Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

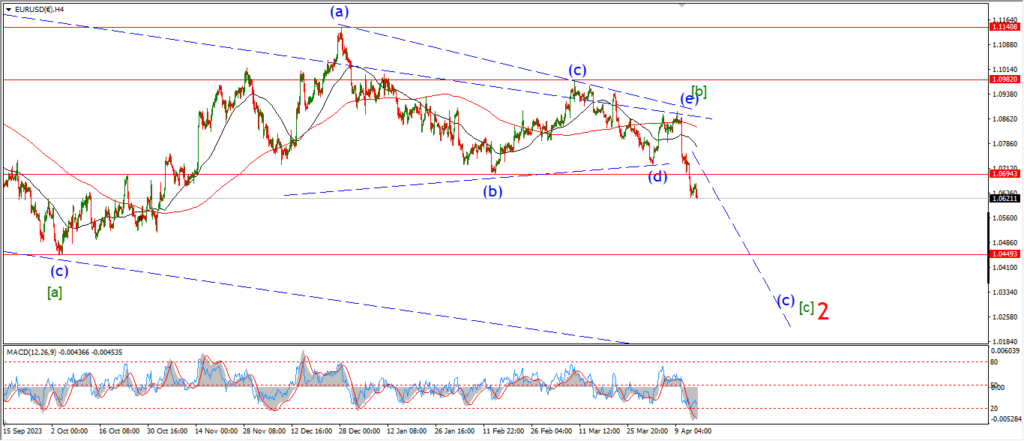

EURUSD.

EURUSD 1hr.

Todays trade brought the rally to confirm that higher wave (ii) scenario.

The price broke clean above the wave ‘a’ high and topped out just below the 78.6% retracement of wave (i).

That high did not last very long,

with an immediate reversal back into the wave ‘a’ high at 1.0750 again.

The high today si now labelled as wave (ii) complete.

And wave ‘i’ of (iii) should now continue lower from here.

The wave ‘b’ low at 1.0650 is the initial target for wave ‘i’.

So we are looking at a significant decline into wave (iii) over the next week.

Tomorrow;

Watch for wave ‘i’ of (iii) to fall sharply into 1.0650 over the coming days.

GBPUSD

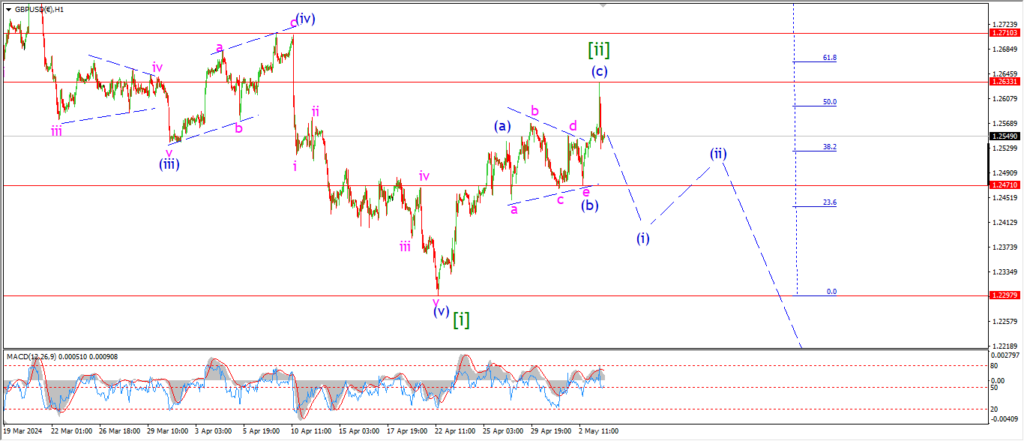

GBPUSD 1hr.

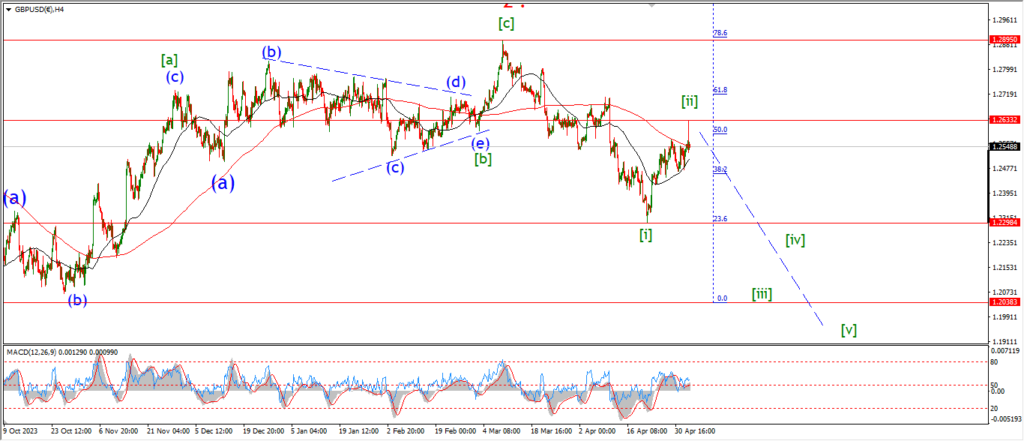

GBPUSD 4hr.

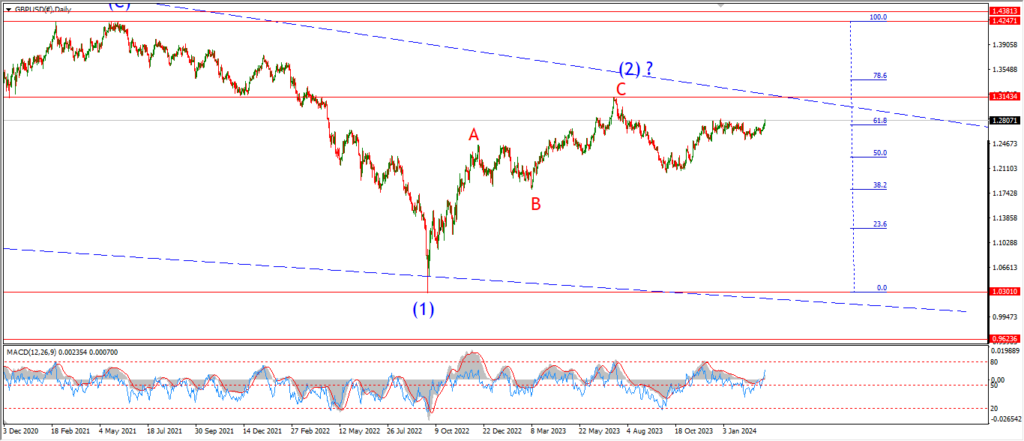

GBPUSD daily.

I have changed up the wave count today and I think it fits the action a little better now.

The rally this week is large enough to consider a higher degree wave [ii].

The high today hit 1.2633,

and that is directly in the middle of the 50% and 62% fib retracement levels.

So,

now we have wave [i] and [ii] complete at this high.

A sharp reversal from here will signal wave [iii] is underway.

Monday;

Watch for wave (i) down to fall back below the wave (b) low at 1.2470.

A break of that level will signal wave (i) of (iii) is underway.

The wave [ii] high should hold from here at 1.2633.

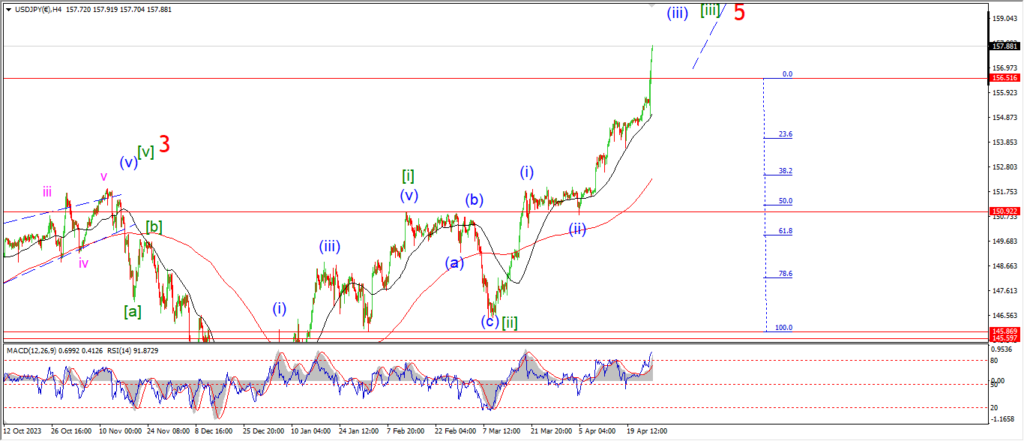

USDJPY.

USDJPY 1hr.

USDJPY is holding above the range of the support at 152.00 this evening after another small drop today.

This wave (i) high at 152.00 formed a shoulder of support over a 2 week period,

and I suspect this level will continue to offer support here even after the steep declines of late.

I think we have enough done here to call wave [ii] complete.

So next week I am looking for a rally to begin into wave (i) of [iii].

Tomorrow;

Watch for wave [iv] to put in a final low on Monday and then I think wave [iii] will be looking up from there.

DOW JONES.

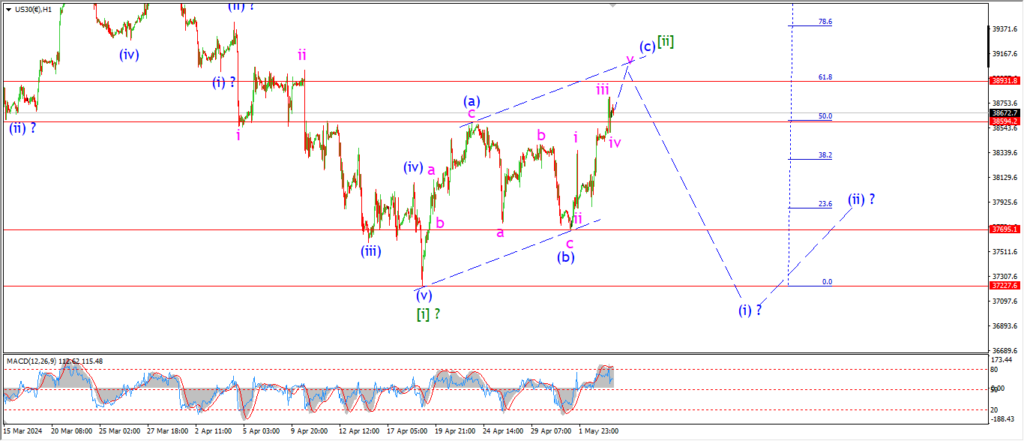

DOW 1hr.

DOW 4hr

DOW daily.

The DOW has confirmed the alternate count for wave [ii] tonight and now I can concentrate on a significant lower high building from here in wave [ii].

The market is sitting in that Fibonacci sweet spot between 50 and 62% retracements.

And we have three waves up as clear as day in that trend channel.

The only question I have now is whether wave (c) makes it up to that upper trend channel line with a break of the 62% level at 38930.

I am allowing for that possibility now.

but,

we will have to wait and see on that front.

The main take-away here is that the next few days completes a dangerous pattern for the market at wave [ii] green.

This will open the trap door for wave [iii] to accelerate lower over the coming weeks.

Monday;

Watch for wave (c) of [ii] to top out by Monday evening by filling the trend channel.

We should immediately see a rejection off the top and a decline back into wave (i) of [iii] by midweek.

I am even expecting wave (i) of [iii] to retrace most of the wave [ii] rally.

So it should be a wake up call if it happens.

GOLD

GOLD 1hr.

Gold has been pretty stagnant in the last few sessions,

so I have shown a new count for wave ‘2’ of ‘c’ tonight.

The price drifted lower in a channel into todays lows,

and now we have a bounce out of that channel this evening.

This is all part of a correction in wave ‘2’ I think.

And we should see a return lower into wave ‘3’ of ‘c’ next week.

Monday;

Watch for wave ‘2’ of ‘c’ to top out an expanded flat correction at 2330 by Monday evening.

And then I can look lower into wave ‘3’ of ‘c’ on Tuesday again.

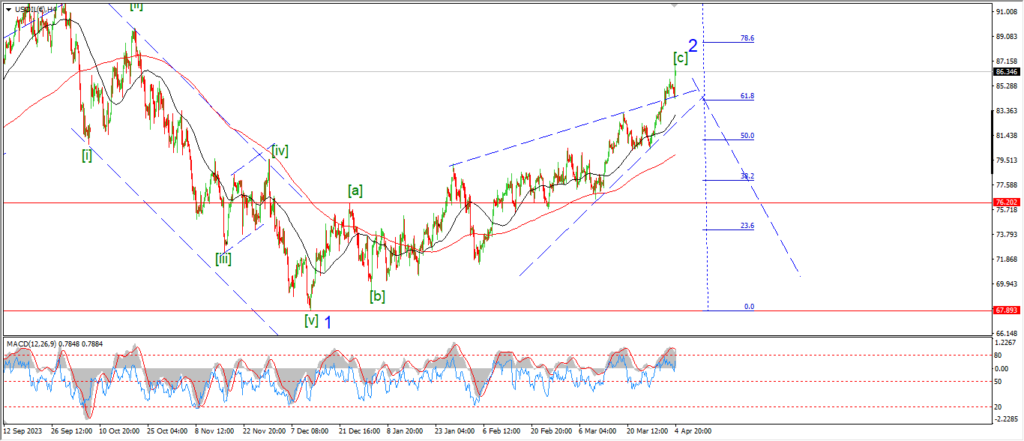

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

The drops keep coming in crude oil and today is no different.

I am still going with the idea that wave ‘iii’ of (iii) will bottom out soon.

And we should see a correction higher in wave ‘iv’ of (iii) next week.

the momentum to the downside has reversed now,

and we should see price follow with a three wave correction back into the 80.00 again in the coming days.

Monday;

the wave ‘i’ low at 80.70 must hold if this wave count is correct.

So wave ‘iv’ of (iii) should top out below that level.

If the price continues lower on Monday without any correction.

then I will consider wave ‘v’ of (iii) already underway.

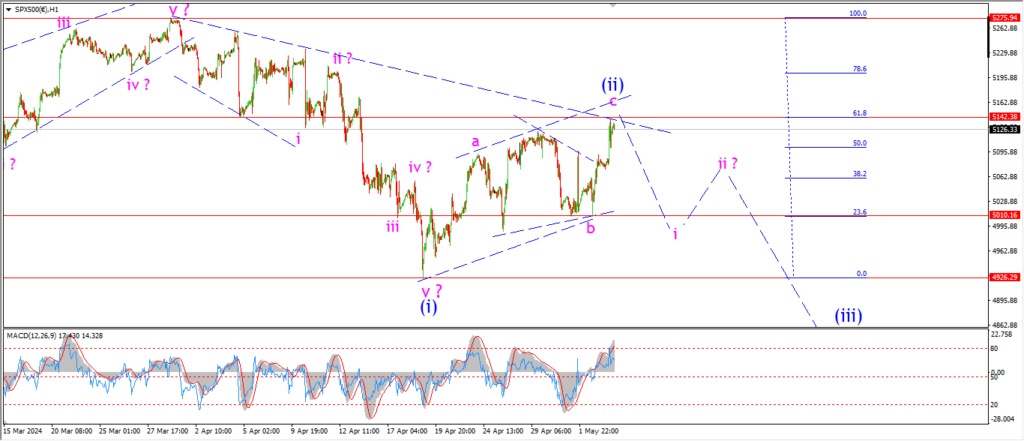

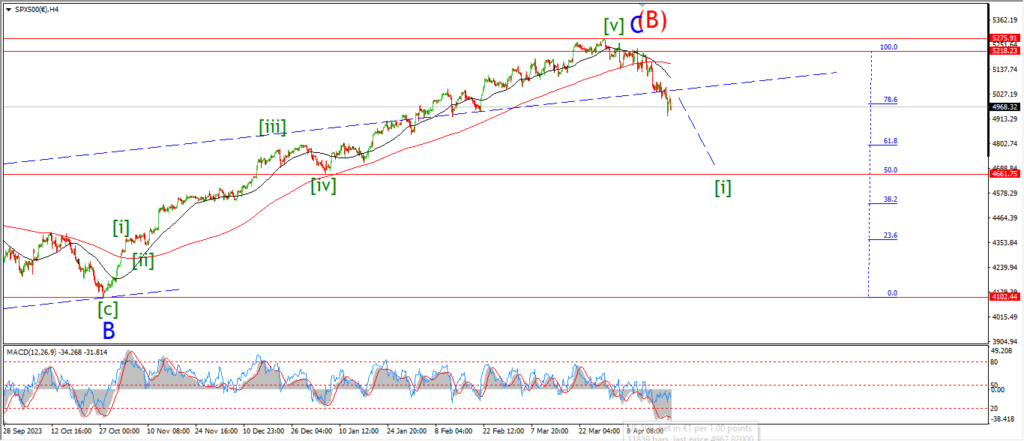

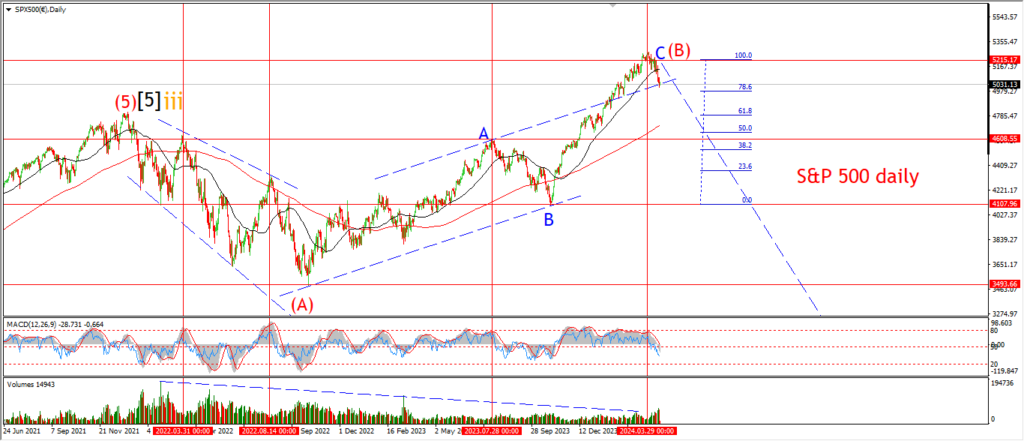

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P requires a rethink tonight.

The rally into this evenings high is still a correction in my mind.

I don’t doubt that at all.

I have relabeled the decline as wave (i),

and now this rally as wave (ii).

So we have the potential of a bearish lower high now.

and next week is going to get very interesting if we see wave (iii) down get underway.

The high has now hit the 62% retracement level,

and wave (iii) down must begin to turn this market lower soon.

Wave ‘i’ of (iii) will fall back below the wave ‘b’ low at 5010 to begin with.

Monday;

Watch for wave ‘i’ of (iii) to drop below 5010 early next week.

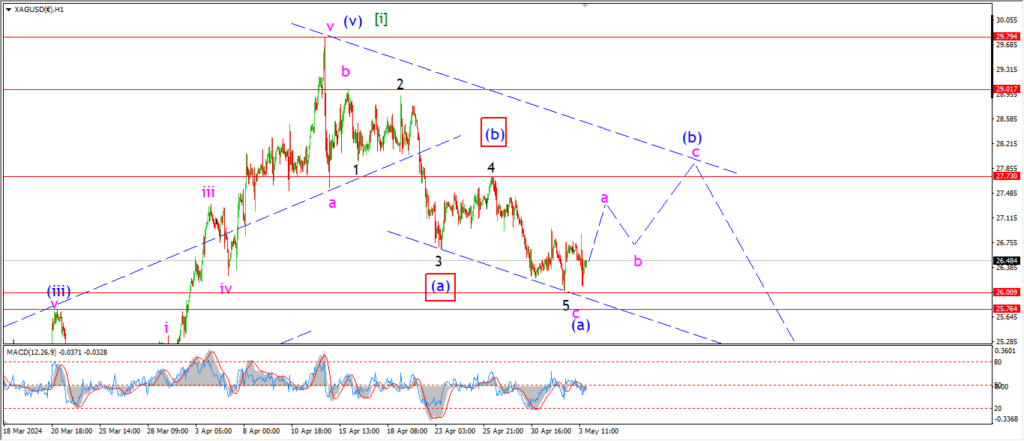

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

The turn up into wave (b) is starting really slow here.

The price has found a temporary low at 26.00,

and I am suggesting that wave ‘a’ of (b) is tracing out three waves up here.

So the price should turn higher again on Monday in this scenario.

WAve (b) should trace out three waves up and top out near 28.00 when complete.

And that should take most of next week.

Monday;

Watch for wave ‘a’ of (b) to trace out three waves up and then create a higher low in wave ‘b’ above 26.00.

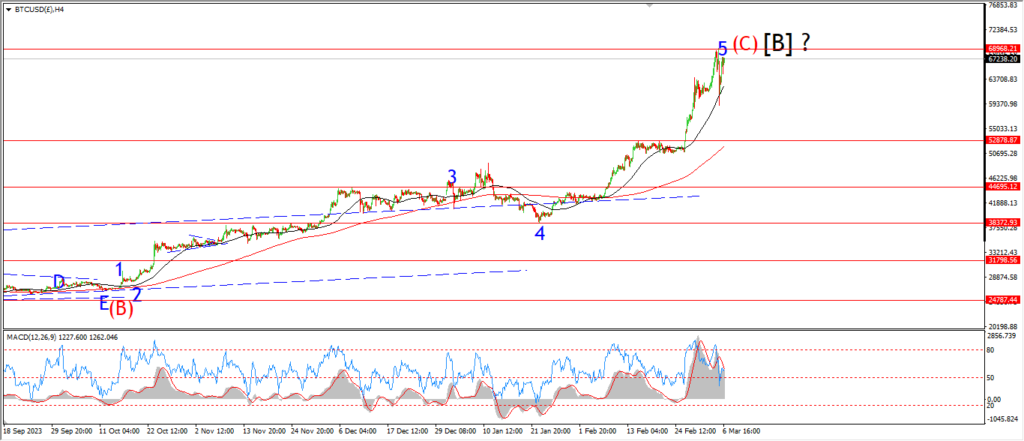

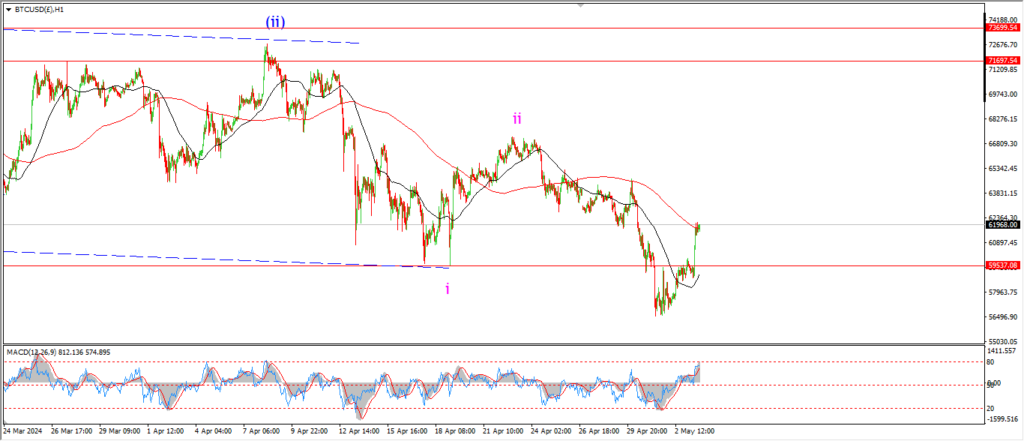

BITCOIN

BITCOIN 1hr.

….

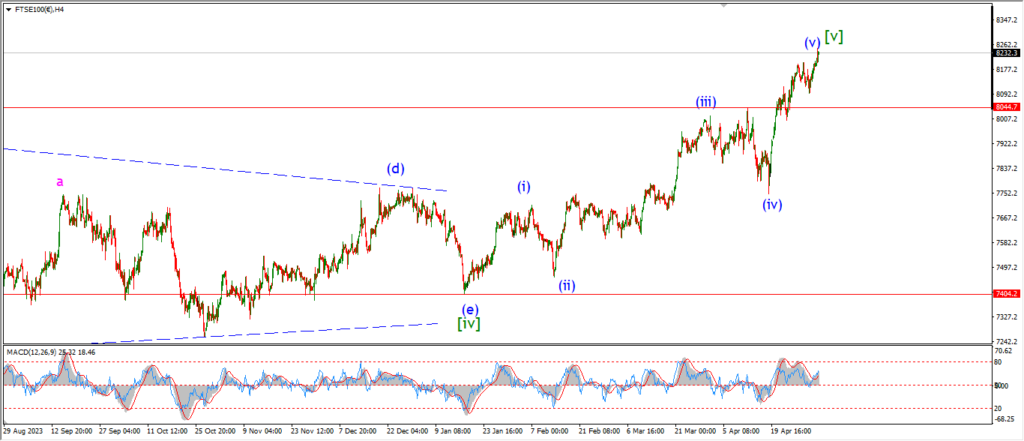

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

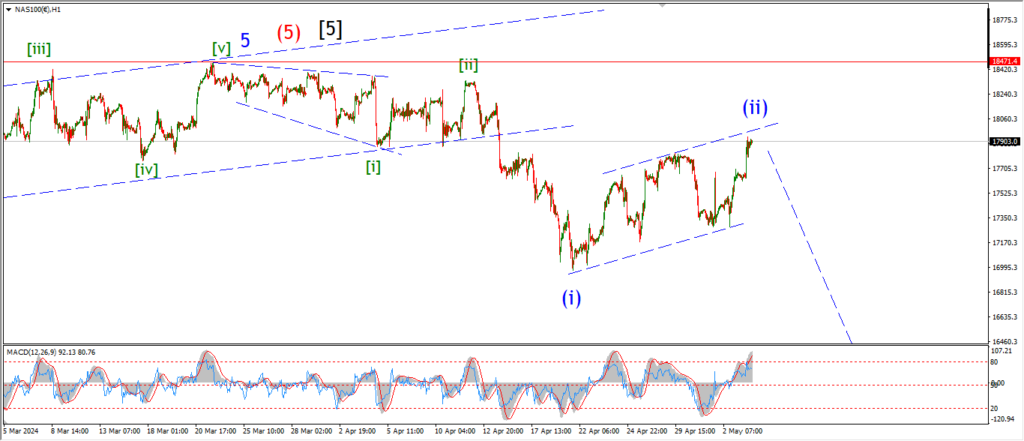

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….