Good evening folks, the Lord’s Blessings to you all.

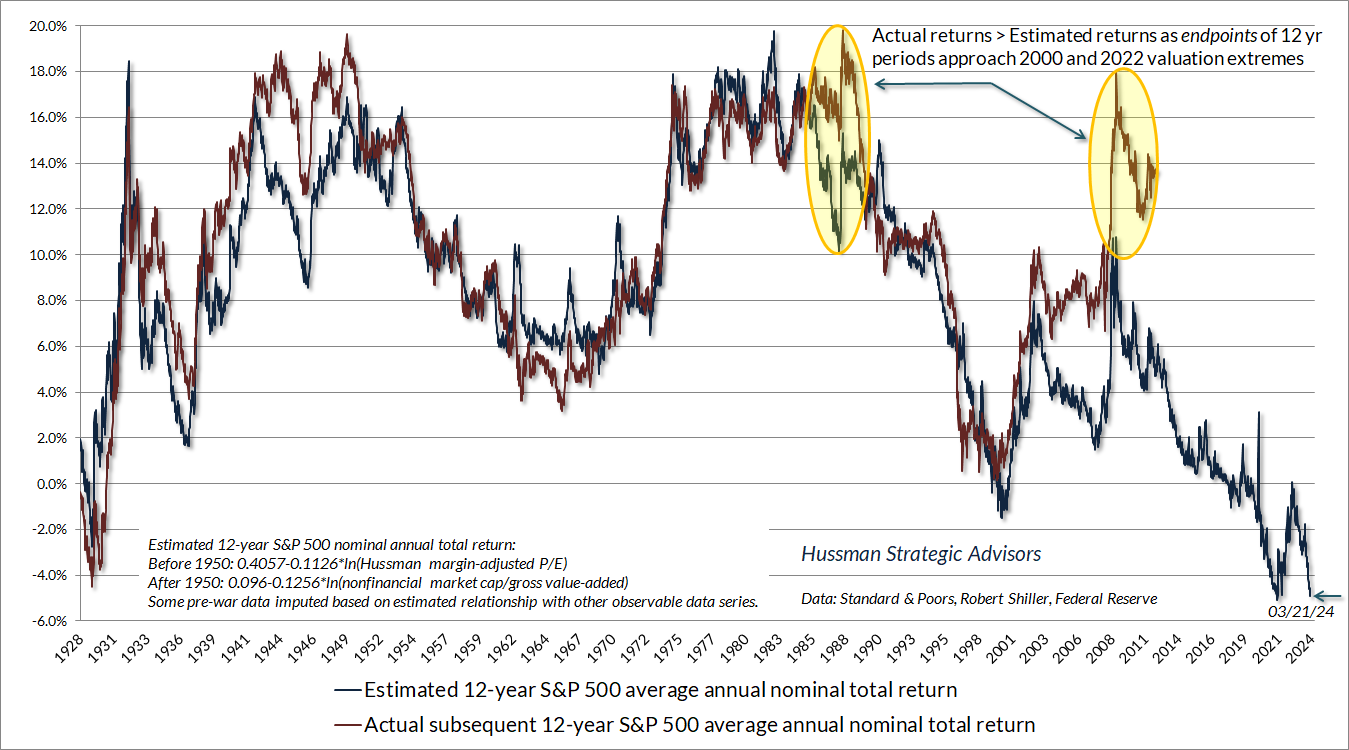

This piece is worth a read for sure.

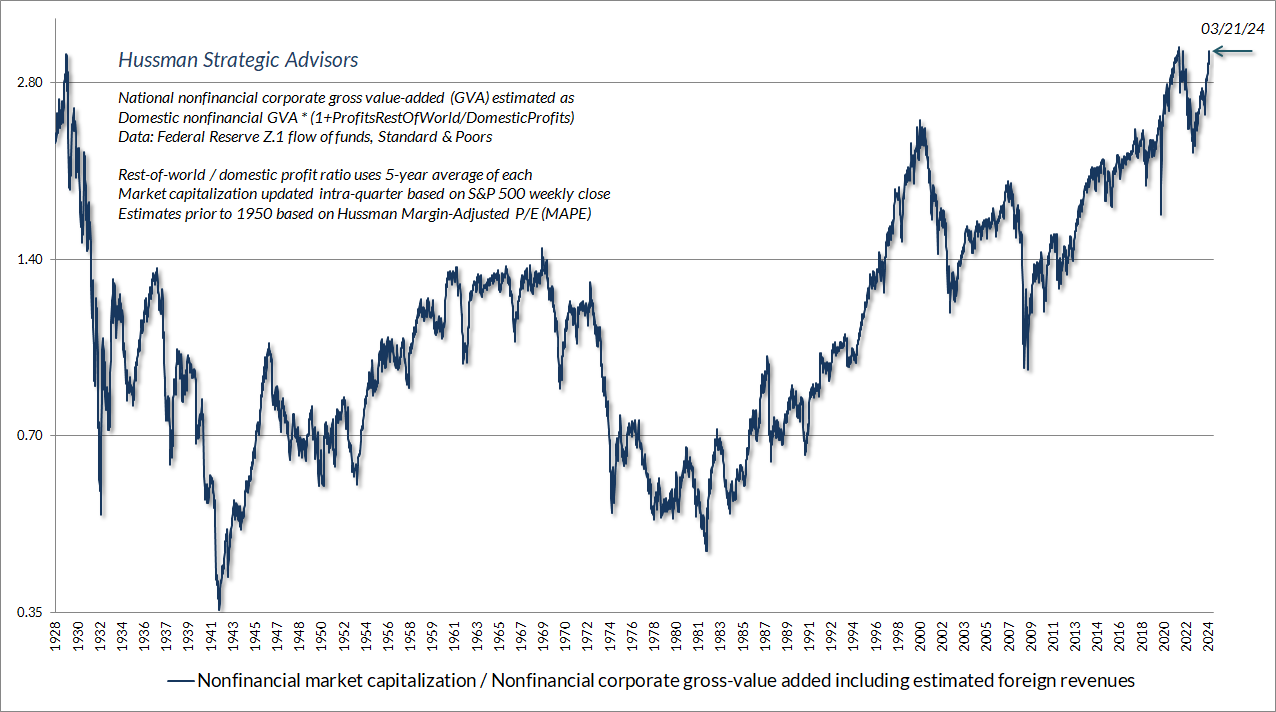

Universal Capitulation and No Margin of Safety

https://twitter.com/bullwavesreal

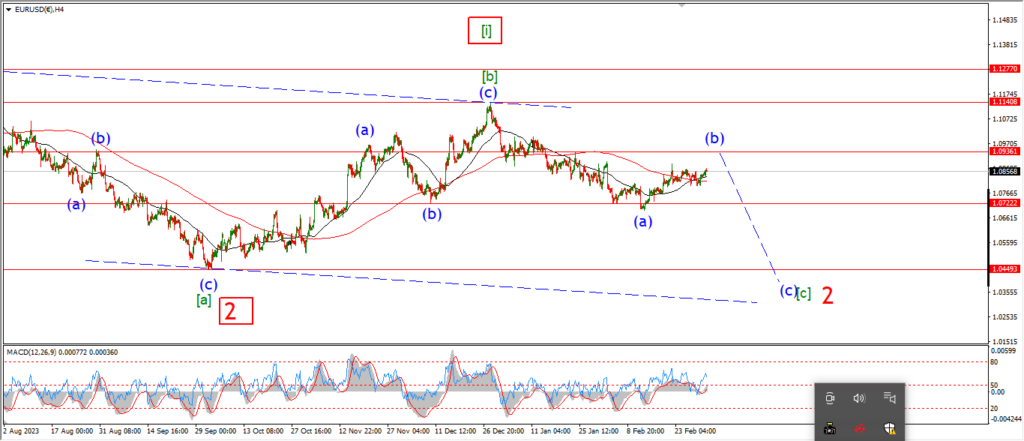

EURUSD.

EURUSD 1hr.

The price moved closer too the wave ‘b’ support at 1.0795,

but so far that level is holding.

A move through wave ‘b’ will do two things.

First,

the recent rally into the wave (b) high will be confirmed as a three wave correction.

and second,

the impulsive nature of this decline will be re-enforced.

If we see a break of the next lower support at 1.0693, that will confirm the overall count for wave [c] of ‘2’.

And at that point we can decide between a three wave decline in wave [c],

or a more standard five wave decline.

That decision will have to wait until next week.

Monday;

Watch for the wave ‘ii’ high to hold at 1.0940.

Wave ‘iii’ of (c) must decline further towards the lower support at 1.0693.

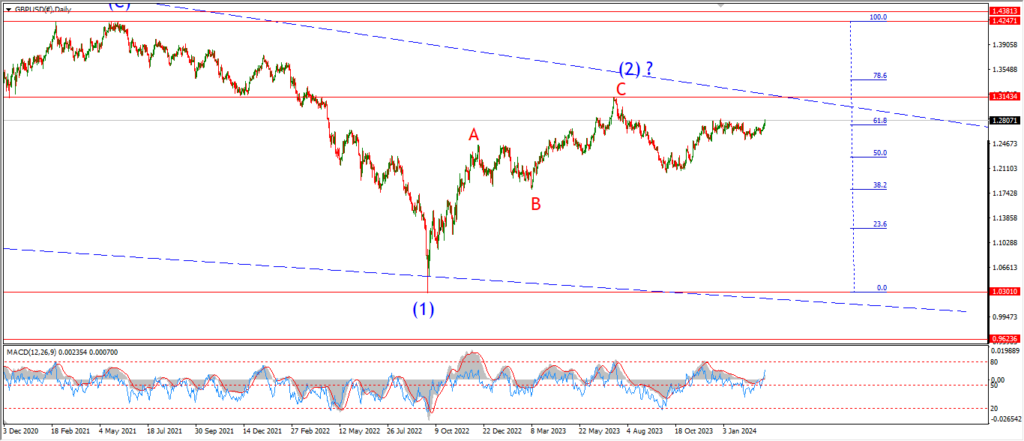

GBPUSD

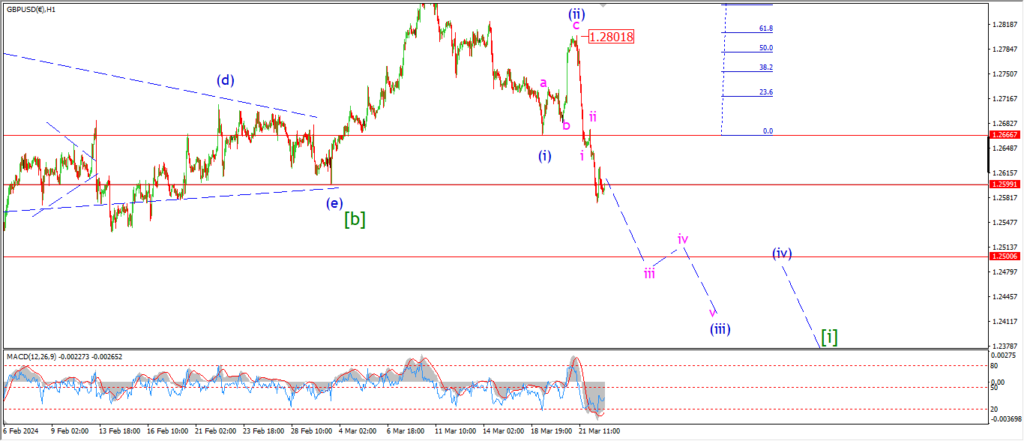

GBPUSD 1hr.

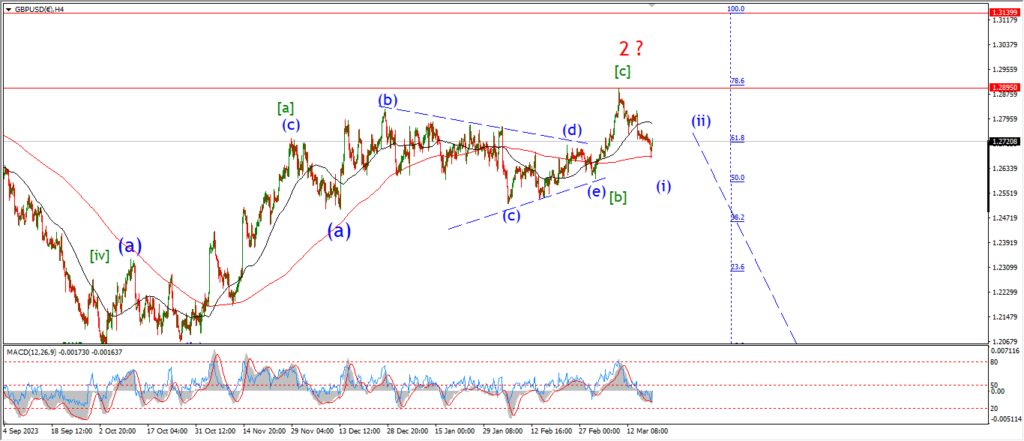

GBPUSD 4hr.

GBPUSD daily.

The wave count for wave (iii) of [i] is moving closer to a reality today,

but the price has not traced out five waves internal in wave (iii) yet,

we need to see further downside in this pattern to confirm.

I am looking for wave (iii) blue to fall below 1.2500 at a minimum.

that level marks the lower bound of the correction in wave [b].

And I want to see a clean break below that support to really turn the tide in this pattern.

Monday;

WAve [i] down should complete five waves down next week if all goes well.

Watch for wave (iii) to complete a five wave pattern as shown near the 1.2400 handle again.

USDJPY.

USDJPY 1hr.

I am beginning to lean in favor of the more bullish count for wave (ii) this evening.

The price has failed to accelerate lower into wave ‘c’ of (ii) today.

The action even looks a little corrective today.

I am going to suggest a switch to the bullish count if we see a break above 151.86 again.

That will confirm wave (iii) of [iii] is underway.

Monday;

A sharp decline on Monday will confirm wave ‘c’ of (ii) is underway.

Watch for that alternate count to get triggered with a break above 151.86.

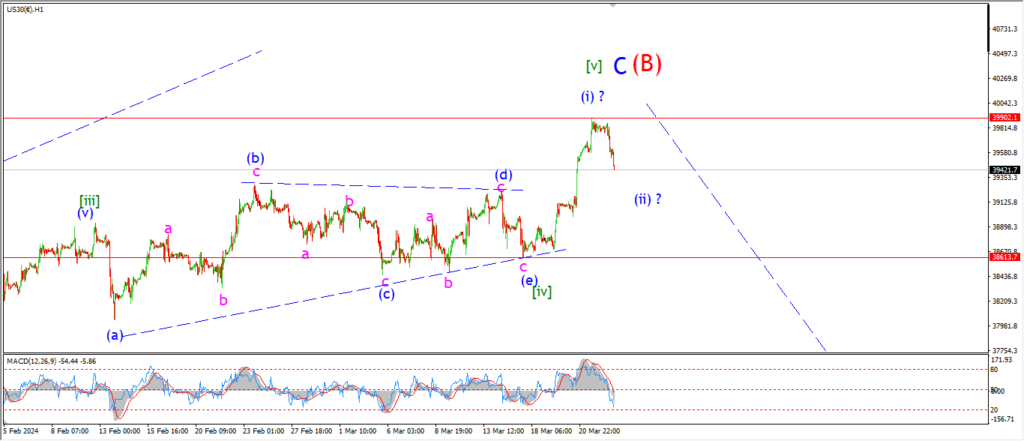

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The DOW is back off the highs of the week today,

but that is to be expected with end of week selling I suppose.

Now,

I have shown the two options with equal weight tonight.

The rally out of wave [iv] is a nice five wave structure.

So there is a possibility that wave [v] is now only beginning.

Wave (i) of [v] is complete,

and the price has dropped into wave (ii) today.

The second option here is that wave [v] is already done at this weeks high.

I that scenario the market is now topped,

and the small decline off the top is the beginning of a longer term decline.

The key to sort out this mess is the wave [iv] low at 38600.

A break below wave [iv] will rule out the (i) (ii) idea and strongly favor the second count.

Monday;

A three wave decline will signal wave (ii) is complete.

But keep one eye on that wave [iv] low at 38600.

A break of that level could open a trap-door under the market.

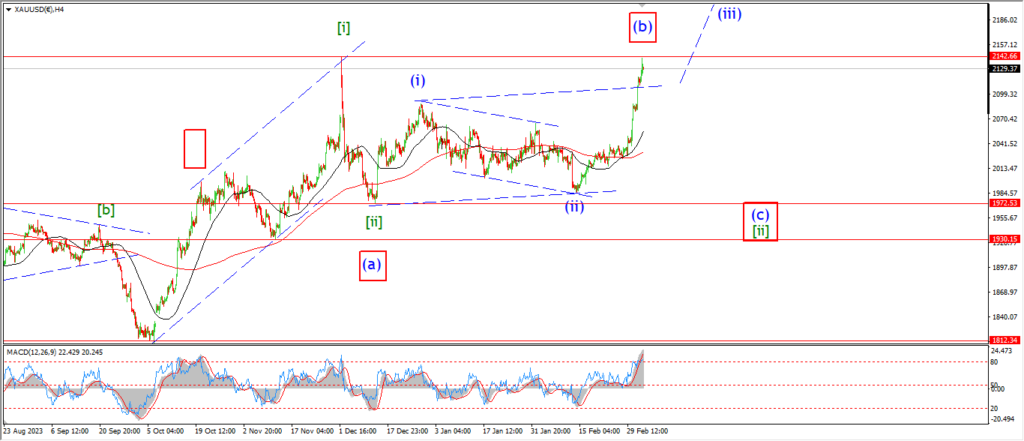

GOLD

GOLD 1hr.

Gold has held above the wave ‘iv’ low today after dropping quite close this evening.

I am suggesting a three wave decline is in play here for wave ‘b’ of ‘b’.

This idea suggests wave ‘b’ is an expanded flat correction.

and then wave ‘c’ of ‘b’ will rally back above the wave ‘a’ high at 2186 to complete.

The larger wave (iv) still requires a longer decline in wave ‘c’ next week.

That will set up the market for another rally in wave (v) of [iii].

Monday;

Watch for wave ‘b’ of (iv) to complete an expanded flat correction as shown.

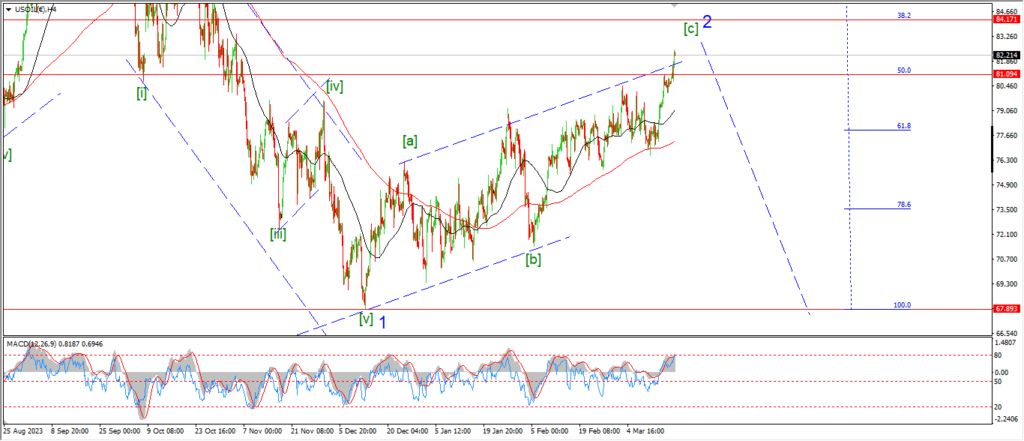

CRUDE OIL.

CRUDE OIL 1hr.

Oil is flat today in a possible wave (ii) correction.

The price has traced out three waves up off this weeks lows so far.

I am suggesting this is wave (ii) of [i],

and if correct,

then wave (iii) of [i] will turn lower again early next week.

And I am looking at that wave (iv) support at 76.55 for the target in wave (iii).

Monday;

Watch for the wave ‘2’ high to hold at 83.10.

Wave (iii) down to take over and turn lower again in five waves.

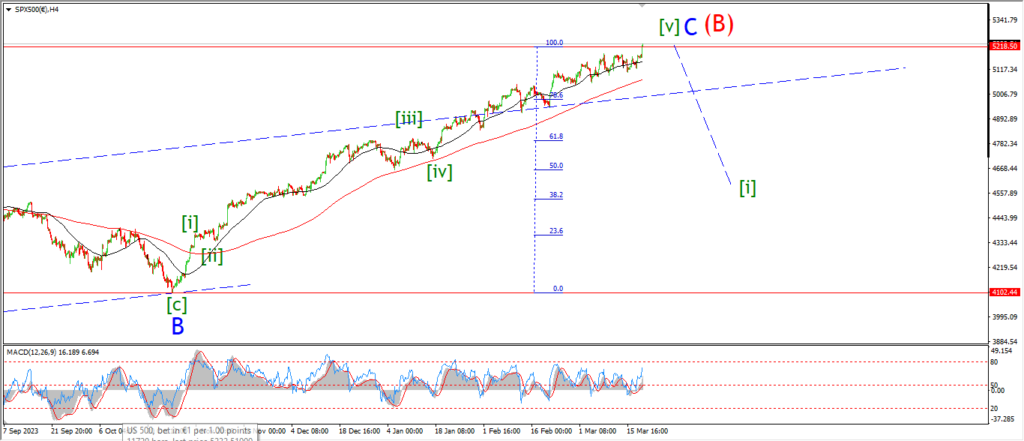

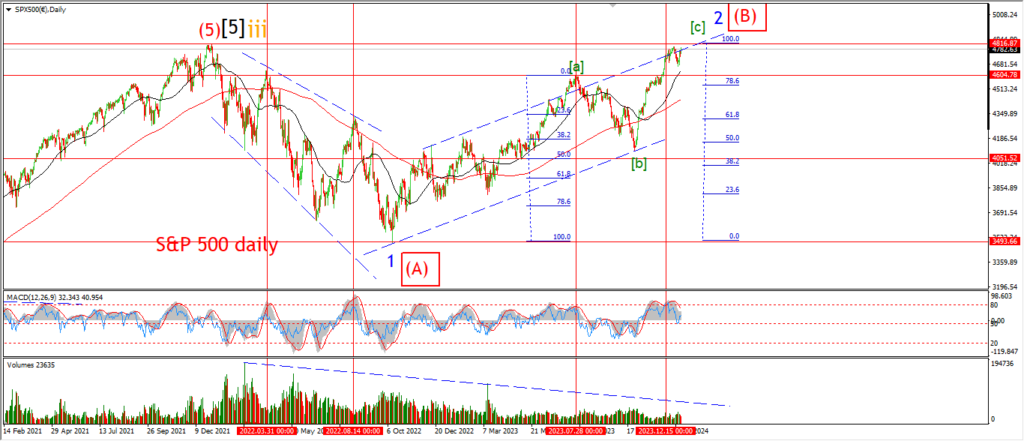

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P is poised to make another stab at a new high going on todays action.

the market is basically flat with a small corrective drift off the top.

The price did tag the upper trend line this week to close out the ending diagonal pattern.

There is still a chance that this pattern will meet that trend line again if wave ‘c’ of ‘v’ completes a larger five wave internal pattern.

So I will just wait and see how this goes early next week.

Even if we do see a new high in wave ‘v’,

that does not rule out the reversal happening next week into wave (i) down.

Support lies between 5048 at wave ‘ii’,

and 5103 at wave ‘iv’.

So there is our test range for the reversal!

Monday;

Watch for a drop out of the wedge pattern and a test of the wave ‘iv’ low to signal wave (i) is underway.

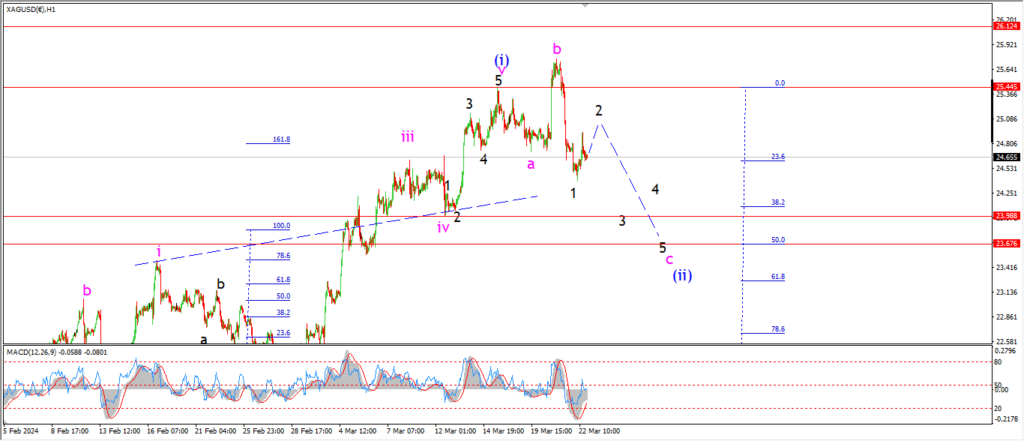

SILVER.

SILVER 1hr

Wave (ii) requires a larger decline in five waves as shown on the hourly chart.

I am looking at the 50% retracement level this week,

and we are not there yet!

The price did correct higher today and I have labelled this as wave ‘2’ of ‘c’ of (ii).

Wave ‘3’ of ‘c’ should drop back into 23.98 at the previous wave ‘iv’ low.

And then we will be close enough to start looking for the final low in wave (ii) blue.

Later next week I will turn my attention higher into wave (iii) of [i].

Monday;

Watch for wave ‘c’ to continue lower in five waves.

The 50% retracement level at 23.67 is the main target.

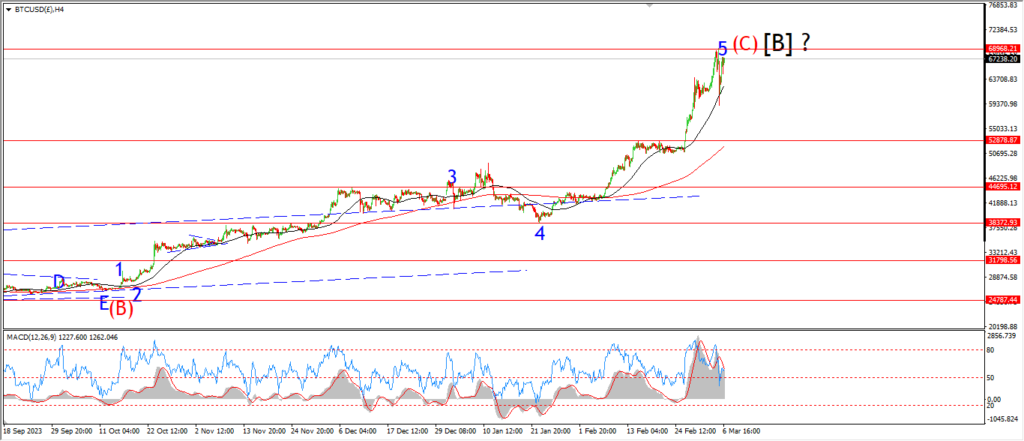

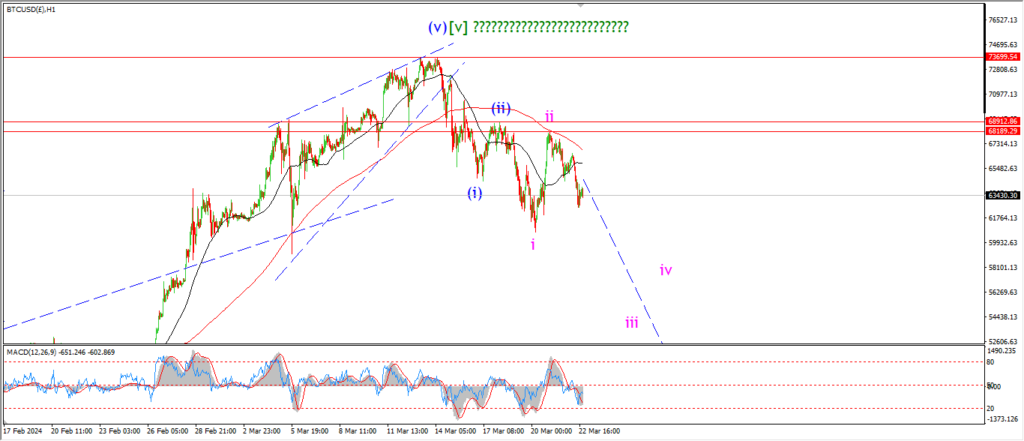

BITCOIN

BITCOIN 1hr.

….

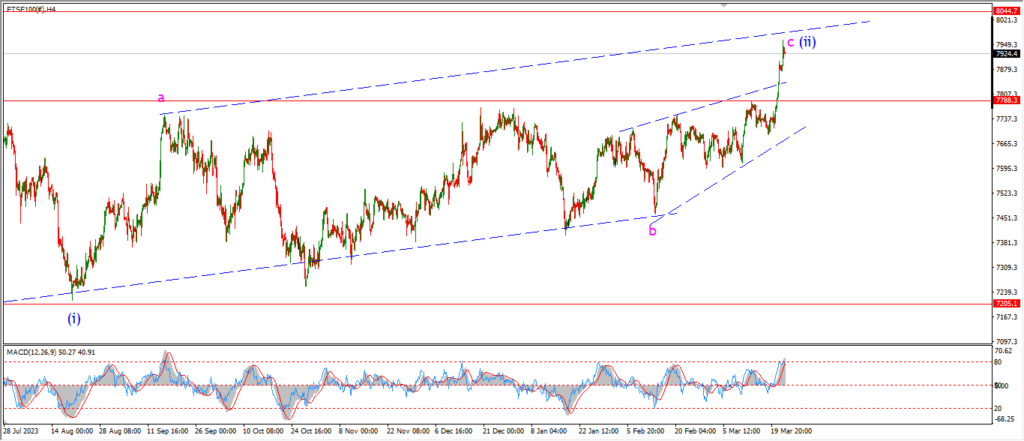

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

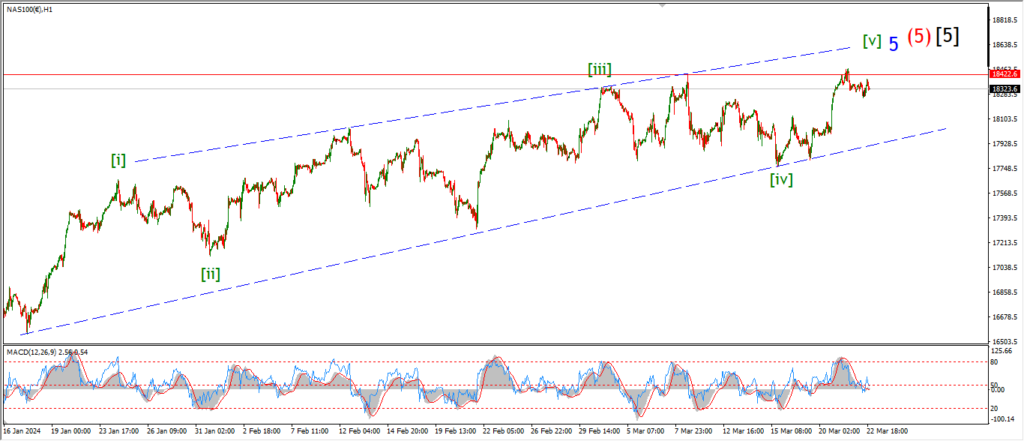

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….