Good evening folks, the Lord’s Blessings to you all.

Here is a great interview with Jeff Gundlach from last week.

https://twitter.com/bullwavesreal

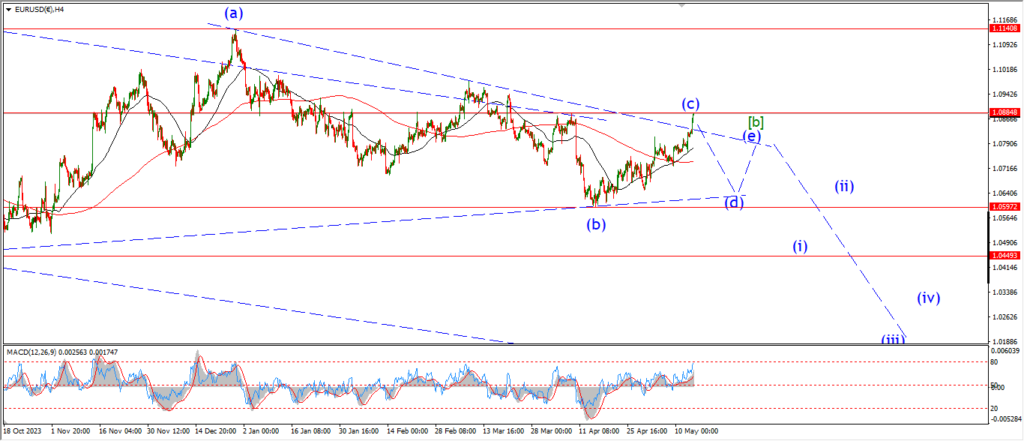

EURUSD.

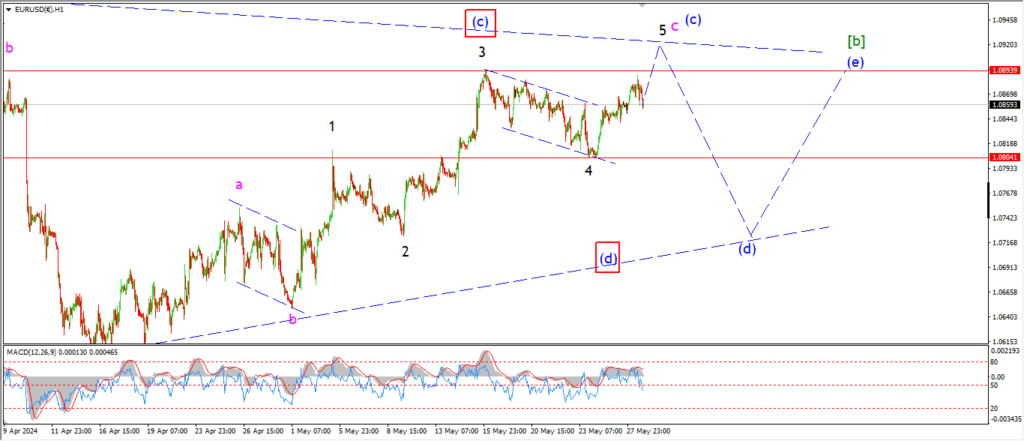

EURUSD 1hr.

EURUSD is close to topping out in wave ‘5’ of ‘c’ of (c) now.

the price has not reached the the minimum target at 1.0894 yet,

the top today came at 1.0888,

So there is room for a push above the target level to complete the pattern.

Once wave (c) tops out,

then we will see a three wave decline into wave (d) for the rest of the week.

The larger triangle pattern in wave [b] green seems to be oscillating around the 1.0800 level overall.

So you can expect that level to continue as an anchor to the range of action over the coming days.

Tomorrow;

Watch for wave (c) to top out and then wave ‘a’ of (d) should turn lower again.

I expect a drop into the 1.0800 level again in wave ‘a’.

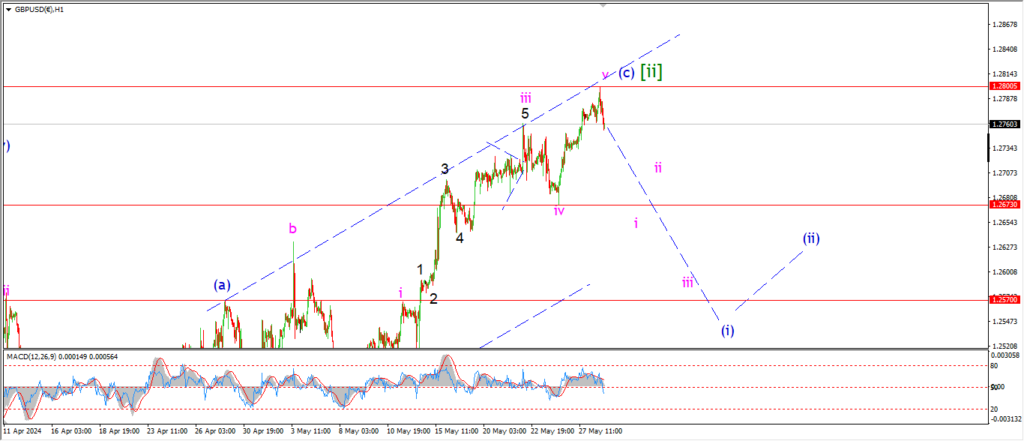

GBPUSD

GBPUSD 1hr.

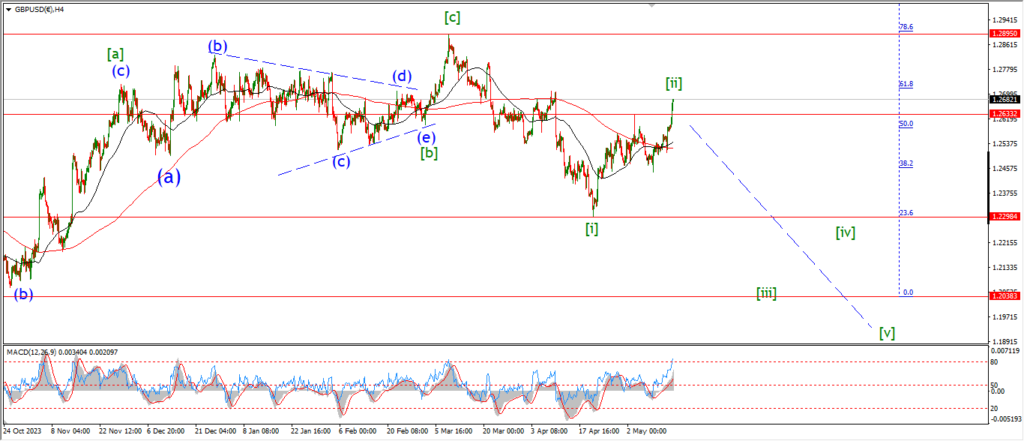

GBPUSD 4hr.

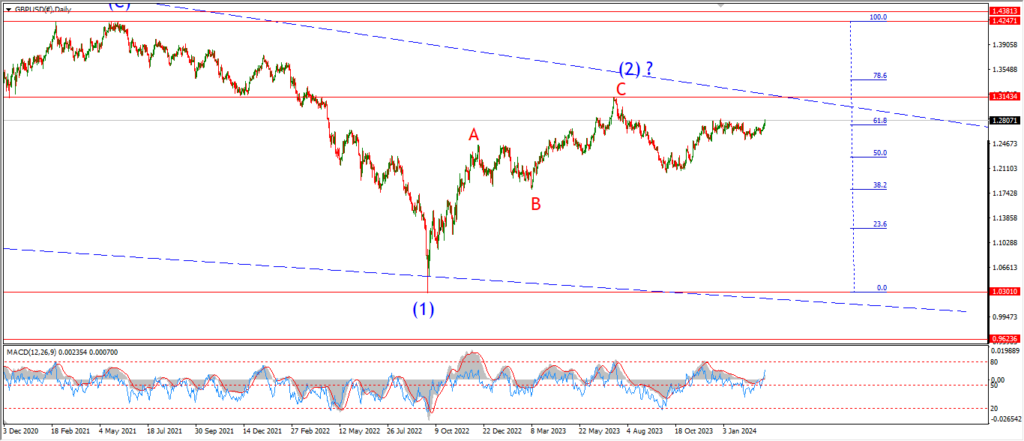

GBPUSD daily.

Cable gave us a new high today in wave ‘v’ of (c) of [ii].

The rally failed just below the upper trend channel line at 1.2800.

And now the pattern in wave [ii] is filled out nicely,

it is time for this market to make a turn lower into wave (i) of [iii] this week.

Tomorrow;

Watch for a drop below the wave ‘iv’ low at 1.2673 to signal wave ‘i’ of (i) is underway.

USDJPY.

USDJPY 1hr.

The action in USDJPY has been corrective to the downside all day in wave ‘2’ of ‘iii’.

Until the market bounced out of the lows at 156.56 this evening and rallied back into the wave ‘1’ high again.

The action is still a little undecided here,

I need a spike higher again to signal wave ‘iii’ pink is underway.

But as long as the upside action continues,

then the bullish count sticks.

Tomorrow;

Watch for wave ‘3’ of ‘iii’ to take the price up towards the initial target level for wave (iii) blue at 158.50.

A break of 155.84 will be a cause for concern in the short term.

DOW JONES.

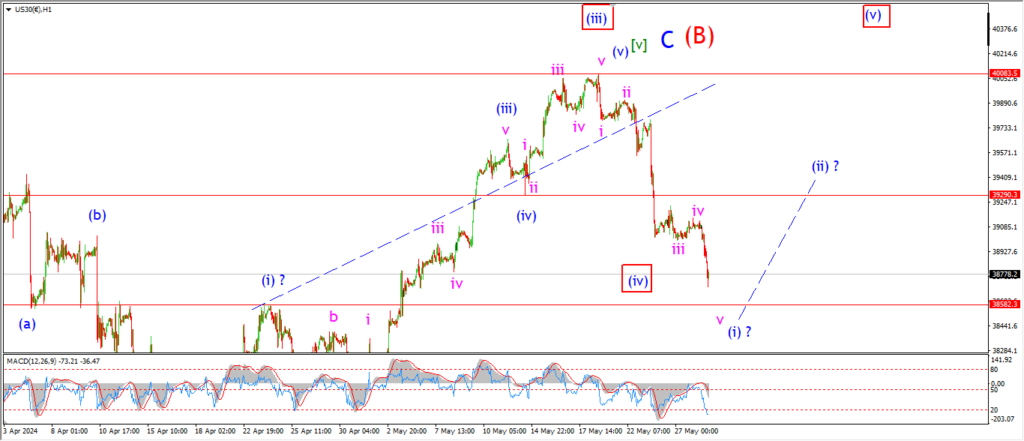

DOW 1hr.

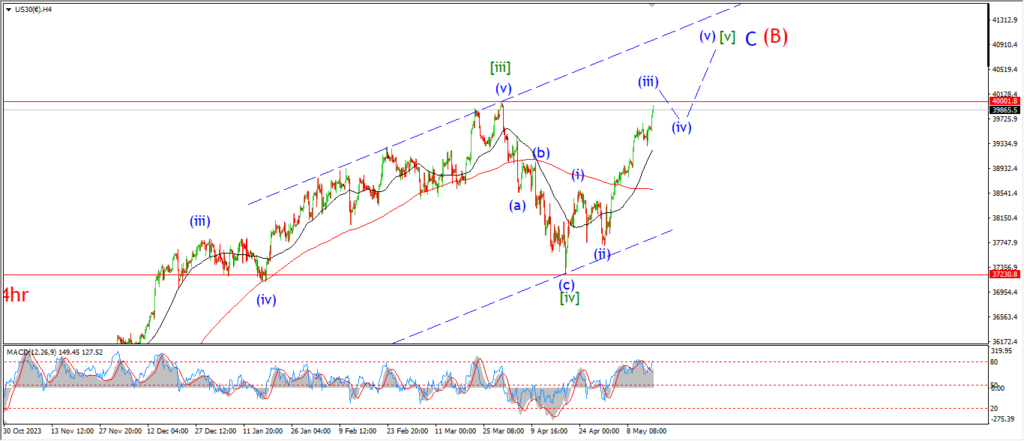

DOW 4hr

DOW daily.

The DOW becomes the first market to trace out five waves down off the new high today.

The ideal target for this initial decline is a break of the previous wave (i) high at 38580,

we are not there yet,

but getting close as I write this evening.

So,

There is a chance here that we have a new impulsive structure building to the downside.

and the real possibility of a top in place for wave (B) is again on the table.

Tomorrow;

In an ideal world,

wave ‘v’ of (i) will break the previous wave (i) high at 38580.

So lets see if that happens.

After that I will look for a correction higher into wave (ii).

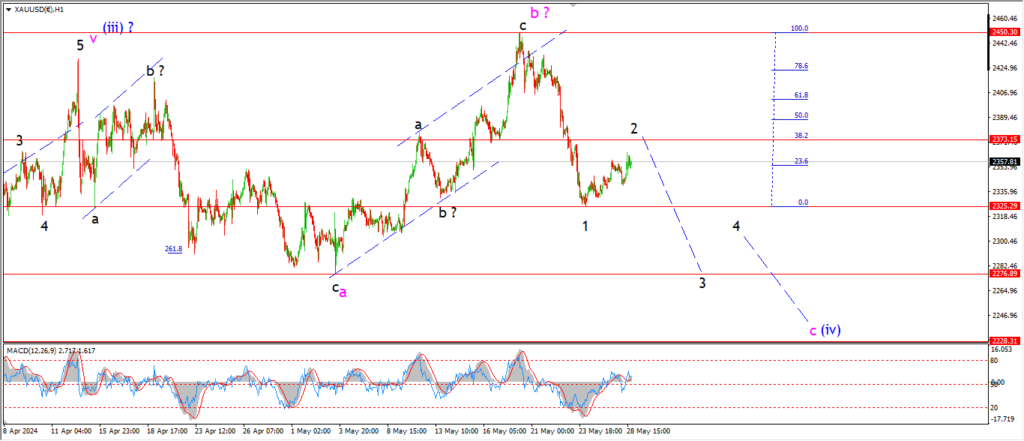

GOLD

GOLD 1hr.

Gold is holding pretty steady in a correction higher today.

the price has drifted higher this evening,

but I do think we are drawing close to a top for wave ‘2’ of ‘c’ now.

And the next move will be to the downside in wave ‘3’ of ‘c’ of (iv) later this week.

the correction in wave ‘2’ is still relatively shallow in terms of the retracement.

At the most wave ‘2’ has only broken the 23.6 Fib level so far.

I have market the 38% Fib at 2373 as a potential turning point.

Tomorrow;

Watch for wave ‘2’ to complete this corrective rise in the next few sessions.

Wave ‘3’ of ‘c’ should then fall back sharply by the end of this week.

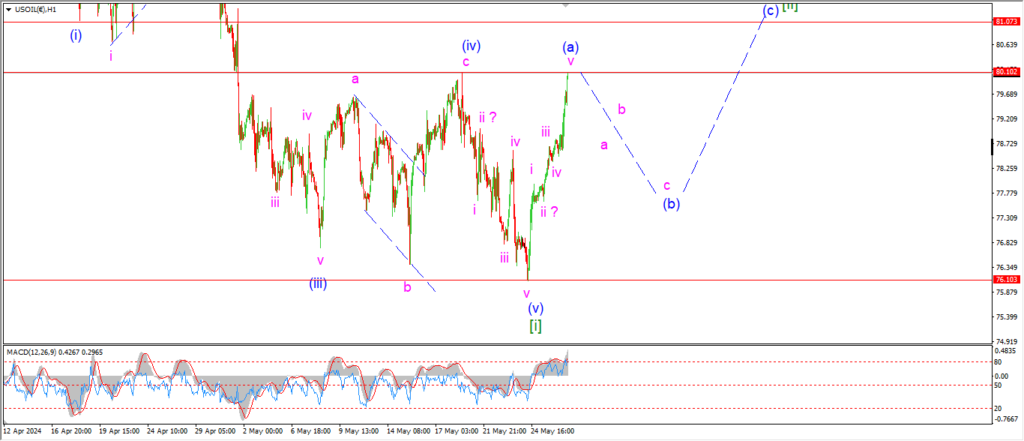

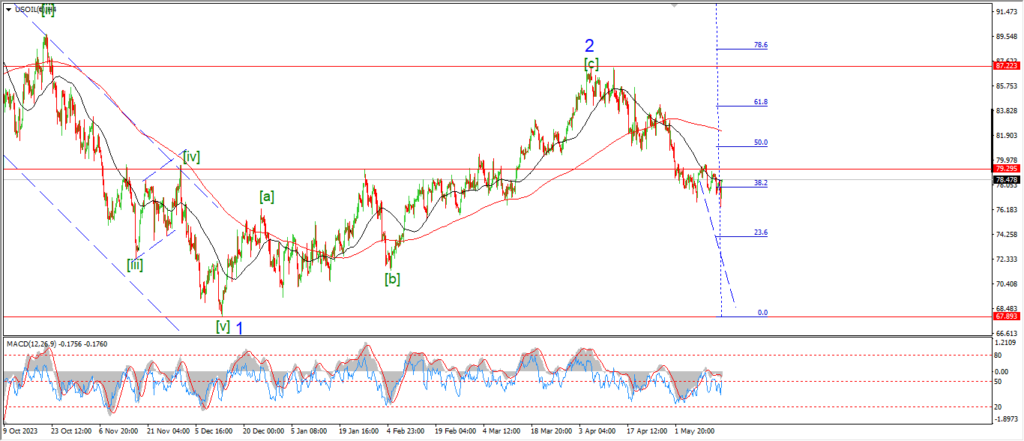

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude has continued its rally in wave (a) of [ii] today,

but I am now suggesting that wave (a) is a five wave pattern rather than a three wave pattern I showed last week.

The highs today have hit the previous wave (iv) high at 80.10 this evening.

And that is the initial target level for wave (a).

There is a possible five wave pattern in place at todays highs,

so I think wave (a) has done enough now.

I am looking for a decline into wave (b) over the next few sessions.

Tomorrow;

Watch for wave (a) of [ii] to top out a five wave rally at this resistance level.

Wave (b) should fall in three waves back below the 78.00 level again by the end of this week.

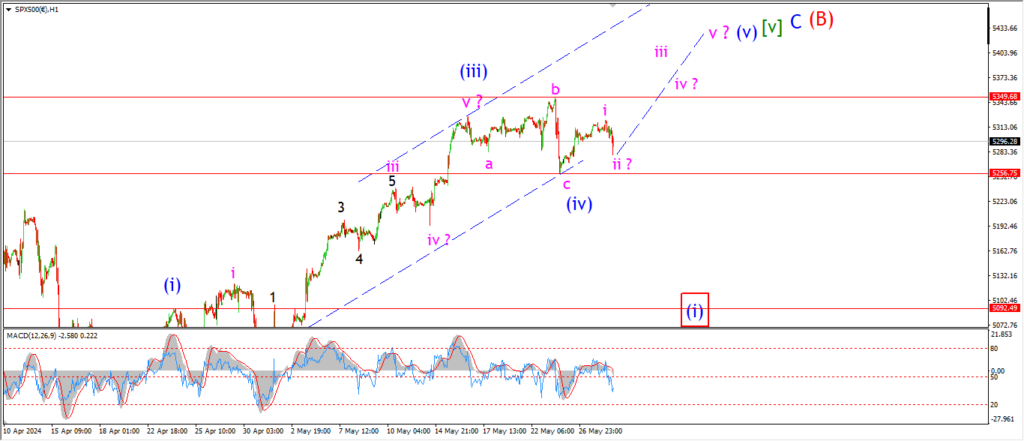

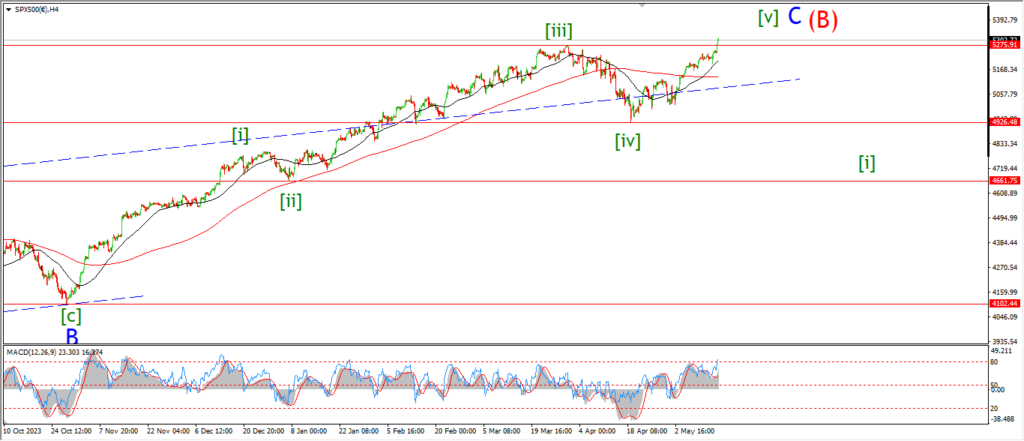

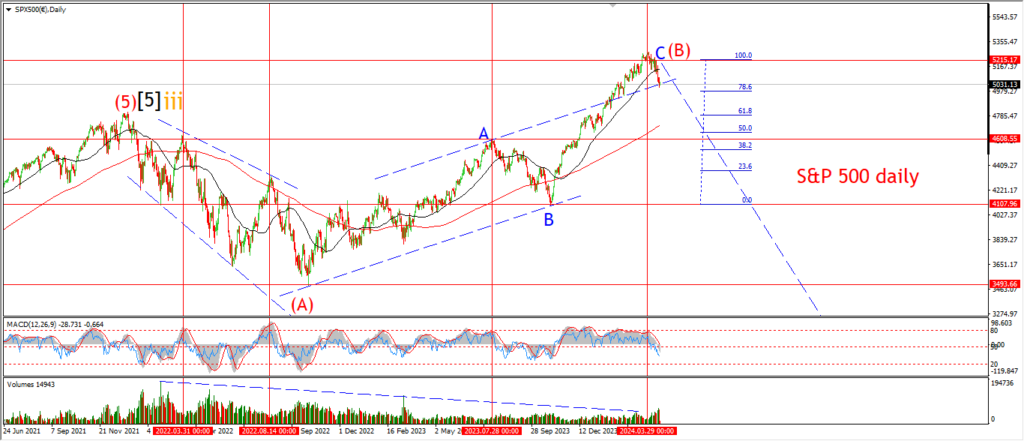

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P is holding above the wave (iv) lows at 5256 this evening and I have shown a possible count for wave (v) developing.

Wave ‘i’ and ‘ii’ have created a higher low so far.

And wave ‘iii’ is expected to rally out to a new high tomorrow.

If all goes well here,

then wave (v) of [v] will complete this week with a break above 5350 again.

And then I will look for a reversal to begin wave (i) down.

Tomorrow;

Watch for wave (iv) to hold and wave ‘iii’ of (v) to turn higher again.

A break below 5090 will signal that wave (i) is already underway.

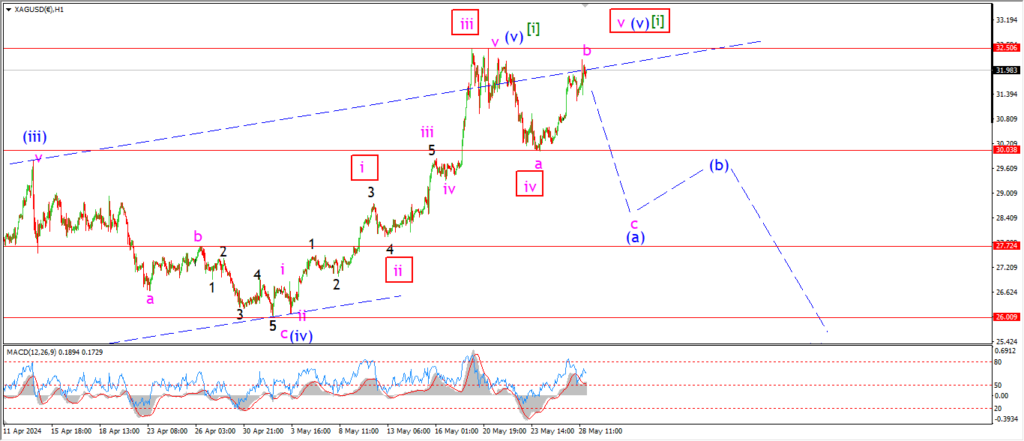

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

Silver is holding a lower high below wave [i] today,

but the wave count for wave (a) is not convincing me yet.

this lower high is labelled as wave ‘b’ of (a).

And this requires a turn lower into wave ‘c’ very soon.

Wave ‘c’ should fall below 30.00 again with ease.

And then we can look for a consolidation in wave (b) possibly next week.

The alternate count for wave (v) is shown boxed in red.

This is a real possibility now after todays spike higher.

So we will see which count wins out tomorrow.

Watch for a drop below 30.00 again in wave ‘c’ of (a) to confirm the main pattern.

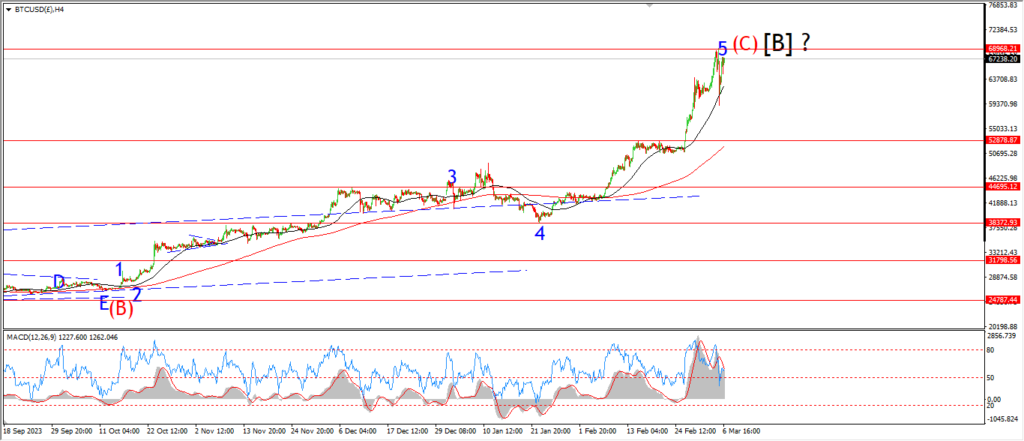

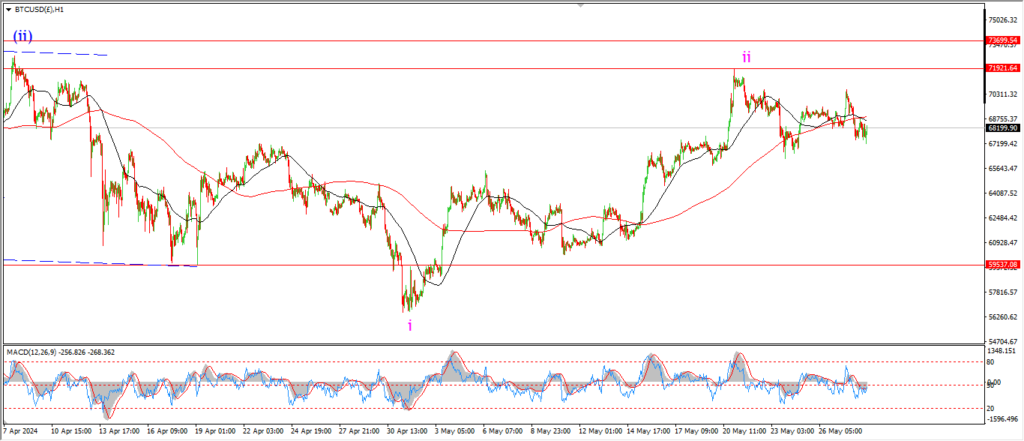

BITCOIN

BITCOIN 1hr.

….

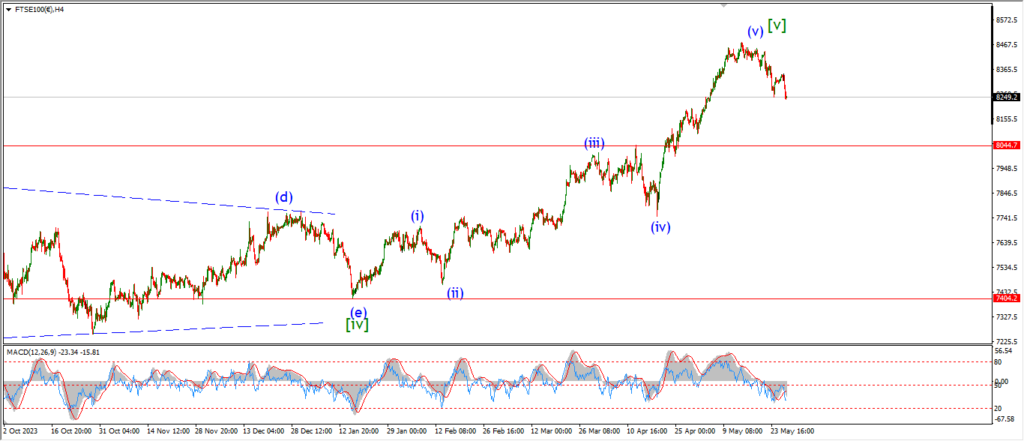

FTSE 100.

FTSE 100 1hr.

….

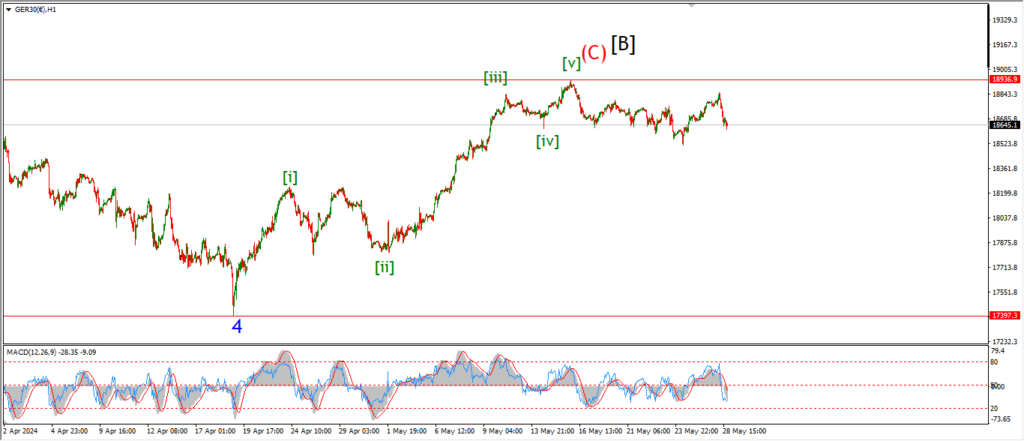

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

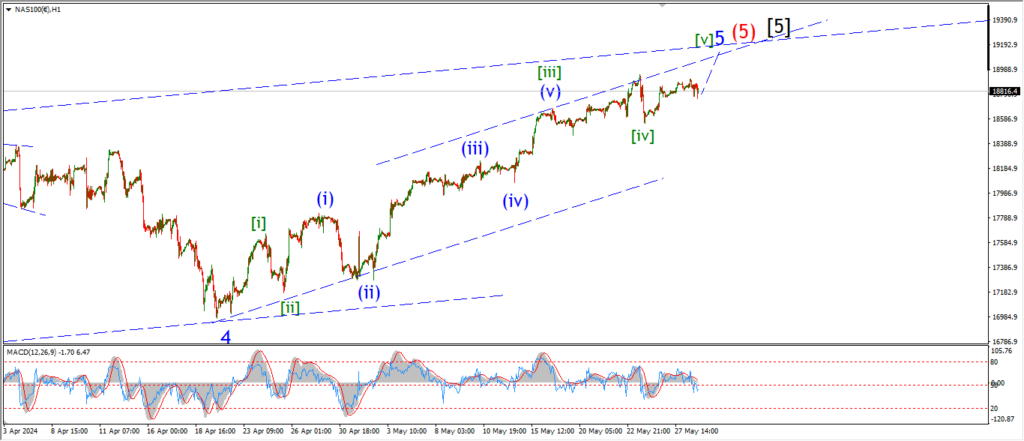

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….