Good evening folks, the Lord’s Blessings to you all.

Welcome back to a new week in the wonderland that is the financial markets, where smoke a mirrors rule and nothing makes any sense at all!

https://twitter.com/bullwavesreal

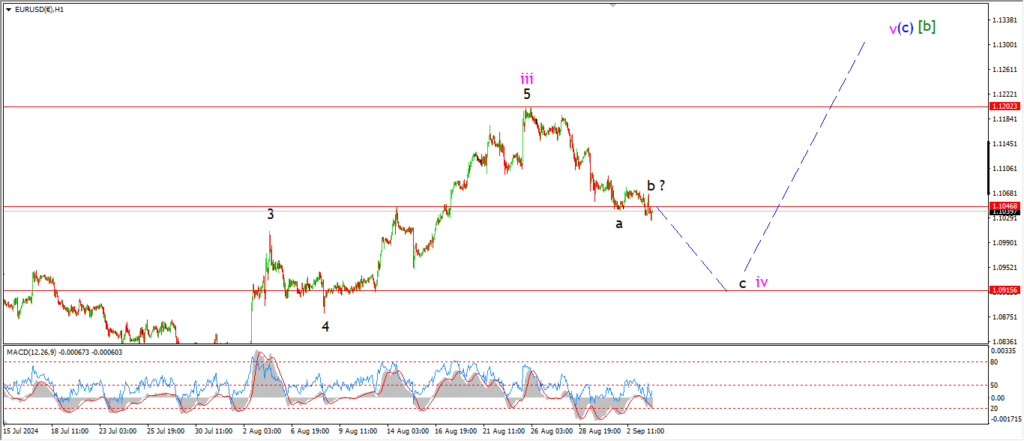

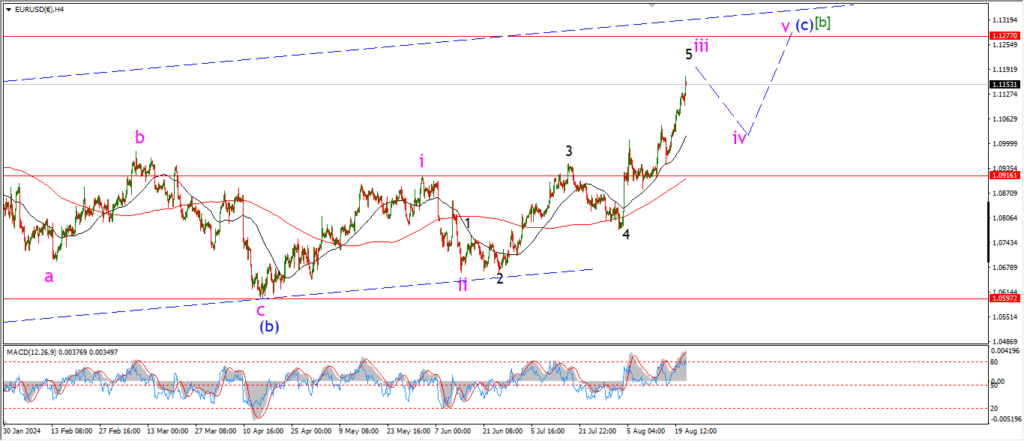

EURUSD.

EURUSD 1hr.

EURUSD 4hr.

EURUSD daily.

EURUSD is moving lower this evening after spending most of the session in a sideways correction.

A possible wave ‘b’ is in place after that sideways move,

although I will admit that wave ‘b’ is relatively small in comparison.

Now I am looking for a drop in wave ‘c’ of ‘iv’.

The low of wave ‘iv’ must hold above the wave ‘i’ high at 1.0916,

and once we have a full corrective pattern in place in wave ‘iv’,

then I will look for a rally into wave ‘v’ later this week.

Tomorrow;

Watch for wave ‘c’ of ‘iv’ to continue lower and complete near 1.0950.

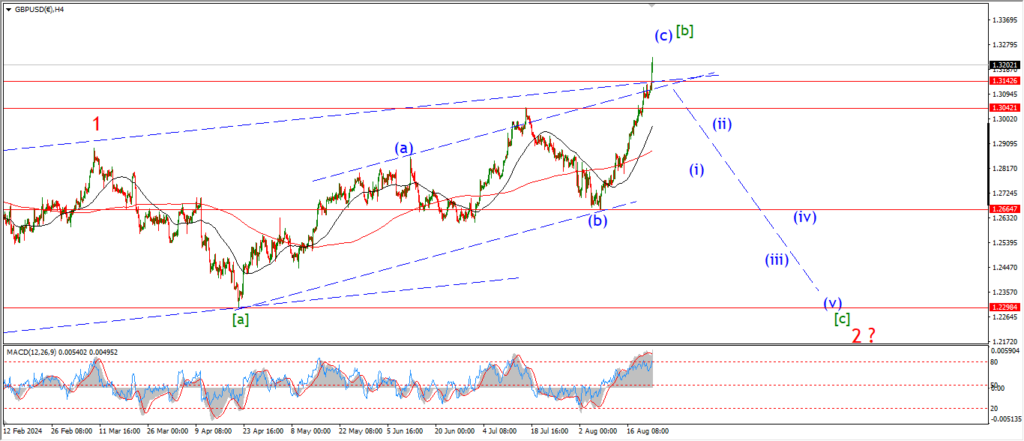

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

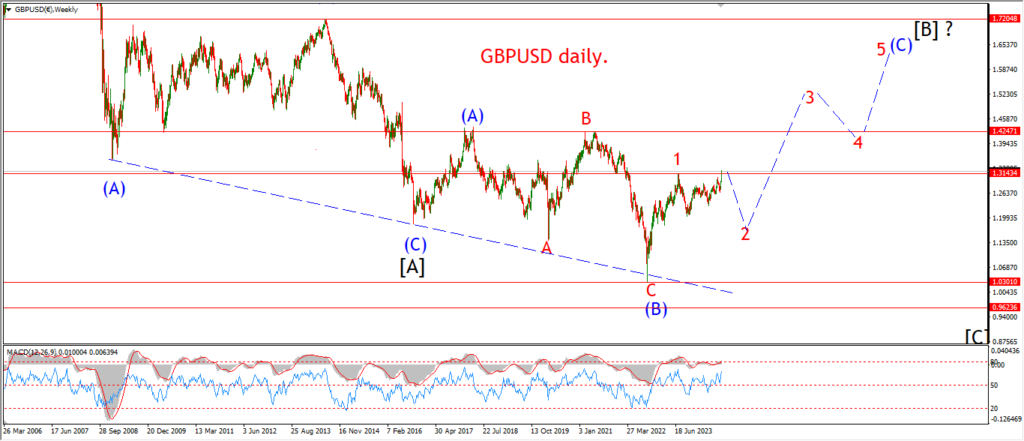

GBPUSD daily.

Another drop in cable today brings the pattern off the top of wave [b] more in line with a typical impulse wave now.

Wave ‘i’ down is close to retracing all of the previous wave ‘v’ now.

we are not quite there yet,

but a break of 1.3044 will add weight to this wave count for sure.

Tomorrow;

watch for wave ‘i’ to break support at wave ‘iv’ to complete five waves down as shown.

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

A sharp drop off today has broken out of the previous pattern from Friday now.

I am looking at a series of impulsive steps higher to begin that larger wave [c] as a possible explanation here,

but I must admit,

this pattern needs a hard rally into wave ‘iii’ of (iii) here to save the overall idea.

A break of the wave [b] lows at 143.46 will invalidate the overall idea and I will be forced back to the drawing board.

Tomorrow;

watch for wave ‘iii’ of (iii) to turn higher into wave [c] of ‘B’ to confirm this pattern.

DOW JONES.

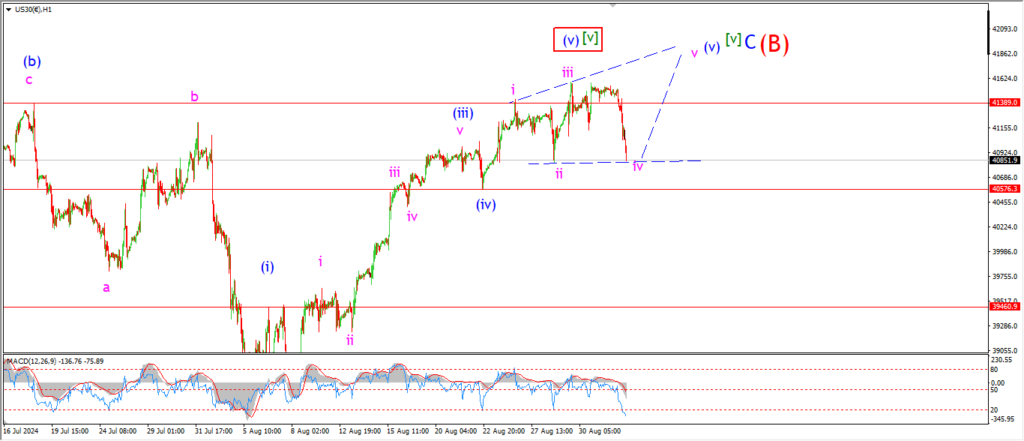

DOW 1hr.

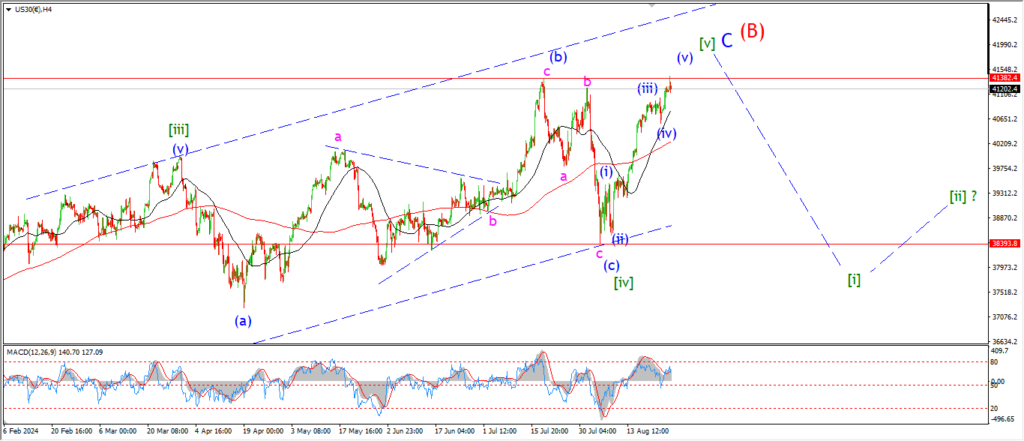

DOW 4hr

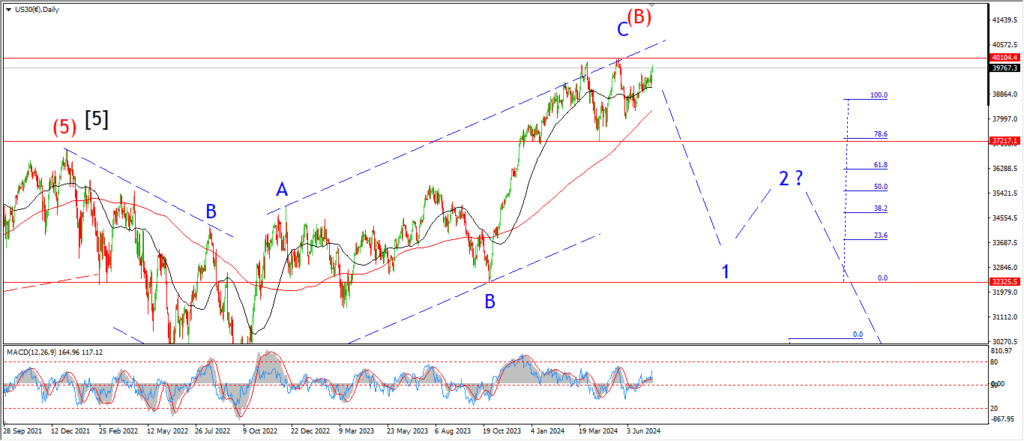

DOW daily.

That’s a pretty good reversal pattern off the top to be honest!

but I cant jump on every decline as ‘the one’ to start the big bear market decline.

Todays drop off has ruled out Fridays count.

But I am showing a possible expanding wedge as an explanation for the action today.

If this is correct,

then we will see a final fifth wave rally into wave (v) of [v] this week.

A continued drop off to break significant support at 39460 again will favor the idea that the market is lining up for a top again.

but we have a way to go before that becomes a reality.

Lets see how the week goes first.

If we see a break of that wave (i) high at 39460 again,

then I can get serious about a top.

Tomorrow;

Watch for wave ‘v’ of (v) to turn higher to top out that expanding wedge pattern as shown.

GOLD

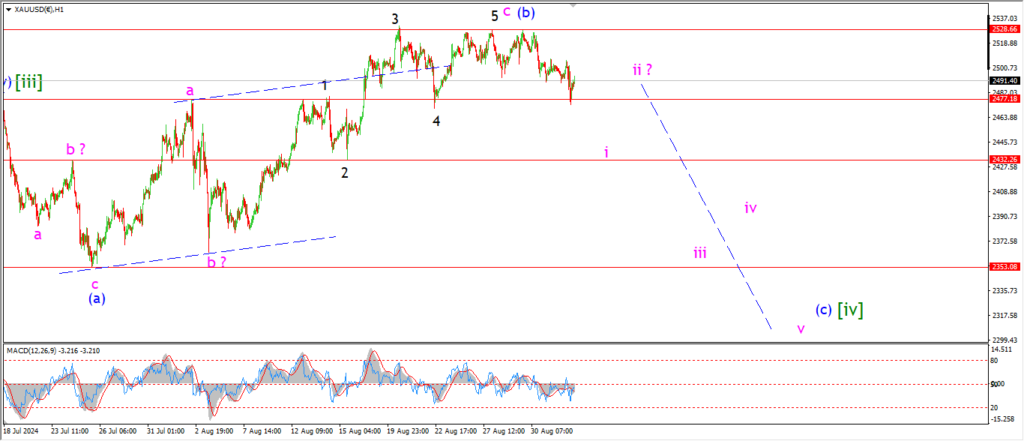

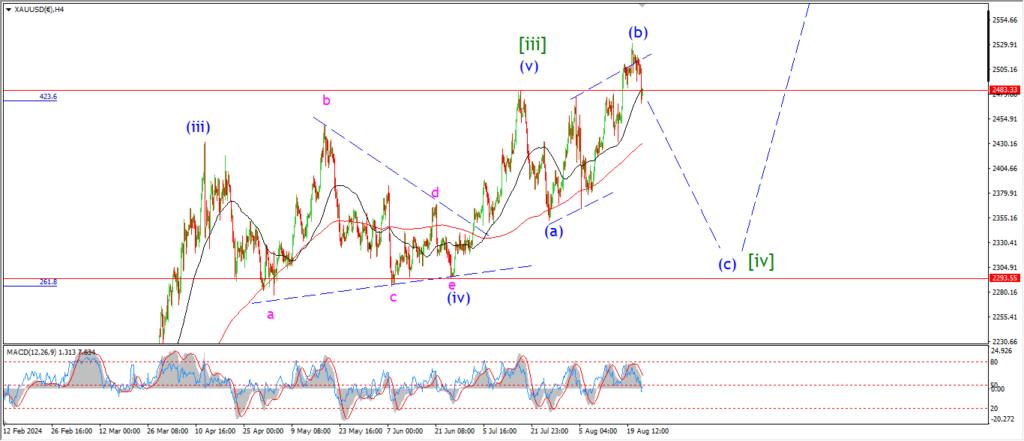

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Gold is joining the downside move today but there is not enough here to signal wave (c) is underway yet.

The internal pattern of this decline is in five waves it seems,

we need to see some follow through to confirm wave (c) has begun though.

The previous wave ‘a’ high at 2477 has acted as support for this pattern twice now,

so,

if we see a solid break down below that level again that will add to the picture that is developing here.

It will be a very interesting week ahead if the market continues lower into wave (c) of [iv].

Tomorrow;

watch for wave ‘i’ and ‘ii’ to form a lower high as shown to begin wave (c).

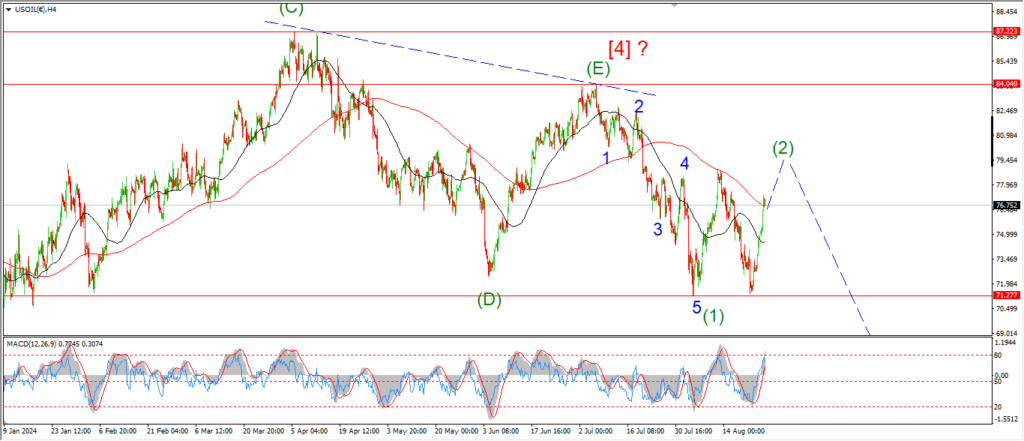

CRUDE OIL.

CRUDE OIL 1hr.

Ok todays move has opened up another possible count for wave (2) green.

I was looking at a flat correction for wave (2) on Friday,

wave ‘C’ was expected to continue higher this week in that scenario.

This idea has been invalidated now.

And there is two main possibilities.

Wave (2) is complete as a running flat at 77.30 and wave ‘1’ of (3) is now underway.

Or,

wave (2) is tracing out an expanded flat correction,

and the current low is in wave ‘B’ of (2) as per the alternate count.

Tomorrow;

If we see a five wave pattern to complete at a new low this week,

that will signal wave ‘1’ of (3) is complete.

Watch for wave [iv] to correct higher tomorrow.

S&P 500.

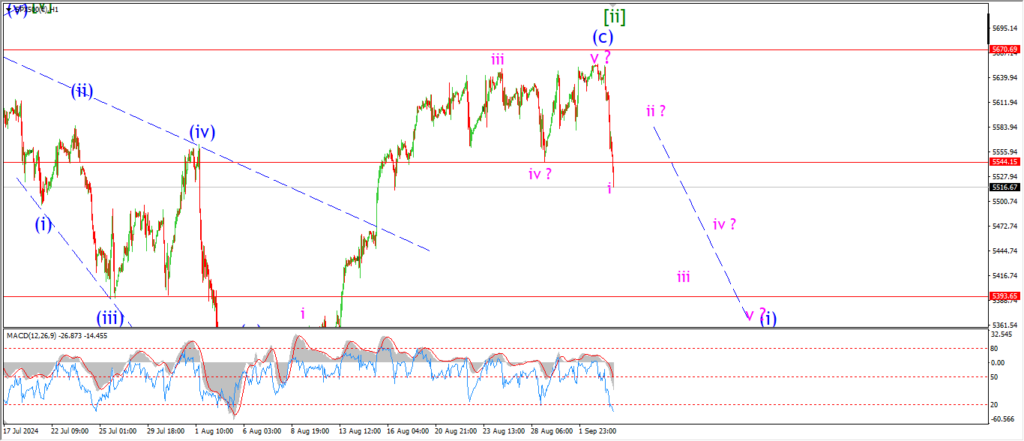

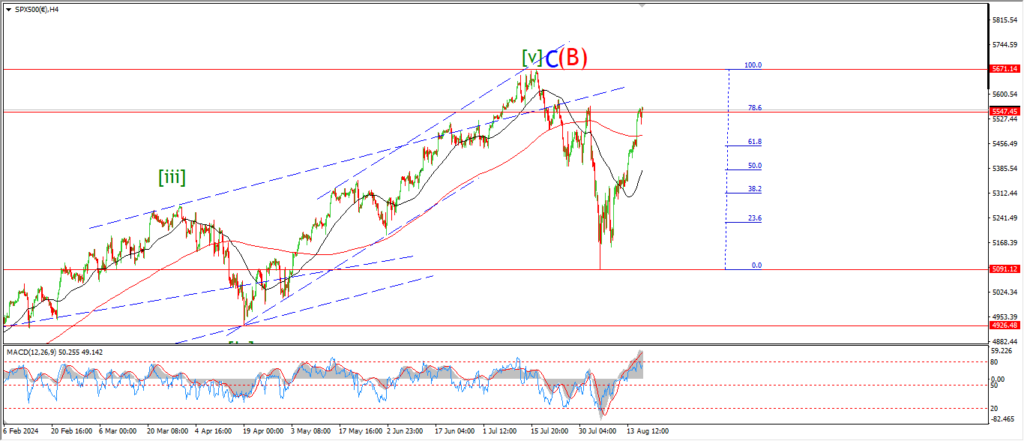

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

Well,

that’s a pretty good rejection below the all time high today.

And the decline looks very impulsive too.

Despite all the opportunity to break to a new high last week,

the market did not do it!

I am going to stick with that wave [ii] lower high again today,

and the decline today is labelled as wave ‘i’ of (i) of [iii].

If this count is correct,

then we will see a solid five waves down in wave (i) blue to break 5400 again.

Tomorrow;

Watch for wave ‘ii’ to create a lower high and then drop back into wave ‘iii’ later in the week.

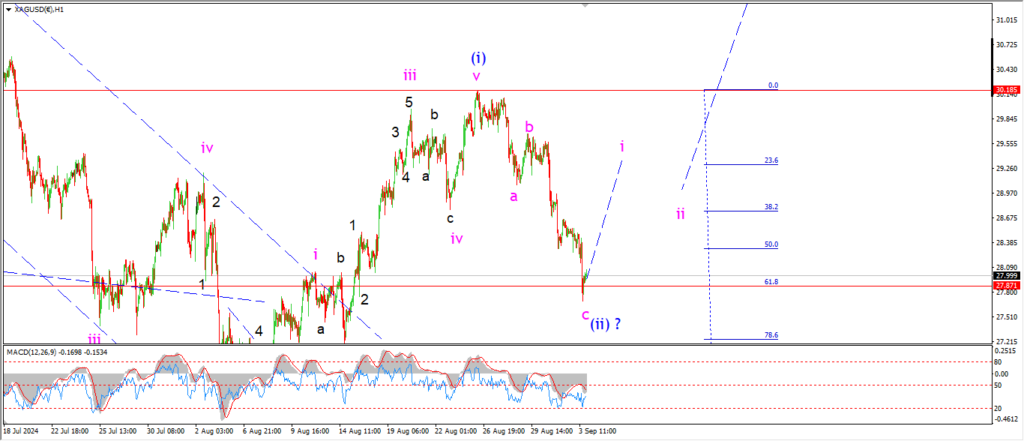

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

Silver has retraced into the 62% retracement level of wave (i) today,

Wave (ii) is labelled as complete now.

And that brings with it a possibility of a completed impulse wave off the lows at wave [ii] to begin wave [iii] green.

If wave [iii] is now in play here,

then wave (iii) of [iii] must turn higher again this week.

And that rally could in wave (iii) could easily push back above 35.00 when complete.

Tomorrow;

Watch for the lows at wave [ii] to hold at 26.44.

Wave ‘i’ of (iii) should now turn higher and carry back above 29.00 quickly.

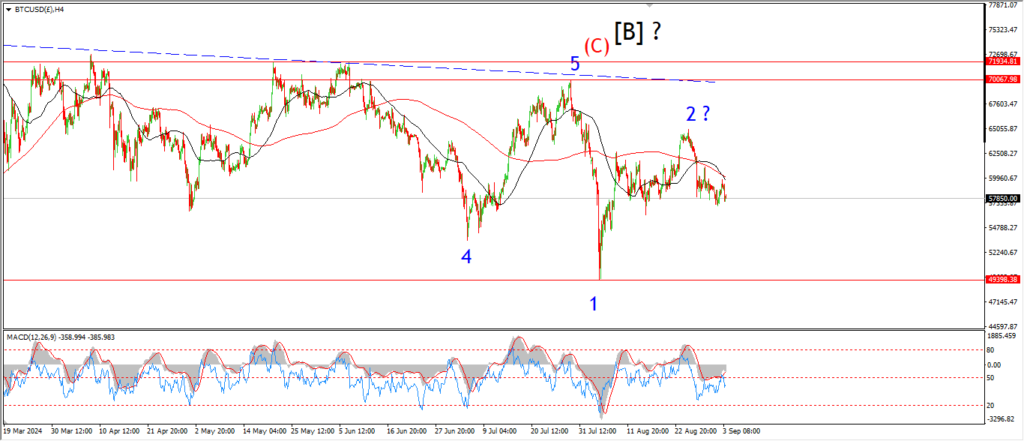

BITCOIN

BITCOIN 1hr.

….

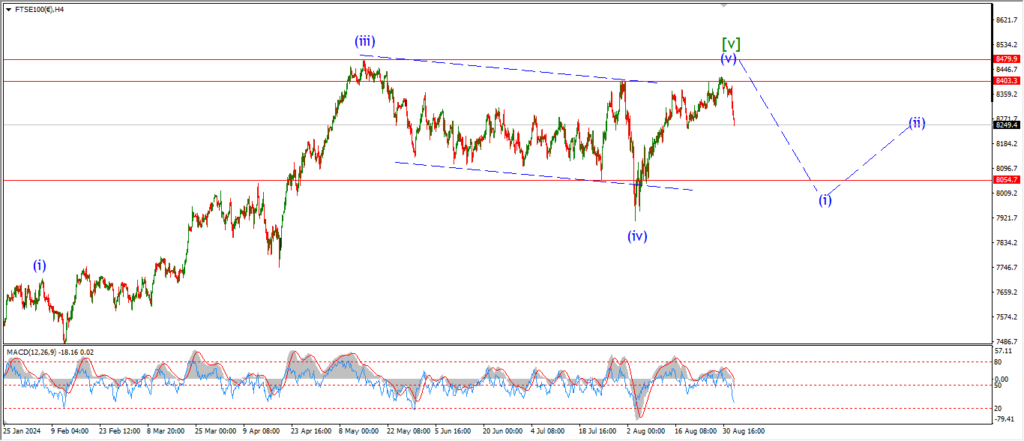

FTSE 100.

FTSE 100 1hr.

….

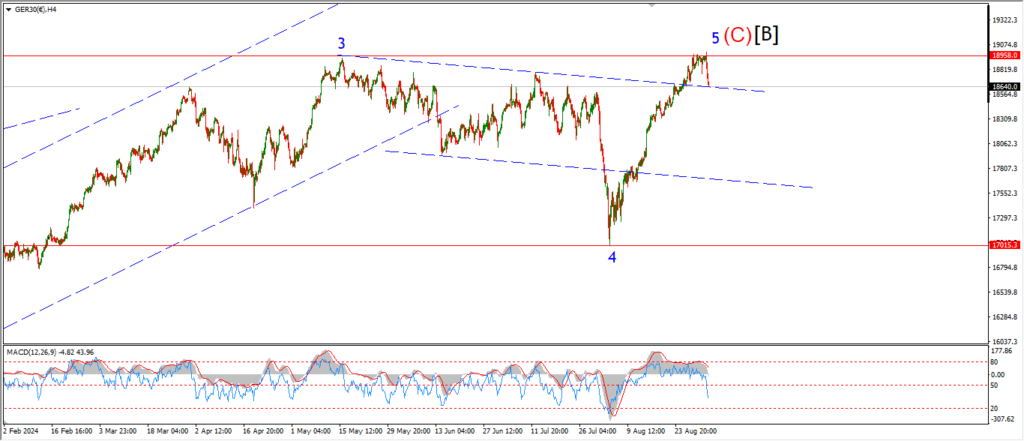

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

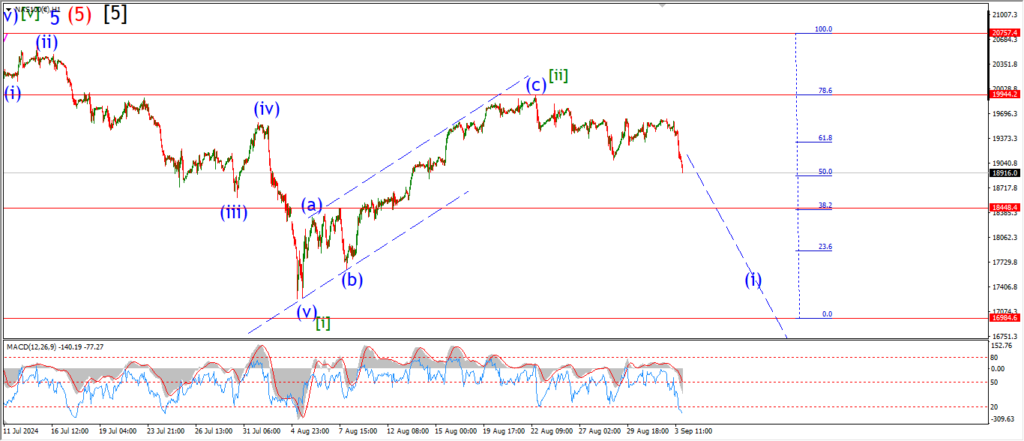

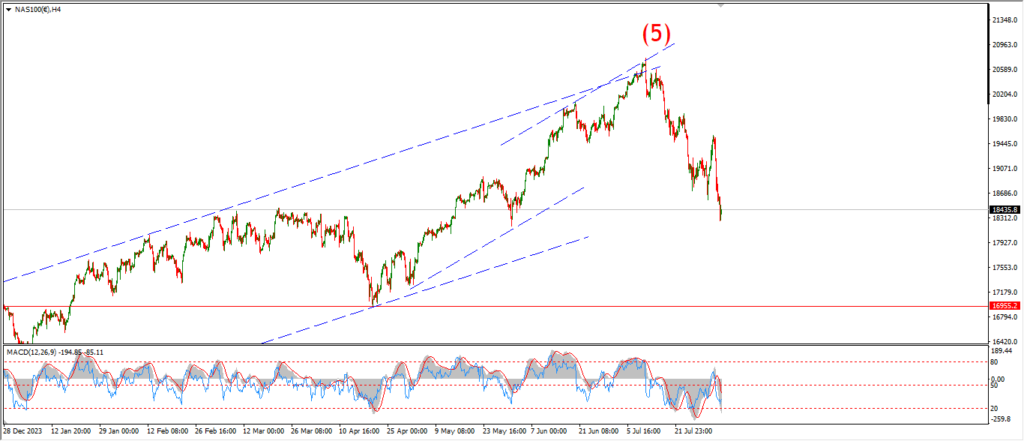

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….