Good evening folks and the Lord’s blessings to you.

“Worse Than The 2008 Financial Crisis” – Germany Becomes A Nation Of Bankruptcy With No End In Sight

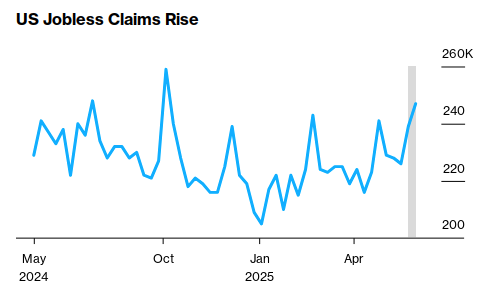

The ISM Services PMI new orders index dropped 5.9 points in May, to 46.4, its second-lowest reading since 2020.

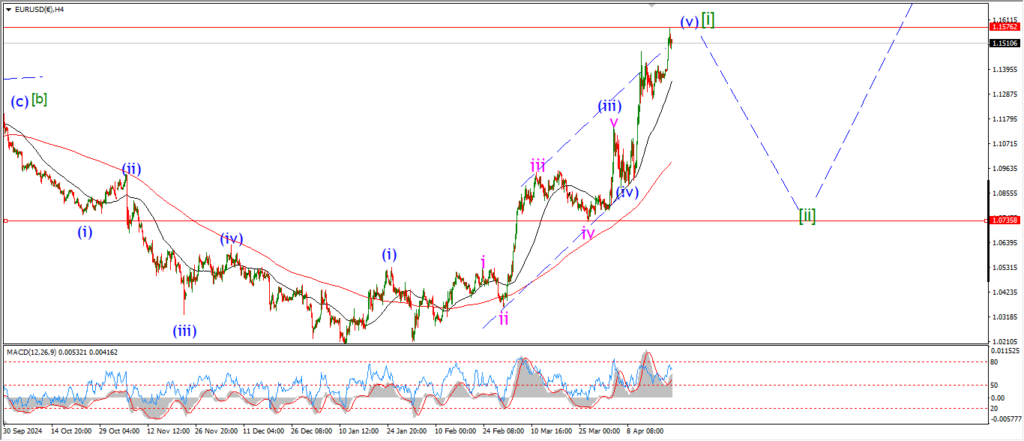

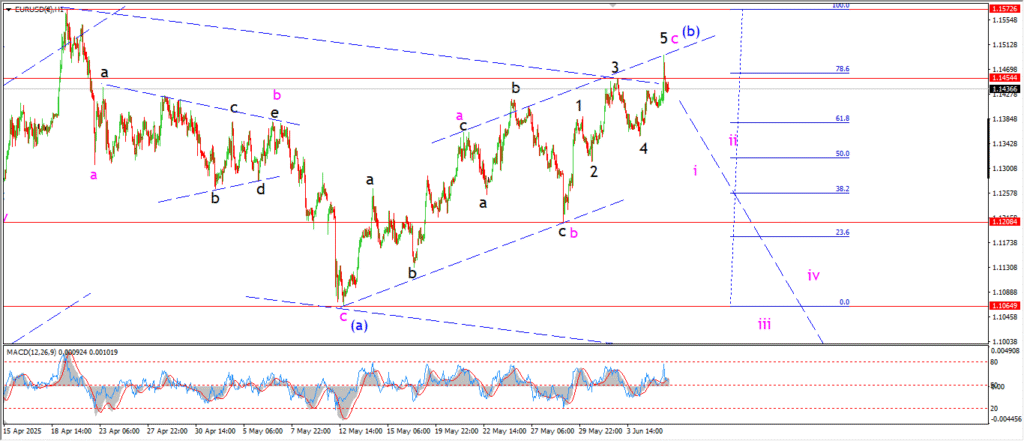

EURUSD

EURUSD 1hr.

A different view on wave ‘c’ tonight after a pop above the previous high again.

The price touched the upper trend line at wave ‘5’ of ‘c’.

And now we have a drop back off that level.

the action in general has been quit labored to the upside this week.

and that fits a possible ending diagonal pattern.

Tomorrow;

Watch for wave (b) to be confirmed with a reversal back into wave ‘i’ pink.

A break of 1.1300 again will signal that wave (c) has begun.

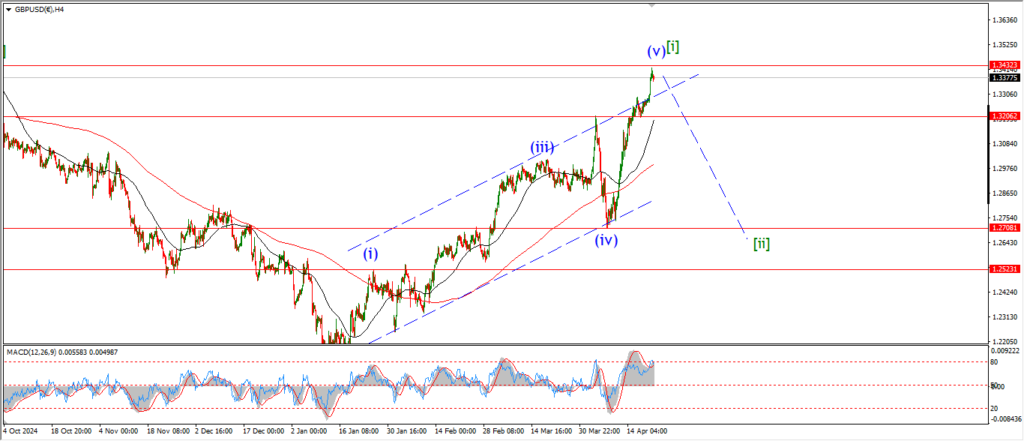

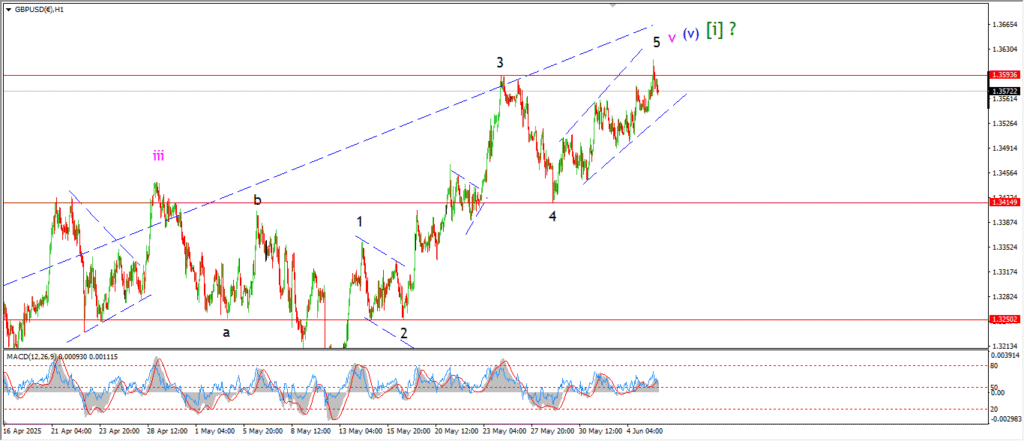

GBPUSD

GBPUSD 1hr.

I have been struggling with this pattern in cable during the week.

the action has been corrective looking to the upside,

and this did fit the idea of a second wave correction.

that idea was invalidated today with a break of 1.3593.

And now I am forced to rethink the larger pattern again.

The rally into this high is now labelled as the end of wave [i] green again.

Wave (v) of [i] has ended with an expanded wedge pattern.

This explains a very choppy weeks trade.

The overall pattern still calls for a correction in wave [ii].

But that has not begun yet.

tomorrow;

Watch for a signal that wave (v) of [i] is done with a sharp drop below initial support at 1.3415.

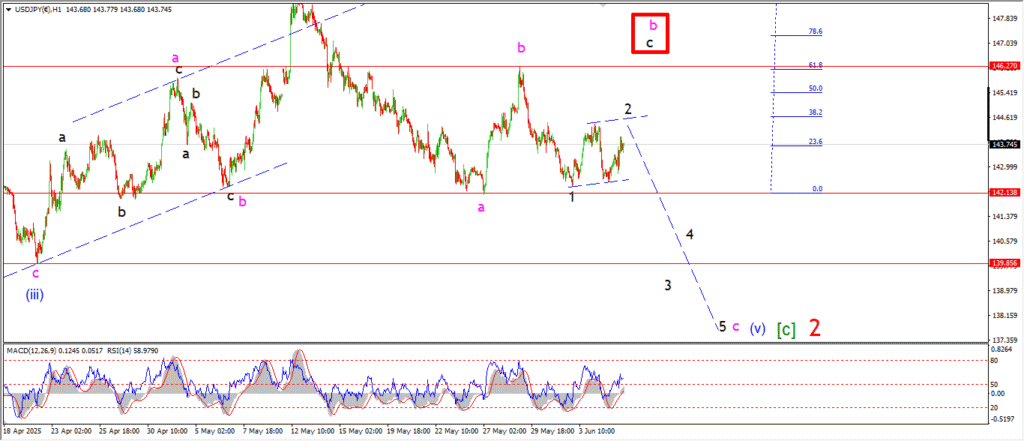

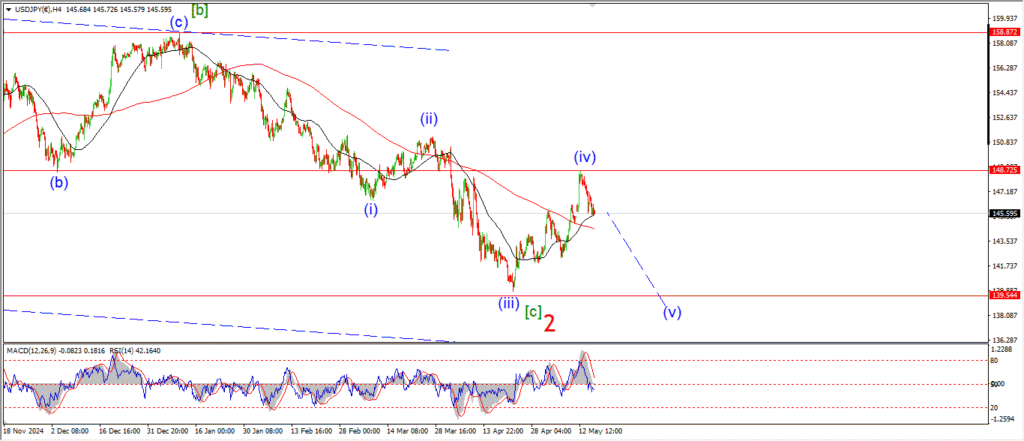

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

Looking at the action today I suspect that wave ‘2’ is still in play.

The price should rise to meet that upper trend line as shown.

And from there a turn down into wave ‘3’ will begin.

Tomorrow;

This count will remain valid as long as the wave ‘b’ high holds at 146.27.

Watch for wave ‘3’ of ‘c’ to turn lower and break 142.13 to confirm the pattern.

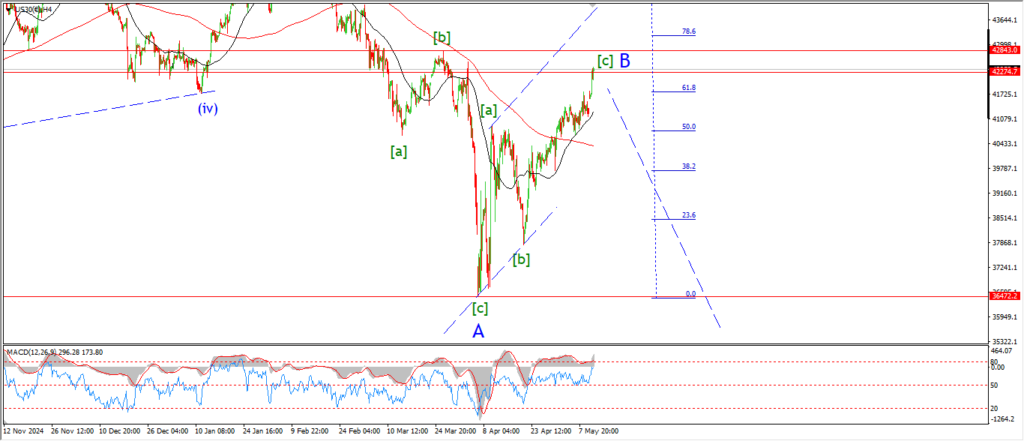

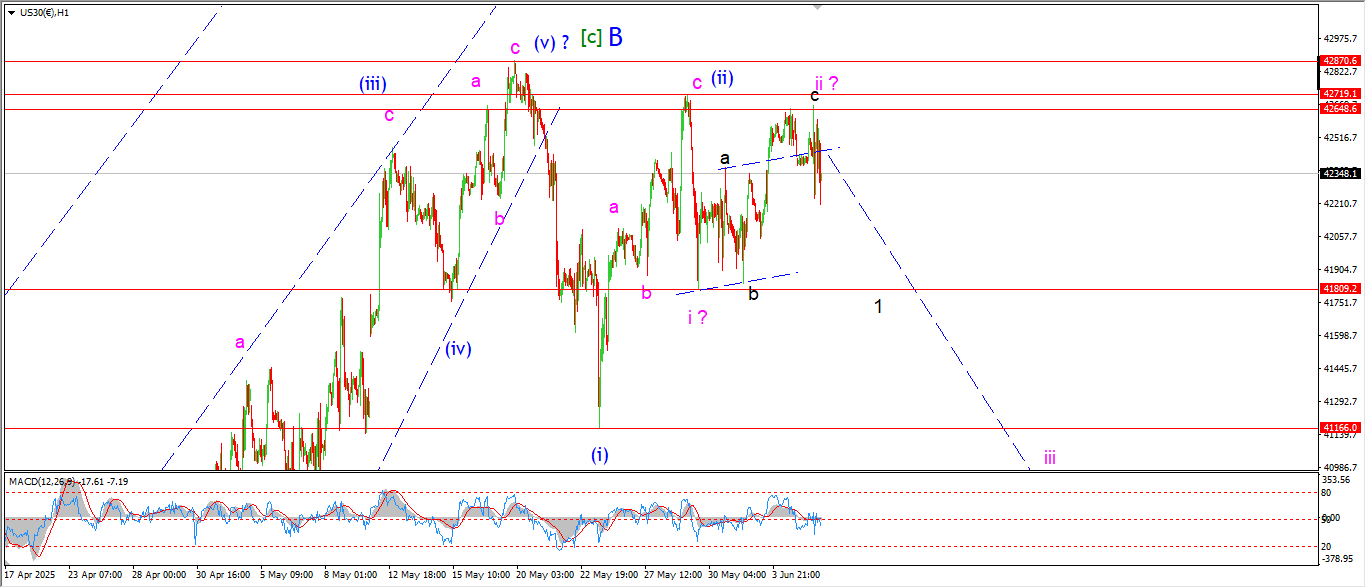

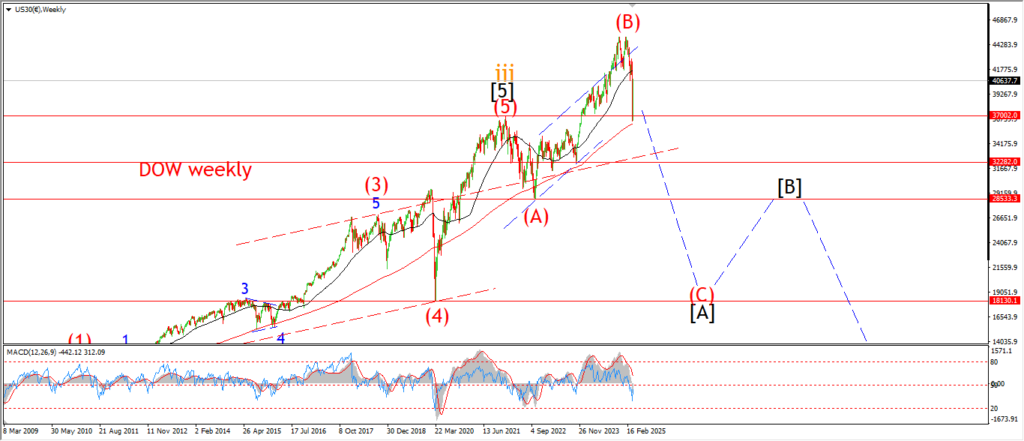

DOW JONES.

DOW 1hr.

The stock market is on edge today after dismal numbers across the board.

I suspect we are waiting for payrolls data tomorrow before any decisions are made.

My suspicious nature is telling me that the phone call between Xi and Trump is a diversion tactic.

And that may be an indication of some bad numbers coming tomorrow.

Just a hunch!

the market has held the lower high below the wave (ii) blue level again today even though we came close to a break.

So this qualifies as a rejection at a lower high.

A follow through tomorrow into wave ‘1’ of ‘iii’ is what the wave count suggests.

So lets see if that will materialize.

Tomorrow;

Watch for wave ‘ii’ pink to hold at todays highs.

wave ‘iii’ down is still on the cards,

I have been waiting for that move for too long now.

So a break of the wave ‘i’ support will be most welcome.

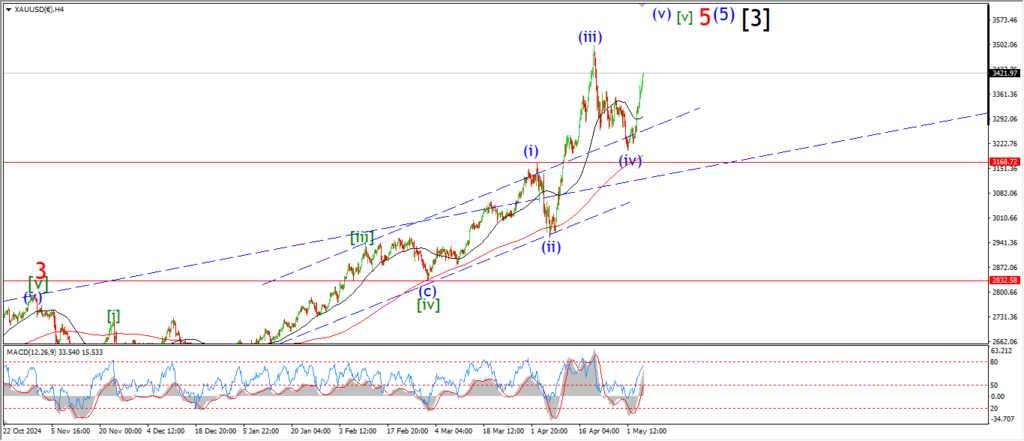

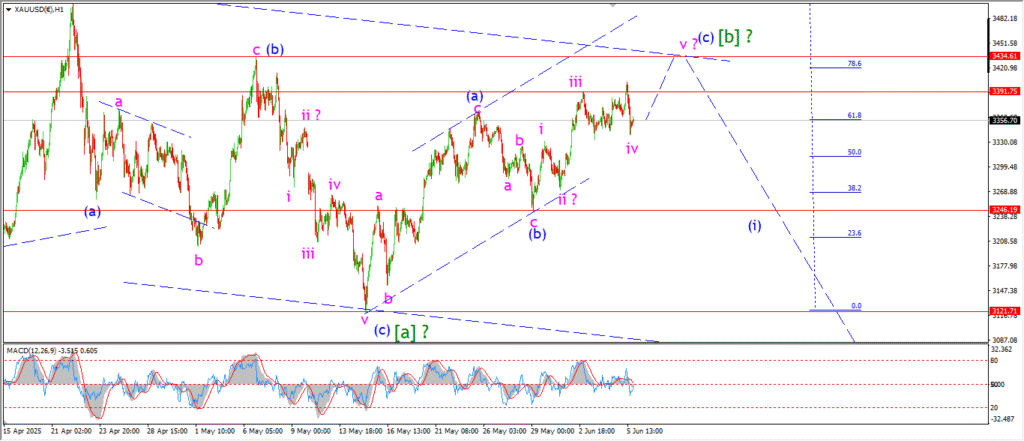

GOLD

GOLD 1hr.

gold has traced out a possible running flat correction at todays lows.

and wave ‘v’ of (c) can still run higher in this scenario.

the previous wave ‘b’ lies at 3434,

so that remains the target for wave [b] to complete.

Tomorrow;

Watch for wave ‘v’ of (c) to run higher into 3434 to complete three waves up in wave [b].

If the price breaks down below 3246 again that will be a signal that wave (i) of [c] is in play.

CRUDE OIL.

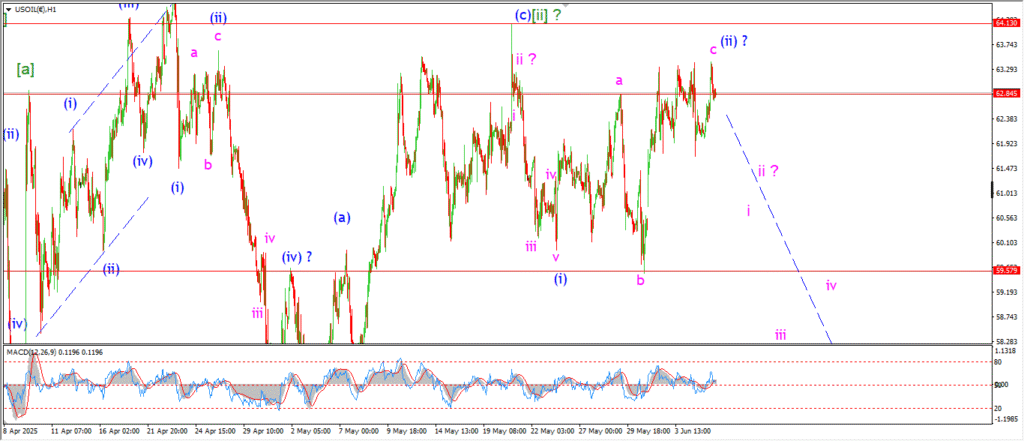

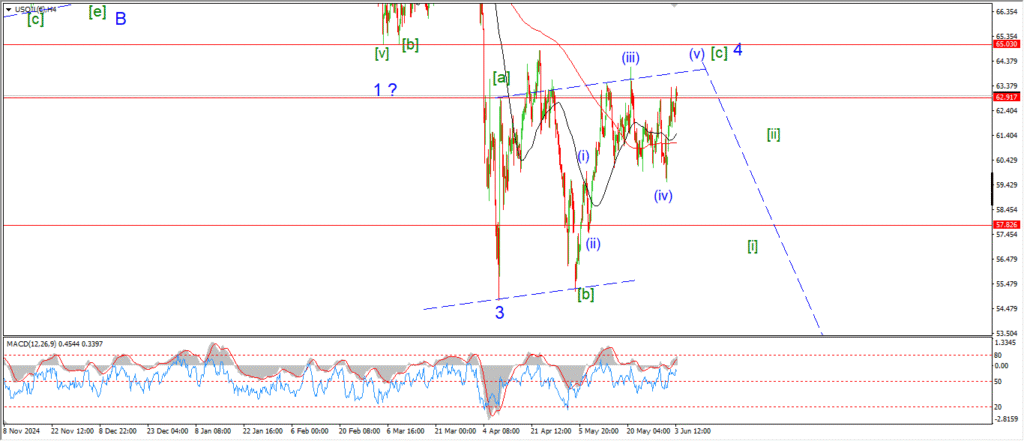

CRUDE OIL 1hr.

CRUDE OIL 4hr.

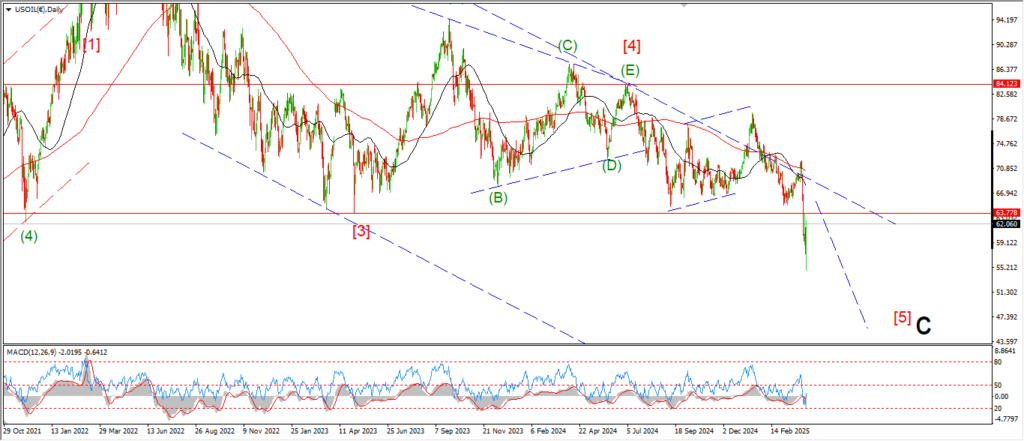

CRUDE OIL daily.

Talk about waiting for a start to fall eh!

Crude oil has made a quadruple top at a lower high in wave (ii) this week.

The market is in a bind here.

and so far there is nothing but a series of failed attempts at a break out above wave [ii] green.

I am sticking with the wave (ii) blue idea tonight,

and I will so long as the lower high remains.

Wave ‘i’ of (iii) has not begun yet.

And that is the big question here.

when will this count be confirmed with a drop into wave (iii) of [iii].

Tomorrow;

Watch for wave ‘i’ of (iii) to take the price lower with a drop towards 60.00 again.

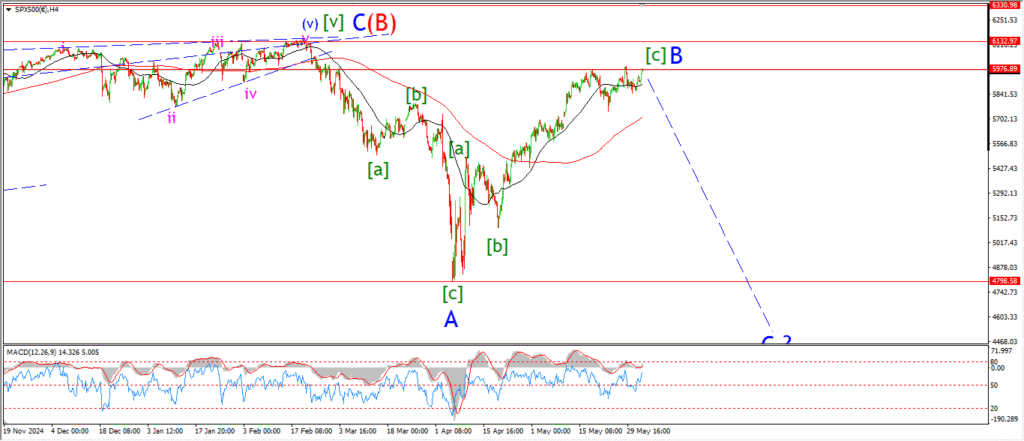

S&P 500.

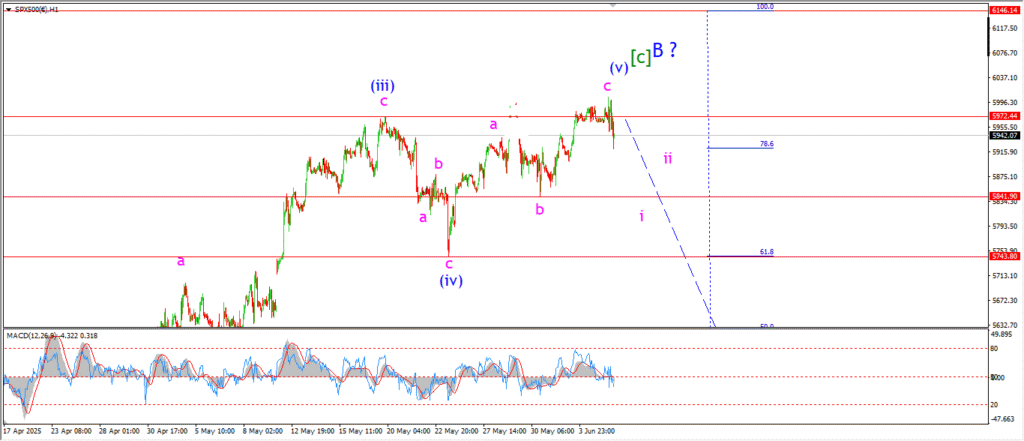

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P has turned back off the highs today and there is a ray of light beginning to shine in favor of this count again.

I am stuck in the same bind here though,

the price has yet to prove my thesis with a serious impulsive decline to wipe the smiles off people again.

So I can talk all I like about reversals until I’m blue in the face,

but the market has to cough up sooner or later to give this count a chance.

Wave (i) down should fall back below 5740 to break support,

and that sort of move will open the door to a larger turn down.

Tomorrow;

Watch for wave ‘i’ down to begin with a drop below 5840.

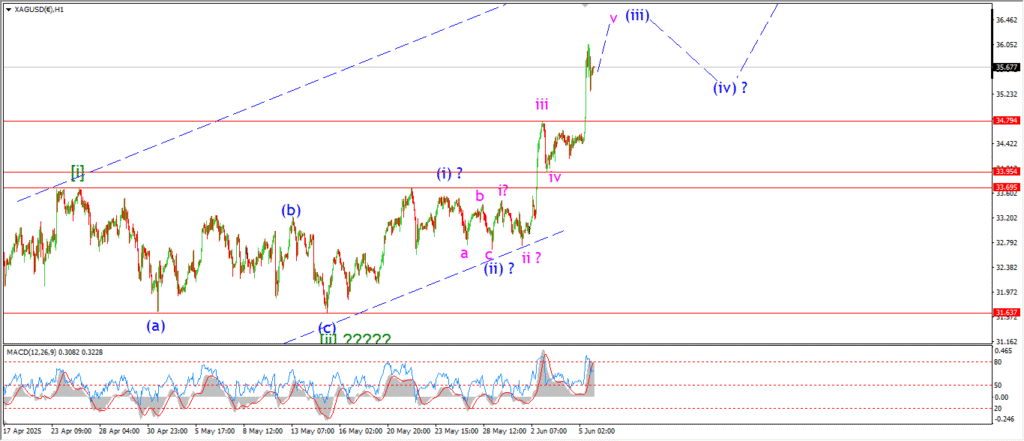

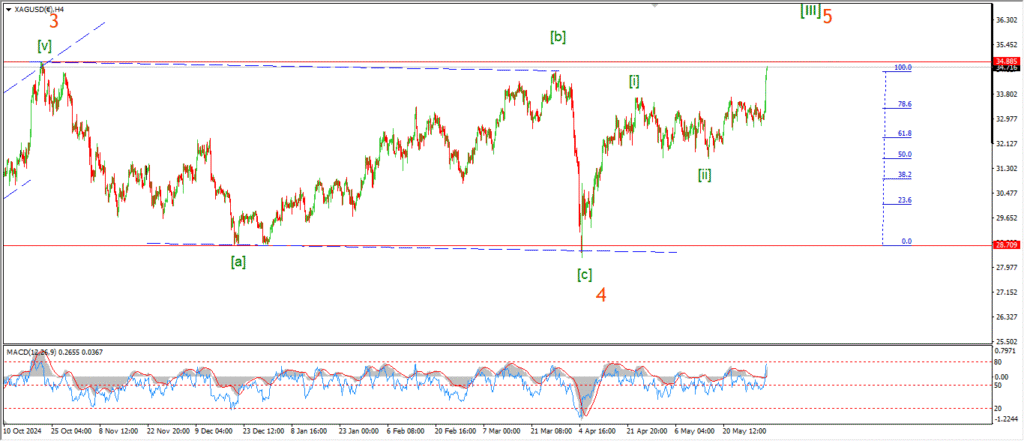

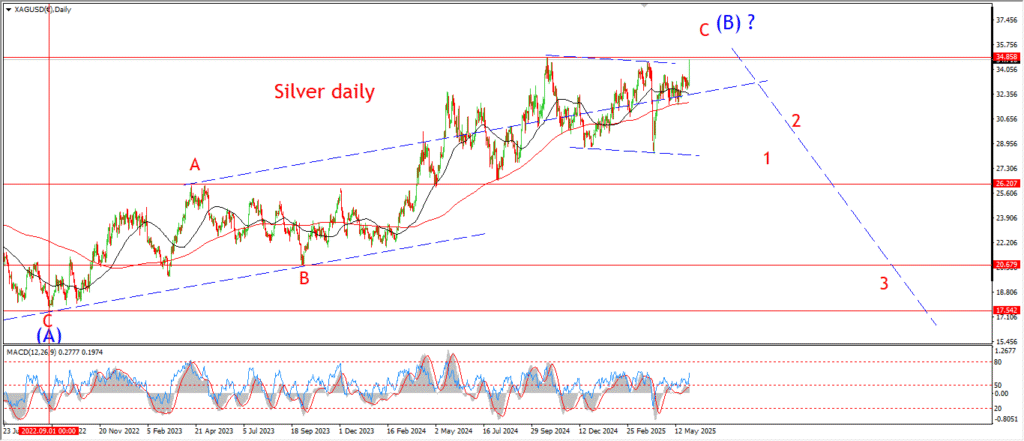

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

Another day,

another new count for silver.

This count is just a variation on last nights to be honest.

the fact that we saw two separate accelerations this week suggests wave (iii) is underway here.

This acceleration is happening in wave [iii] green.

And the 4hr chart suggests wave [iii] can reach above 37.00 again in this scenario.

Tomorrow;

If wave (iii) blue is underway,

then we should see a clear five wave pattern in wave ‘v’ pink to complete that rally.

At the moment the pattern requires one more step higher to close out wave (iii).

So lets see if wave ‘iv’ can hold at 33.95 and wave ‘v’ will turn higher again.

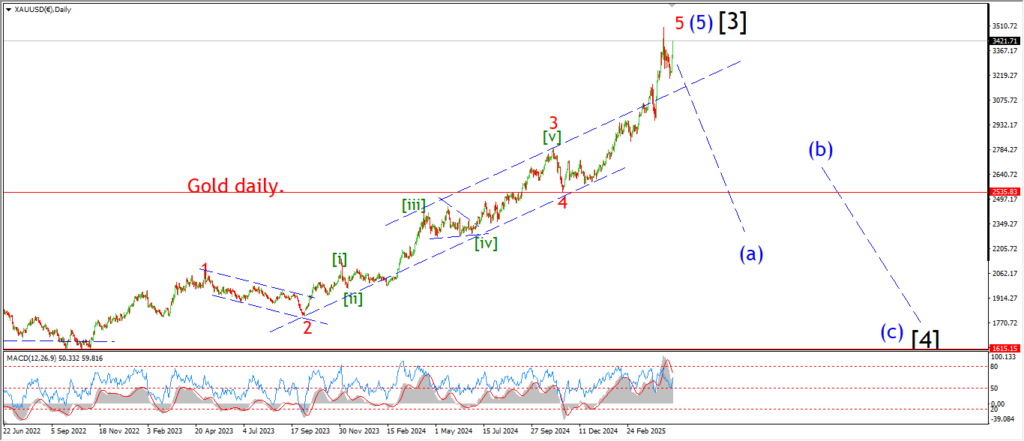

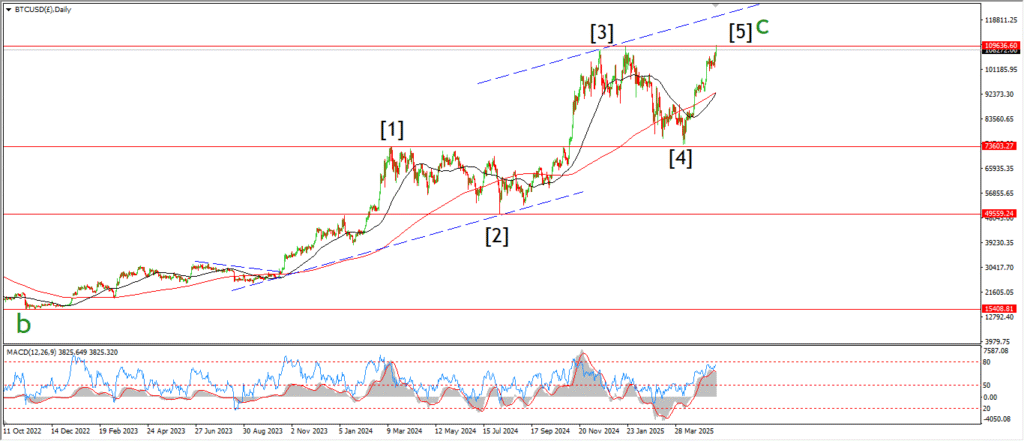

BITCOIN

BITCOIN 1hr.

….

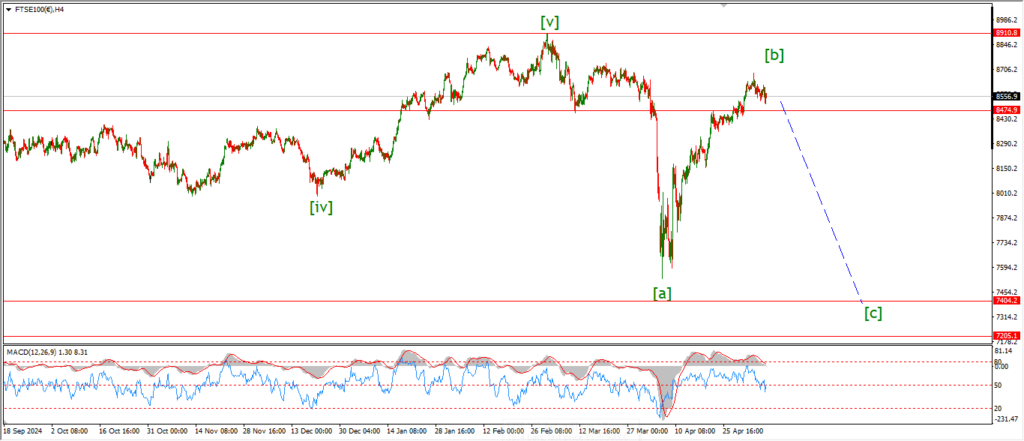

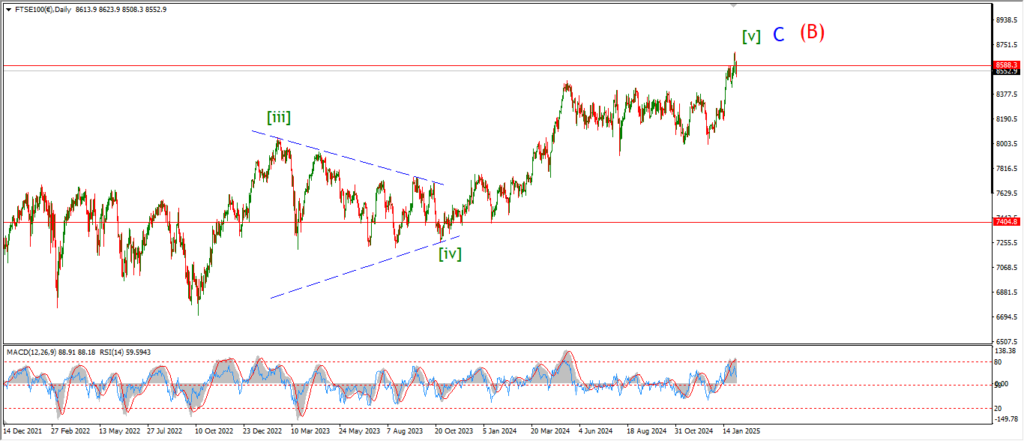

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

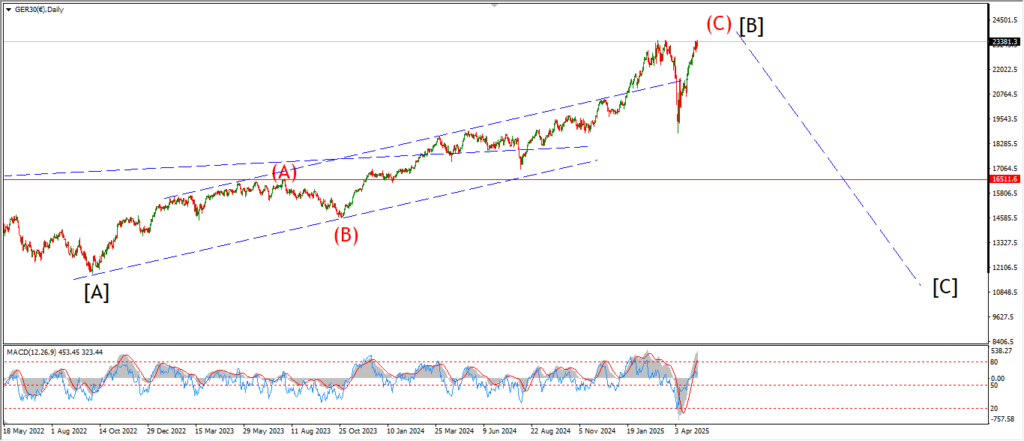

DAX.

DAX 1hr

….

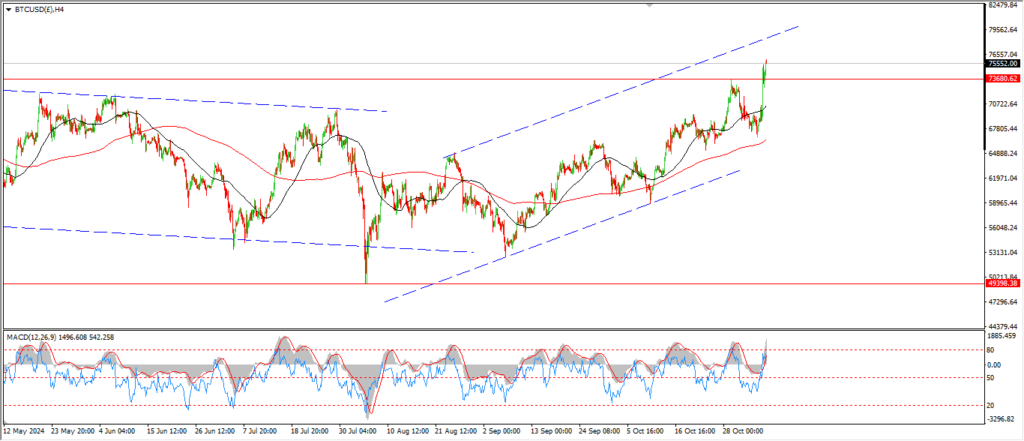

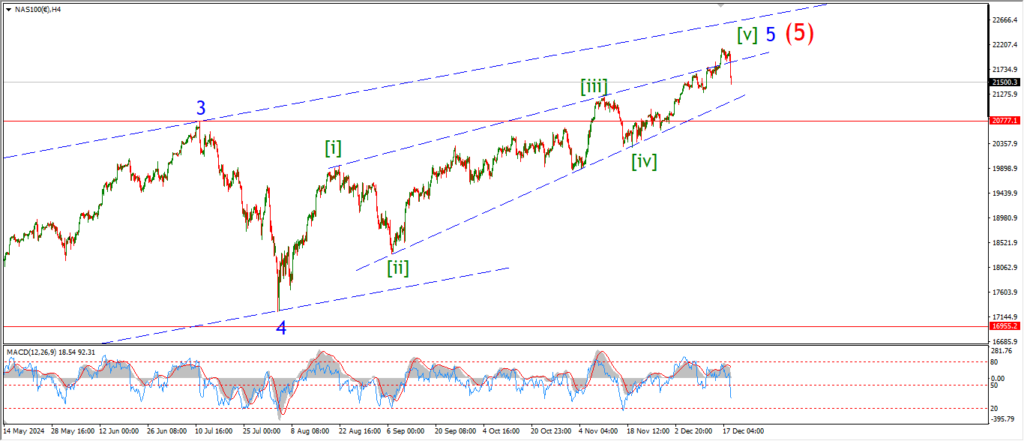

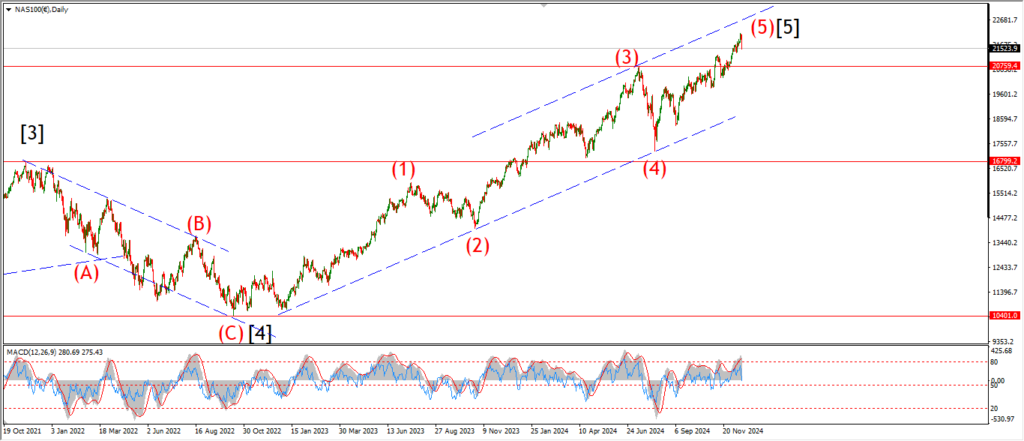

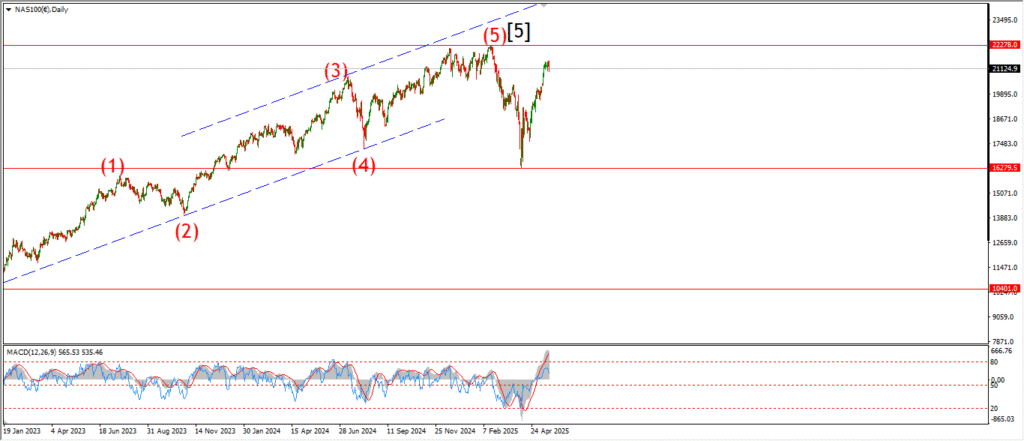

NASDAQ 100.

NASDAQ 1hr

….