[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Good evening to one and all.

I have to update early tonight as I have an engagement tonight.

Sounds fancy, but it ain't!

I realise that I am publishing before the markets react to the fed rate decision.

So I may have a whole lot of writing to do tomorrow!

We will see how the trade goes.

It's a case of damned if you do and damned if you dont.

Cut rates,

and you could ask why do we need rate cuts when the economy is supposed to be great?

Leaves rates alone,

and the market might throw a temper tantrum,

and we know that Powell does not like that one bit!

I expect he does exactly what the market wants him to do.

Anyway,

lets get on with it.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

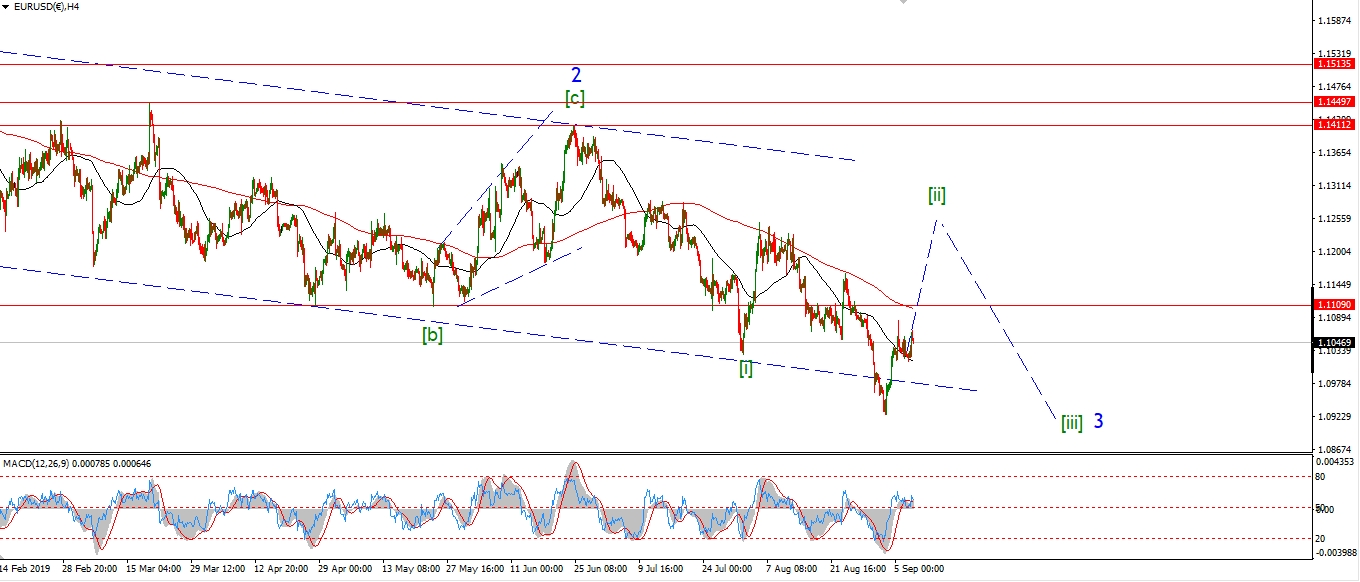

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD is holding above the 1.0989 level today and rising again.

Wave 'iii' of (c) is in play

and it should continue higher for the rest of the week.

The decline off the 1.1109 high could trace out a larger three wave correction,

which would finish above 1.0925,

and the wave count will still be valid.

But I would like to see wave 'iii' continue higher and break 1.1109.

Tomorrow;

1.0925 must hold.

Wave 'iii' should continue higher and break 1.1109.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

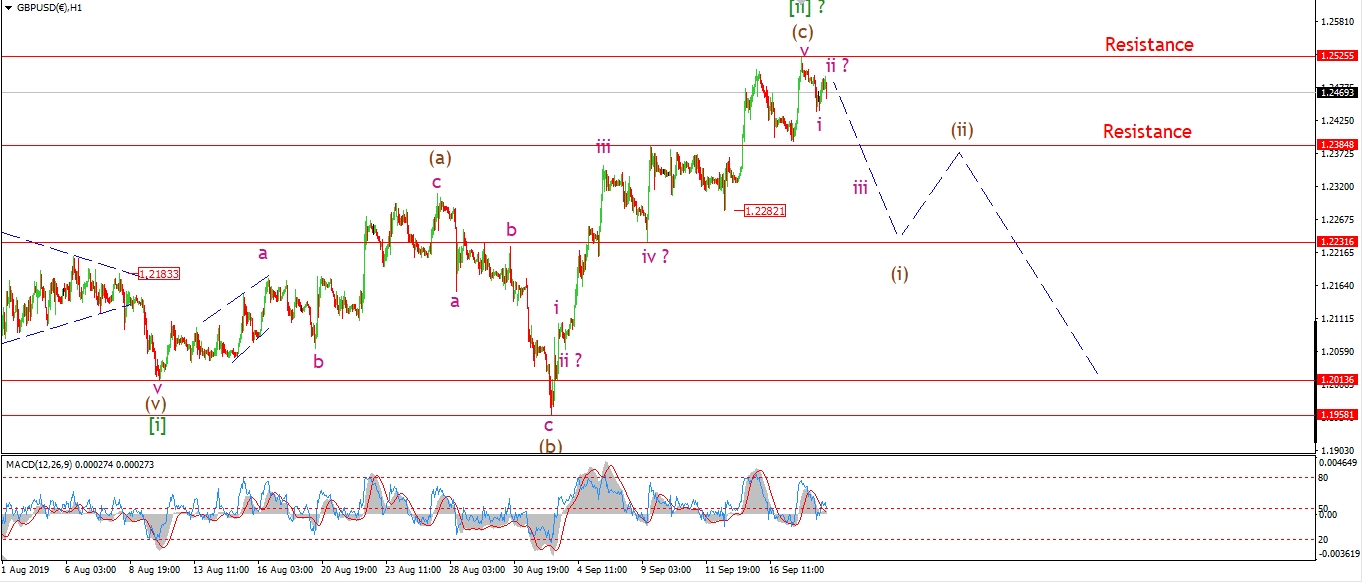

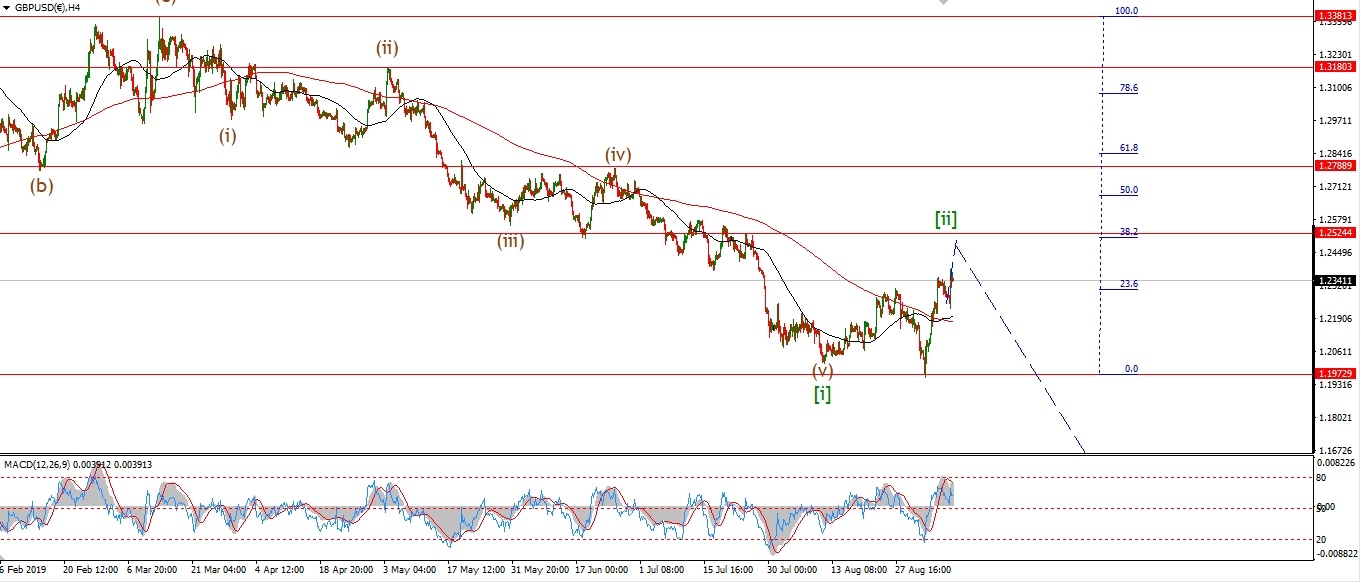

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Cable is again lower off that spike high created yesterday.

yesterdays high reached that 1.2520 level at the previous triangle.

this level has formed the target for a while,

and wave (c) of [ii] is now looking near to completion.

All we need is a five wave decline off the eventual high

to turn our focus firmly to the downside again in wave [iii].

Tomorrow;

Todays decline may be the beginning of something much bigger if the short term pattern holds up.

Watch for wave 'ii' to form a lower high below 1.2525

and then turn lower again into wave 'iii'.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

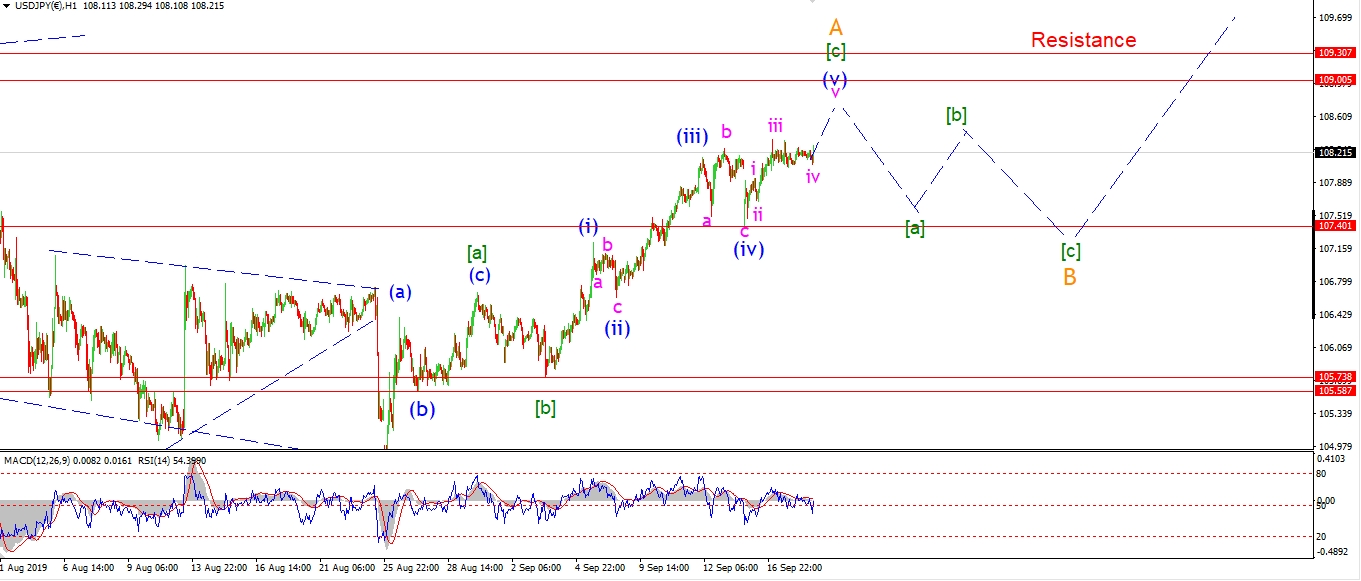

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Nothing much to report in USDJPY today,

The price action is dead in the water over the last few sessions.

this sideways action could be a small fourth wave correction within wave (v).

This is labelled wave 'iv' of (v).

Wave 'v' of (v) is still expected to spike towards 109.00 to complete the pattern in wave 'A'.

We are close to the end of this rally now,

so if we see a decline back below 107.40 again that will signal wave [a] of 'B' has begun.

Tomorrow;

Watch for another run up to 109.00 to complete wave 'v' of (v).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

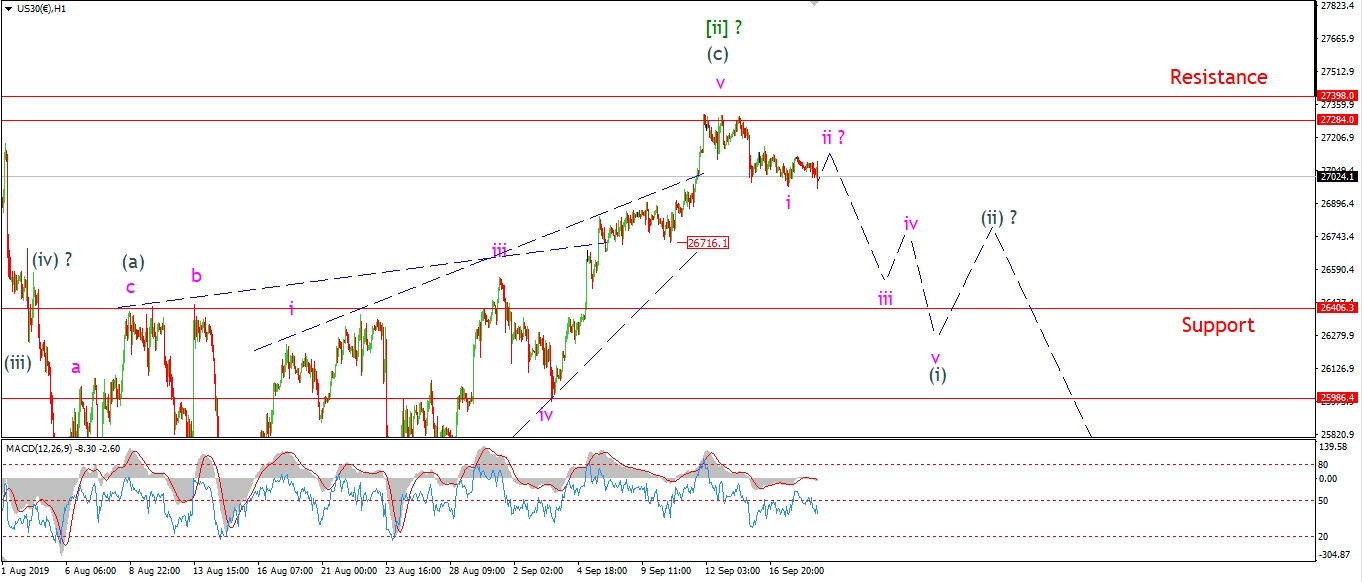

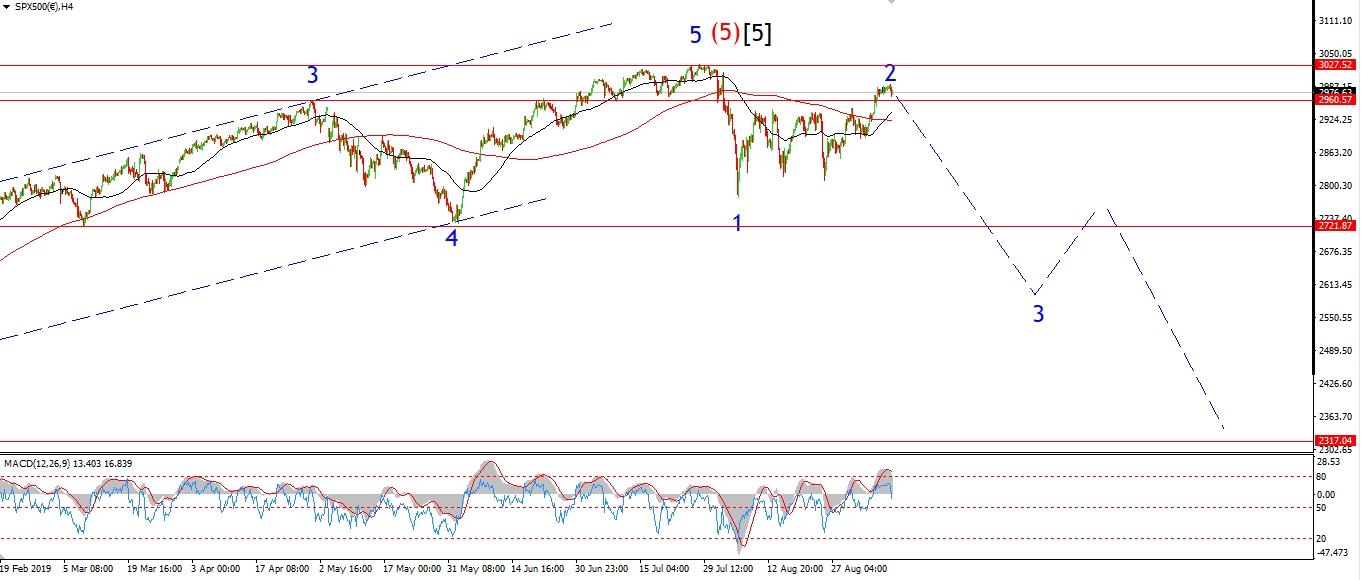

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

There is a very deark humour about the fact that the market is sitting at the second highest peak in human history,

and all people can talk about is interest rate cuts!

Am I the only person that see this for what it is,

pumping amphetamines into the veins of a coked up raver who has been partying for far too long.

I'm no doctor,

but this has heart attack written all over it!

The market is understandably quiet in anticipation of the inevitable today!

I am still sticking with the bearish interpretation

against an onslaught of opinion on why the market can only going higher.

The market can go higher,

but it wont last as the alternate count shows.

But this coke addict can just as easily have a heart attack tomorrow.

And that is why I am sticking to my guns for now.

If the sideways action is a correction in wave 'ii' as shown,

then tomorrow will begin a sharp decline in wave 'iii' of (i)

which should fall below 26700.

Tomorrow;

I may have to swallow my words following the late trade today,

But the bearish count stands for now,

watch for wave 'ii' to complete below the high and wave 'iii' to begin tomorrow.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

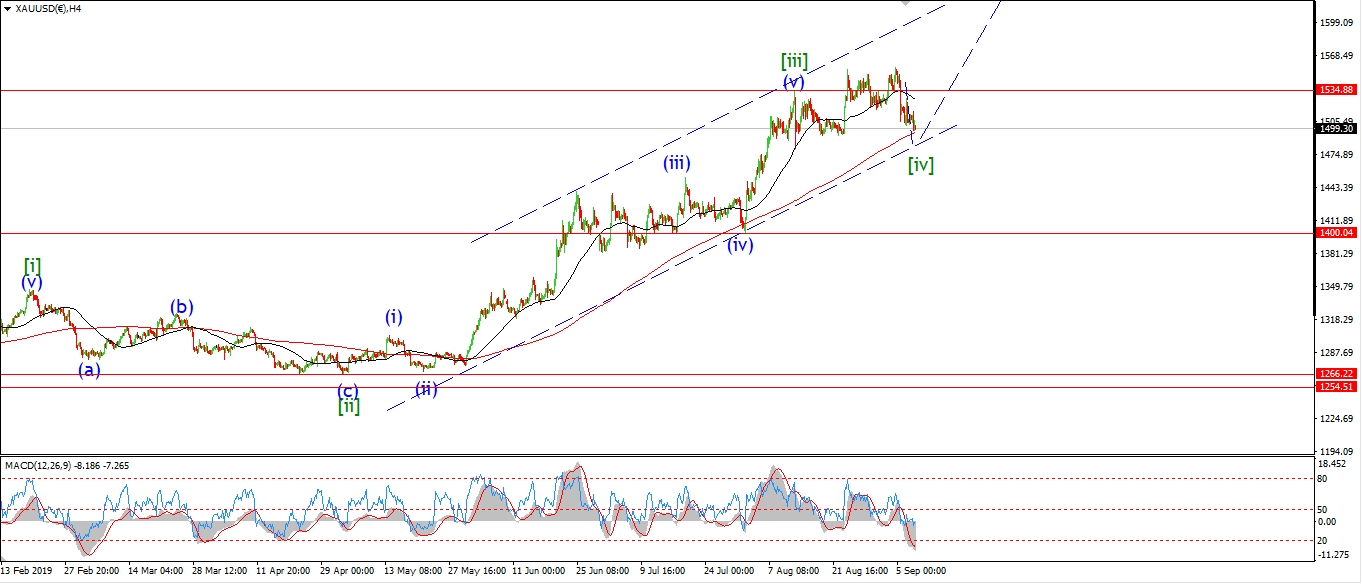

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Gold is rising this afternoon after a correction in wave 'ii' pink,

which completed a higher low above the triangle at wave [iv].

I am tracking a developing five wave move higher off 1485 in wave (i) blue.

And a break of 1524 will be a very good signal,

that the tide is turning higher again for gold into wave [v].

Tomorrow;

Watch for wave 'iii' of (i) to push above 1524.

1485 must hold.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

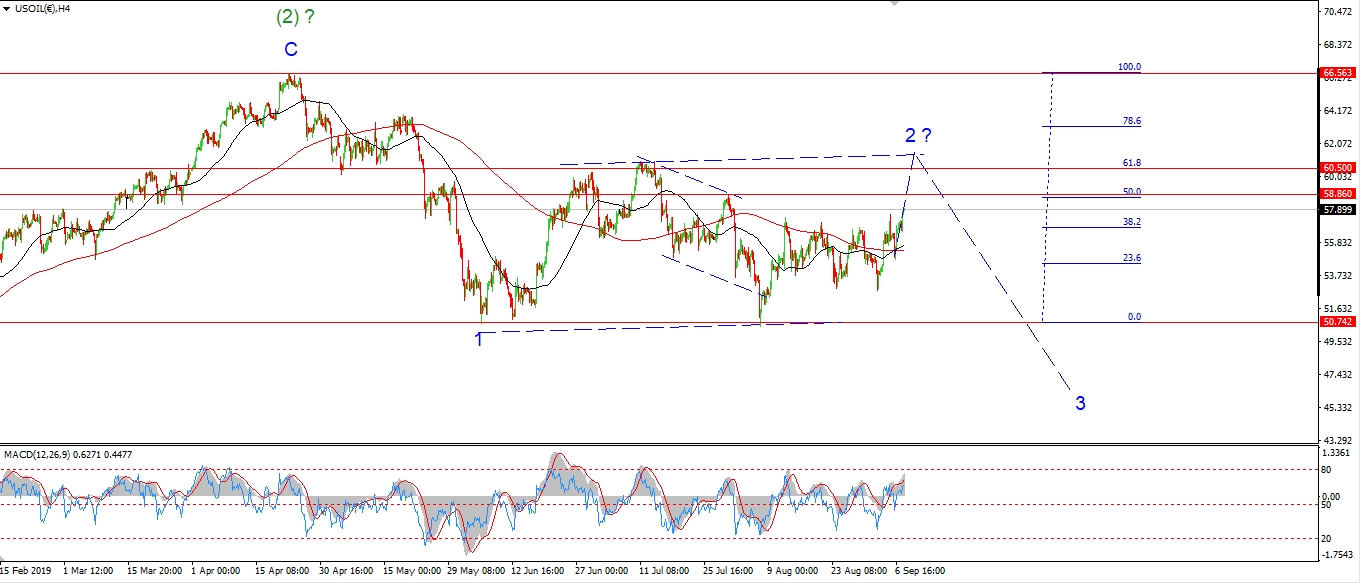

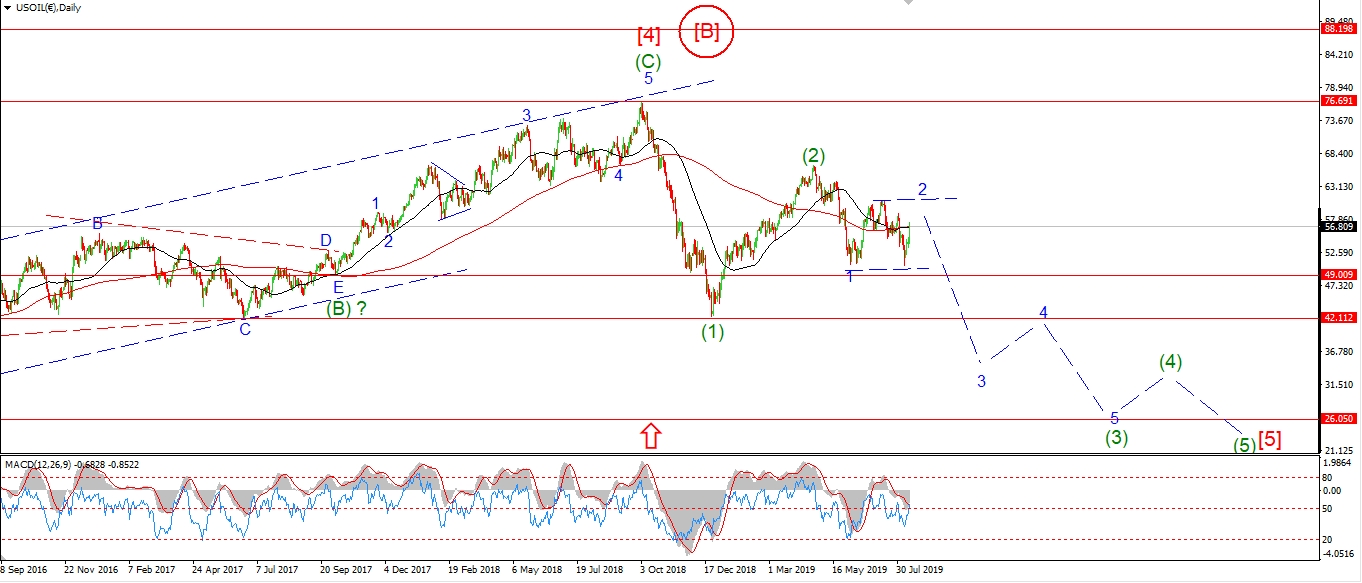

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Crude is now below support at 58.67 and the idea that we have a top in is gaining traction.

The decline in wave (iii) is tracing out a five wave pattern,

with wave 'iii' of (iii) now in-place at todays lows.

I would like to see wave 'iv' of (iii) complete below 58.67

and then turn lower into wave 'v' of (iii).

Ideally wave (iii) should fill the gap created on Monday,

that will bring us much closer to a clear five waves down off the high.

And with that,

we should see a bearish signal develop by next week in wave [ii].

One step at a time!

Tomorrow;

Watch for wave (iii) to continue to the downside for tomorrow at least and complete at about the 56.00 level.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

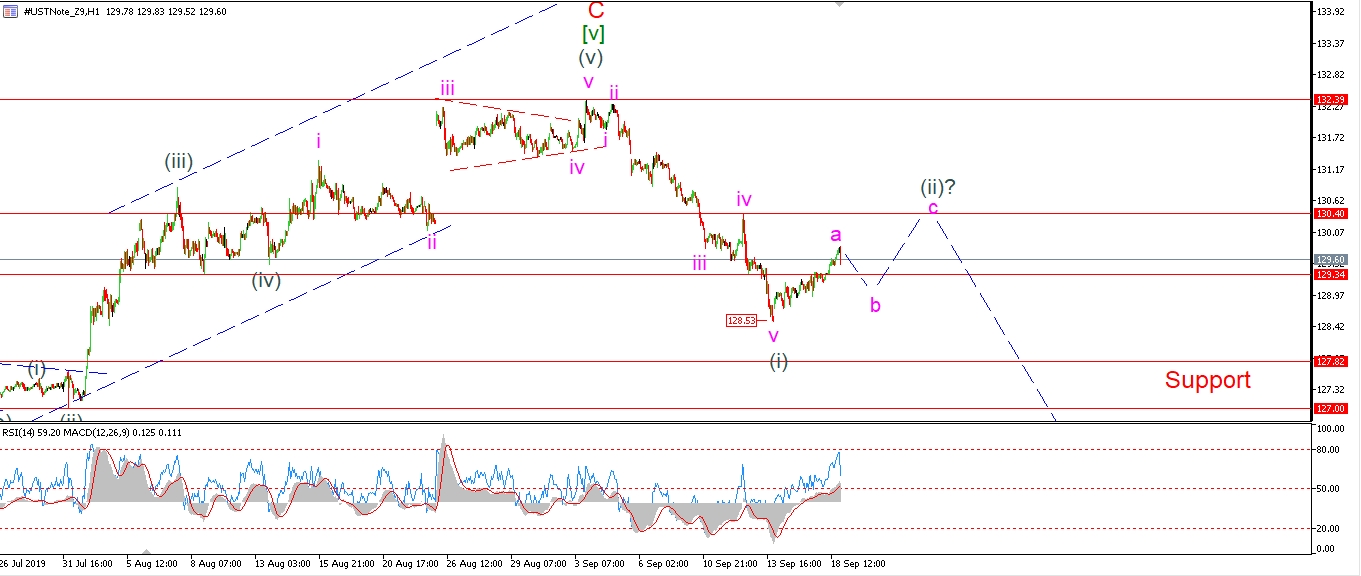

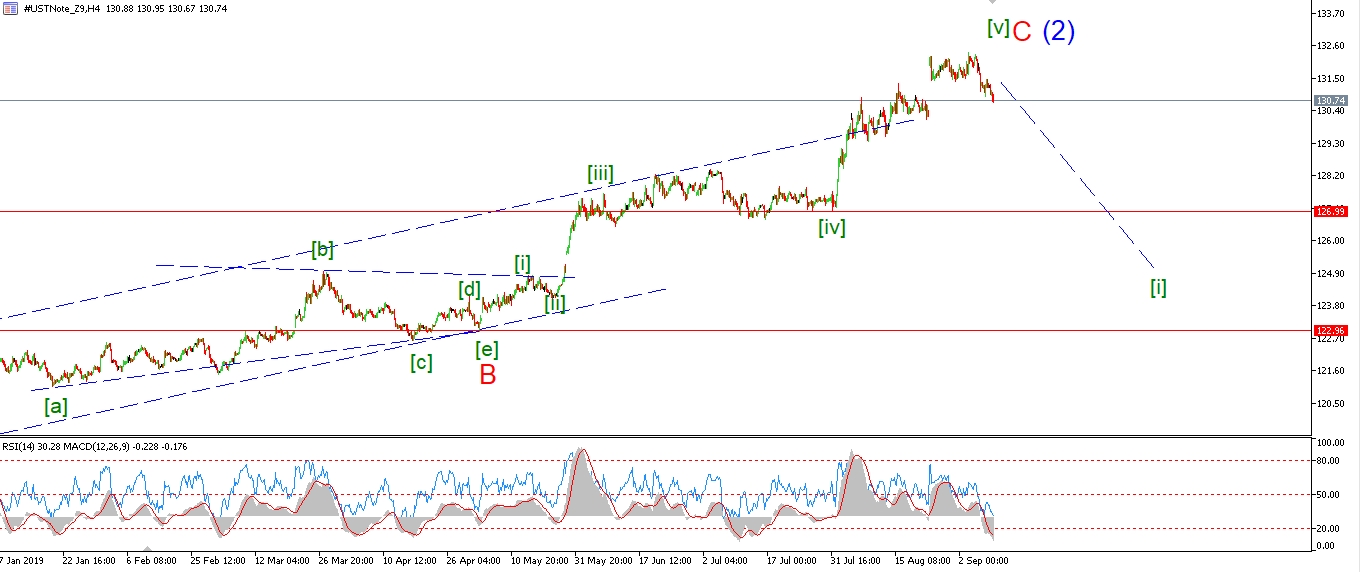

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Bonds continue higher in a very tight price range today.

I am looking for a more pronounced three wave pattern in wave (ii),

so I expect the rise off the low at wave (i) is still only wave 'a' of (ii).

Wave 'b' should drop in three waves off a nearby high as shown,

and then wave 'c' should complete near the previous fourth wave at 130.40 by the end of the week.

tomorrow;

Watch for wave 'b' of (ii) to complete above 128.53 tomorrow.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

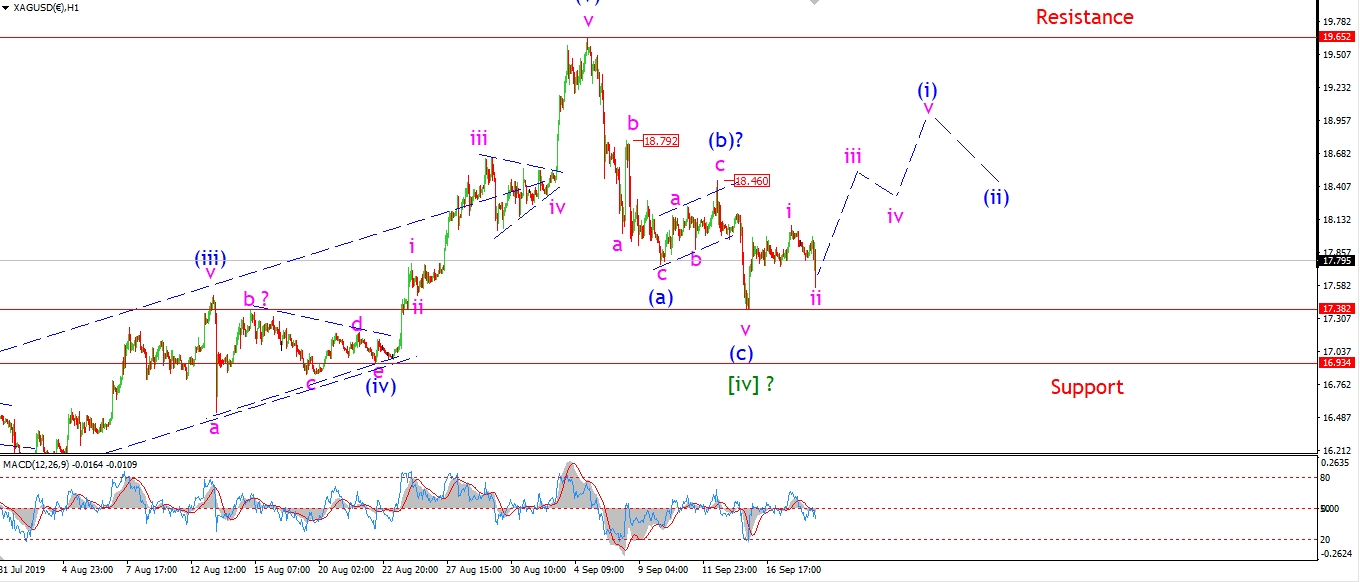

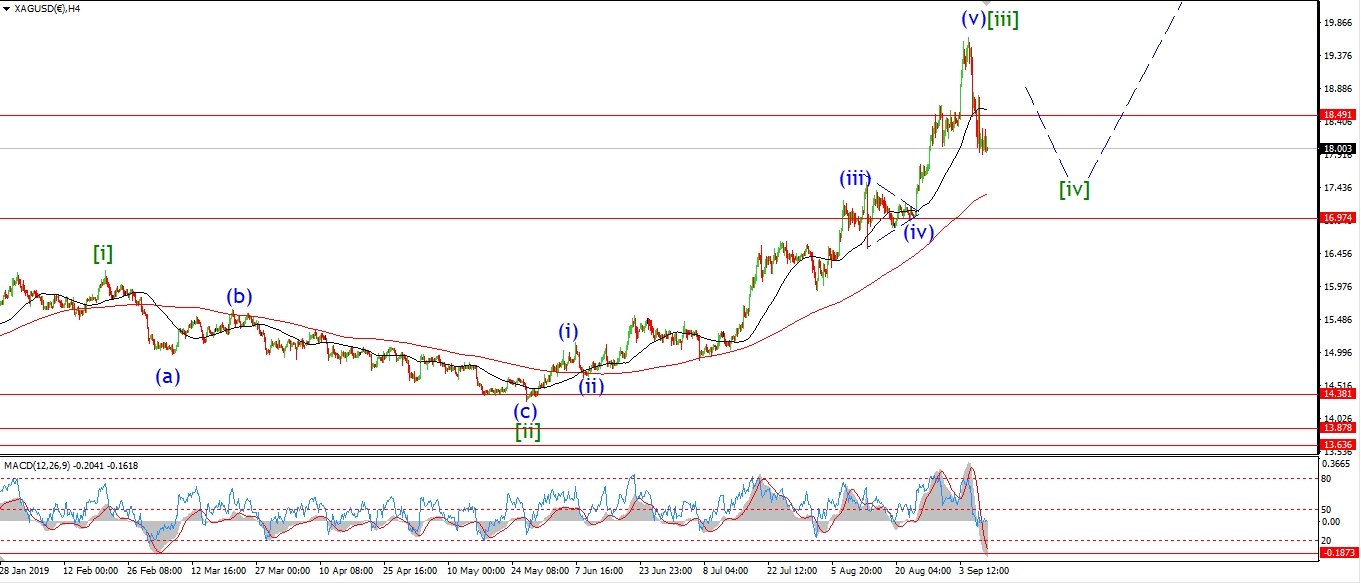

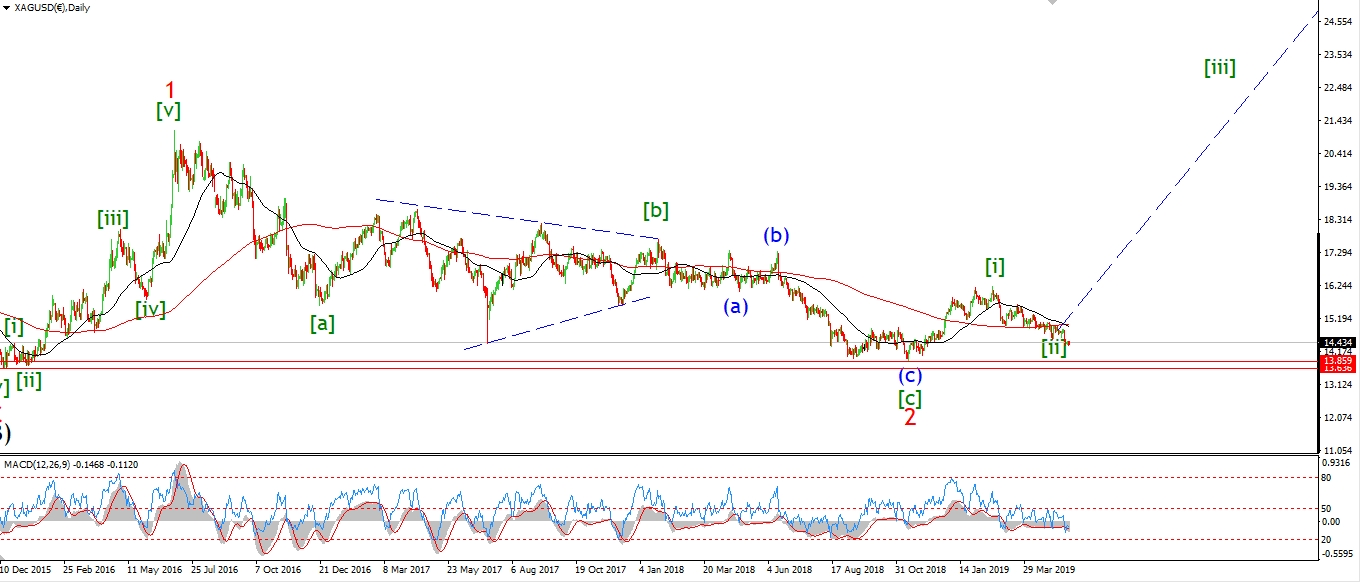

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Price has again fallen in three waves today.

I have switched the wave 'ii' label to this evenings lows,

and this suggests that wave 'iii' will turn higher tomorrow

and hit 18.46 again to confirm the wave (i) idea.

Tomorrow;

Watch for wave 'ii' to hold above 17.40 and we should see the initial rise in wave 'iii' begin.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

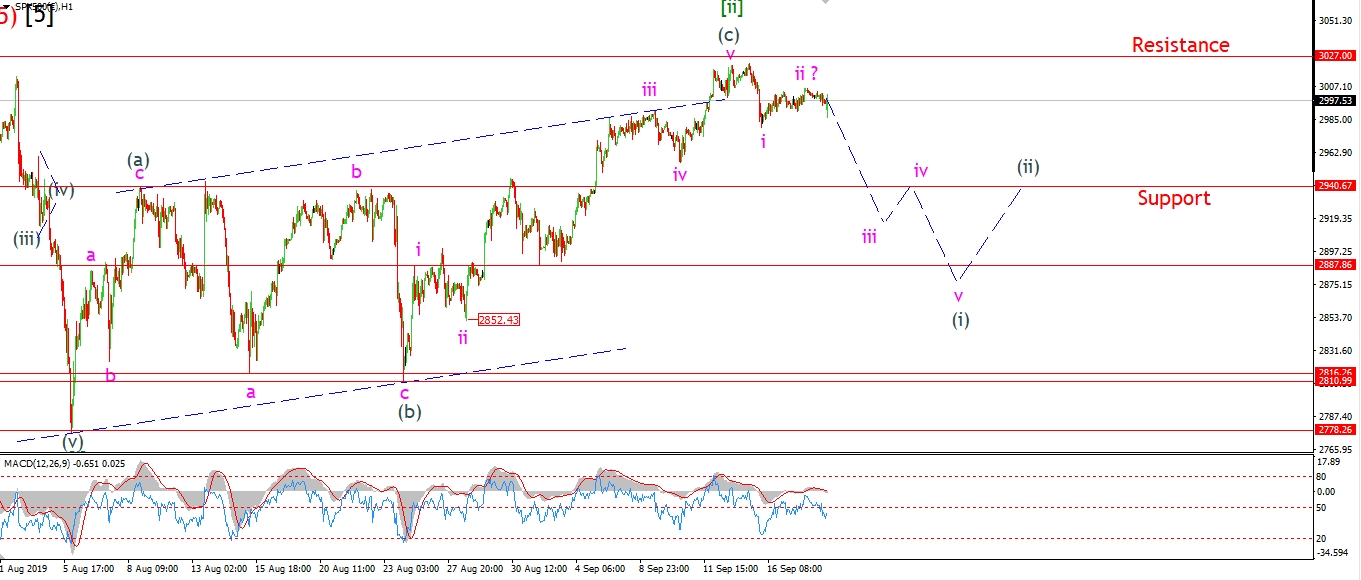

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

It is possible to view the rise into the early high

as a three wave correction in wave 'ii' pink as shown.

This counts depends on an decline in wave 'iii' to begin immediately.

And wave 'iii' should carry us below 2940 again.

I have no idea how the reaction to the rate cut will go,

but It has been talked about so much over the last few weeks,

that I suspect traders have already factored that in and the buying is done!

Tomorrow;

Lets see how the late trade plays out.

If the price holds below the wave 'ii' high and turns lower,

then we could see a sharp sell-off begin tomorrow in wave 'iii'.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]