[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Good evening all!

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

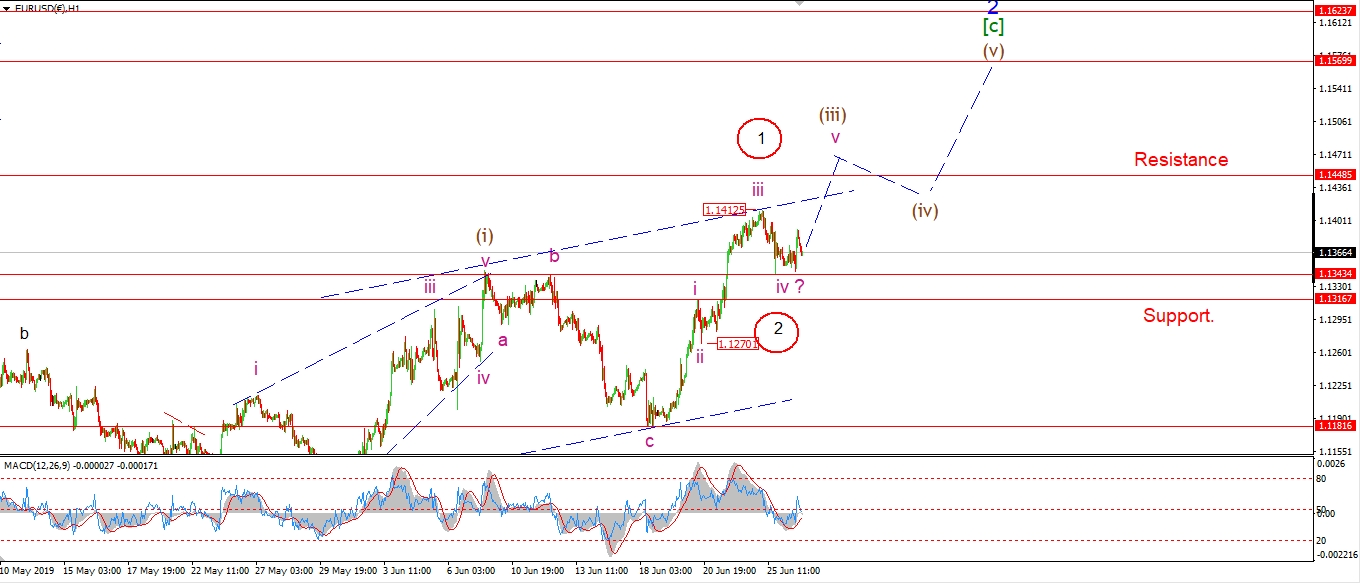

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD is up off Tuesdays low at 1.1343

which means the current count remains valid for the moment.

Wave ‘v’ of (iii) now needs to rally above 1.1413 at the wave ‘iii’ high in order to create a five wave structure in wave (iii).

If the price falls from here and breaks 1.1316 at wave ‘i’,

that action will invalidate the current wave count.

But even if that happens,

we can still view wave (iii) as creating an extension higher as per the alternate count which is circled in red.

In that case price must hold above 1.1270.

Tomorrow;

The outlook is still higher in wave [c],

but we need a rally now in EURUSD to stick with this wave count.

So,

watch for 1.1343 to hold and wave ‘v’ of (iii) to rally above 1.1425 tomorrow.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Cable is fairly flat today in wave ‘ii’ of (v).

The price action seems corrective,

if this is wave ‘ii’ pink,

then it must complete below 1.2784,

and then price should turn lower again in wave ‘iii’ towards 1.2506 over the coming days.

Tomorrow;

Watch for wave ‘ii’ to complete below the declining trend channel line.

Wave ‘iii’ should take us lower again by tomorrow evening.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

What a difference a day makes hey!

Price did not make a new low in wave [c] today as the action suggested last night.

USDJPY actually turned higher again overnight in a nice impulsive fashion

which was expected earlier.

better late than never!

Price has met the initial resistance level at 107.80 this evening.

But I would like to see a further push higher overnight

to bring us closer to a five wave pattern off the low by tomorrow evening.

That would complete wave (i) up,

and then we can look for a three wave decline in wave (ii) to complete a bullish signal.

Tomorrow;

Watch for wave (i) to continue higher towards resistance at 108.80 tomorrow

and trace out a clear five wave form.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

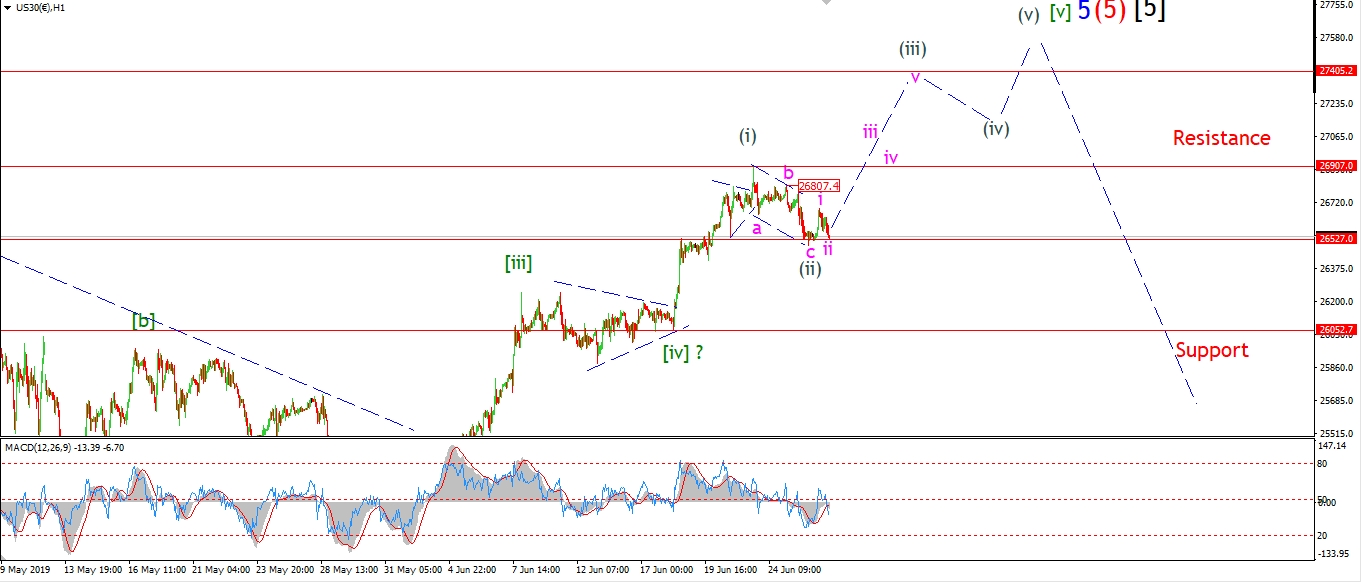

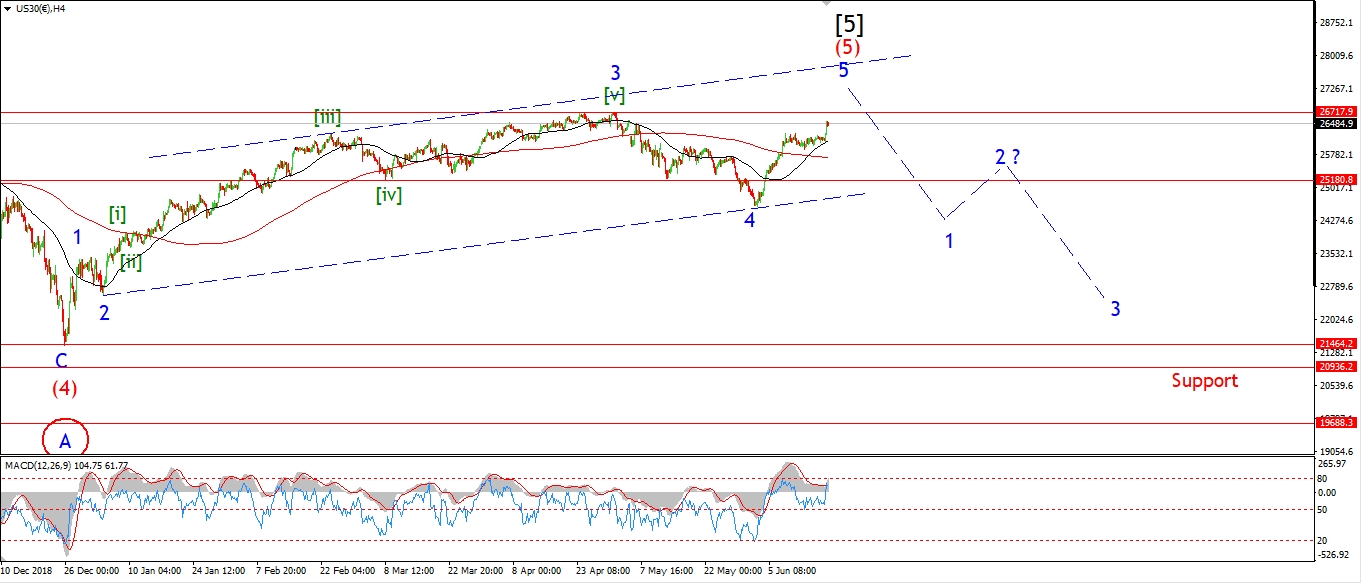

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The DOW has at least stopped falling today!

The price has held above the low labelled wave (ii) at 26527 so far.

This may be the initial move higher to begin wave (iii) of [v].

But we need a rally above 26810 again to signal that wave (iii) has begun.

This level marks the internal ‘b’ wave high within wave (ii).

So that level is key at the moment to the ongoing rally in wave [v].

Tomorrow;

Watch for wave (ii) to hold at 26527 cash.

Wave ‘iii’ of (iii) must now carry the price above 26907 again.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

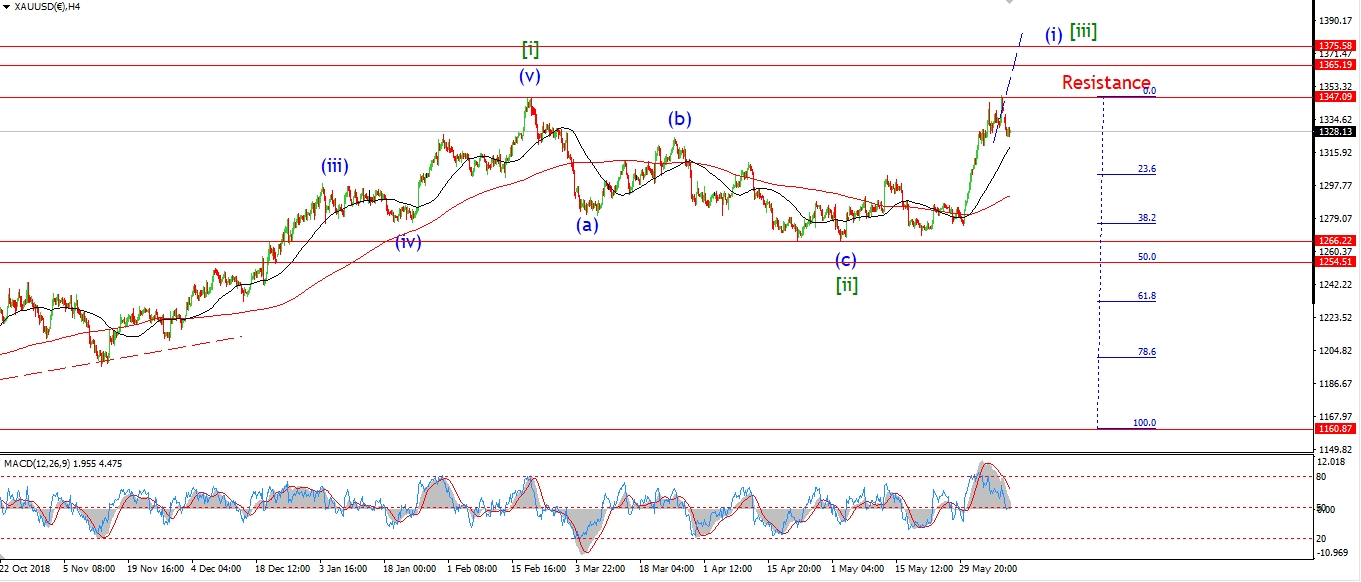

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Gold has recovered slightly off the morning lows.

The session low at 1401 is labelled wave ‘a’ of (ii).

And the rise off that low should form wave ‘b’ tomorrow.

I expect a little more movement higher in wave ‘b’,

possibly up to 1420 to complete a three wave rise.

Then wave ‘c’ should carry us lower again towards the trend channel again

at about 1375 to complete the correction.

Tomorrow;

Wave ‘c’ will most likely begin by tomorrow evening.

Watch for wave ‘b’ to top out early tomorrow and then turn lower into wave ‘c’.

The low at wave (ii) should offer another chance to catch the rally in wave (iii).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

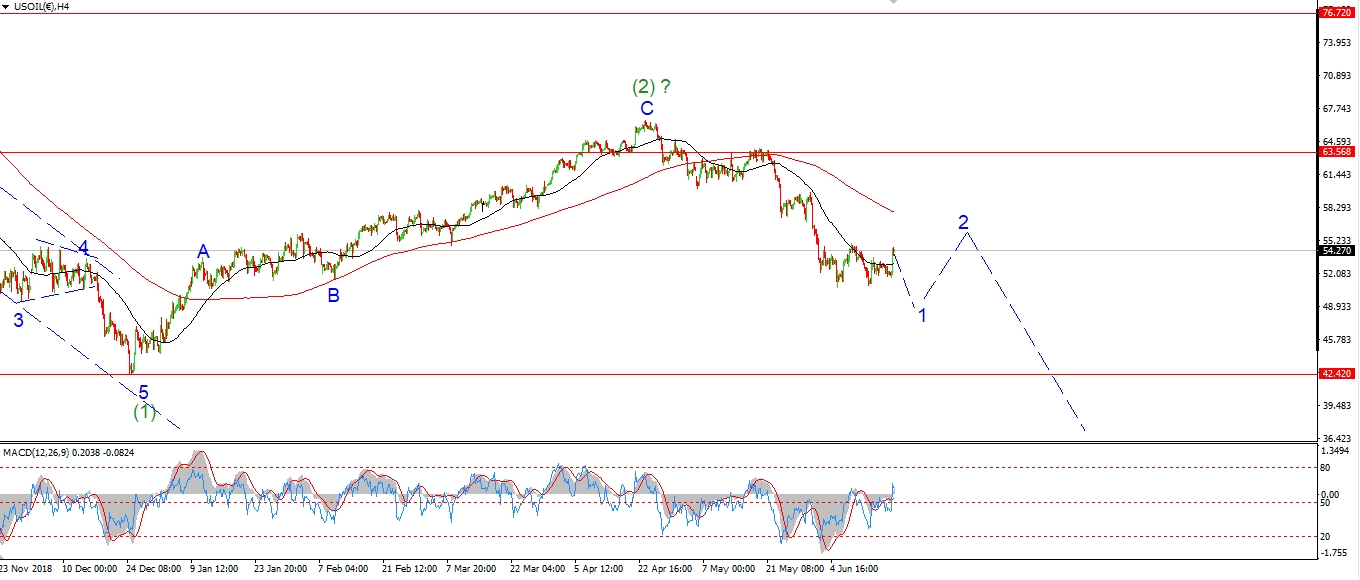

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The continuation of the rally today in Crude has triggered the alternate count.

The price has gone too far to call this a fourth wave correction.

I now view this rally as wave [a] of ‘2’.

If this count is correct,

wave [b] and [c] will likely cause a ranging action for the next few weeks before turning down into wave ‘3’.

And the new alternate count is shown circled in red above.

It is possible that wave ‘2’ is now completing at this high.

The action from here will decide which count is most fitting.

Tomorrow;

watch for wave [b] to begin with a decline below 57.58.

Wave [b] should fall in three waves into the 53.50 area over the coming week.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

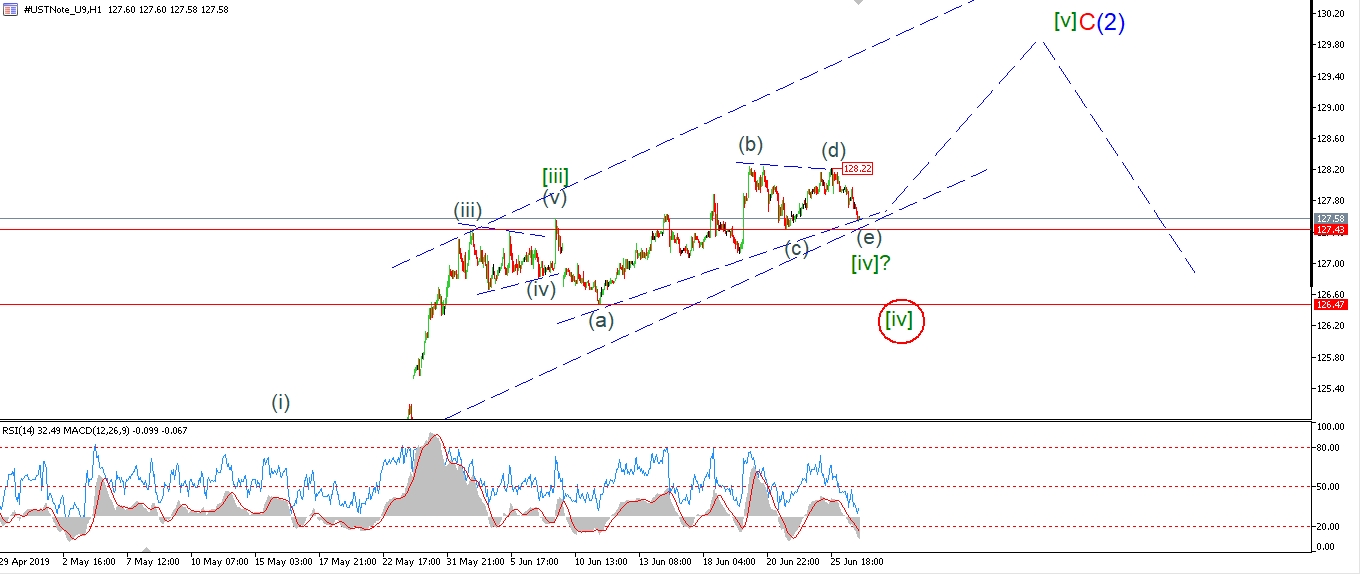

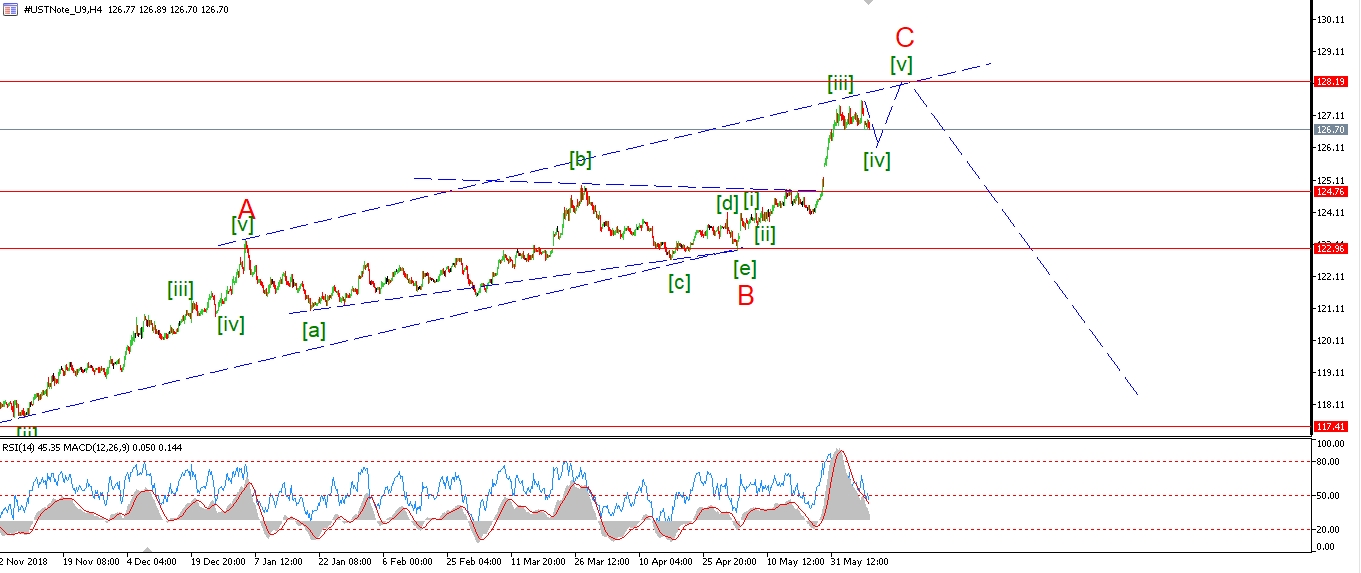

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The lack luster performance over the last few weeks has forced another rethink of the pattern in operation.

The price range has continued to contract during this time,

so,

I have shown a possible triangle wave [iv] in play.

In this scenario wave [iv] must hold above 127.43 and then turn higher in wave [v].

Tomorrow;

Watch for wave [iv] to complete and wave [v] begin with a rally above 128.22.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

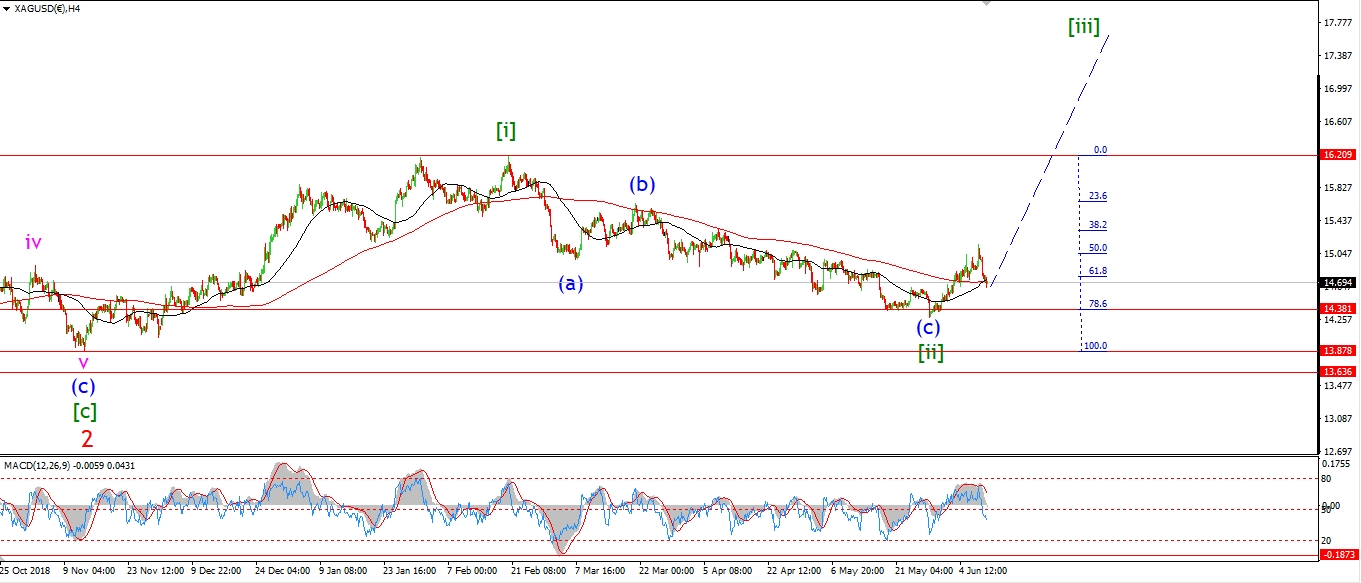

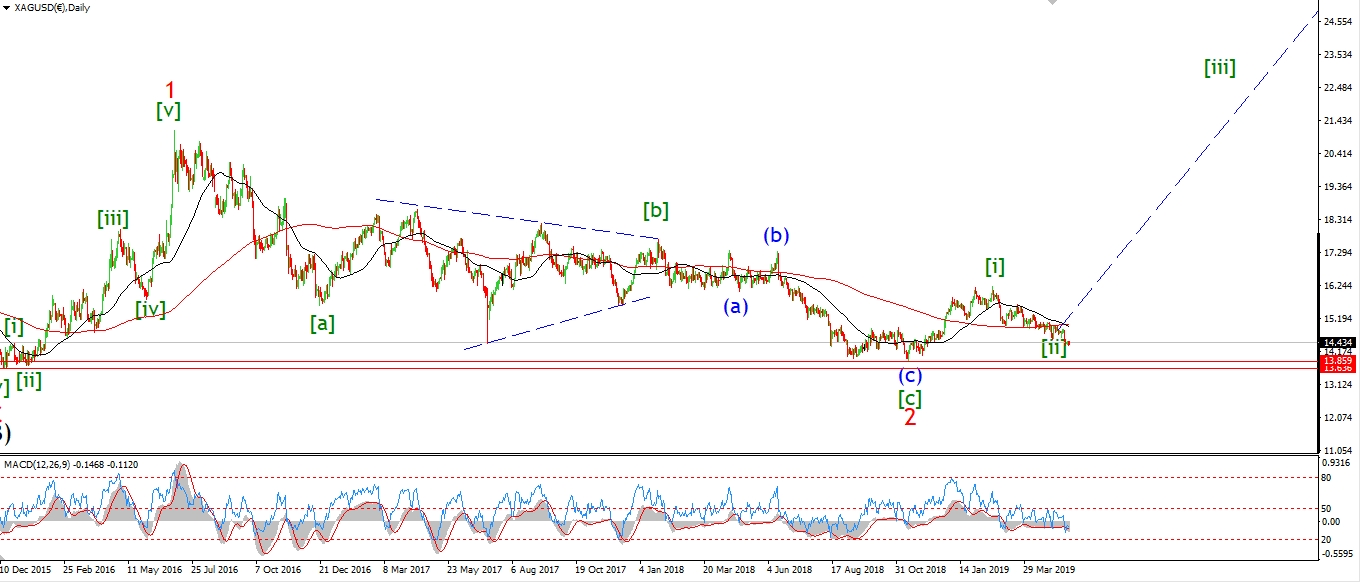

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver made it close to 15.15 today but rebounded slightly off that level without breaking.

This could be a running flat correction in wave (ii) at todays low of 15.16,

or we may get another break tomorrow and make this a clean three wave pattern.

We will see on that front.

Wave (iii) up should begin shortly either way,

and this will be confirmed with an impulsive run higher to break 15.55 again.

Tomorrow;

watch for wave (ii) to find a final low with a break of 15.15 again.

Wave (iii) should begin with a spike higher off the low of wave (ii).

Support at 14.90 should hold.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

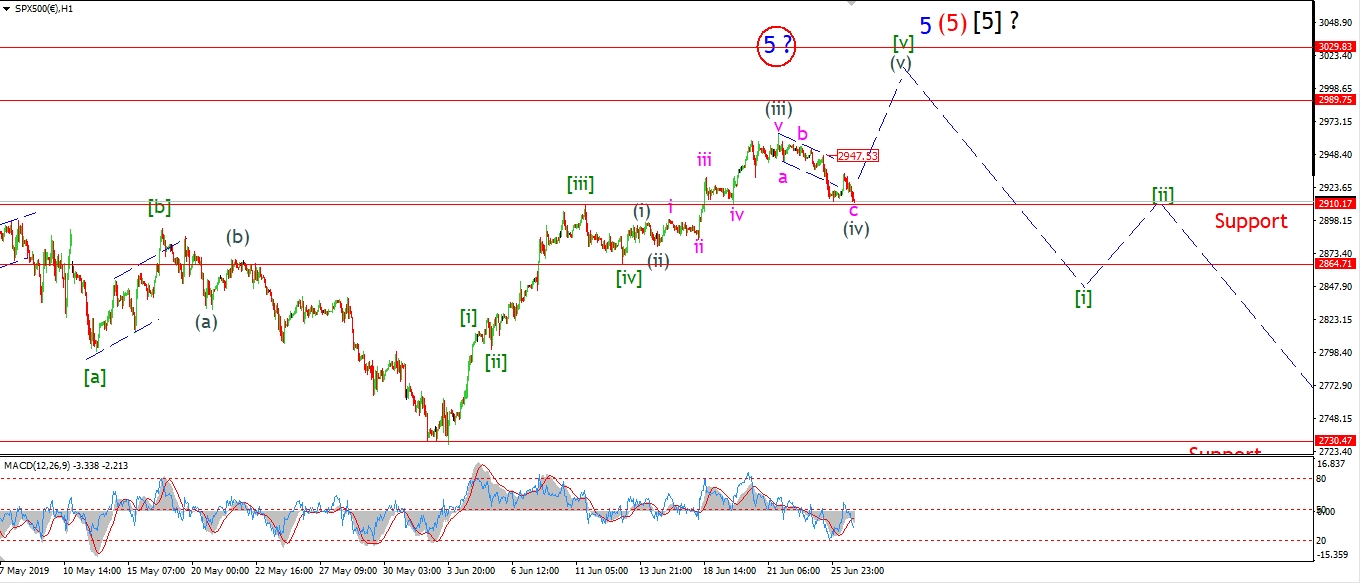

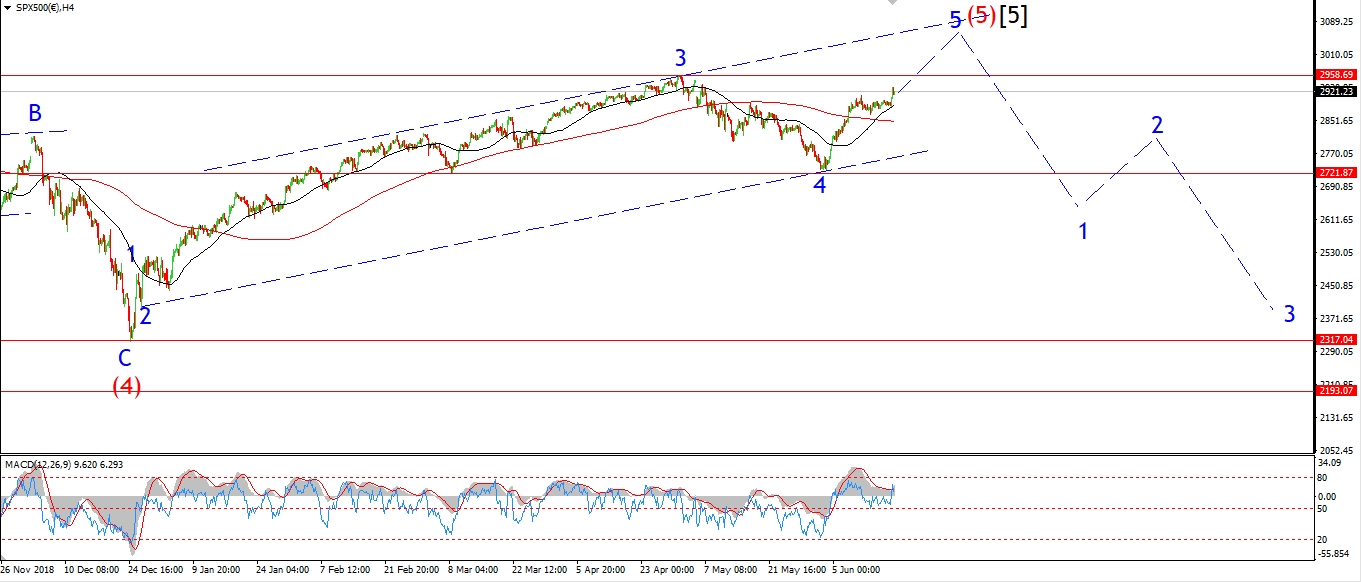

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P is holding above support at 2910 this evening.

If wave (iv) is still in force here,

then the price must turn higher tomorrow in wave (v).

A break above 2950 again will confirm wave (v) has begun.

The main alternate count calls the top of wave ‘5’ already in place at the recent high.

A break of 2864 will increase the probability of this bearish alternate.

tomorrow;

Watch for wave (v) of [v] to begin with a break of 2950.

2910 should hold the price for now.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]