Good evening to one and all.

The Lord’s Blessing’s to you all again tonight.

https://twitter.com/bullwavesreal

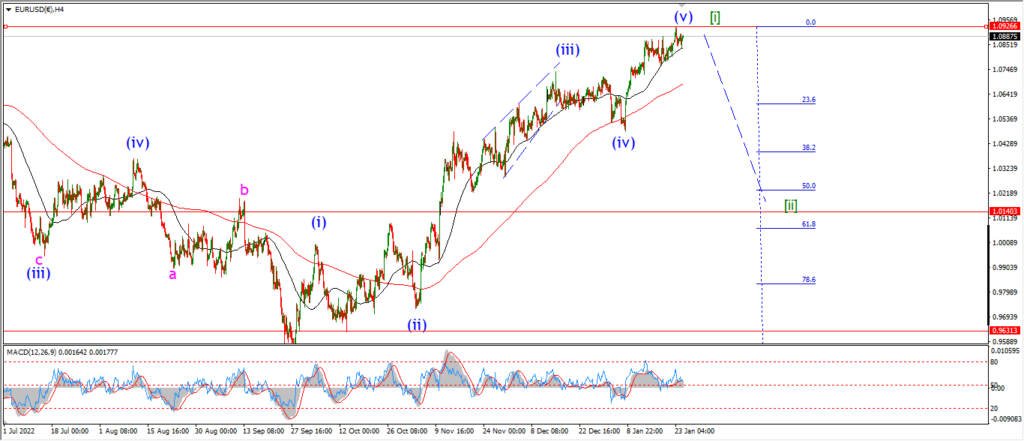

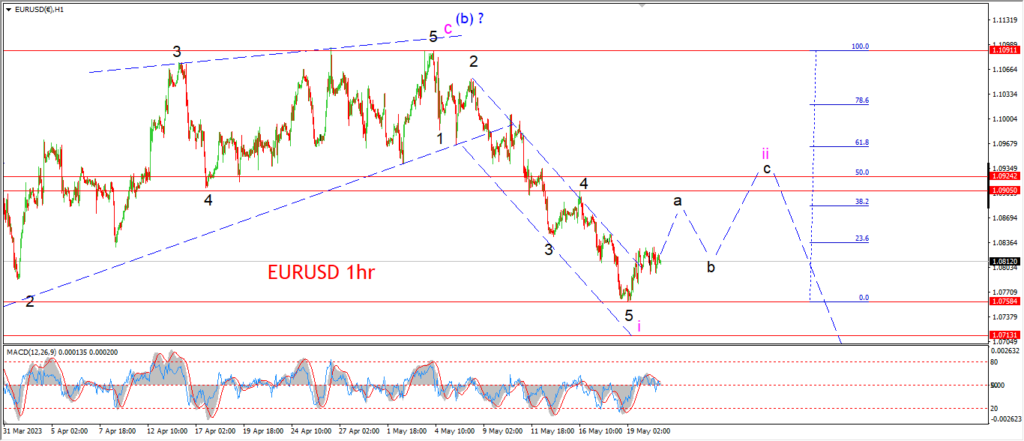

EURUSD.

EURUSD 1hr.

It’s been a fairly weak rise off the wave ‘i’ low created last Friday.

so far the rally has not managed to retrace more than half of the previous wave ‘5’ of ‘i’.

At the moment I am suggesting this rally is part of wave ‘a’ of ‘ii’.

In this scenario wave ‘a’ will create a three wave pattern higher into the 1.09 area.

Overall wave ‘ii’ would complete a flat correction ,3,3,5 pattern higher.

And that means the trade this week will be very choppy and lacking any real direction today.

Three waves up should top out near the 50% retracement level at 1.0930.

Tomorrow;

Watch for wave ‘a’ and ‘b’ to complete a higher low above 1.0758 by midweek this week.

If I am correct here then this weeks trade will be slow!

But we will see soon enough.

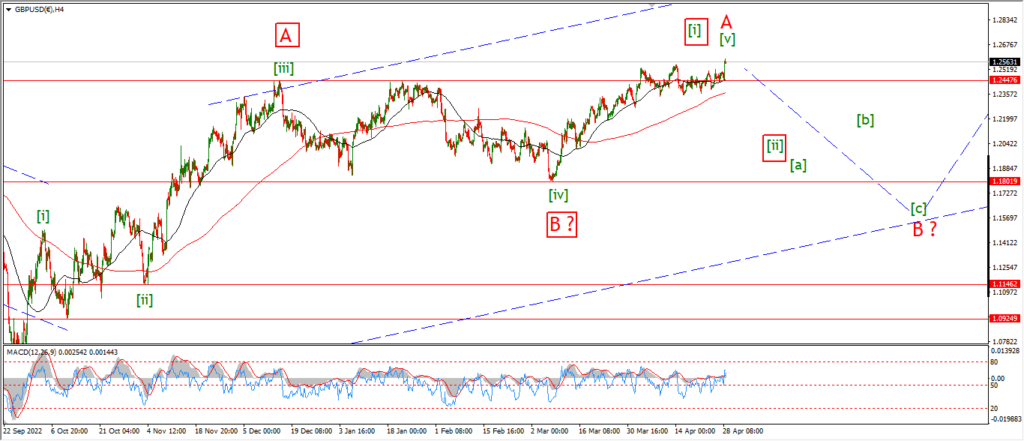

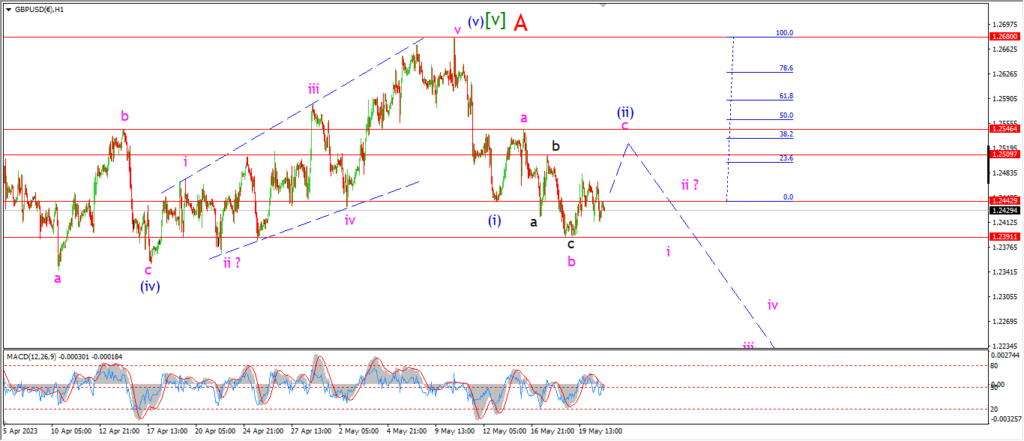

GBPUSD

GBPUSD 1hr.

A similar story in cable tonight as the action todays was flat overall.

I am expecting a rise into wave ‘c’ of (ii) for the first half of this week to complete an expanded flat correction.

So far the price is holding a higher low above wave ‘b’ at at 1.2391.

And as long as that level holds tomorrow,

then this pattern will remain my preferred count.

Tomorrow;

watch for wave ‘c’ of (ii) to continue higher towards 1.2546 in a three wave pattern.

An expanded flat correction will complete above that level and then turn lower into wave (iii).

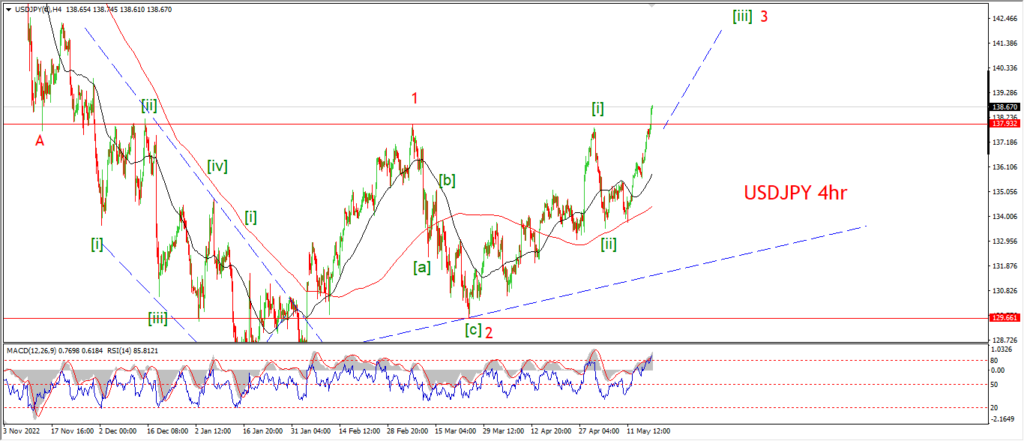

USDJPY.

USDJPY 1hr.

USDJPY is higher today and which is in line with the wave ‘v’ idea at the moment.

The price has not broken to a new high above wave ‘iii’ just yet,

so that wave ‘v’ label is still uncertain.

There is a possibility that wave ‘iv’ could be developing into a larger pattern

and in that case wave ‘iv’ will drop back into the 137.40 level again as shown by that alternate count.

In either case,

wave ‘iv’ will complete soon enough.

wave (i) then requires one more rally to top out above 139.00.

And once that happens later in the week,

then I will begin to look lower into wave (ii) to begin as shown.

Tomorrow;

Watch for wave ‘iv’ of (i) to hold at 137.40.

Wave ‘v’ should continue higher as suggested and top out near the 139.50 level.

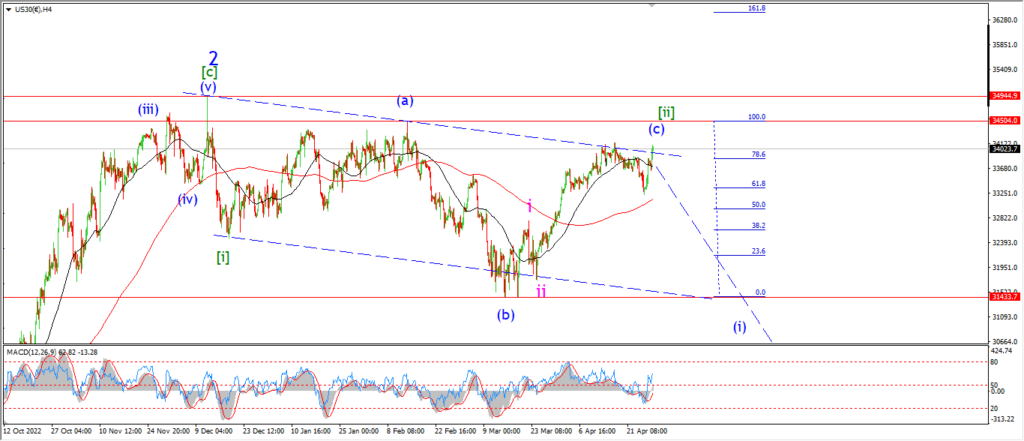

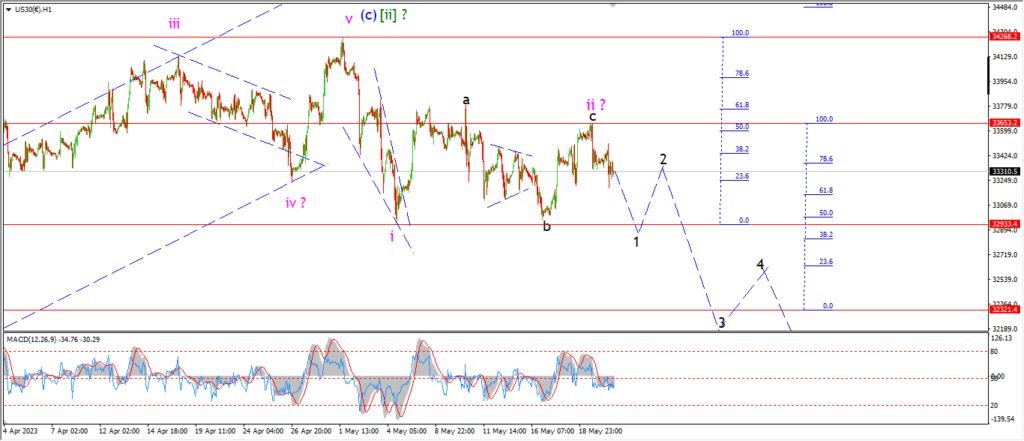

DOW JONES.

DOW 1hr.

Well apart from an early spike lower the market is basically flat as the session closed this evening.

The action has not confirmed any third wave decline into wave ‘iii’ yet.

but as longs as the main bias in the trade is to the downside,

then I think we can continue looking for wave ‘iii’ of (i) to build over the coming days.

Tomorrow;

Watch for the wave ‘ii’ top to hold at 33650.

Wave ‘1’ of ‘iii’ should continue lower and break the wave ‘b’ low from last week.

If that happens,

the wave ‘iii’ count will get a major probability boost.

Lets see if the downside bias can continue tomorrow.

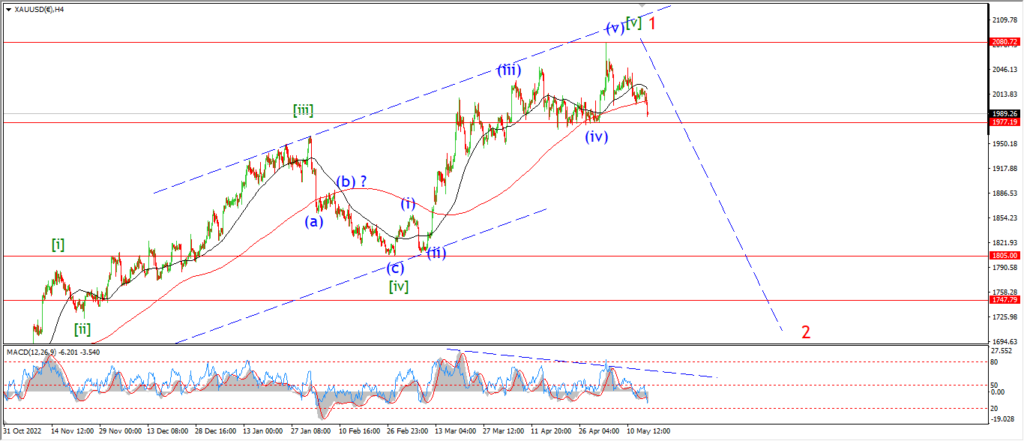

GOLD

GOLD 1hr.

It’s a similar story of delay for gold today also.

The action has not turned lower into wave ‘5’ of ‘iii’ yet.

And so there is doubt about the idea that wave ‘4’ is complete at Fridays highs.

I am going to allow this count one more day to clear up any doubts that linger here.

And if the price does not fall below 1950 again to complete wave ‘iii’ of (i) of [a] of ‘2’.

then I will switch to the alternate count for this decline.

And that alternate count suggests the pattern is tracing out three waves down in wave (a) of [a] of ‘2’.

Overall both counts should end up in a similar target area when wave ‘2’ completes.

Tomorrow;

WAtch for the wave ‘1’ low at 1999 to hold.

Wave ‘5’ of ‘iii’ should turn lower again and break 1950 at a minimum.

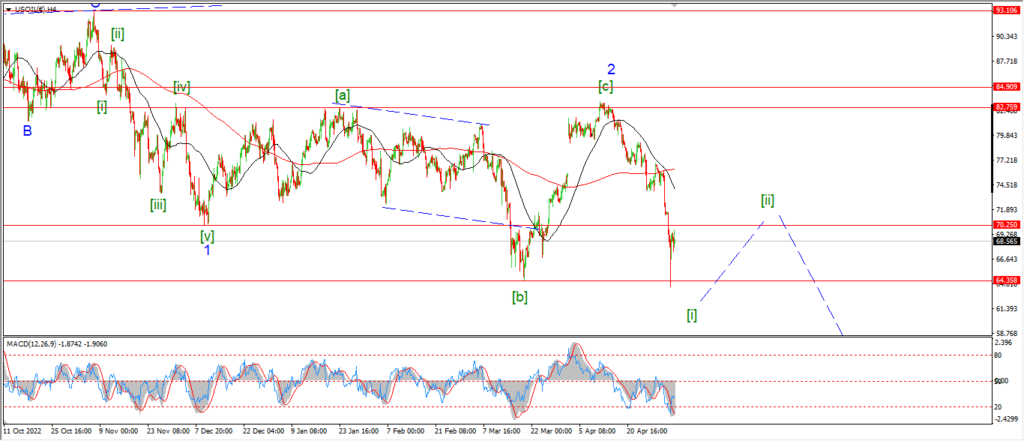

CRUDE OIL.

CRUDE OIL 1hr.

I have updated the hourly chart tonight to show the most recent action moving at one degree higher than last Fridays count.

I may have been a bit ambitious with the previous count!

The overall theme here is similar,

we are watching a developing pattern lower into wave (iii) of [iii].

This next leg down could be quite dramatic if this count is correct.

wave (iii) blue could drop the price back to the $60 handle if it all goes to this plan.

I do have that alternate wave [ii] count hanging in the back ground here,

so its not all plain sailing into wave (iii) of [iii].

The alternate count for wave [ii] is suggests that wave (b) of [ii] is now closing out with a drop below 69.30 again.

And then wave (c) has the potential to rally back towards $75 again to complete that larger pattern.

Tomorrow;

Watch for wave ‘ii’ of (iii) to hold that lower high.

Wave ‘iii’ of (iii) will be confirmed with a break of 69.34 again.

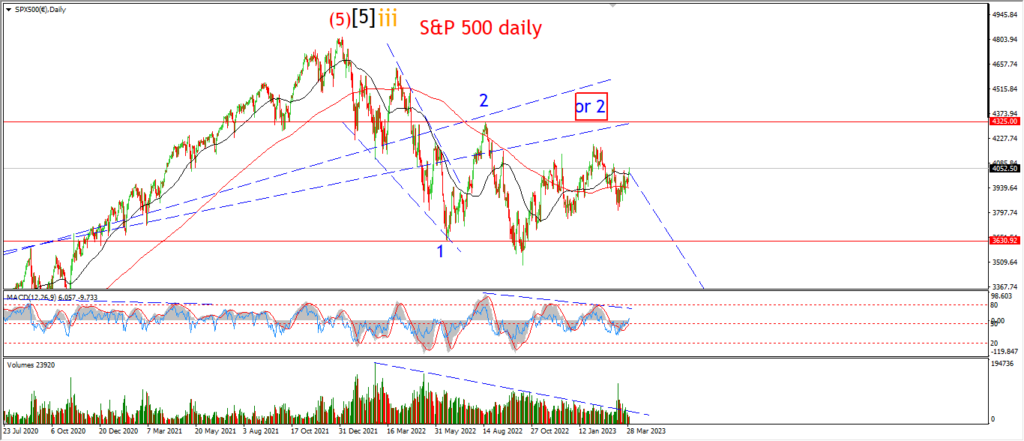

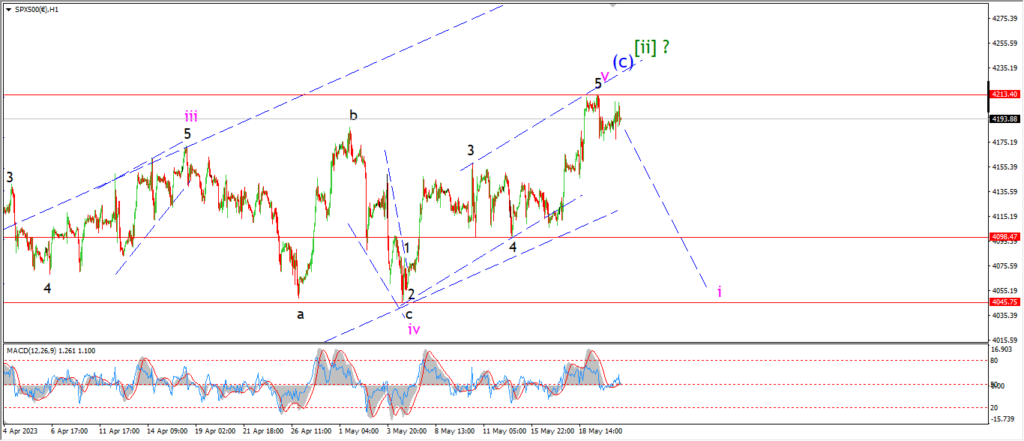

S&P 500.

S&P 500 1hr

I am changing the count for wave ‘v’ of (c) a little tonight but the outlook does not change much.

The action today is pretty corrective looking and Fridays highs are holding.

Its early days again here,

but the possibility of another sharp reversal building in wave ‘i’ this week is still quite real.

I know this count requires a large decline of about 100 points in order to be confirmed,

but the way this market is leveraged to the hilt these days,

that can happen in an afternoon with ease!

We will see what the week brings here,

but I am favoring another impulsive reversal into wave ‘i’.

Tomorrow;

Watch for Fridays highs to hold again and for the market to begin stepping lower into a five wave pattern in wave ‘i’ down.

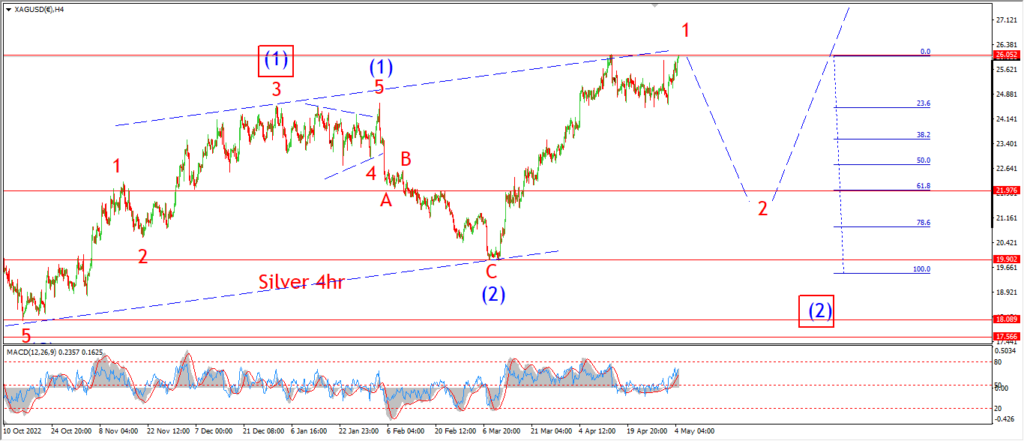

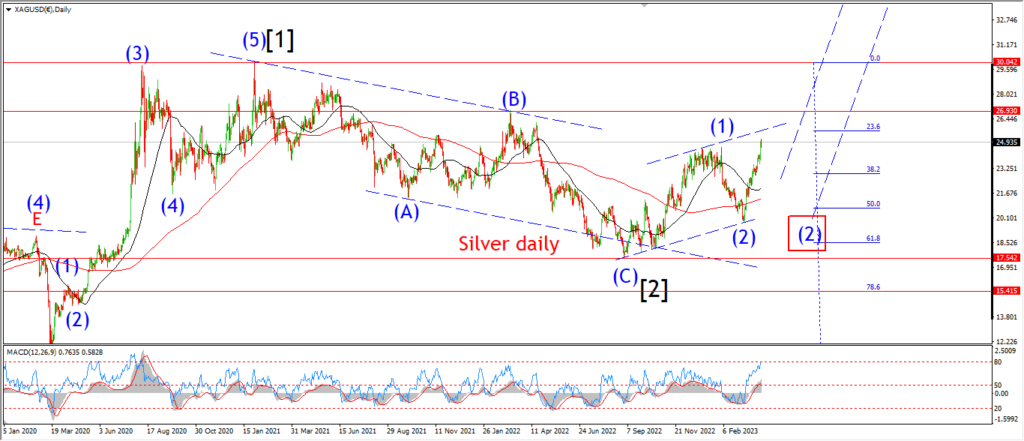

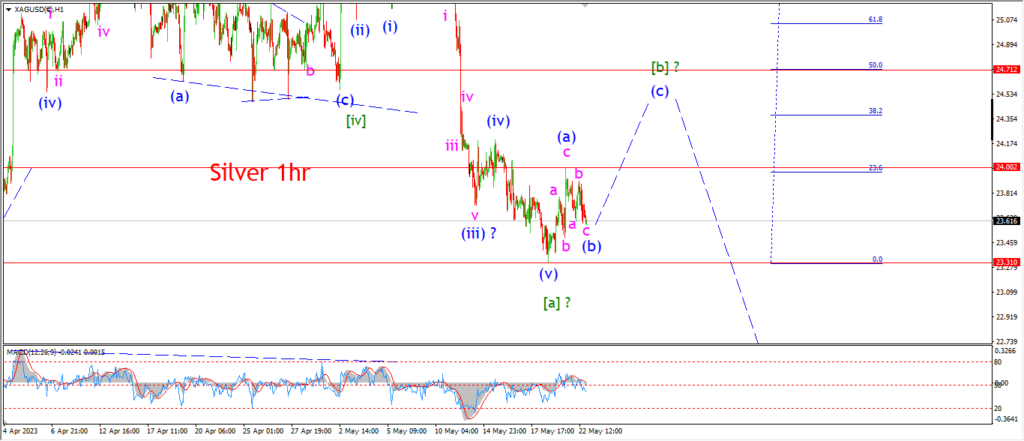

SILVER.

SILVER 1hr

Silver has traced out a three wave pattern sideways in wave (b) now.

The price is holding above the wave [a] lows so far.

And the action today further re-enforces the idea that wave [b] is underway here.

And in this scenario we should expect wave (c) to turn higher again by tomorrow evening and rally back towards 24.70 again at the 50% retracement of wave [a].

Tomorrow;

Watch for wave (b) to hold that higher low.

Wave (c) will be confirmed with a rally back above 24.00.

BITCOIN

BITCOIN 1hr.

….

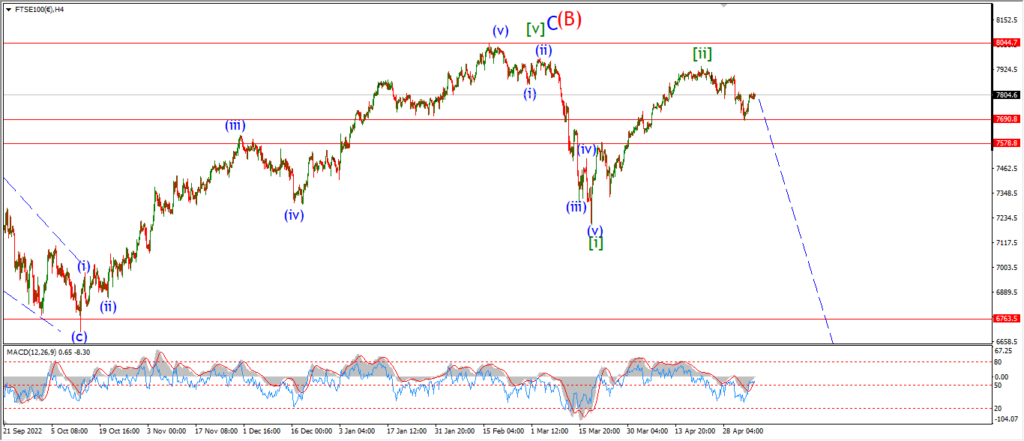

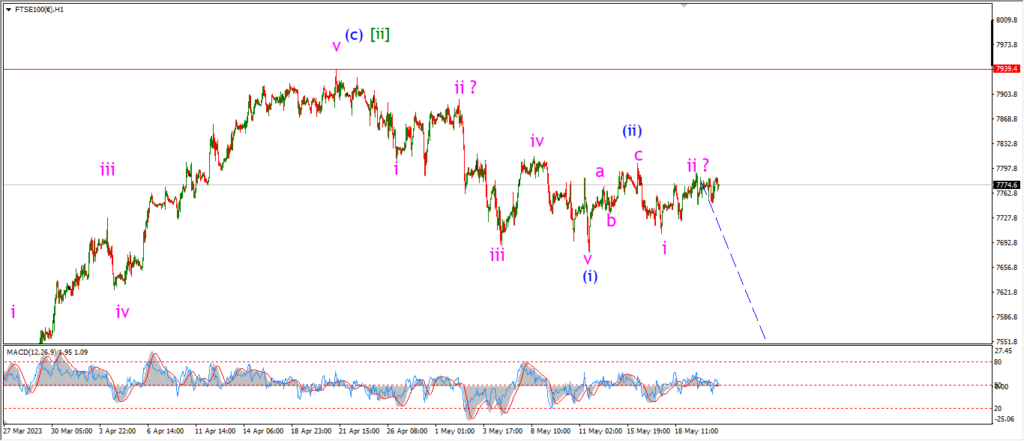

FTSE 100.

FTSE 100 1hr.

….

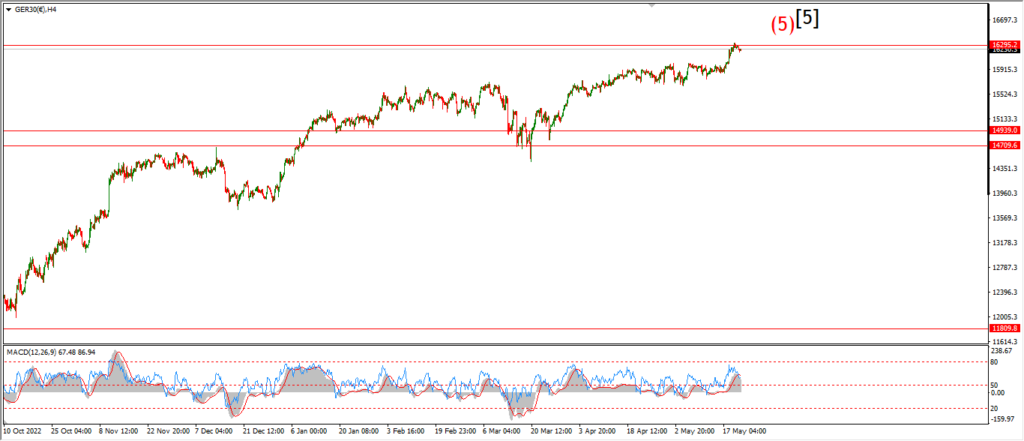

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

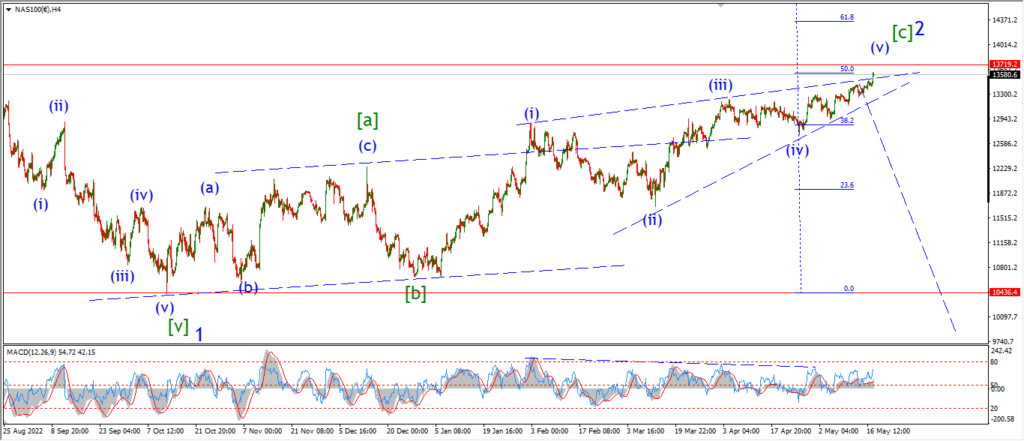

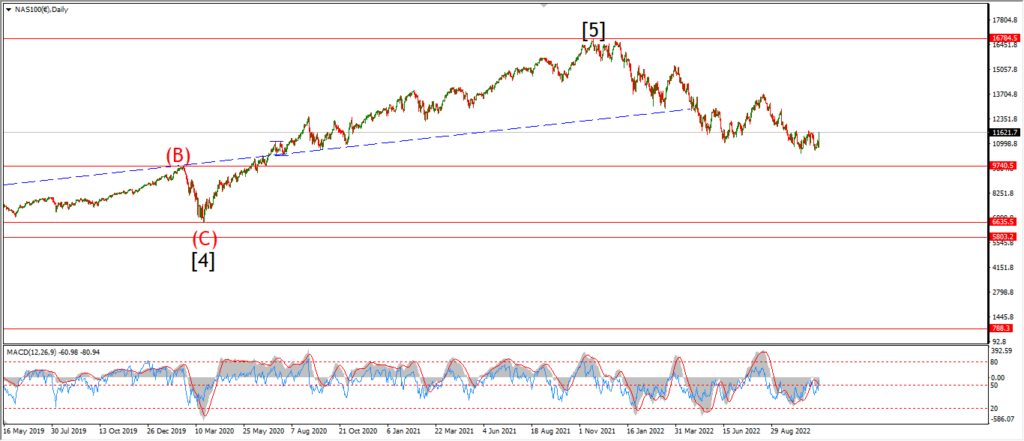

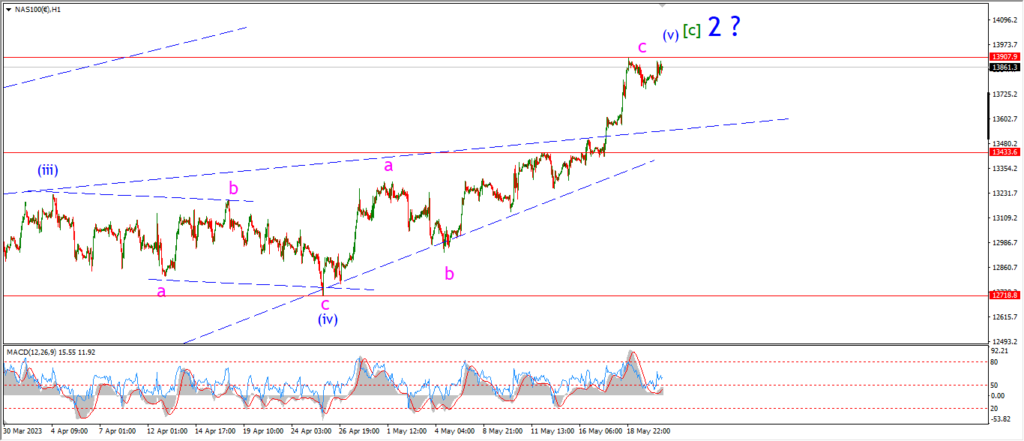

NASDAQ 100.

NASDAQ 1hr

….