Good evening folks, the Lord’s Blessings to you all.

‘Growth Scare’ Narrative Builds As US Factory Orders Plunge Most Since COVID Lockdowns In June

Recession Triggered: Payrolls Miss Huge, Up Just 114K As Soaring Unemployment Rate Activates “Sahm Rule” Recession

https://twitter.com/bullwavesreal

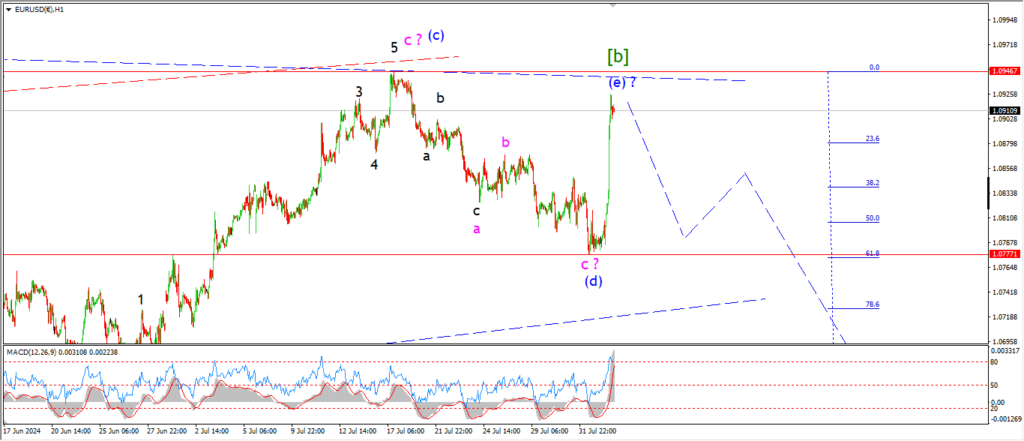

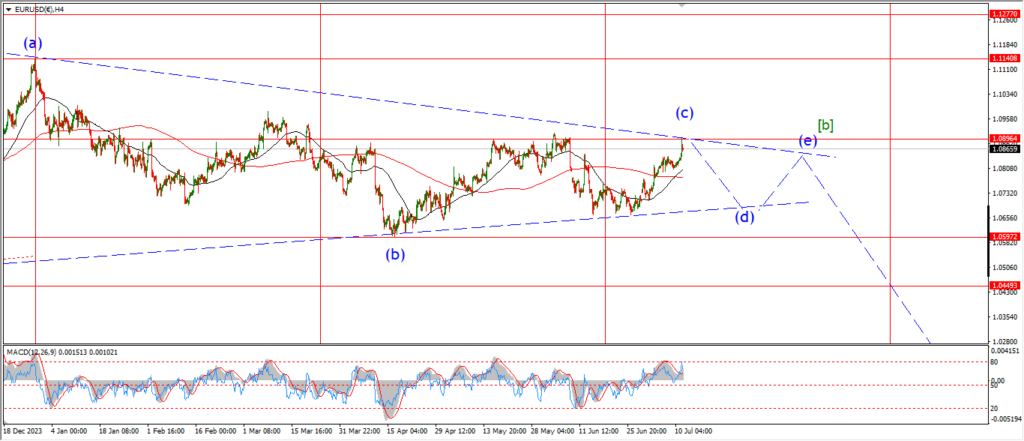

EURUSD.

EURUSD 1hr.

EURUSD 4hr.

EURUSD daily.

That was a serious rebound today.

Even though the action is very impulsive looking,

the overall pattern here is still in line with the wave count.

The triangle in wave [b] will remain as the main count as long as the high at 1.0946 holds.

Wave (e) is labelled as complete at the high today.

And that means the triangle is over.

We should expect a decline into wave [c] to begin very soon.

Monday;

Watch for wave [b] to hold below 1.0946.

That level must not break if this wave count is correct.

WAve (i) of [c] should now turn lower to break the previous wave (d) low at 1.0777.

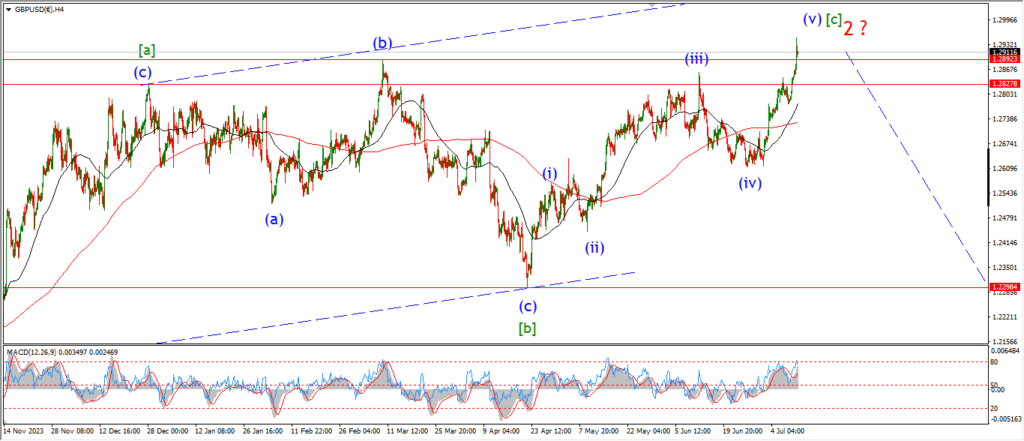

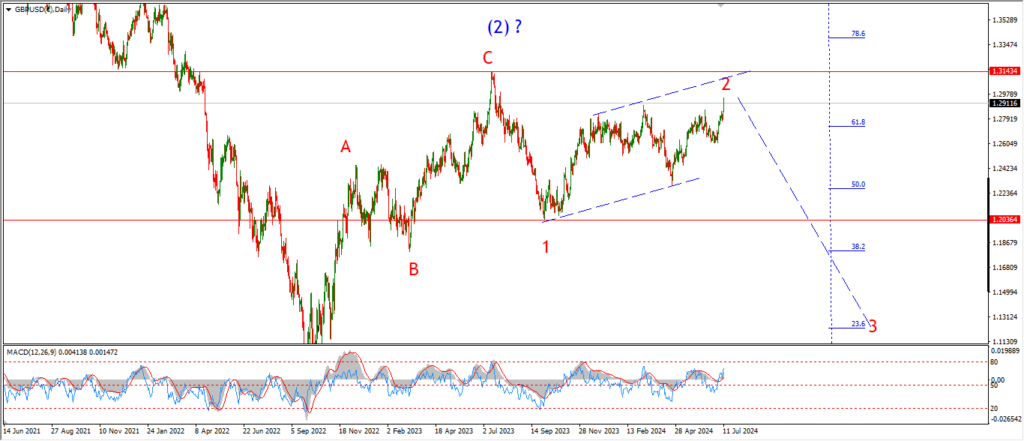

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

Cable rallied today to begin wave (ii) blue

todays top is labelled wave ‘a’ and now the price has turned lower into wave ‘b’.

Wave ‘c’ and wave (ii) should complete by midweek next week if all goes to plan.

Monday;

Watch for wave ‘b’ to hold above 1.2707.

Wave ‘c’ should complete the correction in wave (ii) near the 1.2900 area.

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

USDJPY has dropped to a new low today in wave (v) of [a].

The internal pattern of wave (v) has now completed five waves down also.

And I suspect we will see the price turn higher early next week into wave [b] green.

I have marked the 155.00 area as the area to watch for wave [b] to complete.

This is the level of the previous wave (iv) high.

Monday;

WAtch for wave ‘v’ of (v) to complete and then a turn higher into wave (a) will begin.

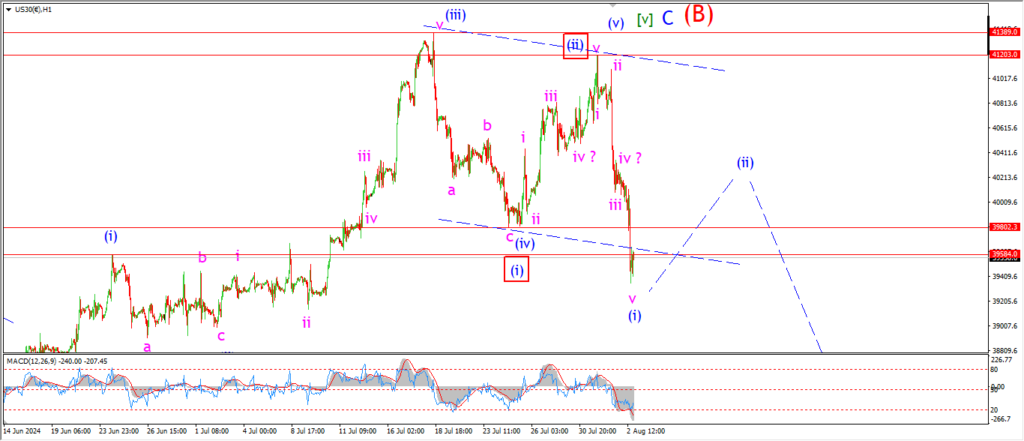

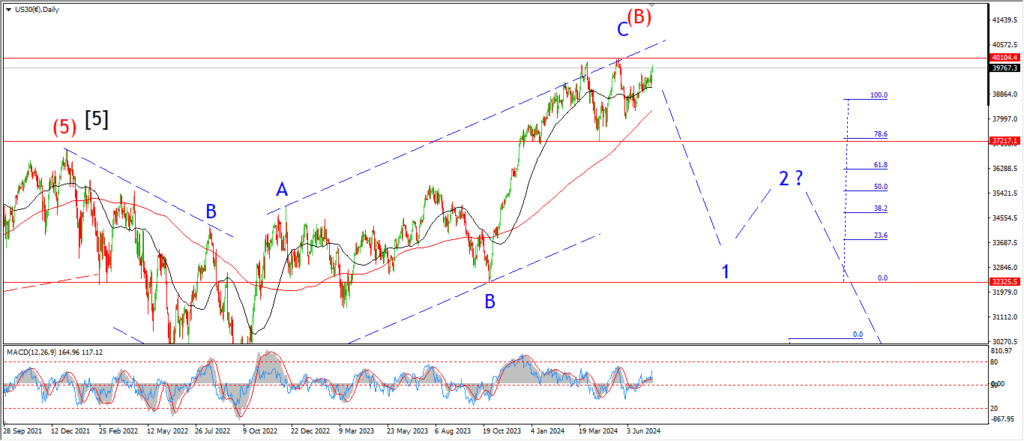

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The S&P has completed three waves down off the recent top.

this can still be viewed as a corrective pattern overall,

And because of that I still have an element of doubt here.

so I won’t get too excited about todays impulsive move lower.

I am counting this as wave (i) down to begin a possible turn lower into the bear market.

Any move higher from here must be decisively corrective.

And The earlier the correction into wave (ii) top out the better.

So a small three wave rally into the 40000 barrier again will be perfect to complete the first impulse wave lower.

Monday;

Watch for wave (i) to complete even now.

Wave (ii) will take a couple of sessions and I want to see a clearly corrective move higher overall.

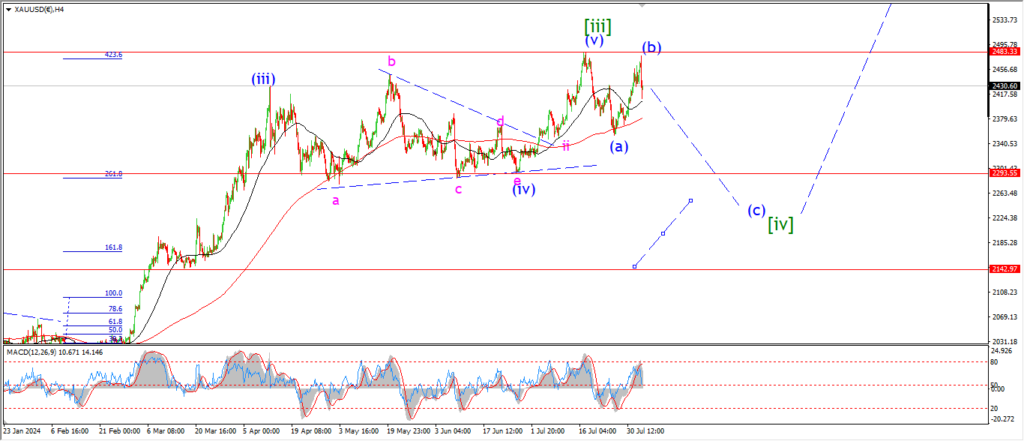

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Wave (b) got very close to hitting the previous wave [iii] highs today but that level has been solidly rejected at the moment.

I have labelled this spike lower as wave ‘i’ of (c).

Wave (c) must continue lower in five waves as shown over the coming week.

And the minimum target for wave (c) remains at 2352 at the wave (a) high.

Monday;

Watch for wave ‘ii’ to create another lower high near 2450.

Wave ‘iii’ down will then turn lower towards that lower channel line and the minimum target low at 2352.

CRUDE OIL.

CRUDE OIL 1hr.

That was quite the drop off today and it does open up a few possibilities for the short term count.

But the first thing to notice here is that the recent rally into the July highs has now been fully retraced today.

That marks a 15% drop in the crude oil price in less than a month.

The strong economy narrative has been called out by this price reversal for sure.

Even though we got a drop to a new low today,

I am going to stick with the idea that this drop is part of wave (2) green.

And wave ‘B’ of (2) has broken to that new low as part of an expanded flat correction here.

Wave ‘C’ can now rally back up towards 78.00 again in this scenario.

If the declines continue on Monday and the rally does not begin,

then I will reconsider the count in wave (2).

Monday;

Watch for wave ‘B’ to hold at a nearby low.

wave ‘C’ should then turn higher towards 78.50 in five waves.

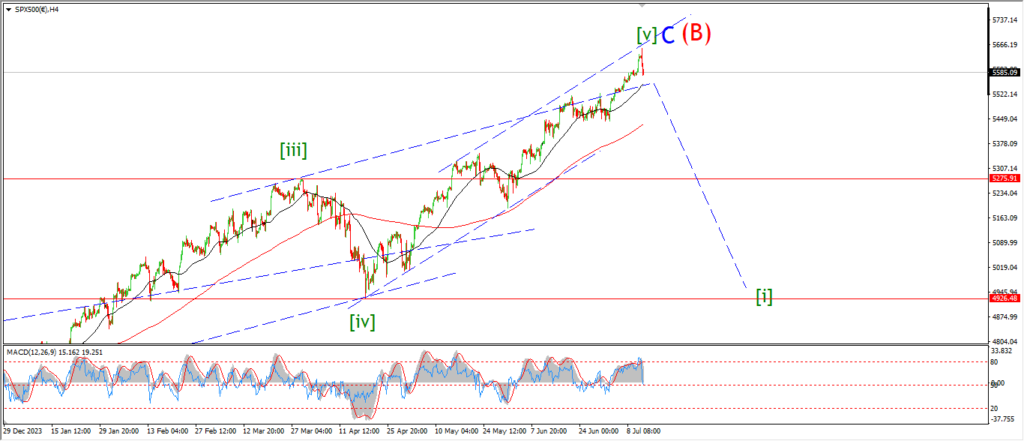

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The action today has continued the drop off into wave (iii) blue.

The decline in wave (iii) has not traced out five waves yet,

so I am suggesting that wave (iii) has more left in it to complete that five wave pattern.

The minimum target for wave (iii) lies at 5286 where it reaches equality with wave (iii).

We will see early next week if that pans out how I suggested.

Monday;

watch for wave (iii) to complete five waves down over the coming days.

The 162% Fibonacci extension lies at 5116 and that is an ideal target for this next move in wave (iii).

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

The action today ruled out last nights count,

but,

Silver has hit a possible higher low in wave ‘ii’ again this evening,

but the market has failed to give us the rally into wave ‘iii’ yet.

The low at wave [ii] at 27.30 is becoming more important now.

A higher low must hold here.

If we see another break of that wave [ii] level then I will be going back to the drawing board again.

then we could be looking at the next lower support at 25.90 to complete wave [ii].

Monday;

Watch for the recent low to hold at wave [ii].

Wave (i) of [iii] must turn higher in five waves as shown.

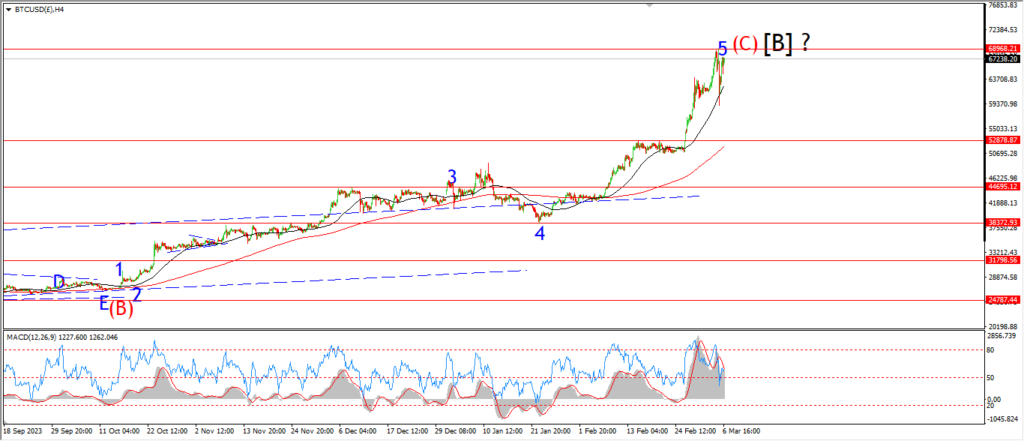

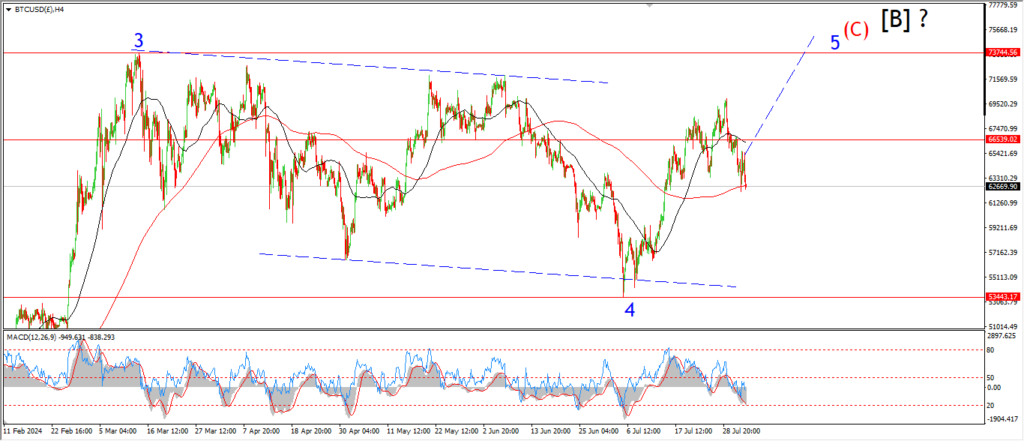

BITCOIN

BITCOIN 1hr.

….

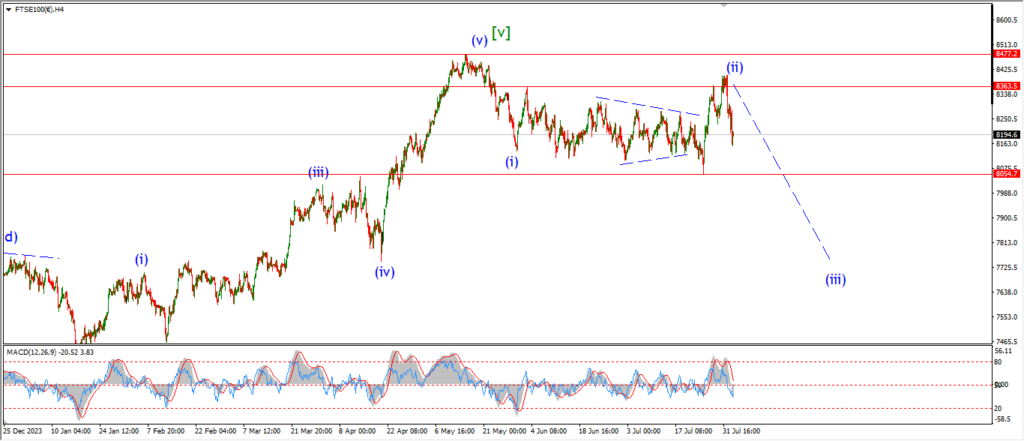

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

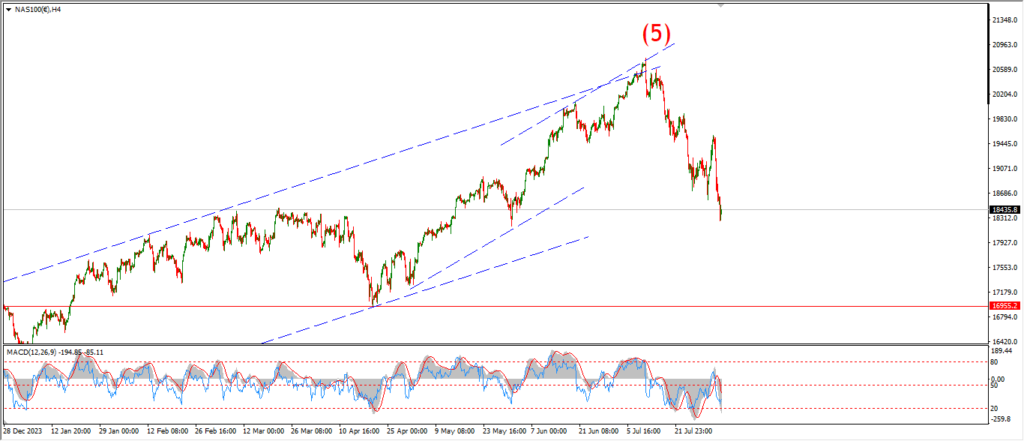

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….