Good evening folks and the Lord’s blessings to you.

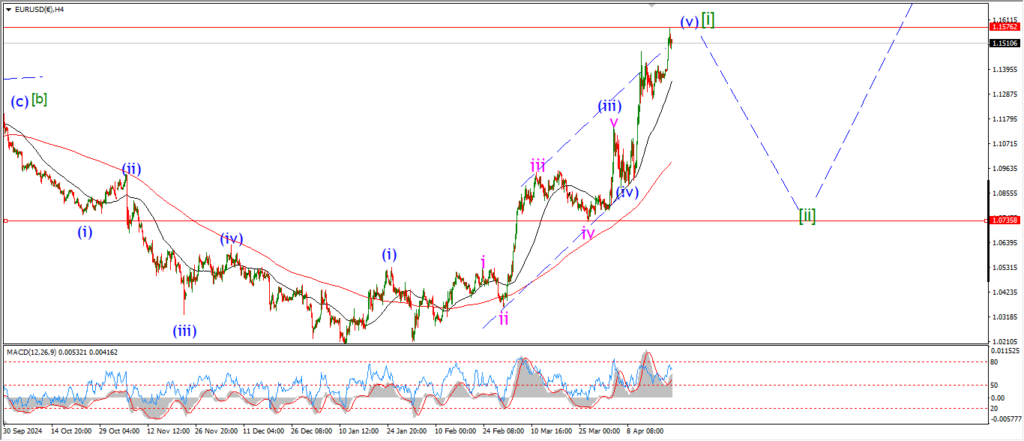

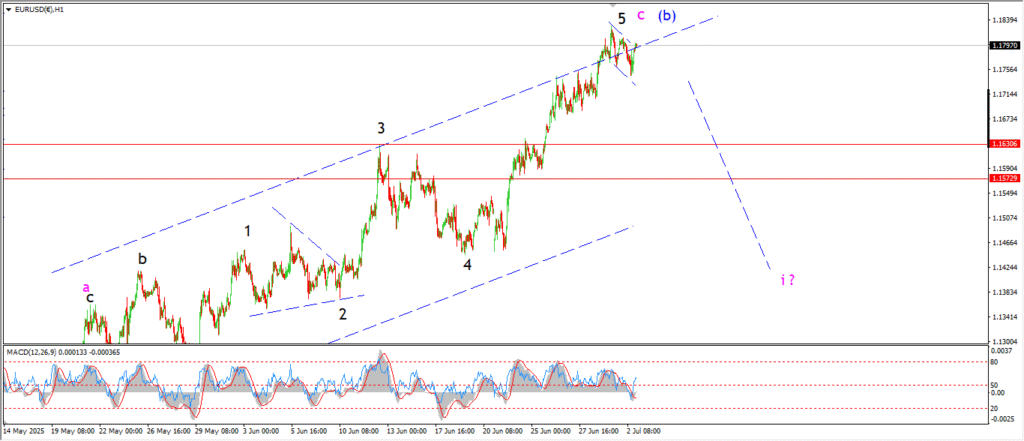

EURUSD

EURUSD 1hr.

Talk about waiting for a star to fall eh!

EURUSD has traced out three waves down in a channel today and bounced out of that lower line again.

This action is corrective for the moment so it seems that wave ‘c’ will stretch a little further before creating a top in wave ‘c’ of (b).

The upper channel line is acting as a magnet for the action over the last week.

We have a throw over in place at the high,

but it seems we will get another attempt before turning into wave ‘i’ down.

Tomorrow;

Watch for a push to a new high in wave ‘c’ of (b),

and then a turn down into wave ‘i’ should come before the end of the week.

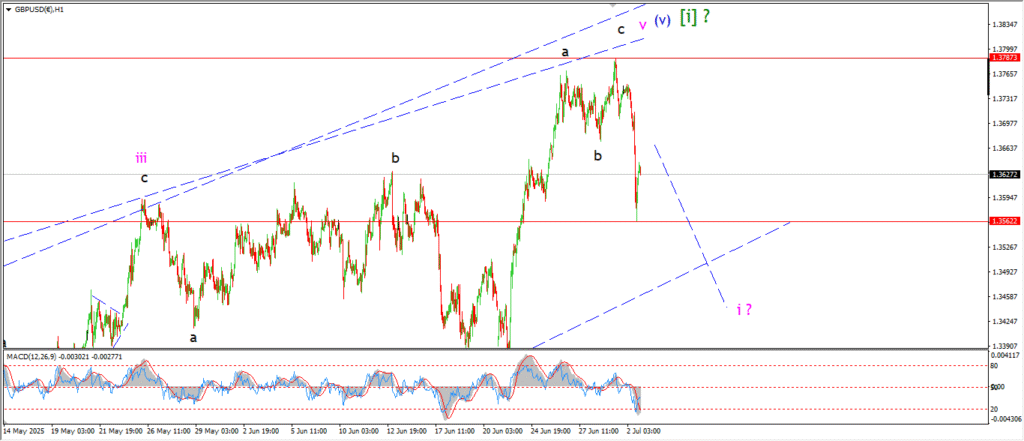

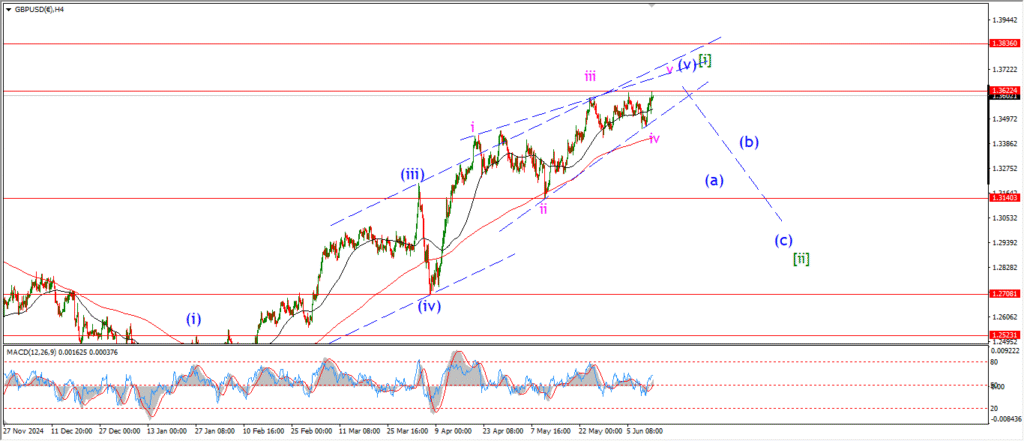

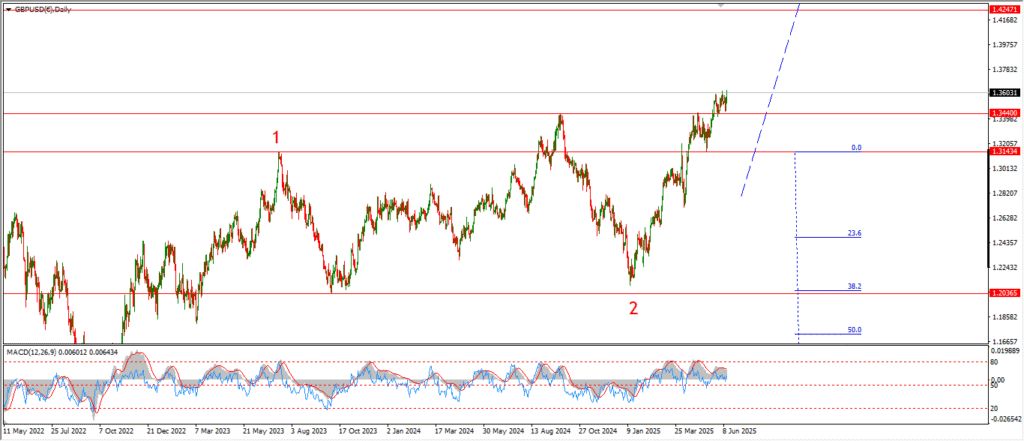

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

Cable turned sharply lower today and the price broke below the previous wave ‘iii’ high at 1.3595.

There is a good chance that we have a top in place for wave ‘v’ now.

The only caveat I will add here is this,

the price has only traced out three waves down so far

Wave ‘i’ will require another step lower as shown,

with a break of the 1.3500 level as a reasonable target.

Tomorrow;

Watch for a drop into 1.35 to complete wave ‘i’ down which should begin the larger wave [ii] finally.

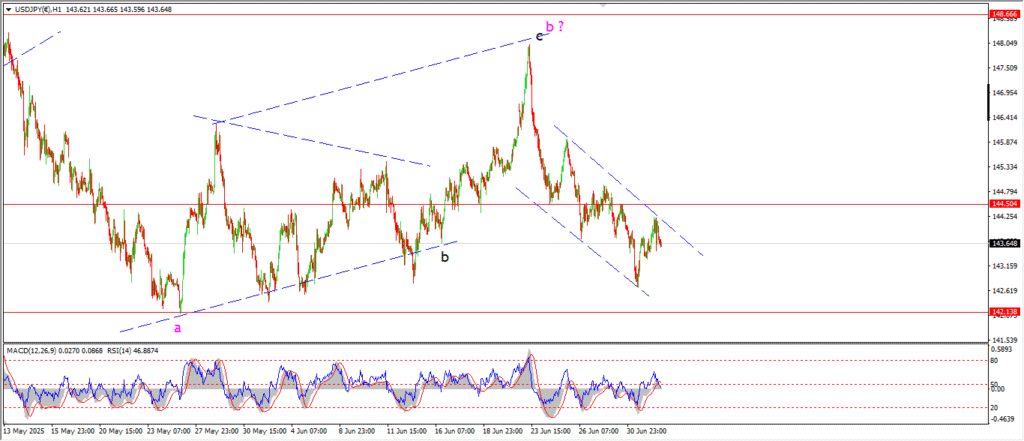

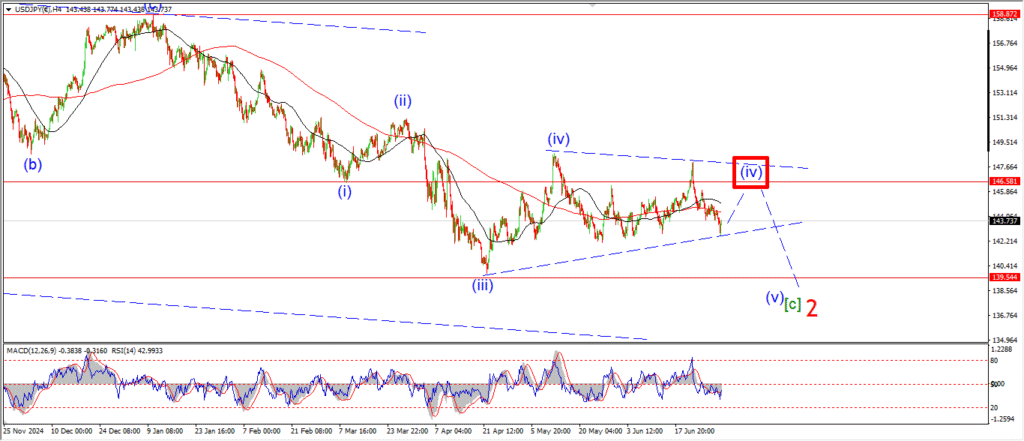

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

There is nothing ideal about the action in USDJPY lately,

and because of the irregular action I am moving towards that alternate idea for wave (iv) more every day.

Today was no different.

We have a three wave rise off this weeks lows that has been largely retraced again today.

This action suggests another corrective move higher,

which in turn suggests a rise in a possible wave ‘e’ of (iv).

I am going to give the main pattern one more day to see if it comes back into force again,

but,

If the price moves higher in a corrective manner towards 146.00 in the coming days,

that will favor the triangle idea in wave (iv).

Tomorrow;

The price must drop back below 142.00 in an impulsive manner to call favor the main count.

144.50 must hold.

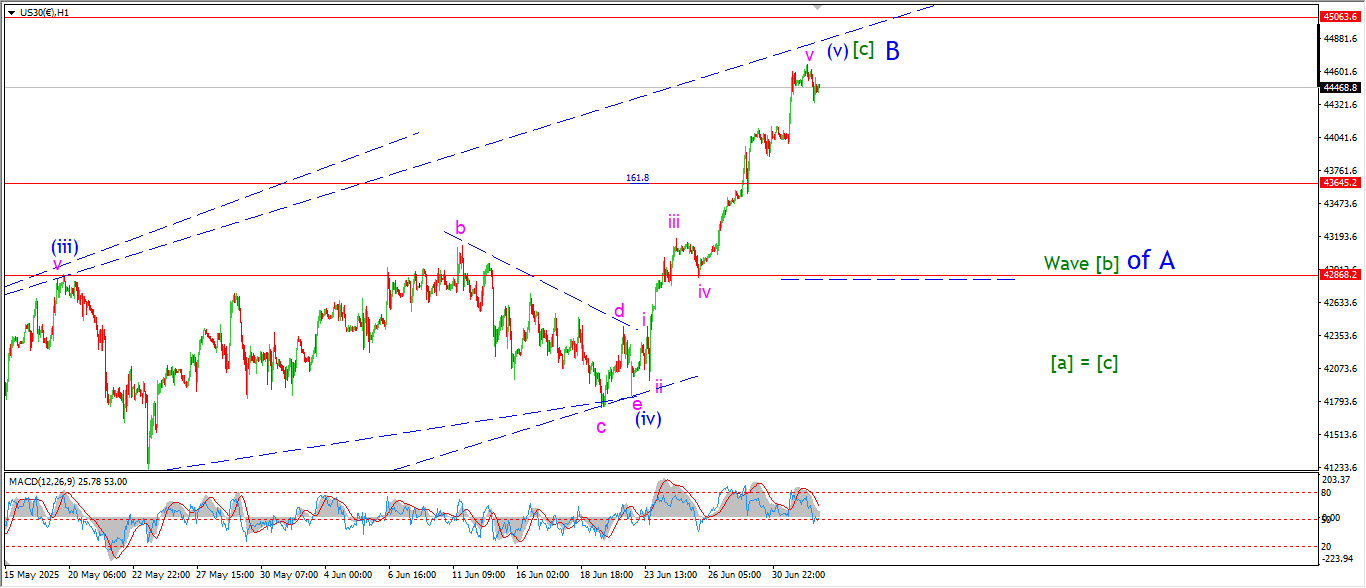

DOW JONES.

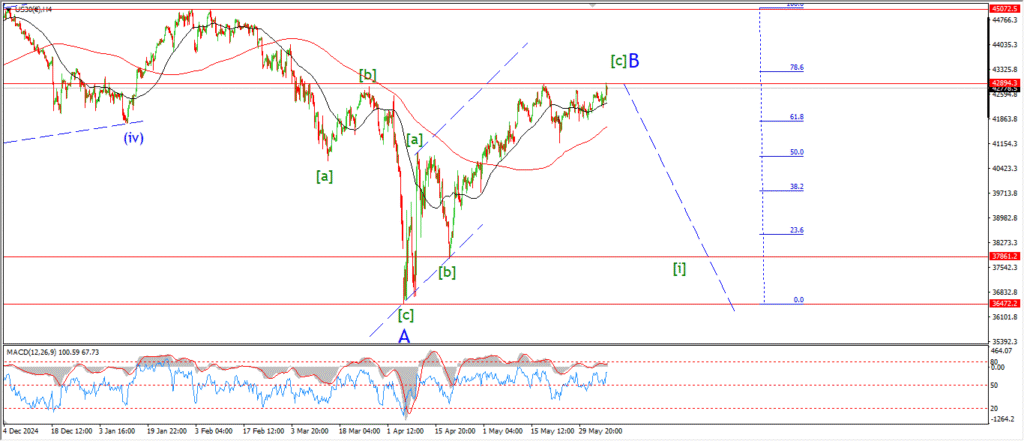

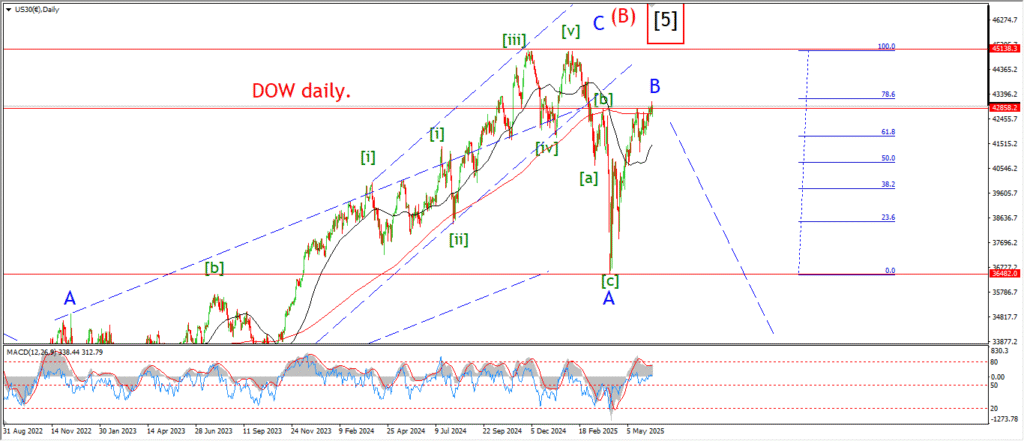

DOW 1hr.

DOW 4hr

DOW daily.

We have a slight weakness in the trade today.

the market is off the highs as we approach the all time high again.

The upper trend line lies just above the high today,

so,

I can only hope that this action begins to form a top here.

This remains to be seen

Tomorrow;

There has been a 7% rally in the last 10 days.

that’s not unprecedented,

but it has happened almost without a question.

This is comparable to the initial rally off the April lows when the great tariff chicken out happened.

Here we are back near the highs again,

and the tariffs are back on the table for next week.

That is going to be interesting for sure.

I can only say I will be watching how the market acts this close to the highs to see if we can reject the top and reverse with intent to the downside again.

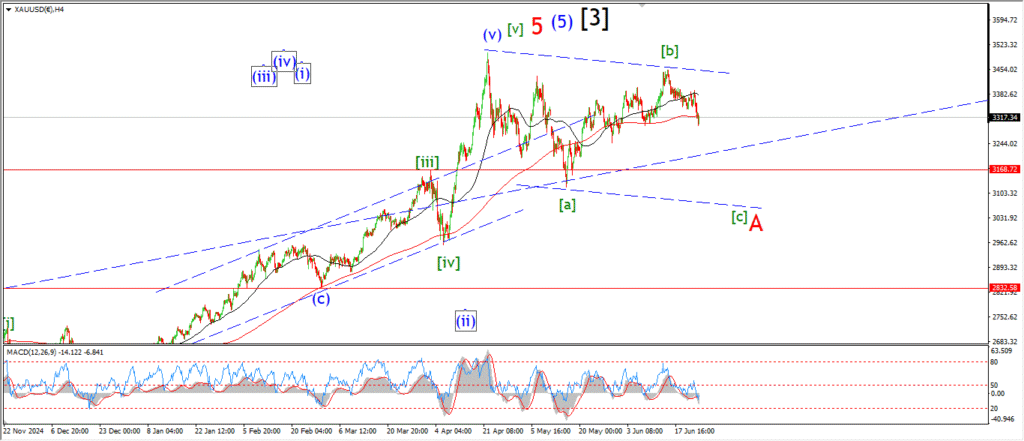

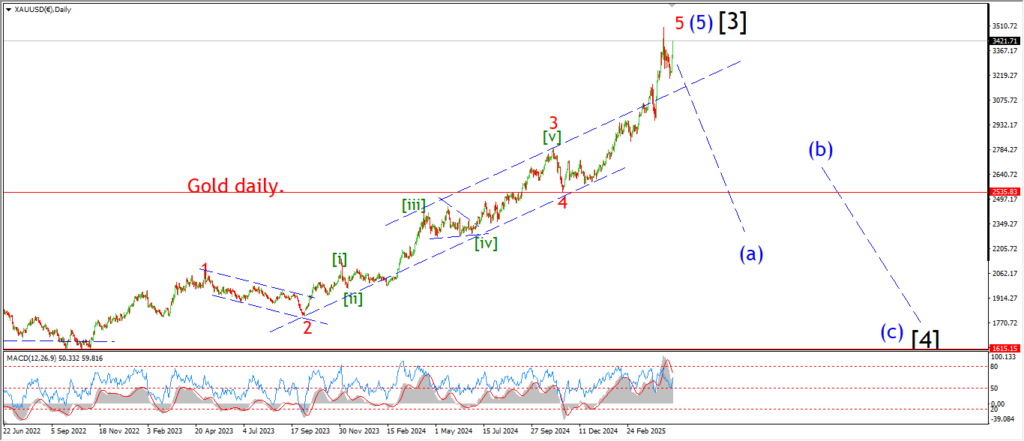

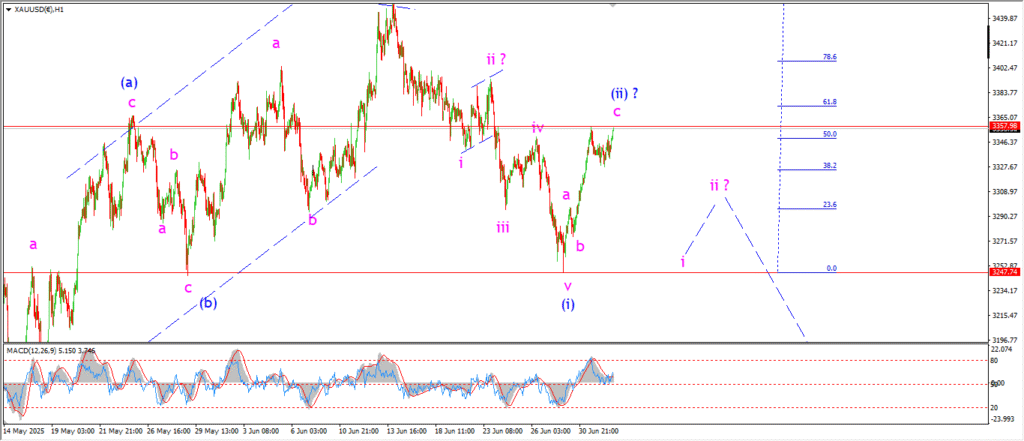

GOLD

GOLD 1hr.

Gold is holding just above the 50% retracement level today,

and it seems the market is still weighing the prospects for the outcome at the moment.

I can stick with the wave (ii) count for the moment,

but I want to see a turn into wave ‘i’ again pretty soon in order to confirm this idea.

It is possible also that wave (ii) is working out a larger pattern here,

but we wont know that until next week I suspect given that the market is closed on Friday.

The count stands,

but proof is now required.

tomorrow;

Watch for a turn into wave ‘i’ with a break below 3300 again.

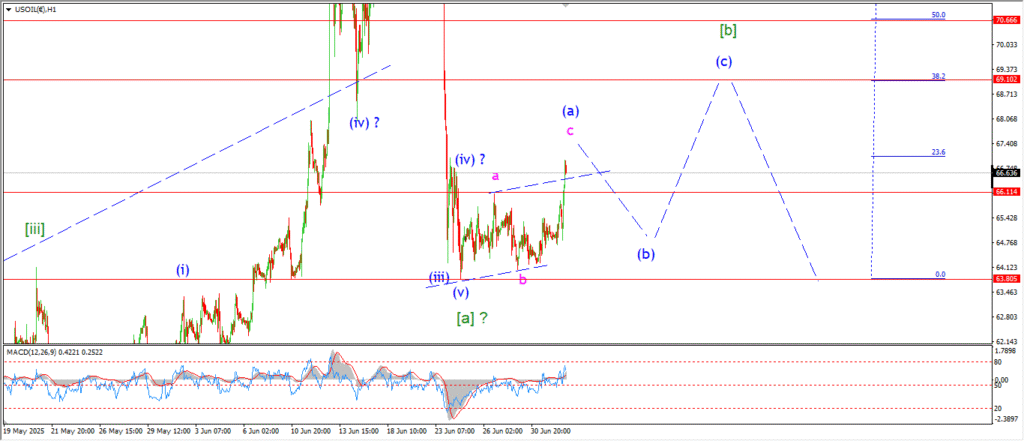

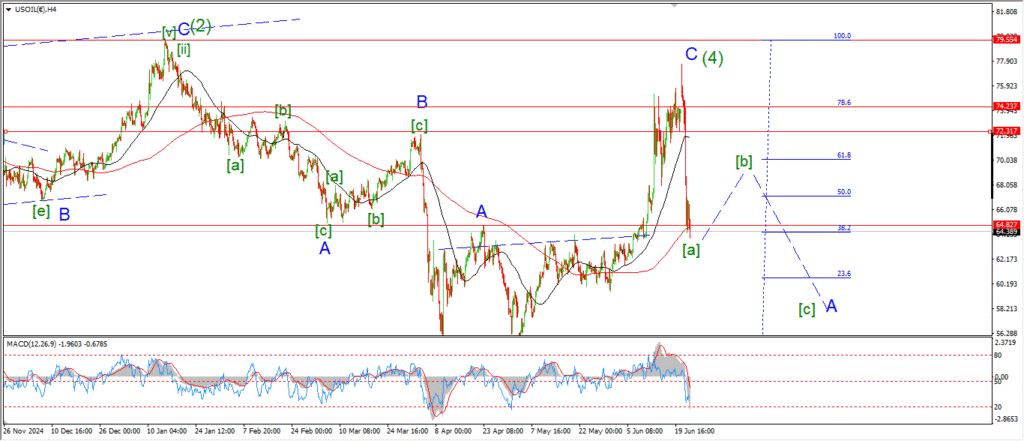

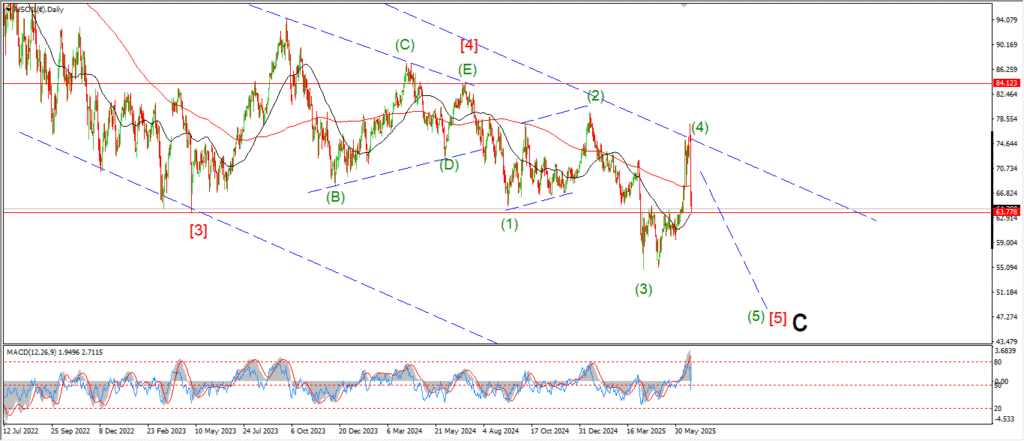

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

The pattern has changed this evening with a late rally above 66.00.

I am now suggesting that wave [b] is underway here,

and the price has just traced out three waves up in wave (a) of [b].

we will see a turn lower in three waves again into wave (b) over the coming days in this scenario.

And wave (b) should complete above 63.80 again.

Wave [b] should hit the 38% retracement of wave [a] at a minimum at 69.10.

Tomorrow;

Wave ‘c’ has already broken above the small trend channel so lets see if wave (b) can turn lower by tomorrow evening.

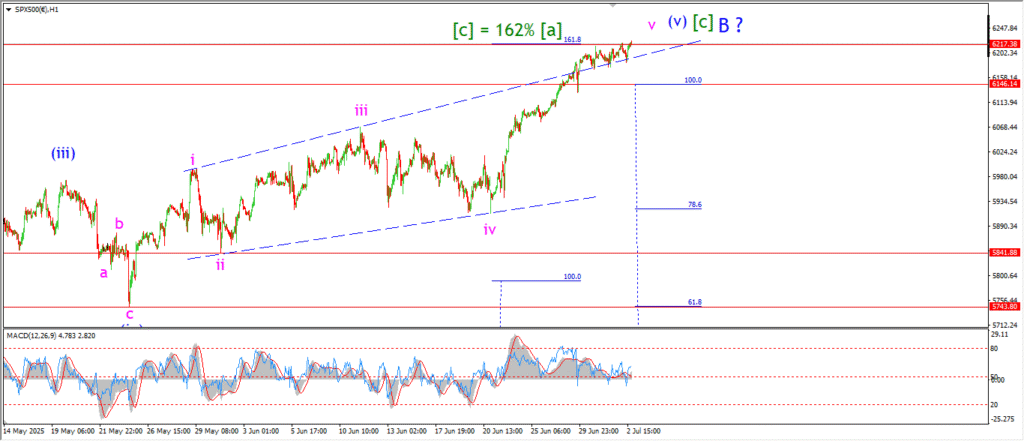

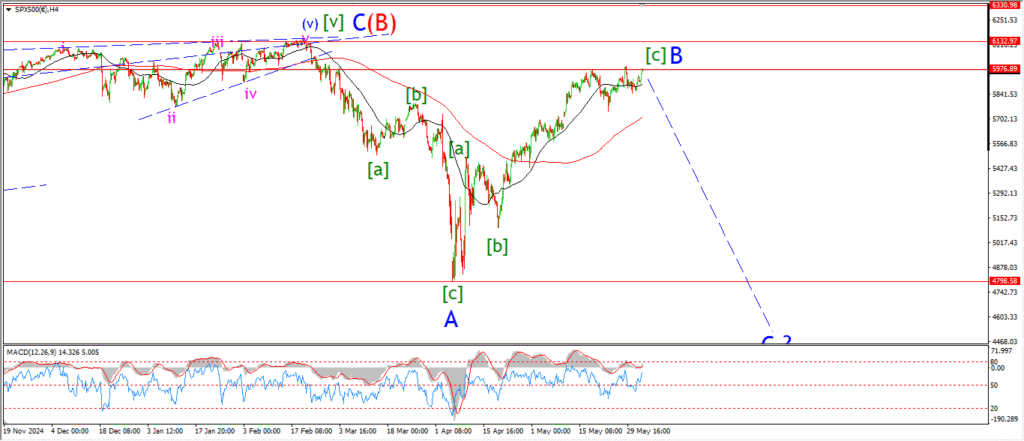

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The market has basically topped out at the highs this week.

The upper trend line of that expanding wedge is acting as a support here.

And the market is going to finish this holiday week near a high it seems.

So I don’t expect a turn lower in any meaningful way this week.

Tomorrow;

Lets see if this top can be proved as wave ‘v’ by holding in this tight range,

or even turning back to break below the upper trend line as a hint of a top.

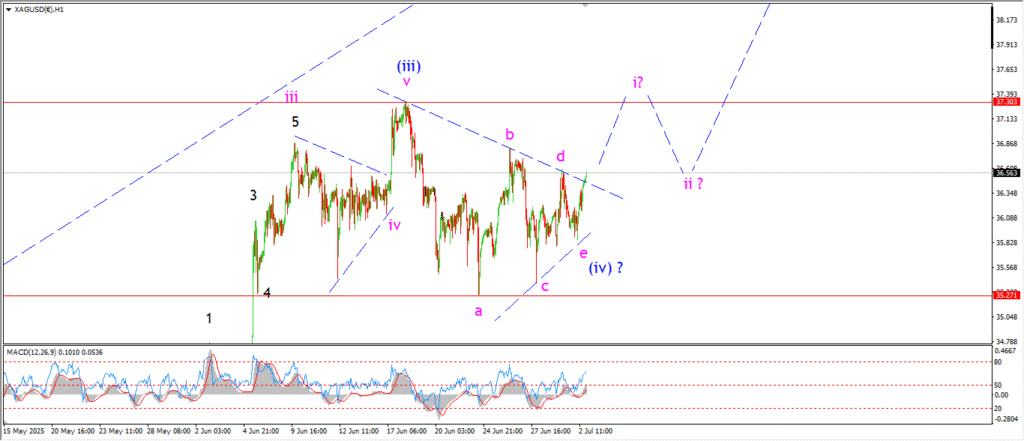

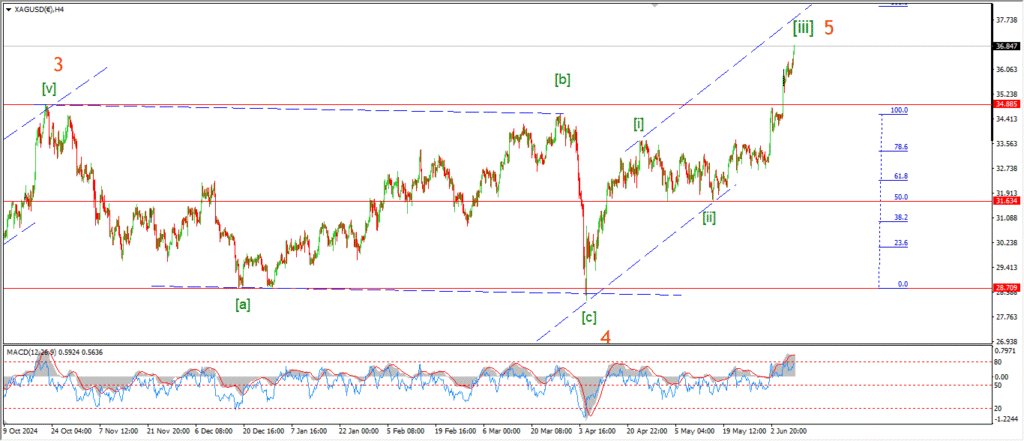

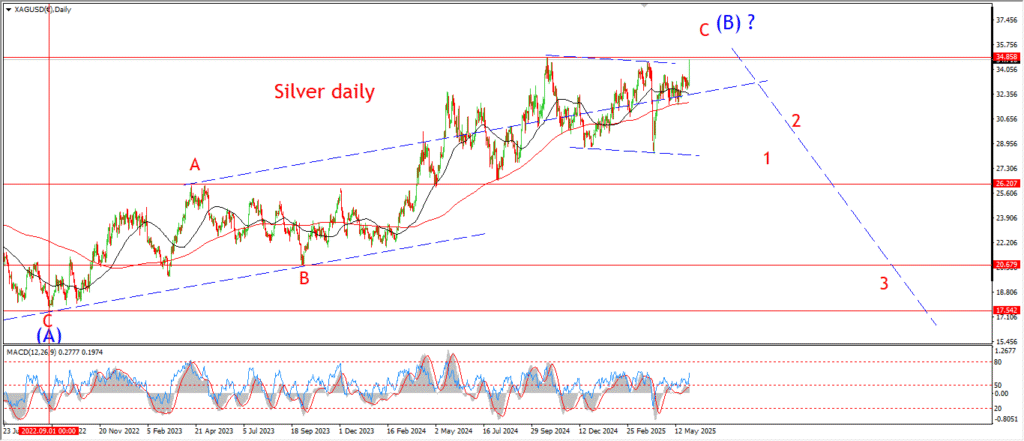

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

I am looking at another possibility for wave (iv) this evening.

The price has pushed back out of the recent decline and this action is pointing to a possible triangle pattern for wave (iv) now.

Wave ‘e’ of (iv) completed at todays low.

and now a turn higher into wave ‘i’ of (v) is on the cards.

Tomorrow;

Watch for wave ‘i’ to push up to the recent highs at 37.30 again in five waves to confirm that wave (v) is underway.