Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

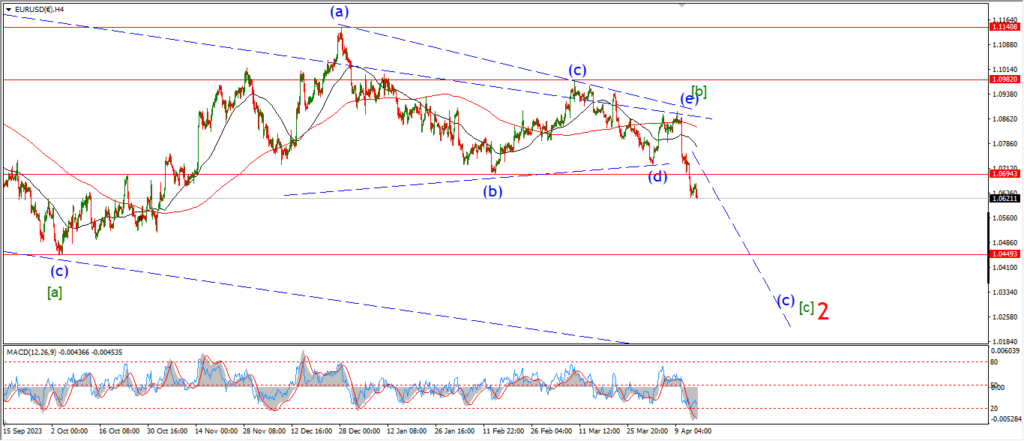

EURUSD.

EURUSD 1hr.

I am taking a back seat in EURUSD again tonight as the price action has failed again to clarify itself.

Most likely,

there is a n3ew high building in wave ‘c’ of (ii).

And that will be confirmed with a break of 1.0812.

I am looking at the possibility of a triangle forming in wave ‘c’ that can be followed by a new high.

In this scenario,

the triangle will hold in a sideways pattern for another day before turning higher again.

Tomorrow;

the price action will clear up soon and then I should be able to nail down the pattern here,

so lets see if tomorrow will being that clarification.

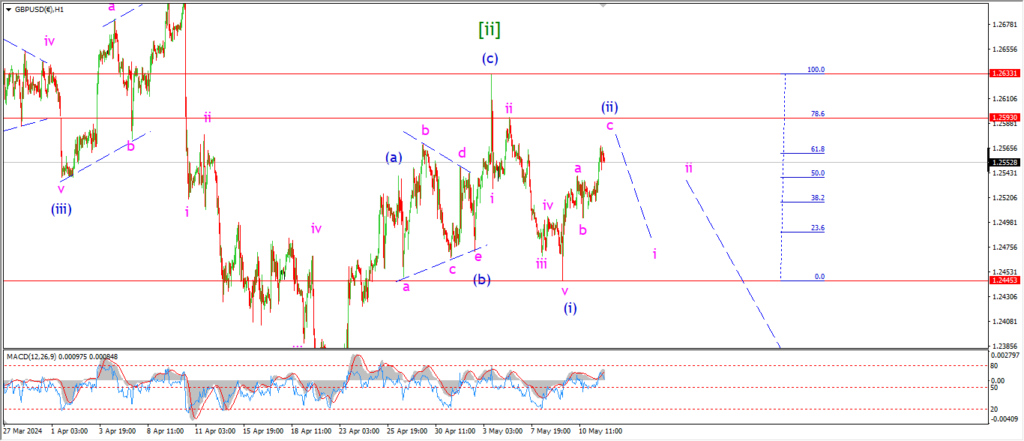

GBPUSD

GBPUSD 1hr.

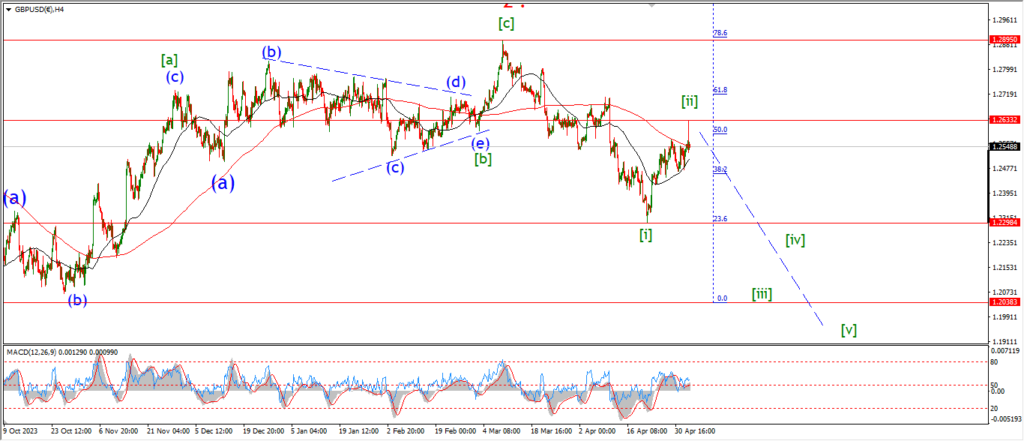

GBPUSD 4hr.

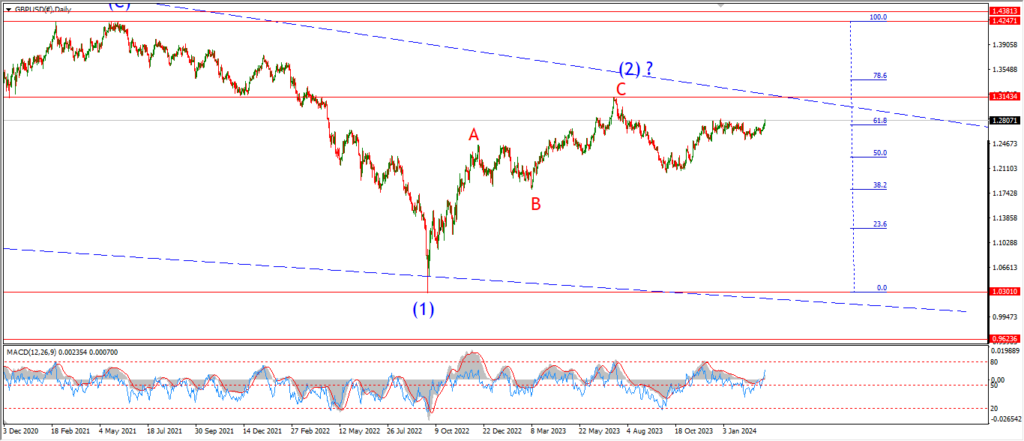

GBPUSD daily.

The market has pushed higher today in wave ‘c’ and this brings us closer to a completed correction in wave (ii) now.

I am looking at the 78.6% retracement level at 1.2590 to close out wave ‘c’ of (ii),

and then we should see a reversal into wave ‘i’ of (iii) by the middle of this week.

Tomorrow;

the high at wave [ii] green must hold.

wave ‘c’ should complete by tomorrow evening and then turn lower into wave ‘i’ of (iii).

A break below the wave (i) low at 1.2453 again will signal wave (iii) is underway.

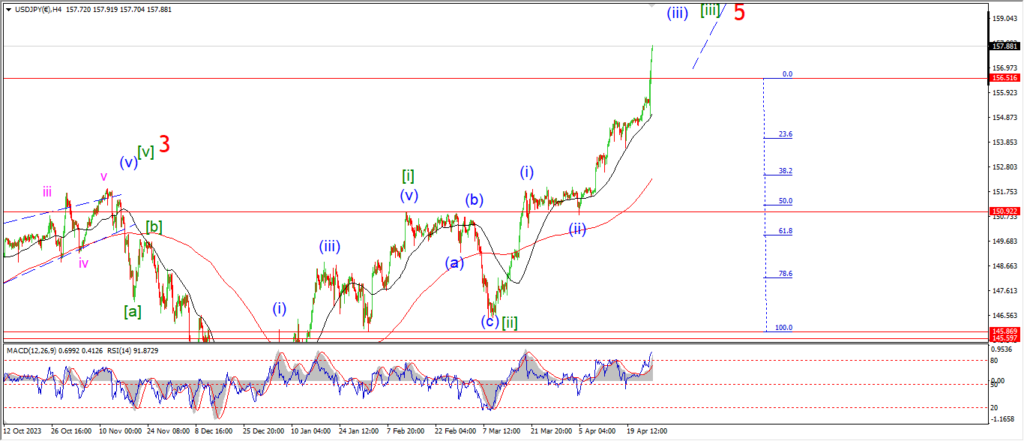

USDJPY.

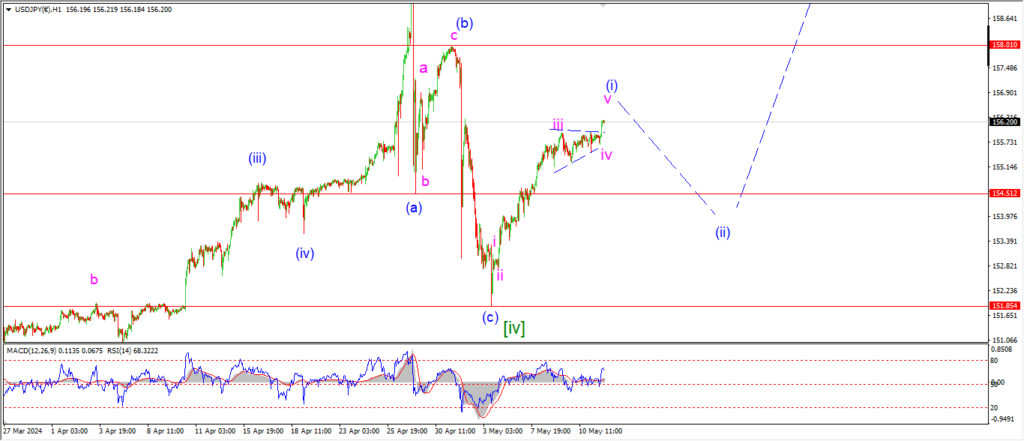

USDJPY 1hr.

USDJPY requires another wave count now, after another push higher today.

This rally is still viewed as wave (i) of [v].

But the sideways action later last week is now viewed as wave ‘iv’ of (i),

with the push higher into wave ‘v’ of (i) now underway.

The wave (b) high at 158.00 should offer plenty of resistance to the wave (i) high,

so I am expecting wave (i) to complete below that level.

And then wave (ii) will take the rest of the week to complete a higher low as shown.

Tomorrow;

Watch for wave (i) to complete this extended rally and then turn lower in three waves from here.

Wave (ii) should complete near 154.00.

DOW JONES.

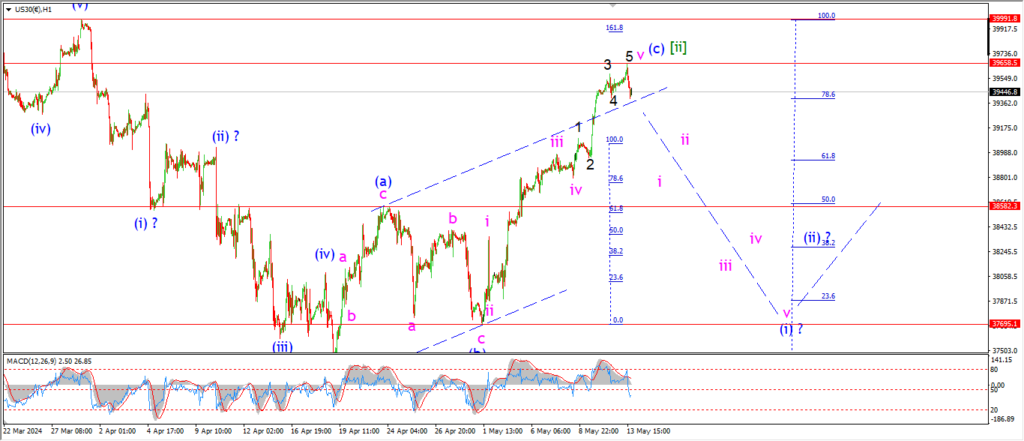

DOW 1hr.

DOW 4hr

DOW daily.

An early new high has been given back this evening and the count stands for wave [ii].

We are so very close to breaking to a new high in this pattern though,

as the market only sits a little over 1% below the all time highs.

I will admit that I am not enjoying this close call here at all.

So the sooner we see a proper sell off, the better for my sanity.

The setup for this week is pretty simple.

Wave [ii] must complete its rally and then wave (i) of [iii] must turn lower again.

A retracement back into the wave (b) low is expected,

and a break of the wave (a) high at 38580 will be a big boost to this pattern.

Tomorrow;

WAtch for the highs to hold again.

wave ‘i’ of (i) should fall back to initial support at 38580.

GOLD

GOLD 1hr.

gold is beginning to move lower in an impulsive manner today which adds to the idea that wave ‘b’ is complete at 2378.

The price has fallen back to the upper end of the range of that triangle correction of wave ‘b’.

I want to see wave ‘1’ of ‘c’ retrace to the wave ‘b’ lows at 2306.

And if that happens that will be the forst signal that wave ‘c’ has begun.

Tomorrow;

Watch for wave ‘1’ down to continue to drop into 2306 in a five wave pattern.

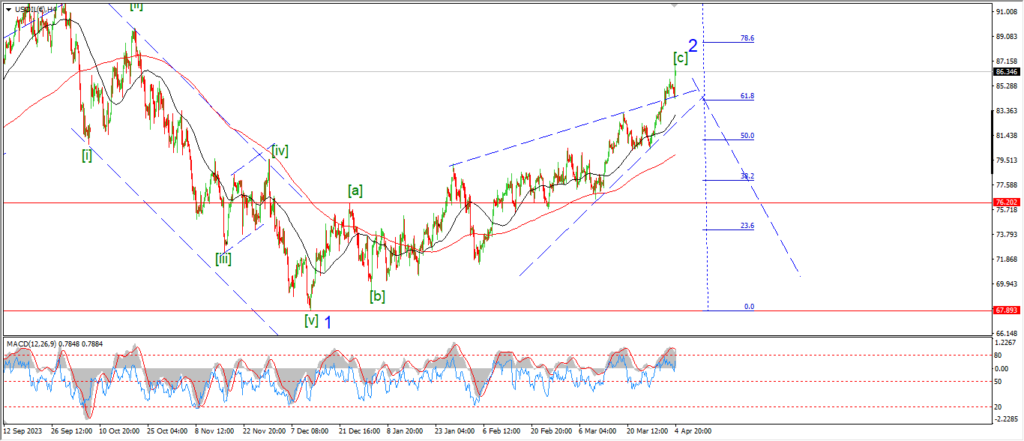

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

A possible wave ‘b’ low is now in at the early lows today.

The price is now moving higher off that level in a possible wave ‘c’ of (iv).

Wave ‘c’ should break above the previous highs at 79.63 again to complete three waves up.

And as usual,

Wave (iv) must hold below 81.07 at the wave (i) low.

There is still a chance that the current correction higher is only wave ‘iv’ of (iii).

That does not change much in the outlook for this week,

but it is interesting to think that crude may have more downside potential!

We will see.

Tomorrow;

the wave (i) high must hold at 81.00.

WAve ‘c’ of (iv) should top out with a break above 79.60.

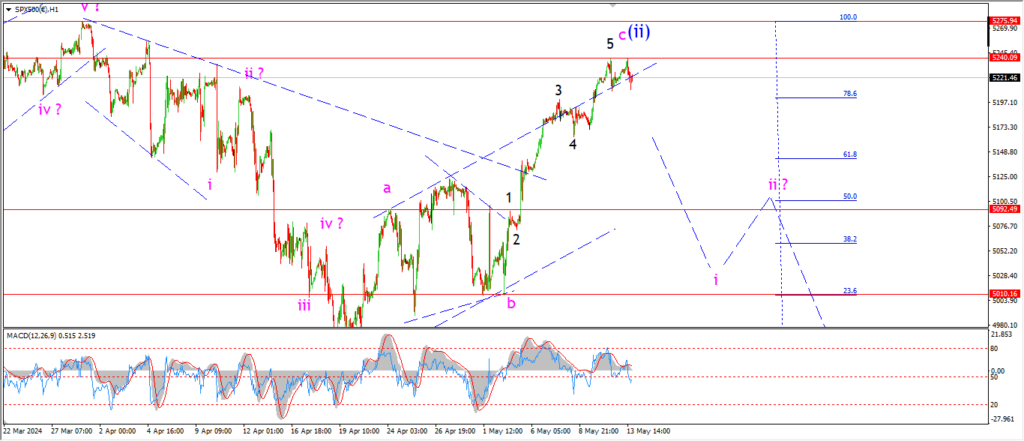

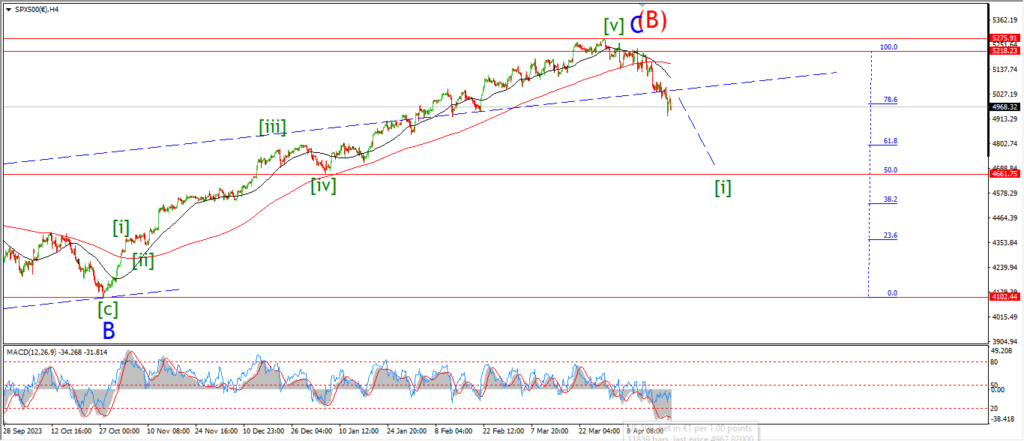

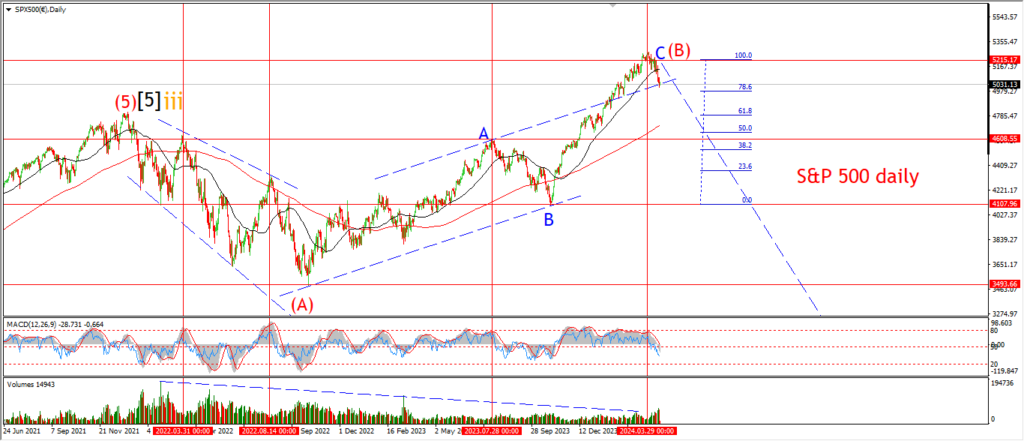

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

A slightly weaker session today but there is no confirmation of a reversal into wave ‘i’ yet.

Just like the Dow,

I am a little bit on edge here as the market is hovering so close to the highs.

There is a cpi release on Wednesday and a knee jerk reaction could push this pattern over the invalidation line.

It is impossible to know how that will impact the trading here.

So I am just going to stick with this pattern until it does not work and then go back to the drawing board.

Tomorrow;

It is a matter of wait and see how this lower high resolves.

A drop below 5090 will favor this count.

But that seems a long way down at this point!

Lets see if wave ‘i’ can take the market lower in an impulsive manner.

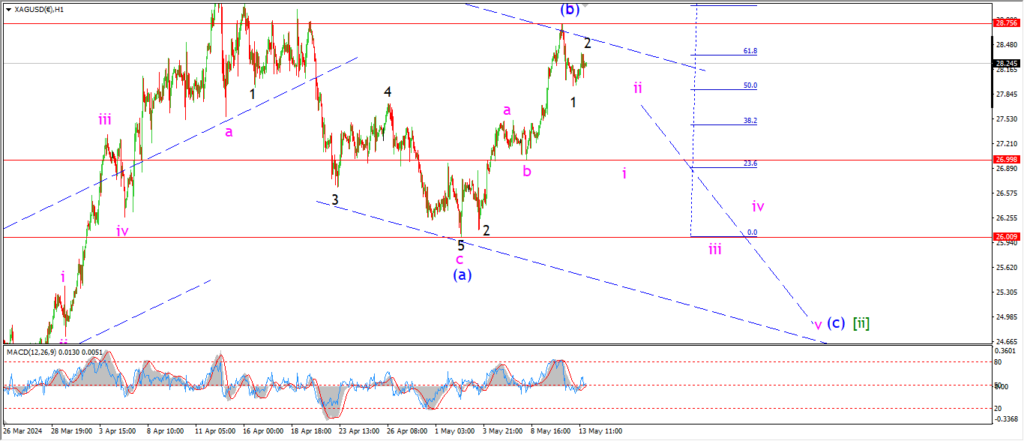

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

Wave (b) is holding today and the market is tracing out a corrective lower high at the moment.

Wave (c) must begin soon if this wave count is correct,

and the confirmation of wave (c) will come with a break of the wave ‘b’ lows at 26.99.

So there is a lot riding on the action over the coming few sessions.

Wave (c) can take the price back down below 25.00 again and create a very nice buying opportunity down there,

but that count needs confirmation now.

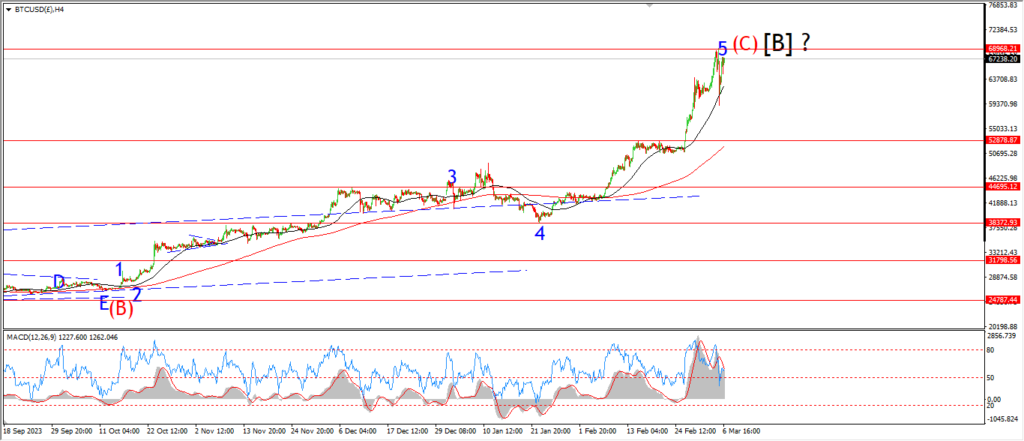

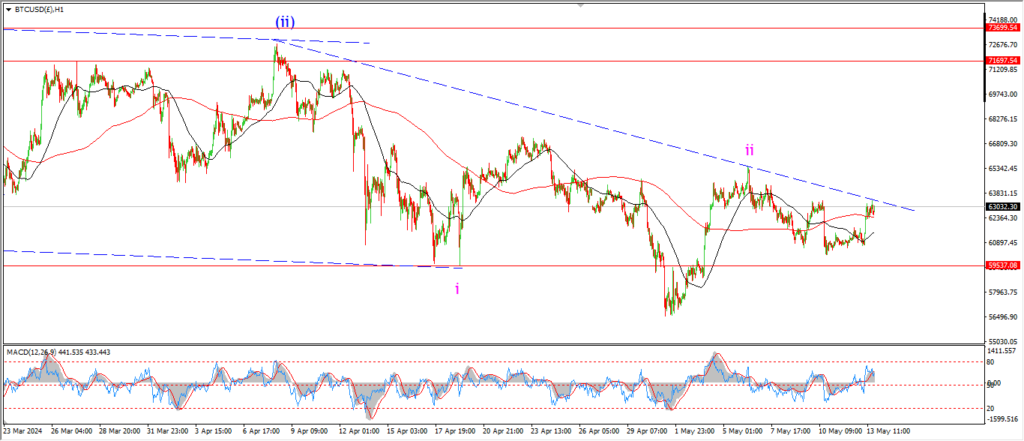

BITCOIN

BITCOIN 1hr.

….

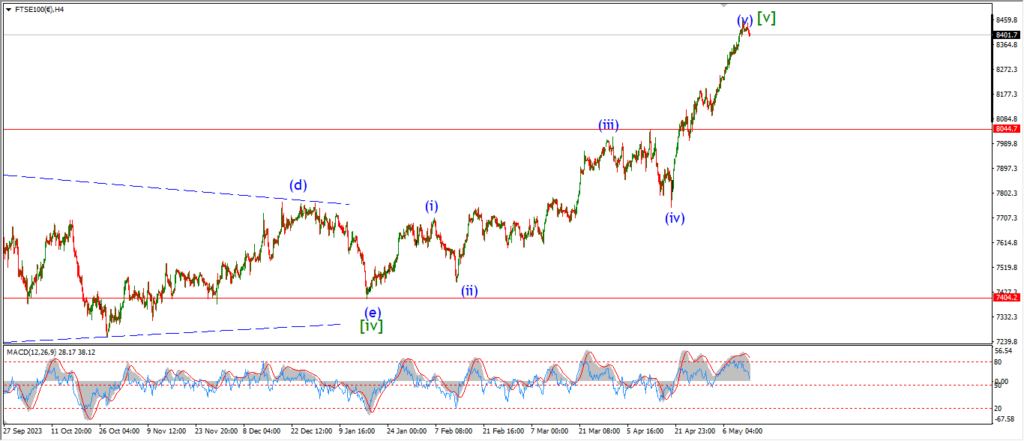

FTSE 100.

FTSE 100 1hr.

….

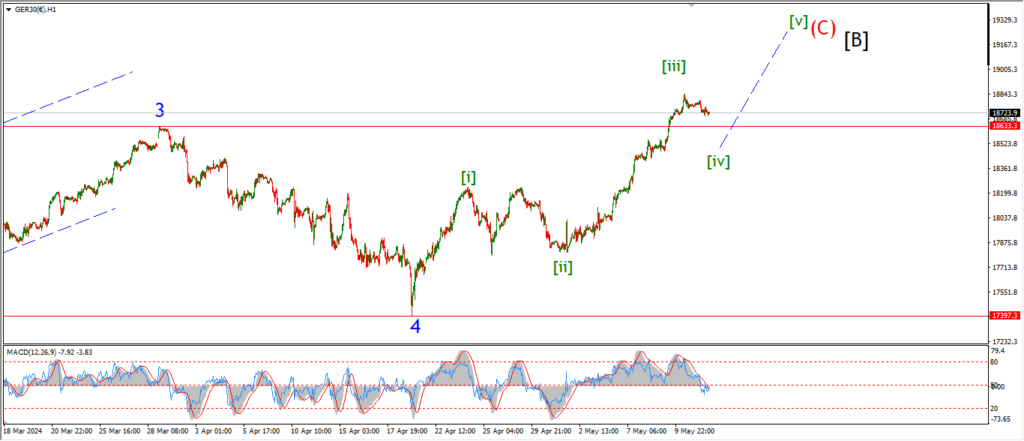

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….