Good evening folks, the Lord’s Blessings to you all.

EURUSD.

EURUSD 1hr.

EURUSD has turned higher today which indicates that wave ‘iv’ is now complete at the weekly lows.

Wave ‘v’ should begin from here and trace out five waves up to break 1.1200 again.

The low of wave ‘iv’ sits at 1.1000 even,

and that level must hold for this count to remain valid.

Tomorrow;

Watch for wave ‘v’ of (c) to continue higher in five waves as shown.

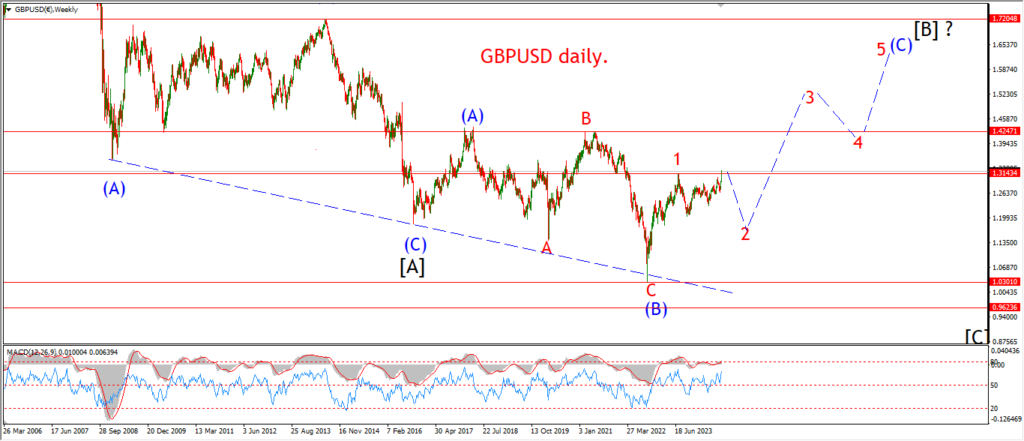

GBPUSD

GBPUSD 1hr.

I have switched to the alternate count for cable tonight as the action favors the idea of a correction into wave ‘iv’ now.

the rise off the lows is in line with a rally in wave ‘v’ of (c) now.

The recent declines have proved itself as corrective,

so I must go with the prevailing wind here!

This pattern will allow for a new high in wave ‘v’ of (c) and that will top out wave (c) of [b] above 1.3266 is all goes to plan.

Tomorrow;

Wave ‘v’ must now trace out five waves up as shown over the coming days.

I will have to wait until the end of next week now for another opportunity to turn into wave [c] again.

USDJPY.

USDJPY 1hr.

The fact that I am looking for a new high in both EURUSD and GBPUSD suggests that USDJPY will now drop to a new low to correspond with that action.

Despite this fact,

I am not changing the main count for wave [b] yet.

The price remains above the recent 140.69 low tonight.

And I am going to allow another few days to see if that illusive wave (i) rally can build.

If the price holds above wave [b] again we see a rally above 144.00 again,

that will give a big boost to the wave (i) of [c] pattern here.

Tomorrow;

Watch for wave (i) to trace out five waves up to break 144.00 by tomorrow evening.

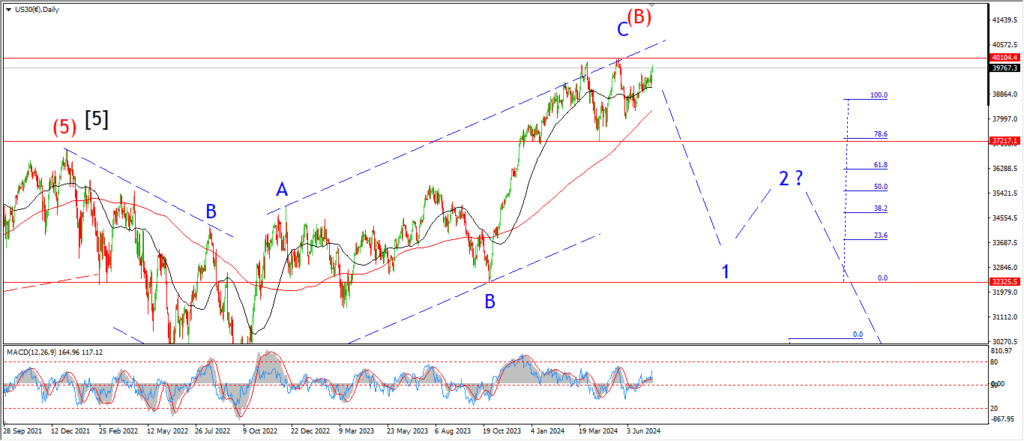

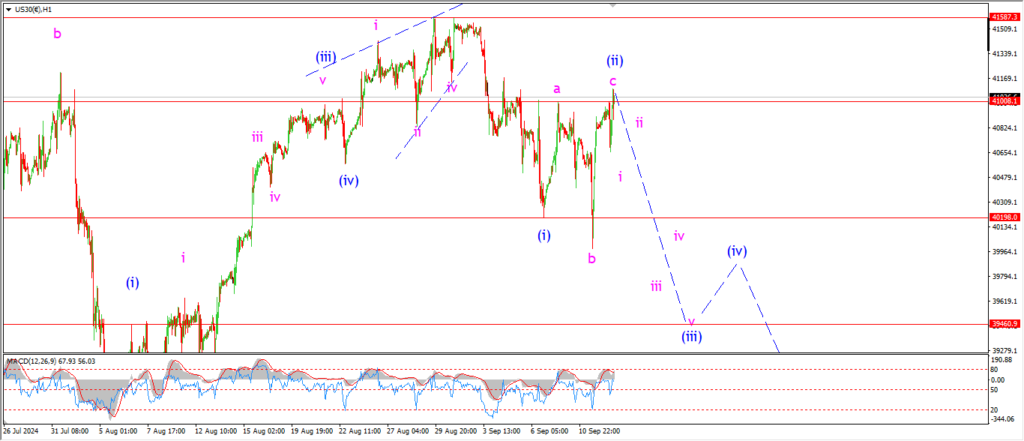

DOW JONES.

DOW 1hr.

Here comes the test for this lower high pattern in wave (ii) blue.

the market spiked higher again today to break above the previous wave ‘a’ high at the top.

Wave ‘c’ of (ii) has now hit the minimum target for an expanded flat correction.

And if this count is correct,

then we must see a reversal into wave (iii) down beginning now.

A run to a new all time high will be very easy from here if it is going to happen.

And this also suggests,

a reversal here will be very important for the larger pattern potential.

Tomorrow;

Lets see if wave (iii) down can get started with a rejection off this lower high wave (ii).

Wave (ii) should fall back below 40000 with ease.

GOLD

GOLD 1hr.

wave ‘c’ of (v) pushed higher again today and the upper trend line of this pattern is very close now.

Wave (v) continues to narrow the trading range even as we hit new highs.

And If this pattern is actually an ending diagonal in the making here for wave [v] green,

then we will see a quick end to the rally and a sharp break below the wedge formation in the next few sessions.

Tomorrow;

Watch for wave ‘c’ of (v) to complete the larger wave [v] pattern and then next week I will look for an early reversal to drop back below the lower trend line.

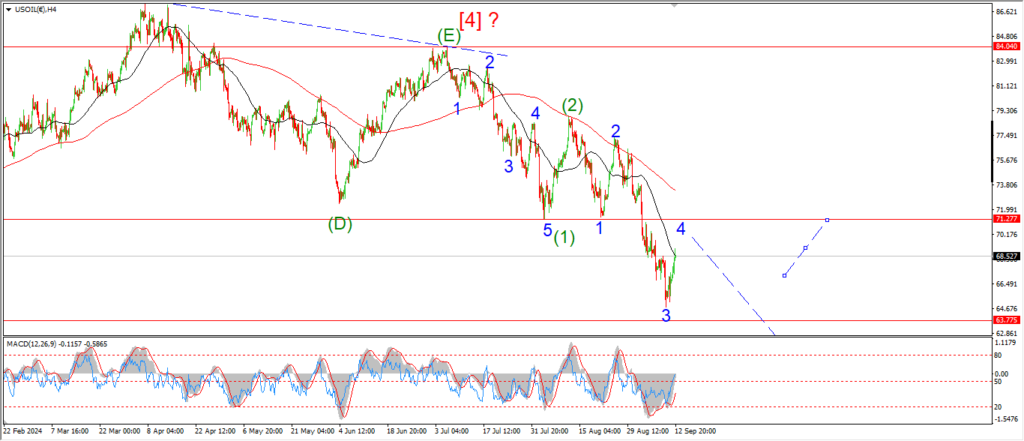

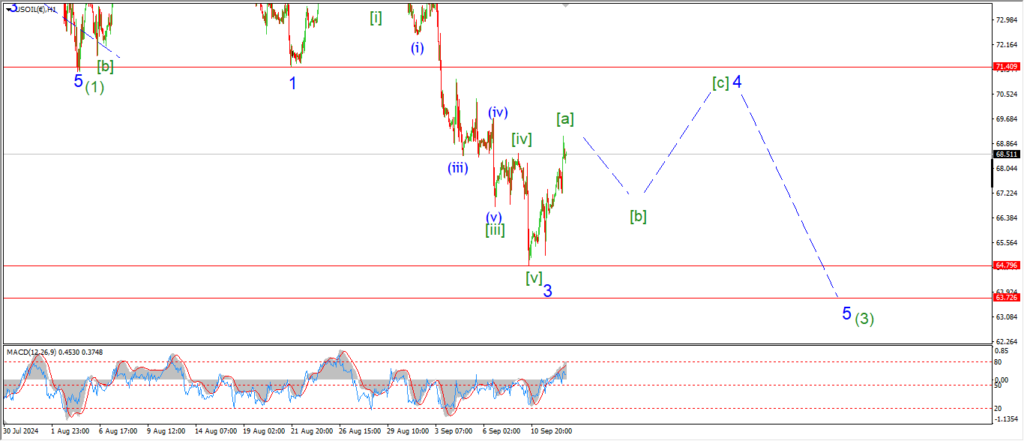

CRUDE OIL.

CRUDE OIL 1hr.

Crude oil has bounced nicely off this weeks lows now and I think this is enough to call wave ‘3’ officially done.

The rally this week is labelled wave [a] of ‘4’,

and wave [b] should now turn lower in three waves to create a higher low above the wave ‘3’ lows.

the wave ‘1’ low at 71.40 must hold as this correction develops in wave ‘4’,

so keep one eye on that level.

Tomorrow;

Watch for wave [b] to turn lower in three waves to firm a higher low over the coming few days.

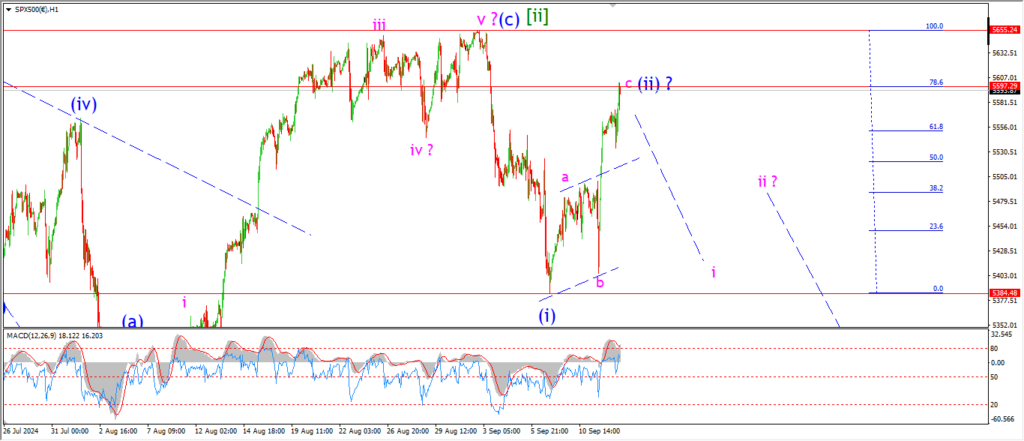

S&P 500.

S&P 500 1hr

The S&P spike higher again today and that should complete the wave (ii) lower high.

If the price continues higher tomorrow,

then I will be forced to rethink this pattern again!

The price has reached the 78.6% retracement of the wave (i) decline at the session high.

so this is an ideal time to turn lower into wave (iii).

And if wave ‘i’ is going to to turn lower,

then it must happen tomorrow.

Tomorrow;

WAtch for wave ‘c’ of (ii) to top out and turn lower into wave ‘i’ of (iii).

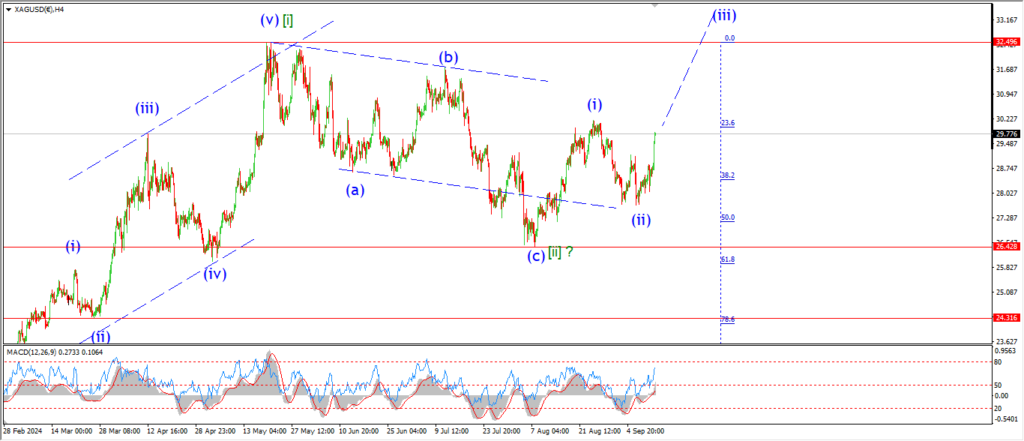

SILVER.

SILVER 1hr

The alternate count for wave (ii) has raised its head again today!

The price spike hard this afternoon which completely ruled out the triangle pattern for wave ‘b’.

There is still a possibility that wave ‘b’ is an expanded flat into todays highs,

but the price must reverse tomorrow into wave ‘c’ as shown.

If the price holds todays gains in tomorrows session,

then I will switch to that alternate wave (ii) count and we can concentrate on wave (iii) next week.

Tomorrow;

Watch for wave ‘b’ to hold and for wave ‘c’ to begin with a sharp drop off this high.

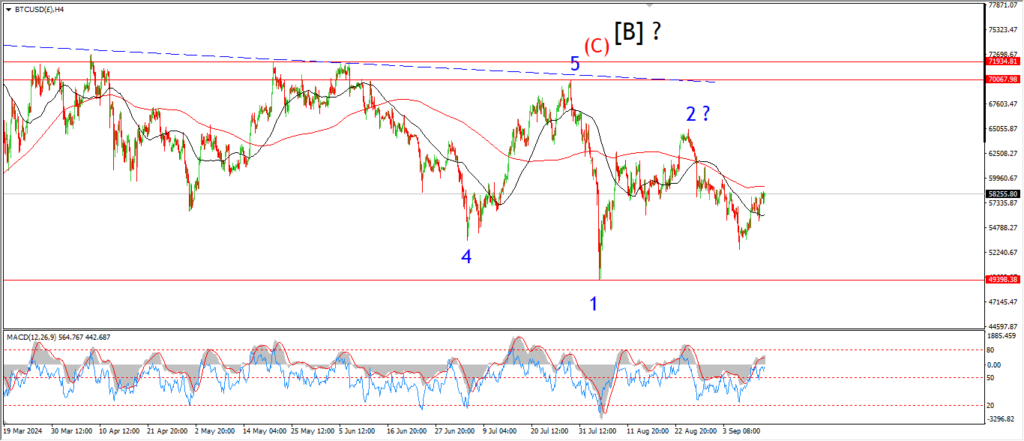

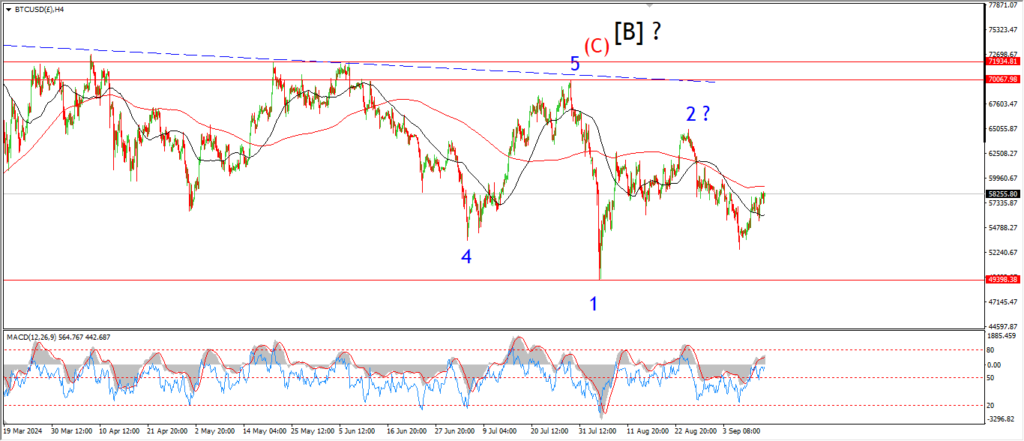

BITCOIN

BITCOIN 1hr.

….

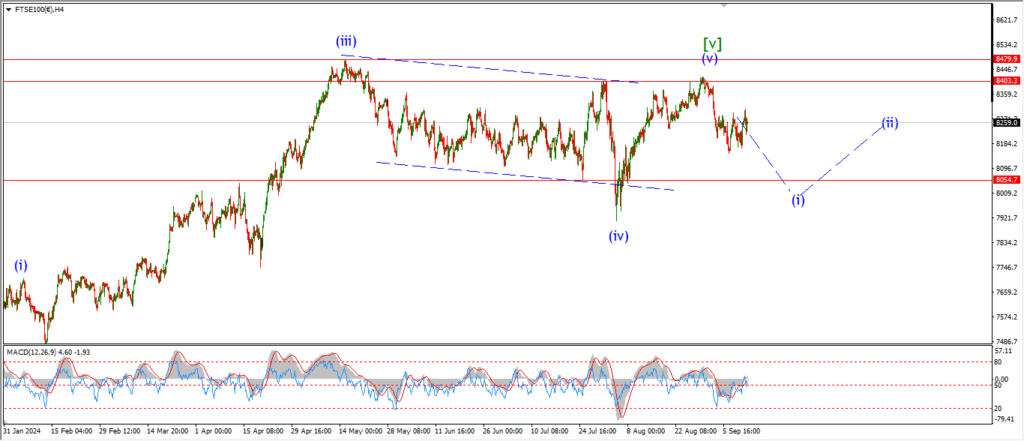

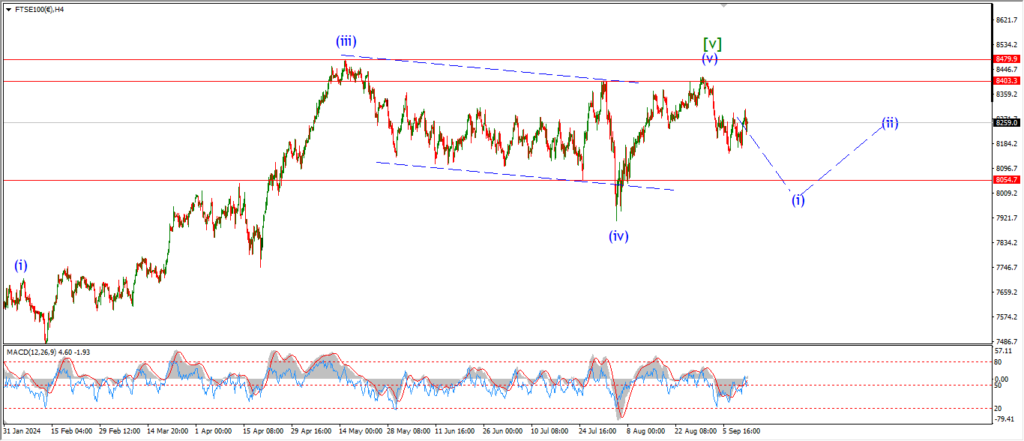

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

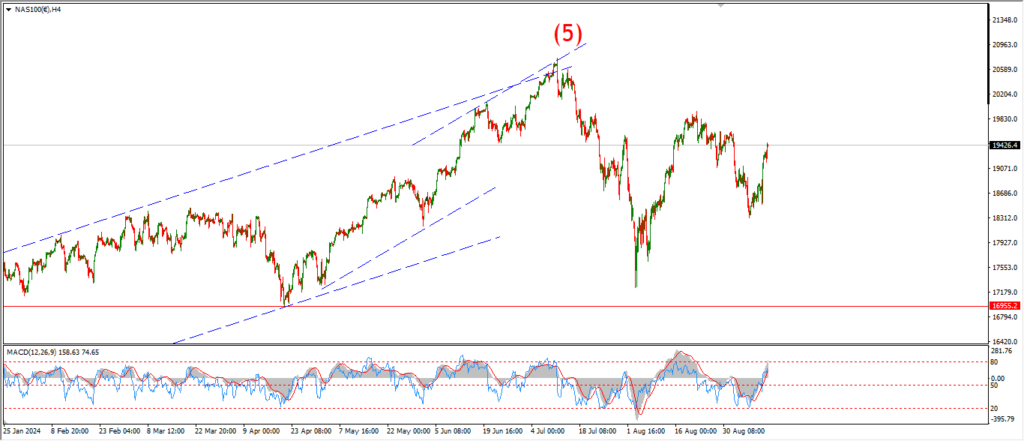

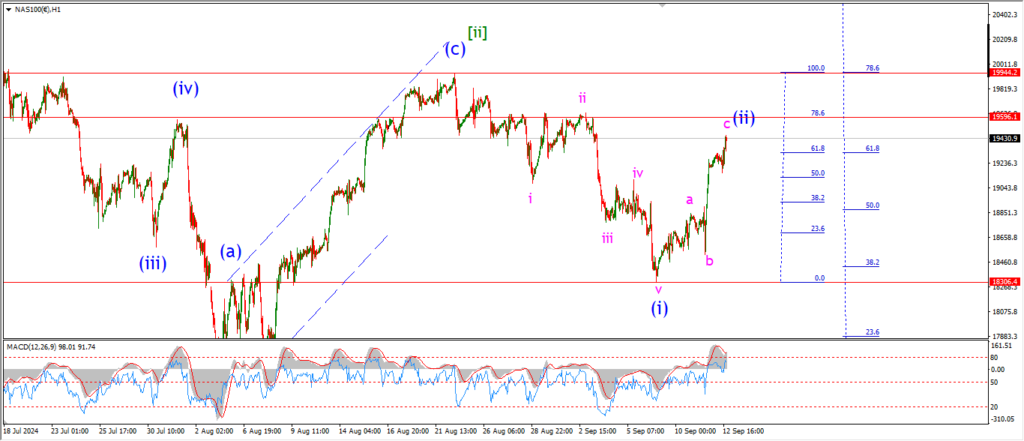

NASDAQ 100.

NASDAQ 1hr

….