Good evening folks, the Lord’s Blessings to you all. Here is another in-depth interview with Melody Wright on the U.S property market. Its a replica of the whole western world to be honest, its a long one though!

https://twitter.com/bullwavesreal

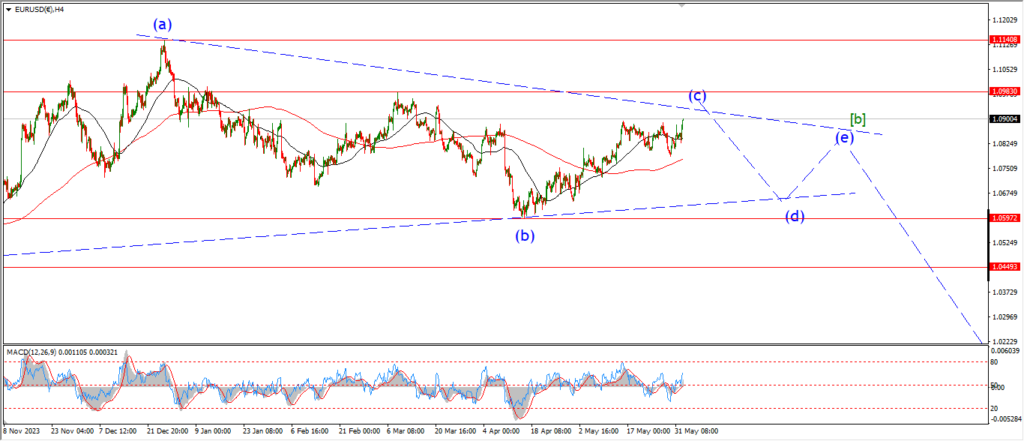

EURUSD.

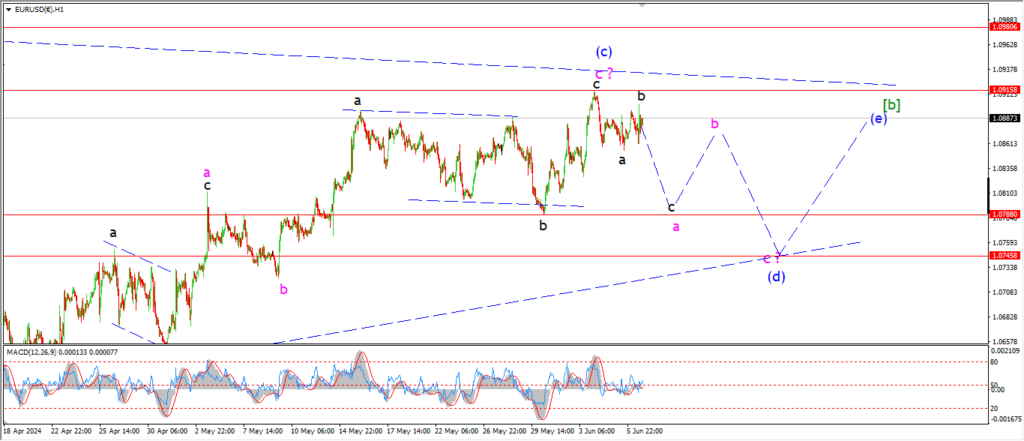

EURUSD 1hr.

EURUSD continues to hold below the wave (c) high at 1.0915 today.

The idea here is that wave (d) will fall in three waves to break 1.0788 at a minimum.

WAve (d) will hit the lower trend line of the triangle at 1.0745.

So that would be an ideal target to be honest.

At the moment wave (d) has not been confirmed,

so I want to see a turn down into support at `1.0788 in wave ‘a’ to do that.

Tomorrow;

Watch for wave ‘a’ of (d) to continue lower and complete three waves down near initial support.

GBPUSD

GBPUSD 1hr.

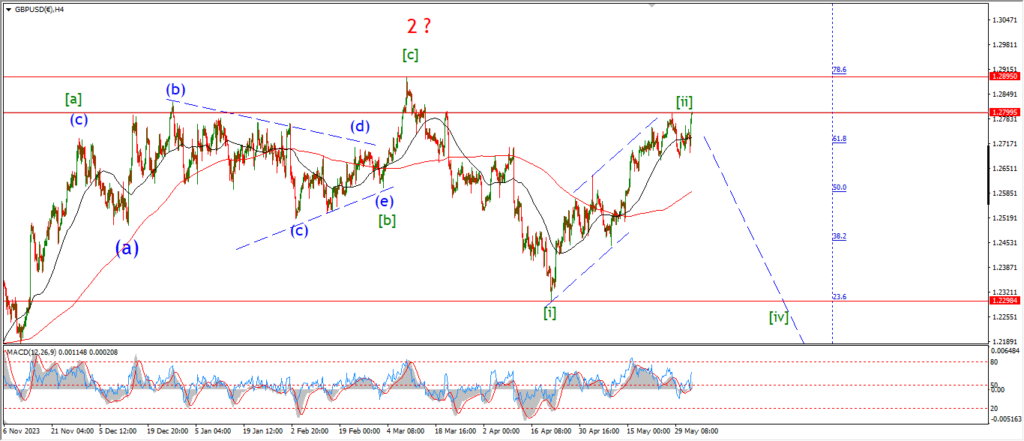

GBPUSD 4hr.

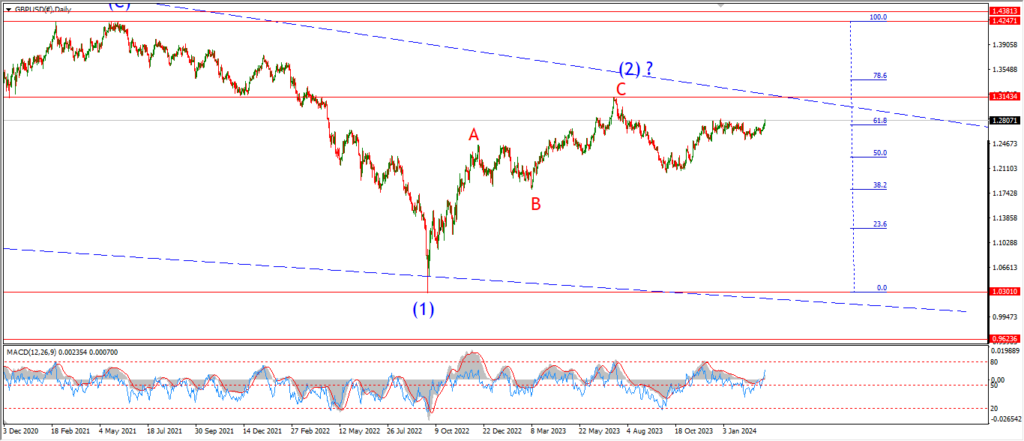

GBPUSD daily.

The possibility of a top in wave [ii] remains open today,

but just like EURUSD,

the turn into wave (i) down has not happened yet.

I am looking at that wave ‘iv’ correction as the initial target level for wave ‘i’ of (i).

So a break of 1.2673 will signal that cable has finally topped out in wave [ii] and the journey into wave [iii] will begin.

tomorrow;

Watch for a break of 1.2673 in wave ‘i’ down.

The wave [ii] high should hold at 1.2817.

A break of that level will postpone wave (i) down for another few days.

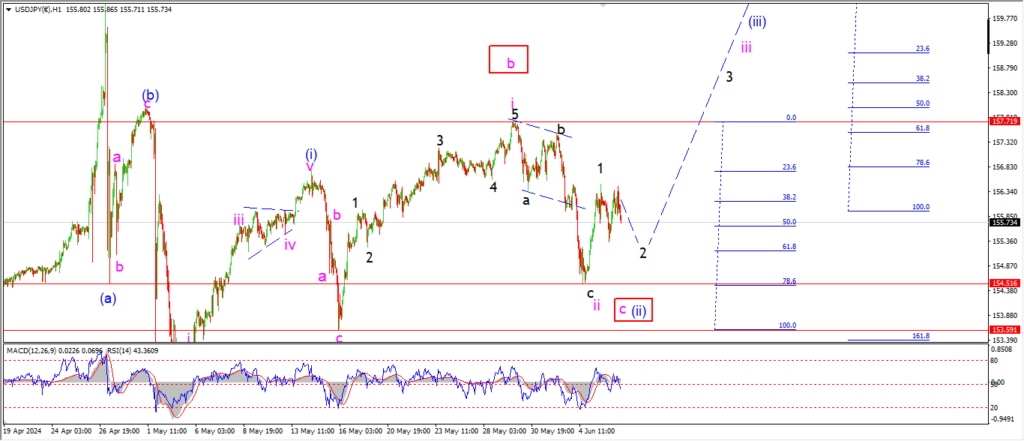

USDJPY.

USDJPY 1hr.

Wave ‘1’ and ‘2’ continue to build a higher low above 154.51 today.

wave ‘iii’ up has not been confirmed yet,

but the action off that wave ‘ii’ low is enough to signal an impulsive rise is beginning here.

A break above the wave ‘i’ high at 157.72 will signal wave ‘3’ of ‘iii’ is underway.

So that is the first goal here.

Tomorrow;

Watch for wave ‘2’ to hold above 154.51.

wave ‘3’ of ‘iii’ must then rally back above 157.72 to confirm the pattern.

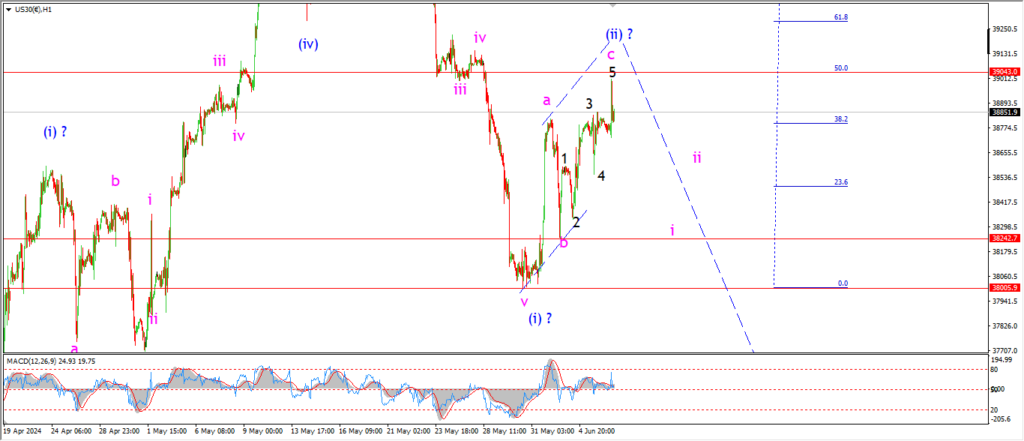

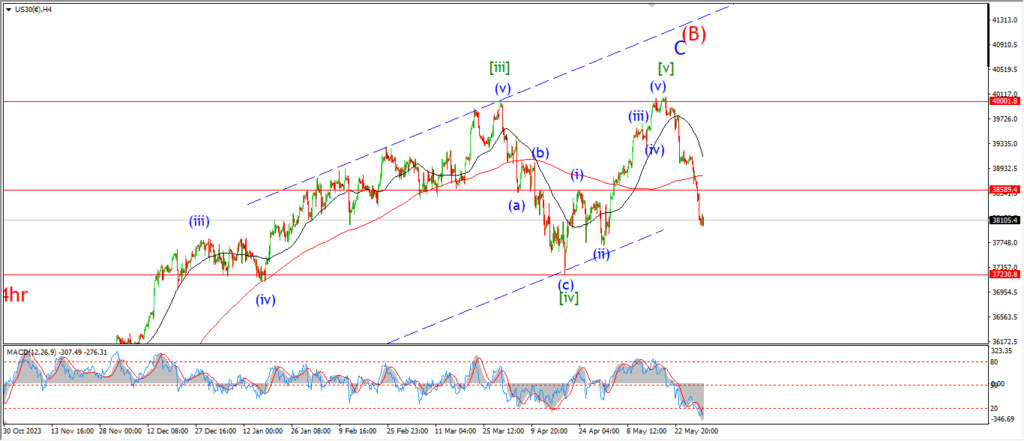

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The DOW had an early pop to the upside which stopped just below the 50% retracement level of wave (i).

That completes three waves within a channel towards a typical Fibonacci target.

That action has done enough to call the correction in wave (ii) complete,

in theory!

We need a reversal to build off this wave (ii) high now to bring that theory into reality.

So it is essential that wave (iii) down begins in the next couple of sessions.

A break back below the wave (i) low will strengthen this wave count substantially.

Tomorrow;

Watch for wave (ii) to hold at the current highs.

Wave ‘i’ of (iii) will fall back to the wave ‘b’ low again at 38240.

GOLD

GOLD 1hr.

Lets start on the 4hr chart tonight.

I am charting a correction in a possible fourth wave these days,

And the pattern is uncertain at the moment.

There is a reasonable chance today that wave (iv) is actually tracing out a triangle pattern

rather than an expanded flat that I have been following.

In that scenario,

the rally today is beginning wave ‘d’ of (iv).

And the correction in wave (iv) is drawing to a close right now.

Wave ‘d’ will top out below the wave ‘b’ high at 2450.

and then wave ‘e’ will form another higher low above 2313.

That will setup up for a rally into wave (v) over the summer months.

Tomorrow;

I am going to track this possible triangle pattern each night to see where it goes.

we should see a three wave rise into wave ‘d’ over the next few sessions.

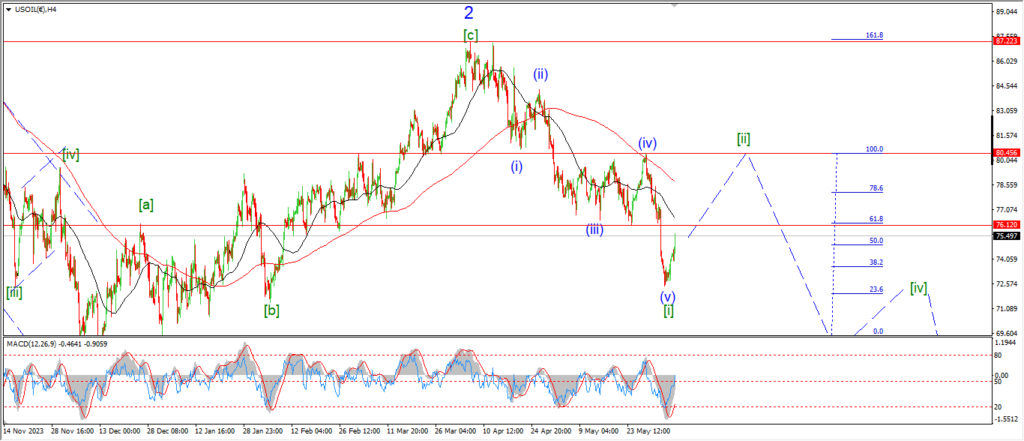

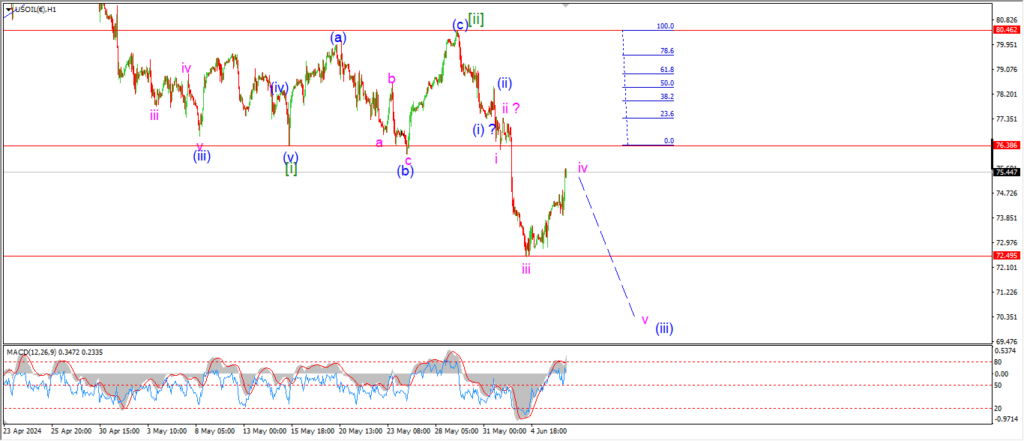

CRUDE OIL.

CRUDE OIL 1hr.

I may be a bit too ambitious with the main wave count so I want to present a possible alternate on the 4hr chart.

This count still involves wave [i] and [ii] to begin wave ‘3’ down.

But I have shown a larger five wave structure in wave [i] that completed at the recent lows.

If this is correct,

then we will see a rebound in wave [ii] back into that corrective high at 80.50 again in three waves.

I think this count will be triggered if the current bounce breaks above the current wave [i] low at 76.38.

Tomorrow;

Wave ‘iv’ of (iii) must stop below 76.38.

Wave ‘v’ should fall again towards 70.00 again to complete wave (iii).

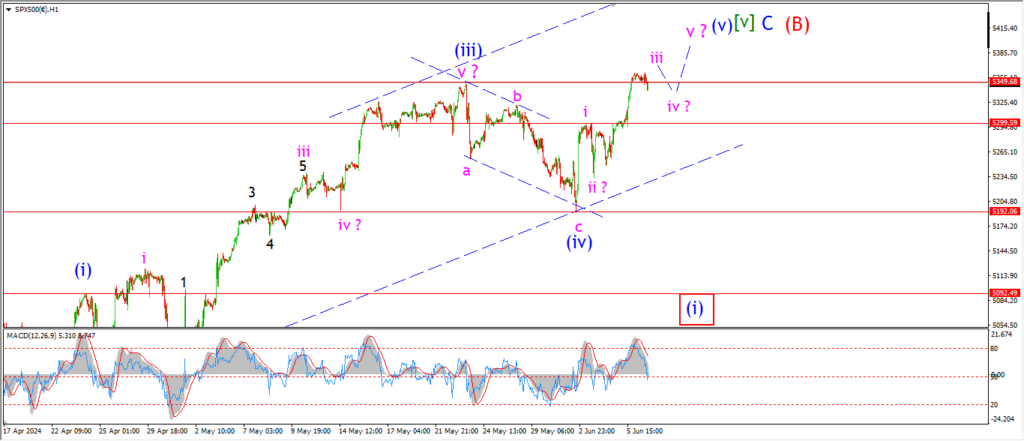

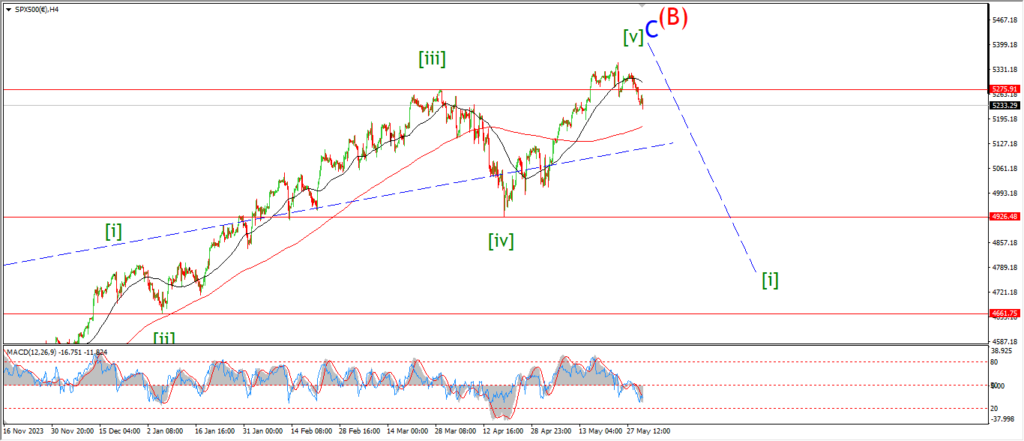

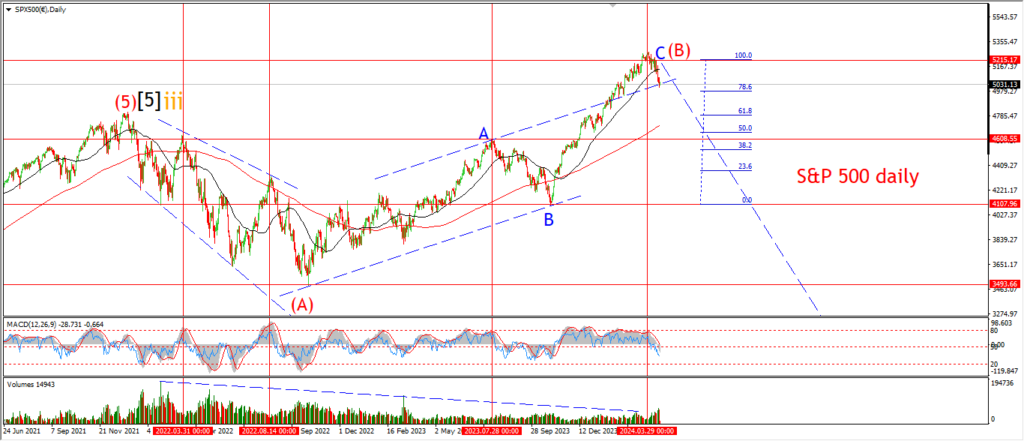

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

the S&P is hanging out at the all time highs again today with very little progress made in the pattern.

I am not sure wave ‘iii’ of (v) has topped out yet as the internal pattern of wave ‘iii’ seems incomplete.

Wave ‘iv’ will hold above the wave ‘i’ high in this pattern no matter what,

so we will see how the current consolidation maps out tomorrow,

but I wount be surprised to see another set of steps higher as wave ‘iii’ and ‘v’ close out.

That brings us into early next week before all hell breaks loose!

There is the a guillotine hanging over the market today in the form of the jobs data due tomorrow.

we will see if that data brings forward the pattern to complete it earlier than next week.

Maybe a whipsaw reaction will do enough to fill in the pattern for wave (v) blue and then I can turn the focus lower on Monday again.

Tomorrow;

Watch for wave ‘iii’ to top and then a drop into wave ‘iv’ should begin.

Wave ‘i’ must hold at 5300.

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

A rally this evening confirms that wave (a) is done at 29.37.

And now I am suggesting wave (b) has begun.

The rally off this weeks lows has already traced out three wavs up into this evenings highs.

That may have completed wave (b) as a three wave pattern even now.

If the price falls sharply tomorrow again,

that will suggest wave (c) has begun.

But I may be asking too much on that front.

Tomorrow;

Watch for wave (b) to top out below the recent highs.

Wave (a) will be confirmed with a break back below 29.37 again.

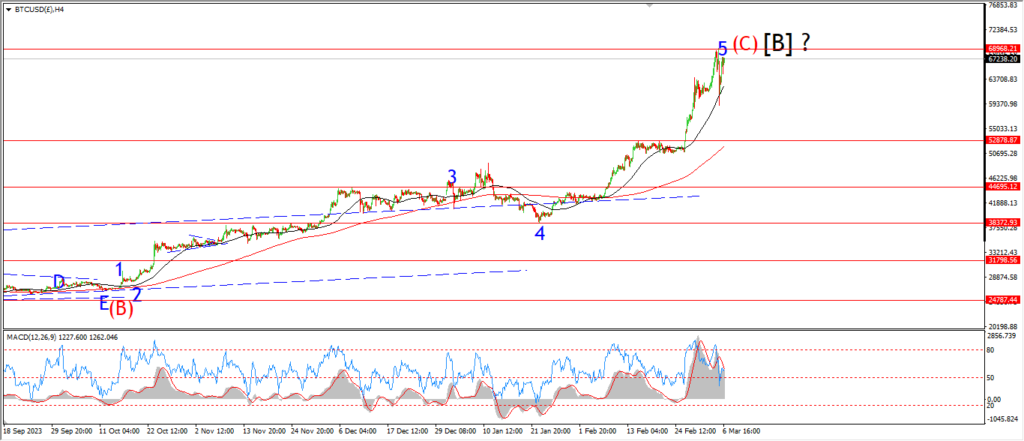

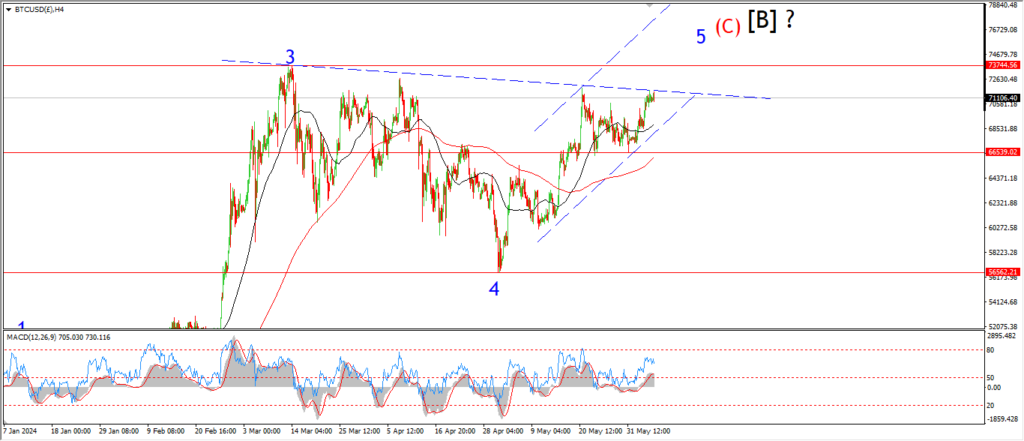

BITCOIN

BITCOIN 1hr.

….

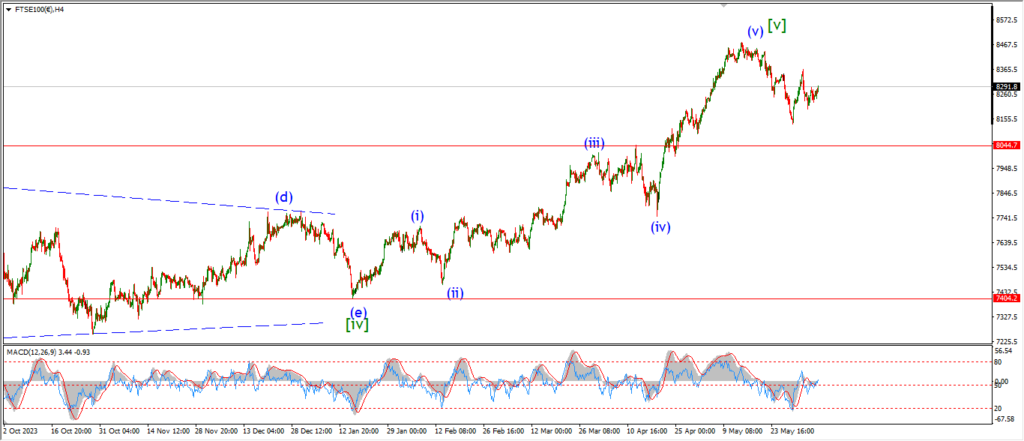

FTSE 100.

FTSE 100 1hr.

….

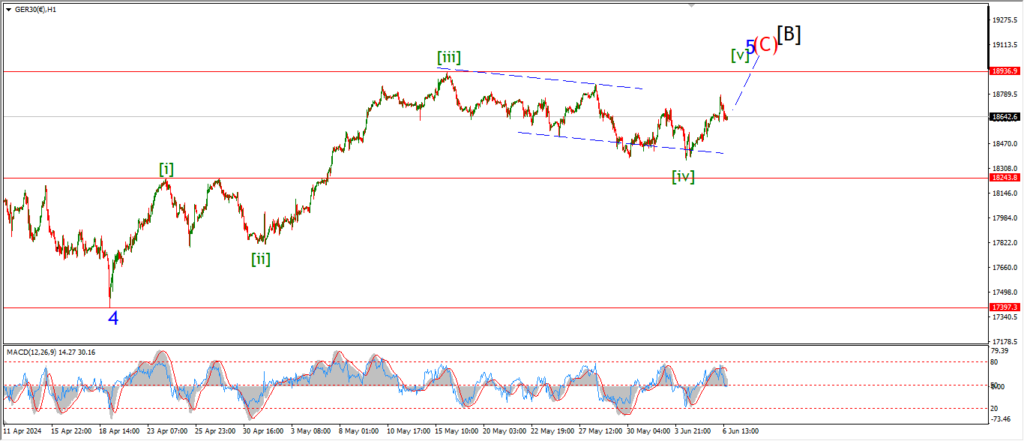

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

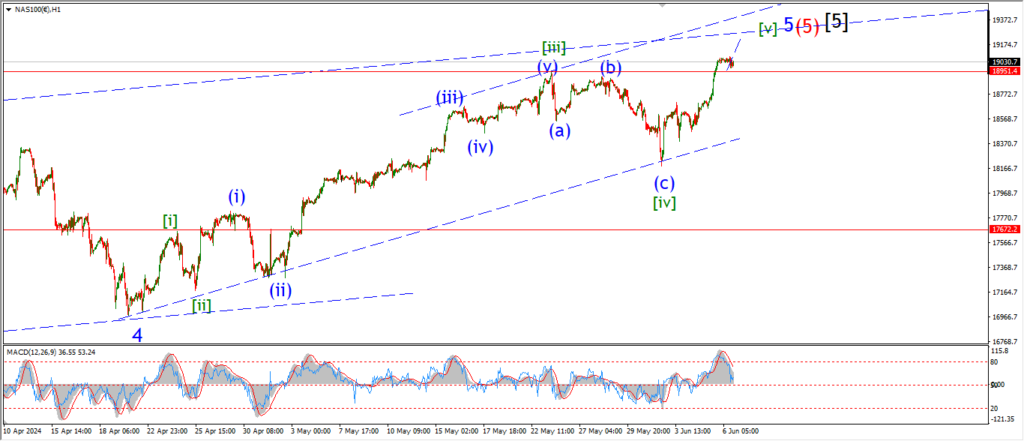

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….