Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

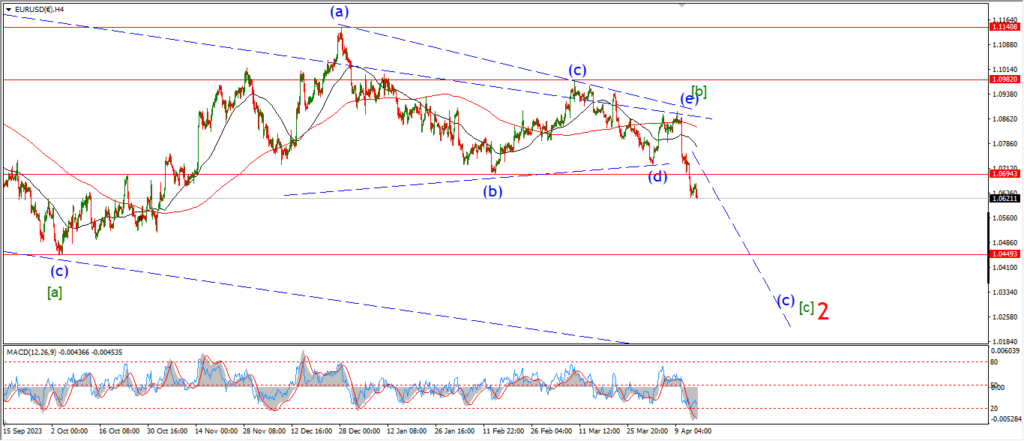

EURUSD.

EURUSD 1hr.

Well,

I am going to take a step back from this wave count tonight as the market is signaling something a little different than I expected.

The rally today was quite impulsive in nature.

And because of that I cannot be over-zealous on the downside in wave ‘i’.

The lower high scenario below wave (ii) is still holding well.

but the price action is not moving in favor of wave ‘i’ down here.

Tomorrow;

I am going to give this action a day to clear up.

If the price holds below wave (ii) tomorrow,

then wave ‘i’ of (iii) is still in play.

And a break of 1.0723 again will signal wave ‘i’ is underway.

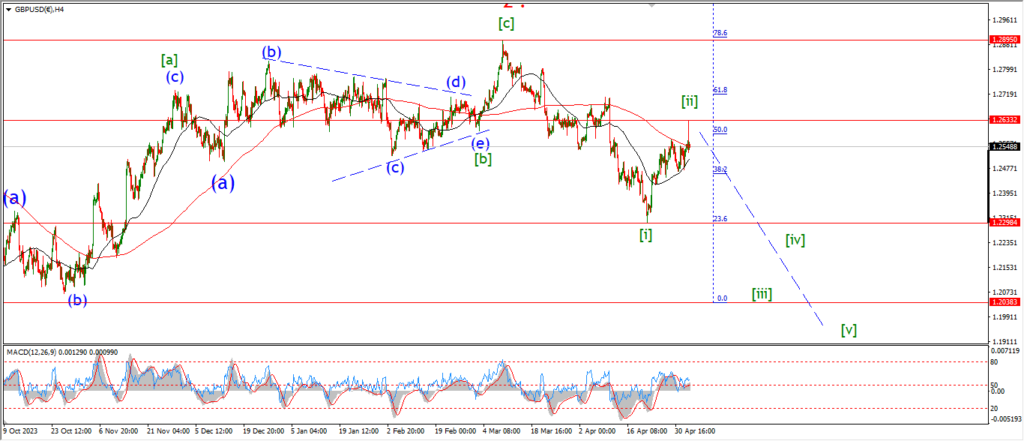

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

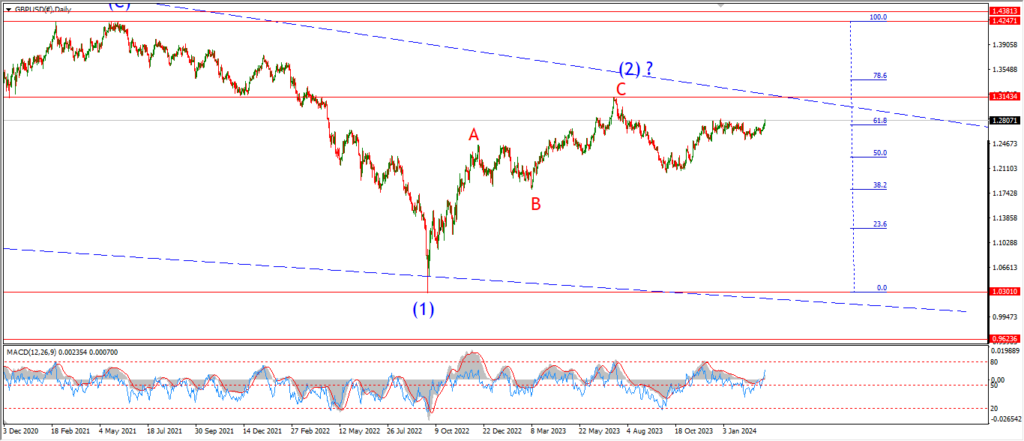

GBPUSD daily.

Cable pushed higher also today and I have switched the count to fit the action a little better.

There is a five wave decline in place at 1.2445,

so that takes the wave (i) label.

Wave (ii) is now underway off that level,

and todays high is labelled wave ‘a’ of (ii).

And wave (ii) will probably take a few more days to close out at a lower high below 1.2633.

Tomorrow;

Watch for wave ‘b’ to correct lower in three waves and hold above 1.2445.

Wave (ii) should trace out three waves up and complete near the 62% retracement level at 1.2560.

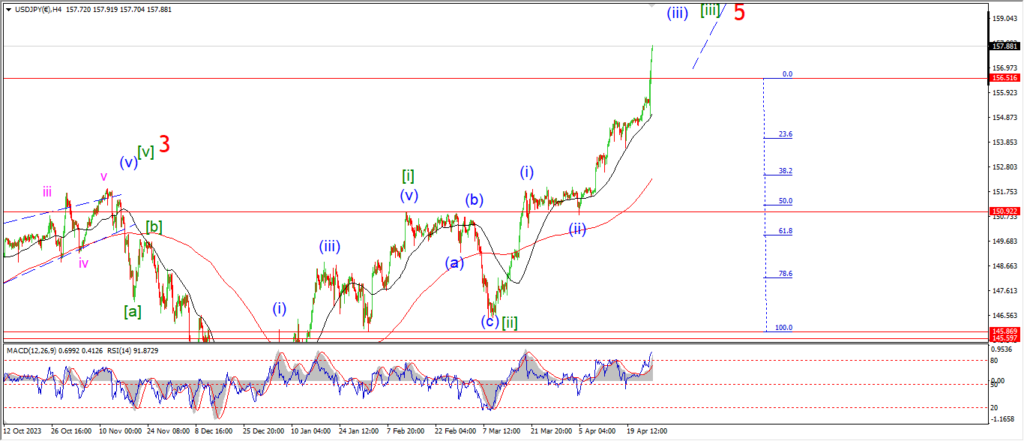

USDJPY.

USDJPY 1hr.

Wave (i) seems to have finally topped out at todays highs and the price is showing weakness off to top at 155.96.

Wave (ii) should trace out a corrective three wave decline and hold above 151.85 at the very low end.

If wave (ii) has started now,

then the correction will take a few days and that will bring us to Tuesday at the earliest to begin a turn higher again.

Tomorrow;

Watch for wave ‘a’ of (ii) to fall back into the 1.54 handle in a corrective manner.

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The market cannot help itself!

A bad jobs report causes speculation and frantic buying on the hopes of a rates turn in the future.

BUt………..

This bid will have no merit even tomorrow,

never mind three months time!

My bet is this rally get wiped out tomorrow morning!

Maybe I am overly dismissive,

but I have been turned into a complete skeptic, bordering on utter contemptuous contrarian heretic by this stock market.

I will leave it at that.

The market has finally broken through the upper trend channel line with todays rally.

And this action gives us a throw-over to complete wave (c) of [ii].

The price now sits at the 78.6% retracement of wave [i].

And the three wave pattern is still the best fit for the action.

All in all,

its a correction higher,

but it has pushed on into wave (c) for sure.

Tomorrow;

I really want to see a reversal off the top of wave (c) to wipe out todays rally.

A break of 38580 will do the trick.

GOLD

GOLD 1hr.

The action in gold has complicated the wave count today and I am now looking at a different interpretation for the overall pattern in wave (ii).

The decline into that recent low can be viewed as five waves down.

And that completes wave ‘a’ of (iv).

Wave ‘b’ continues sideways this week and now approaches the 38% retracement of wave ‘a’.

Most of this weeks action has been taken up by a triangle wave ‘b’ of ‘b’.

And now wave ‘c’ of ‘b’ has turned higher.

tomorrow;

This correction in wave ‘b’ is close to completing a three wave correction higher now.

A reasonable target for wave ‘b’ lies at the 50% retracement level at 2356.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

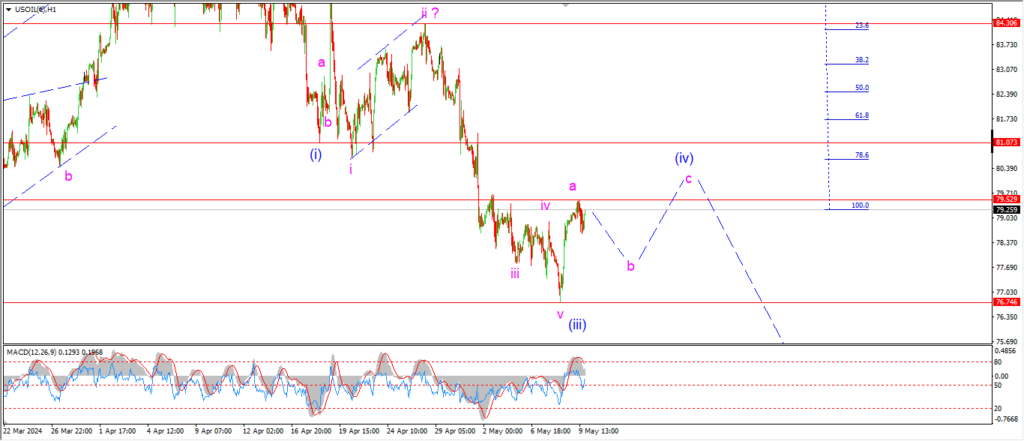

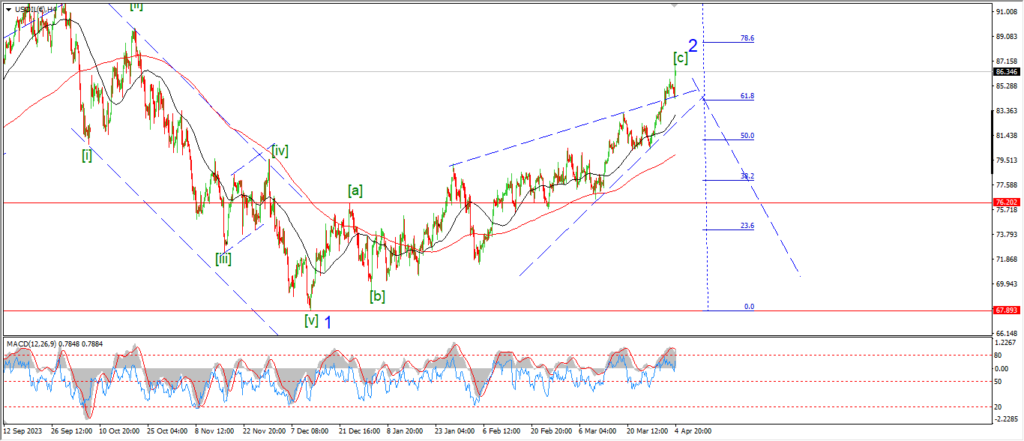

Crude is holding above the lows of wave (iii) again today and that is in line with the wave count for wave (iv).

The pattern for wave (iv) will take time to reveal itself,

but for the moment I will stick with a three wave rally as shown.

Wave ‘a’ has topped out,

and wave ‘b’ should fall in three waves back below 79.00 to form a higher low.

In this scenario,

next week wave ‘c’ of (iv) will turn higher again and complete the correction below 81.00 at the wave (i) low.

Tomorrow;

Watch for wave ‘b’ to fall in three waves and then form a higher low above 76.74.

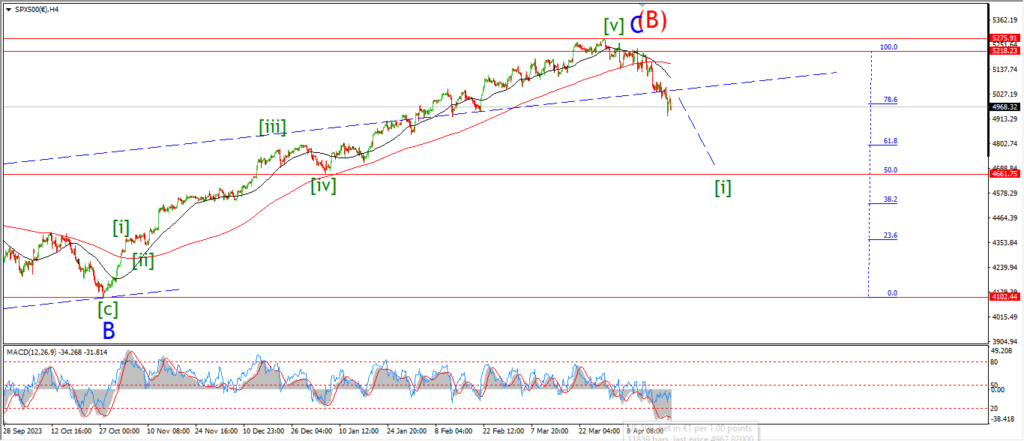

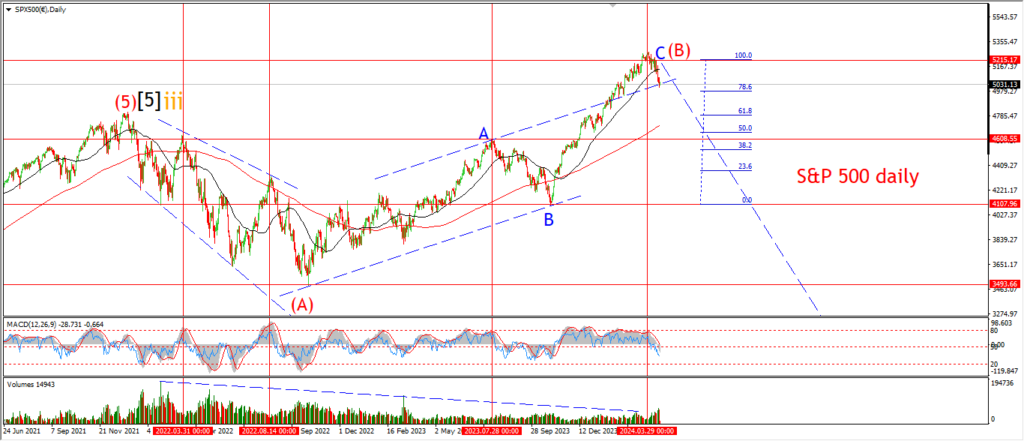

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

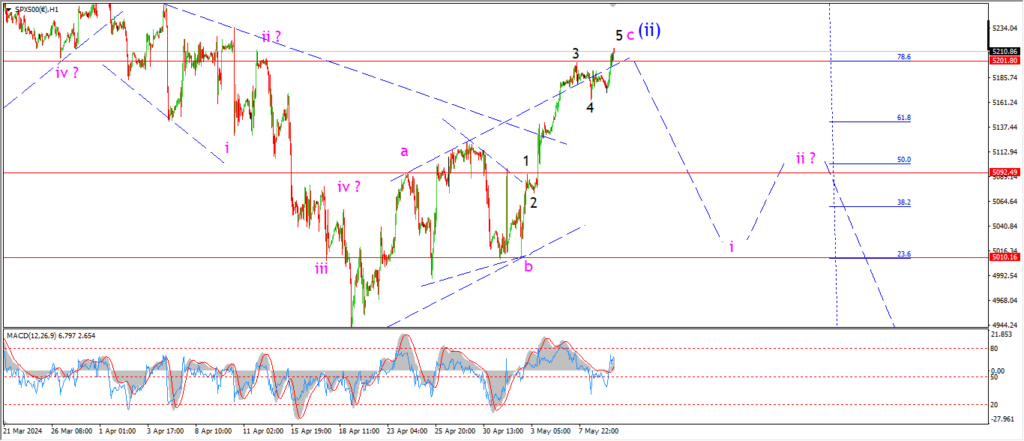

A rally today has brought the market back above the upper trend channel line again,

and it seems wave ‘v’ of ‘c’ is still in control here.

Wave (ii) has broken above the 78.6% retracement level again tonight,

and that is a little concerning to be honest,

but I do expect this knee jerk rally to fizzle out tomorrow,

and then I will look for wave ‘i’ of (iii) to begin again before the close of tomorrow session.

Tomorrow;

Watch for wave ‘c’ of (ii) to top out finally and then fall back in an impulsive manner to begin wave ‘i’ down.

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

I am showing another possible count for the rally into wave (b) tonight.

The initial move up off the wave (a) low can be counted in five waves.

And that should complete wave ‘a’ of a simple zigzag correction.

Wave ‘b’ must fall in three waves from here,

and then wave ‘c’ of (b) can turn lower again as shown.

This weeks rally has brought the market back into the 62% retracement level of wave (a) even now.

So We have seen enough to call wave (b) complete here,

but unless we get an impulsive decline off this high,

then this remains a low probability alternate count.

Tomorrow;

Watch for wave ‘b’ to turn lower as expected before the end of tomorrows session begins.

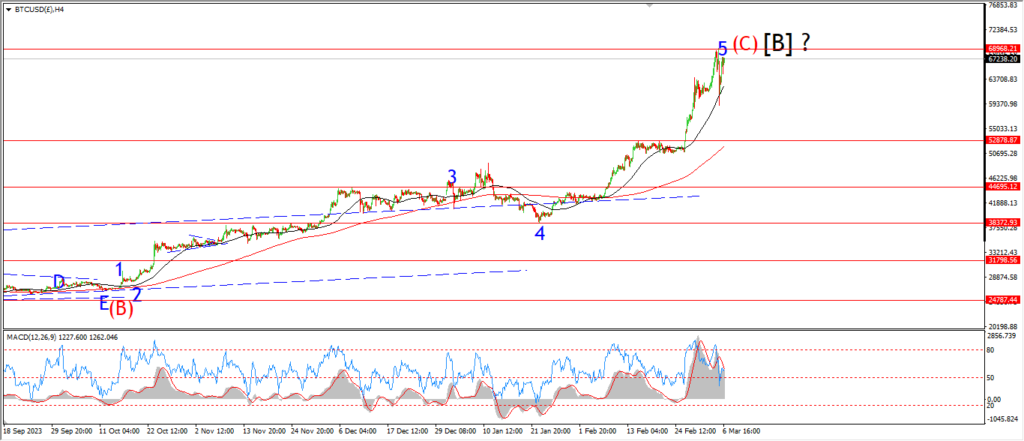

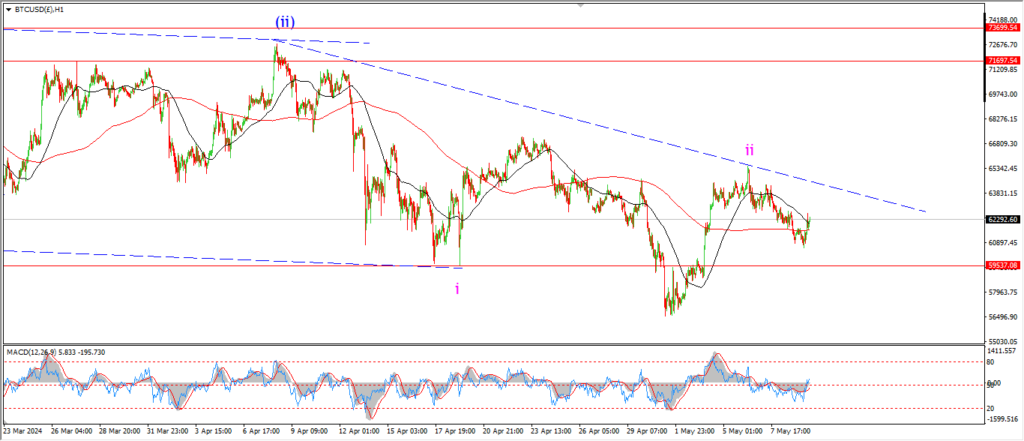

BITCOIN

BITCOIN 1hr.

….

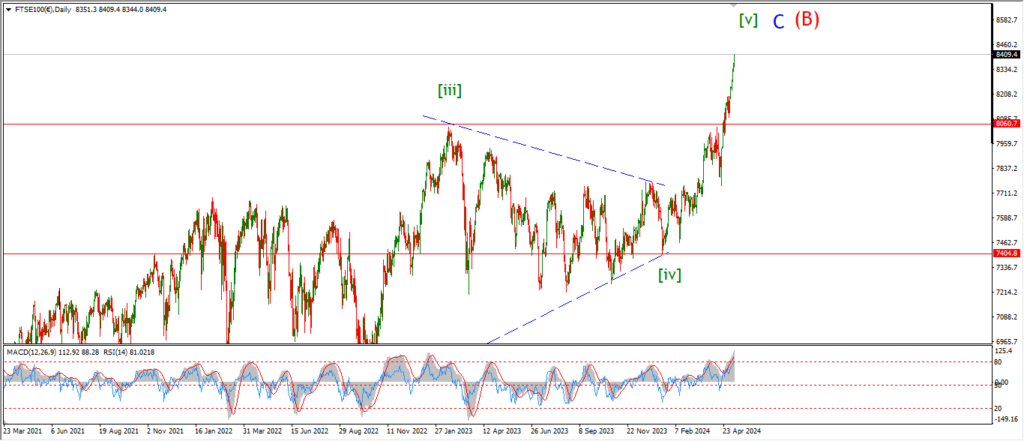

FTSE 100.

FTSE 100 1hr.

….

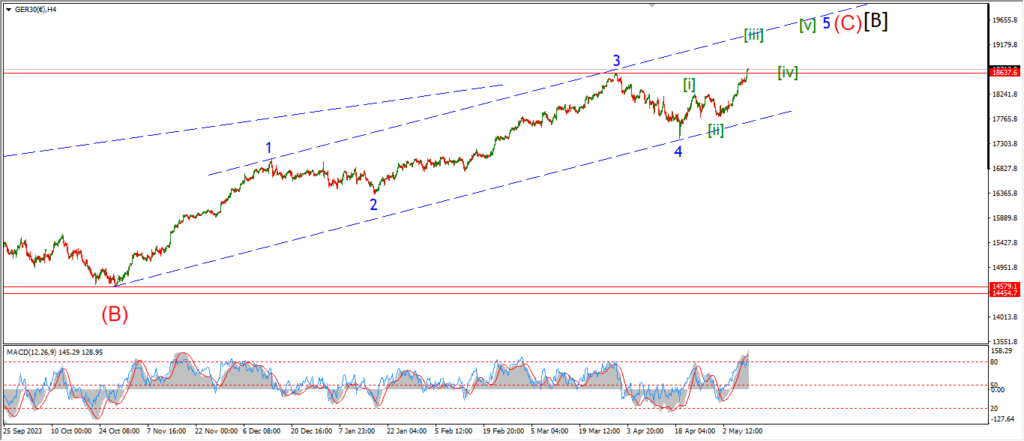

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

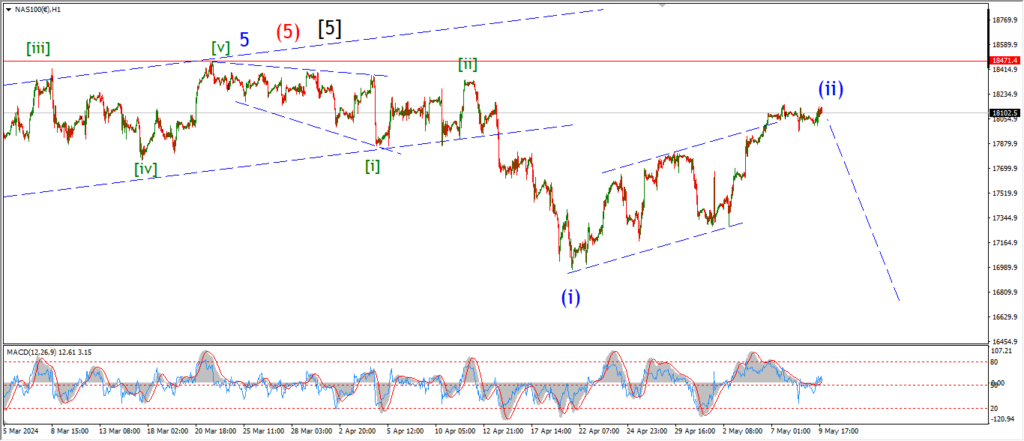

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….