Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

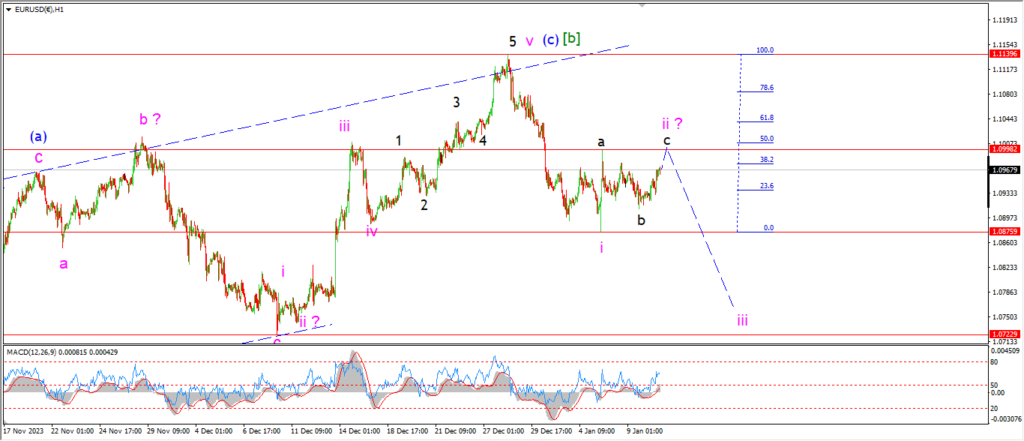

EURUSD.

EURUSD 1hr.

The move higher today in EURUSD is counted as wave ‘c’ of ‘ii’,

with a minimum target at the wave ‘a’ high of 1.0998.

A break of that level will complete a three wave correction in wave ‘ii’ and then we can look lower again into wave ‘iii’ of (i).

Its been a frustrating weeks trade this so far,

but when wave ‘iii’ comes,

that should open up the action a whole lot.

I am looking at the 1.0700 area to complete wave ‘iii’ down.

Tomorrow;

Watch for wave ‘ii’ to complete with a break of the wave ‘a’ high at 1.10 again.

GBPUSD

GBPUSD 1hr.

Cable is stuck in a range also this week with this wave ‘b’ pattern holding the action for another day.

I am looking at a possible triangle correction for wave ‘b’ tonight,

and that triangle is not complete yet.

This should be followed by another pop above 12770 to complete the pattern.

Once that happens,

then I can look lower for wave ‘i’ of (iii) to begin.

Tomorrow;

Watch for wave ‘b’ to complete a triangle near 1.2695.

Wave ‘c’ of (ii) is expected to turn higher later tomorrow.

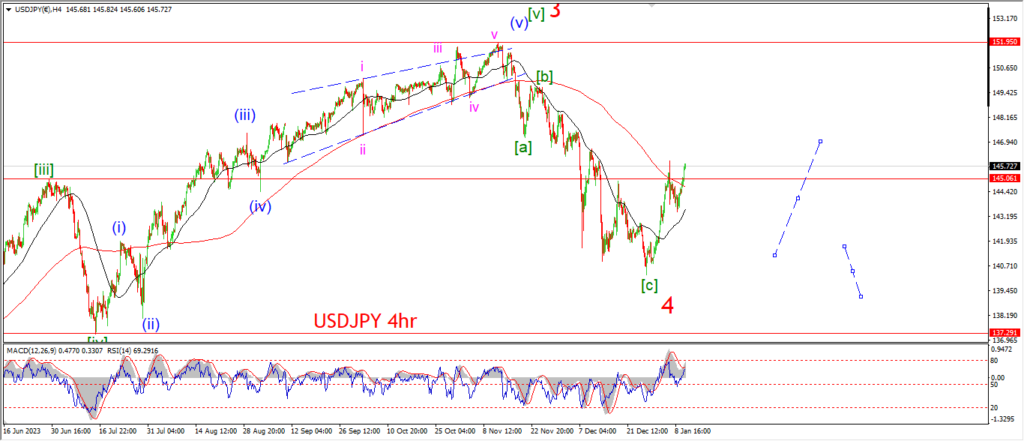

USDJPY.

USDJPY 1hr.

USDJPY has put in a nice rally today and that action now fits an impulsive pattern a little better.

If wave (ii) is complete at 143.41,

then todays rally is wave ‘i’ of (iii).

The price almost broke back above the wave (i) high at 145.96 again,

and that does favor the idea that wave (iii) is now in play here.

Tomorrow;

Watch for wave ‘i’ and ‘ii’ to complete a higher low and then we can look for an acceleration higher into wave ‘iii’ on Friday.

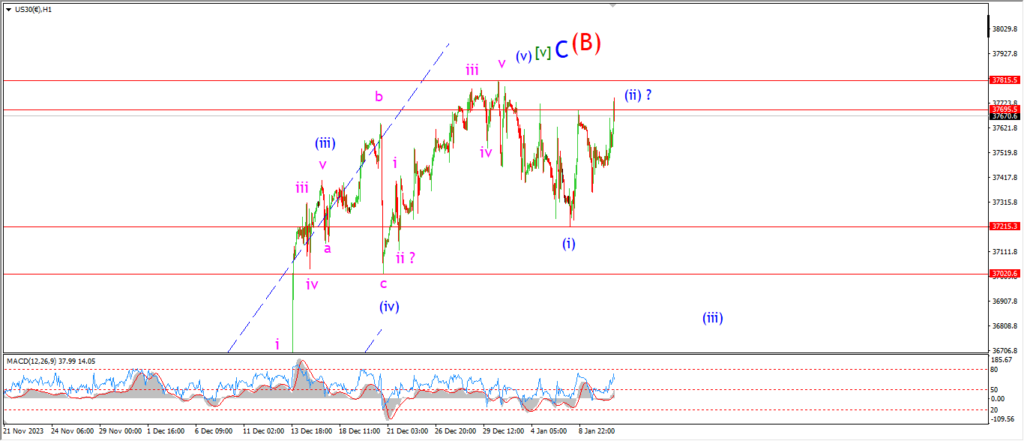

DOW JONES.

DOW 1hr.

The action today has tipped the balance against the impulse wave down idea.

I will admit that it is hard to count that recent decline as a classic impulsive pattern.

The only way to view it in a bearish light was to consider it as a leading wedge.

And that is a rare pattern.

So I am not going to go back to the drawing board for tomorrow anyway.

the market is still holding at a lower high,

so the action can still develop impulsively to the downside.

I am not going to rule that out,

But in that case,

the market must move back in favor of that bearish idea tomorrow.

I will wait and see how that goes before jumping on the bandwagon again.

tomorrow;

If the market can hold the lower high again that will favor the wave (i) and (ii) idea.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

A three wave correction sideways in wave ‘2’ may be complete at the session high today.

That is one possibility here at least.

Wave ‘1’ and ‘2’ have now created a bearish lower high to begin wave ‘iii’ down.

And now it remains to be seen if wave ‘3’ of ‘iii’ will follow through to the downside tomorrow to confirm this pattern.

Tomorrow;

2040 marks the session high at wave ‘2’.

Watch for wave ‘3’ of ‘iii’ to continue lower and break 2015 again.

Wave ‘3’ of ‘iii’ should accelerate lower in an ideal world.

That target for wave ‘iii’ lies at 1972.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude fell back today and now we have a threat to the wave count as the price approaches 70.15 at wave ‘ii’ again.

I am going to stick with the wave [iv] idea until proven wrong here,

but I have introduced a possible alternate count for wave [iv] as a contracting triangle.

If the price falls back below 70.15 again that will favor the alternate count.

Tomorrow;

Watch for wave ‘3’ of ‘iii’ of (c) to turn higher and confirm the count with a break of 74.00 again.

The wave ‘ii’ low must hold at 70.15.

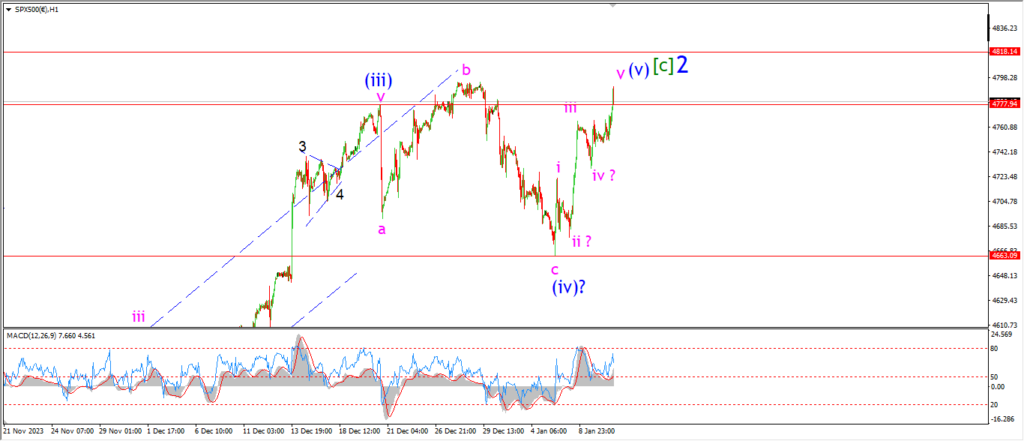

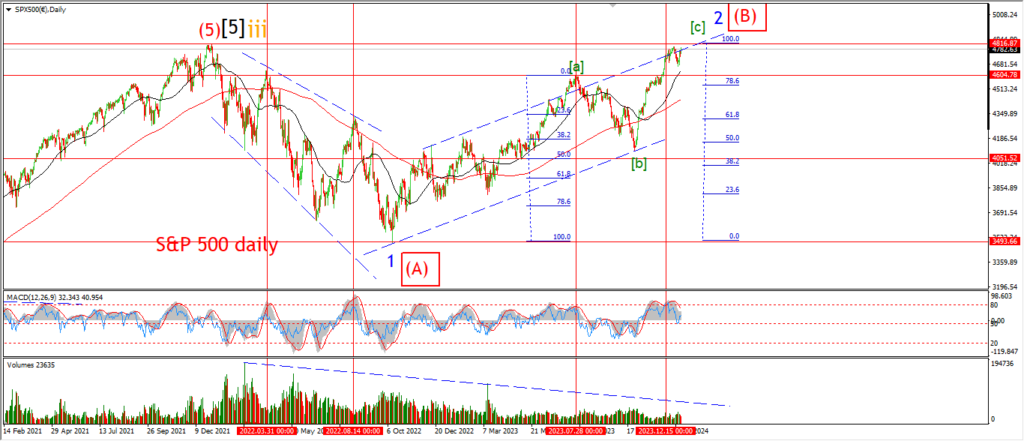

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

Well the rally continued today and that has ruled out the recent bearish count.

We have a possible alternate count here that allows me to keep the wave ‘2’ idea for another day at least!

The fact that the all time higher is so close again means this wave count is in jeopardy also.

The larger alternate count is shown on the daily chart,

that involves an expanded flat wave (B) top now closing out.

And in this scenario we should expect wave (C) to turn lower soon.

This is the same count as the DOW.

The market has traced out five waves up off the recent lows again.

And this is labelled as wave (v) of [c] of ‘2’.

An immediate reversal into wave ‘3’ is now required,

as I have pushed this wave ‘2’ count far enough now.

Tomorrow;

Lets see what comes of the new count.

the all time higher must hold for this to remain valid.

SILVER.

SILVER 1hr

Silver remains stuck in the range today but the price is dropping closer to that lower invalidation line again tonight.

A break of 22.50 will flip the wave count upside down,

and then I will be tracking a much larger decline into wave [c] of ‘2’.

But for the moment we remain stuck in the mud here.

Tomorrow;

the direction that we see this price break out of the range will be the decider for the main count.

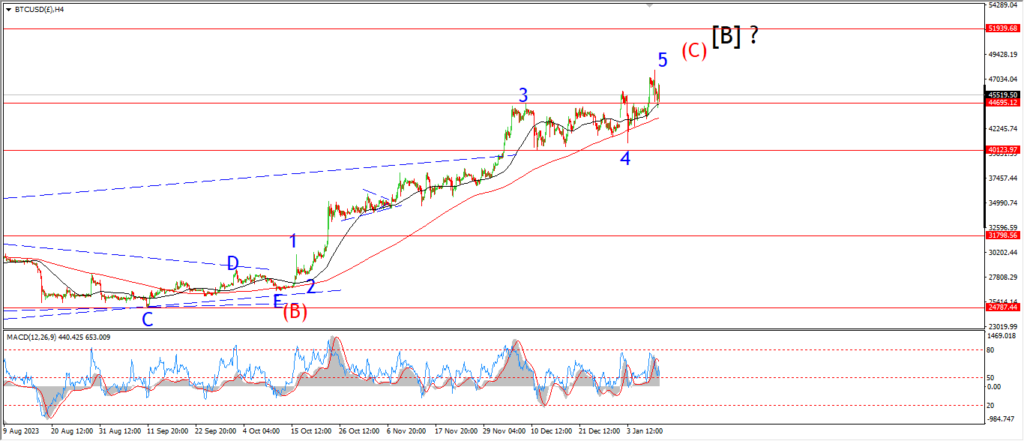

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

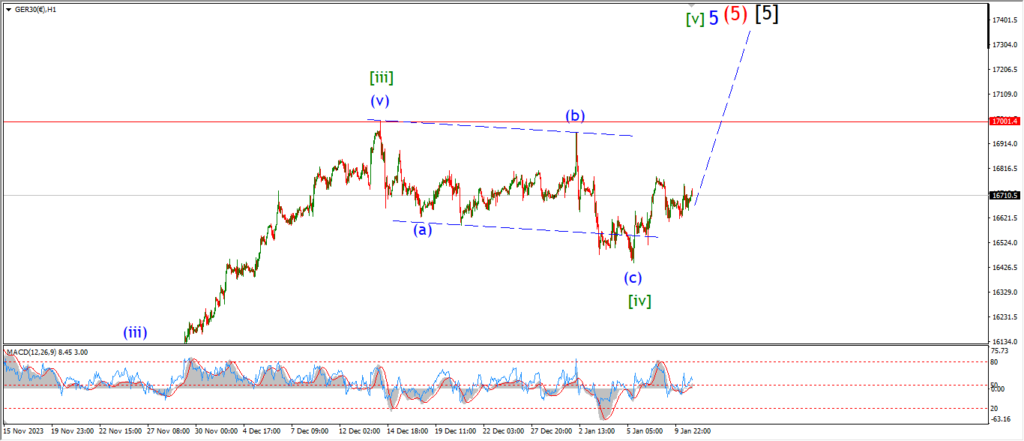

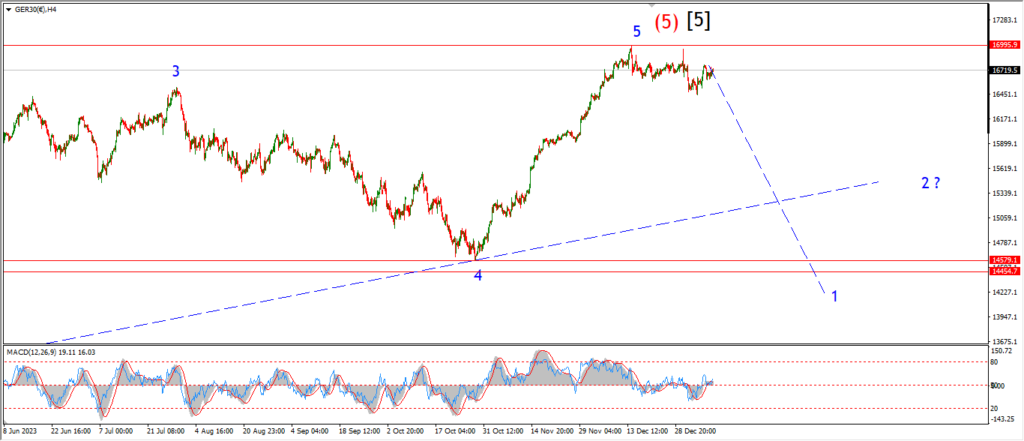

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

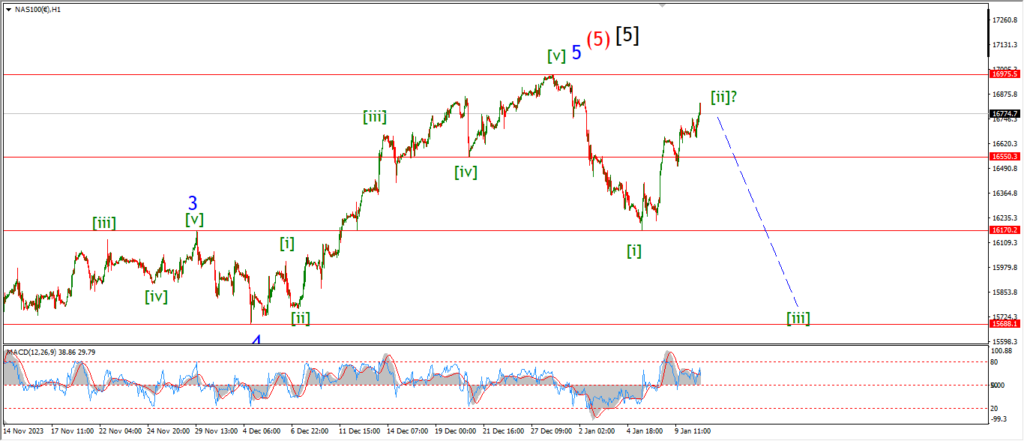

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….