Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

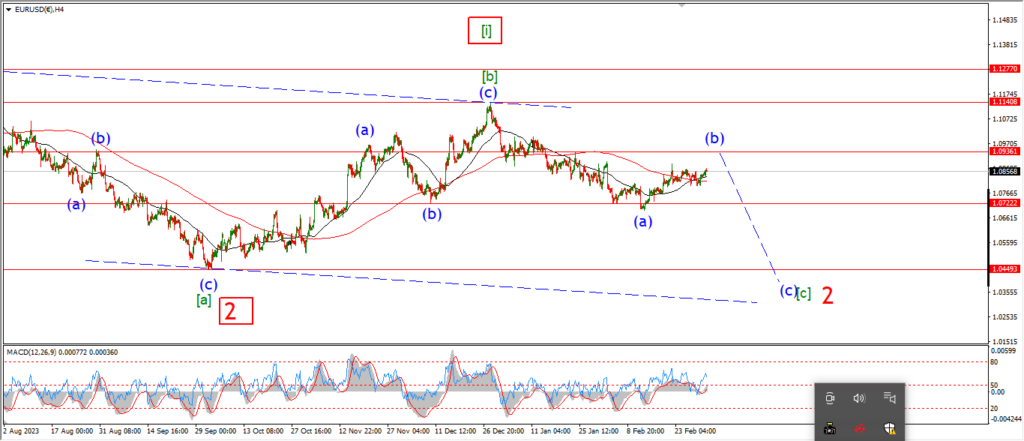

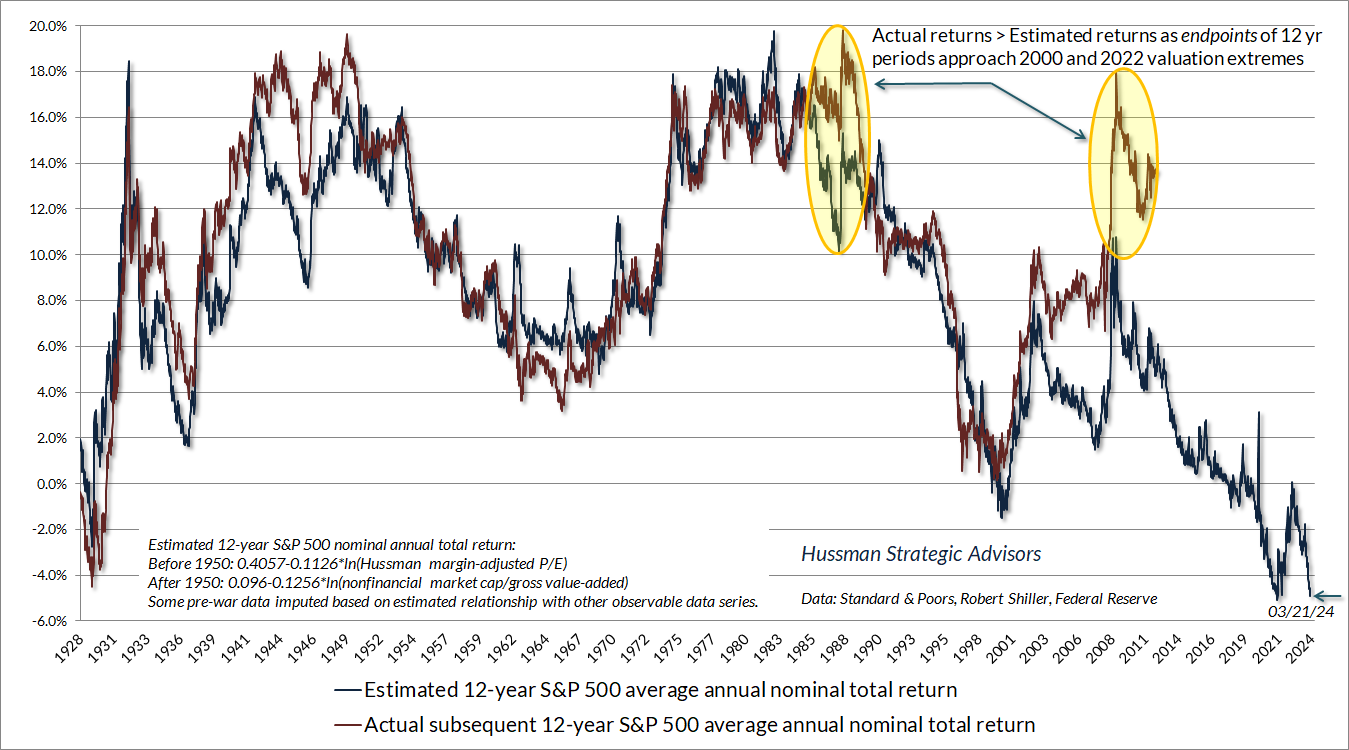

EURUSD.

EURUSD 1hr.

EURUSD has corrected higher today and so far the price refuses to break the wave ‘b’ low at 1.0795.

I do want to see a break of that level very soon in order to confirm the main pattern here.

Wave ‘iii’ down needs to extend lower towards the wave (a) low at 1.0693.

That level is the minimum target for wave (c),

but I want to see even more downside in wave (c) to be honest.

I have labelled todays action as a correction higher in wave ‘2’ of ‘iii’,

wave ‘3’ of ‘iii’ must turn lower tomorrow to get this pattern back on track.

Tomorrow;

Watch for wave ‘iii’ down to turn lower and progress the pattern.

I want wave ‘iii’ to drop into support at 1.0693.

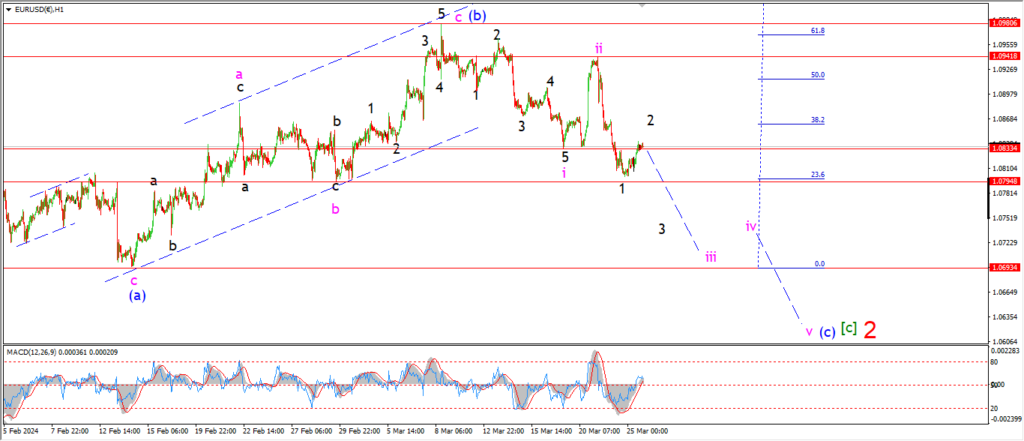

GBPUSD

GBPUSD 1hr.

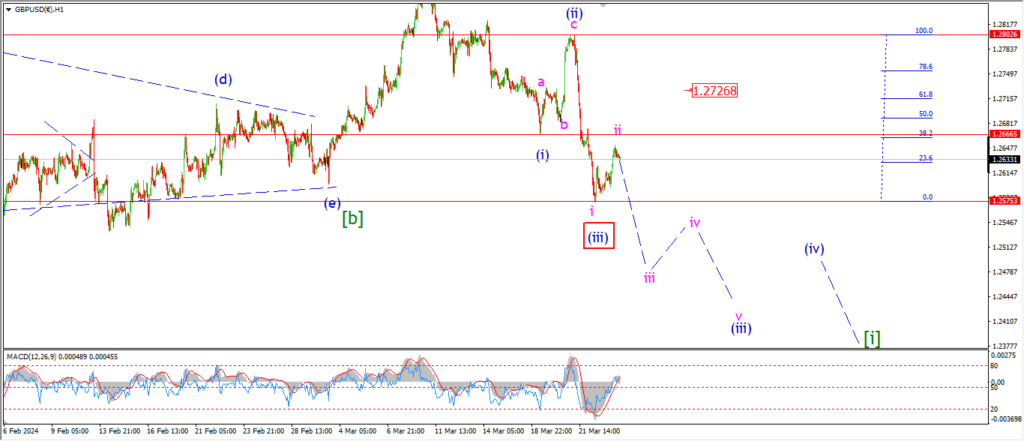

GBPUSD 4hr.

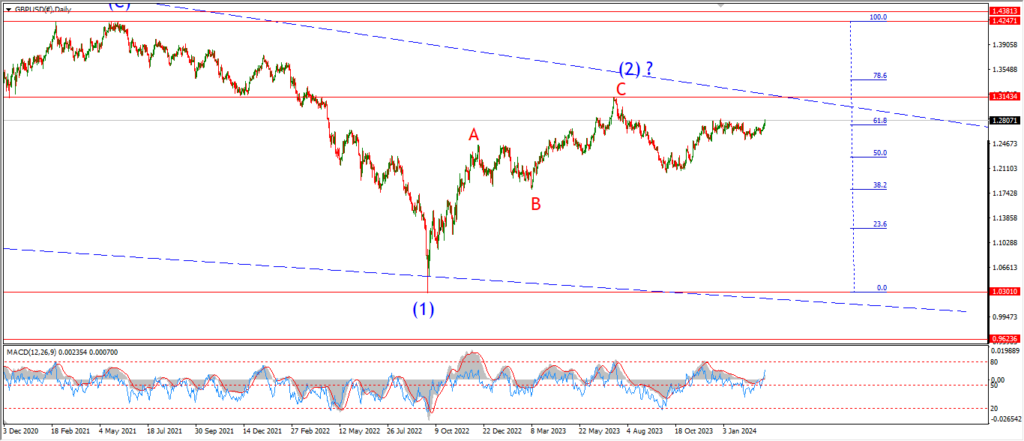

GBPUSD daily.

I am making a note first tonight.

The low registered last week actually hit equality in length with wave (i) at 1.2575.

So the alternate count shows wave (iii) of [i] now complete at that low.

In that scenario wave (iv) is already underway.

The wave (iv) high must complete below wave (i) at 1.2666.

That is a very tight margin for error which actually favors the main count.

Tomorrow;

I will stick with the main count until proved wrong here.

wave (iii) of [i] must continue lower in five waves this week as shown.

Watch for wave ‘ii’ to complete and reverse lower into wave ‘iii’ of (iii).

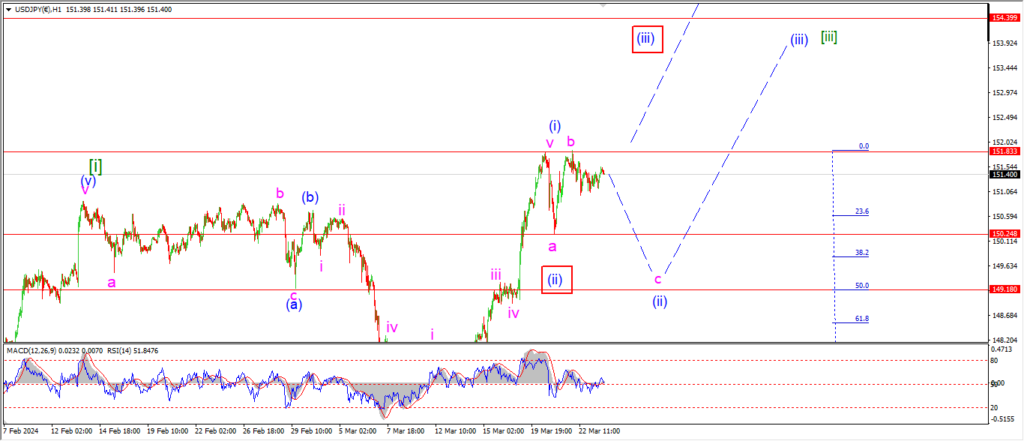

USDJPY.

USDJPY 1hr.

The price has basically done nothing today and that does not fit well with the main wave count for wave ‘c’ of (ii).

I want to see wave ‘c’ of (ii) turn lower in five wave a from here.

The ideal target area lies at the 50% retracement level of wave (i) at 149.18.

But the minimum target level for wave ‘c’ lies at the wave ‘a’ low at 150.24.

And that should happen tomorrow.

If the price breaks higher tomorrow that will trigger the alternate count for wave (iii).

Tomorrow;

Watch for the wave (i) high to hold at 151.83.

A break of that level will trigger the alternate count.

Wave ‘c’ must continue lower to break 150.25 at a minimum.

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

I realize that I am being very ambiguous with the short term count here.

I am not doing this to be annoying,

but rather to show all the options from the outset.

It is very possible that wave [v] of ‘C’ is complete at last weeks highs.

And along with that,

it is very possible that last weeks high is only wave (i) of [v]!

The price action today does not favor either to be honest.

If the current action is only wave (ii) of [v],

then the market will complete a correction above the wave [iv] low,

and wave (iii)of [v] will carry on higher again later this week.

In the case of the alternate wave [v],

it is all downhill from here.

The decline off the recent high does have a reasonable impulsive ‘look’ to it

and that keeps the top idea alive here.

The key level as always is the previous wave [iv] low at 38613.

If that level breaks then the action will favor the topping idea for wave [v] of ‘C’.

Tomorrow;

Watch that wave [iv] low to see if we break through it to favor the alternate count.

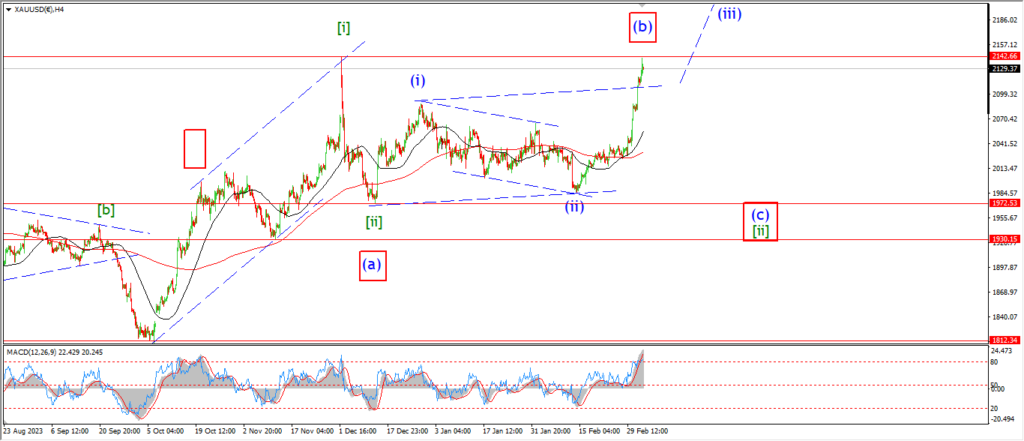

GOLD

GOLD 1hr.

I am thinking about a triangle correction for wave ‘b’ after the price action remains range bound again today.

Todays high is labelled wave ‘c’ of ‘b’ in this scenario,

and wave ‘c’ of (iv) will turn lower once the triangle completes.

The overall target for wave (iv) remains similar in the area of 2130.

Tomorrow;

Watch for a triangle to complete soon with wave ‘e’ of ‘b’ to close out near 2175.

The wave ‘c’ high at 2181 must hold for this pattern to remain valid.

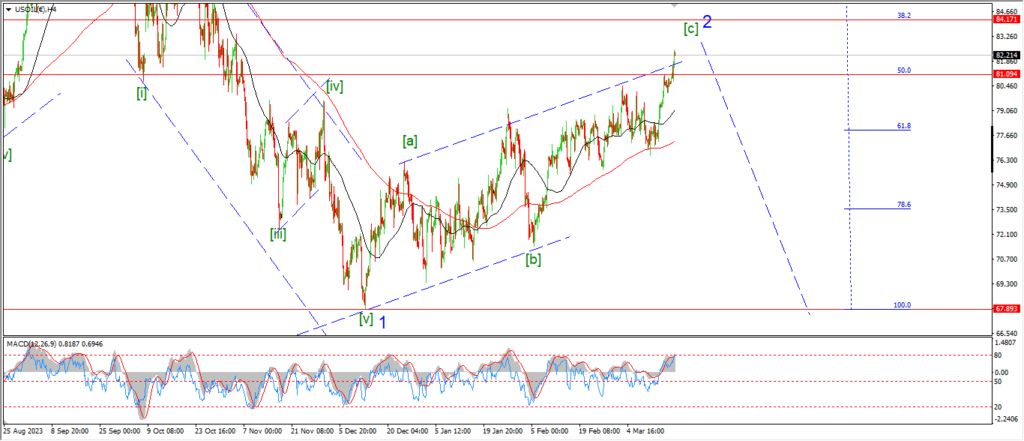

CRUDE OIL.

CRUDE OIL 1hr.

I may be jumping the gun with this bearish count again,

but I think the action off the top is still easily read as a bearish impulse wave lower at the moment.

This count will be proved wrong very quickly if it is wrong!

A new high above the wave ‘2’ level at 83.11 will do just that,

and then its back to the drawing board again for wave (v) of [c] of ‘2’ again.

I am pretty happy with the overall count for wave ‘2’,

so it is a matter of time until wave ‘3’ down comes in in my humble opinion.

The next few sessions will be critical for this wave count at least.

Tomorrow;

watch for wave (ii) to hold below the recent wave ‘2’ high.

Wave (iii) of [i] should fall into the 76.50 area at the wave (iv) lows over the coming days.

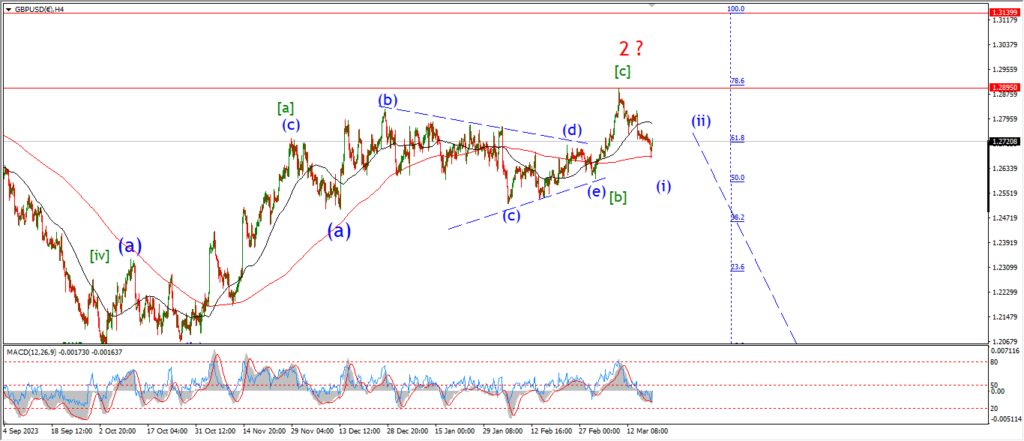

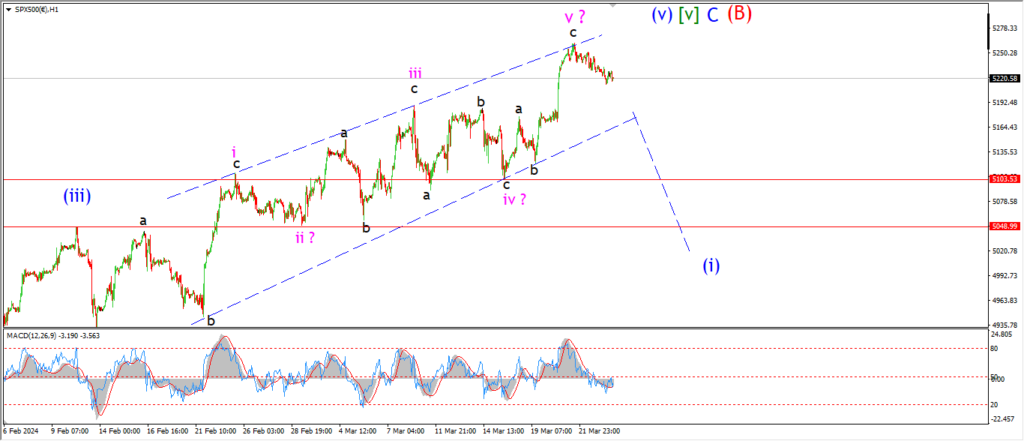

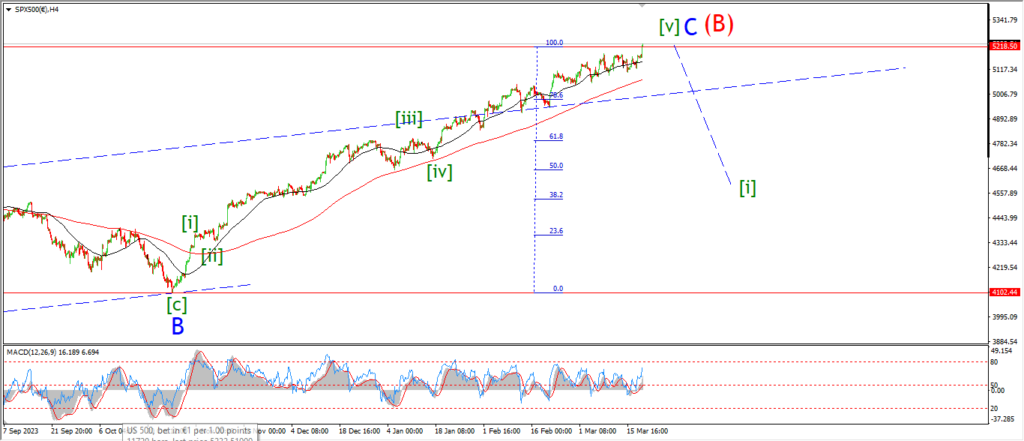

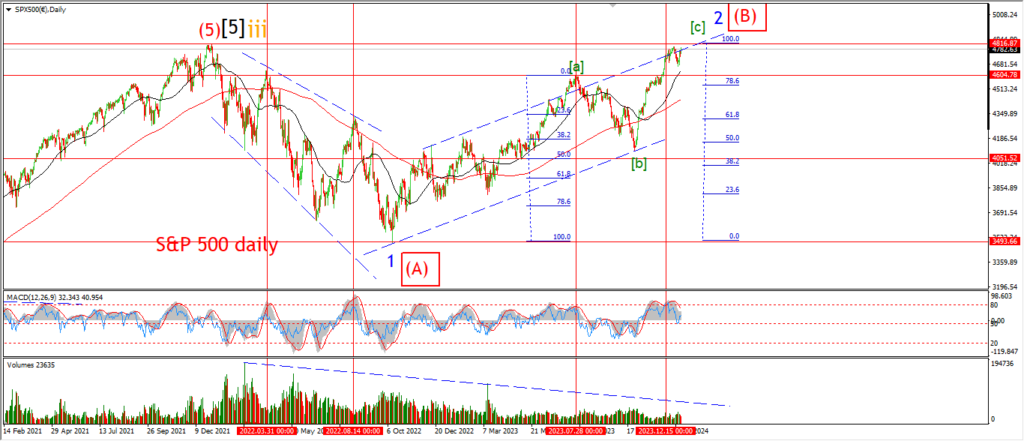

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

I am interested in one feature of the recent rally in the S&P,

that is the upper trend line of the wedge pattern of wave (v).

This trend line touches the three tops of the five waves perfectly.

Each time that trend line has marked the beginning of turn lower.

The market has turned lower again after hitting the recent top,

and that does raise the question if that is in fact wave ‘v’ of (v) now in place.

We will see soon enough for sure.

The price is holding below the highs today without an impulsive move lower yet.

So this remains an open question here.

But I will admit that I do like the idea that the recent rally in an ending diagonal actually stopped at the upper trend line.

Tomorrow;

A solid acceleration lower to break the wave ‘iv’ low again will signal wave (i) is underway.

SILVER.

SILVER 1hr

Silver has not completed a correction in wave ‘2’ yet today.

the price has not budged off Fridays close all day.

This lack of movement suggests wave ‘2’ of ‘c’ is still in play here.

And we should see a lower high form in wave ‘2’ tomorrow near 25.09.

Wave ‘3’ down should turn lower again and hit the 24.00 level.

With the low for wave ‘c’ suggested at the 50% retracement level at 23.67.

Tomorrow;

Watch for wave ‘c’ to continue over the coming days and complete five waves down before the end of this week.

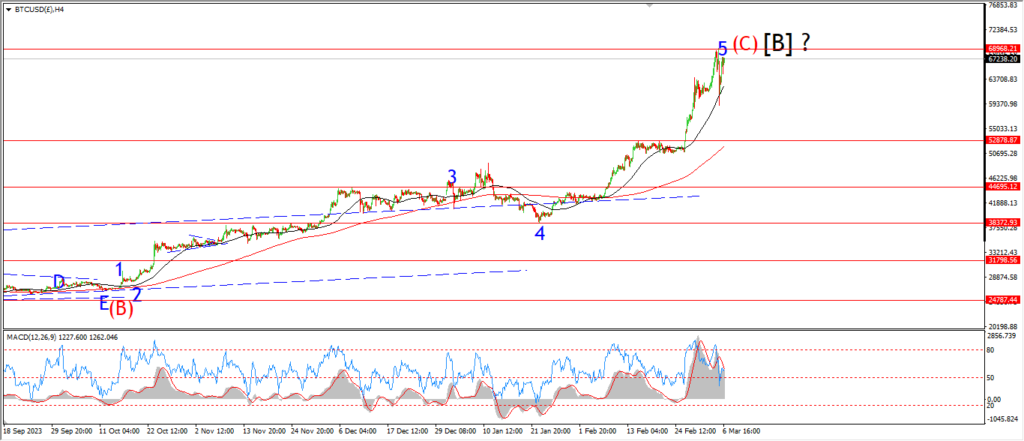

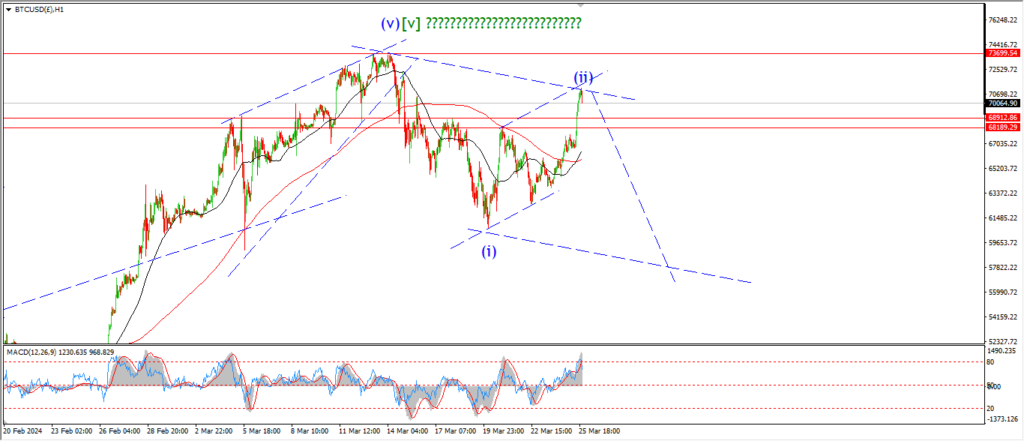

BITCOIN

BITCOIN 1hr.

….

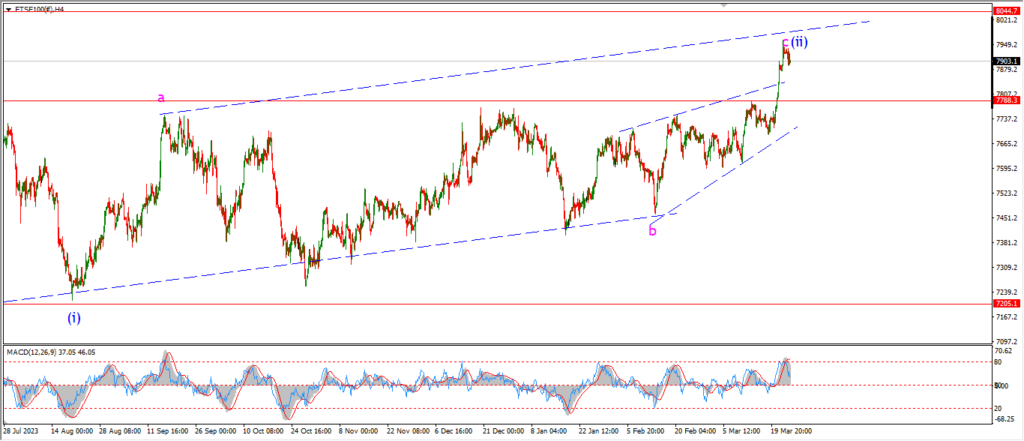

FTSE 100.

FTSE 100 1hr.

….

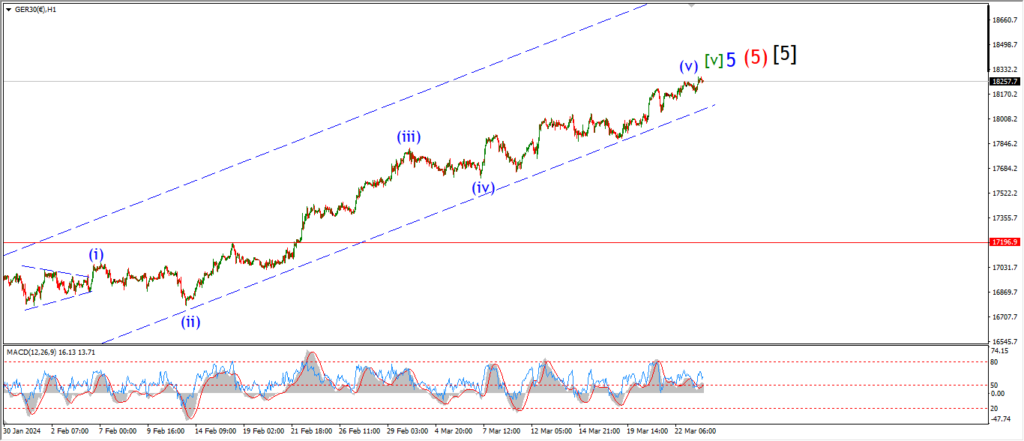

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….