Good evening to one and all.

Here is the video from earlier today.

https://twitter.com/bullwavesreal

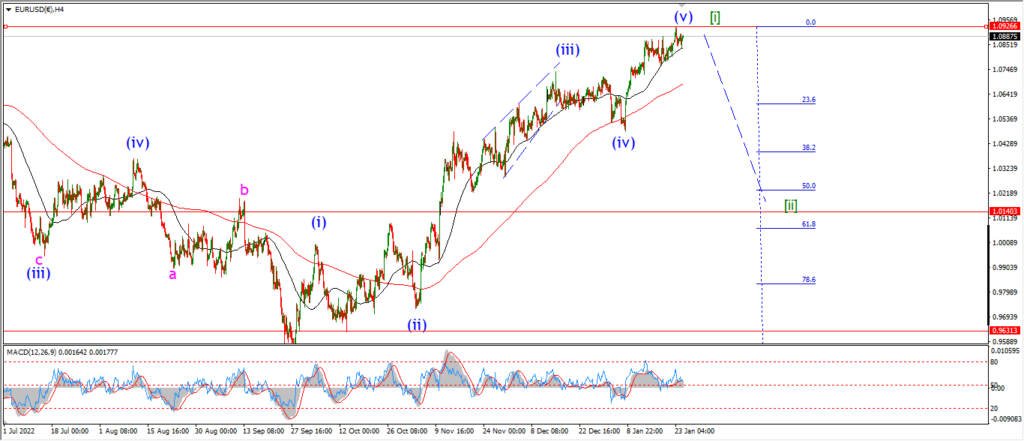

EURUSD.

EURUSD 1hr.

Right on que, wave ‘b’ turned down off the wave ‘a’ high today.

This begins wave ‘b’ of ‘iv’ and we should see a higher low form on Monday to complete wave ‘b’.

Wave ‘iv’ is tracing out a 3,3,5 flat correction so far.

Wave ‘a’ formed a three wave pattern higher,

and now wave ‘b’ should fall in three waves to a higher low.

Wave ‘c’ of ‘iv’ is set to rally in five waves again towards 1.0850 and that will finish off this pattern.

I suspect we will see wave ‘iv’ complete by Tuesday evening and then wave ‘v’ will carry the price lower for the rest of the week.

Monday;

Watch for wave ‘b’ to complete above 1.0634 by Monday evening and then turn higher into wave ‘c’ of ‘iv’ by Tuesday.

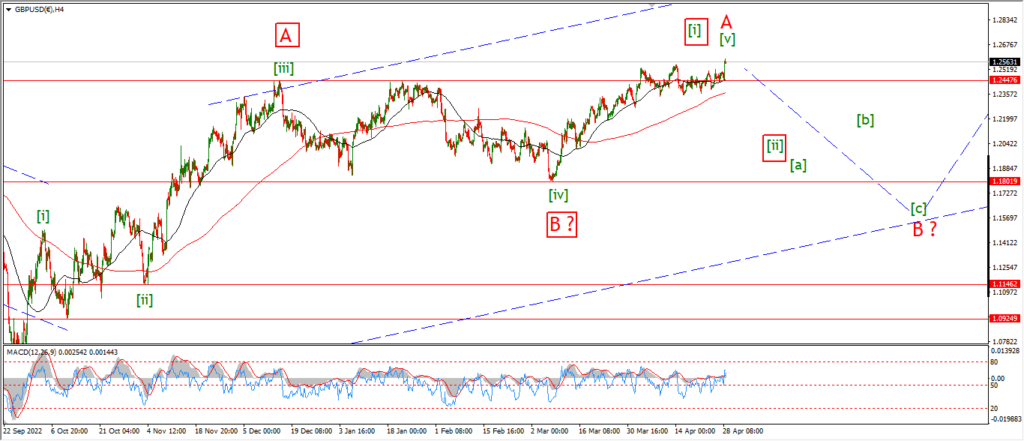

GBPUSD

GBPUSD 1hr.

Cable took a dive this afternoon after just peaking above the 62% retracement level last night.

I can’t confirm if this is the final top for wave (b),

but the sharp decline is definitely hinting at a turn into wave (c) down.

The price is holding at the wave ‘a’ high this evening,

and if we get a solid break below that level that continues below 1.24 again that should be confirmation that wave ‘i’ of (c) is underway.

Monday;

Watch for wave ‘i’ of (c) to trace out five waves down to the wave ‘b’ low at 1.2350.

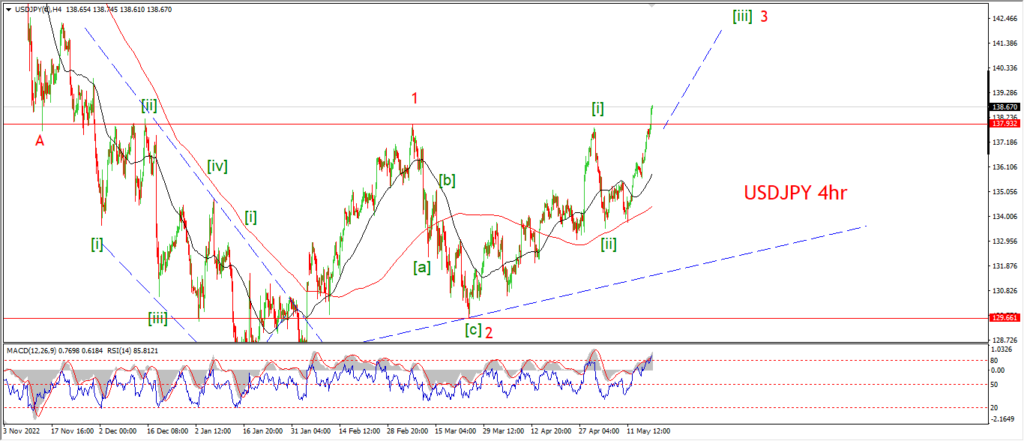

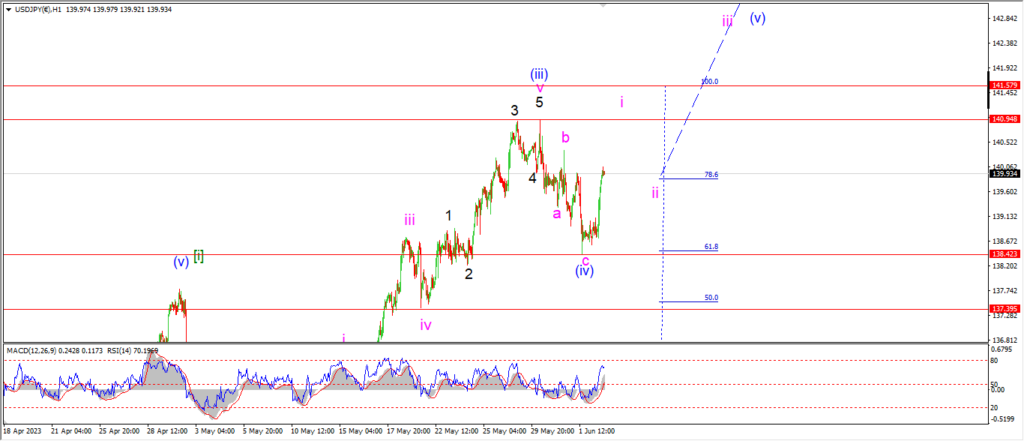

USDJPY.

USDJPY 1hr.

Wave (iv) of [iii] completed earlier than expected at 138.42 and now we have a nice spike rally off that wave (iv) low to begin wave ‘i’ of (v).

Wave ‘i’ should continue higher on Monday,

and then wave ‘ii’ should complete a bullish higher low above 138.42 early next week.

The larger degree wave (v) blue will only be confirmed with a break above 140.94 at the wave (iii) high.

Once that happens,

then we can concentrate on target for the next leg up to complete.

Monday;

Watch for wave ‘i’ of (v) to trace out five waves up towards the wave (iii) high at 140.94.

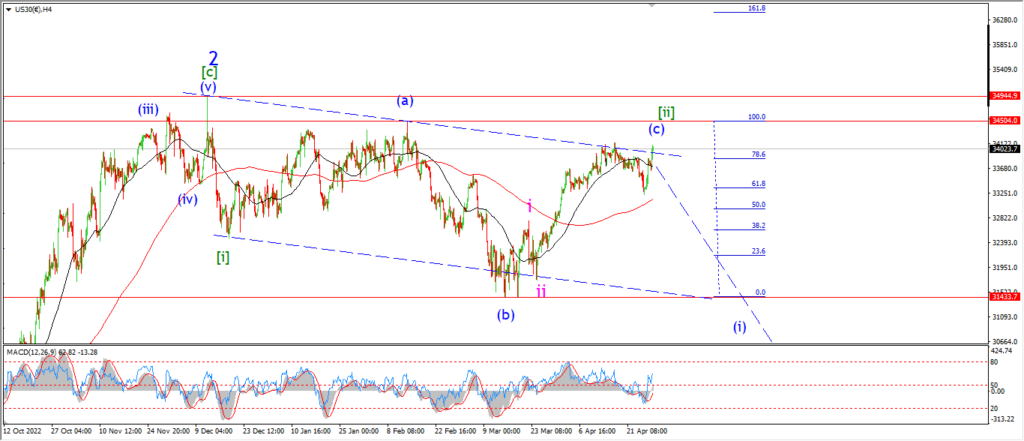

DOW JONES.

DOW 1hr.

I think we can call that a blow out day in the market.

For some reason people think the jobs number has some connection to actual reality on the ground.

It doesn’t,

but that don’t stop an algorithm switching to buy an a news item prompt.

And here we are after that rally with a pretty reasonable wave count left on the verge of being invalidated.

I am pretty confident that this rally will be sold on Monday because of it’s knee jerk nature without any basis in truth.

Those algo’s are probably already rethinking things!

But we will see how the early trade goes next week to confirm or deny the main wave count.

As for that count.

I am running with a large expanded flat correction wave ‘ii’ this evening because of that rally.

The lower high is holding below wave [ii] green.

And if the market does roll over again on Monday that will reinforce the idea of a third wave decline in wave (i) of [iii].

Monday;

If the new count for wave ‘i’ and ‘ii’ is correct,

then tonight’s high has retraced back to the 62% Fib level of wave ‘i’.

This is a perfect reversal level.

Watch for wave ‘iii’ to take the price lower beginning on Monday.

The high at 34268 must hold at wave [ii] green.

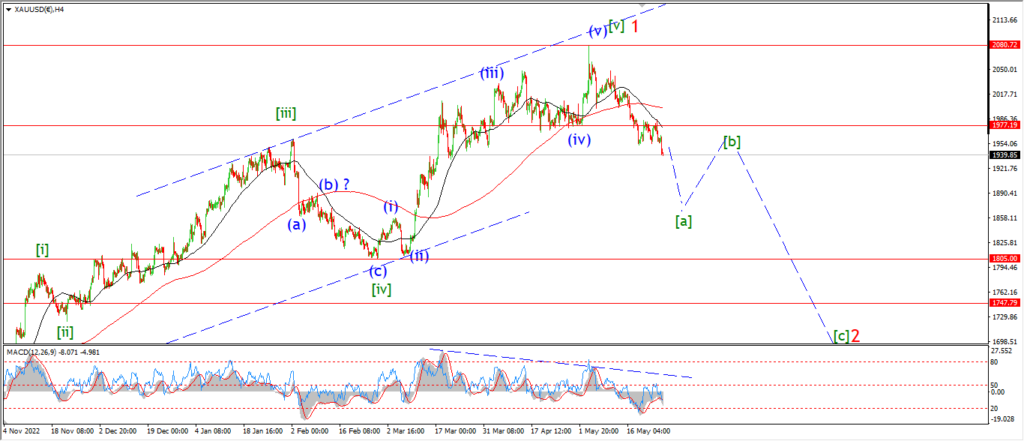

GOLD

GOLD 1hr.

I going to give Gold the benefit of the doubt here tonight.

The price has traced out three waves up into this weeks highs,

and now today the price has turned lower sharply again.

The alternate count calls wave (b) complete,

and wave ‘i’ of (c) underway at todays sharp decline.

Normally I would just run with that idea,

but I don’t think wave (b) has enough work done in terms of time and price to call it complete.

so I am allowing for a larger wave (b) to complete over the next few days.

With wave ‘c’ of (c) left to rally back towards 2000 again by the end of next week.

Monday;

Watch for wave ‘b’ to hold above 1932 and then wave ‘c’ to rally in five waves towards 2000.

A break of the wave (a) low again will favor the alternate count.

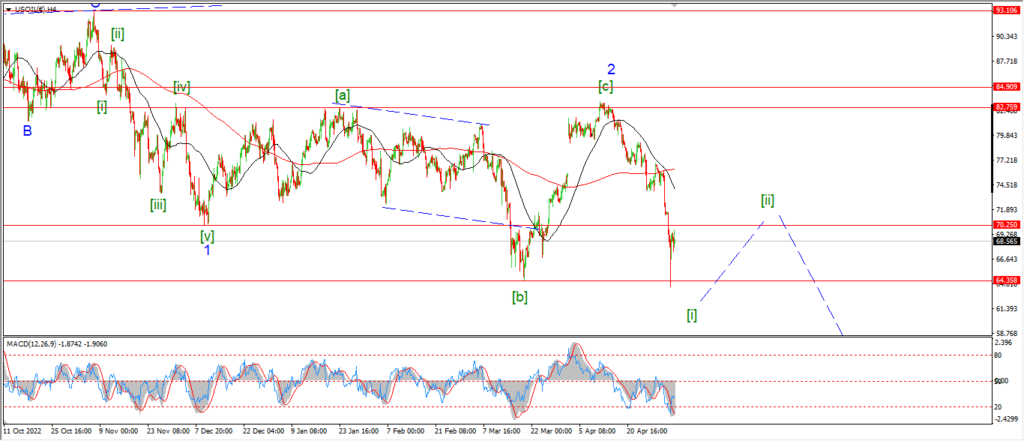

CRUDE OIL.

CRUDE OIL 1hr.

Crude is working its way higher in a less than stellar manner today.

The action so far this week is encouraging for the wave count but this count still hangs in the balance.

I am suggesting that wave ‘iii’ of (c) should reach to the corrective high at 73.55 again to confirm this pattern.

With the minimum target for wave (c) at 74.69.

Monday;

Watch for the wave ‘i’ high to hold at 69.57.

A break of that level will favor the alternate count again.

wave ‘iii’ of (c) should push a little higher to confirm this count.

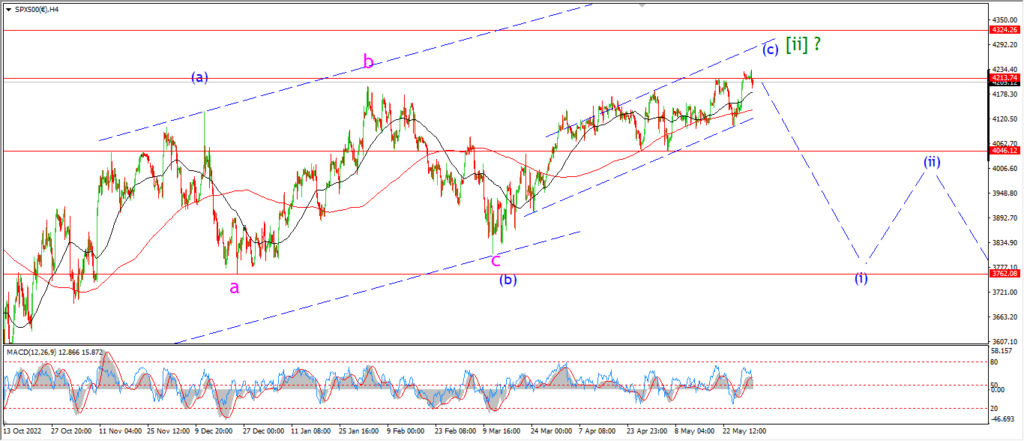

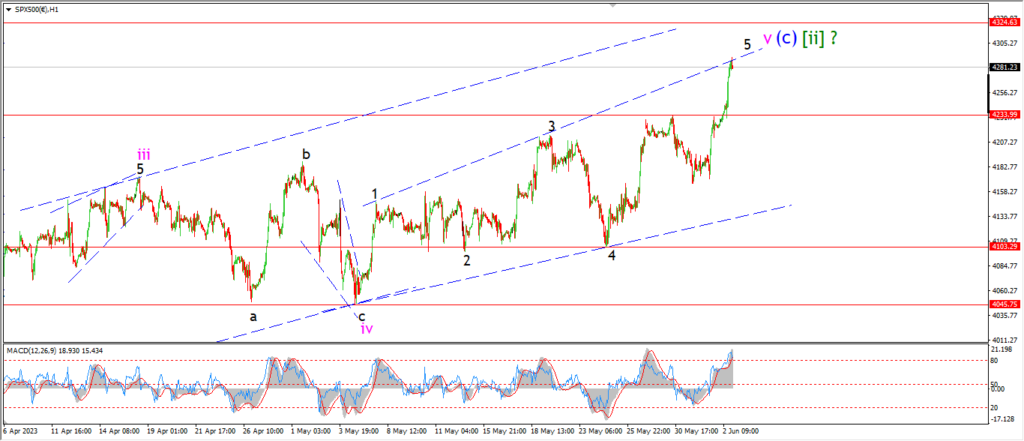

S&P 500.

S&P 500 1hr

The S&P has pushed the boundaries of the main count also tonight.

The pattern is and to be honest,

I will be surprised if the main wave count for wave (c) of [ii] holds.

But that still does not rule out the possibility for a reversal as I mentioned earlier in the Dow section above.

The rally today has reached the upper trend line of this expanding wedge pattern.

and at this moment,

the previous high of wave ‘2’ at 4324 is holding.

So I can stick with this count for as long as that high continues to hold.

If that resistance level breaks at 4324 that does not at all rule out the overall bearish setup here.

The wave alternate count for wave ‘2’ just kicks in,

and we begin the search for wave ‘3’ down all over again.

I know this is annoying,

believe me,

I know.

But,

a nine month rally that barely manages to retrace 62% of the whole decline off the all time highs is not a new bull market.

Even at that point,

this is just a second wave retracement.

And we wait for the reckoning to begin in wave ‘3’.

Monday;

Lets see if the high at wave ‘2’ holds at 4324.

A quick reversal of todays rally on Monday will revive this main wave count again.

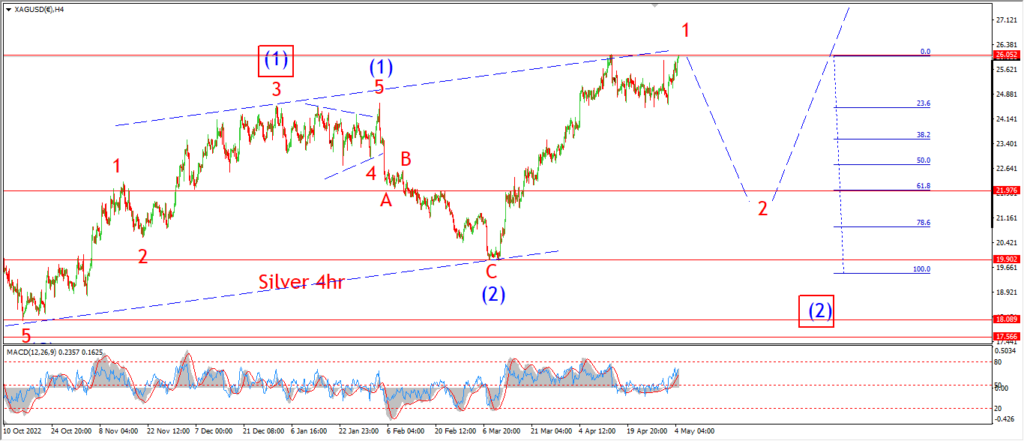

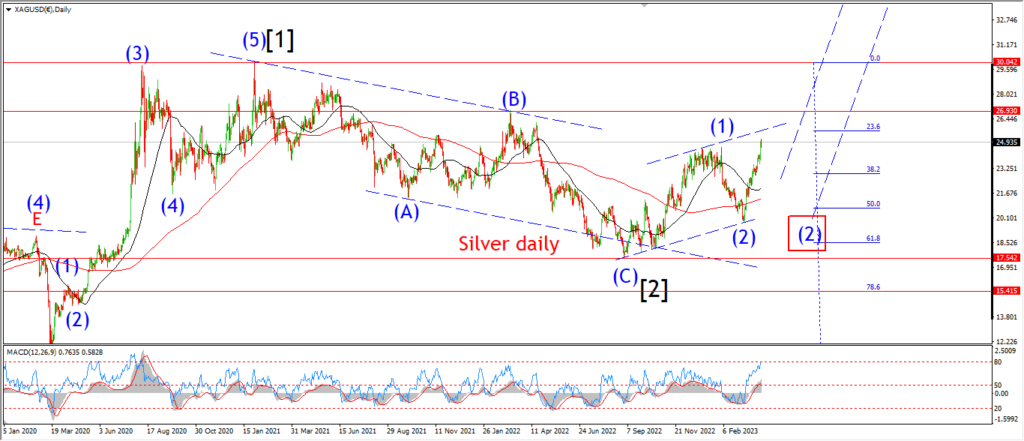

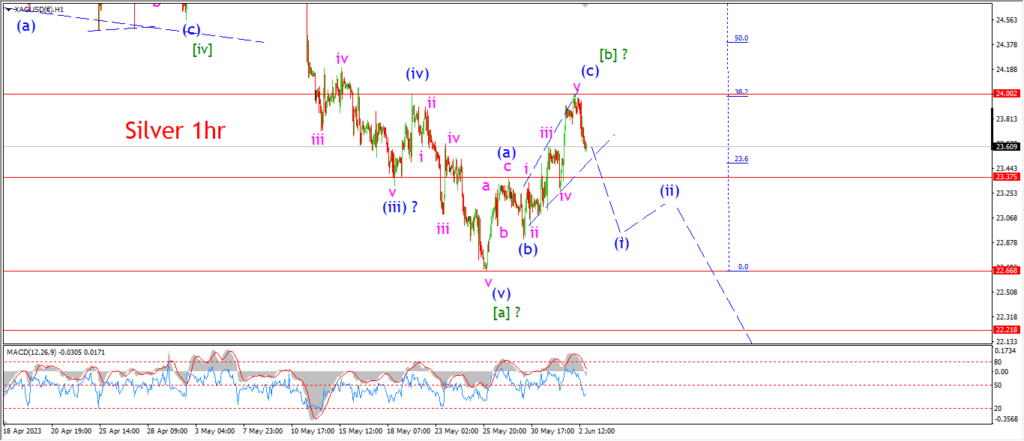

SILVER.

SILVER 1hr

Silver topped out this weeks very awkward rally at the 38% retracement level of wave [a] today.

And now we have a three wave rally in wave [b],

with a small decline off the top already in place at the close.

Todays highs also matched the previous wave (iv) high to add weight to this interpretation also.

So with the price action now pointing to a possible top in wave [b],

The turn lower this evening is also pointing to the beginning of wave [c] down.

Monday;

The high at wave [b] should hold from here.

Watch for wave () of [c] to take over and trace out five waves down towards 23.00 again.

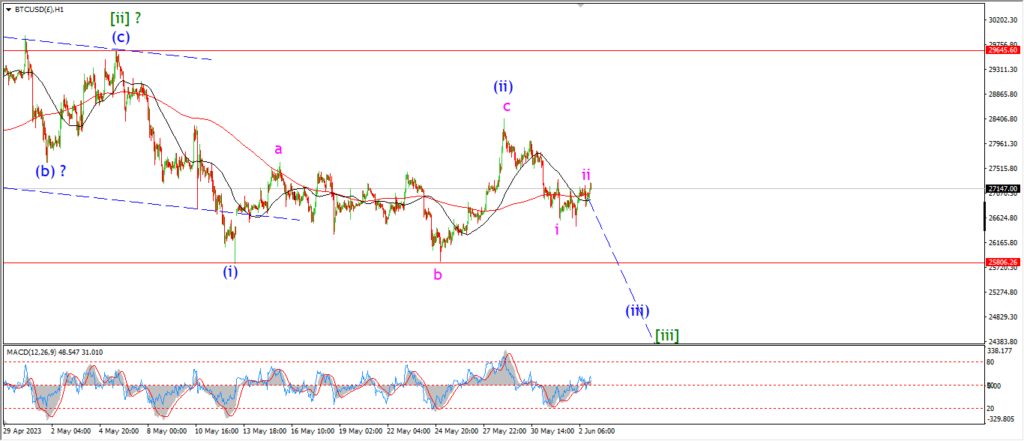

BITCOIN

BITCOIN 1hr.

….

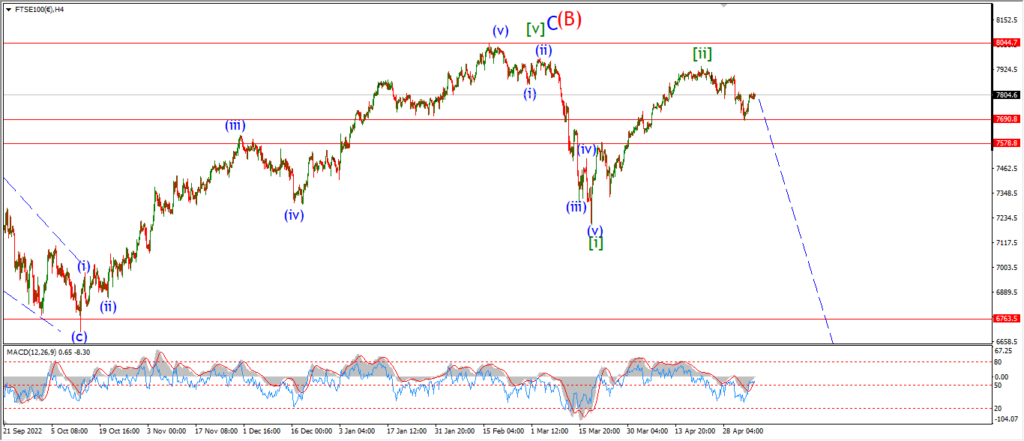

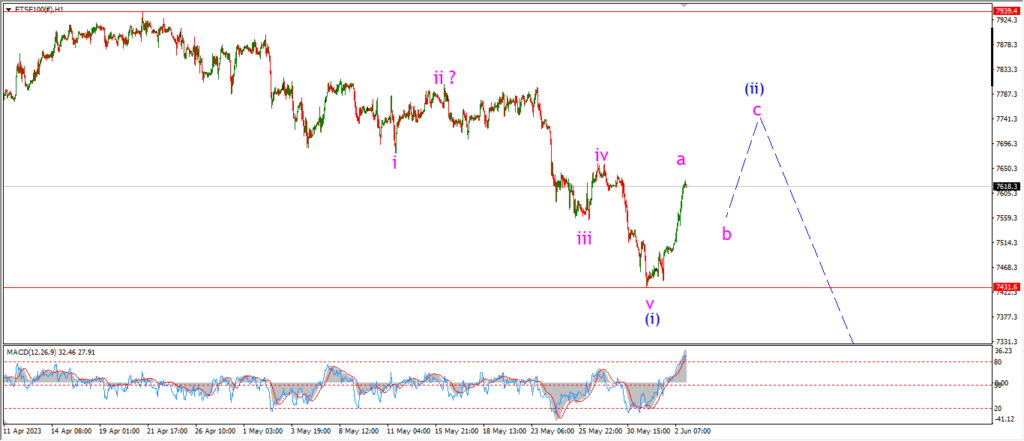

FTSE 100.

FTSE 100 1hr.

….

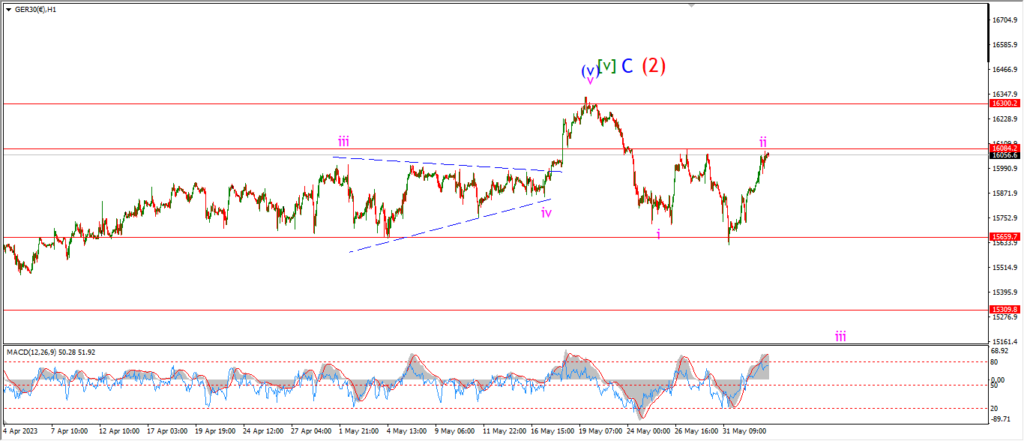

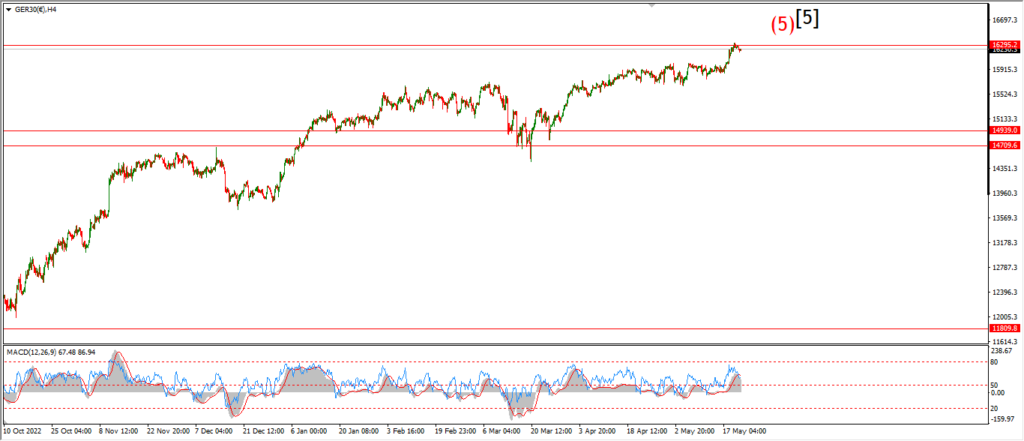

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

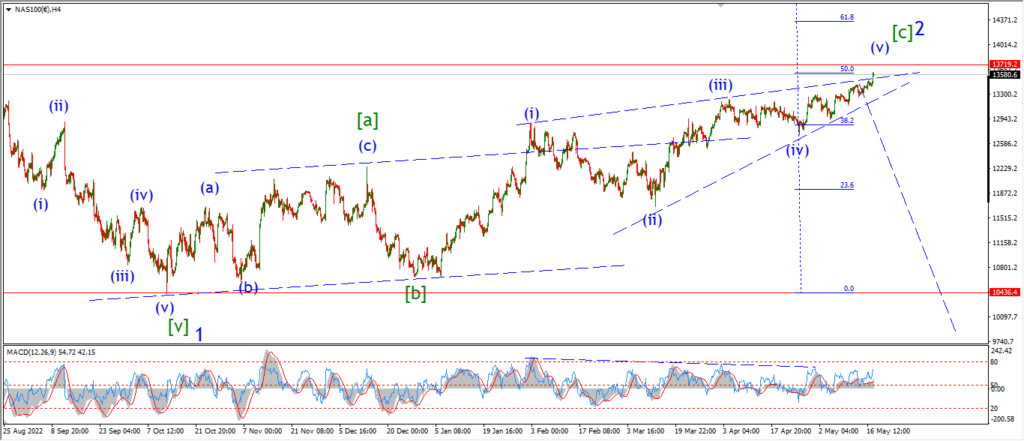

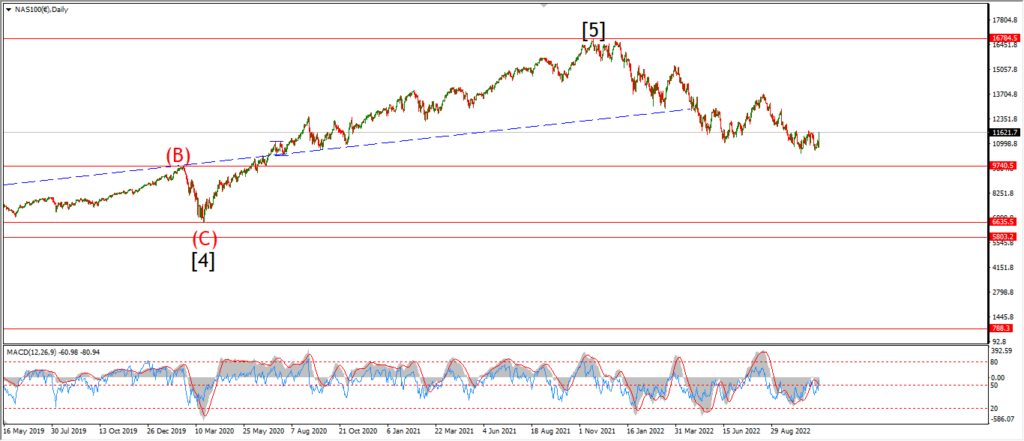

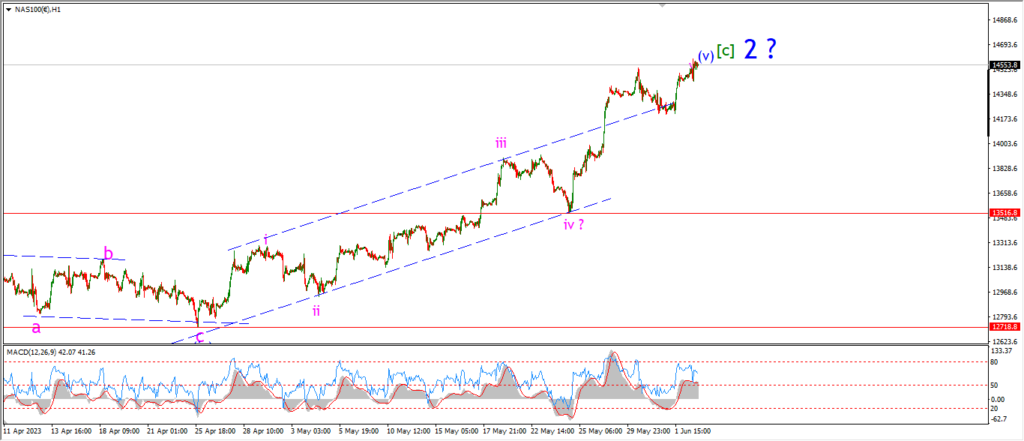

NASDAQ 100.

NASDAQ 1hr

….