Good evening folks, the Lord’s Blessings to you all.

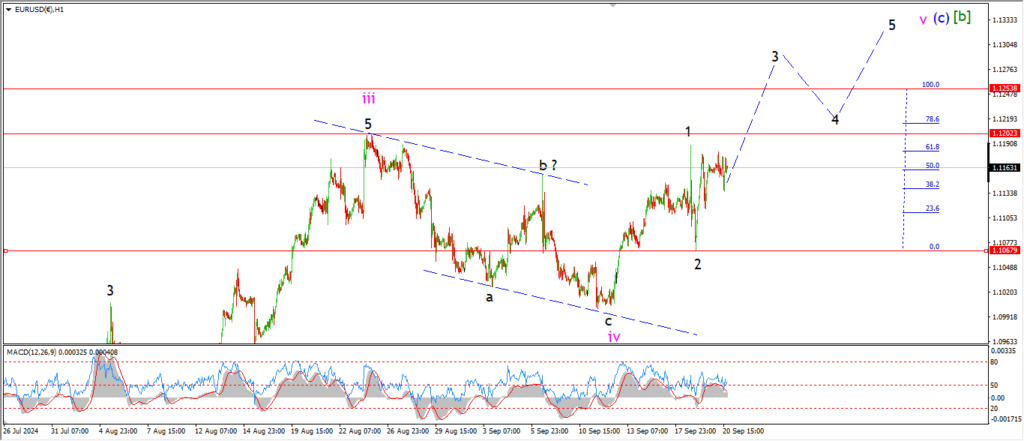

EURUSD.

EURUSD 1hr.

Another day if indecision in EURUSD!

The price is holding within the range of a wave ‘3’ rally.

And even the action off the wave ‘2’ low suggests an impulsive beginning to wave ‘3’.

The problem is,

the rally to a new high in wave ‘3’ of ‘v’ has not materialized yet.

This pattern will clear up soon enough,

and from there we can plot the next step,

but for the moment I am sticking with a five wave rally in wave ‘v’ of (c) of [b].

Monday;

Watch for wave ‘v’ to continue higher and complete an extended pattern above 1.1300.

The minimum target for wave ‘v’ is at 1.1202.

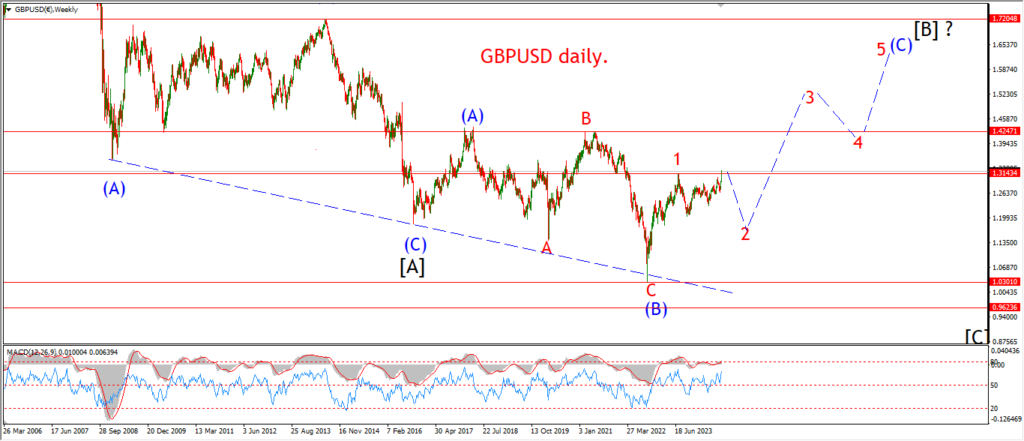

GBPUSD

GBPUSD 1hr.

Cable has hit a new high for its fifth wave rally,

and the action is not very clear here either!

I am looking at the wedge pattern that has developed in the last few sessions,

and this is more in line with the final throws of a rally in wave ‘v’.

Because of this pattern,

I am suggesting that wave ‘v’ may be drawing to a close even now.

This can only be proved by a reversal pattern off the highs.

So I will wait for that possibility on Monday.

Tomorrow;

Watch for wave ‘v’ of (c) to complete the wedge and then drop back out of the rally in five waves to indicate wave [b] has topped out.

USDJPY.

USDJPY 1hr.

We have the opposite picture developing in USDJPY today.

this pair has put in a reasonable rally off that wave [b] low this week.

And I am suggesting that a possible five wave pattern is no in place for wave (i) blue.

I did want to see a larger reversal in wave (i) to break above 147.00,

but that is not to be it seems.

The price action has completed a possible leading wedge pattern into todays high,

now if the rally continues on Monday then we could see a standard five wave rally develop.

For the moment,

I will be looking for wave (ii) to create a higher low as shown.

Tomorrow;

Watch for wave (ii) to complete a higher low as shown over the first few sessions next week.

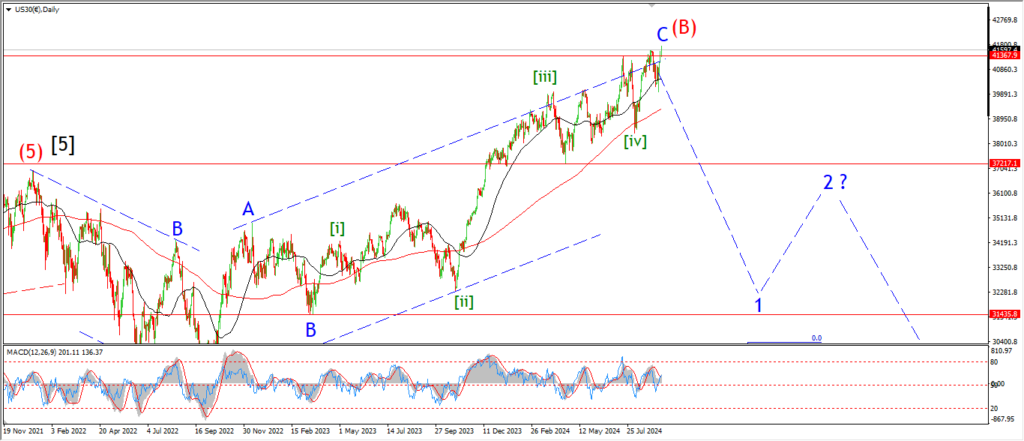

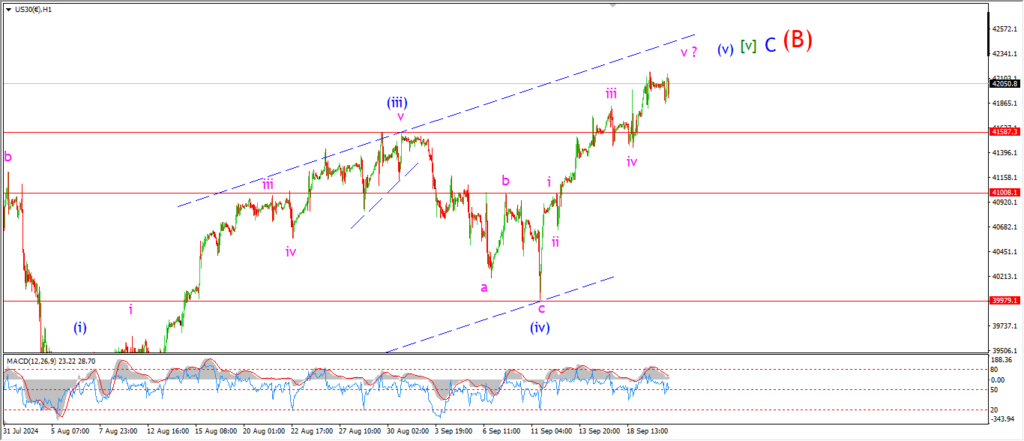

DOW JONES.

DOW 1hr.

There is not a whole lot to say about todays action really.

the market is holding up pretty well just below the upper trend channel line.

There is a developing five wave pattern in wave (v) blue.

And the trade today is basically flat.

So It is unlikely that wave ‘v’ pink is done yet.

If the market spikes again on Monday

then we will see a break into the upper channel line and I will be very interested to see a reaction off that level.

Monday;

Next week will complete wave (v) blue for sure,

and then I will look for a turn again.

GOLD

GOLD 1hr.

Gold is also holding up in wave ‘c’ of (v) at the end of another week.

there was a small reversal midweek that had potential to begin a reversal,

but the price rallied out of the lows in a five wave pattern into this evenings top.

There is now a clear extended five wave pattern in place for wave ‘c’ of (v).

That completes a n ending diagonal pattern overall in wave [v] green.

And if I am correct here,

we are very close to closing out wave ‘3’ red also.

Monday;

the price will signal a reversal into wave [a] of ‘4’ by breaking below the rising wedge,

and one that happens,

then I will start to make some predictions for the initial turn down.

Lets see how this wave ‘c’ rally tops out in the next few sessions.

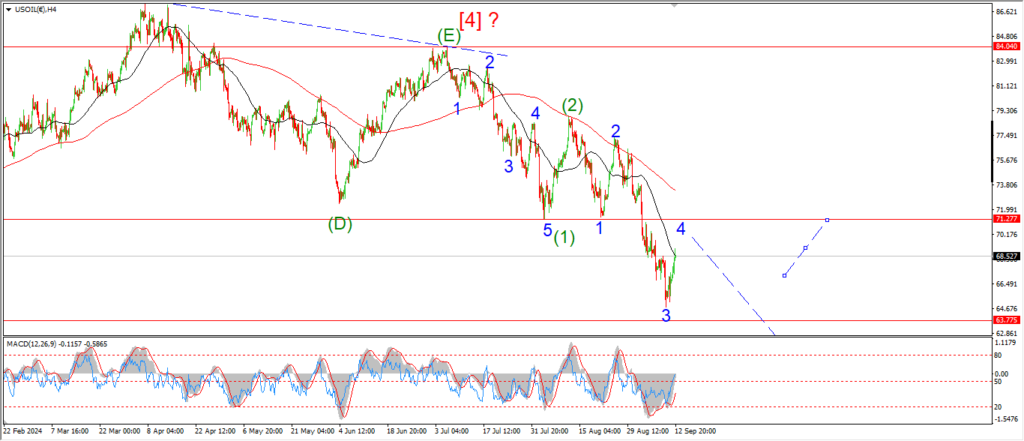

CRUDE OIL.

CRUDE OIL 1hr.

The rally in crude seems to have closed out today but wave [b] has not begun yet.

Wave [b] will be confirmed with a drop back below 69.00 again.

If the triangle count is correct for wave ‘4’ blue,

then we should see a narrowing of the trade over the next month or so,

and the final top for wave ‘4’ will occur near that level.

this level also marks the top of wave (a) of [a],

and a break of that level should mark wave (a) of [b].

Monday;

watch for a turn down into wave (a) of [b] as shown.

S&P 500.

S&P 500 1hr

The market is not quite there yet for wave ‘v’ of (v).

The action today is quite corrective looking to be honest,

and it seems we will see another push to a new high in wave ‘v’ of (v).

That drags on wave ‘v’ into next week before an opening for a reversal comes my way again.

Monday;

5380 now marks the wave (iv) low.

Wave (i) down should fall into that level again and then I will begin tracking the bigger turn down into wave [i] of ‘1’ of (C).

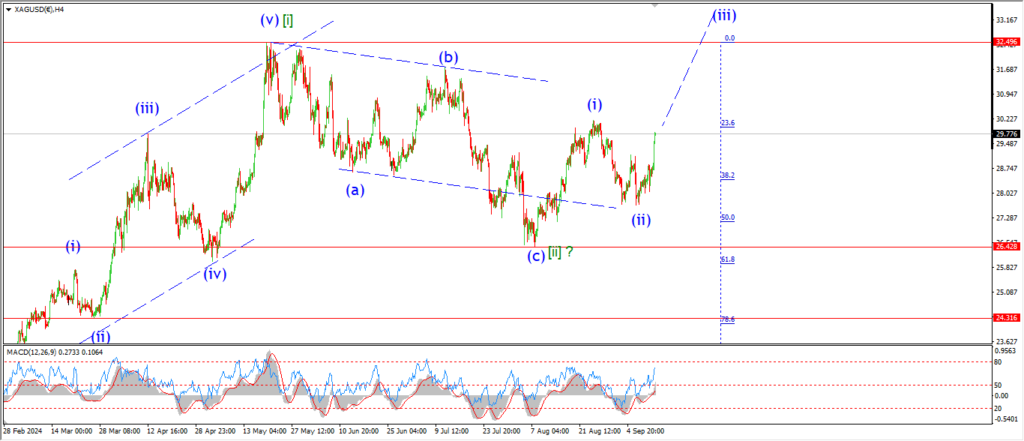

SILVER.

SILVER 1hr

I spoke about the alternate count for silver in the video earlier today,

and I must say that the price action in the last few days is getting interesting in terms of that alternate count.

The price is hugging that upper trend line this evening.

And the rally has definitely run out of steam here.

three waves up is now as clear as day,

and I do think it is worth watching for the possible wave (c) down to come.

As for the main count.

We have a top forming inw ave ‘i’ of (iii) now.

and I am looking for a correction into wave ‘ii’ over the next few days.

that correction will bring us back below 30.00 again in three waves,

and if we see a solid higher low build at that level,

then the main count will get very tempting,

as a rally in wave ‘iii’ of (iii) of [iii] may be on the cards.

Monday;

Watch for wave ‘ii’ to turn lower in three waves to complete near 30.00.

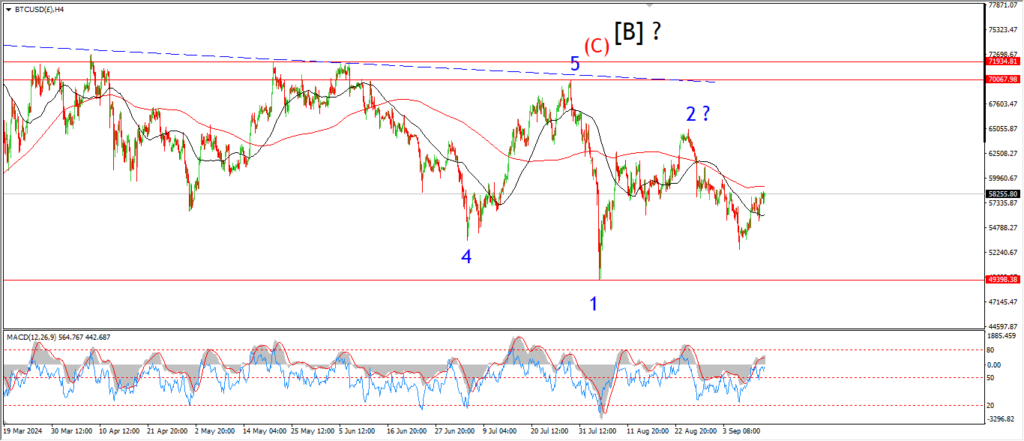

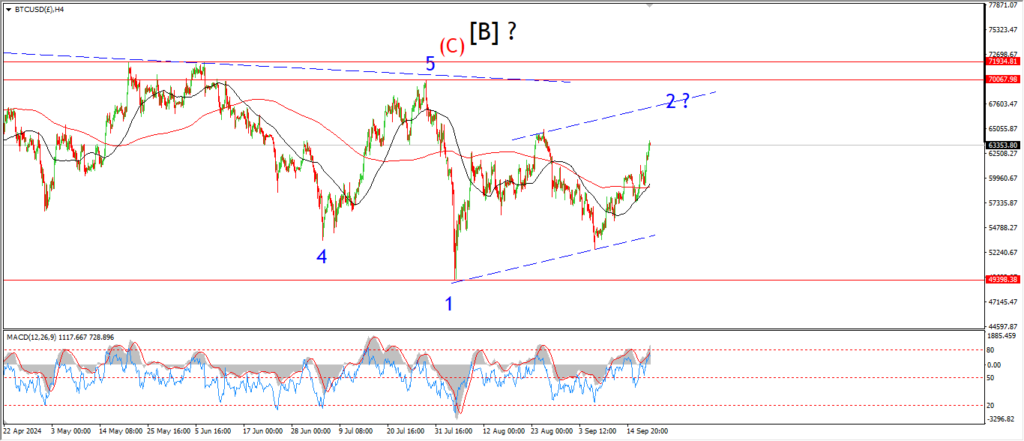

BITCOIN

BITCOIN 1hr.

….

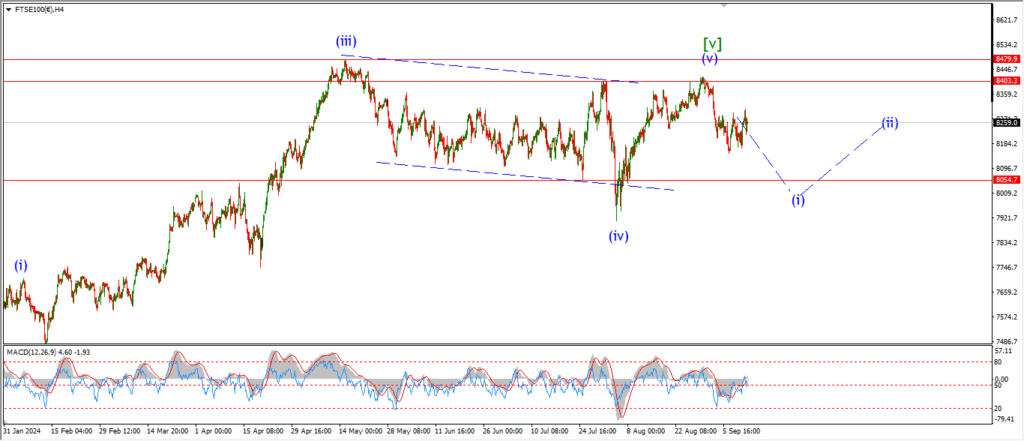

FTSE 100.

FTSE 100 1hr.

….

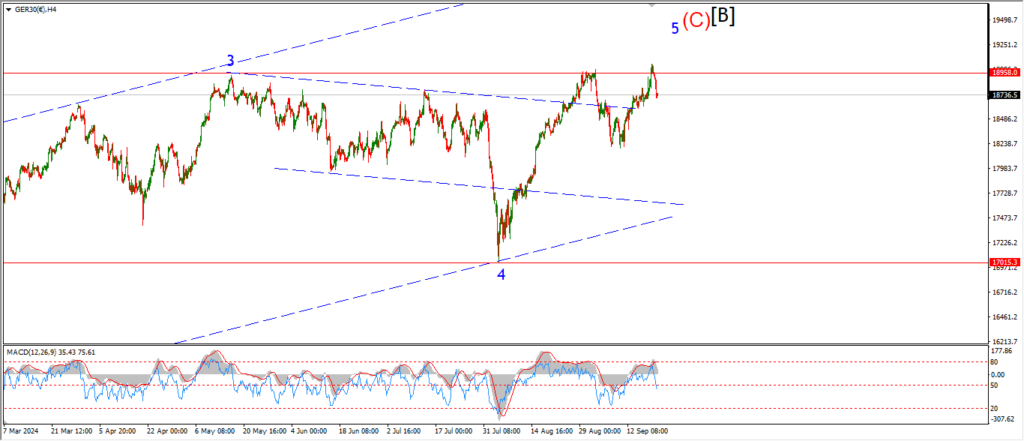

DAX.

DAX 1hr

….

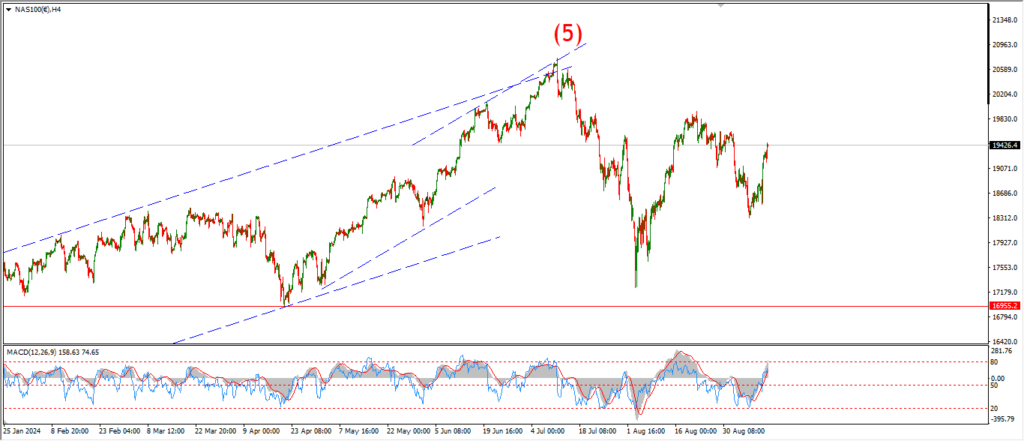

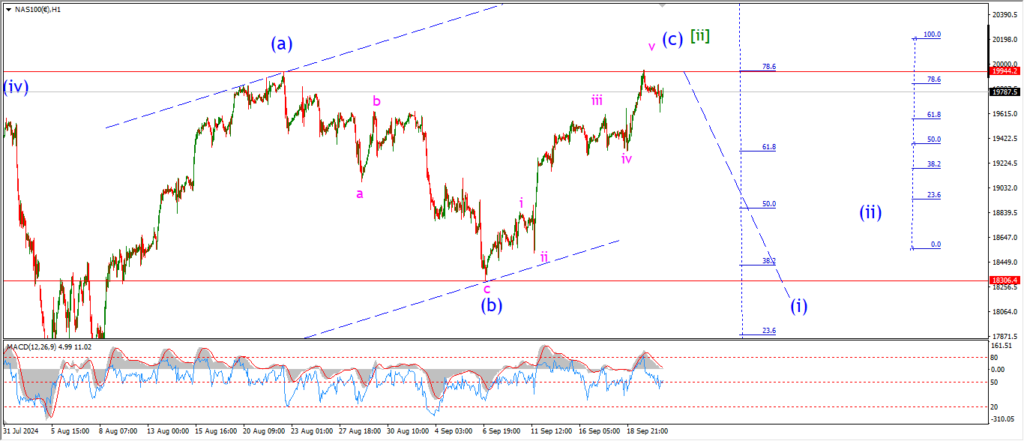

NASDAQ 100.

NASDAQ 1hr

….