[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

hi everyone, welcome to a new week.

Here are a few interesting articles that I have come across over the last week.

https://edition.cnn.com/2019/08/26/investing/stock-market-insider-selling/index.html?

The big picture has not improved over the last year, as this slow moving train wreck is is still in play.

The background image behind the major stock market top is one of deceleration in the rally,

and decay in the quality of investment underway.

Whether the final top is in or not does not matter in one sense, as the outcome is the very same.

This market will crash and destroy trillions in paper wealth.

That is a given.

Down to business.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

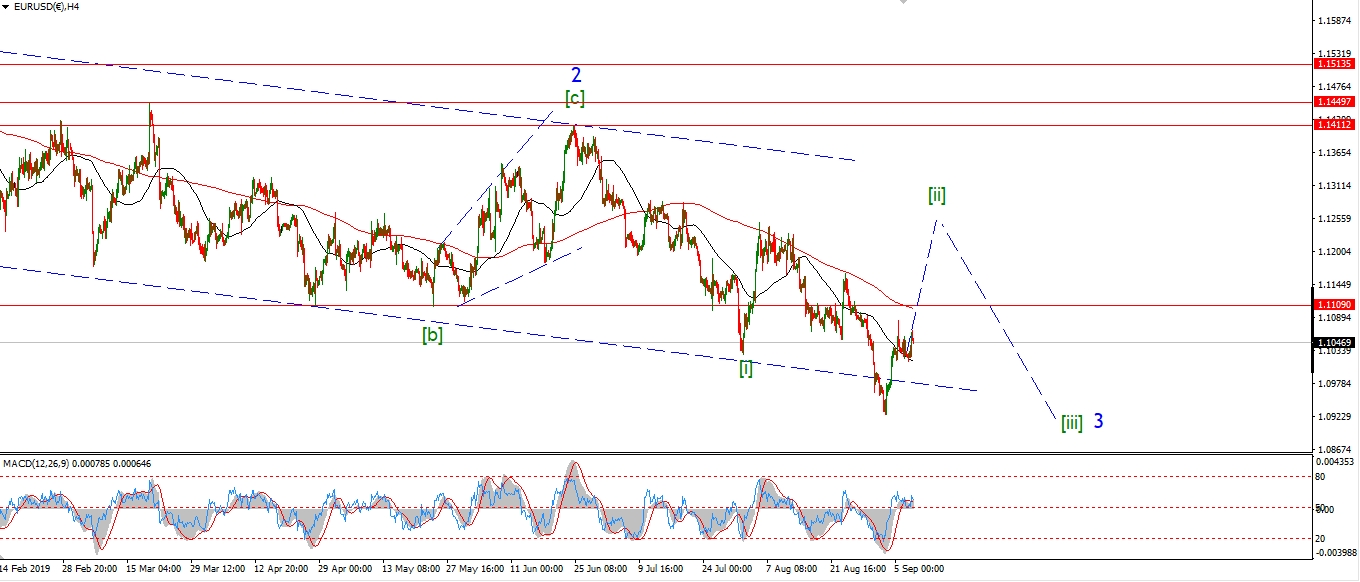

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Todays decline in EURUSD is raising the flag for me now.

The alternate count shown gets a small boost in probability because of the sharp nature of the decline.

I will be watching closely tomorrow to see if this develops into something interesting on the downside.

but for the moment,

I will hold with the idea that wave (c) is continuing.

The decline today was in three waves,

so this could be a correction within wave (c) as a 1,2, wave to the upside.

Price must hold above 1.0925 for this to remain valid.

Tomorrow;

watch for wave ‘iii’ to hold above support.

Wave ‘iii’ must push higher again tomorrow and break 1.1109 again to remain bullish in wave (c).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

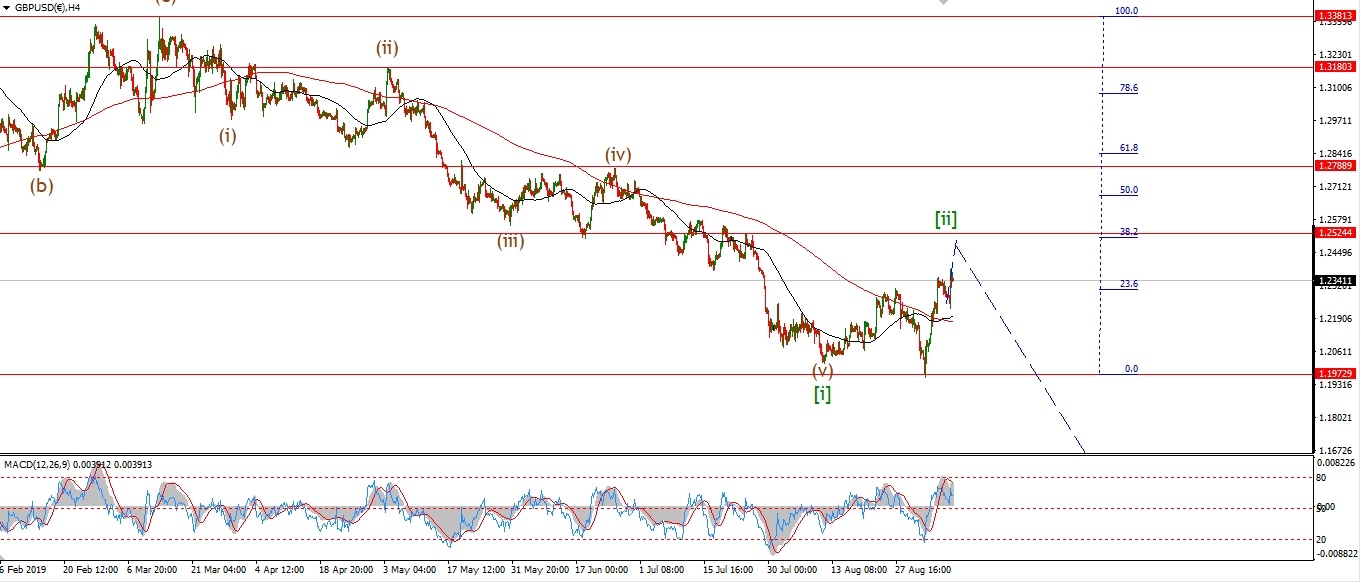

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Five waves up completed on Friday evening in wave (c) of [ii].

and todays trade has backed off that level in a reasonably impulsive fashion.

Its is early days yet to get too excited,

but If we see a clear impulse wave form to the downside this week,

then next week could bring a sharp fall in wave (iii) of [iii].

Tomorrow;

watch for 1.2504 to hold,

wave (i) down should continue in five waves over the coming days.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

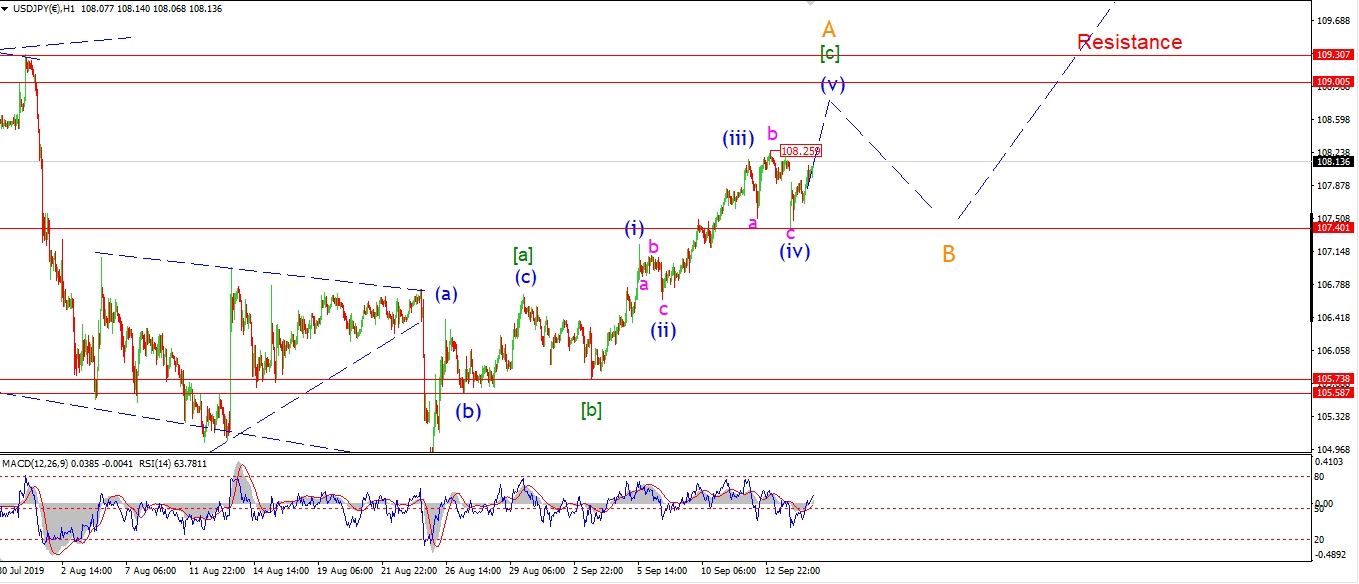

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

I have switched to the alternate count this evening for USDJPY.

The rally off the recent lows is now viewed as wave ‘A’ of (D)

within a very large triangle correction.

Wave (iv) created a three wave expanded flat correction into todays low,

And todays rally is viewed as wave (v),

the pattern is in three waves higher so far so this rally must continue.

Wave (v) of [c] should create one last new high up near 109.00 to complete wave [c].

At that point,

we should look lower into wave ‘B’ into next week.

Tomorrow;

the level to watch in the short term is the low of wave (iv) at 107.40.

Wave (v) must hold above this point.

A break of 108.25 will confirm wave (v).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

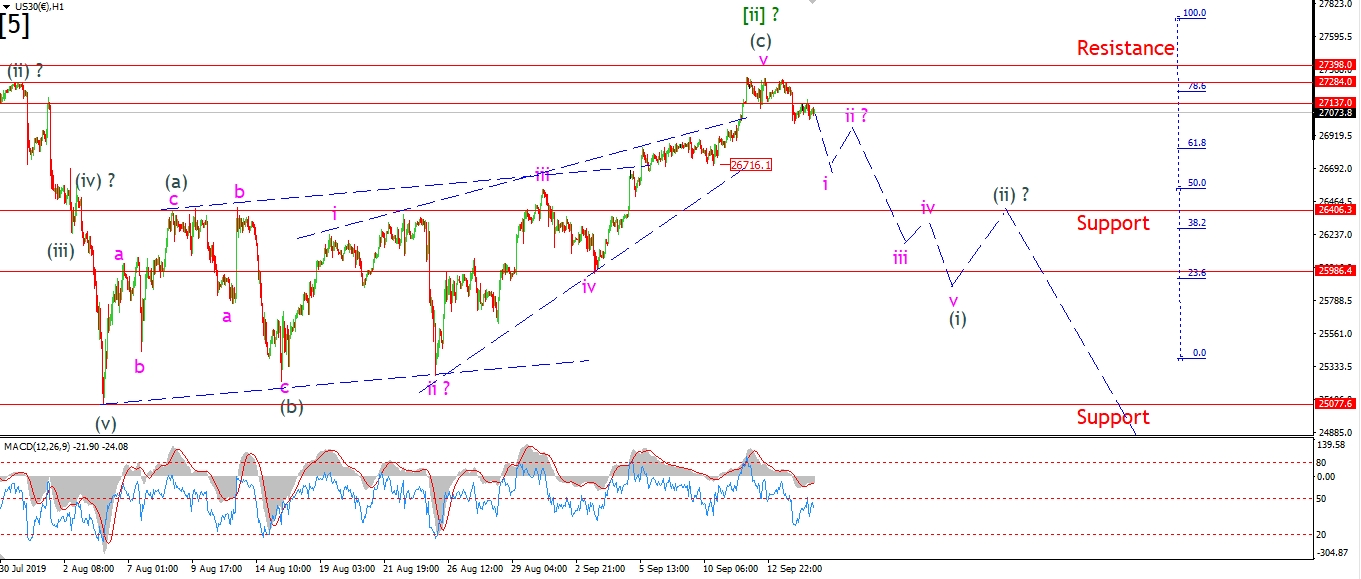

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The DOW gaped lower this morning and has corrected sideways off that low.

It is possible that wave (i) down is now underway,

which is welcome for sure!

But we will have to wait patiently for the coming few sessions

to see if we get that long awaited five wave decline.

And if we can build an impulse wave lower to signal wave [iii] is underway.

The high at 27398 must continue to hold,

if we are to stick with the bearish outlook in the short term pattern.

Tomorrow;

Watch for wave (i) down to continue lower over the coming week.

A break of 26700 will be a good target for wave ‘i’ of (i).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

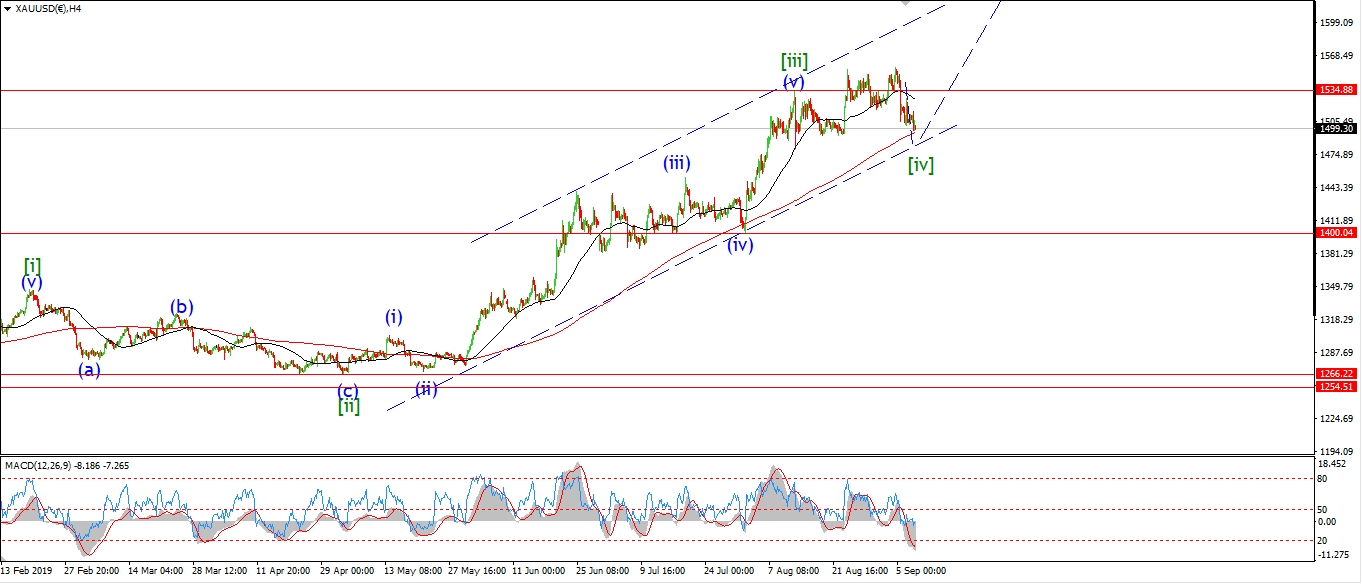

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The short term pattern in gold is interesting again after todays action.

The price did not make a new low today to break wave (a).

And the decline on Friday completed in three waves.

Instead we got another spike to the upside with a corrective drift off the high.

So,

it is possible that wave [iv] traced out a triangle as shown.

And wave (e) of the triangle completed on Friday at 1485.

I am open to the idea that todays spike higher is the beginning of wave (i) of [v].

If this is the case,

then [iv] should hold at 1485 and wave (i) and (ii) should trace out a clear 5/3 pattern higher over the coming days.

Tomorrow;

Watch for wave ‘iii’ of (i) rally again tomorrow.

1485 must hold for the triangle idea to remain valid.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

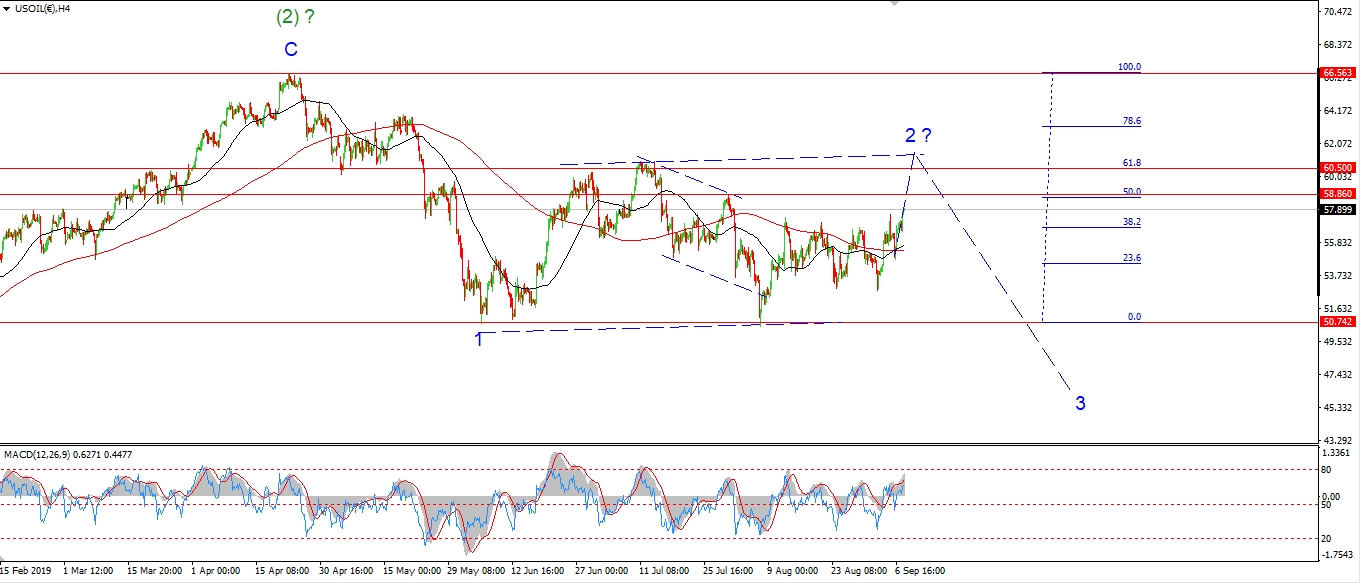

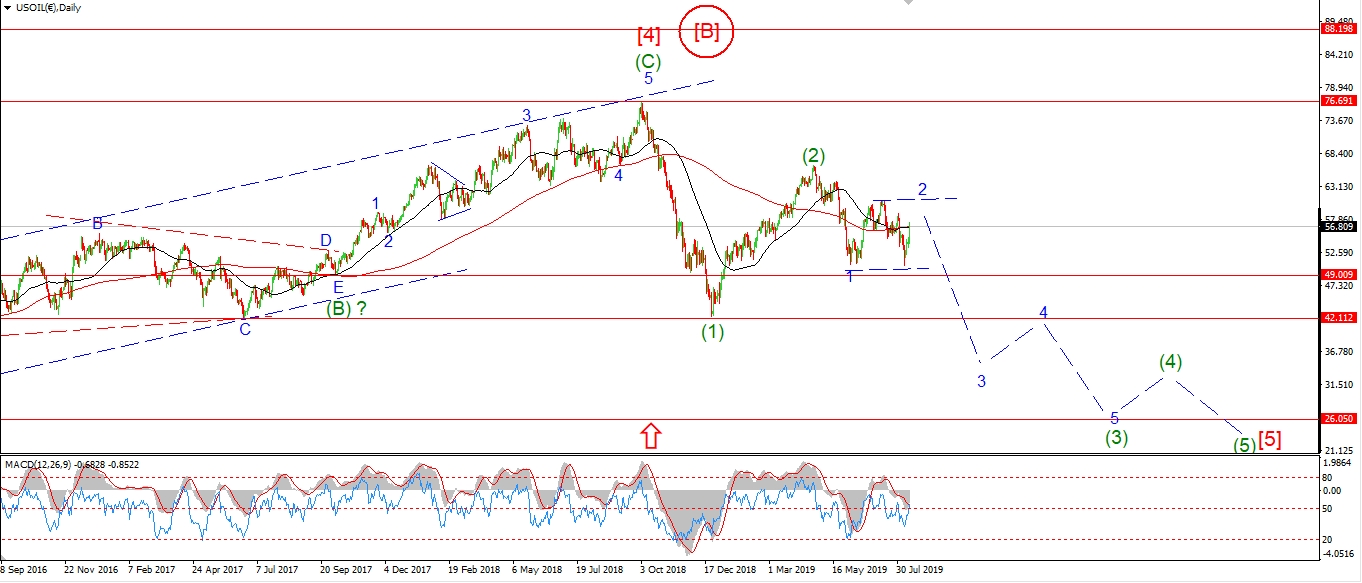

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

After expecting a rally last week which never materialized

I had given up on a new high for wave ‘2’.

And then last night we saw that massive gap higher by almost 900 points,

which hit the previous target area,

and this action completes the larger wave ‘2’

with a throw-over above the upper trendline.

If waves ‘1’ and ‘2’ are now done,

then we should now expect wave ‘3’ down to begin to track lower over the coming week.

A break of 50.50 will confirm wave ‘3’ has begun,

and we should see a five wave decline occur in wave [i] over the coming week.

Tomorrow;

Todays sell off and recovery to a lower high may be waves (i) and (ii).

Watch for wave (iii) to push lower again tomorrow and break 59.00 again.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

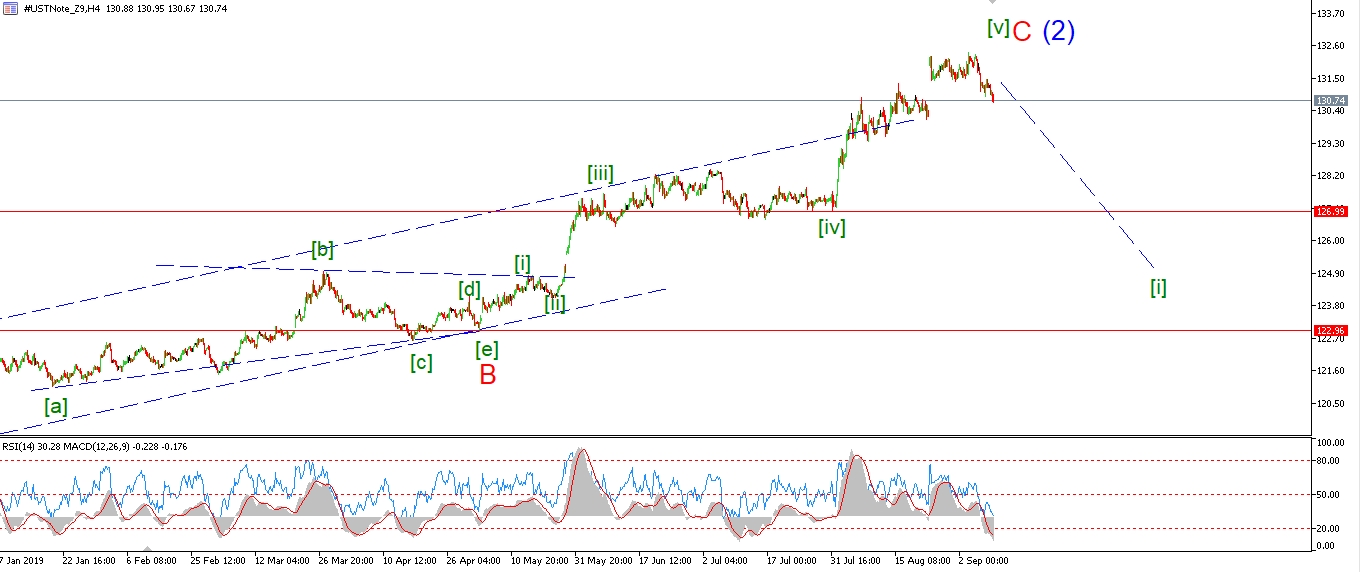

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Bond’s created another new low today in wave ‘v’ of (i),

which briefly broke the 128.00 level before recovering slightly into the close.

It is not clear if wave (i) down is yet complete,

another drop below 128.40 will create a clear five waves movement within wave ‘v’.

that should be enough to call wave (i) complete,

and then we can look to a three wave recovery in wave (ii) for the rest of the week.

Tomorrow;

Watch for wave (i) to complete at a nearby low,

wave (ii) should rise in three waves to about 130.40 again.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

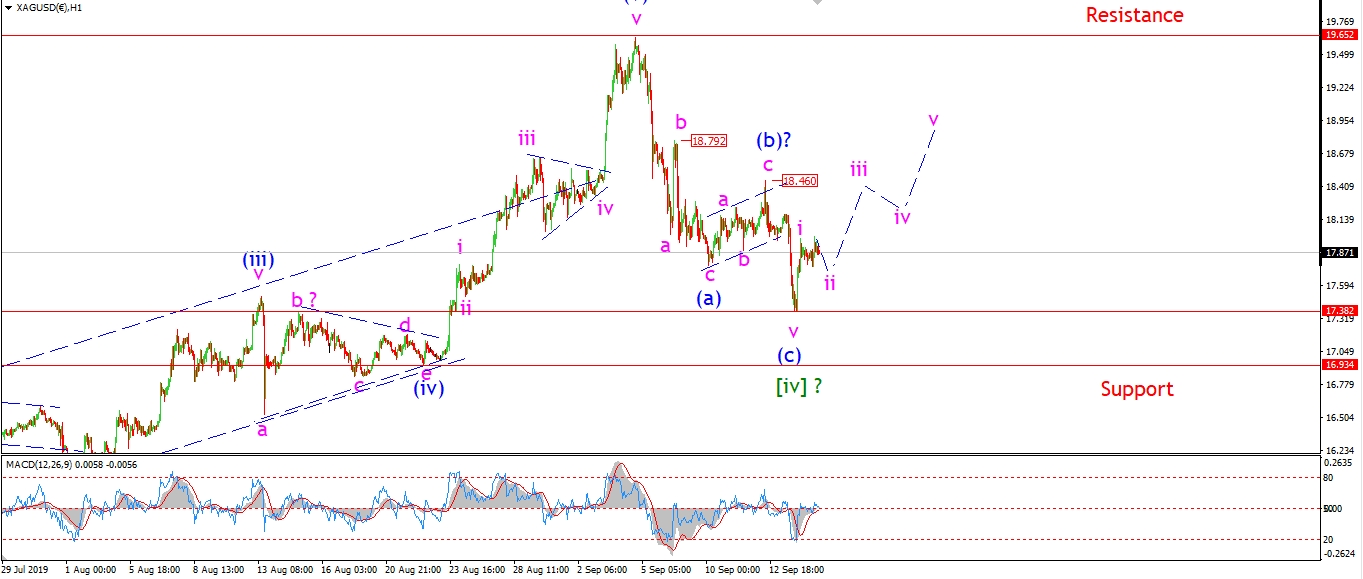

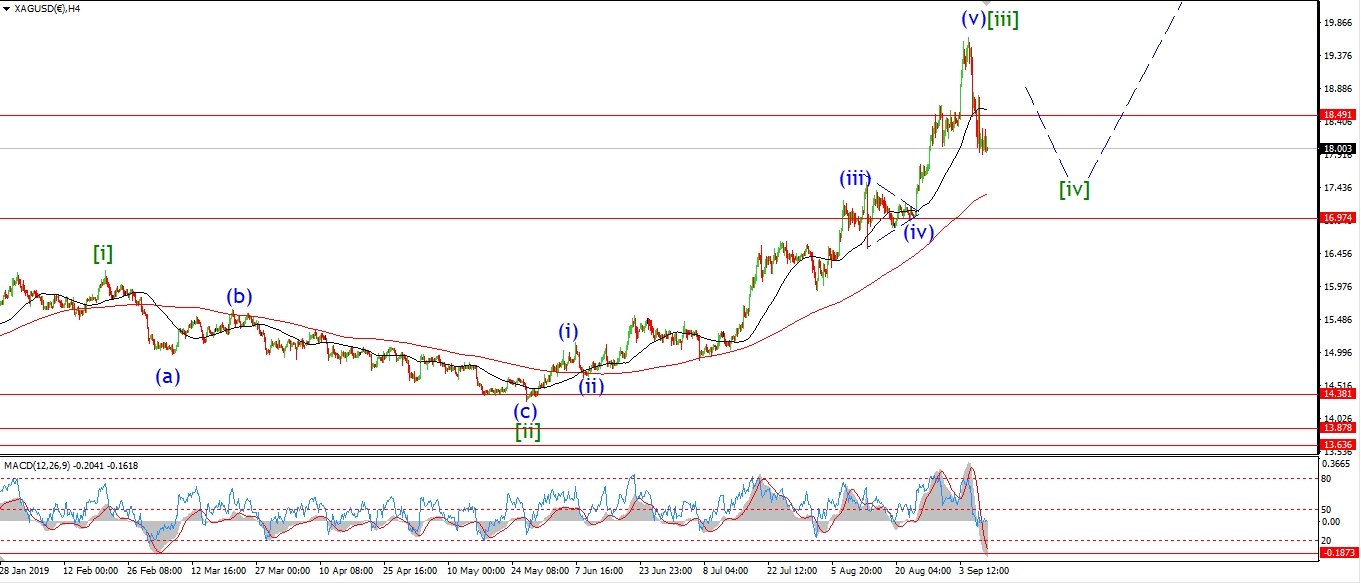

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Fridays low in silver was not broken today as expected.

The price spiked off that low overnight

and it has held above that level in a corrective drift sideways throughout the day.

Give that we have a three wave decline in place off the wave [iii] high now,

and the price has created a bullish move higher today,

it is reasonable to assume that wave [iv] is now complete at 17.38.

Wave [v] will begin with a five wave move higher to break 18.46 over the next few sessions.

Tomorrow;

Watch for a small second wave decline to hold above 17.38.

Wave ‘iii’ should hit 17.46 again this week.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

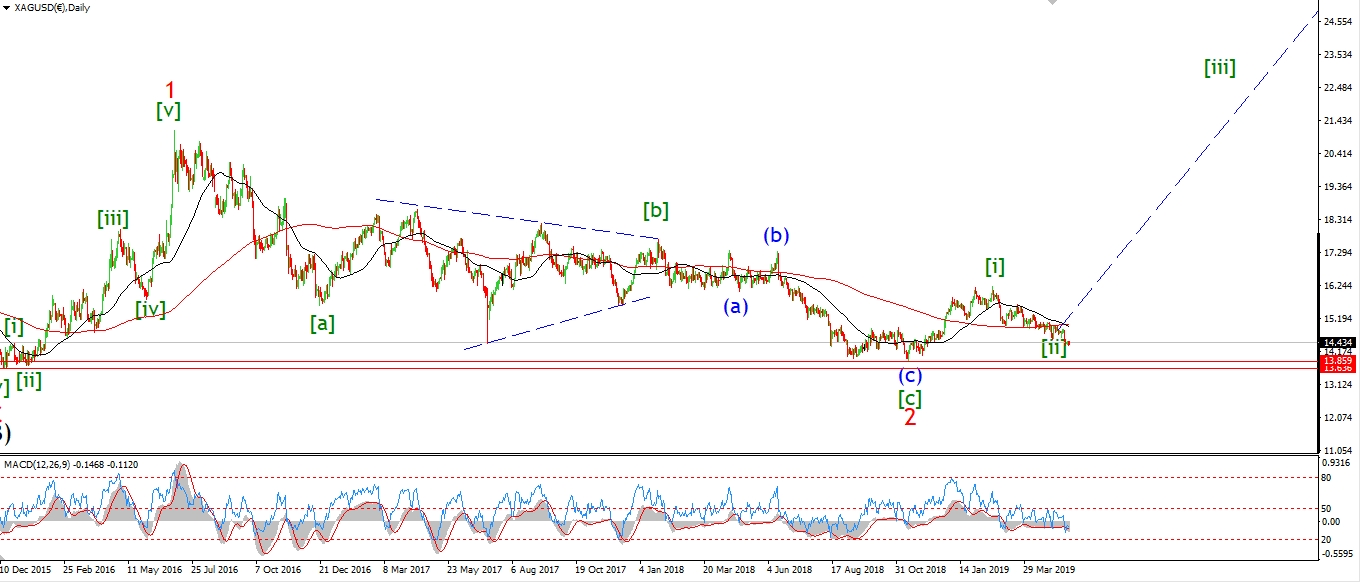

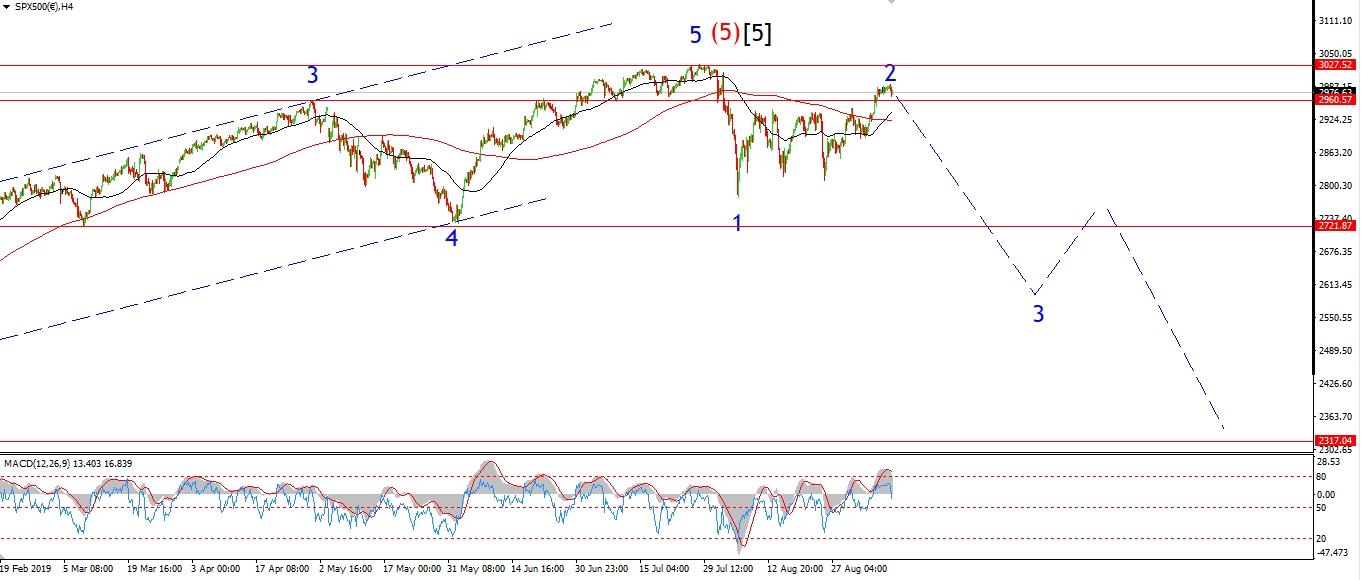

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P is tracking lower today also with a possible low in wave ‘i’ in place at the session low.

I know that the invalidation line is very close at hand at the all time high,

but that level has not broken,

the rally off wave [i] still counts as a three wave pattern.

And if we see a five wave decline to break 2940 again,

that will raise the possibility that the major bearish count is back on track!

Tomorrow;

3027 must hold,

watch for wave ‘iii’ of (i) to drop towards 2940 tomorrow.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]