Good evening folks, the Lord’s Blessings to you all.

Well,

That knee jerk came as I feared it would and things have changed in a few markets because of the whipsaw moves we saw.

I do find it quite ironic though,

The CPI actually missed on the low side for the first time in a long time.

Which actually means the price base of the economy is disinflating now.

While this may not result in lower prices across the board,

it sure does mean that some prices are declining.

So purchasing power is increasing.

But the all knowing market actually sells the USD???????

this is proof that the financial markets are not rational.

The US treasury did get bid today so yields fell and prices rose.

The bond market may be reading the cpi better than most.

Here is my take.

Inflation is now pretty much a story that has died.

credit is deflating across the board,

and it is credit that drives economic markets.

The road from here will be wild I think.

The banking sector does not do well at all in a deflating credit scenario.

Because the assets that back its loans are declining in price.

You can easily hit a point of bankruptcy if we keep that up.

We can already see the cracking and deflating commercial property market in the US and EUROPE.

China is right on board with that one.

The consumer has pulled back at last,

going on the results from McDonald’s and other retail outlets.

So across the board we have a decline in economic activity and credit issuance.

There is one big one left to give way,

thats the financial markets.

And now we are running on empty……………

https://twitter.com/bullwavesreal

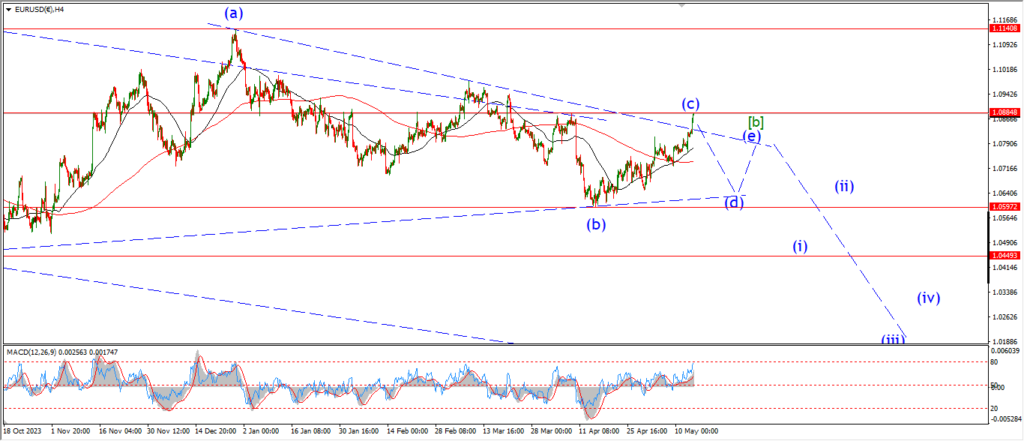

EURUSD.

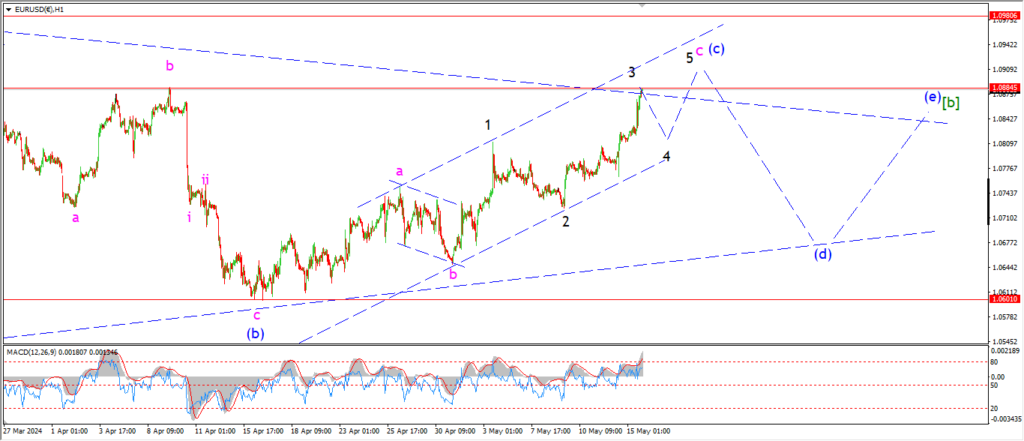

EURUSD 1hr.

EURUSD has broken out of the recent pattern that I was working with and now we are back looking at the wave [b] triangle at one higher degree.

Take a look at the 4hr chart.

I have shown a larger triangle in wave [b] now with wave (c) of [b] coming to an end with this weeks rally.

The rally off the recent lows still has a three wave pattern in play here.

and I am tracking an ending diagonal for wave ‘c’ of (c) with a five wave internal pattern.

Todays rally brings the price back to the initial resistance level at 1.0885.

and I do think we will see an end to wave (c) near this level.

Tomorrow;

Watch for this choppy rally in wave ‘c’ of (c) to close out by the end of this week and next week should begin a three wave decline into wave (d) of [b].

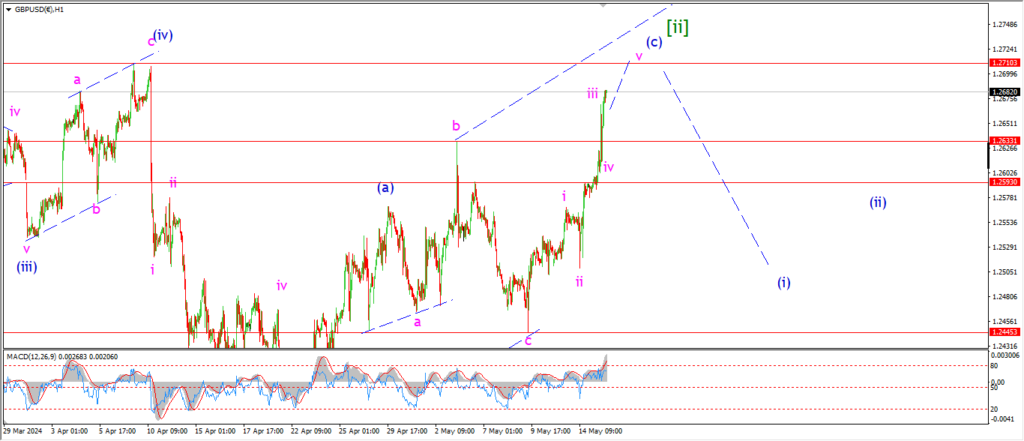

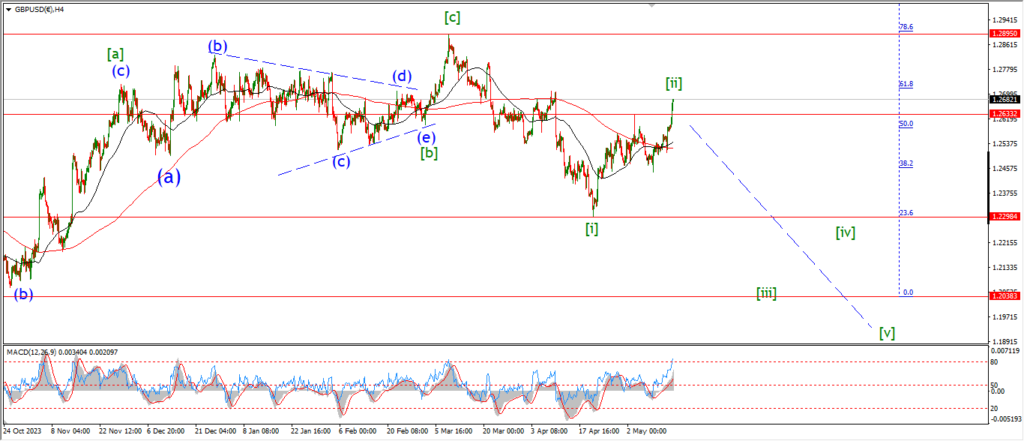

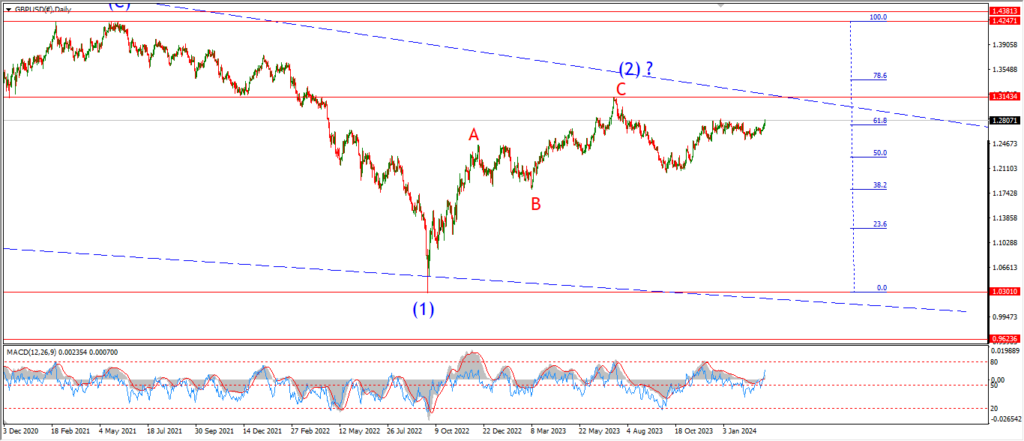

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

The rally today has not changed the idea of a correction higher in cable.

but we are back to the larger wave [ii] correction rather than last nights wave (ii) pattern.

The overall trend of the market should be lower into wave [iii] over the summer,

but we gotta complete this second wave retracement first.

The rally in wave (c) of [ii] went vertical taking out the top at 1.2633 today and that invalidated last nights count.

Wave (b) of [ii] is shown as an expanded flat,

with wave (c) of [ii] well underway now.

We may even be close to a five wave pattern in wave (c) already after todays spike rally.

Tomorrow;

Watch for a possible five wave rally in wave (c) to top out near 1.2710 at the previous fourth wave resistance.

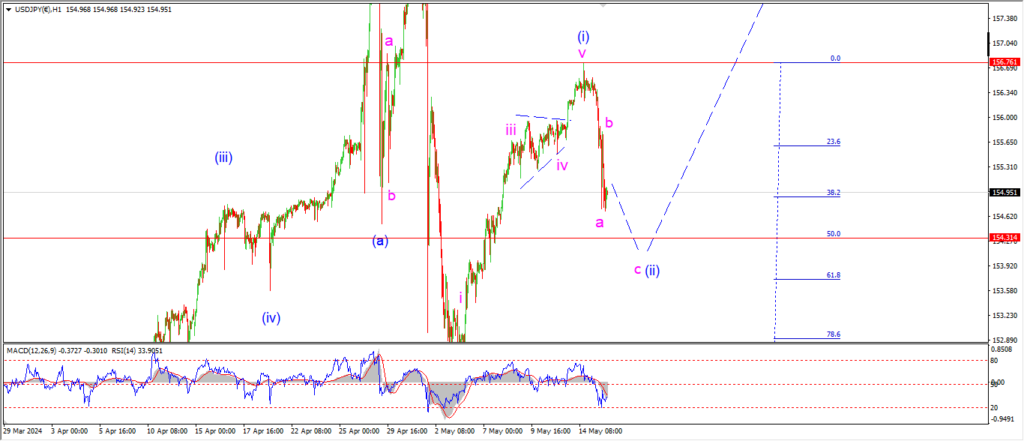

USDJPY.

USDJPY 1hr.

Well the plunge into wave (ii) is well and truly underway now.

The action was so quick this afternoon that I think we have completed wave a’ and ‘b’ of the correction.

And wave ‘c’ of (ii) should be done by the end of the week.

If all goes well,

then wave (ii) will bottome out near 154.00,

and then next week will be set for wave (iii) to begin.

Tomorrow;

Watch for wave ‘c’ to complete three waves down near the 50% retracement level at 154.30.

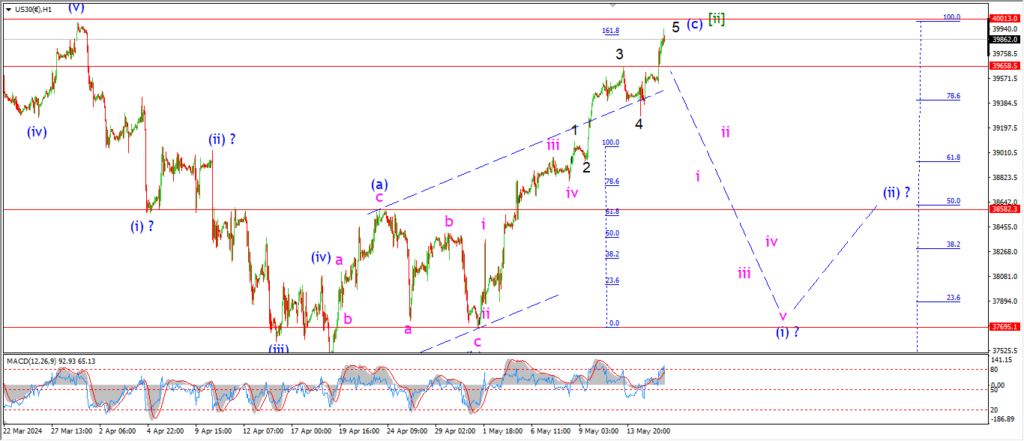

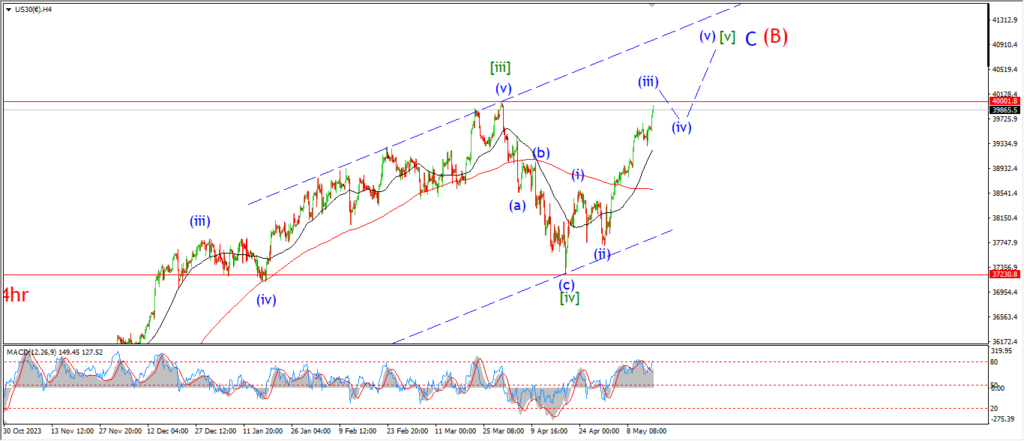

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The DOW is on the way to a new high today but we are not there yet.

I am going to play this pattern out until proven wrong.

Even though it is most likely a forgone conclusion that we will see a new high tomorrow and I will be forced to switch to the alternate count on the 4hr chart.

Tomorrow;

If we see a new high tomorrow,

that becomes wave (iii) of [v].

And obviously,

a massive reversal will begin wave (i) of [iii].

GOLD

GOLD 1hr.

WAve (iv) is still in play here tonight.

But I have changed to an expanded flat correction now.

The new low has taken the wave ‘b’ label.

And now wave ‘c’ should rally out to break 79.60 and complete the pattern.

Wave (iv) should be done by the end of this week.

and next week I can look lower into wave (i) of [i].

Tomorrow;

Watch for wave ‘c’ to pop above 79.60 and complete the pattern.

The wave (i) low at 81.00 must hold.

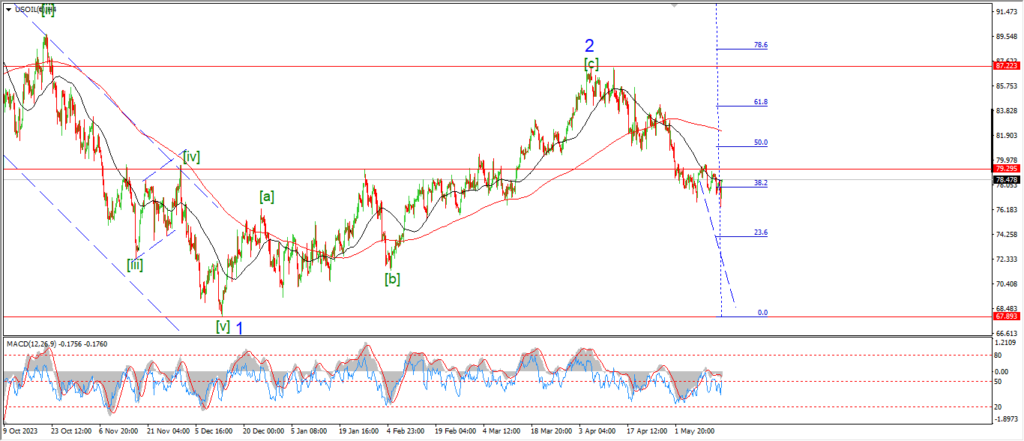

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

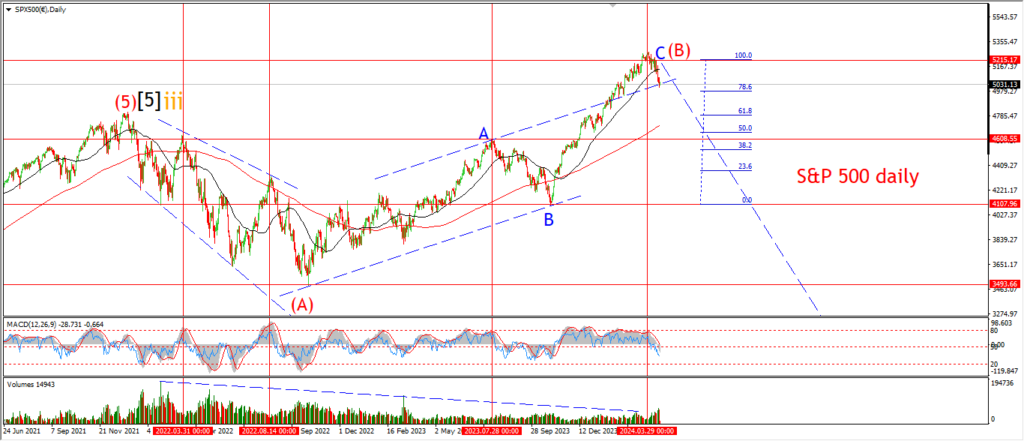

The S&P has reverted to a simple five wave rally in wave [v] of ‘C’ of (B).

I know this seems like a drastic change in outlook here.

But we have a new high that postponed the inevitable wave (B) top by a few weeks at most.

And as we work though this pattern it will become even harder to extend the top I think.

The high tonight will complete wave (iii) of [v].

Wave (iv) comes in next week.

And wave (v) will close out the channel again the following week.

Tomorrow;

Watch for wave (iii) to top out and then a drop into the previous wave ‘iv’ low again should begin on Friday.

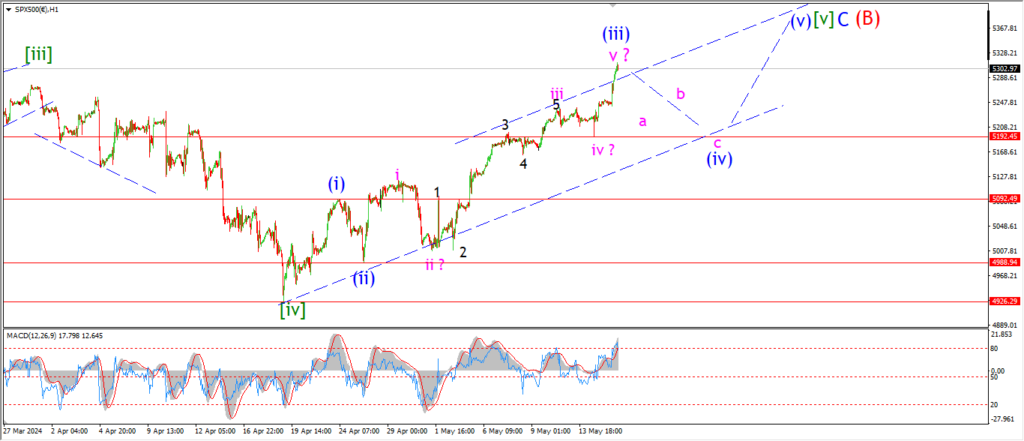

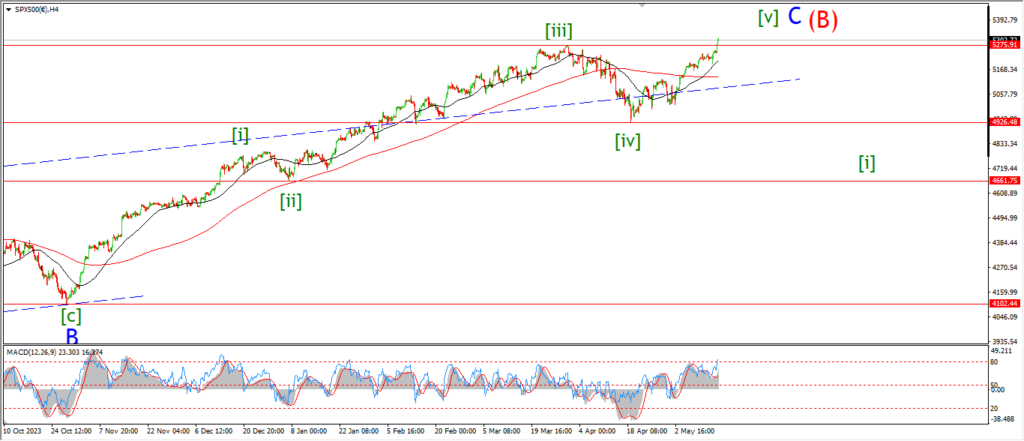

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

Take a look at the 4hr chart to start with;

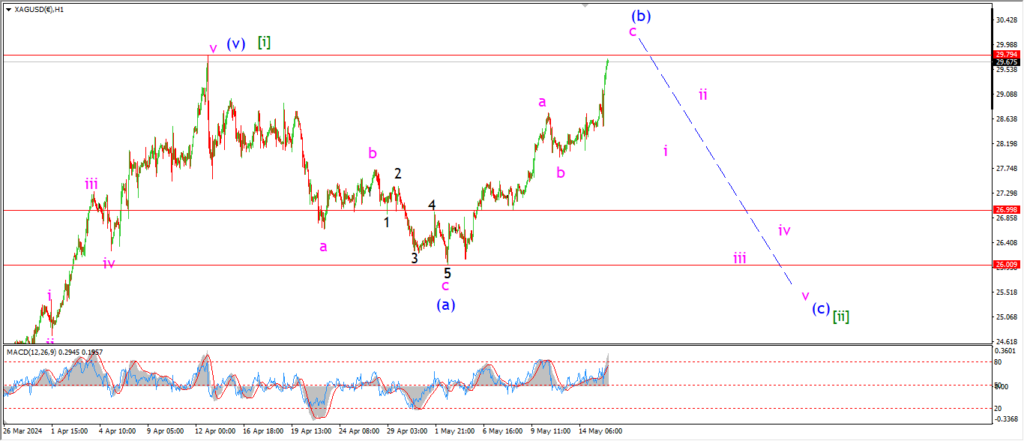

Silver pushed back to the high today and that opens up the possibility that wave [ii] is complete at the 26.00 lows.

this high will finish wave (i) of [iii] in this scenario,

and wave (ii) will come next week.

Wave (ii) should see a correction back to the 27.50 area in three waves.

The hourly chart shows the possibility of an expanded flat wave [ii].

With wave (b) holding the highs now.

A break above 29.80 again will complete wave (b).

and then wave (c) can turn lower next week.

wave (c) will break 26.00 again in this scenario.

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

Silver is holding flat also today.

This does not favor the main count,

but it has not been invalidated yet either.

So far we have a potential top in place for wave ‘c’.

and if the price falls back below the wave ‘b’ low at 26.99 then this count gets a big confirmation.

At the moment it is too close to call so I am just going to wait for confirmation on this one.

Tomorrow;

Lets see if wave ‘i’ down falls back into support at 26.99 to confirm the pattern.

A break of 28.76 does not rule out wave (b) altogether,

but it will postpone the decline into wave (c) until next week I think.

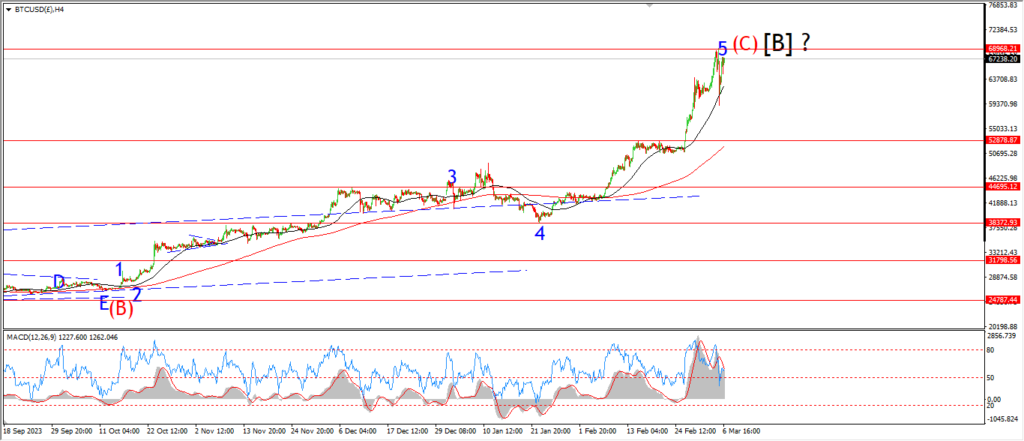

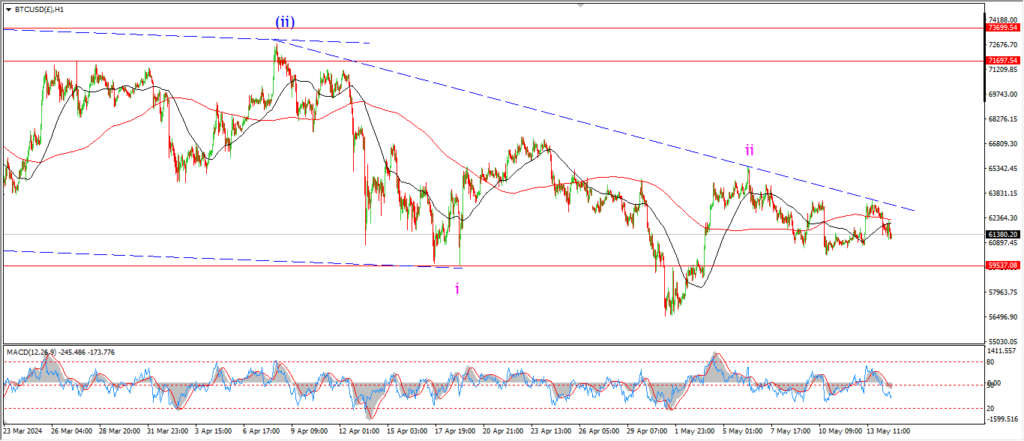

BITCOIN

BITCOIN 1hr.

….

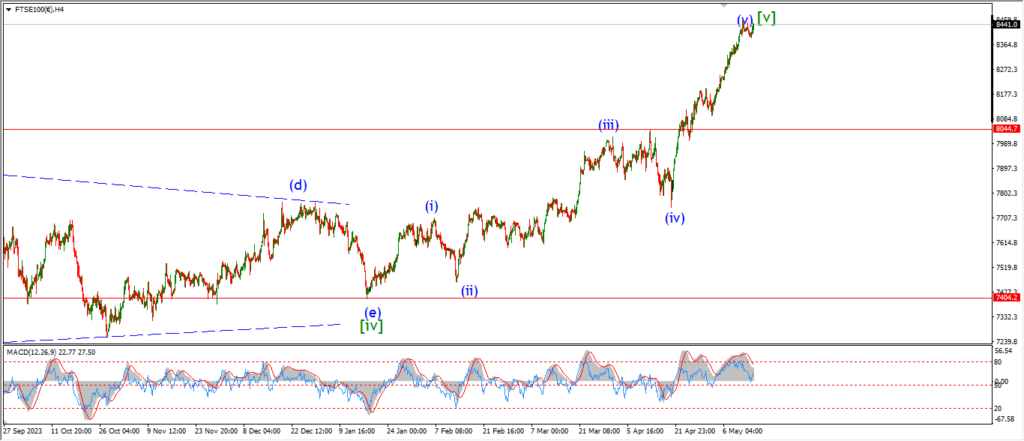

FTSE 100.

FTSE 100 1hr.

….

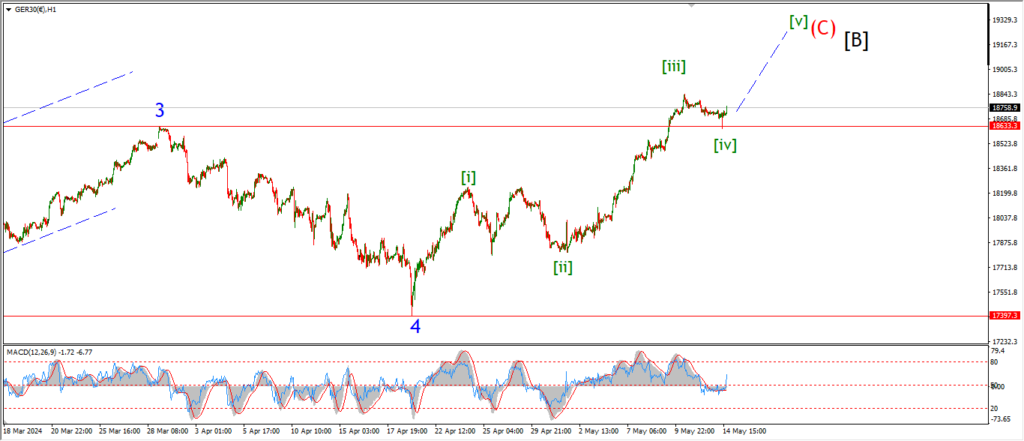

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….