Good evening folks and the Lord’s blessings to you.

EURUSD

EURUSD 1hr.

I am suggesting that EURUSD has completed wave ‘a’ of (ii) tonight.

Wave ‘b’ will rebound slightly to form a lower high as shown over the next couple of sessions.

And then wave ‘c’ should finish the job with a drop into the 50% retracement level at 1.0355 if this count is correct.

Tomorrow;

Watch for wave ‘b’ to correct higher as shown with a top near 1.05 again.

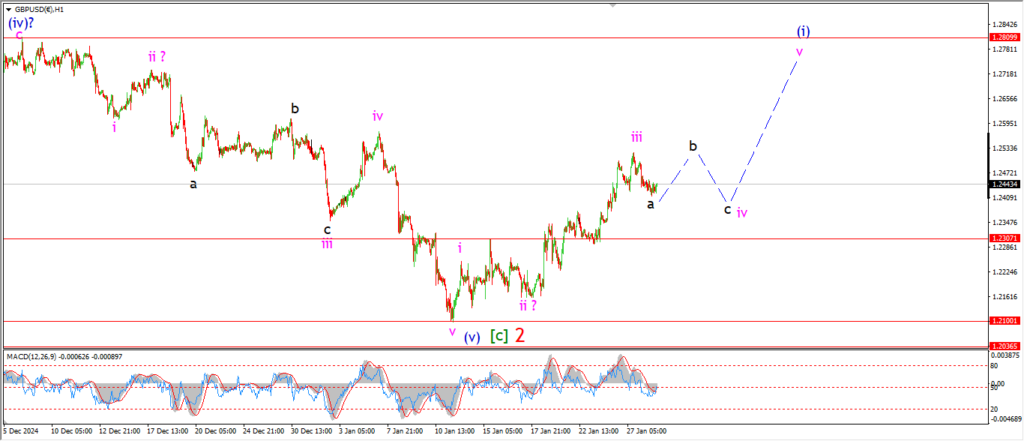

GBPUSD

GBPUSD 1hr.

The drift lower into wave ‘iv’ is underway now and I have marked todays lows as wave ‘a’ of ‘iv’.

I want wave ‘iv’ to complete above 1.2310.

and that leaves a pretty tight margin for error here.

I am suggesting a sideways flat correction as a possibility.

But it is just too early to tell at the moment.

Tomorrow;

Watch for wave ‘iv’ to continue to develop in a corrective pattern and hold above 1.2310.

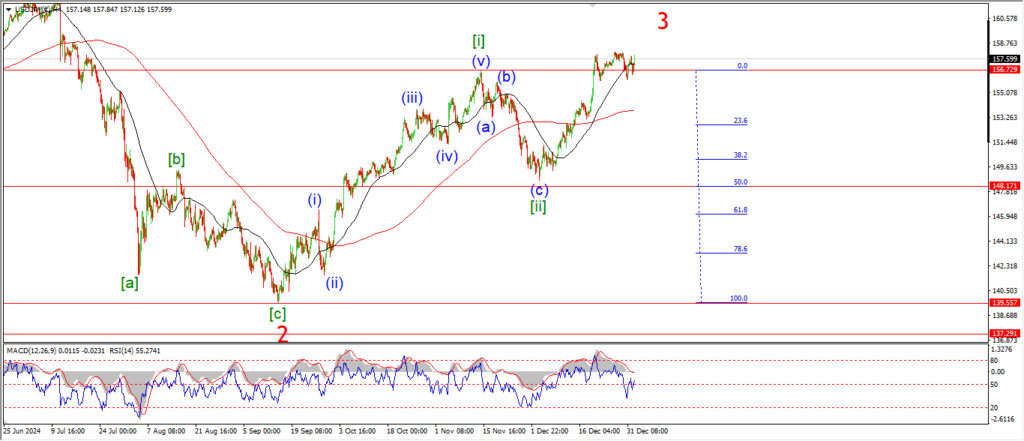

USDJPY.

USDJPY 1hr.

USDJPY is holding above the wave (ii) low at 153.70 again today,

and because of that I do think we are moving up into wave ‘i’ of (iii) now.

Wave ‘1’ is complete at the recent high,

and now wave ‘2’ is underway as a three wave decline.

Wave ‘2’ might even complete overnight and then we are left with a rally into wave ‘3’ of ‘i’ for tomorrows trade.

A break back above 157.50 again will favor this count strongly.

And a break above 158.86 will confirm this idea.

Tomorrow;

Watch for a higher low to form in wave ‘2’ of ‘i’ as shown.

Then a rally into wave ‘3’ should follow.

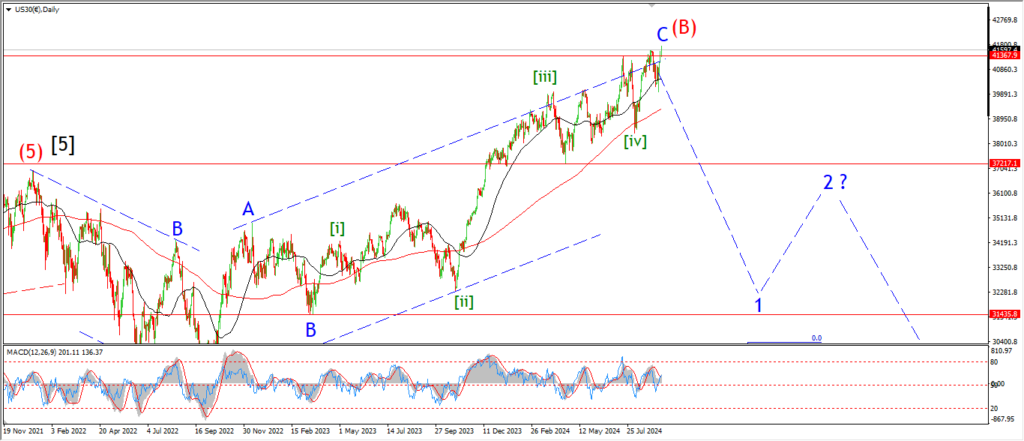

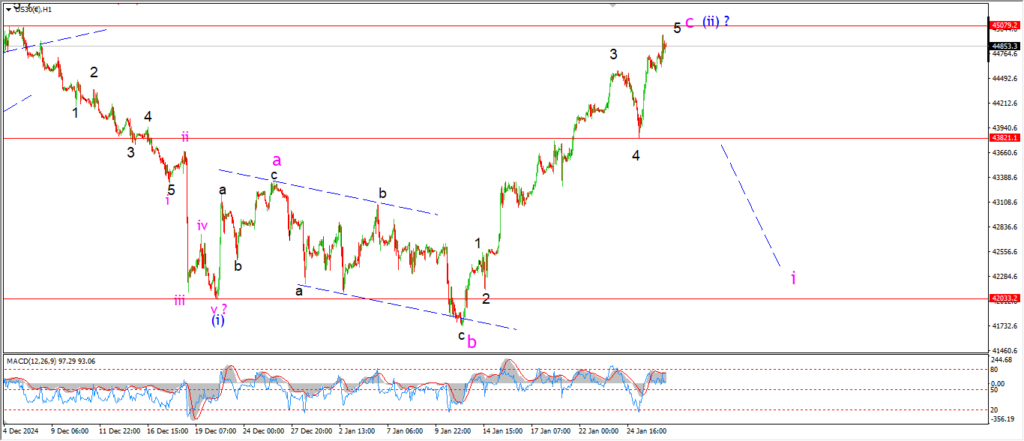

DOW JONES.

DOW 1hr.

Well that pretty much seals the deal on the short term count,

but I have not changed the hourly chart yet!

A break to a new high will shift the pattern along and wave [v] will be back on the table again.

I am leading with the daily chart tonight to show the wave (B) top again,

this is the current alternate count.

There is still no change here.

the rally into this top is in three waves overall off the wave (A) lows.

And wave ‘C’ of (B) is a five wave pattern.

We keep postponing the inevitable top in wave (B) with each new rush of extreme sentiment.

And here we are again on the verge of invalidating a perfectly reasonable attempt at a reversal off the top.

A new top will most likely happen this week.

and I will deal with the fall out from there.

GOLD

GOLD 1hr.

The decline off the top at wave [b] started well last week,

but the pattern only traced out three waves down.

now we have a rebound to a lower high forming here.

So far that rebound seems to be in three waves.

But;

I am not sure what pattern is developing off the recent top here to be honest.

So I am going to give this market a few days to see if this pattern clears up.

Tomorrow;

Watch for a lower high to form and then lets see if wave ‘i’ down can reassert itself and turn the price lower again.

CRUDE OIL.

CRUDE OIL 1hr.

Crude oil is now building a higher low off a completed wave [i] pattern today.

the low of wave [i] reached 72.25,

I have labelled the bounce off that low as wave (a) and (b).

With wave (c) set to rally later this week.

The 50% retracement level lies at 75.92,

and that marks the initial target level for this correction.

If all goes well,

wave [ii] should complete by the end of this week.

Tomorrow;

Watch for wave [ii] to track higher in three waves over the rest of this week.

We should see a completed corrective lower high in wave [ii] ready to set up for wave [iii] down next week.

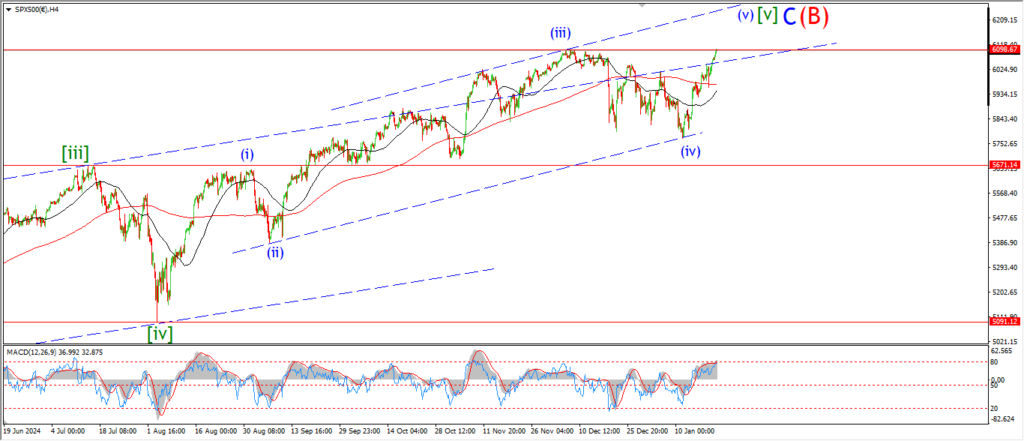

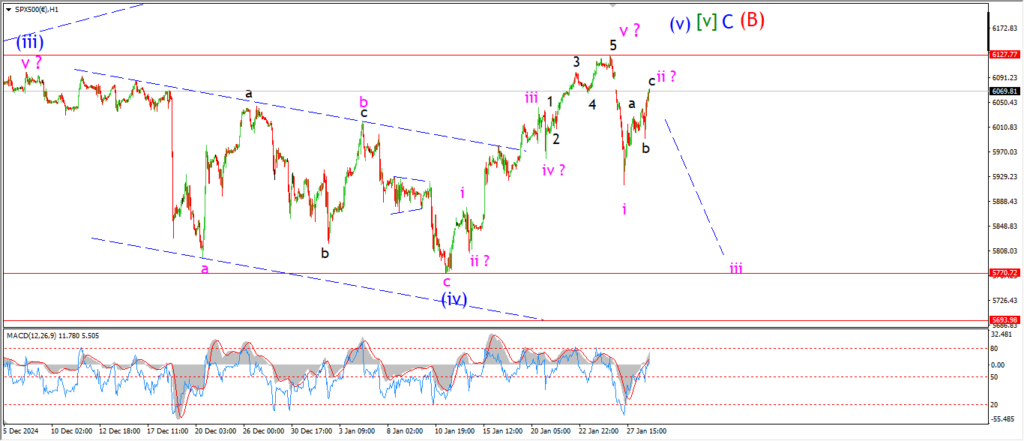

S&P 500.

S&P 500 1hr

The S&P has reached a second wave lower high this evening in wave ‘ii’ pink.

there is no guarantee that the market will turn lower from here into wave ‘iii’ down,

but I can only let the action play out to see if the pattern continues to fit.

The decline off the high certainly looks impulsive,

so there is at least the possibility here of a reversal into a five wave decline overall.

We saw yesterday how quickly the market can sell off when the rug is pulled out.

There were reports of no bid moments yesterday when the market dropped hard.

and now we see that even with all the advancements in market participation and endless leverage through options and efts etc.

The market is after all, only a confidence game.

And it is possible that investors can lose confidence very quickly.

Tomorrow;

It is a test for this wave ‘ii’ lower high.

Lets see if it holds.

A third wave decline will drop back into the recent lows again below 5800.

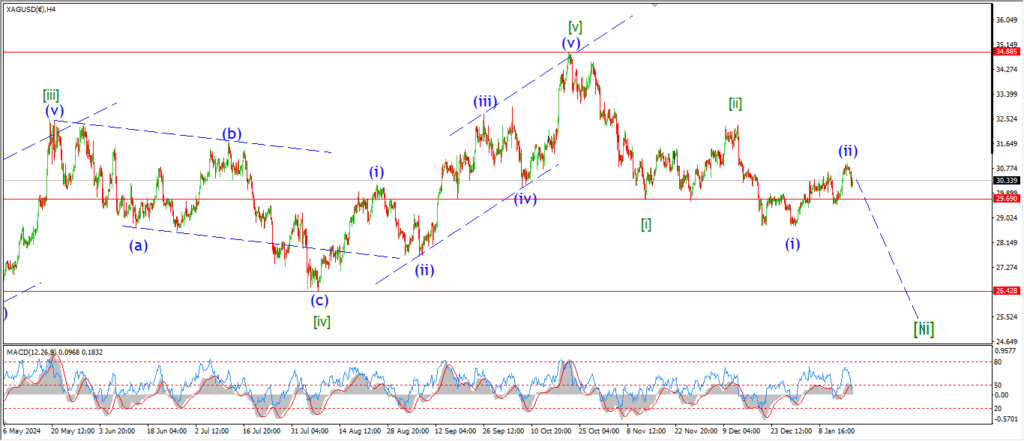

SILVER.

SILVER 1hr

I am giving this pattern the benefit of the doubt here with wave ‘i’ down taking the lows and now a rebound into wave ‘ii’ this evening.

So far we have three waves up,

and this is a corrective form,

so this wave count holds as a reversal off the wave (ii) high.

And wave ‘iii’ of (iii) down is in play now.

Tomorrow;

the highs at wave (ii) must hold from here on out.

A break below 30.00 again will signal wave ‘iii’ down has begun.

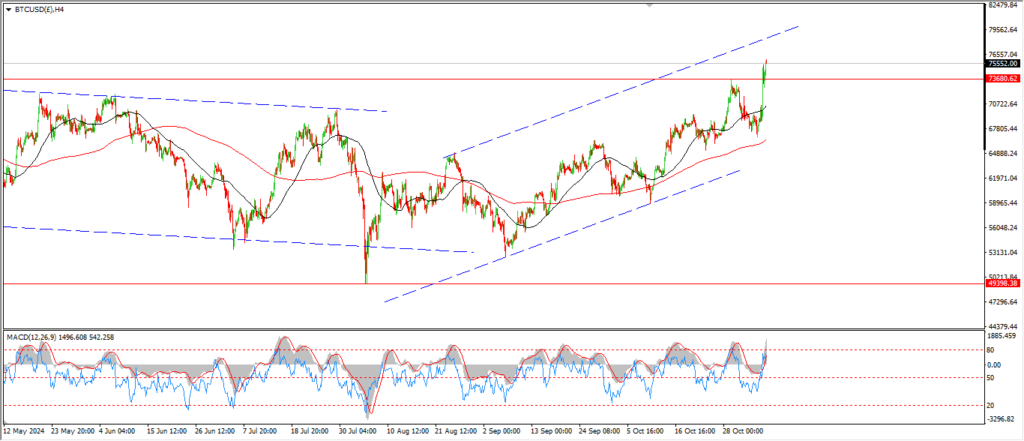

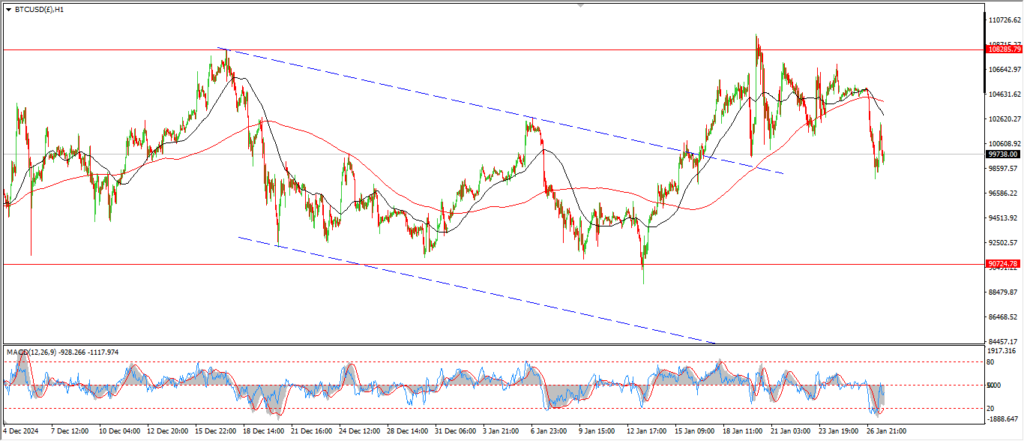

BITCOIN

BITCOIN 1hr.

….

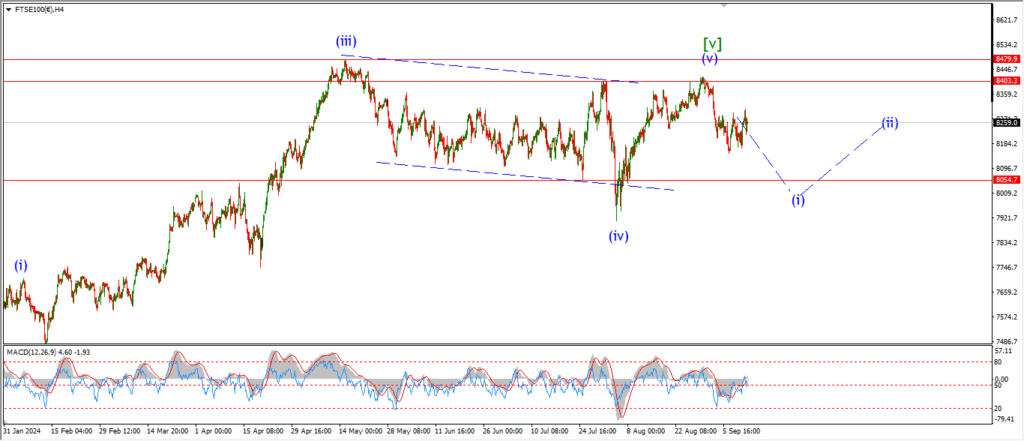

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

….

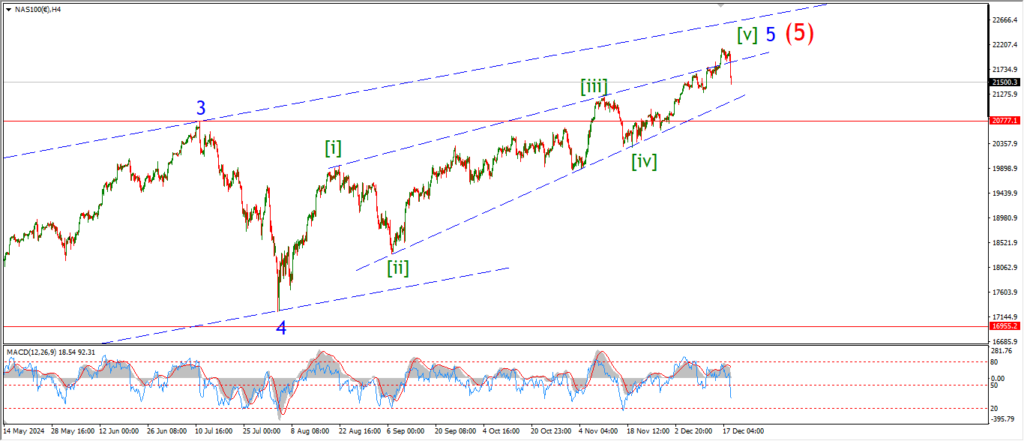

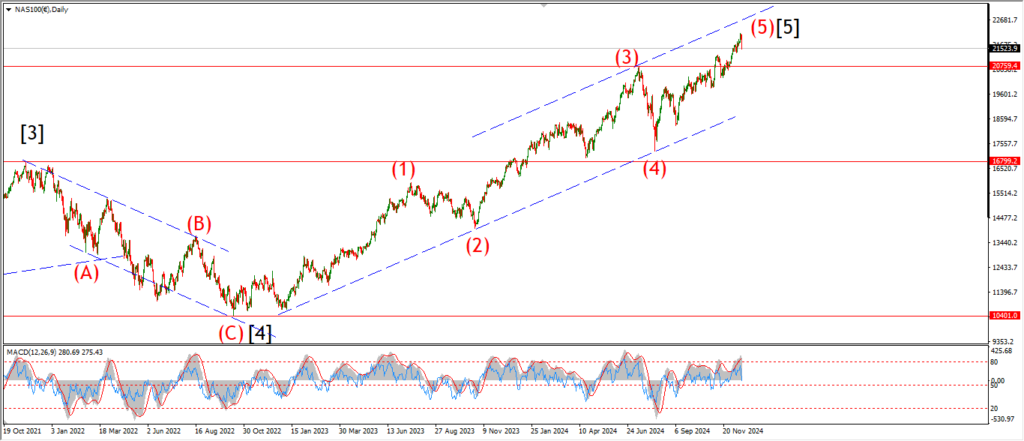

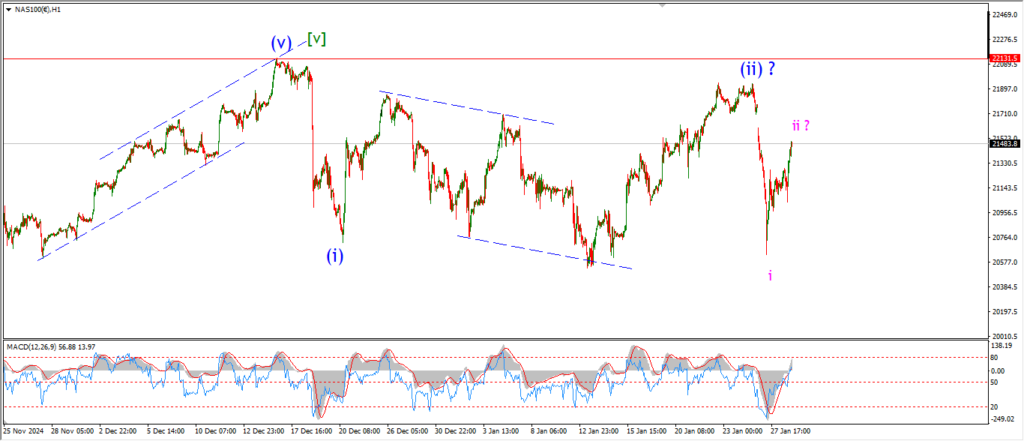

NASDAQ 100.

NASDAQ 1hr

….