Good evening folks, the Lord’s Blessings to you all.

I want to show you a few charts that should tell us something about the situation in the markets at large.

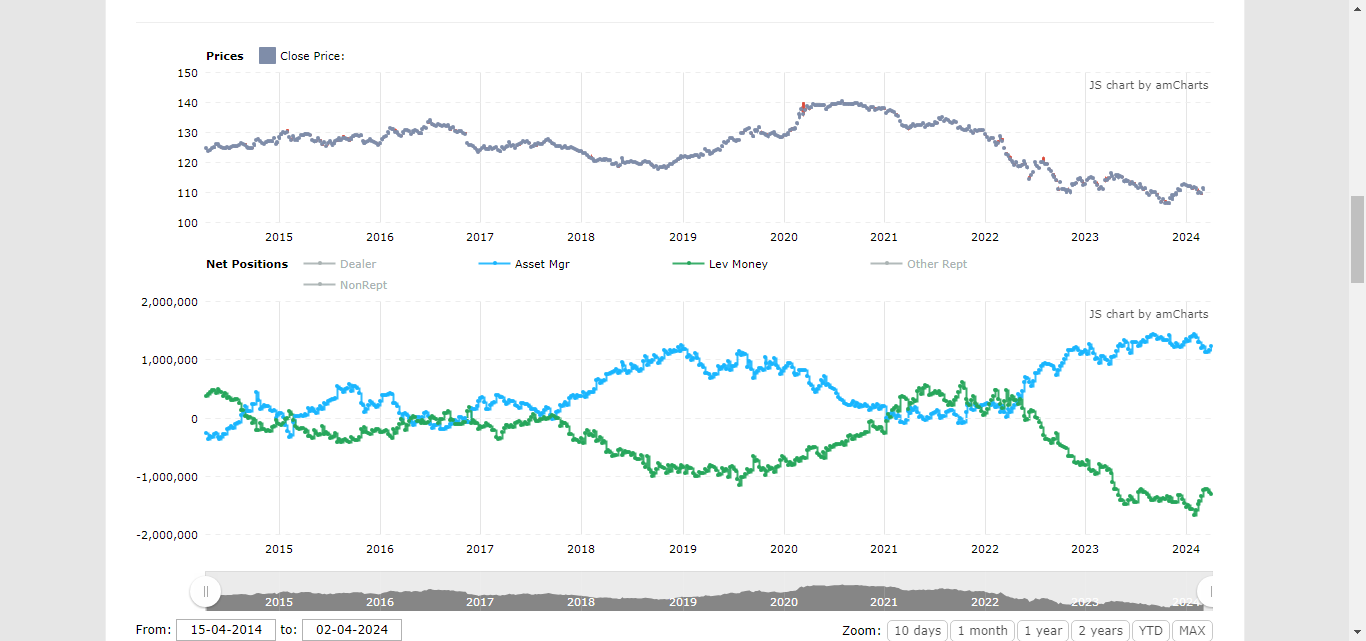

U.S 10yr;

The 10yr note is now sitting at a more extreme low than in 2018 after a serious onslaught of selling over the last year. Futures positioning in the opposite sides of the market are now more extreme than at that point also. This market is poised for a major rally on this basis alone.

All who wanted to sell, have done so. now we have room for a counter strike!

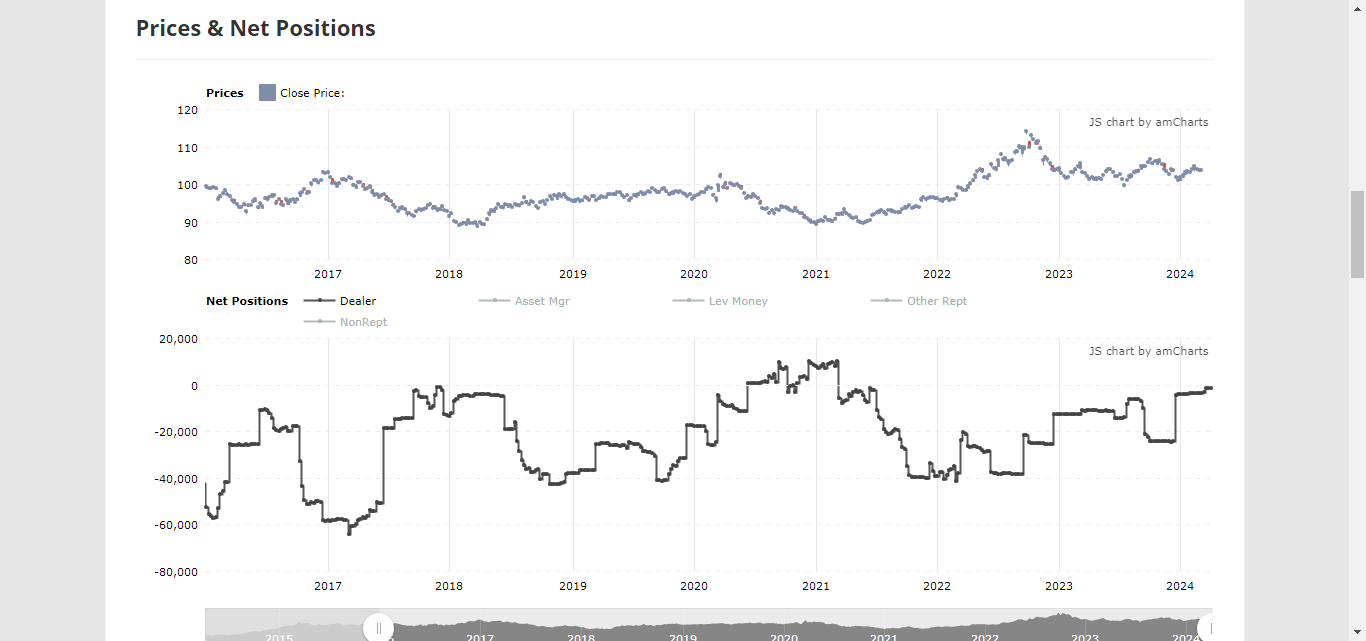

Dollar index;

The USDX can be viewed in the same way. the dollar has been sold all throughout the last year off that 114 high but we are witnessing a base building going on here. the price is about 10% off the last high, and now we have a futures market in a position similar to the 2021 lows again. it is an interesting flipside to the bonds situation. and both of these markets are a very interesting mirror to the risk assets markets in general. FYI.

https://twitter.com/bullwavesreal

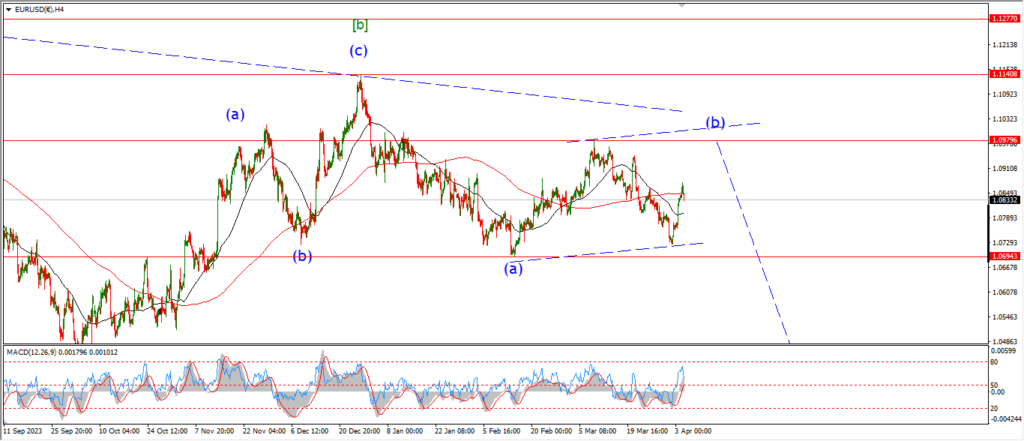

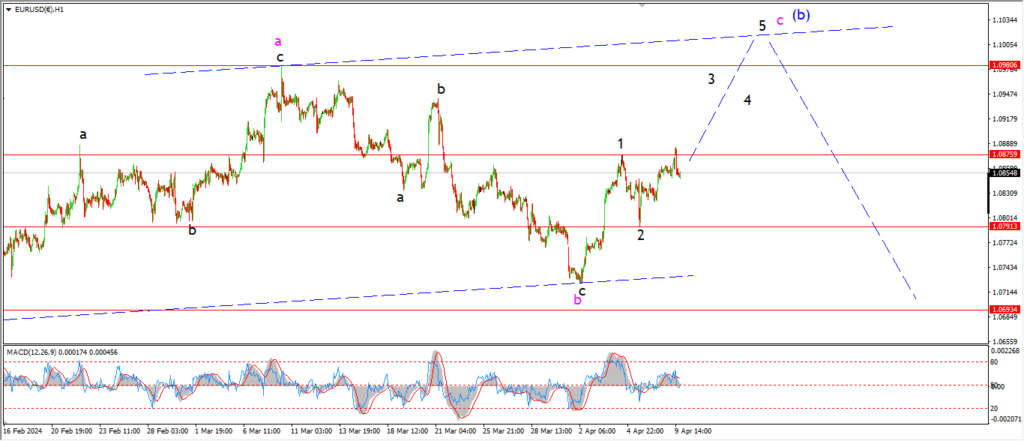

EURUSD.

EURUSD 1hr.

EURUSD broke above the wave ‘1’ high at 1.0876 for a brief moment today,

and then turned lower very quickly off that high.

At the moment it seems wave ‘3’ is underway with that slight new high.

And that pattern should extend higher in a five wave form to complete wave ‘3’ of ‘c’ near the recent high at 1.0980.

Tomorrow;

Watch for wave ‘3’ of ‘c’ to continue higher as suggested.

The wave ‘2’ low must hold at 1.0791.

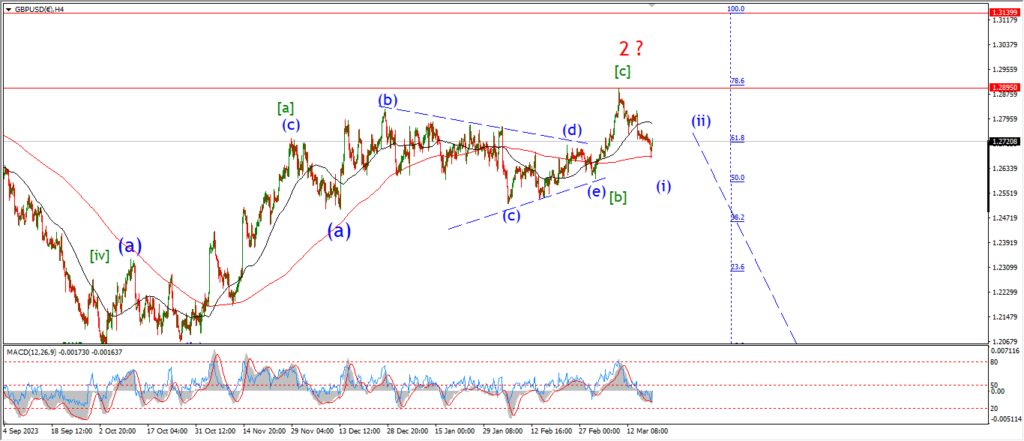

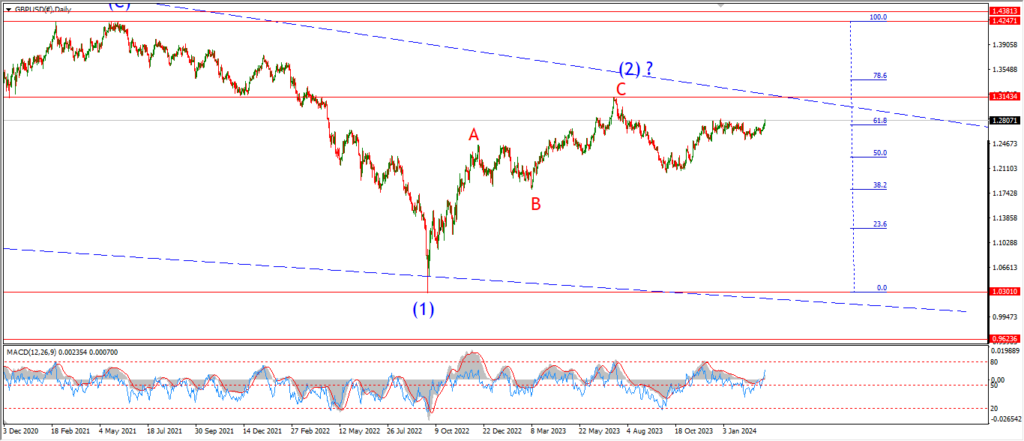

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

Cable got interesting today.

the price has completed a five wave pattern higher in wave (c) now.

the high of the session failed just below the 50% retracement level at 1.2715.

And now we have a small spike lower off that high to close out the session.

The price has also completed a three wave pattern higher in wave [ii] at todays highs.

It is not a big leap after todays session,

to suggest that wave [ii] is now done and wave [iii] down is underway.

This wave count must prove itself now with a drop back below 1.2574 at the wave (b) low.

Tomorrow;

Watch for wave [ii] to hold at 1.2710.

Wave (i) of [iii] will be confirmed with a drop back below 1.2574.

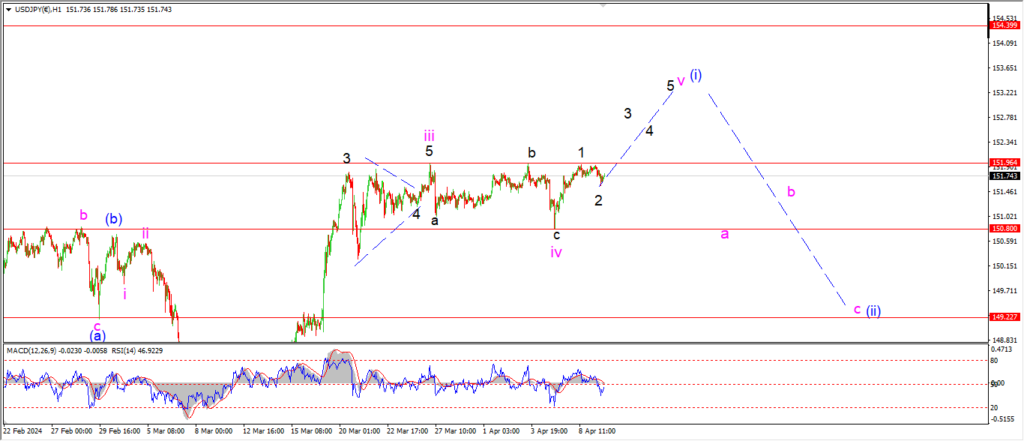

USDJPY.

USDJPY 1hr.

The price basically corrected sideways today and that action is now viewed as a small second wave within wave ‘v’ pink.

Wave ‘3’ of ‘v’ should now turn higher towards the 153.00 level tomorrow.

And we should see a five wave rally in wave ‘v’ top out later this week.

Tomorrow;

wave ‘iv’ must hold at 150.80.

watch for wave ‘v’ to continue higher as shown to complete the larger wave (i) pattern.

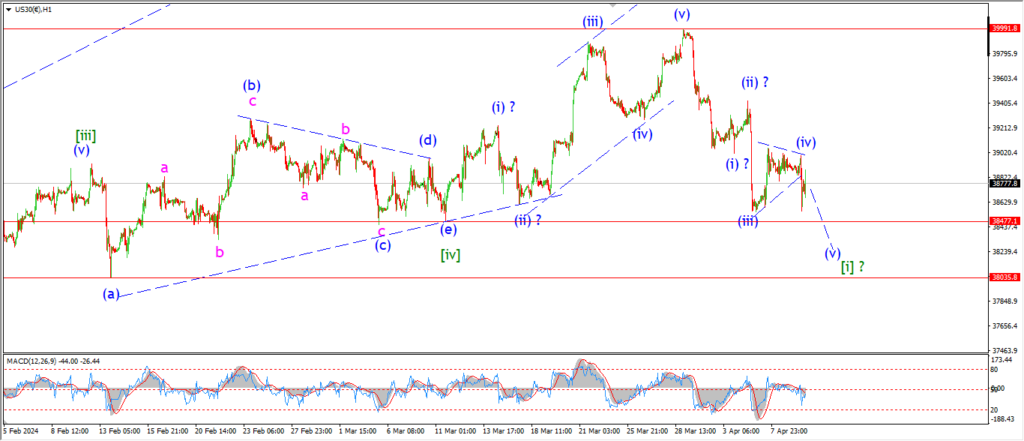

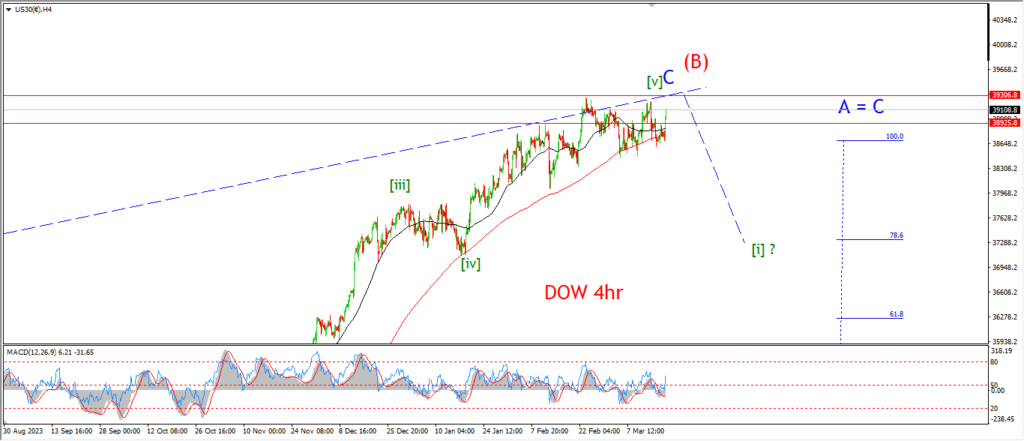

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

I am going to continue to allow this bearish pattern in the DOW to develop each day as long as there is still a chance to get five waves down.

And tonight is no different.

The internal action over the last few days is not perfect.

But,

there is a chance we have a contracting triangle wave (iv) now in play here.

The market did break lower out of the triangle pattern today,

and now I am looking for a break of support at 38480 in wave (v) to add weight to this overall idea.

Tomorrow;

Watch for wave (v) blue to trace out a five wave pattern lower to break support at the previous wave [iv] low.

The lower we get here,

the better this pattern will fit the bearish case.

The low end of the wave [iv] correction lies at 38030.

A break of the full triangle pattern will be even more encouraging.

GOLD

GOLD 1hr.

I am still searching for a top in wave ‘v’ of (iii) today.

the price action is getting choppy off the previous wave ‘5’ highs now.

This slowing momentum in wave ‘v’ is happening at the upper line of the trend channel surrounding wave (iii).

This is just another tick in the box to suggest wave (iii) is all but done here.

And after an extended rally over the last month,

its getting close to a consolidation time now.

Tomorrow;

Watch for wave ‘5’ of ‘v’ of (iii) to top out and reverse into wave ‘a’ of (iv).

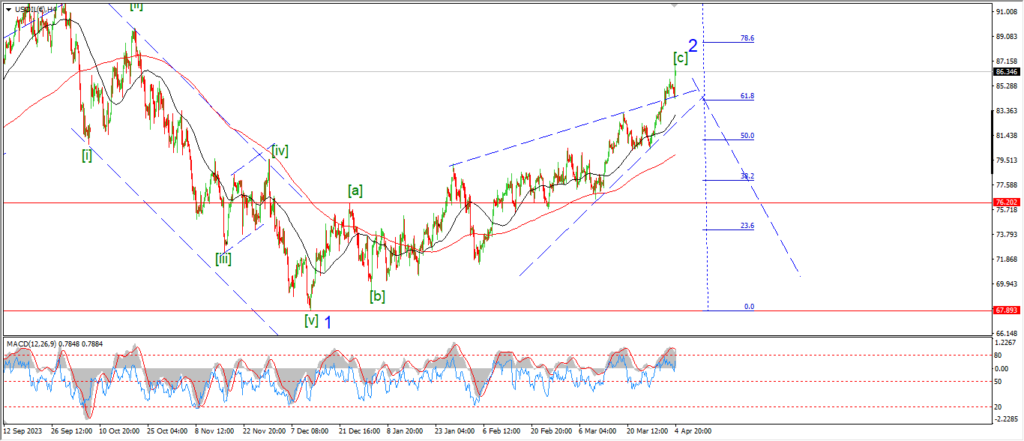

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

First the price hit the upper channel line in wave (v).

Then we got a spike lower off that high.

A lower high did form below the recent top at wave ‘2’ labelled wave ‘ii’ pink,

and now the market is giving us a turn lower again.

the bearish pattern in wave (i) is not confirmed with this action obviously,

but there is definitely the growing chance of an impulsive decline here.

That is the main point tonight.

Lets see if we get a five wave decline off the top this week to build the case for a turn down into wave ‘3’.

Tomorrow;

Watch for wave (i) down to continue lower in five waves to break the wave ‘b’ lows at 80.43.

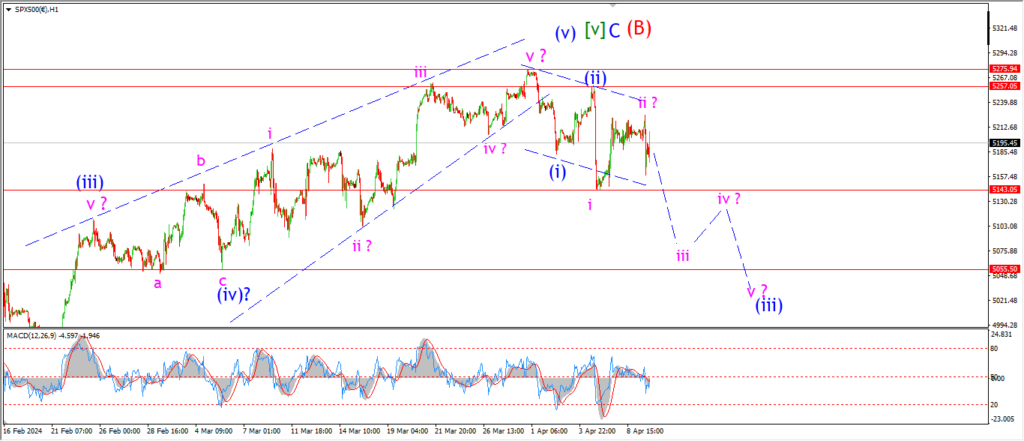

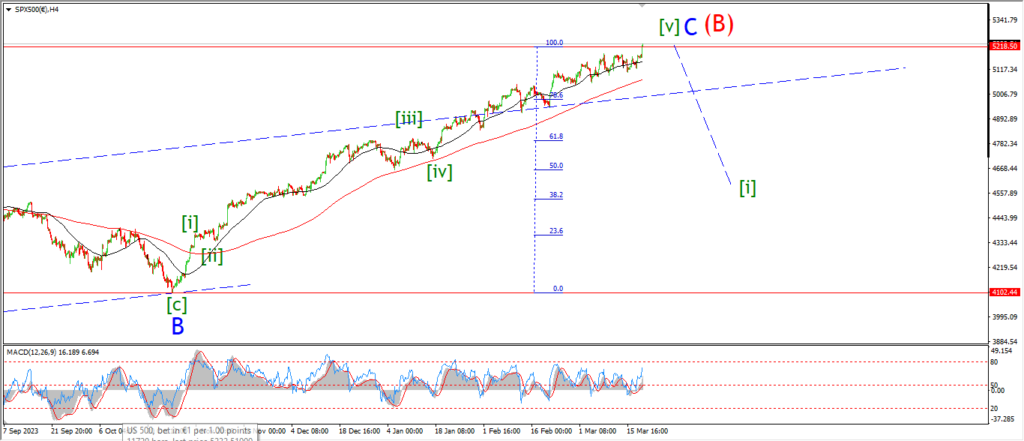

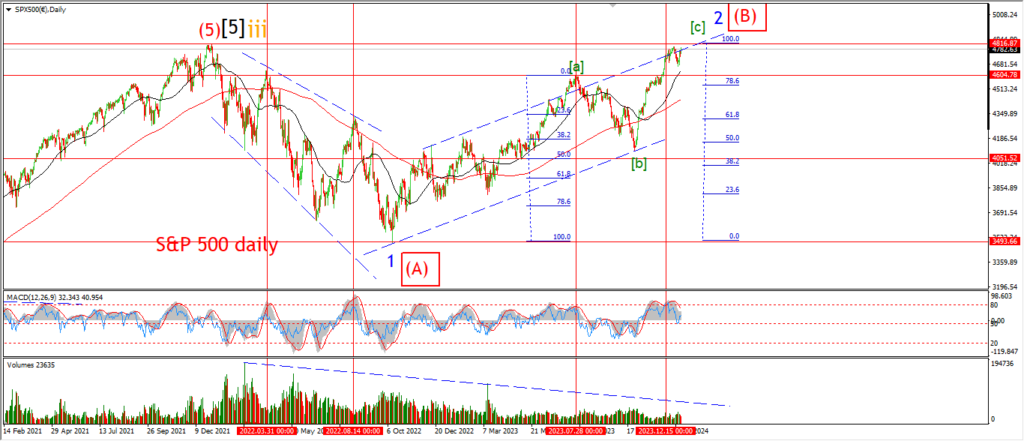

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P did drop earlier today but failed to break the wave ‘i’ low at 5143 yet.

The pattern off the top is still in line with a series of 1,2 waves as shown.

And if we do get a follow through tomorrow into wave ‘iii’ of (iii),

that will give this bearish count a boost for sure.

Its a patience game at the moment until we see a completed five wave decline in wave [i] green.

this will confirm the idea of a top in place,

and then we can begin to build the bigger picture patterns off the top.

Tomorrow;

lets see if wave (iii) down can take the market lower as suggested.

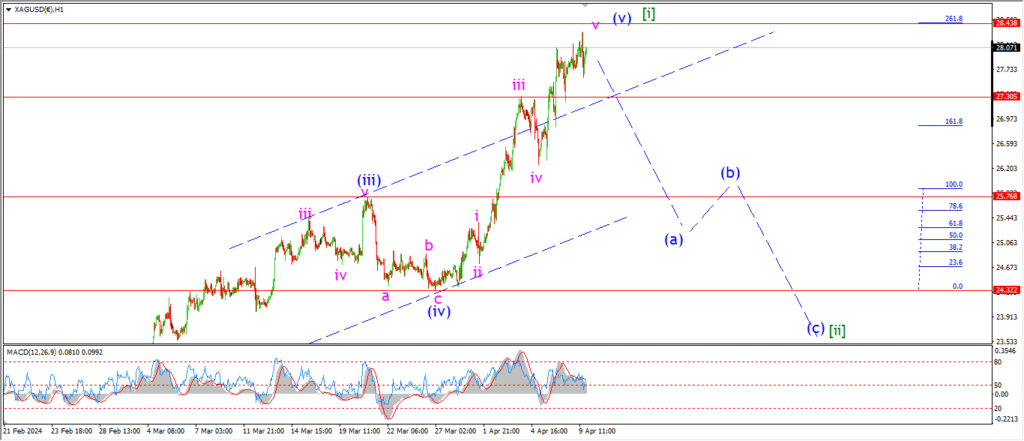

SILVER.

SILVER 1hr

The throw-over pattern in silver is as clear as the nose on my face now!

The action is showing signs of a momentum reversal now as the final subwaves complete in wave (v) blue.

And this comes after a punch above the upper trend channel line.

And just like the gold market,

its time for this rally in wave [i] to take a rest here and begin a correction in wave [ii].

There is no actual move into wave (a) of [ii] yet.

I am looking at that channel as the first indication of wave (a).

A break of 27.30 at the wave ‘iii’ high will come with a break back into the trend channel.

And if that happens I will begin to track wave (a) of [ii].

Tomorrow;

Watch for a break of the wave ‘iii’ high at 27.30 to indicate a turn lower into wave (a) has begun.

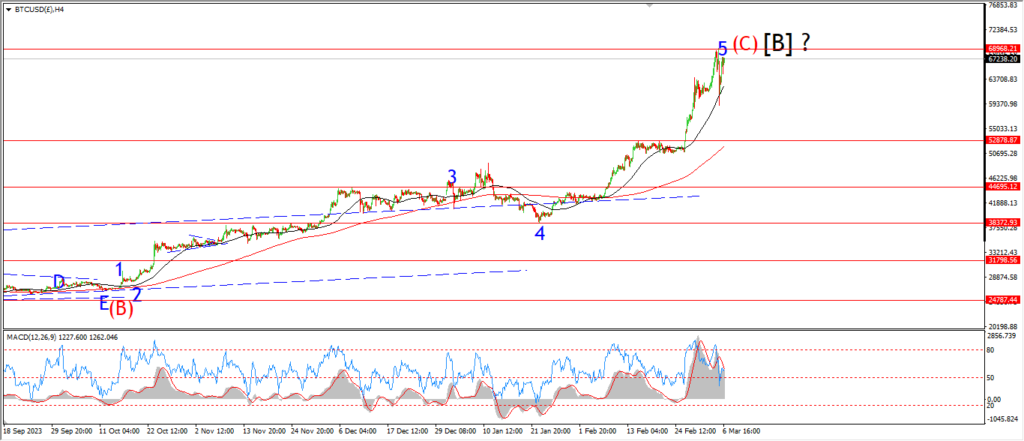

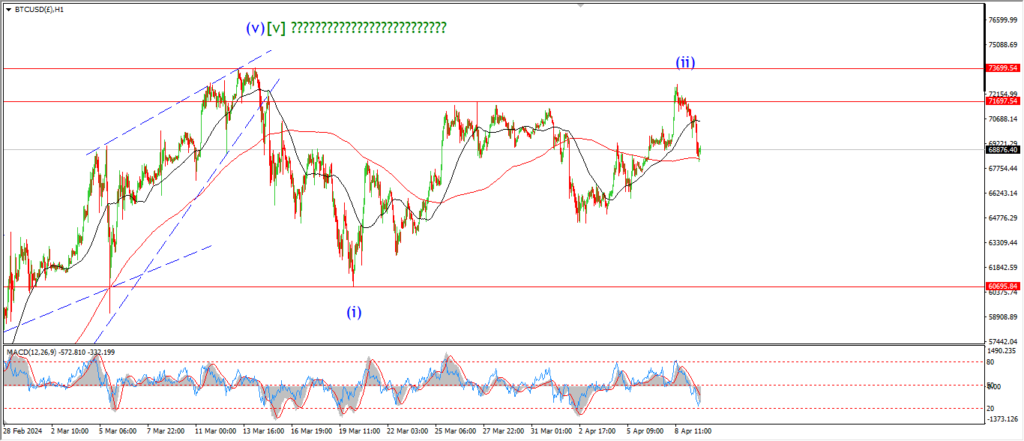

BITCOIN

BITCOIN 1hr.

….

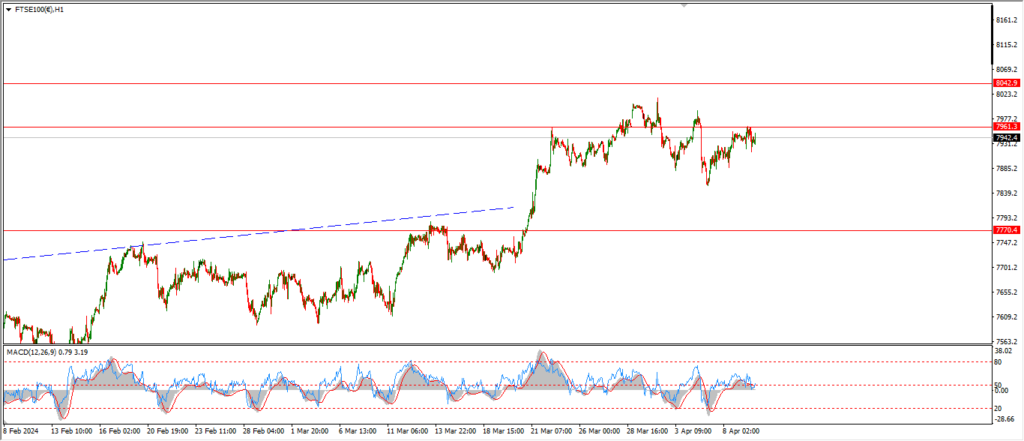

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

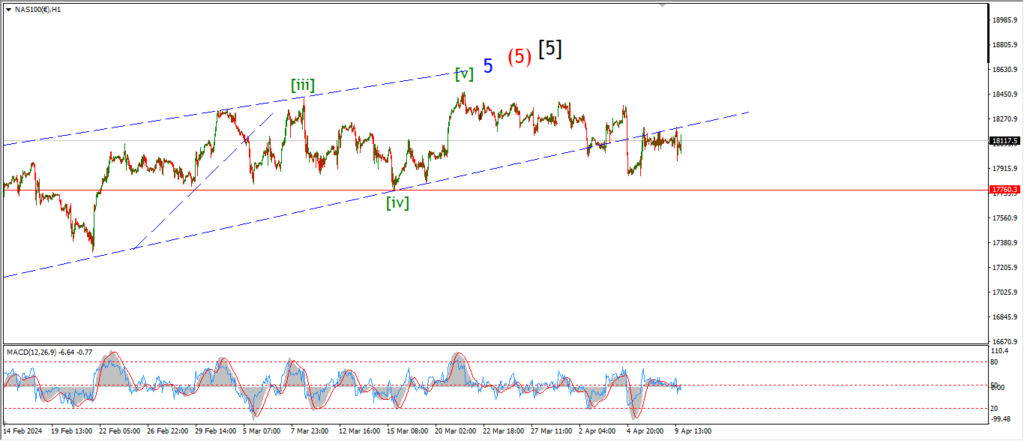

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….