Good evening folks, the Lord’s Blessings to you all.

EURUSD.

EURUSD 1hr.

EURUSD is slightly lower this evening,

and the action is corrective so far.

I am suggesting that wave ‘2’ of ‘v’ is now in play here,

but ideally wave ‘2’ should be a deeper correction.

We will see how it plays out.

I am looing for a low in wave ‘2’ near 1.1080 or so.

and then wave ‘3’ of ‘v’ will turn higher again before the end of this week.

Tomorrow;

Watch for wave ‘2’ to complete with a break of 1.11 and then wave ‘3’ of ‘v’ can begin.

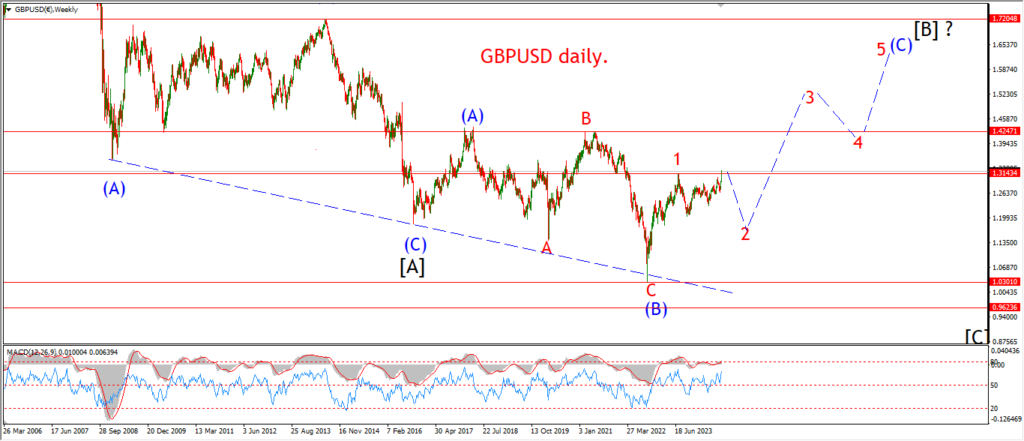

GBPUSD

GBPUSD 1hr.

Cable turned down harder than EURUSD today but I am looking at this drop as wave ‘2’ of ‘v’ also.

So this decline should prove corrective in nature,

and wave ‘3’ of ‘v’ can then turn higher towards that minimum target at 1.3266 at the wave ‘iii’ high.

Tomorrow;

Watch for wave ‘2’ to correct into the recent small corrective shoulder at 1.3100

wave ‘3’ of ‘v’ can then turn higher as shown.

USDJPY.

USDJPY 1hr.

USDJPY has made a move higher off the lows of wave [b] again today,

and I am looking for some follow through to the upside this week,

in order to break above 143.00 at a minimum to signal that wave (i) of [c] has finally begun.

Wave ‘iii’ of (i) should break that level with ease,

but if that fails to happen,

then the rally into wave (i) will be postponed again.

Tomorrow;

Watch for wave (i) to continue higher as shown and break the 143.00 level in wave ‘iii’ pink.

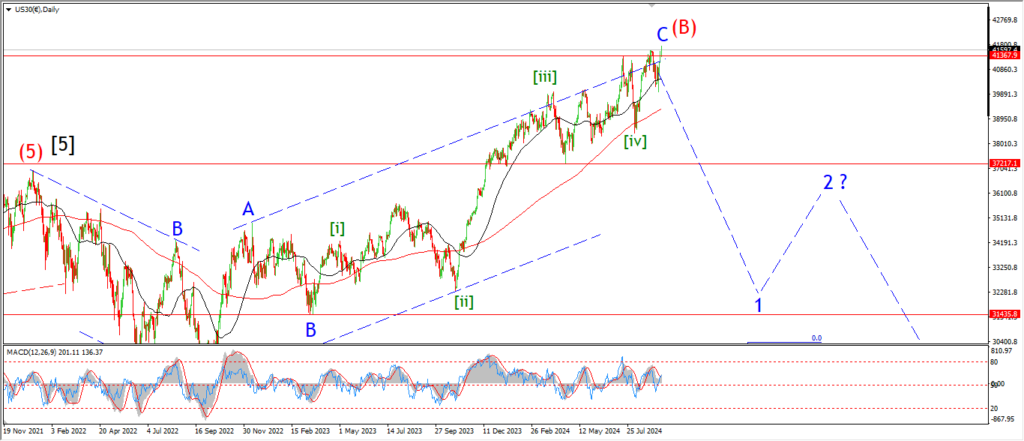

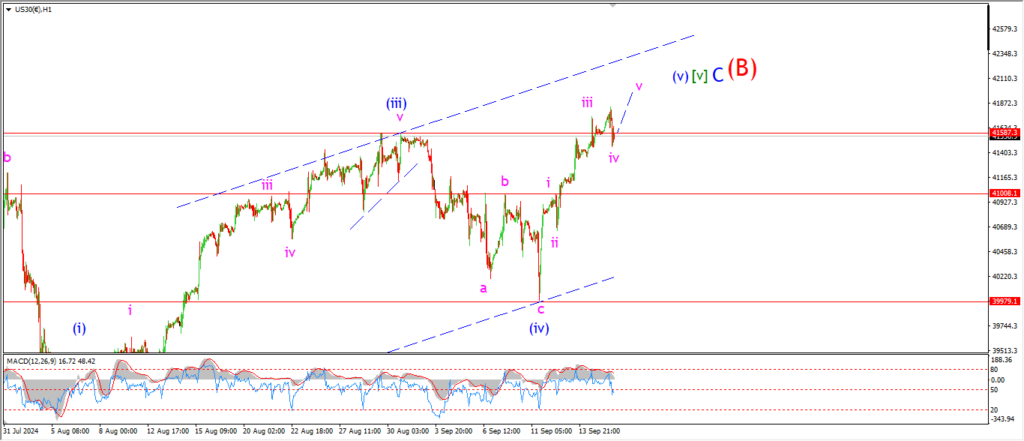

DOW JONES.

DOW 1hr.

As I wait for a final top to wave (B) again,

I am thinking of the previous large degree wave ‘B’ top back in history that is quite analogous to the current situation.

I remember October 2007,

the market was sitting at 14400,

and there was a wide understanding among avid market watchers that a top was forming,

And there was a looming recession in the making.

but,

nobody in the wider economy actually believed there was rot in the system.

debt was exploding,

mal-investment was everywhere,

we were living in a dream where expansion was guaranteed for the future no matter what.

The market was topping in wave (B) of [4] of ‘iii’ at that time.

The current high is occurring in wave (B) of [A] of ‘iv’.

Then it happened all of a sudden,

the market topped and the rest is history.

B waves are deceptive by nature.

and even more so when a ‘B’ wave makes a new high as we had in October 2007,

and as we have right now in September 2024.

The next part of this story is already known to us.

And the crash that is coming our way will be far worse than the GFC.

Tomorrow;

I am currently tracking the rally in wave (v) blue, and we are almost there with that pattern.

GOLD

GOLD 1hr.

Gold turned lower in a corrective decline today in wave ‘4’ of ‘c’.

Wave ‘c’ needs one more pop in wave ‘5’ of ‘c’ and that should be enough to complete wave (v) blue.

the real test for this pattern comes at that point,

we need a sharp drop back below the wedge pattern to begin the turn into wave [a] of ‘4’.

Tomorrow;

Watch for wave ‘5’ of ‘c’ of (v) to complete and then I will look for a turn into wave [a] over the coming days.

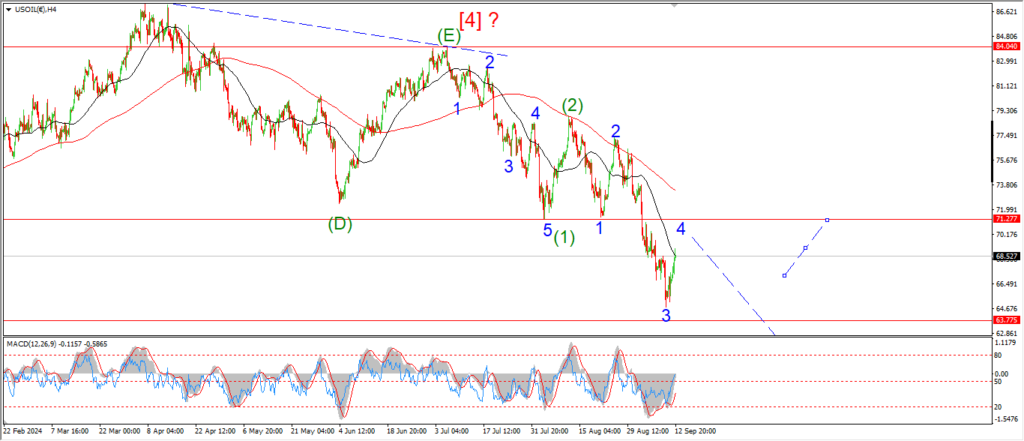

CRUDE OIL.

CRUDE OIL 1hr.

Crude has gone quite far now in the rally off the wave ‘3’ lows.

The price is now close to hitting 71.40 at the wave wave ‘1’ lows.

If that happens,

then I will have to rethink the larger wave count.

But we are not there yet.

For the moment,

I am looking at another possible pattern for wave ‘4’.

A triangle could fit this action quite well,

and in this scenario the initial rally in wave [a] of ‘4’ can break the wave ‘1’ low without invalidating the overall count.

So I will test this pattern over the coming days.

Tomorrow;

We have a three wave rally in wave [a] of ‘4’ in place now,

I want to see a drop in three waves from here into wave [b] as shown.

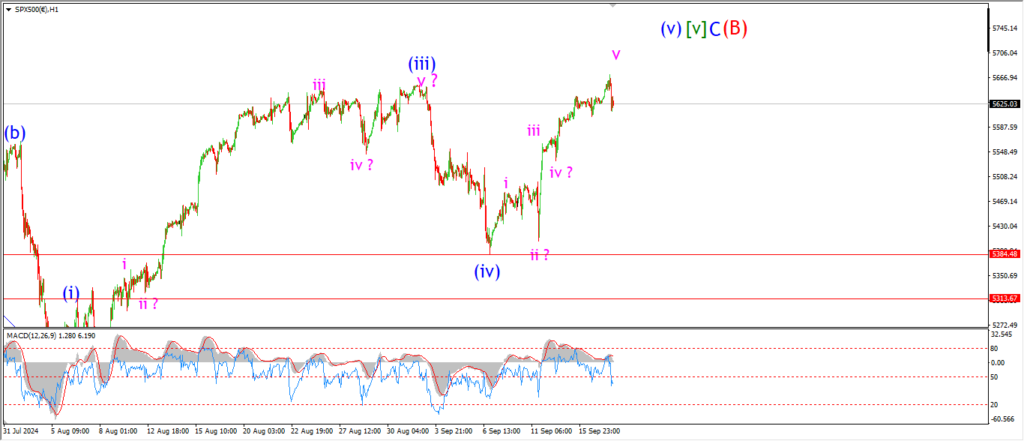

S&P 500.

S&P 500 1hr

The market has finally triggered the alternate count today.

A possible five wave pattern in wave (v) of [v] is close to done here tonight.

the market hit a new high then rejected with a small spike lower again.

I am looking at this top as wave ‘v’ of (v) already here,

even though the new high is less than convincing!

The action for the rest of the week will either prove this pattern and the price will fall into the wave (iv) low again in five waves.

Or,

we will hang on and tip toe to another new high as wave (v) extends again.

We will know soon enough.

Tomorrow;

If the market retraces the wave (v) rally this week that will be a very good sign of a reversal again.

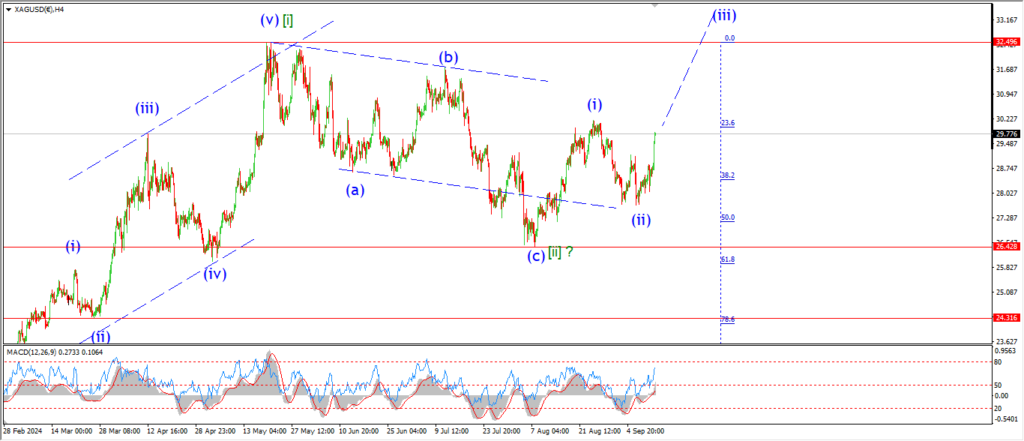

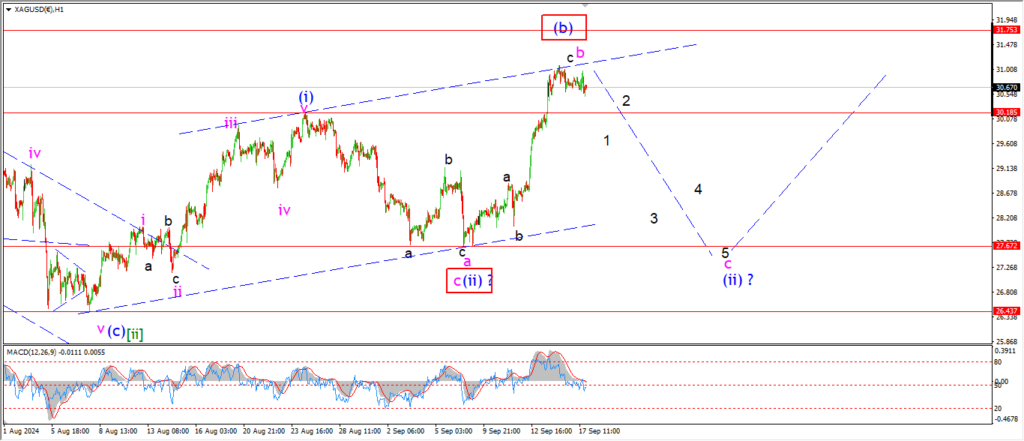

SILVER.

SILVER 1hr

Silver is holding at the current highs today and I cant really read much into the action here.

If we have a larger turn down tomorrow,

then I will be confident that wave ‘c’ is underway.

A five wave drop into wave ‘c’ of (ii) is expected to complete with a break of 27.60.

Tomorrow;

The action today is still quite corrective looking so there may be a spike higher first before we turn lower into wave ‘c’ proper.

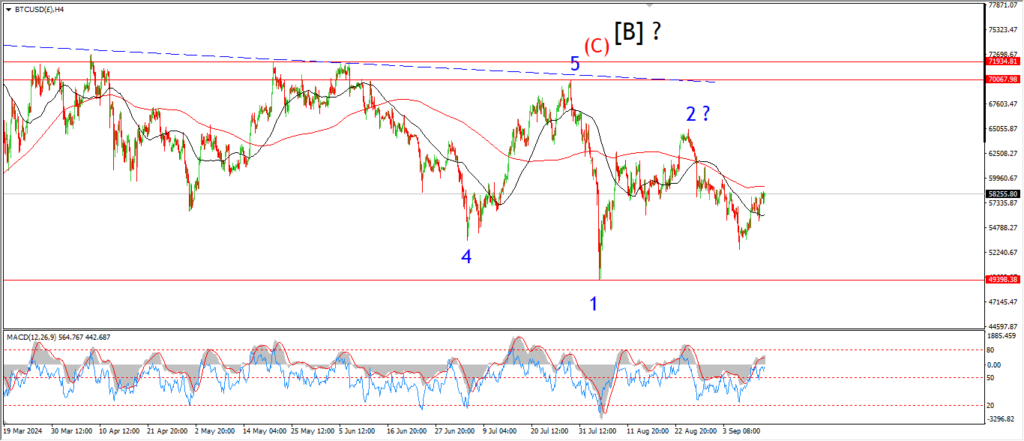

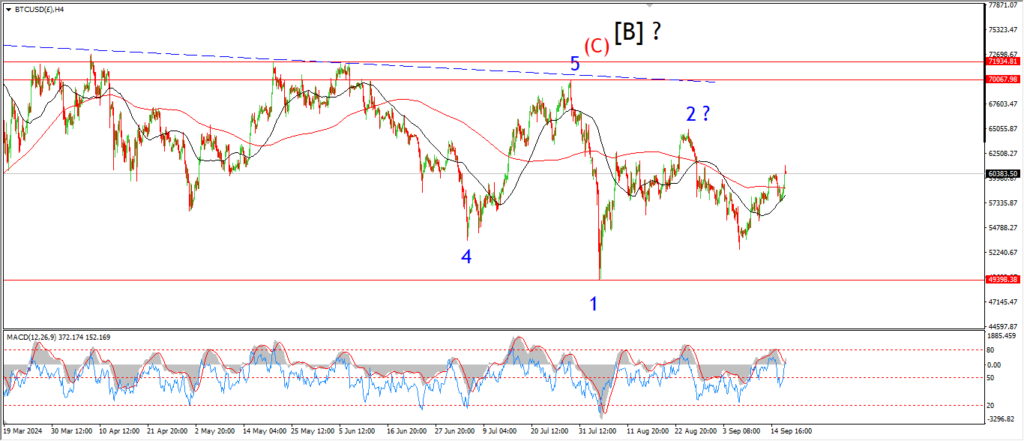

BITCOIN

BITCOIN 1hr.

….

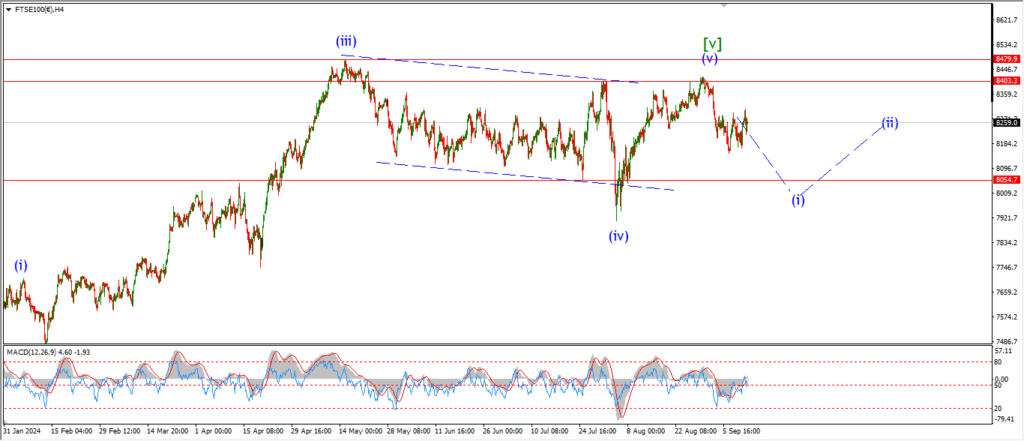

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

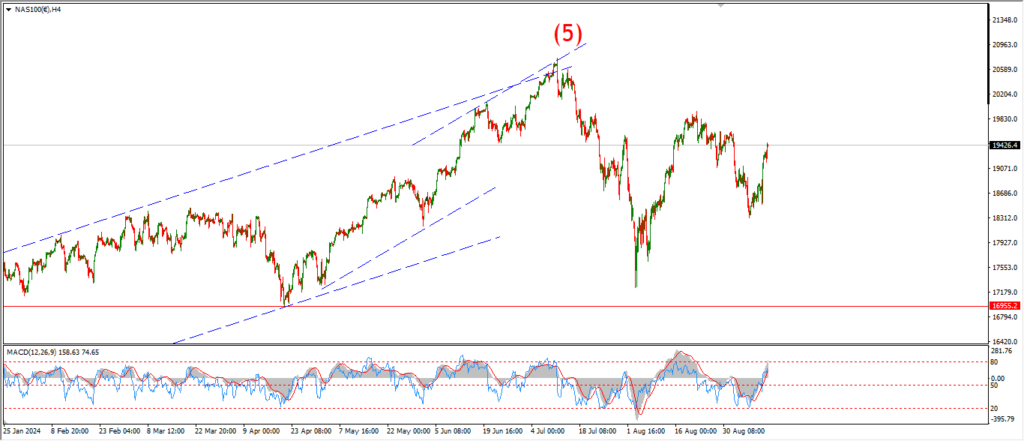

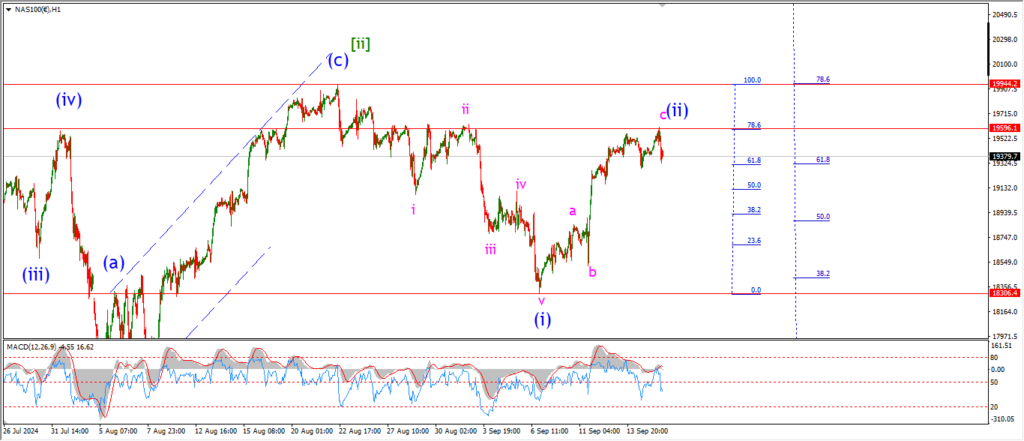

NASDAQ 100.

NASDAQ 1hr

….