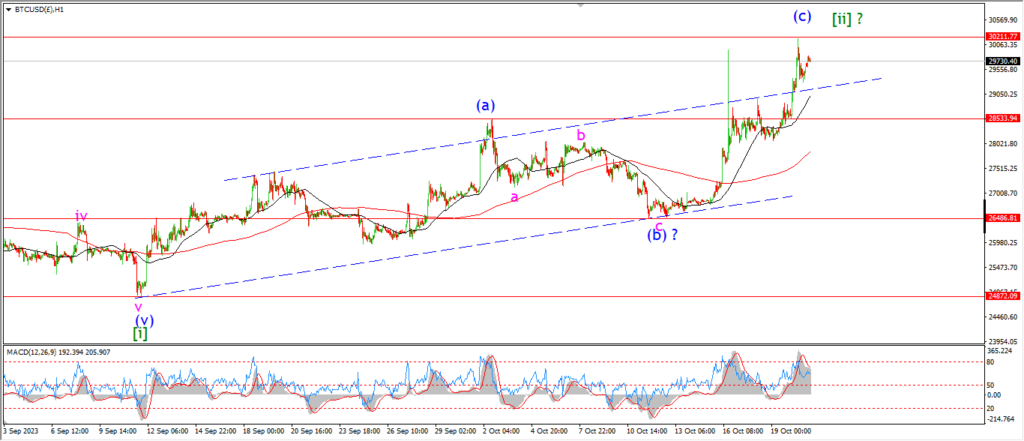

BITCOIN

BITCOIN 1hr.

….

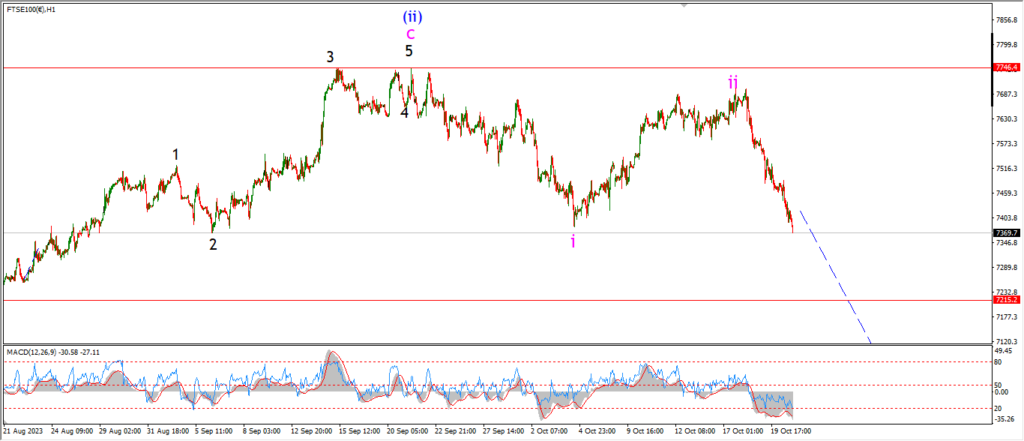

FTSE 100.

FTSE 100 1hr.

….

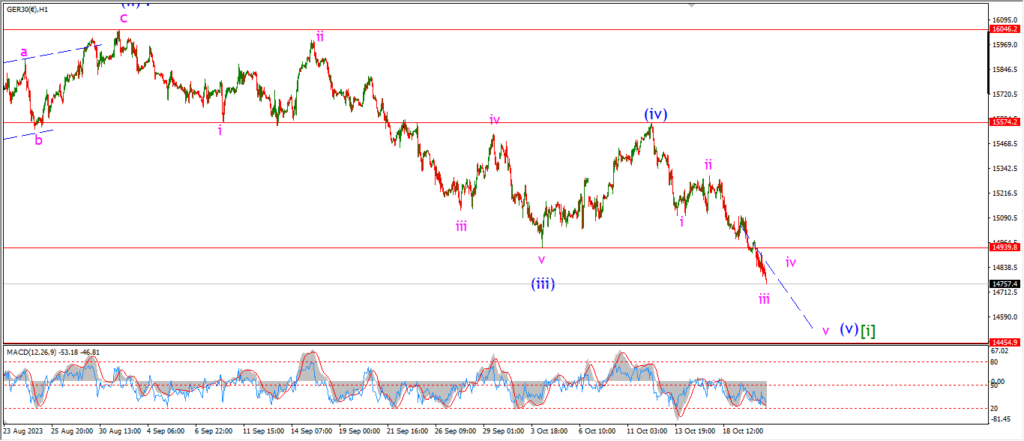

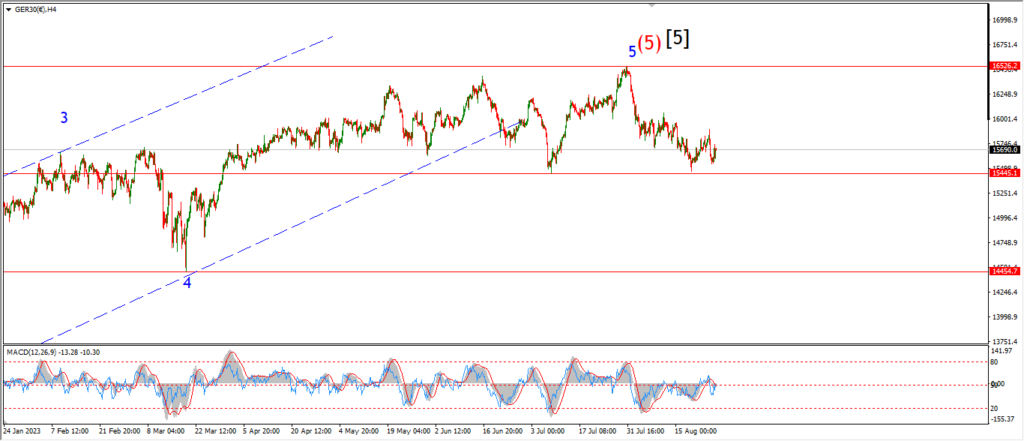

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

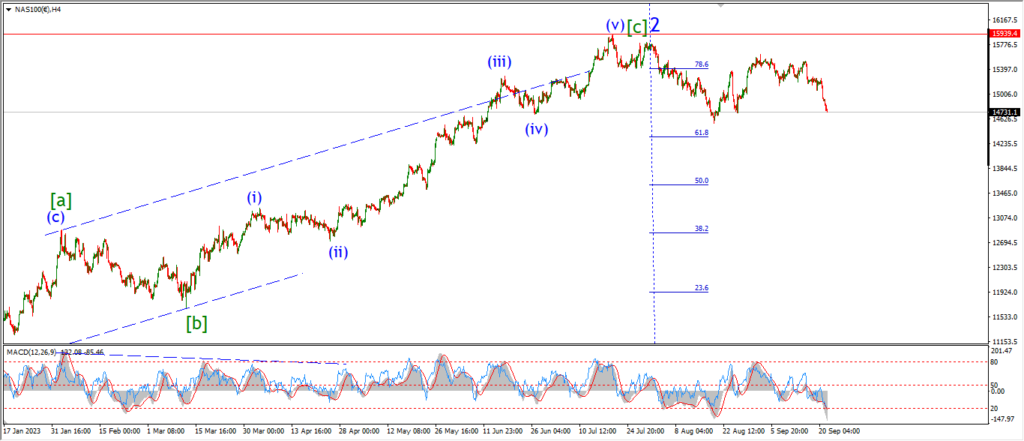

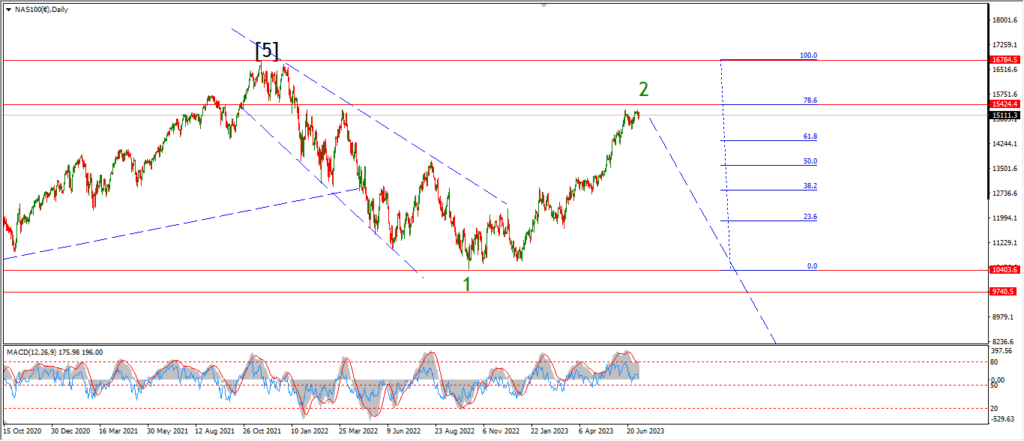

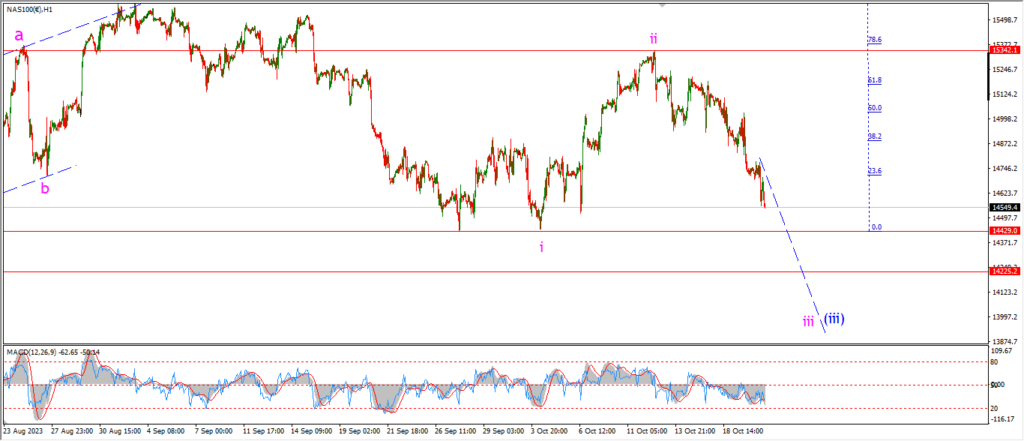

NASDAQ 100.

NASDAQ 1hr

….