Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

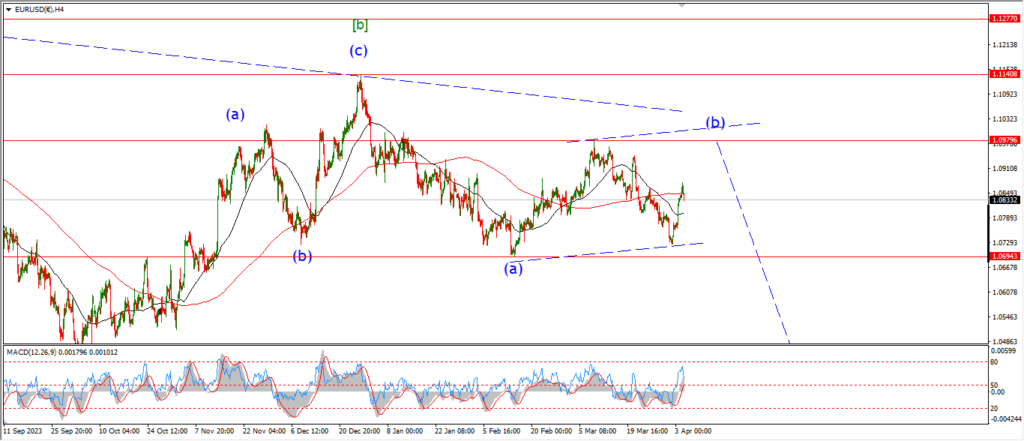

EURUSD.

EURUSD 1hr.

The decline today is a little too steep to be called a fourth wave within wave ‘c’.

The rally off the wave ‘b’ low is now labelled as waves ‘1’ and ‘2’ to begin a five wave rally in wave ‘c’.

Wave ‘2’ has traced out three waves down so qualifies as a correction.

And the price rallied back out of the session low with some momentum.

Wave ‘3’ of ‘c’ should now be underway and I am suggesting wave ‘3’ should top out around 1.0950 early next week.

The larger three wave pattern in wave (b) is solid I think.

So we should see a top in wave (b) and a reversal into wave (c) next week.

Monday;

Watch for wave ‘c’ to continue higher in five waves with a target above 1.0980 at the wave ‘a’ high.

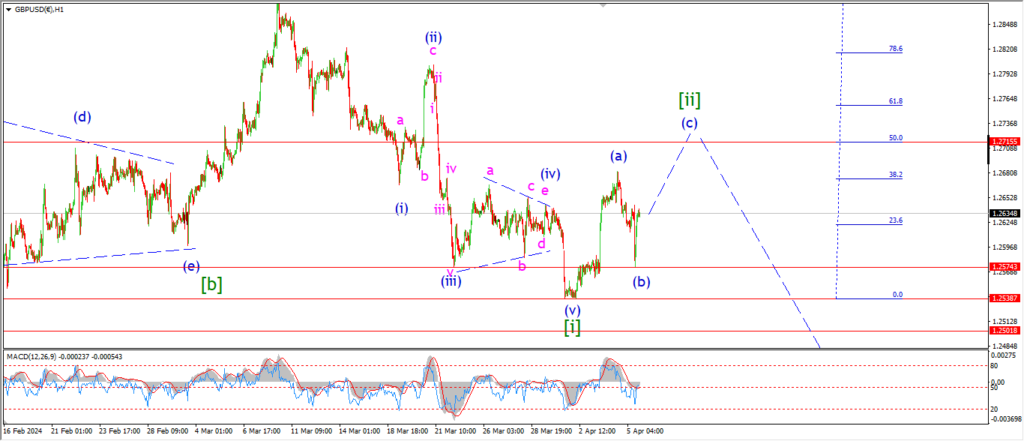

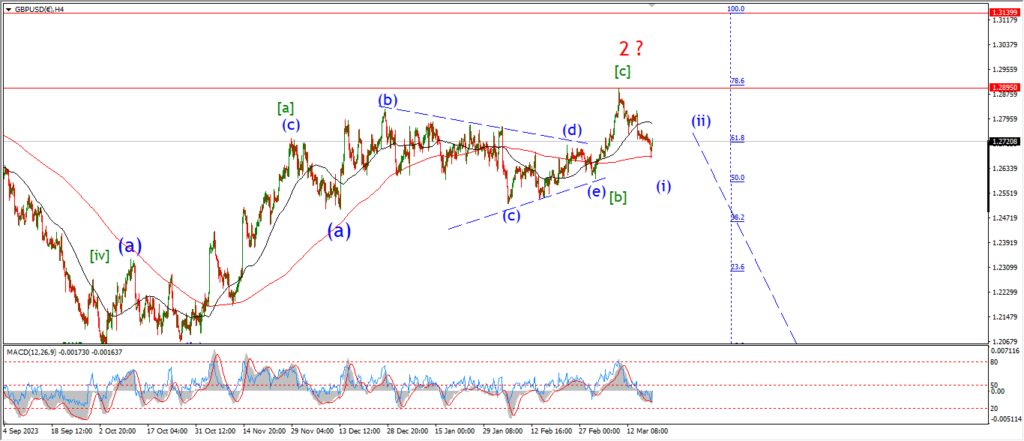

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

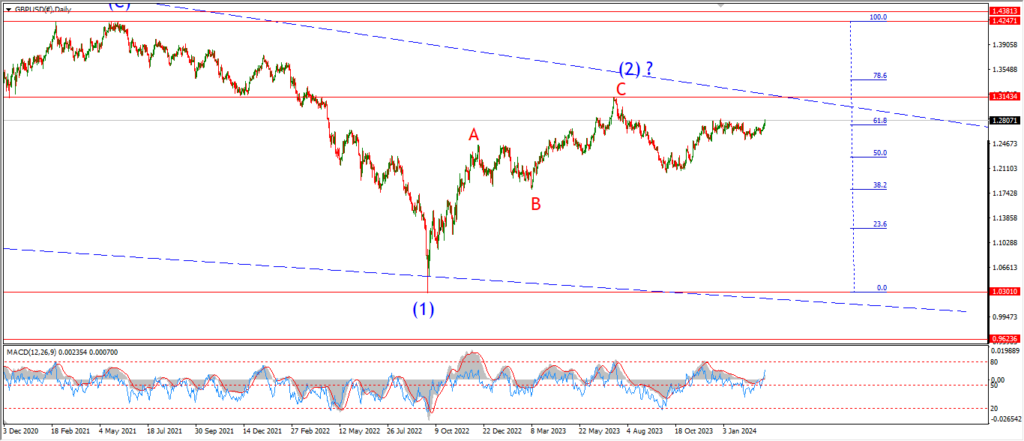

GBPUSD daily.

Wave (a) of [ii] traced out a five wave rally this week,

and now the price has dropped off today to form a higher low in wave (b).

that spike rally off the lows is the beginning of wave (c) and we should see this rally continue to the target level at 1.2715 next week.

Monday;

Watch for wave (c) of [ii] to continue higher in five waves to top out near 1.2715.

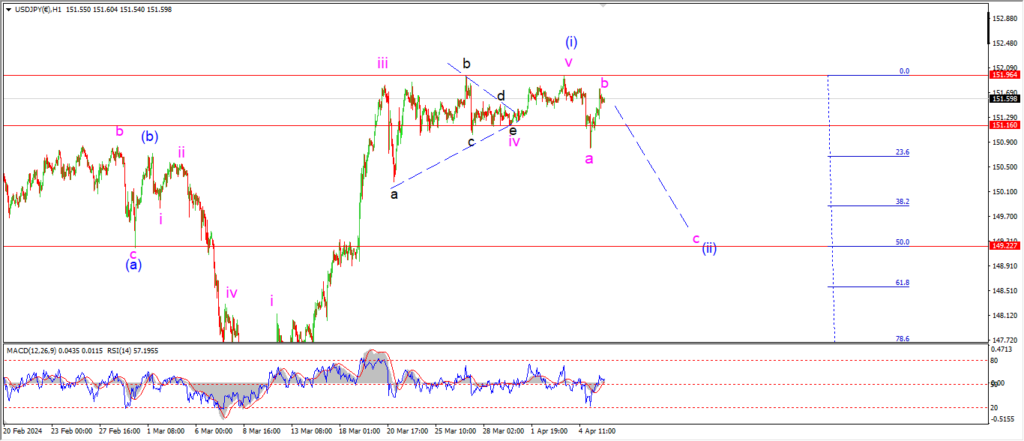

USDJPY.

USDJPY 1hr.

Expecting a larger decline in USDJPY is not paying off this week.

the market has remained flat for 2 weeks now,

and while that does favor the bullish outlook in general,

it does not favor a larger wave (ii) decline just yet.

I cant see a better option for the price action just yet,

so I am going to stick with the wave (ii) decline as shown until this is proven wrong by a further rally.

We do have a lower high in place today,

so that takes the wave ‘b’ label.

Wave ‘c’ should turn lower again on Monday to confirm this pattern.

We will see how it goes.

Monday;

Watch for wave (i) to hold at 151.96.

Wave ‘c’ must turn lower again to confirm this pattern.

And the initial target area for wave (c) lies at the 50% retracement level at 149.22.

DOW JONES.

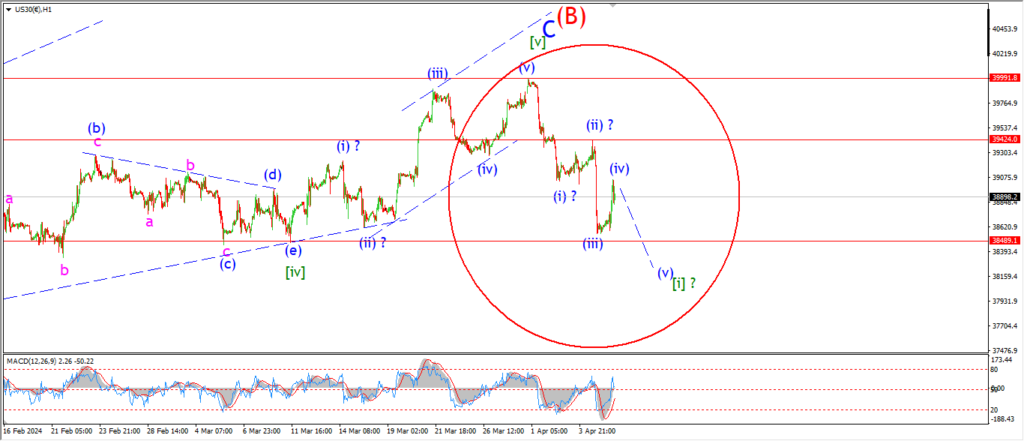

DOW 1hr.

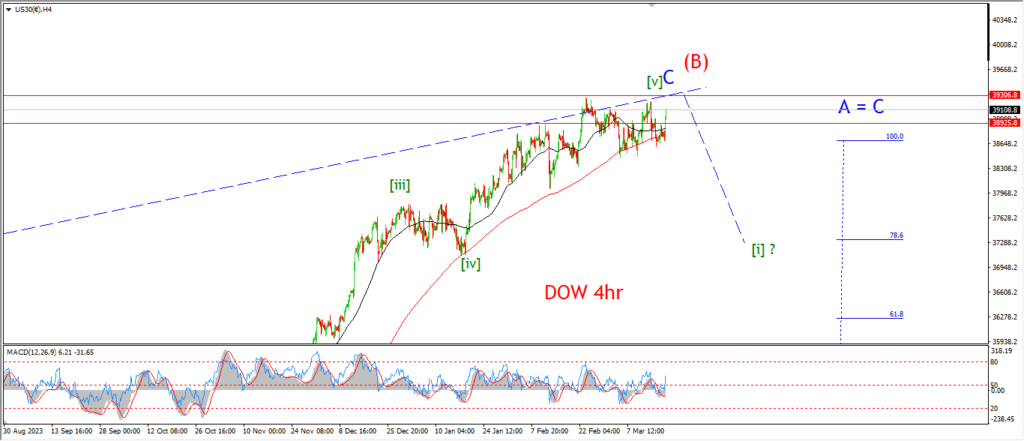

DOW 4hr

DOW daily.

The DOW has only managed to trace out three waves down into the lows last night.

And the price did not break the wave [iv] support at 38490 yet either.

While I am showing a possible leading wedge pattern off the top here.

I can’t confirm this idea at all.

A leading wedge will trace out five waves down and break support at wave [iv] with ease.

the high this evening is labelled wave (iv) blue,

with wave (v) down now expected to fall back below support.

The rebound today has thrown confusion on the simplest of patterns off the top so I al forced to wait for the next move to either confirm or deny the short term count.

Monday;

Watch for wave (v) of [i] to complete a five wave decline as shown.

GOLD

GOLD 1hr.

Gold extended higher today to rule out last nights count.

The top of wave ‘v’ of (iii) should come in soon,

but wave (iii) has control of the action for the moment.

The action suggests wave ‘3’ of ‘v’ has extended the pattern,

the correction yesterday was only wave ‘4’ of ‘v’,

and now we have wave ‘5’ of ‘v’ in play here.

The rally in wave (iii) has now hit the 261% extension of wave (i) blue.

So next week will bring a corrective decline in this scenario.

Monday;

Watch for wave ‘5’ of ‘v’ of (iii) to top out and we should see the beginning of wave ‘a’ of (iv) by the middle of next week.

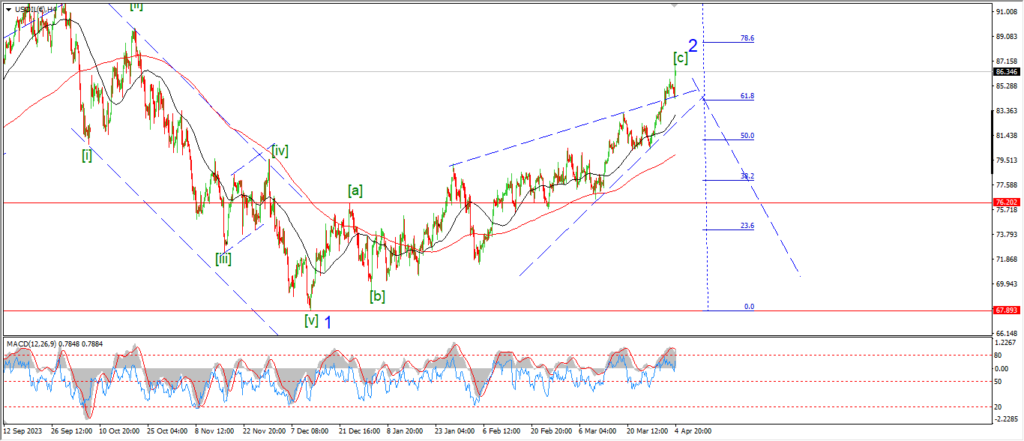

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude oil pushed higher and tagged that upper trend line again today and reversed again this evening.

This is not a signal of an immediate collapse into wave [i] of ‘3’.

But it is a signal that three waves up in wave (v) is coming to a end here.

The price has completed a nice three wave pattern into this weeks high in wave (v).

And while this rally has gone farther than expected in wave (v),

that does not negate the usefulness of the overall pattern in wave ‘2’.

So,

its a case of “don’t throw out the baby with the bath water”

Monday;

There is very little to add to the pattern here until we see some downside action that can confirm the major pattern.

I think that will happen with a break of the 80.00 level again.

And that is where I am looking for next week.

Tomorrow;

Wave [i] down should begin next week and the trigger level is that 80.00 handle again.

Lets see if the trend channel holds that three wave pattern to the upside in wave (v).

A break of 83.00 at wave ‘a’ will be a good first signal that the turn is in.

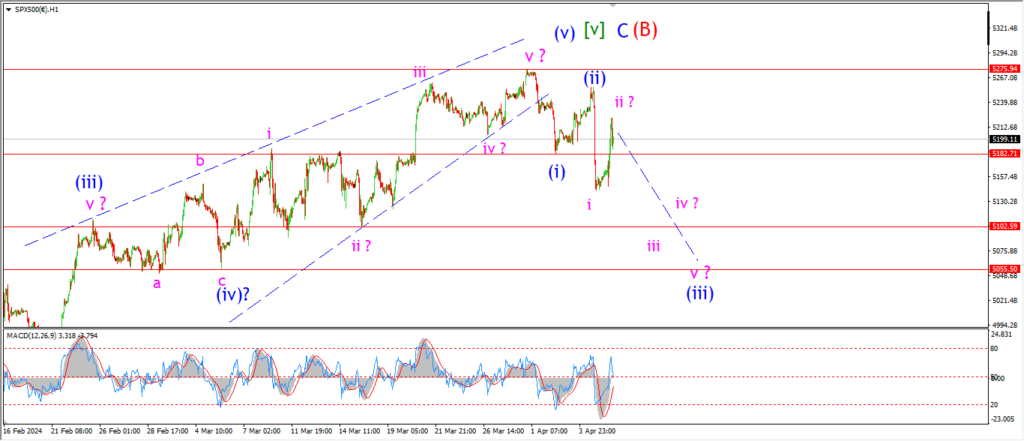

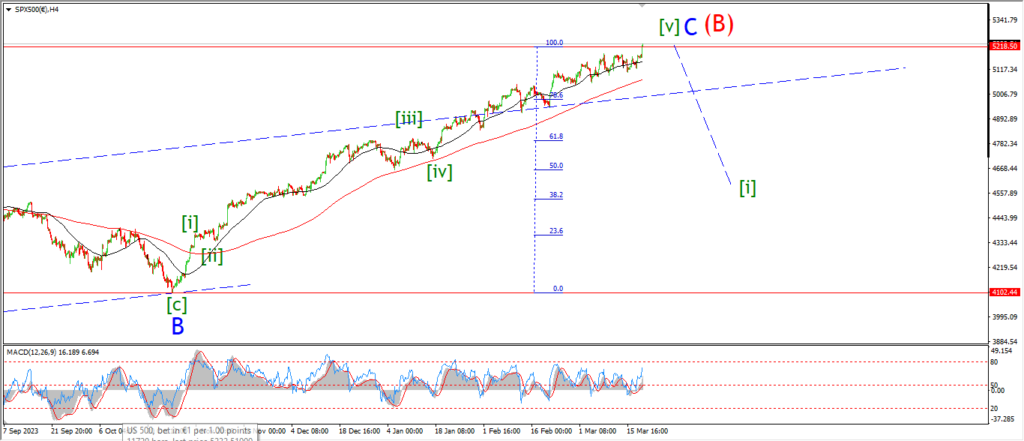

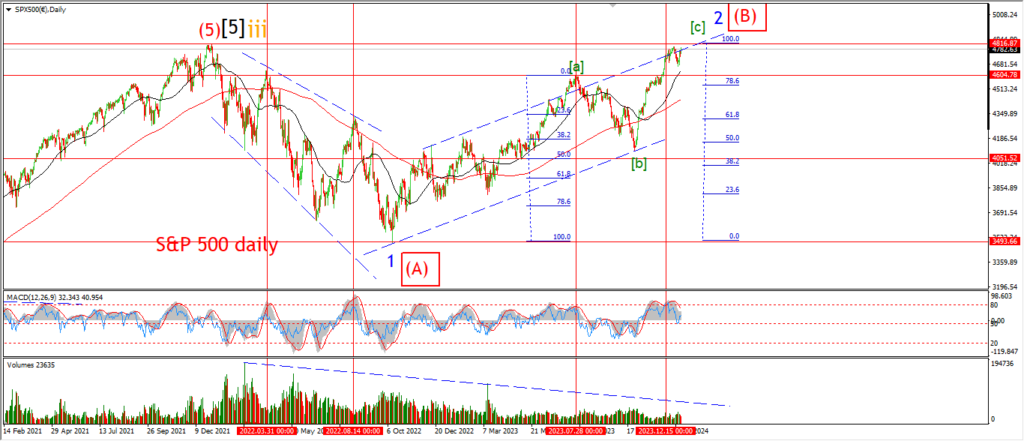

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The pattern off the top has only managed three waves down so far and that is obviously not what I want to see here.

I am going to give this reversal idea another day to see if a follow through decline can happen.

And I have switched to a new pattern off the top to allow for that to happen.

A series of impulsive waves lower does fit the reversal pattern so it is worth giving this time to play out.

If this recent decline turns out to be corrective,

then most likely we are looking at a correction within wave (v) again.

And the top will be be postponed for another week or so.

Monday;

WAtch fro wave (ii) to hold and wave (iii) down to develop a five wave pattern as shown.

A confirmation of this bearish pattern will come with a break of the support at wave (iv) at 5055.

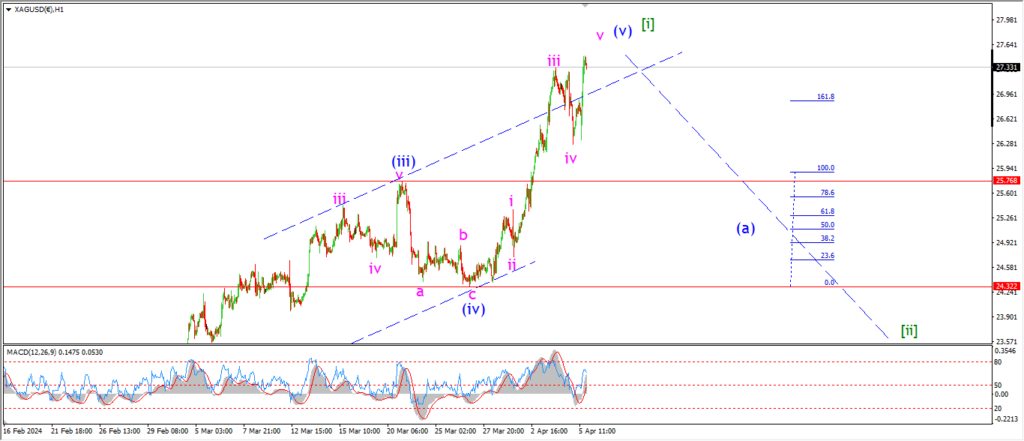

SILVER.

SILVER 1hr

Silver pushed higher today and now seems to be close to topping out wave ‘v’ of (v) again.

The price has broken above the upper trend channel line again today.

And we are looking at a throw over top in wave ‘v’ of (v) of [i] now.

This rally in wave (v) blue has come too far too fast I think.

So a correction into wave [ii] will clear out some over optimism and bring the market back into balance again.

This will allow for the larger rally into wave [iii] to take hold later in the month.

Monday;

Watch for wave ‘v’ of (v) to top out and then drop back below 26.00 again to signal a start to wave (a) of [ii].

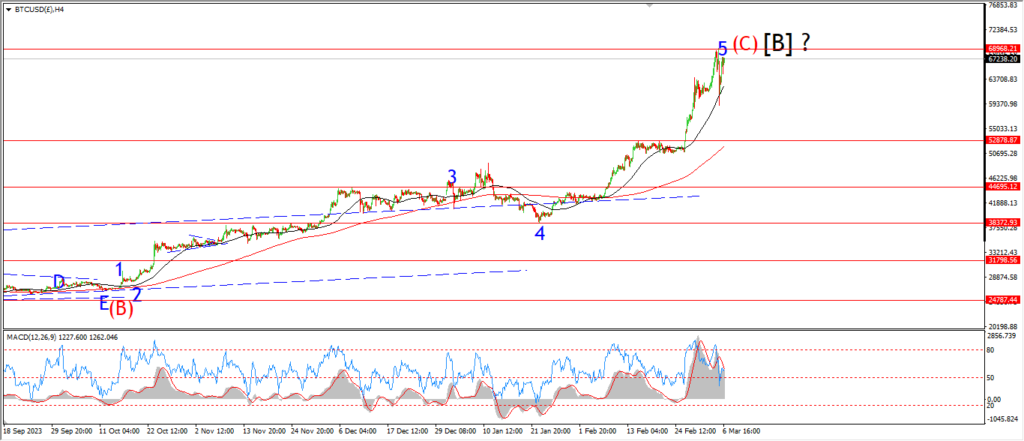

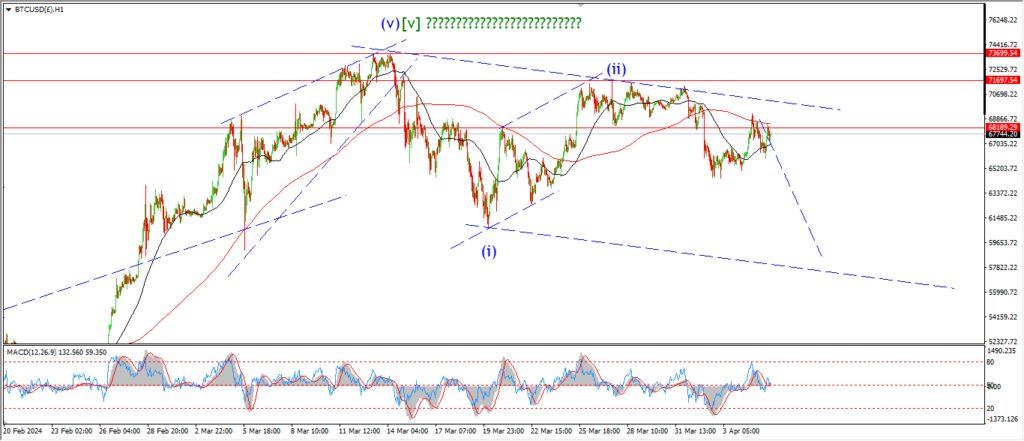

BITCOIN

BITCOIN 1hr.

….

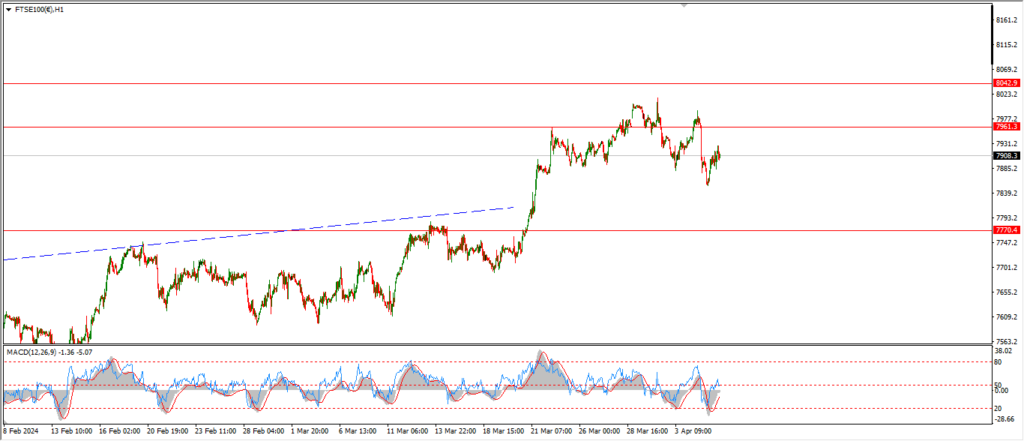

FTSE 100.

FTSE 100 1hr.

….

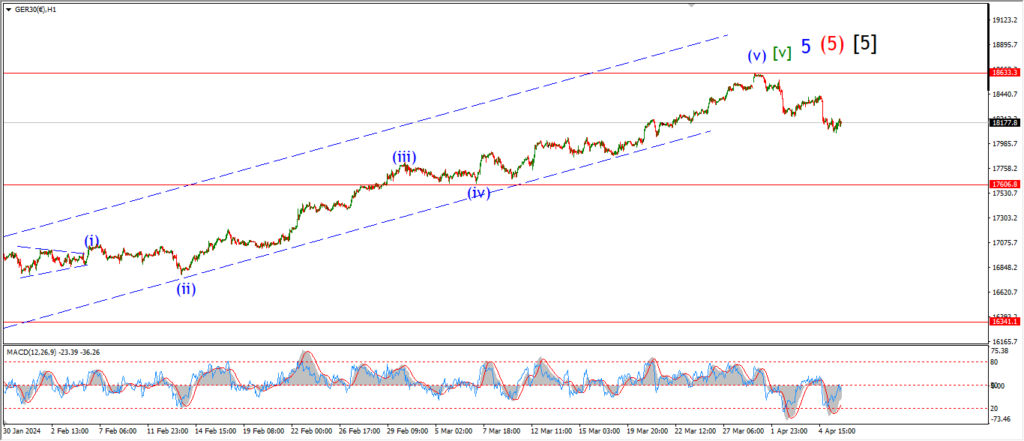

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….