Good evening folks and the Lord’s blessings to you.

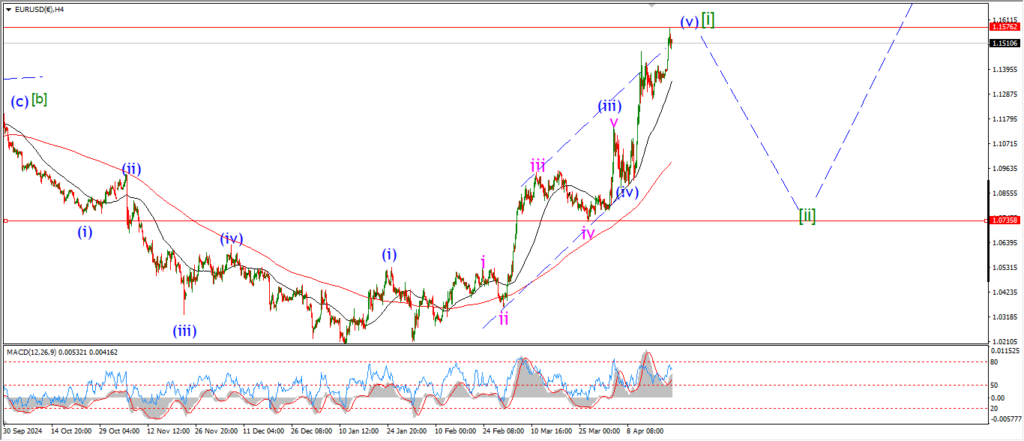

EURUSD

EURUSD 1hr.

Situations turn on a dime these days,

And that may be true for EURUSD tonight.

What I suggested as a small corrective decline is now morphing into a larger pattern now.

The price has dropped enough to consider wave [ii] green now in play.

The target area for wave [ii] lies down near 1.0800 again with a three wave decline.

I am suggesting that wave (a) of [ii] is underway now,

with a five wave decline into wave ‘a’ pink almost complete.

Tomorrow;

Watch for wave ‘a’ to find support at 1.1265 at the wave ‘iv’ low.

And wave ‘b’ should return higher from there to form a lower high.

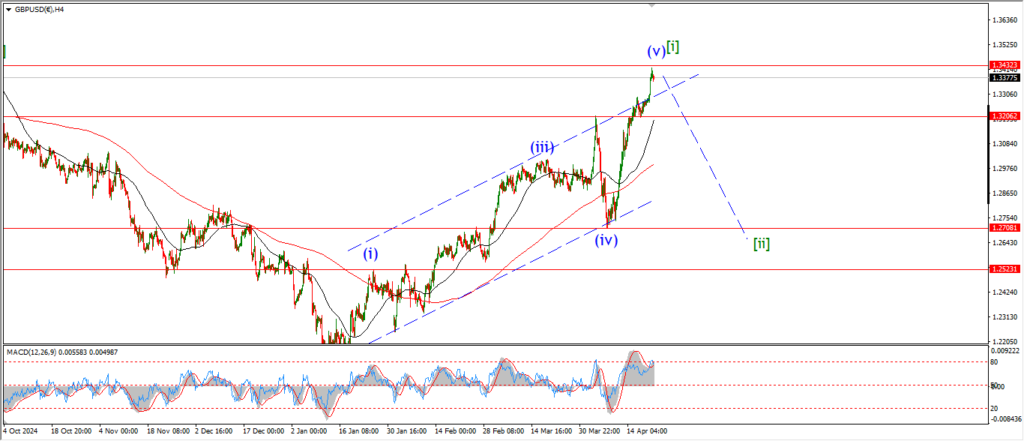

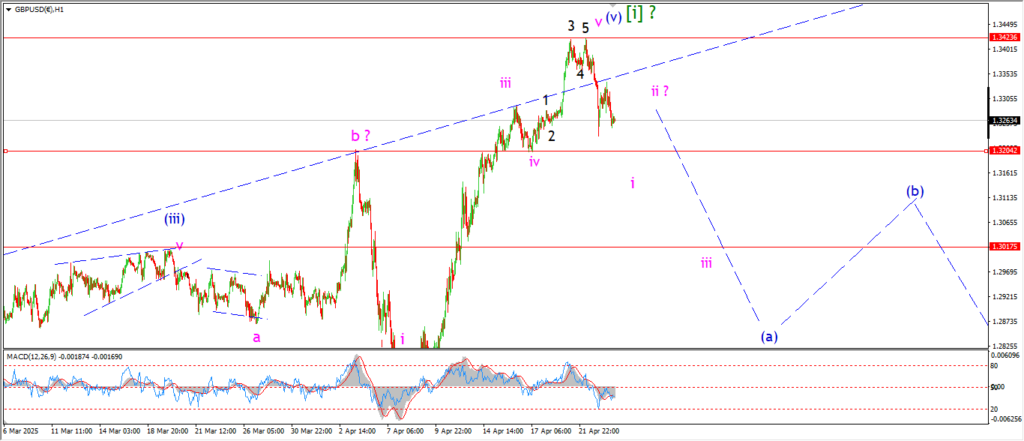

GBPUSD

GBPUSD 1hr.

Cable has dropped off by a large enough degree now to suggest that wave [ii] is in play also.

I am looking for a break of that wave ‘iv’ low in wave ‘i’ of (a) of [ii].

And that initial drop in wave (a) should break below 1.3000 again with ease.

If this pattern is correct we may even see that target hit this week.

Tomorrow;

Five waves down in wave ‘i’ of (a) should hit the 1.3200 level at wave ‘iv’ pink.

and then a small rebound in wave ‘ii’ will begin.

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

USDJPY is rising today off that support at 139.58.

And that level is the minimum target for wave [c] of ‘2’ to complete,

and we failed to break that level.

So I am apprehensive to call this rally a turn into wave [i] up because wave ‘2’ did not hit the minimum target.

There is of course a possibility that wave ‘2’ is done and I am nit picking here,

but I will remain cautious until a clear impulsive pattern higher is in place.

Tomorrow;

the action so far is developing quite well,

but this can still prove to be a relief rally before breaking the target low.

I will give this a few more days to see if a clearer pattern develops.

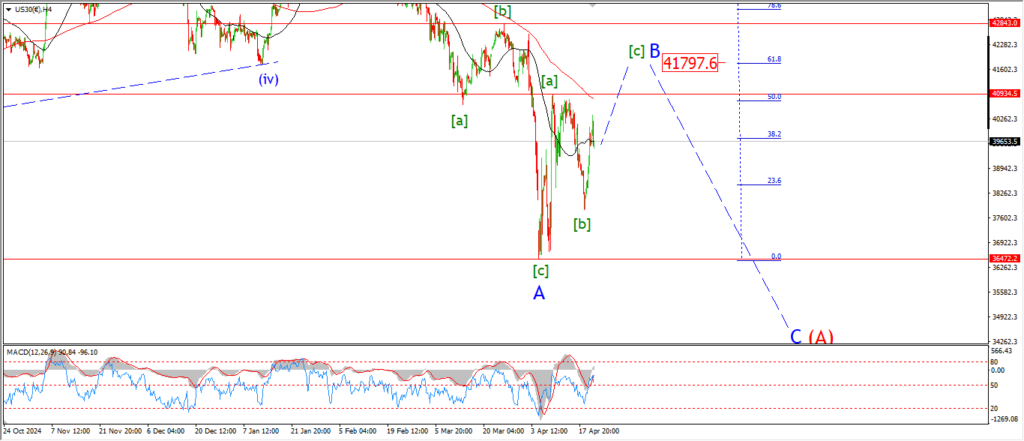

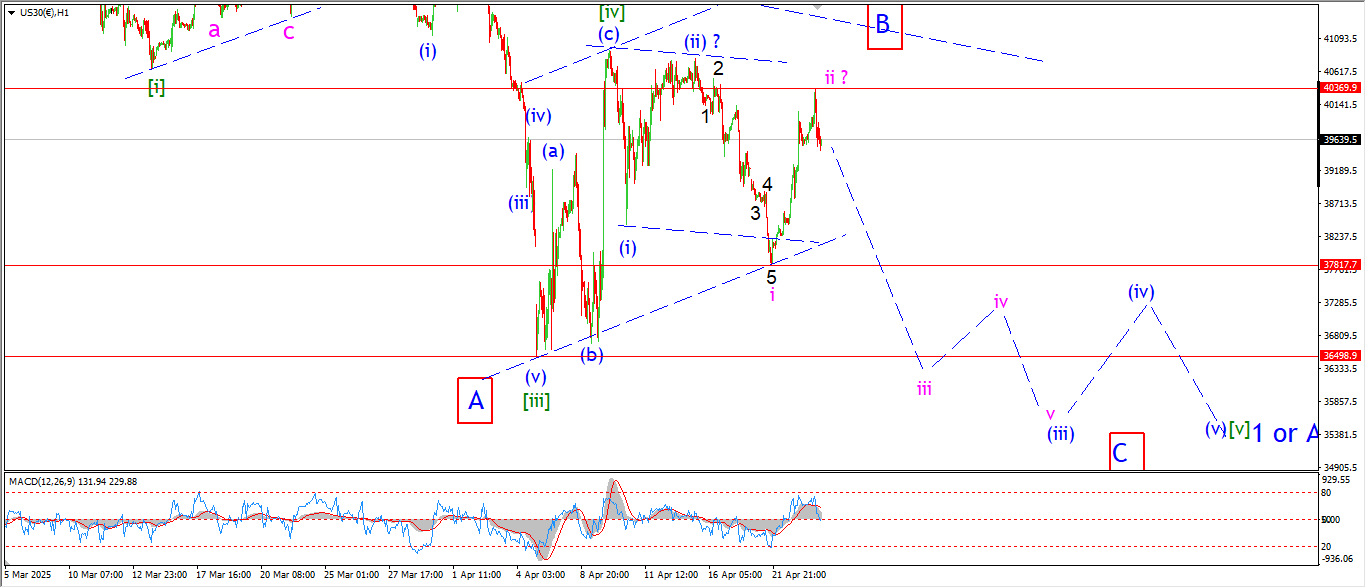

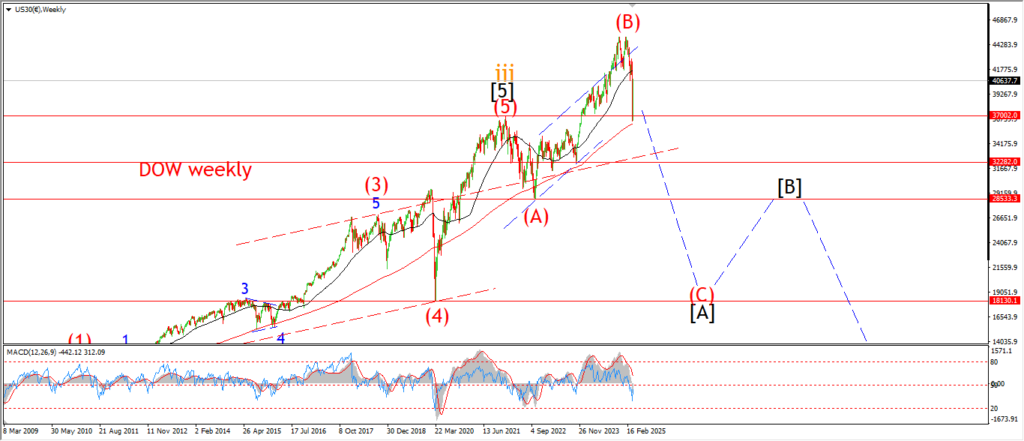

DOW JONES.

DOW 1hr.

Starting on the 4hr chart first tonight again.

the action today is really looking like a possible wave [c] of ‘B’ rally now.

There is no confirmation of this pattern yet,

but I would say we have a 50/50 probability between both wave counts now.

If the alternate count is correct,

then we will see five waves up to hit a high near 42000 level to top out wave ‘B’.

And from there a turn down into wave ‘C’ will be quite the shocker.

The main count is still viable at the moment,

but wave ‘ii’ pink has gone farther than I would like.

If the decline this evening is a turn into wave ‘iii’ of (iii),

then we will see a sharp drop tomorrow to bring the price back below 37000 in wave ‘iii’ of (iii).

And from there,

we will follow wave [v] down into next week.

Tomorrow;

Watch for wave ‘iii’ of (iii) to take the price back below the wave ‘i’ lows to confirm this pattern.

A break above 40400 again will trigger that alternate count.

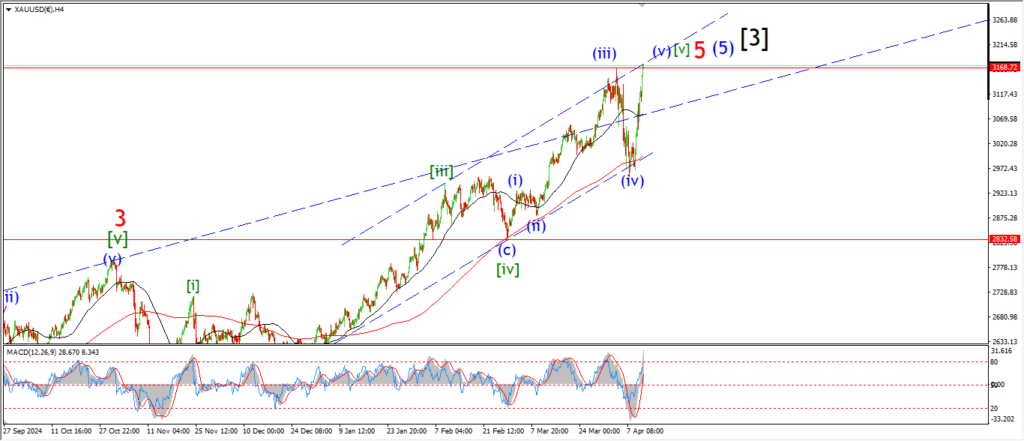

GOLD

GOLD 1hr.

Gold stepped lower today which is building confidence in the possibility of a top in wave [v] now.

I am looking at that wave (iii) high as the first confirmation of a turn.

that wave (iii) top lies at 3167,

and if we break below that level that will lead to a drop into the next support at 2956 in wave [i] green.

This turn is gaining traction now,

but a five wave decline to break support will confirm this idea.

tomorrow;

lets see if wave [i] down can trace out a five wave decline over the coming week.

And if that happens,

then the door will open for a much larger correction in wave [4] black again.

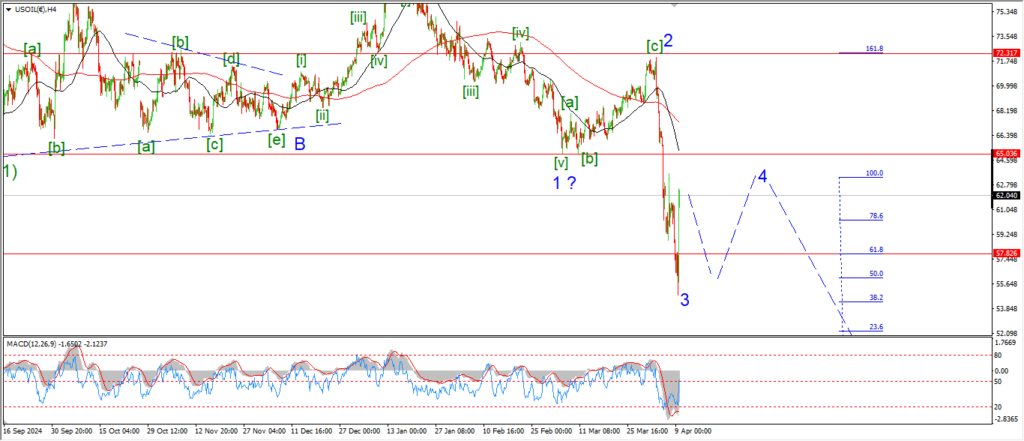

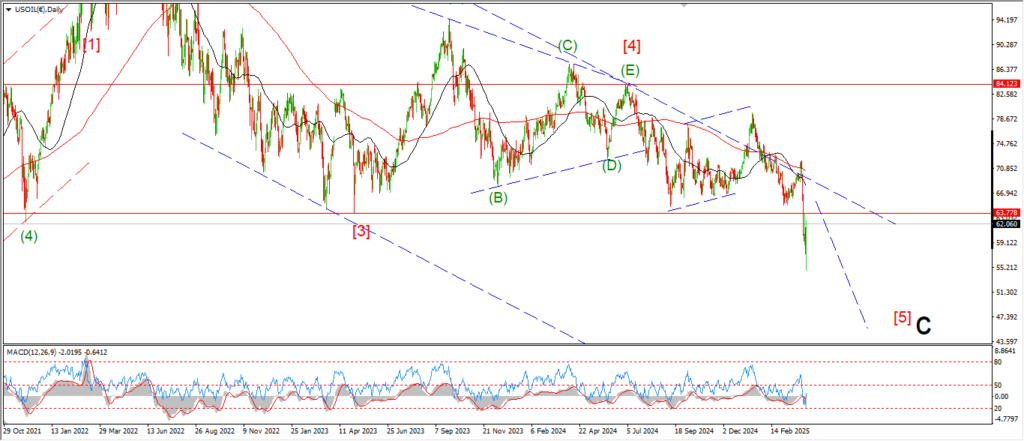

CRUDE OIL.

CRUDE OIL 1hr.

That new count in crude got a major boost today with a complete rejection off the highs of the session.

the price completed a possible ending diagonal pattern in wave [c] of ‘4’ at the high,

and now this reversal is labelled wave (i) of [i] of ‘5’.

If this pattern is correct,

then wave [i] down will trace out five waves into the 58.00 area again over the next few days.

And that will begin a much larger decline in wave ‘5’ blue over the coming months.

Tomorrow;

Watch for wave (i) and (ii) to form a lower high as suggested by the end of this week.

the wave ‘4’ high must hold at todays highs.

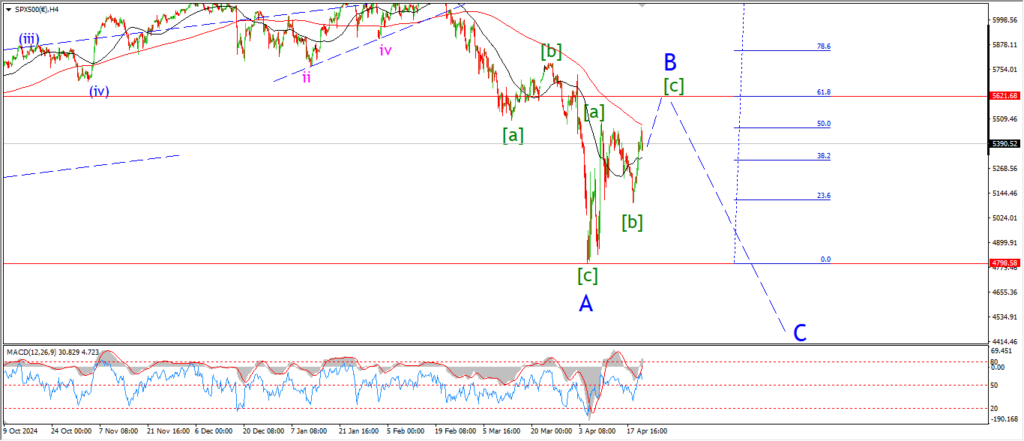

S&P 500.

S&P 500 1hr

Just like the DOW,

the S&P is now sitting between two counts with a shift coming towards the alternate count.

That alternate is best viewed on the 4hr chart.

if the price breaks the [iv] high again at 5495 that will trigger the alternate count.

I have shown another possibility for that wave (ii) correction on the hourly chart.

The market did not break that wave [iv] top at the session highs today so this count is still valid.

Wave (ii) of [v] topped out at the high today,

and the price is now falling into wave (iii) of [v].

A break below 5090 again will confirm this idea.

And we can expect a drop into 4800 in wave (iii) again.

tomorrow;

Watch for wave (iii) down to accelerate lower to break 5090 and confirm the pattern.

the wave [iv] high must hold.

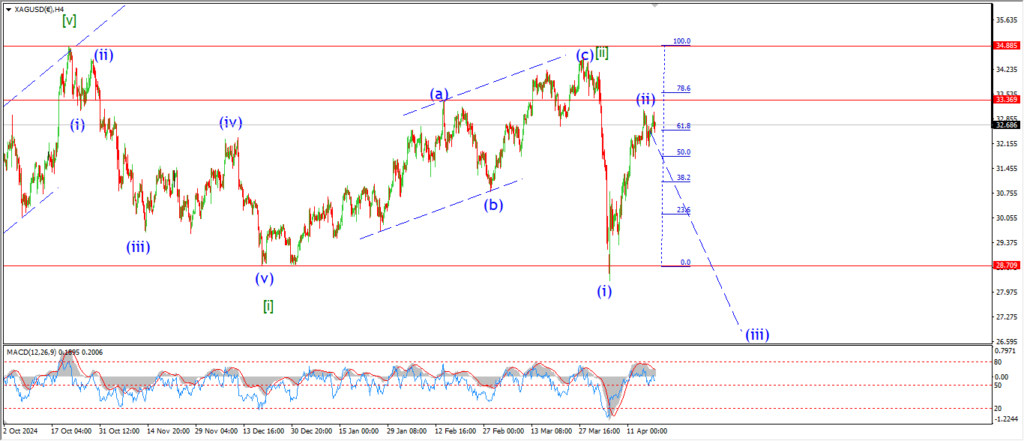

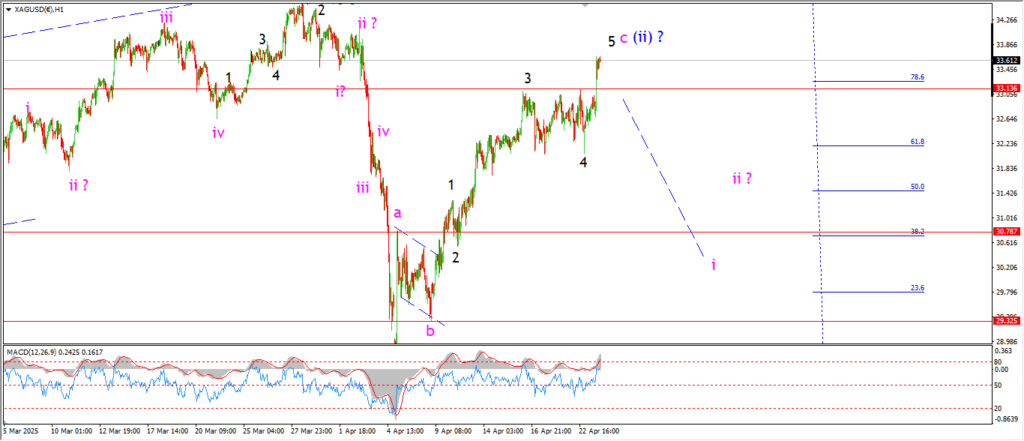

SILVER.

SILVER 1hr

I am going to be forced to rethink this whole count in silver if the price does not turn quickly into wave (iii) down.

The price popped again today out of a corrective low in wave ‘4’ of ‘c’.

Wave ‘5’ made a new high,

and wave now the price must drop into wave ‘i’ of (iii) again to confirm this count.

I am holding my breath at the moment,

and this week will either confirm the main count,

or I will be back to the drawing board.

Tomorrow;

Lets see if that turn into wave ‘i’ comes finally.

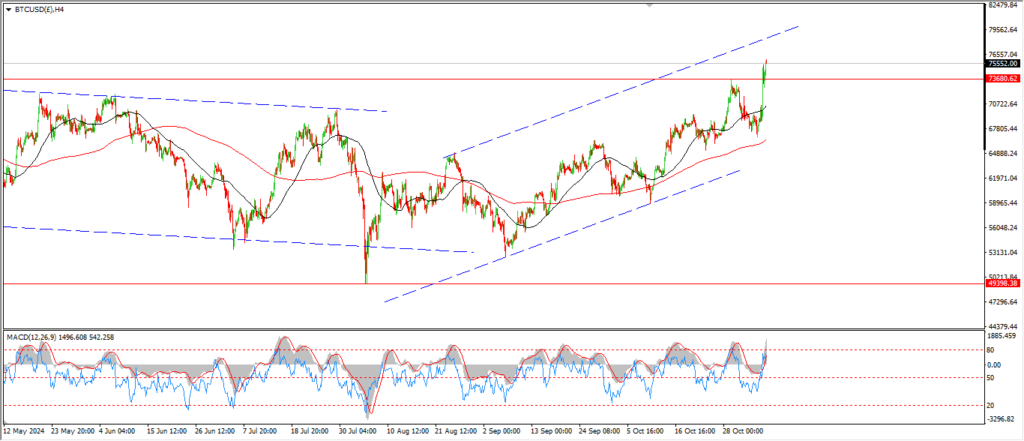

BITCOIN

BITCOIN 1hr.

….

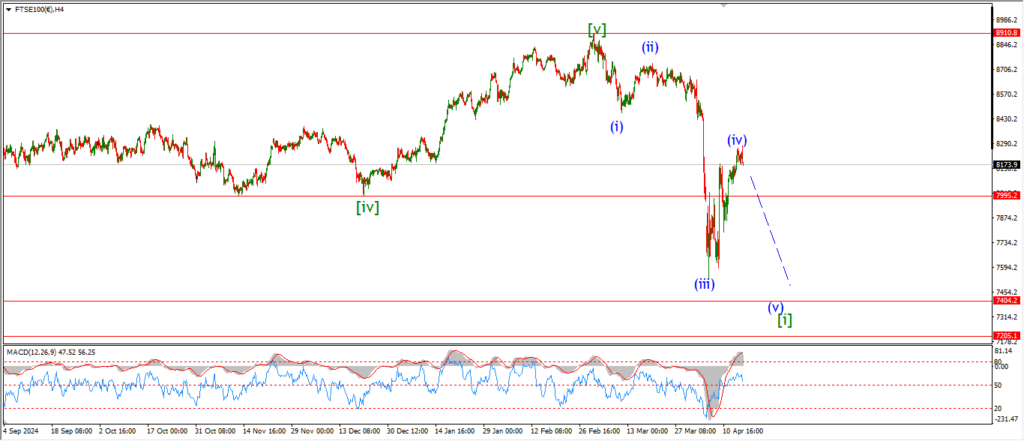

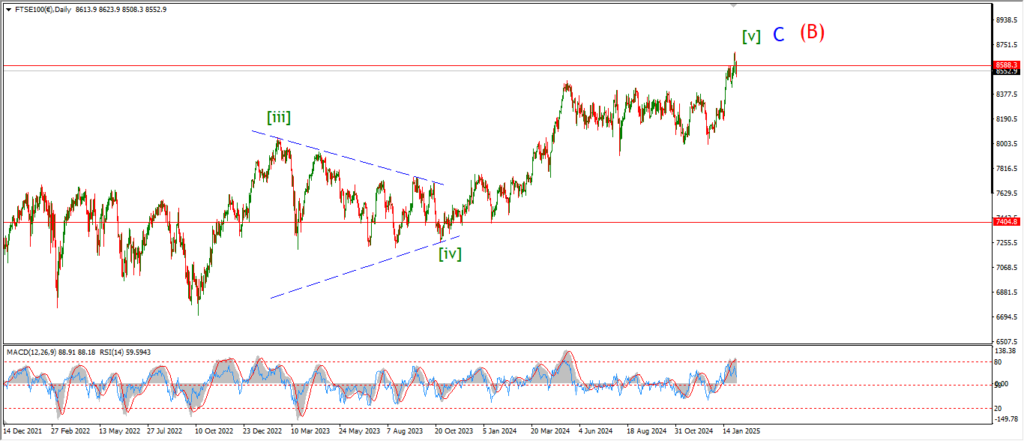

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

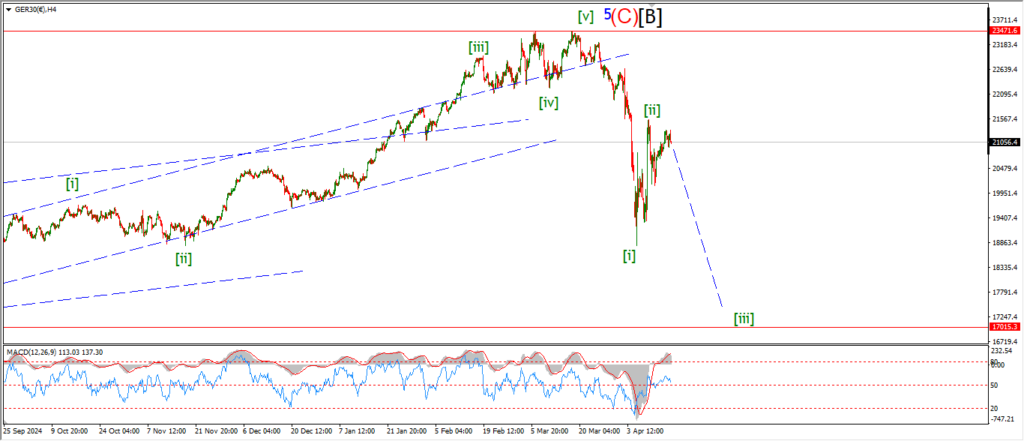

DAX.

DAX 1hr

….

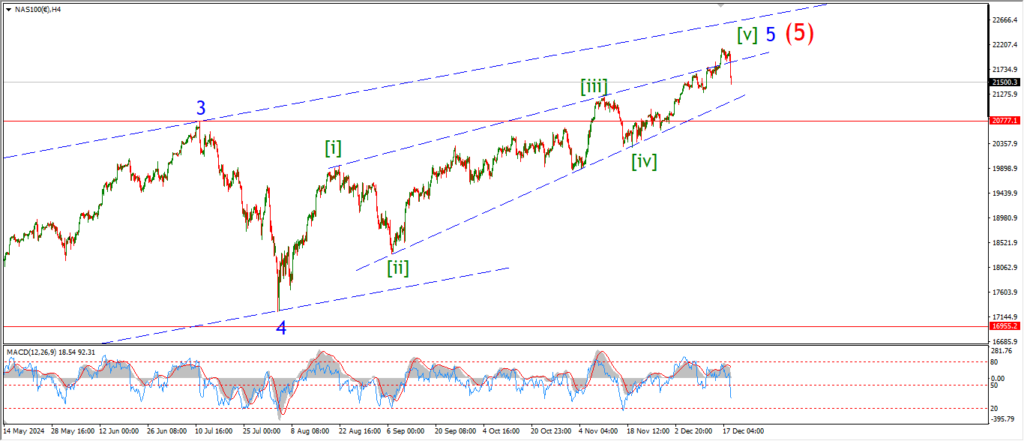

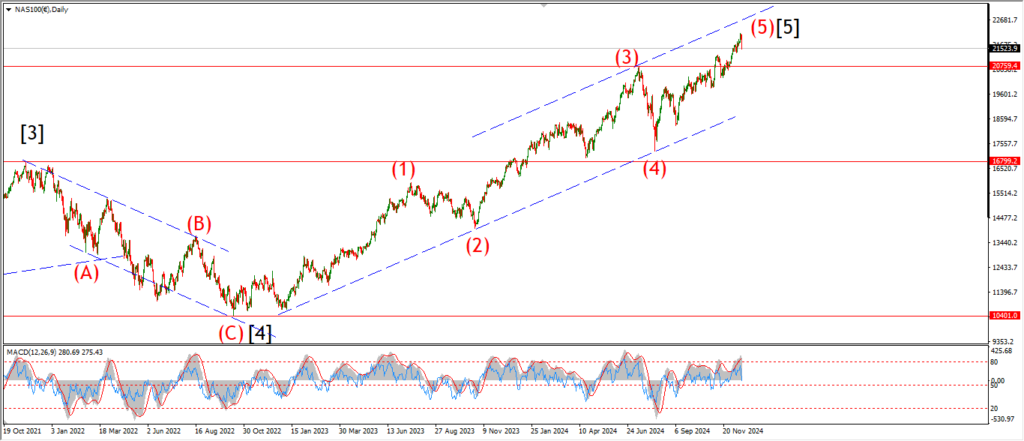

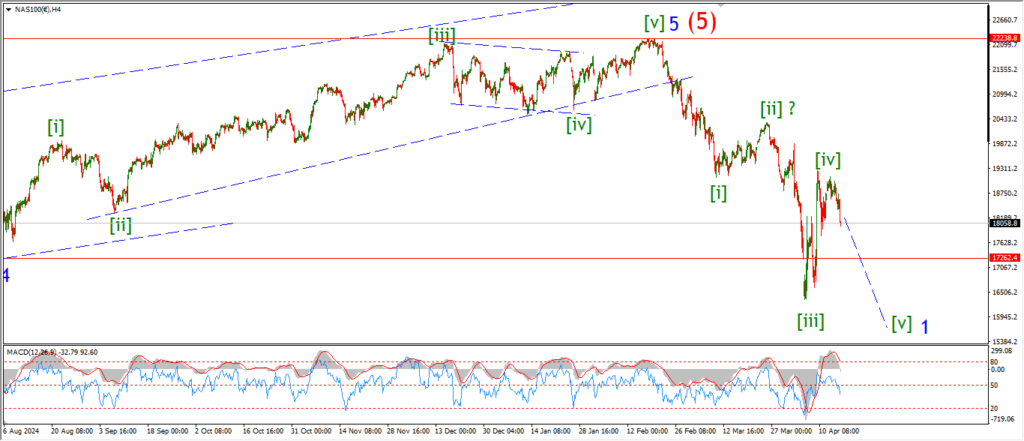

NASDAQ 100.

NASDAQ 1hr

….