Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

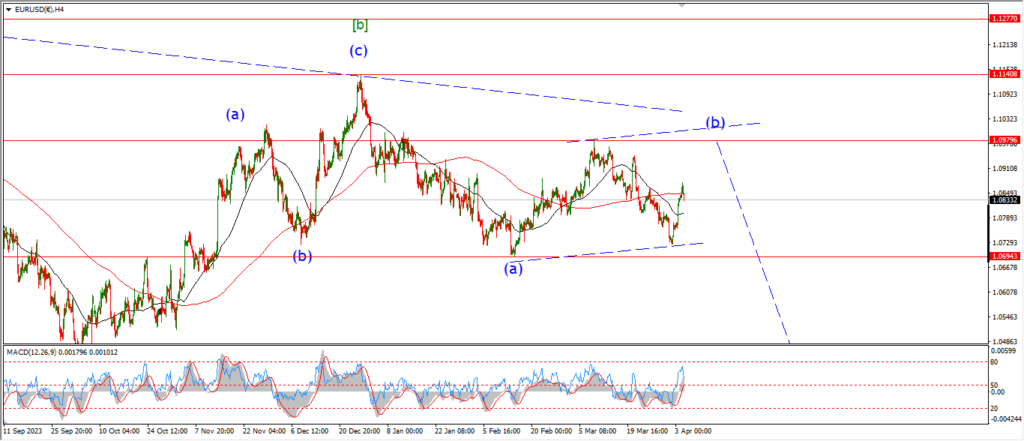

EURUSD.

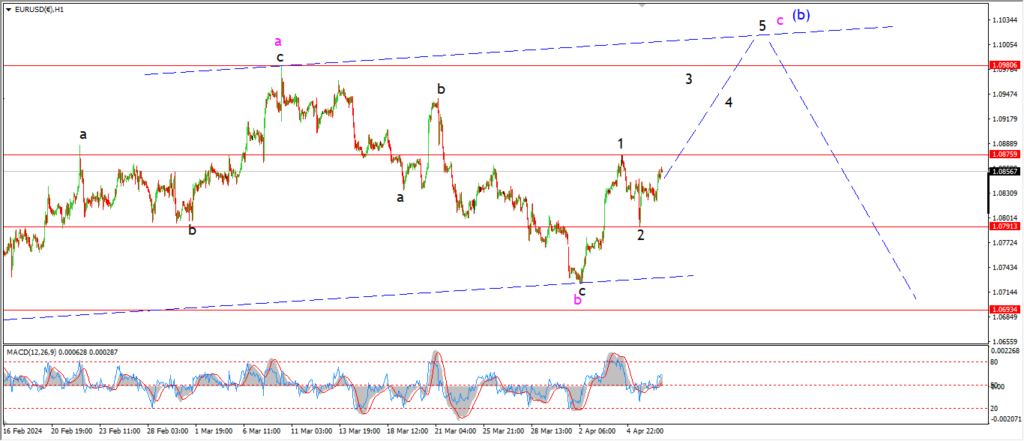

EURUSD 1hr.

EURUSD has drifted higher today without much conviction.

I am taking the view that this move is the beginning of wave ‘3’ of ‘c’ here.

But this requires a quick move back above 1.0876 to confirm.

This week should bring a five wave rally towards the 1.10 handle to complete the larger wave (b) pattern.

And once that happens,

I will look lower again into wave (c) down.

Tomorrow;

Watch for wave ‘3’ of ‘c’ to break above 1.0876 to confirm the pattern for wave ‘c’.

Wave ‘2’ must hold at 1.0791.

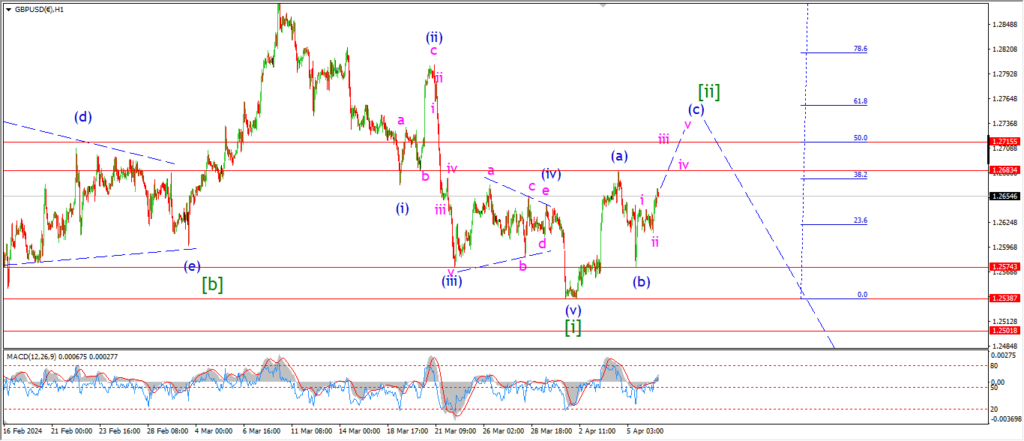

GBPUSD

GBPUSD 1hr.

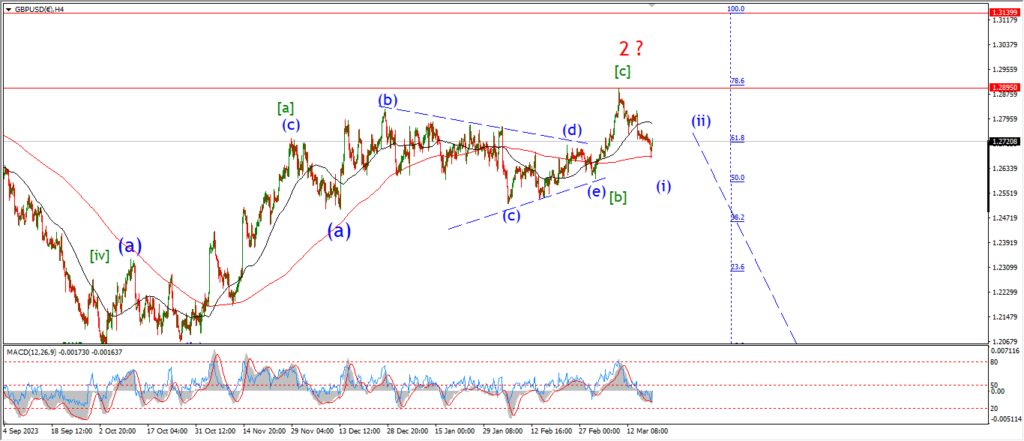

GBPUSD 4hr.

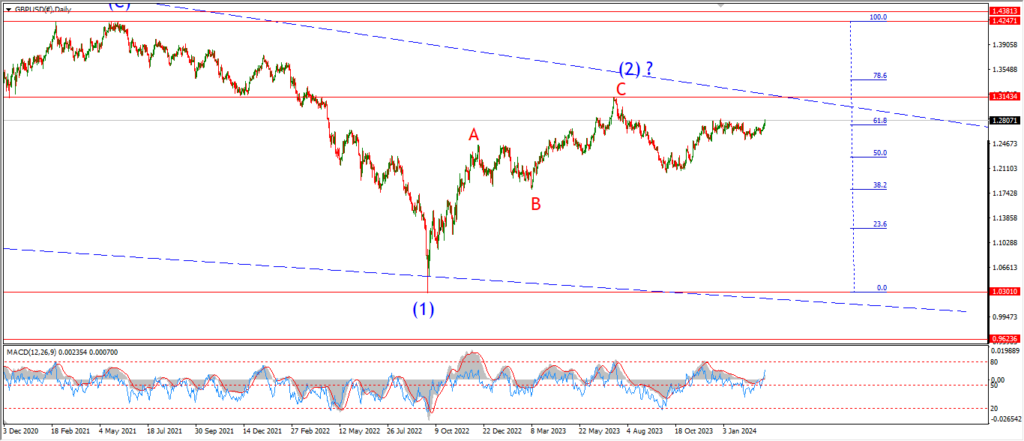

GBPUSD daily.

Cable is also moving higher into wave (c) of [ii] today.

the price has not broken above the wave (a) high yet to confirm this pattern.

A break of 1.2683 will do just that.

And then we can expect a lower high to form later this week in wave [i] as shown.

Tomorrow;

The initial target for wave (c) of [ii] lies at 1.2715 at the 50% retracement level of wave [i].

Watch for wave (c) to continue higher in five waves to hit that target over the next few days.

USDJPY.

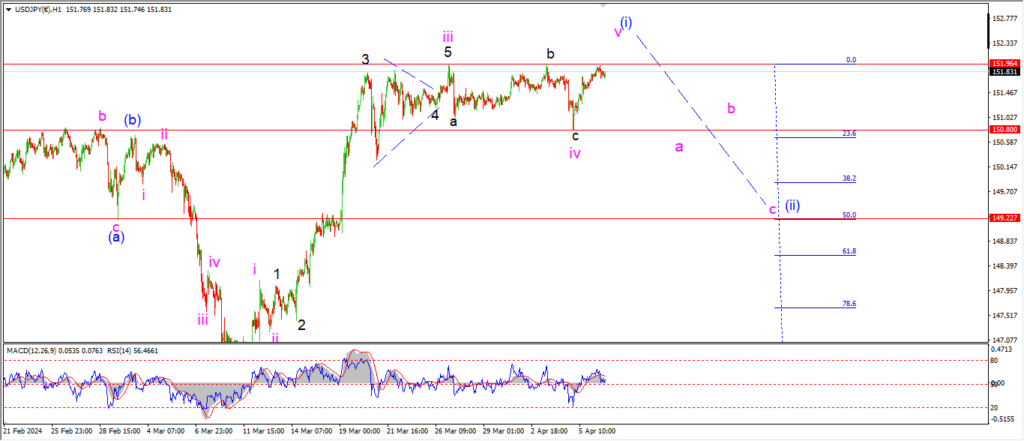

USDJPY 1hr.

The turn down into wave (ii) has been postponed by todays action it seems.

The price has created a double top at 151.96.

This action suggests wave (i) is still underway here,

and wave (ii) will come later this week.

The sideways action over the last week has been hard to pin down,

but I am suggesting a triangle in wave ‘iii’ followed by an expanded flat in wave ‘iv’.

Todays rally akes the wave ‘v’ of (i) label.

And again we are pretty close to closing out the larger wave (i) pattern now.

Tomorrow;

Watch for wave ‘v’ of (i) to complete the rally with a break back above 152.00 again.

Once the price breaks below the wave ‘iv’ low at 150.80 again that will confirm wave (ii) has begun.

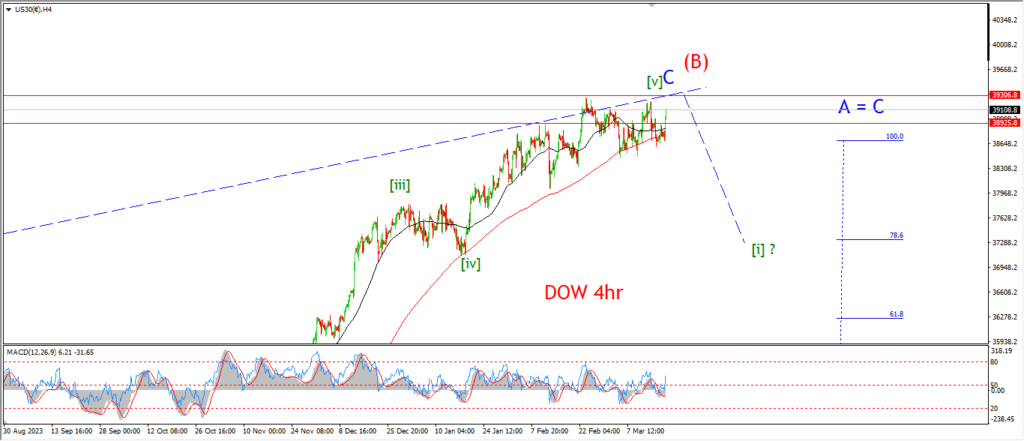

DOW JONES.

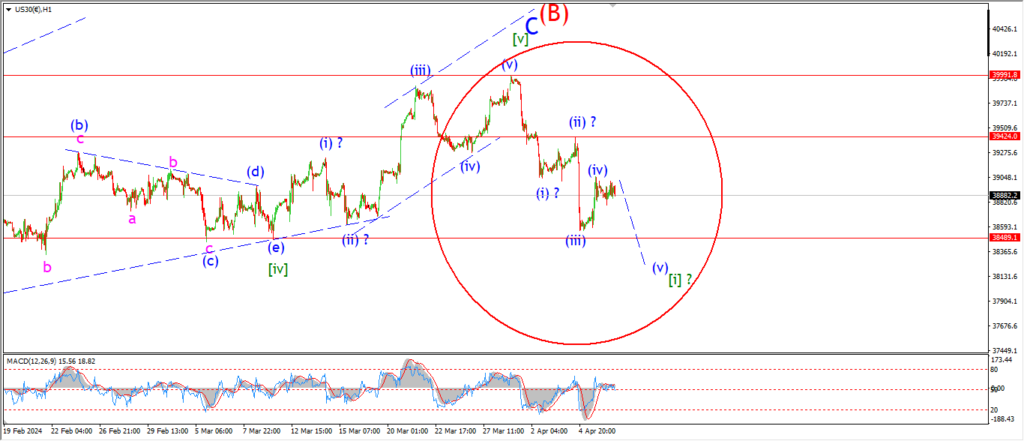

DOW 1hr.

DOW 4hr

DOW daily.

There is not much to say about todays action as we are basically flat off Fridays highs.

The leading wedge idea off the top is still in play,

but no confirmation of that yet.

A leading wedge is similar to an ending diagonal in the fact that an overlap happens between waves (i) and (iv).

But the internal pattern has the standard 5,3,5,3,5 format.

I have shown a different possibility for the S&P wave count.

This pattern could be used here also,

but the market is so close to breaking support at the wave [iv] low that I want to see if a clean five wave decline can break that support.

A leading wedge fit the bill in this market.

So we will find out tomorrow if that can happen.

Tomorrow;

Watch for wave (v) down to fall and break the lows at 38490.

If that happens we can look for a low in wave [i] pretty soon.

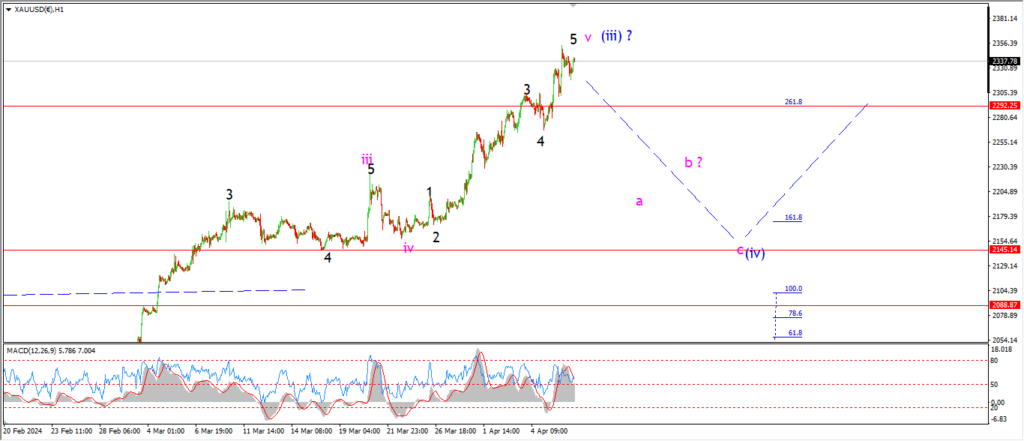

GOLD

GOLD 1hr.

The gold price is holding near the highs again this evening,

and I can only suggest that wave ‘v’ of (iii) is still underway here.

This week should bring a reversal into wave (iv) in three waves.

Wave (iii) is already over-extended in terms of pattern.

The price has hit the 262% extension of wave (i) now.

It is high time for a correction.

And I am looking at the shoulder of support at 2145 as the target for the next correction.

Tomorrow;

Watch for wave ‘v’ of (iii) to top out and reverse to begin wave ‘a’ of (iv).

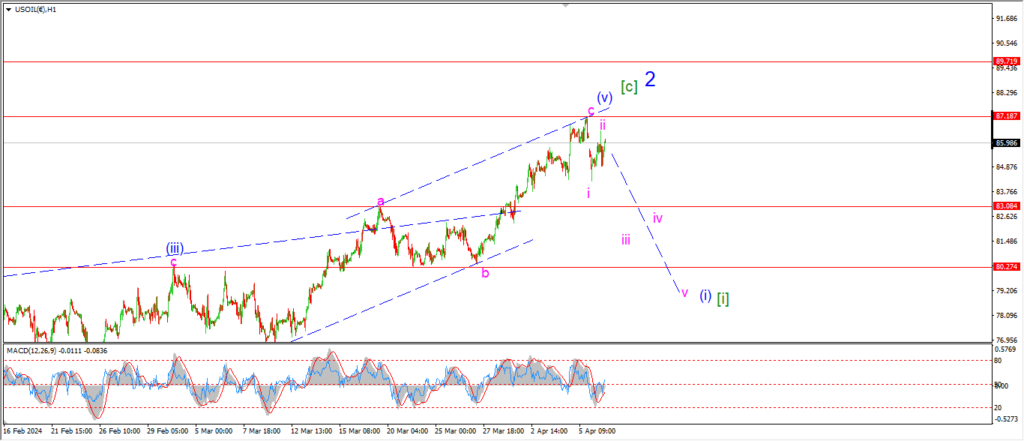

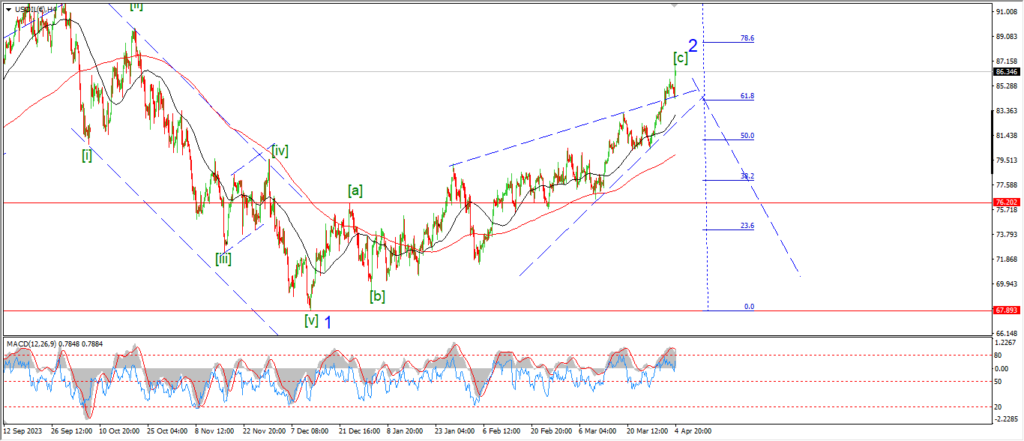

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude oil hit the upper channel line in wave ‘c’ of (v) on Friday.

the market begin today with a sharp drop back and a lower high is forming now as I write.

I have labelled this action as wave ‘i’ and ‘ii’ to begin the larger turndown into wave (i).

It is a little early to get over excited about the possibilities here.

But if tomorrow does bring a break of the 83.00 level again that will definitely fit the reversal idea here.

Tomorrow;

Watch for that high at wave ‘c’ of (v) to hold at 87.18.

Wave ‘iii’ of (i) should fall back below 83.00 again.

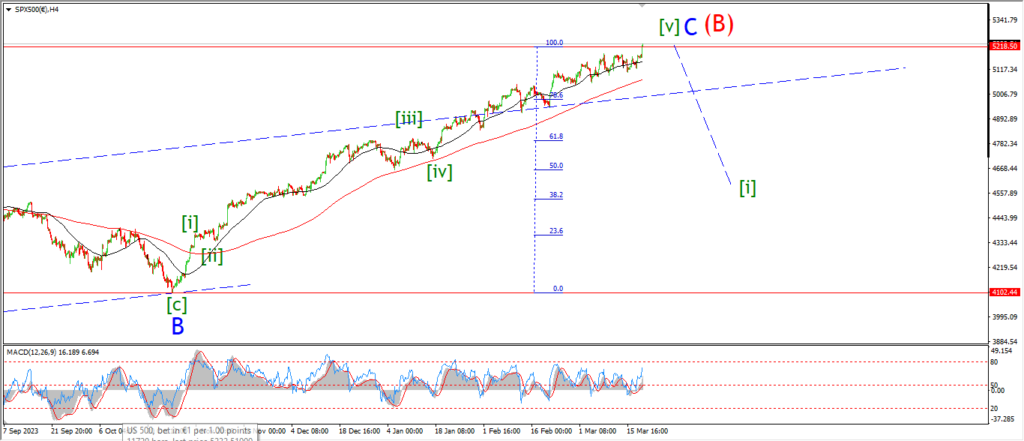

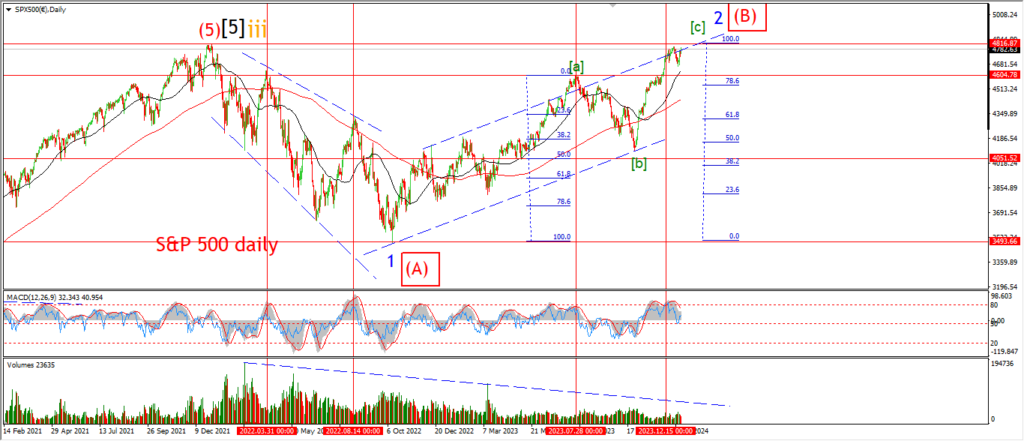

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The pattern off the top has only managed three waves down so far and that is obviously not what I want to see here.

I am going to give this reversal idea another day to see if a follow through decline can happen.

And I have switched to a new pattern off the top to allow for that to happen.

A series of impulsive waves lower does fit the reversal pattern so it is worth giving this time to play out.

If this recent decline turns out to be corrective,

then most likely we are looking at a correction within wave (v) again.

And the top will be be postponed for another week or so.

Monday;

Watch for wave (ii) to hold and wave (iii) down to develop a five wave pattern as shown.

A confirmation of this bearish pattern will come with a break of the support at wave (iv) at 5055.

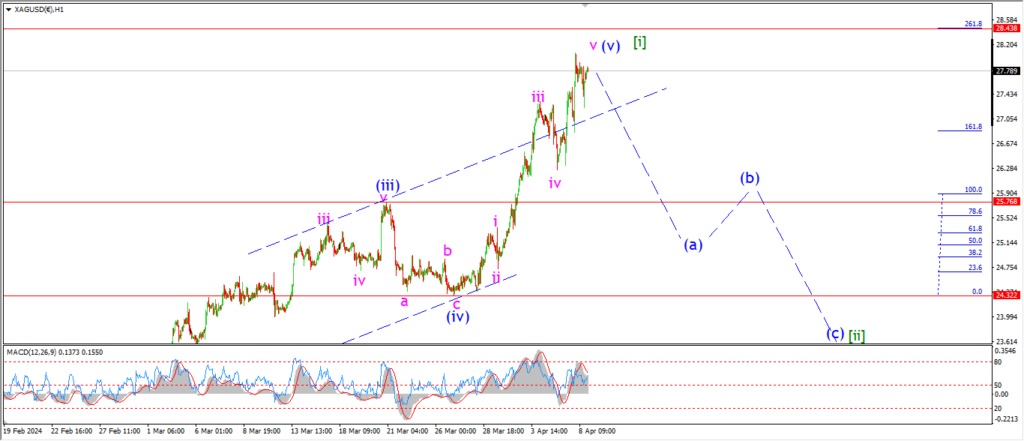

SILVER.

SILVER 1hr

Silver is holding just off the highs tonight,

and so far this can be viewed as wave (v) complete.

There is no specific action yet to call wave (a) in play here.

The price has reached close to the 262% Fibonacci extension of wave (i) now so we are definitely in the ballpark for a top.

So I am waiting for the initial move into wave (a) to break the 27.00 handle again.

Tomorrow;

Watch for a break of 27.00 to signal wave (a) is underway.

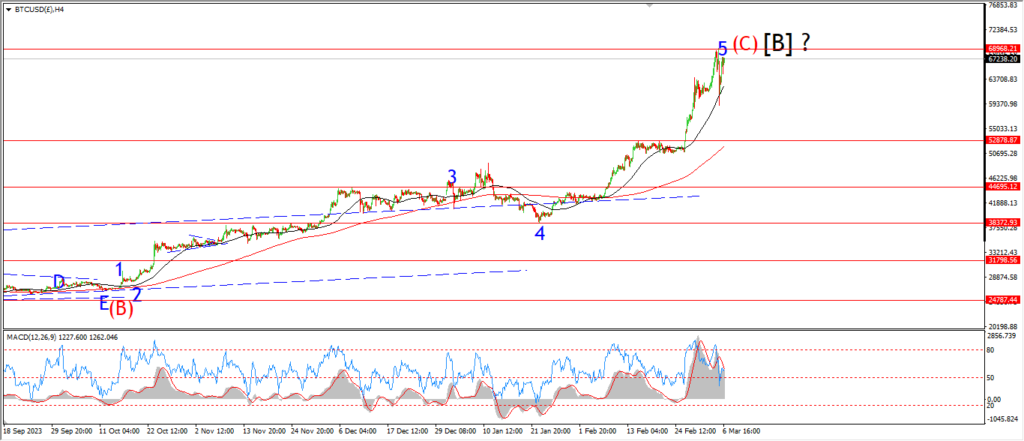

BITCOIN

BITCOIN 1hr.

….

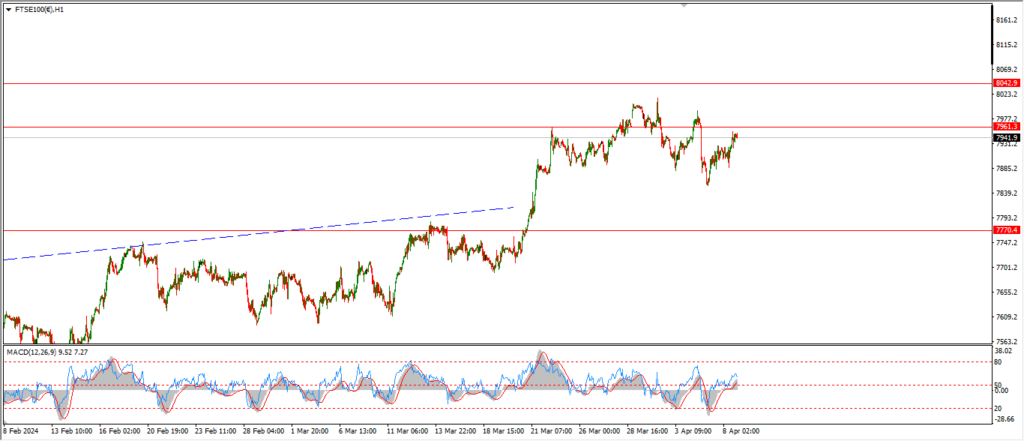

FTSE 100.

FTSE 100 1hr.

….

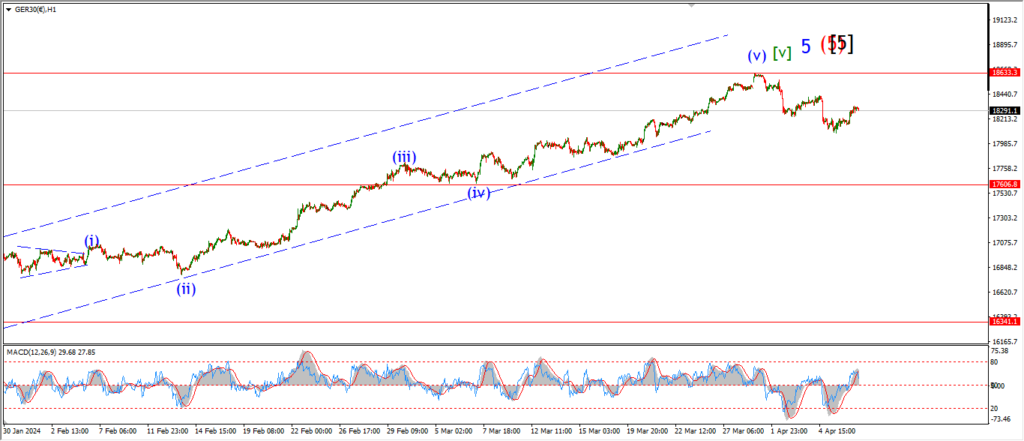

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

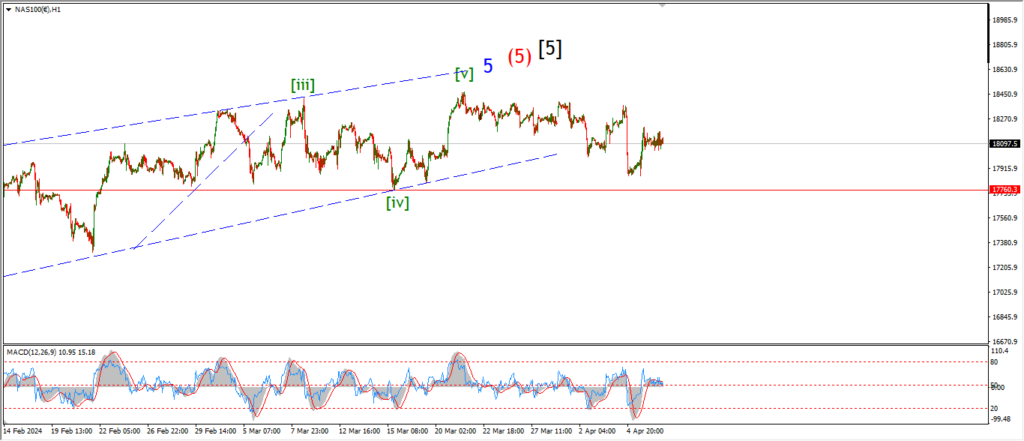

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….