Good evening folks, the Lord’s Blessings to you all.

EURUSD.

EURUSD 1hr.

EURUSD completed the perfect three wave correction into the wave ‘iv’ low this week,

and from that low 1.1001,

the price has bounced with a nice impulsive look to the action.

This suggests wave ‘v’ is now underway,

and we can look for a new high in wave ‘v’ of (c) of [b] next week.

the minimum target for wave ‘v’ lies at 1.12002 with a break of the wave ‘iii’ top.

Once we hit that level we can see where the pattern stands,

and begin looking for a top in wave ‘v’ of (c).

Tomorrow;

Watch for wave ‘iv’ to hold at 1.10,

wave ‘v’ should trace out five waves up as shown.

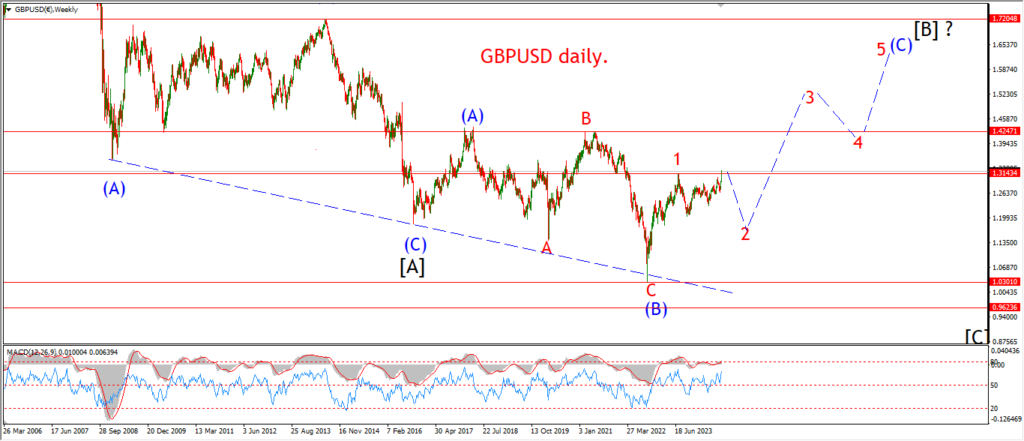

GBPUSD

GBPUSD 1hr.

Cable is holding up nicely after an impulse move off the wave ‘iv’ lows to finish the week.

The price should complete a ‘1’ ‘2’ pattern on Monday,

and then a wave ‘3’ of ‘v’ should hit the highs again near 1.3266.

Wave ‘v’ should break to a new high later next week and that will top out the larger pattern again in wave (c) of [b].

What comes next after wave [b] is done will be a shock to the system I think!

A rapid decline back below 1.2200 again in wave [c] of ‘2’ is what this wave count calls for.

I do believe this will coincide with a major stock market reversal across the west at least.

So this fall will be very interesting indeed!

Monday;

Watch for wave ‘v’ of (c) to close out after a five wave rally as shown.

USDJPY.

USDJPY 1hr.

USDJPY managed a new low overnight which puts back the start of wave [c] by another few days.

I am now suggesting that a break above 143.00 again will signal wave (i) of [c] is in play.

It is just a matter of waiting for this pair to turn now,

the pattern into the wave [b] low is full,

so lets see how it goes early next week.

Monday;

WAtch for wave ‘i’ of (i) to push back above 142.00 as an initial hint that the pattern is turning higher.

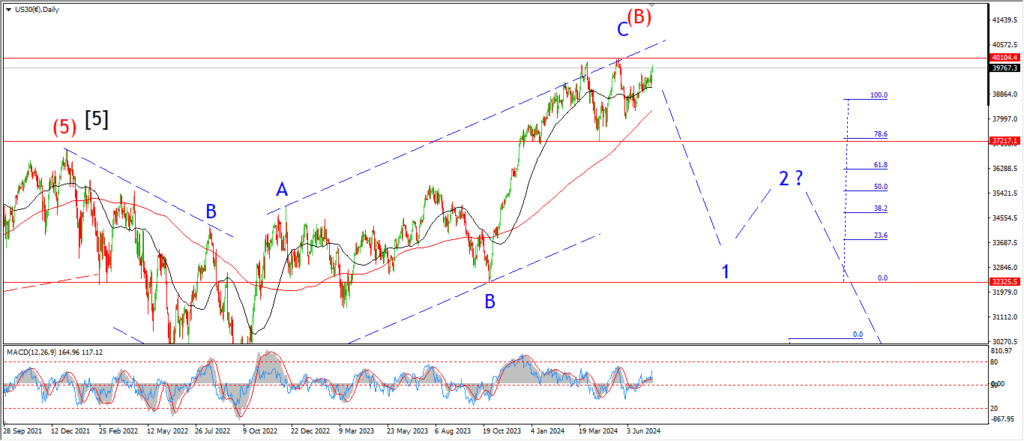

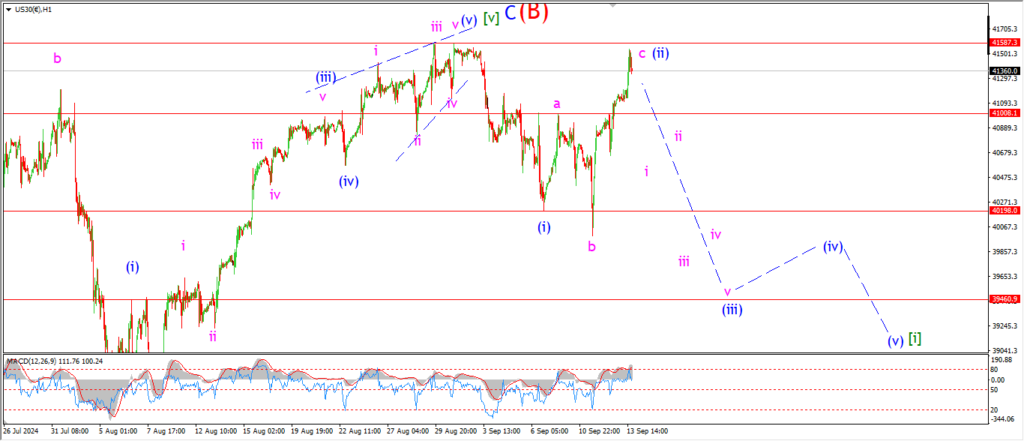

DOW JONES.

DOW 1hr.

The 4hr count in the DOW shows the alternate count for the current action.

This involves a five wave pattern in wave [v] as normal,

except the recent drop off the top happened as a correction in wave (iv) of [v],

rather than an impulse wave down in wave (i).

This alternate will allow for a new high next week.

Monday;

the main count remains the same on the hourly chart.

A sharp drop on Monday to break below 41000 again will signal wave ‘i’ of (iii) is underway.

GOLD

GOLD 1hr.

Gold has topped out above the upper trend line today in wave ‘c’ of (v).

the ending diagonal pattern in wave [v] is now full.

There is no more room to the upside in this particular pattern,

And that means only one thing here,

if the pattern for wave [v] of ‘3’ is correct,

then we must expect a reversal into wave ‘4’ to come soon.

There seems to be an endless appetite to bid gold higher along with the stock market these days,

and I think gold will suffer initially because of this correlation when the stock market actually does turn.

That wave [a] decline will take a large bite out of this premium high,

wave [a] can easily hit 2300 to begin wave ‘4’ red.

It is unlikely to happen on Monday!

but this turn is coming close.

Tomorrow;

Watch for wave (v) of [v] to top out early next week as the ending diagonal pattern seems complete after todays rally.

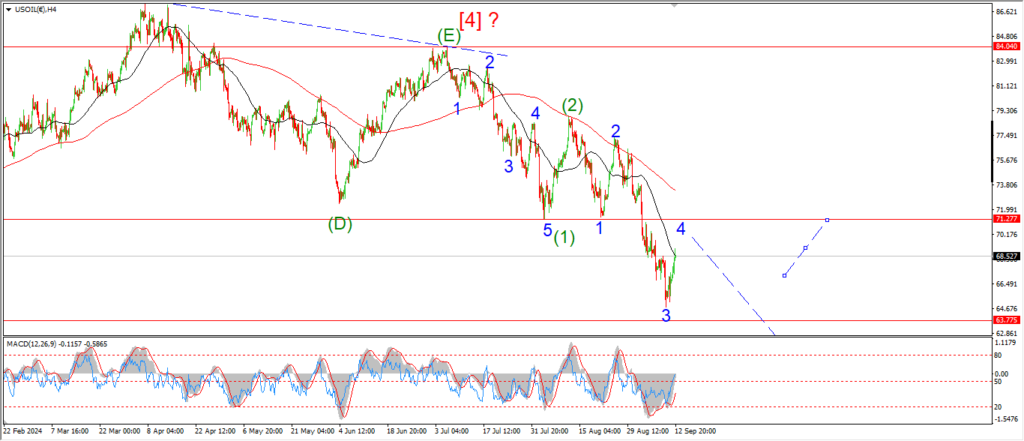

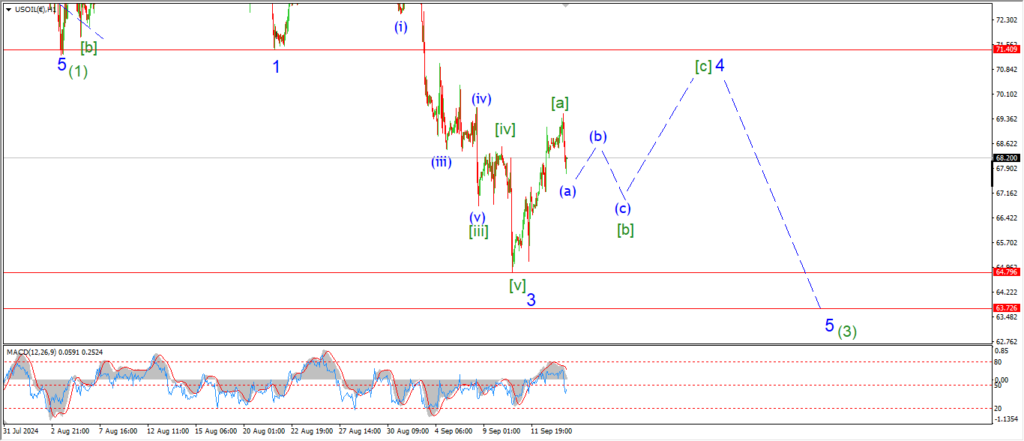

CRUDE OIL.

CRUDE OIL 1hr.

Crude took a turn lower today off the top of wave [a] as suggested.

The rally in wave [a] actually reached a bit higher than I thought it would,

but the drop today is enough to suggest wave [b] is now underway.

I have labelled the decline as wave (a) of [b].

and wave [b] should trace out three waves down and form a higher low near the 66.00 level later next week.

Monday;

Watch for a three wave decline to a higher low in wave [b] to complete next week.

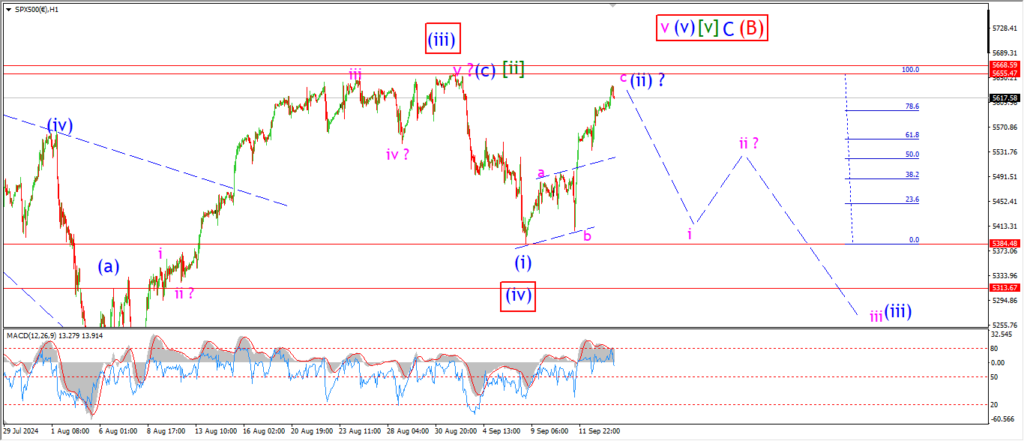

S&P 500.

S&P 500 1hr

It is a cruel thing to be forced to do,

but I will always admit when I am wrong!

The market did not break to a new high today but we came damn close.

The price has turned lower this evening off the session highs.

So there is still the slightest chance that a wave (ii) lower high is now complete.

that is the count I have shown on the hourly chart,

and the alternate count is shown on the 4hr chart.

Monday;

It is up to the market mood on Monday to decide where this goes,

I will leave the option open here for a drop in wave ‘i’ of (iii).

I will be relieved if that happens,

but there is no point in ignoring the alternate count here either.

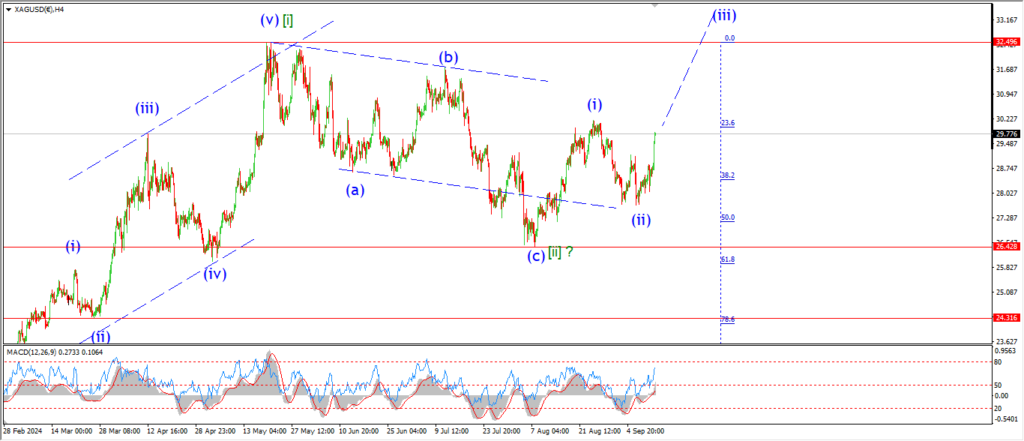

SILVER.

SILVER 1hr

The price has broken to a new high in silver today but that has not broken the wave count I believe.

The price has traced out a five wave pattern in wave ‘c’ of ‘b’ at todays high,

but that has only traced out three waves up overall in wave ‘b’ of (ii).

So we have an expanded flat in wave (ii) now in play,

and wave ‘c’ of (ii) will fall in five waves to break below 27.60 at the wave ‘a’ low over the coming week in this scenario.

Monday;

Watch for wave ‘c’ to begin with a drop in wave ‘1’.

Wave ‘1’ should easily break the 30.00 level again to begin the next leg down.

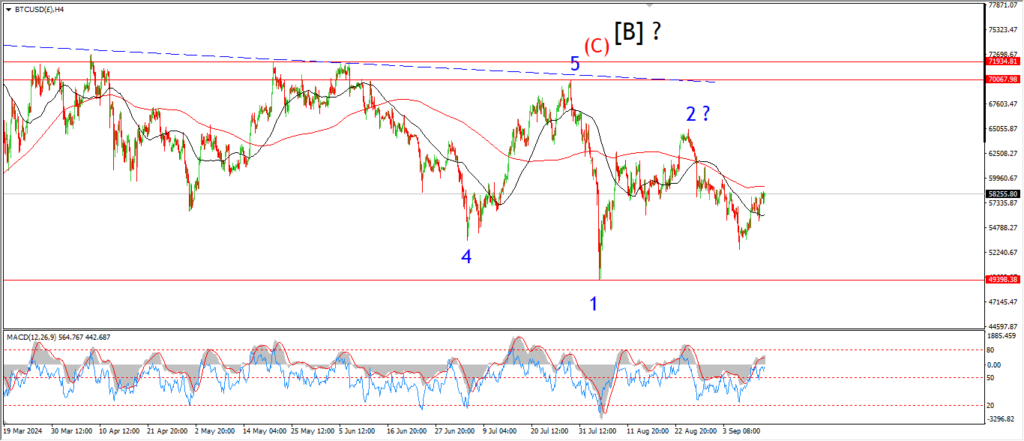

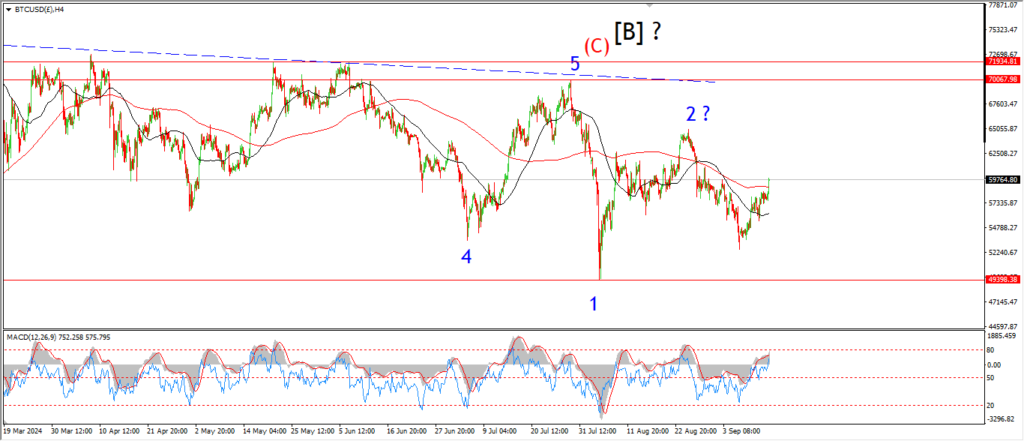

BITCOIN

BITCOIN 1hr.

….

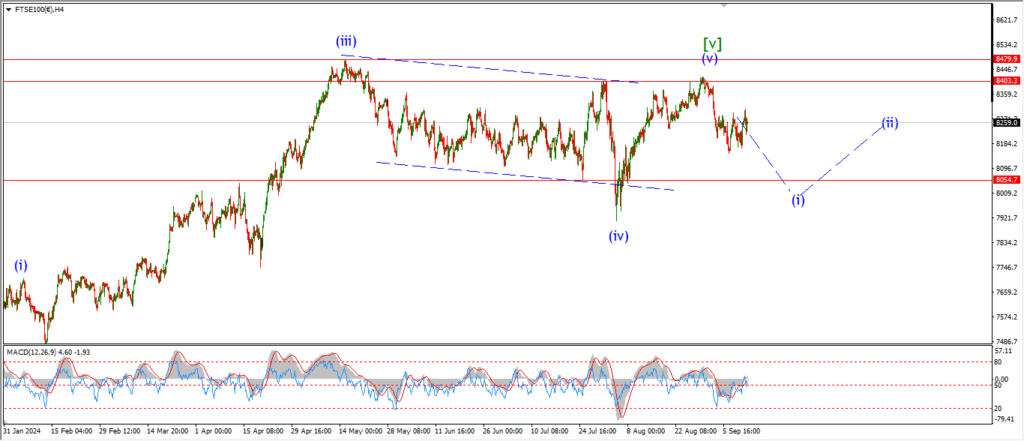

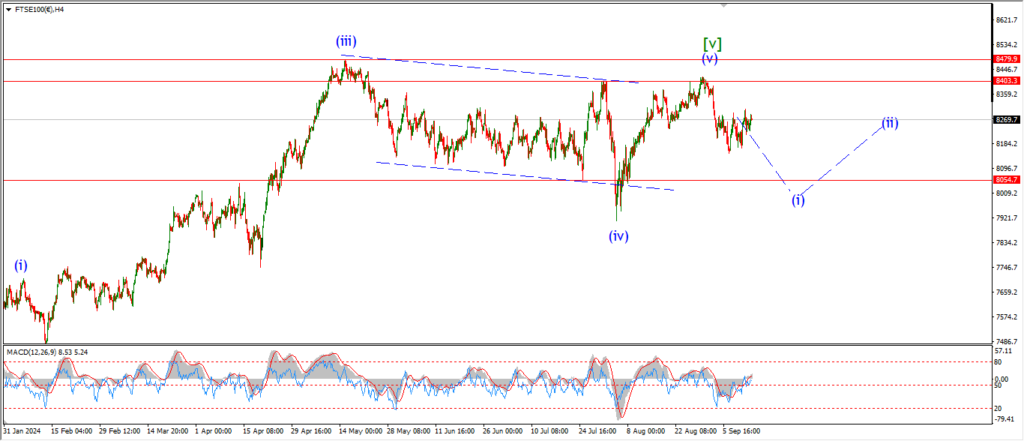

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

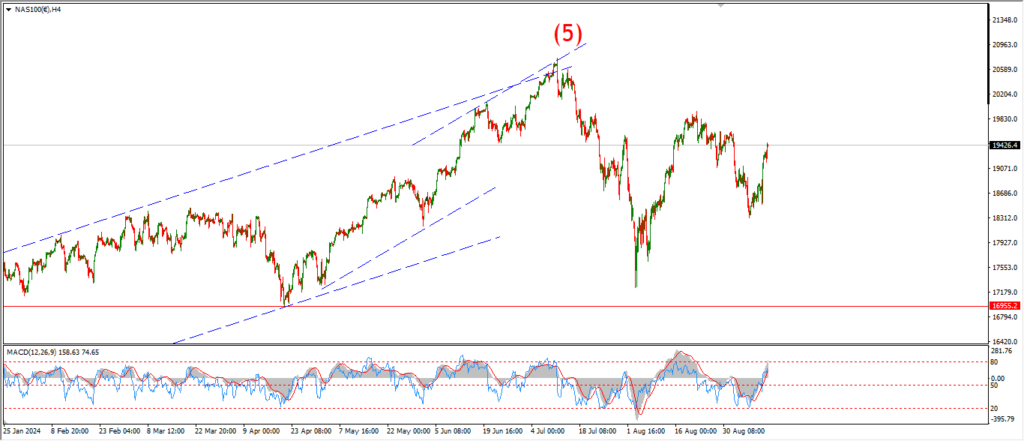

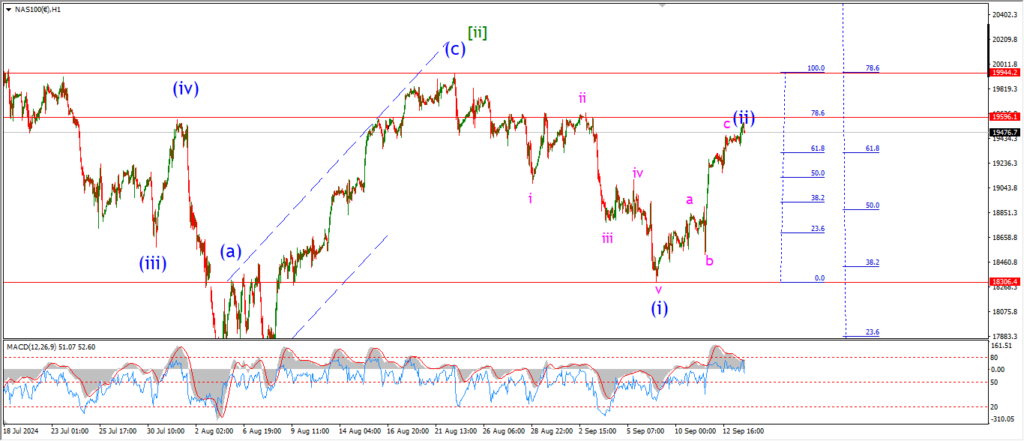

NASDAQ 100.

NASDAQ 1hr

….