Good evening folks and the Lord’s blessings to you.

Here it is for those who are interested.

Daniel 10.4

Daniel the prophet is on the banks of the Tigris river and sees a vision of the Messiah.

4 On the twenty-fourth day of the first month, as I was standing on the bank of the great river, the Tigris, 5 I looked up and there before me was a man dressed in linen, with a belt of fine gold from Uphaz around his waist.

The Messiah tells him of a war with the Prince of Persia where he was delayed by 21 days fighting the Prince of Persia.

13 But the prince of the Persian kingdom resisted me twenty-one days. Then Michael, one of the chief princes, came to help me, because I was detained there with the king of Persia.

The Messiah then tells Daniel that He must go back to fight the Prince of Persia and the Prince of ‘Javan’ will then come to battle.

Here is the connection.

The Iran Israel War started on June 13th.

It lasted until June 24th, with a cease fire coming into effect.

The 24th day of the month!

Persia resisted the Messiah for 21days and then He had to go back and fight Persia again.

June 13th plus 21 days is July 4th.

If this war begins again on July 4th, then we are in for something major that will also involve Turkey, which is the area of ancient ‘Javan’.

This is the reason I do not trust what is going on here with ceasefires and talks of ‘peace’.

When they say peace and safety sudden destruction will come upon them.

On with the show

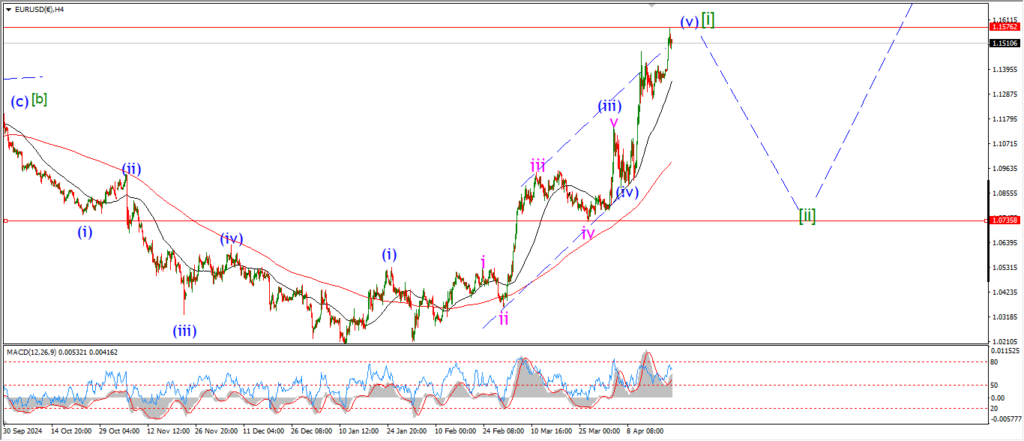

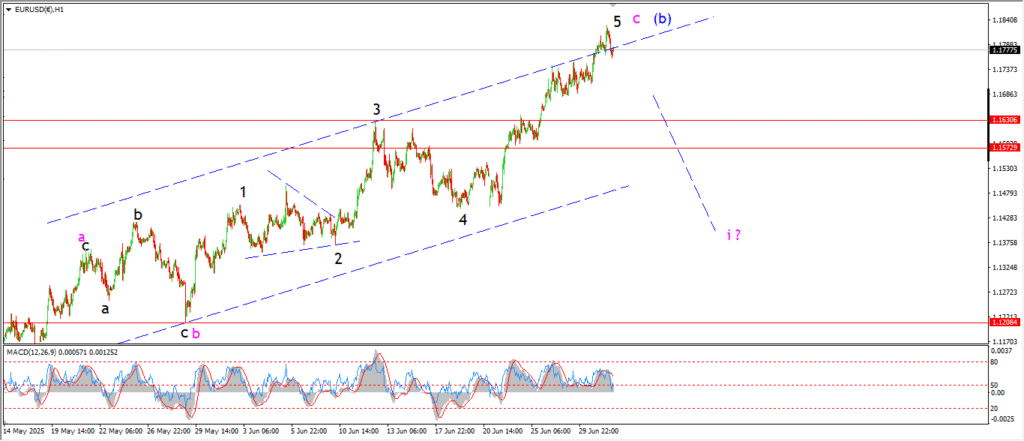

EURUSD

EURUSD 1hr.

Wave ‘5’ of ‘c’ of (b) has topped out above the upper trend channel line today.

That gives us a throw over in place for a fifth wave top.

and now a small reversal back into the channel is in play this evening.

There is a significant band of support starting at 1.1630 at the wave ‘3’ high.

And below that the wave [i] top lies at 1.1573.

If we see a break below that support band,

then we have a good chance that wave (c) of [ii] has begun.

Tomorrow;

Lets see if that turn into wave ‘i’ of (c) can begin with a drop into 1.1630.

GBPUSD

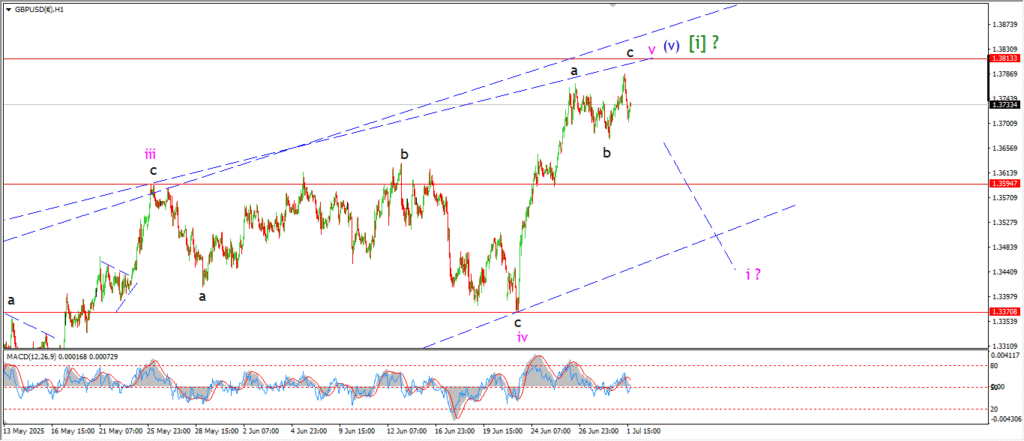

GBPUSD 1hr.

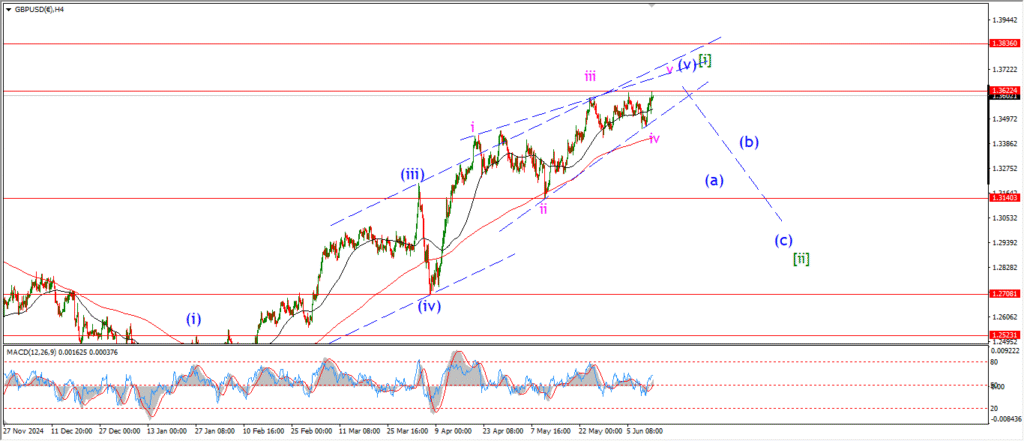

GBPUSD 4hr.

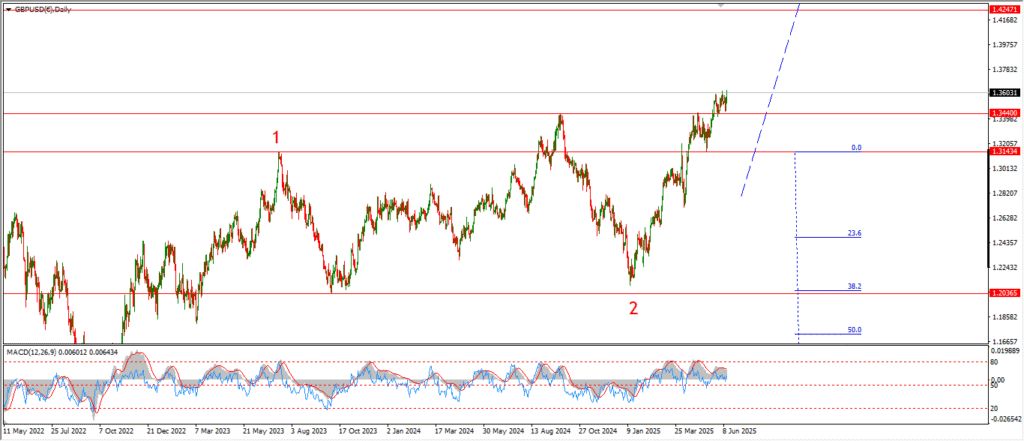

GBPUSD daily.

Cable has turned lower today off a possible high in wave ‘v’ of (v) again.

The price must fall much further to confirm a top in wave [i],

and a turn into wave [ii].

But for now,

I am looking for the initial drop into wave (a) to begin.

Tomorrow;

If we see a break below the previous wave ‘iii’ top at 135.95 then the door will open for wave ‘i’ down.

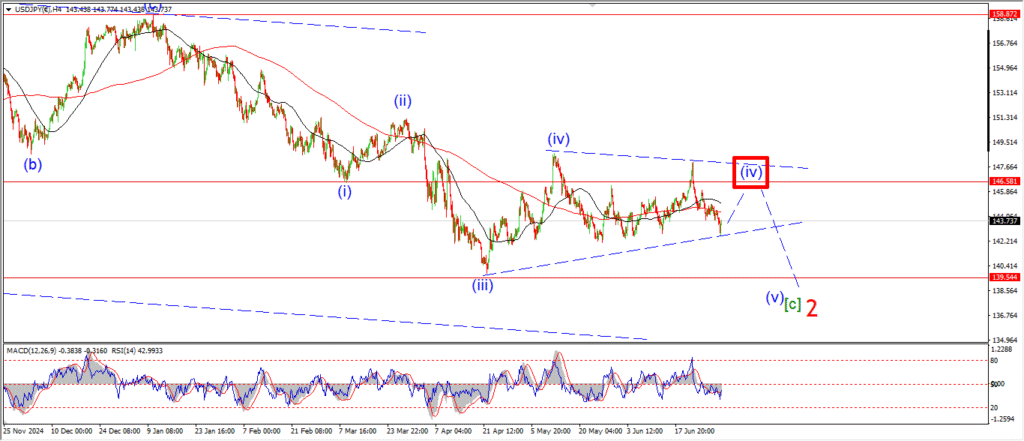

USDJPY.

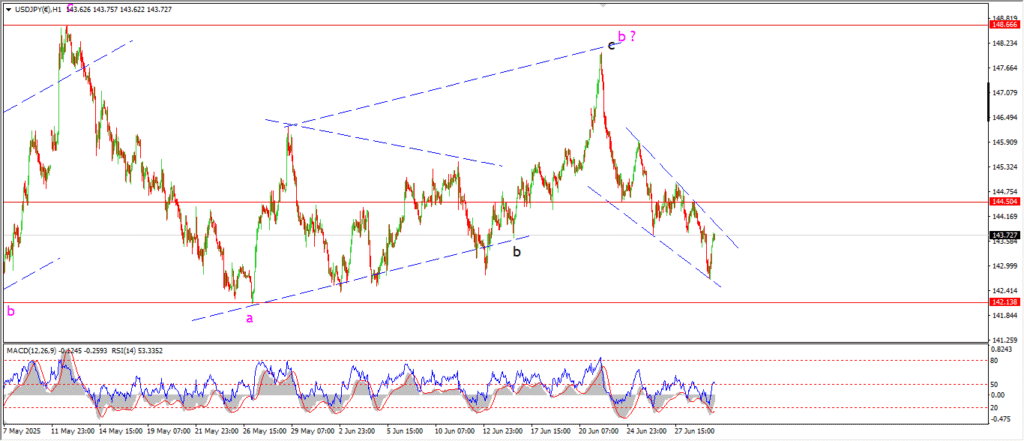

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

If we take a look at the 4hr chart first tonight you can see there is a viable alternate idea for wave (iv) now.

The action over the last week is still biased to the downside,

but given that we saw a spike higher today,

I think it is worth considering a possible alternate for wave (iv).

If the triangle is in play here,

then we will see a rally in wave ‘e’ of (iv).

And wave ‘e’ should top out below 146.58.

that level marks the wave (i) low.

From there wave (v) will turn lower again in five waves to break 139.54.

Tomorrow;

If we see a break of 144.50 that will trigger the alternate count for wave (iv).

If not,

then wave ‘c’ of (v) is still in play here.

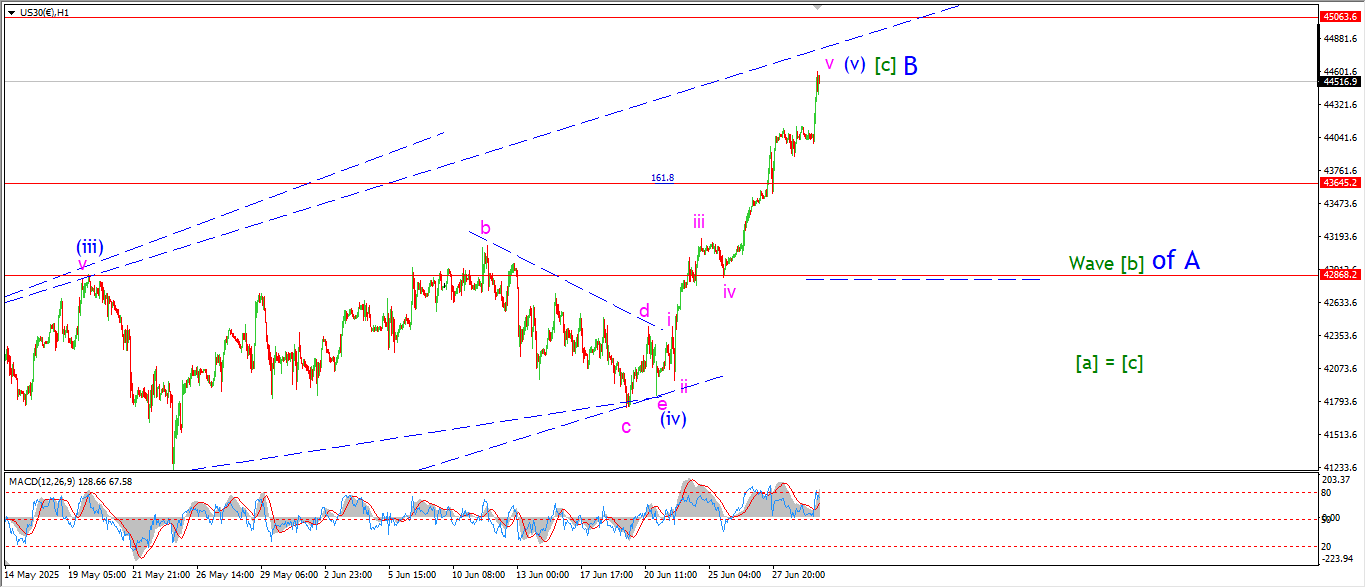

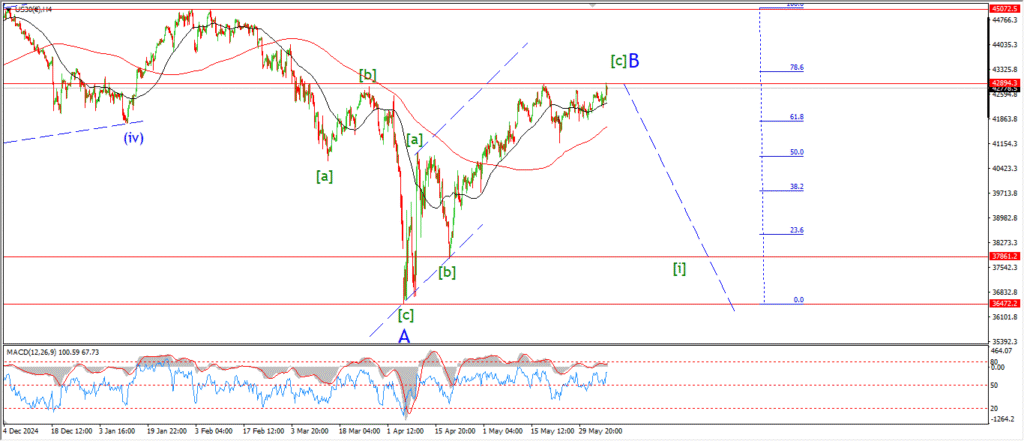

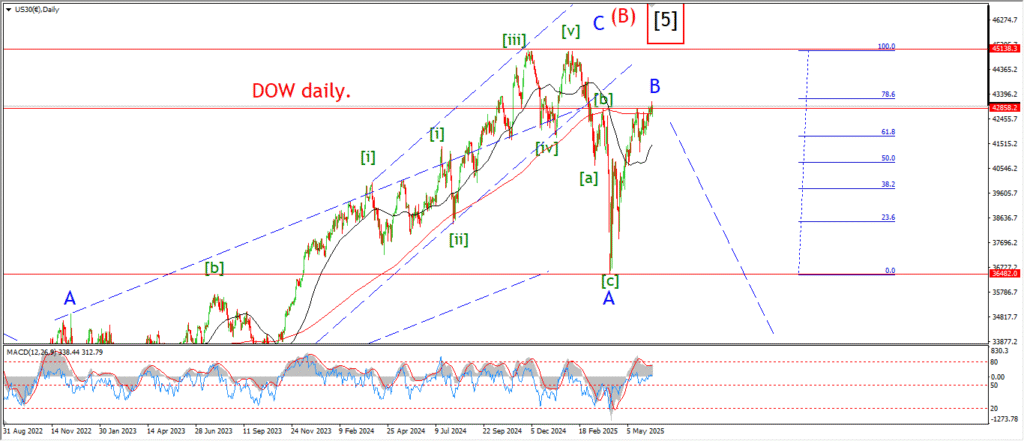

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

I am asking myself now, is a new high just inevitable?

Will the algorithms just continue to buy in until something fundamentally changes in the world.

Will the market refuse to turn first before the economy contracts in a major way?

Usually the market goes first,

and then the economy follows,

but we seem to be operating at a level of delusion so engrained that there is no other option for people then to continue buy,

and hope that the market will take care of them.

well,

that is an interesting thesis at least.

The DOW is hovering just below that upper trend line this evening without breaking the previous highs yet.

If the upper trend line holds,

then we still have a chance.

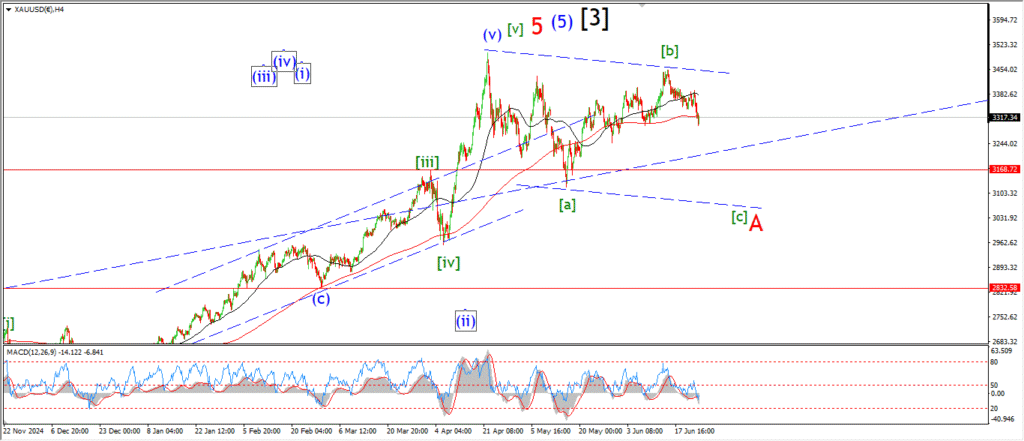

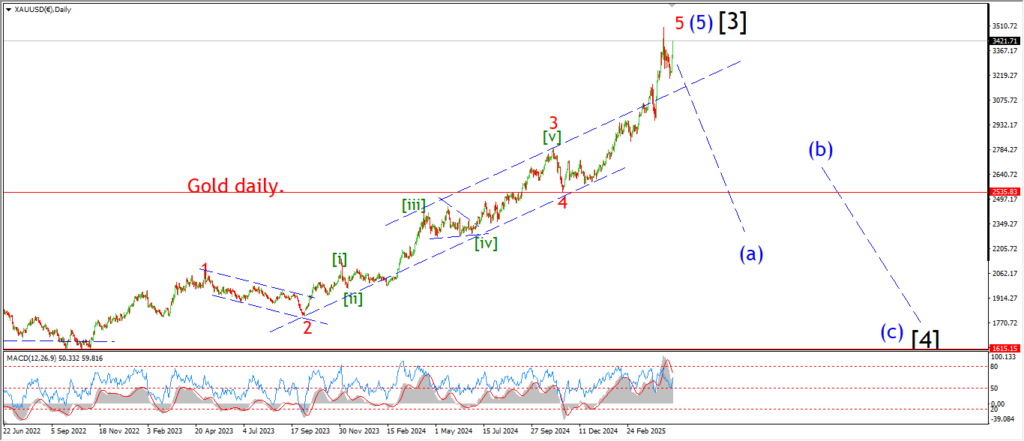

GOLD

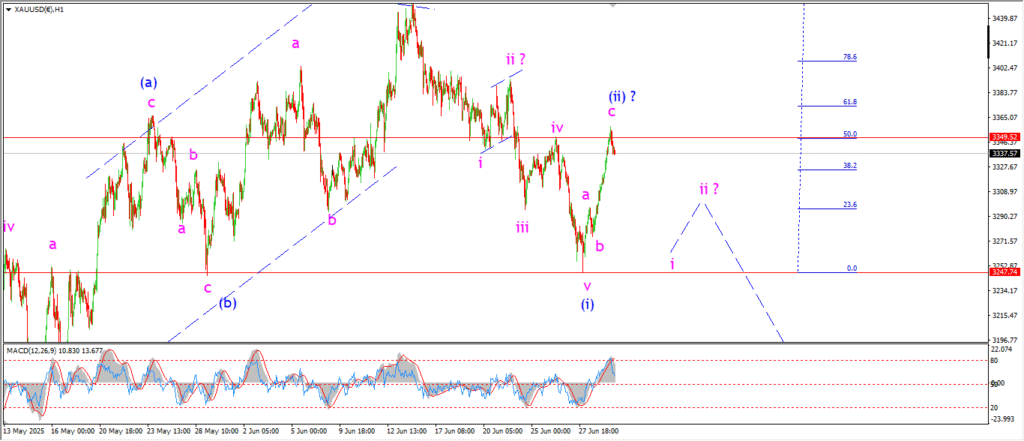

GOLD 1hr.

That was quite a sharp rally today which calls into question the wave (ii) idea now.

The pattern is still valid at the moment,

but I am suspect of the impulsive looking nature of the rise.

The price has topped out just above the 50% retracement level of wave (i) at the high.

So if this pattern is correct,

then we must see a turn down into wave (iii) blue over the rest of this week.

Tomorrow;

Wave ‘i’ of (iii) should retrace most of that rally into wave (ii).

If we see a low in wave ‘i’ of (iii) near 3270,

that will be satisfactory.

If the price continues higher tomorrow,

then I will be forced to rethink what is going on here in that larger pattern.

CRUDE OIL.

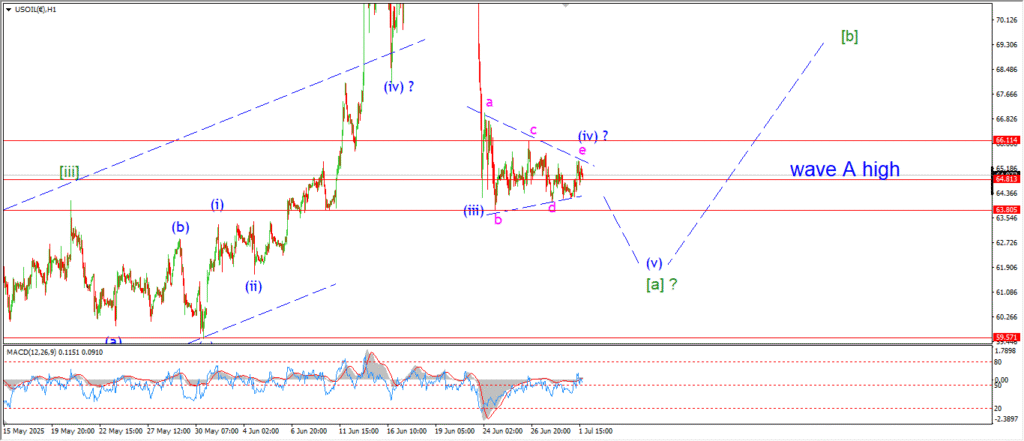

CRUDE OIL 1hr.

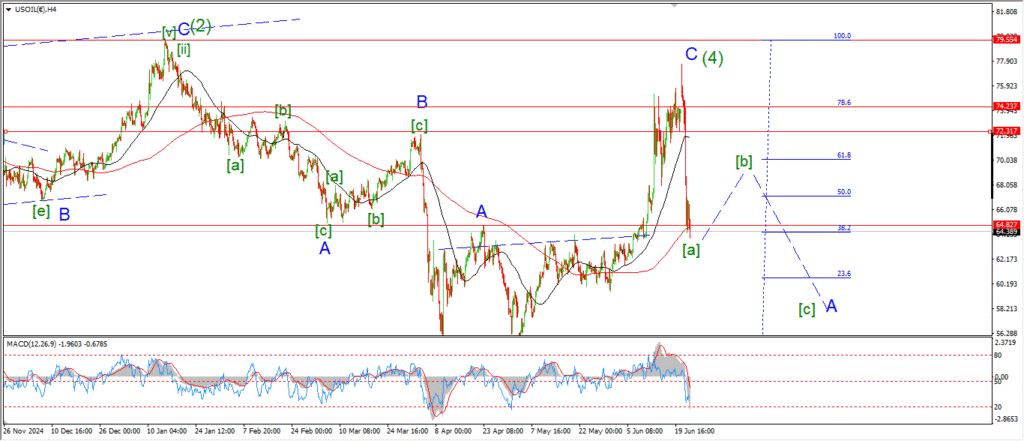

CRUDE OIL 4hr.

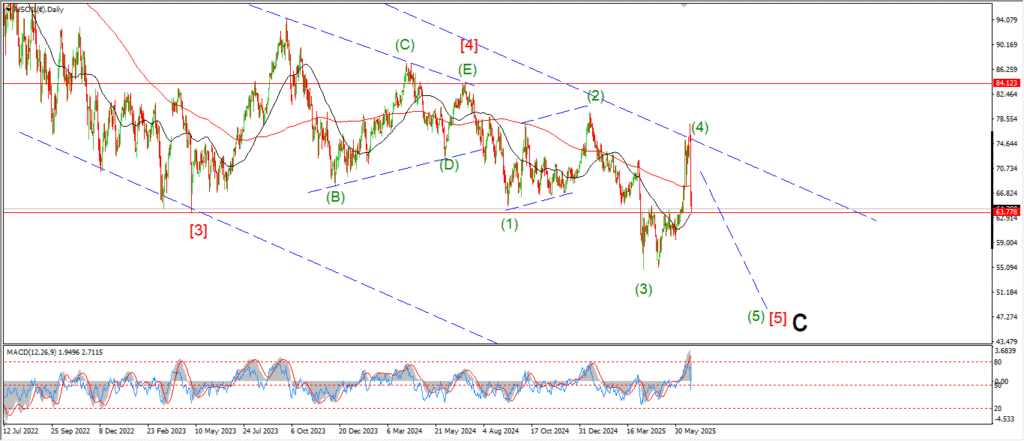

CRUDE OIL daily.

Crude is holding in that contracting triangle pattern again today,

so the wave (iv) idea remains strong at the moment.

As long as 66.00 holds at the wave ‘c’ high,

then this pattern will remain valid.

Tomorrow;

Watch for wave ‘i’ of (v) to break below the range of the triangle at 63.80 to confirm that wave (v) is underway.

S&P 500.

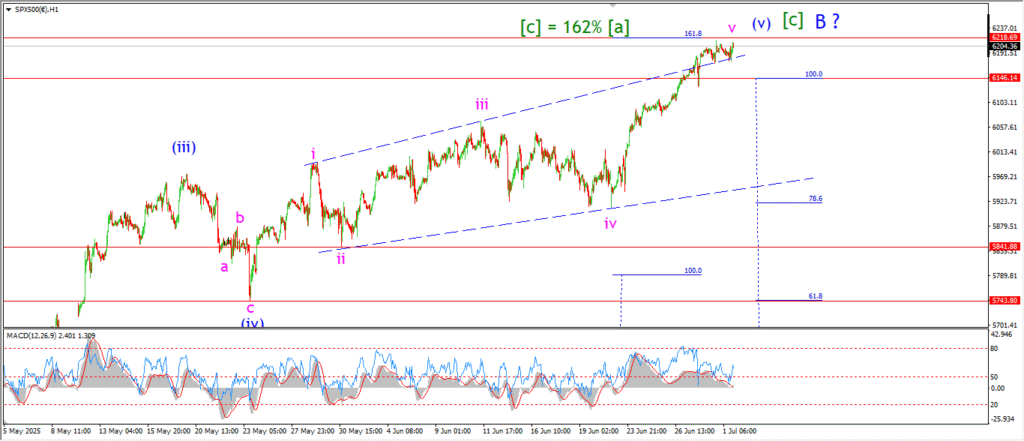

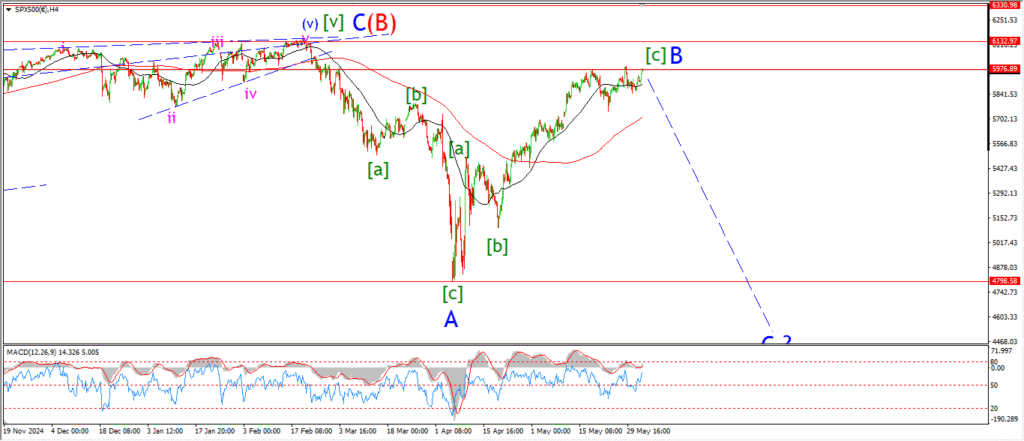

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P is holding close to the highs today which suggests this push into wave ‘v’ is not yet done.

The next level of interest lies at 6218 where wave [c] reaches 162% of wave [a].

I suppose we are close enough to that target to call this rally done,

but the market is feeling lucky this week,

plus we have a holiday weekend ahead so it is unlikely that a major turn happens this week,

unless something major happens!

Tomorrow;

As long at the market holds above that upper trend line of the expanding wedge,

then wave ‘v’ remains in control.

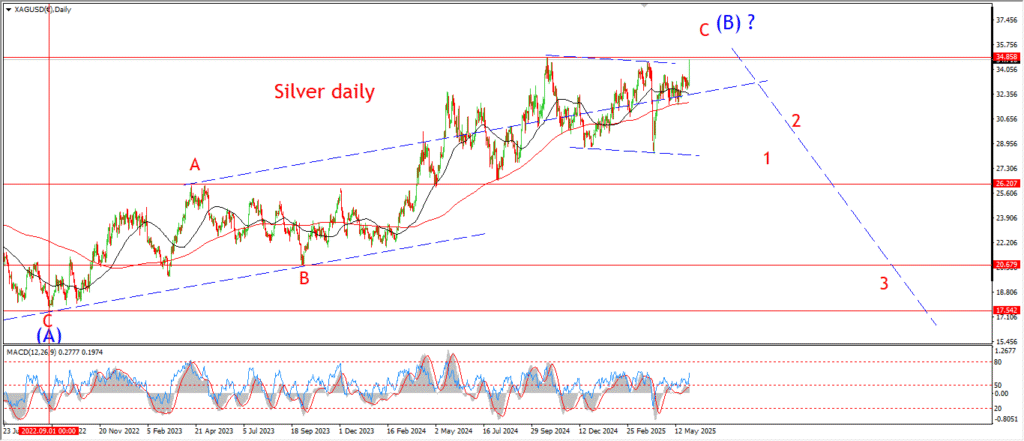

SILVER.

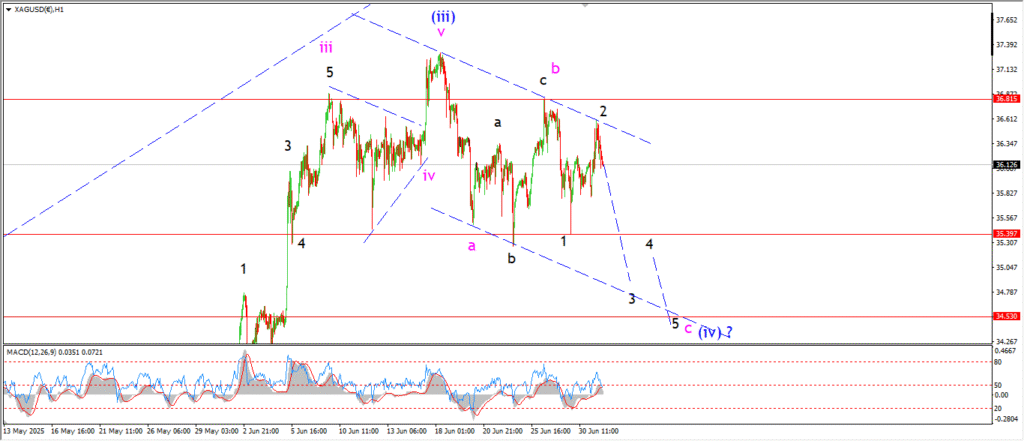

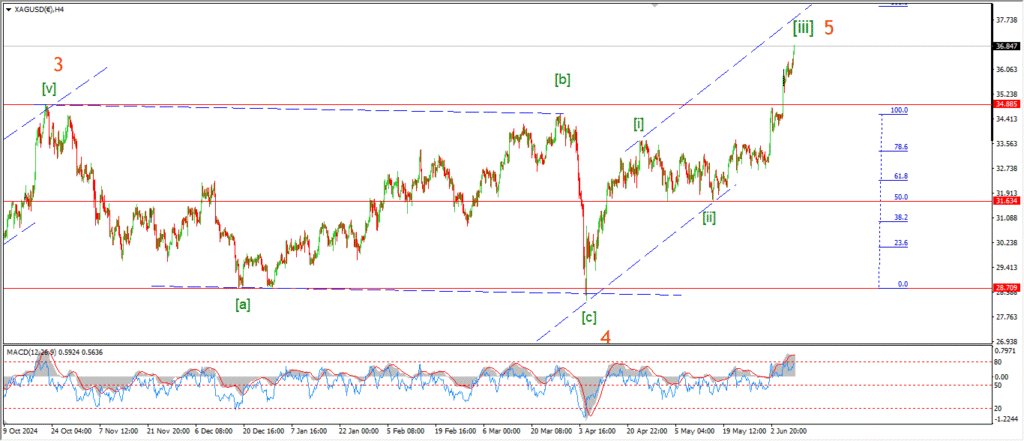

SILVER 1hr

SILVER 4hr.

SILVER daily.

I am watching a three wave rise into the high today.

and so far the price is holding a lower high below wave ‘b’ at 36.81.

If this count is correct,

then wave ‘2’ must hold now,

and wave ‘3’ of ‘c’ can head lower into the lower trend line at 35.00 again in this scenario.

Tomorrow;

Watch for wave ‘3’ of ‘c’ to head lower to break the wave ‘1’ low at 35.40 to confirm the pattern.