Good evening folks, the Lord’s Blessings to you all.

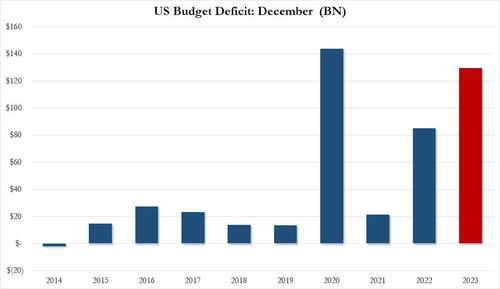

US Budget Deficit Soars By 50% In December As Fiscal Collapse Under Biden Accelerates

China Pummeled By Dire Deflation, Trade And Credit Data As Labor Strikes, Protests Explode

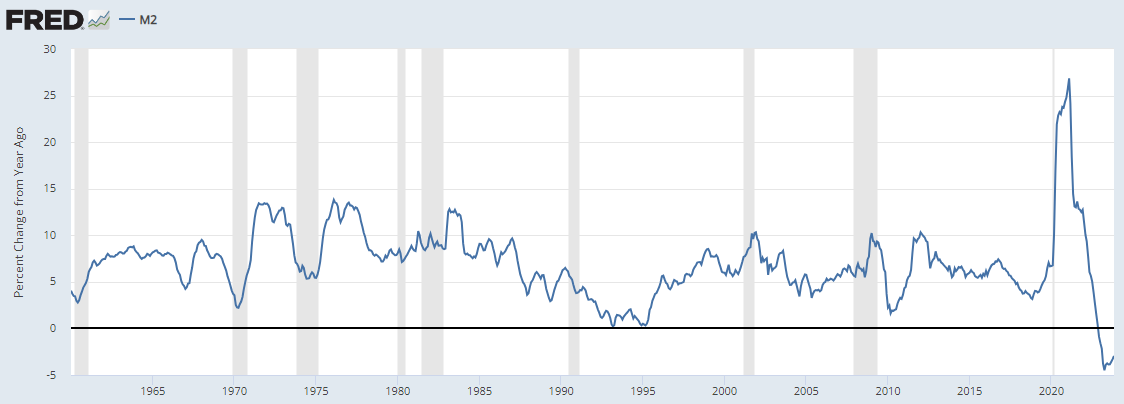

US M2

https://twitter.com/bullwavesreal

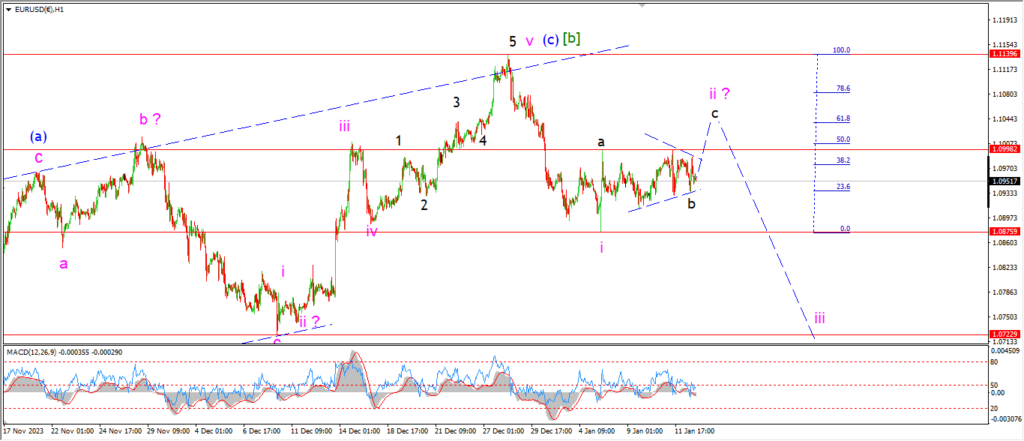

EURUSD.

EURUSD 1hr.

EURUSD has barely moved today and because of that, I am now considering another pattern for wave ‘ii’.

The price action over the last few days has basically gone sideways in a range.

I have labelled this move as a triangle in wave ‘b’ of ‘ii’.

Wave ‘c’ should break higher on Monday and complete near 1.1040.

this pattern will take another day at least to complete.

And then I will look lower into wave ‘iii’ by Tuesday evening.

Monday;

Watch for wave ‘ii’ of (i) of [c] to complete near 1.1040.

wave ‘iii’ down will turn lower again from there.

GBPUSD

GBPUSD 1hr.

There is a similar argument to be made in cable also tonight.

the action is still holding a lower high in wave (ii) this evening.

so the main wave count is still valid here.

and even though the action has drifted higher over the week,

I can view the rise as an ending diagonal wave ‘c’ of (ii).

The price has turned lower again this evening.

A drop into wave (iii) must begin soon.

So I will be looking for wave ‘i’ of (iii) to get going on Monday.

Monday;

Watch for wave (ii) to hold below 1.2828.

Wave ‘i’ of (iii) will be confirmed with a break of 1.2610.

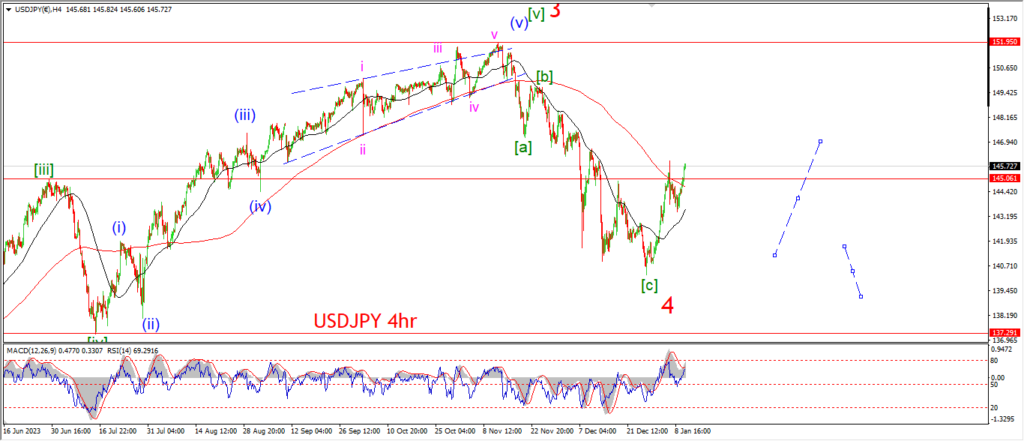

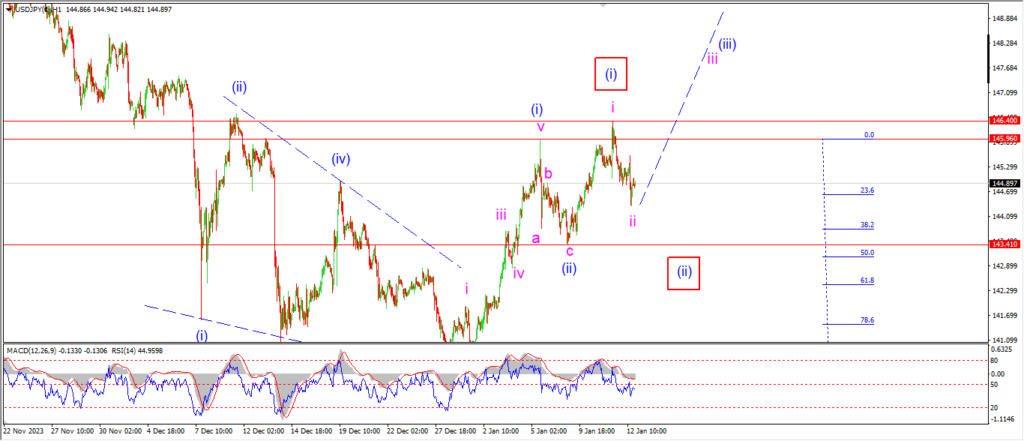

USDJPY.

USDJPY 1hr.

USDJPY is following the wave count quite well at least!

The price has dropped off the top of wave ‘i’ in three wave now.

And I am suggesting that wave ‘ii’ of ‘iii’ may be complete at todays lows.

If this count is correct,

then wave ‘iii’ of (iii) will rally out to a new high next week.

Wave ‘iii’ of (iii) has the potential to reach up towards 150.00 when complete.

So this one will be worth keeping an eye on.

The alternate count for this rally suggests wave (ii) is still underway.

Monday;

The wave (ii) low must hold at 143.41.

Wave ‘iii’ will be confirmed with a break of 146.40 again.

DOW JONES.

DOW 1hr.

It is a matter of shuffling the deck chairs on the titanic in the DOW this week!

The market is cycling through a number of differing wave counts for the same end of the line pattern.

The market pipped out above the previous high today and then reversed right back into the range this evening.

The close this evening is matching the wave (iii) high again.

That’s three weeks with nothing to show for it!

The daily chart shows us exactly why this is happening,

and that is;

a momentum death at the end of trend.

WAve ‘C’ of (B) is signaling to us that there is a turn coming.

I am looking at the wave (v) of [v] pattern in a different light.

And the pattern into the session high can be read as an ending diagonal.

The patter is solid and as usual,

the proof will be in the reversal that is coming.

Monday;

Watch for wave (v) to hold again and a drop back below the wave (iv) low to signal wave (i) is underway.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Another day of spiking action which requires a new look at the main count.

WAve ‘i’ is still a clear pattern.

But the rally today has traced out a larger pattern for wave ‘ii’.

Wave ‘ii’ is shown as an running flat correction as wave ‘c’ completed below wave ‘a’ this evening.

The pattern needs to be confirmed on Monday with a drop into wave ‘iii’ down as shown.

Monday;

watch for that wave ‘ii'[ high to hold at 2062.

Wave ‘iii’ should fall into support at 1972 over the next week or so.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Another decline in crude oil has ruled out the simple wave (c) pattern that I was working with all week.

the price rose in three waves into this weeks highs.

and now the decline this evening has retraced most of that rally.

I am rethinking wave (b) this evening as a result.

The sideways actio can be viewed as a triangle now.

With todays decline beginning wave ‘c’ of (b).

Monday;

Watch for wave ‘c’ of (b) to trace out three waves down into the trend line at about 71.00.

The sideways action will continue for another few sessions at least as this triangle develops.

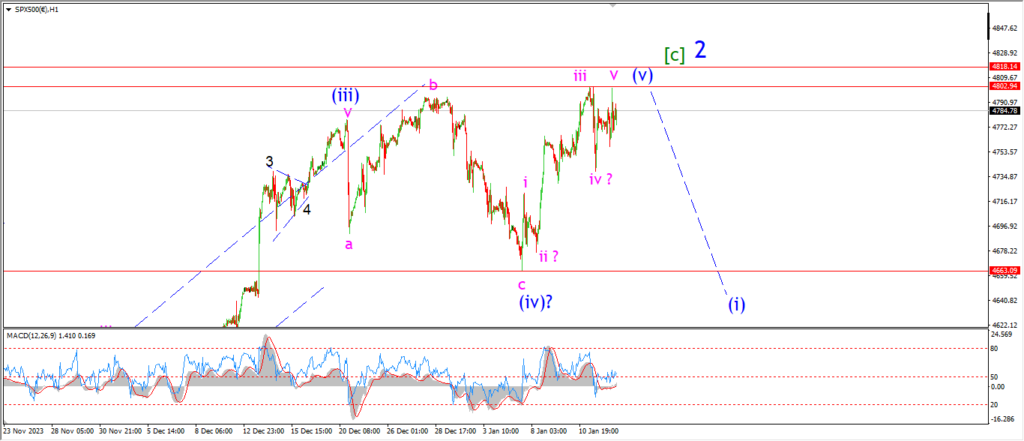

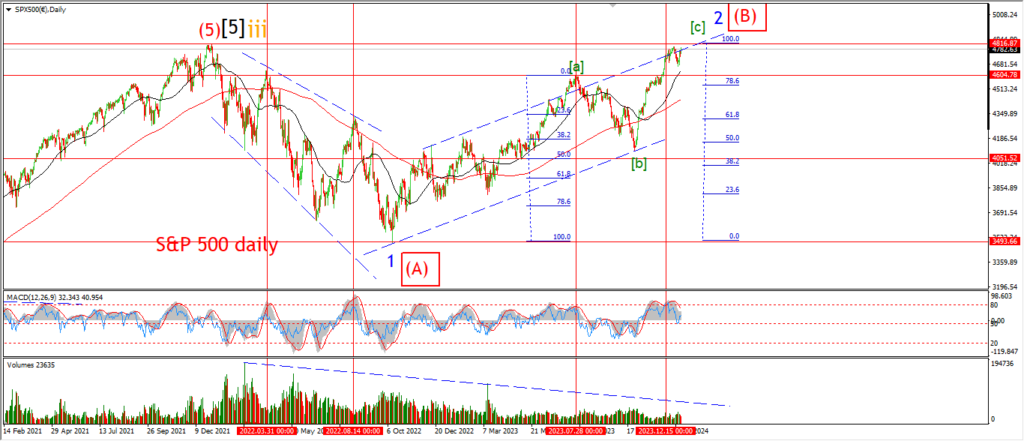

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

I know I am really holding onto this wave ‘2’ count with all my might these days,

but the shoe still fits for the moment!

The price can easily break out to a new high and trigger the alternate wave (B) count for sure.

The outcome of that count functionally the same;

A long and painful decline in five waves over the next 6 months at least.

The market is holding at near the highs of the week again tonight.

and there is not much to add to the overall count even after todays action.

the wave (v)of [v] pattern has brought the market to an all too close lower high.

And the decline that never seems to come into wave (i) is now needed more than ever to stick with the wave ‘2’ idea.

If the price breaks out to a new high next week.

That will trigger a similar wave count to the DOW.

And we will be looking at the top of wave (B) rather than wave ‘2’ as shown.

And even from that point,

wave (i) down will be the next expected move.

Tomorrow;

Watch for wave (i) to finally kick in and drop the market back below the wave (iv) lows at 4660.

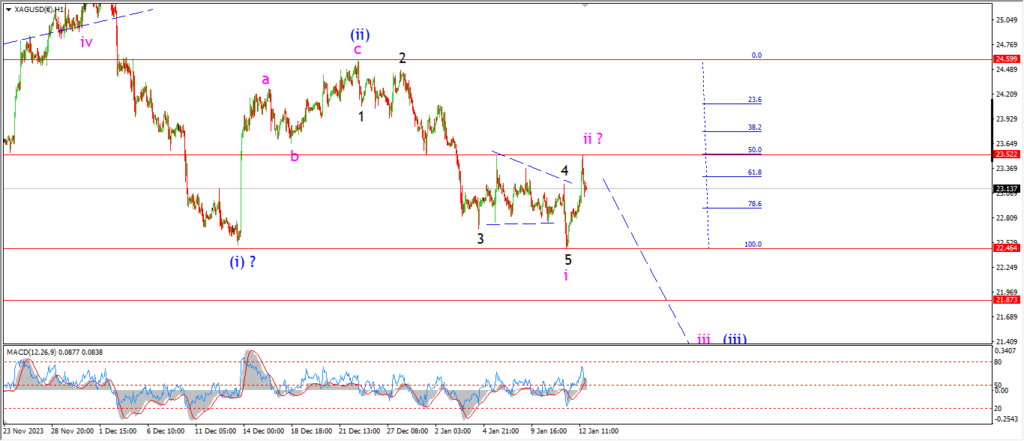

SILVER.

SILVER 1hr

Silver has broken out of last nights pattern also today.

the overall direction of the pattern is no different here though.

Wave ‘i’ is counte3d a little different with a triangle forming wave ‘4’ and wave ‘5’ dropping to this weeks low.

Wave ‘ii’ completed again at todays high.

And the rally today actually topped at the 50% retracement level of wave ‘i’.

So now we have another potential turning point into wave ‘iii’ of (iii).

Monday;

Watch for that wave ‘ii’ high to hold at 23.52.

Wave ‘iii’ down should begin with a break below 22.46.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

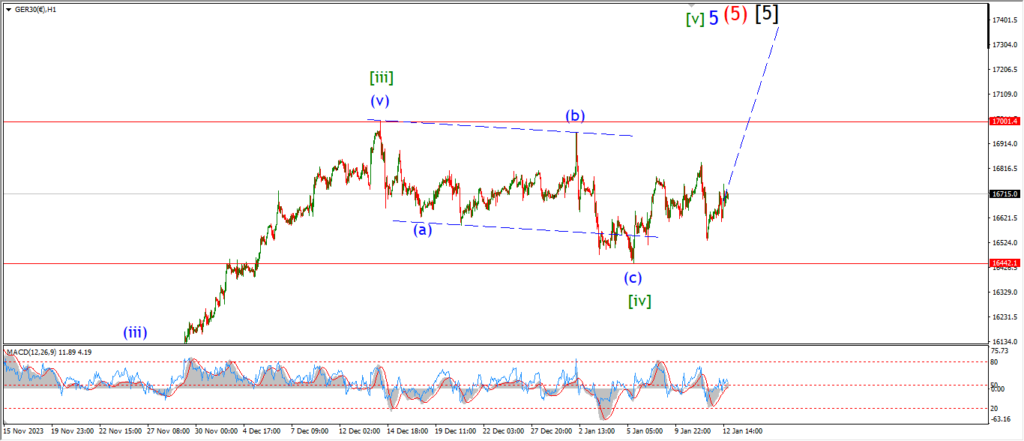

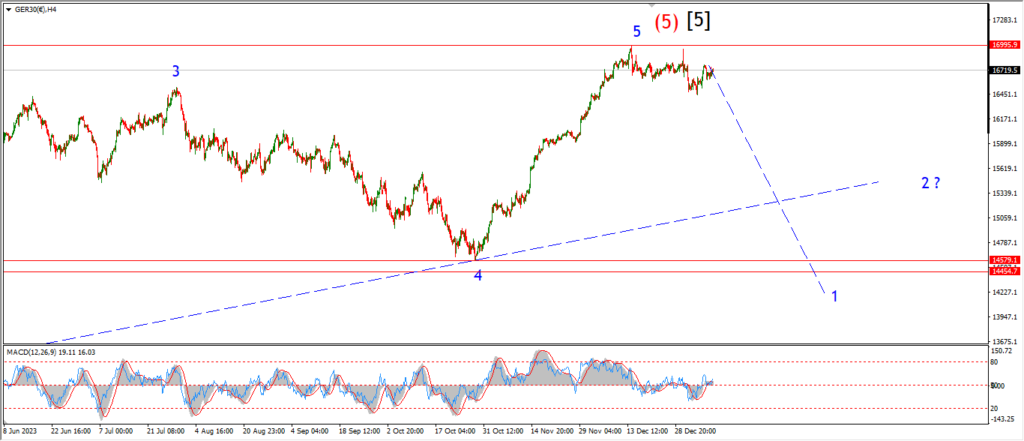

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

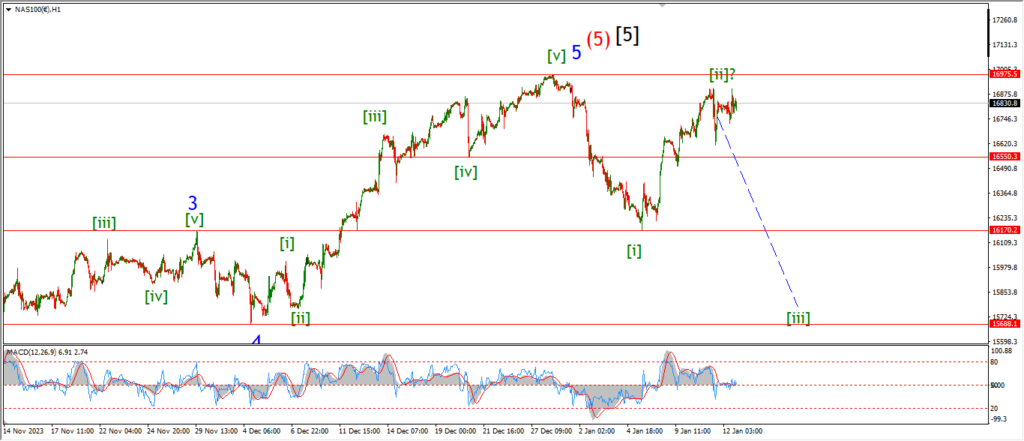

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….